- Home

- »

- Biotechnology

- »

-

Immunohistochemistry Market Size, Industry Report, 2030GVR Report cover

![Immunohistochemistry Market Size, Share & Trends Report]()

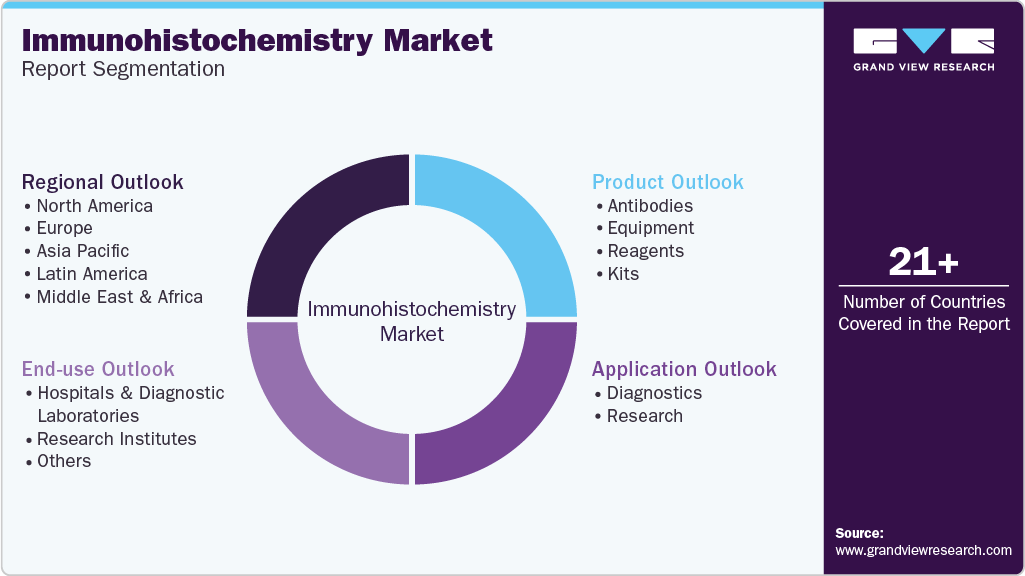

Immunohistochemistry Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Antibodies, Equipment, Reagents, Kits), By Application (Diagnostics, Research), By End use (Hospitals & Diagnostic Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-718-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Immunohistochemistry Market Summary

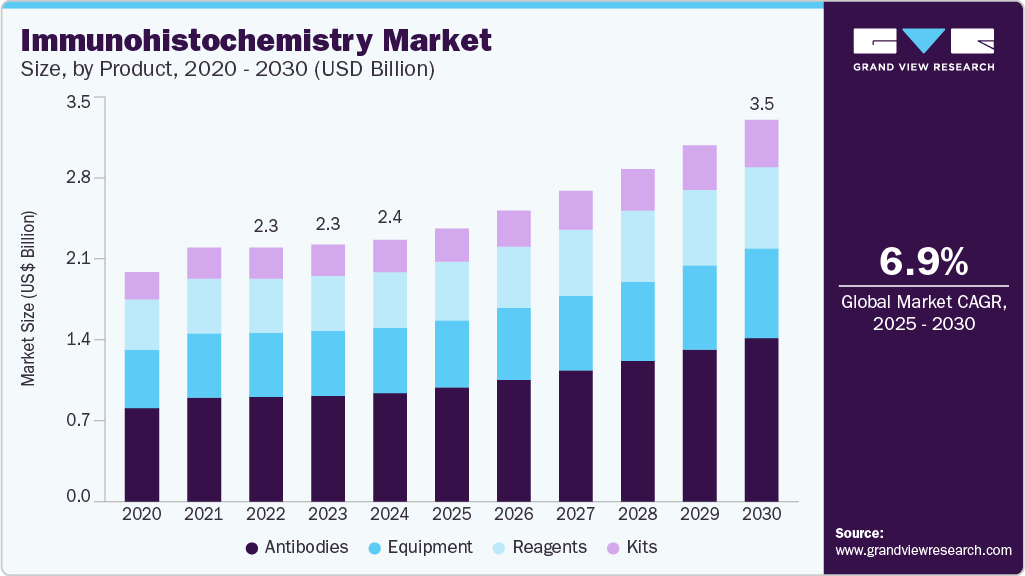

The global immunohistochemistry market size was estimated at USD 2.40 billion in 2024 and is projected to reach USD 3.50 billion by 2030, growing at a CAGR of 6.93% from 2025 to 2030. Increasing implementation of automation and machine learning in immunohistochemistry (IHC), coupled with the introduction of technologically advanced immunohistochemistry solutions, is expected to significantly drive the market throughout the forecast period.

Key Market Trends & Insights

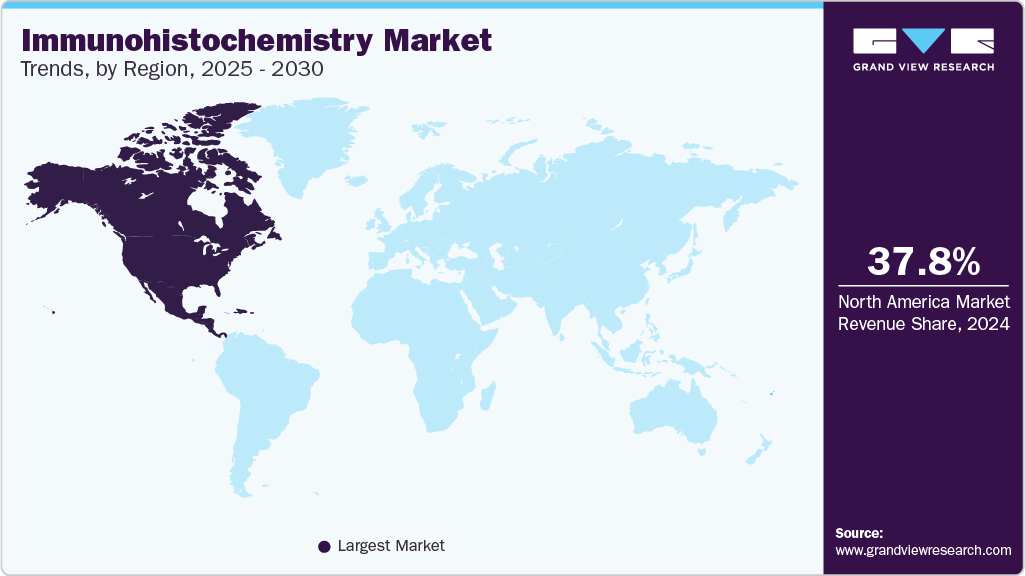

- North America dominated the Immunohistochemistry market with the largest revenue share of over 37.77% of the global revenue in 2024.

- The U.S. immunohistochemistry market is experiencing significant growth, driven by increased research and substantial investments in advanced diagnostic technologies.

- Based on product, the antibodies segment led the market with the largest revenue share of 41.4% in 2024.

- In terms of application, the diagnostics segment held the largest revenue share of over 68.6% in 2024.

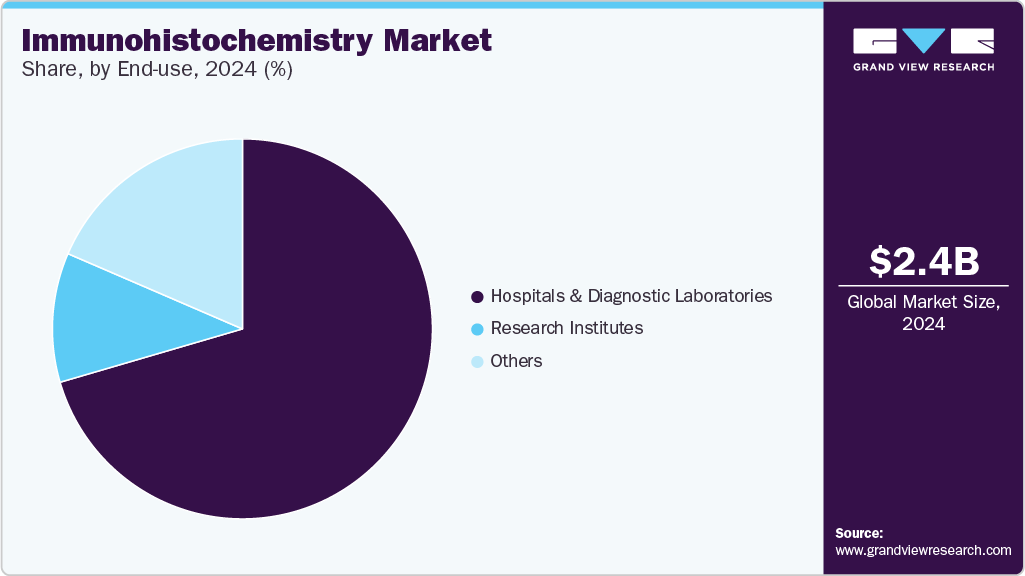

- Based on end use, the hospitals and diagnostic laboratories segment dominated the market, accounting for the largest revenue share of over 70.4% of the overall revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.40 billion

- 2030 Projected Market Size: USD 3.50 billion

- CAGR (2025-2030): 6.93%

- North America: Largest market in 2024

Advancements in IHC protocols have boosted its demand to a significant level in disease diagnosis. In addition, the rise in product approvals and the launch of technologically advanced immunohistochemistry systems for disease diagnosis are further propelling the market growth. Supporting this trend, companies are actively working to introduce platforms that reflect current technological capabilities while addressing end-user needs. In December 2023, Biocare Medical unveiled the intelliPATH+, a next-generation enhancement of its proven intelliPATH FLX staining system. This advanced platform has been meticulously redesigned with user input and the latest technological advancements to become a fully open system, offering unparalleled flexibility and efficiency in IHC workflows.

The intelliPATH+ integrates cutting-edge features that streamline laboratory processes, reduce turnaround times, and enhance diagnostic accuracy. Such innovations underscore the industry's commitment to integrating advanced technology into IHC processes, improving patient outcomes, and supporting the market's robust growth trajectory.

Newer techniques, such as multiplexed IHC, allow multiparametric and detailed analysis from a single tissue segment by utilizing advanced mass spectrometric detection methods. Multiplexed IHC helps address the technical challenges posed by the labeled fluorescence detection-based method, thereby spurring the market revenue. The growing elderly population in both developed and emerging nations would favorably impact the IHC market. The frequency of age-related disorders is expected to rise dramatically as the global geriatric population grows significantly.RT-PCR, immunohistochemistry, and electron microscope were used to detect the virus, indicating that the effect of SARS-CoV-2 is not limited to the lungs.

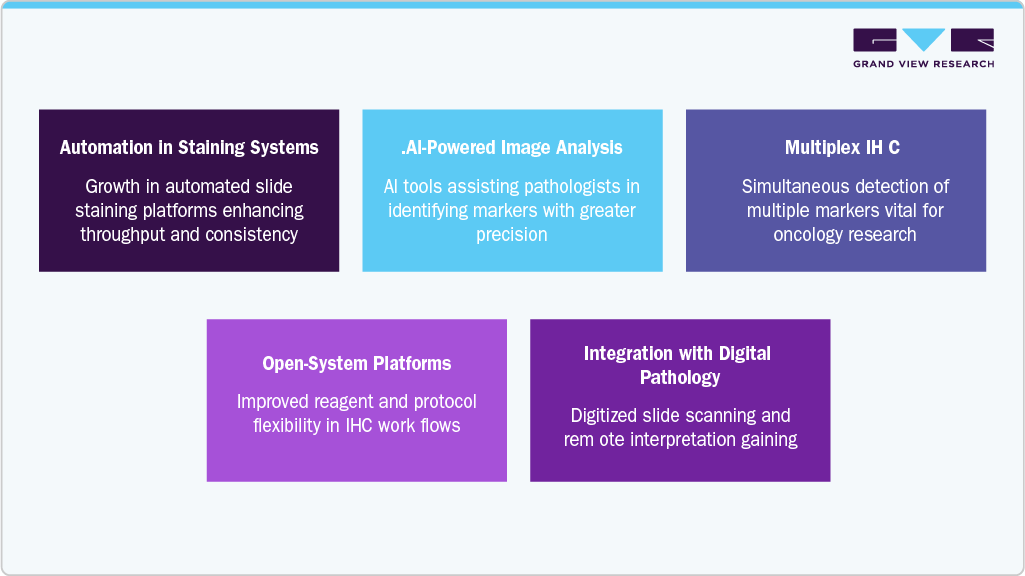

Key Technological Trends Shaping the Immunohistochemistry Market

The IHC market is witnessing a transformative shift driven by the integration of advanced technologies to improve diagnostic precision, speed, and scalability. These innovations are not only enhancing workflow efficiency but are also supporting the broader movement toward personalized medicine. Below are some of the prominent technological trends reshaping the IHC landscape.

1. Automation in Staining Systems: Automation is becoming a core element in modern pathology labs, significantly reducing manual intervention and human error. Automated staining systems offer higher throughput, standardized results, and improved reproducibility, which is particularly important for high-volume laboratories. These systems are increasingly designed with user-friendly interfaces and are compatible with laboratory information systems (LIS), supporting end-to-end workflow integration.

2. AI-Powered Image Analysis:Artificial intelligence and machine learning algorithms are being embedded in digital pathology platforms to assist in evaluating IHC slides. These tools can identify subtle variations in staining patterns, quantify marker expression, and reduce inter-observer variability. AI-driven image analysis is especially valuable in cancer diagnostics, where accuracy and consistency are critical.

3. Multiplex IHC: Multiplexing allows for the simultaneous detection of multiple biomarkers within a single tissue section. This technique is increasingly used in oncology research and diagnostics to analyze complex signaling pathways and tumor microenvironments. Multiplex IHC reduces tissue consumption, shortens analysis time, and provides a more comprehensive view of disease mechanisms.

4. Open-System Platforms: The demand for open-system staining platforms is growing, as they offer laboratories the flexibility to use reagents and protocols of their choice. This flexibility supports research innovation and enables customization in clinical settings. Recent launches, such as the intelliPATH+, reflect this trend by offering modular designs and user-defined protocol capabilities.

5. Integration with Digital Pathology: The shift toward digital pathology is closely tied to IHC advancements. Digital slide scanners, cloud-based image storage, and remote access enable pathologists to collaborate globally and make faster, more informed decisions. This integration enhances the scalability and accessibility of IHC-based diagnostics.

These technological trends collectively steer the IHC market toward higher efficiency, greater diagnostic value, and broader clinical utility. As laboratories adopt these innovations, they are better positioned to meet the evolving demands of modern pathology and precision medicine.

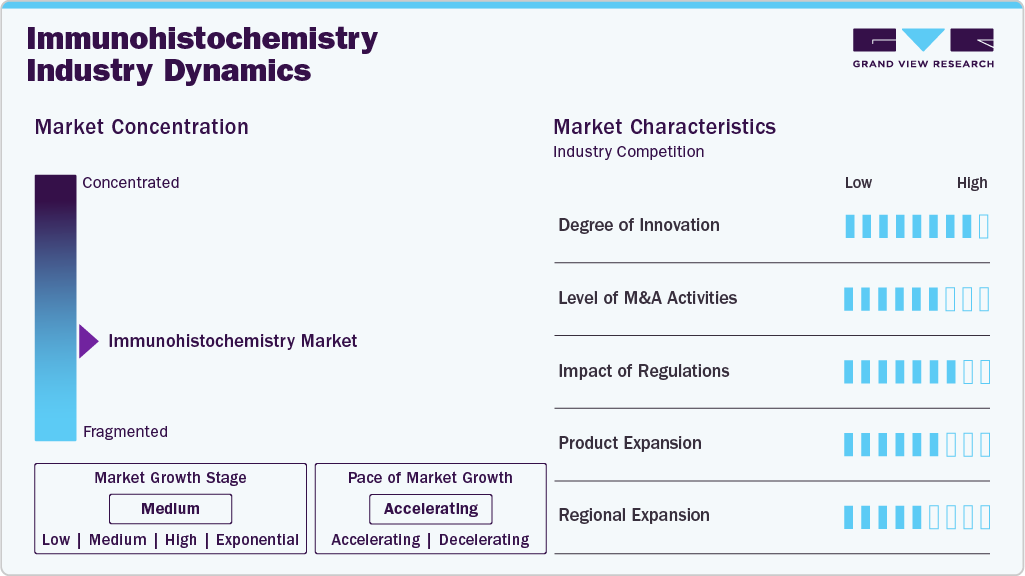

Market Concentration & Characteristics

Immunohistochemistry advances through multiplexed staining, digital pathology integration, and next-generation antibody development, enabling higher diagnostic precision and broader biomarker coverage. Innovations include automated staining platforms, AI-assisted image analysis, chromogenic and fluorescent dual detection, and tissue microarray compatibility. These developments reduce diagnostic variability, streamline workflows, and support personalized therapy selection. Enhanced antigen retrieval techniques and recombinant antibody engineering accelerate product iteration, supporting high-throughput, reproducible assays tailored for oncology and immune profiling.

The market has witnessed steady mergers and acquisitions, primarily aimed at strengthening technology portfolios, expanding geographic presence, and acquiring complementary product lines. Strategic deals are often focused on gaining access to advanced antibody technologies, digital imaging solutions, or reagent production capabilities. While large players continue to consolidate smaller, specialized firms, mid-sized companies are also entering M&A activities to enhance competitiveness and broaden service offerings.

Regulation plays a significant role in shaping the IHC market. Regulatory approvals, particularly in the U.S. and Europe, are essential for clinical-grade IHC products. Compliance with standards such as CE-IVD, FDA 510(k), and CLIA is crucial for product commercialization. The impact is especially high in companion diagnostics, where IHC assays are co-developed with targeted therapies and require close coordination with drug regulatory bodies. Additionally, evolving regulatory frameworks around digital pathology and AI use in diagnostics are beginning to influence product development strategies.

Product expansion in the IHC market is ongoing, with companies launching new antibody clones, detection systems, and fully automated platforms to address rising demand for high-throughput and standardized diagnostics. There is a clear trend toward expanding assay menus, particularly those used in oncology and immunotherapy. Companies are also focusing on developing products that support multiplexing and offer enhanced sensitivity and specificity.

Regional expansion is evident as companies target emerging markets in Asia-Pacific, Latin America, and the Middle East due to rising healthcare investments, growing cancer incidence, and improvements in diagnostic infrastructure. North America and Europe remain key regions due to high procedural volumes and advanced laboratory capabilities, but growth strategies are increasingly focused on establishing partnerships and distribution networks in underserved markets to capture new demand.

Product Insights

The antibodies segment led the market with the largest revenue share of 41.4% in 2024. This is due to the essential role of antibodies in diagnosing diseases and testing drugs. Monoclonal antibodies, along with antibody-related products like Fc-fusion proteins, antibody fragments, and antibody-drug conjugates, have become the most widely used in the industry. Antibodies are used in various fields, including pathology, neuropathology, and hematopathology, making them a key component in IHC applications.

The kits segment is expected to grow fastest during the forecast period. Kits simplify the IHC process by eliminating the need to select the right combination of antibodies and stains for a tissue sample. Their compact size and ease of use drive the segment's growth. IHC kits are particularly popular in academic institutions and research laboratories, where smaller quantities of these products are needed for research. The increasing number of research programs that use IHC assays is also contributing to the growth of this segment.

Application Insights

The diagnostics segment held the largest revenue share of over 68.6% in 2024 and is expected to maintain its leading position throughout the forecast period. IHC tests are commonly used to diagnose a variety of chronic conditions, including cancer, cardiovascular diseases, infectious diseases, diabetes, autoimmune diseases, and kidney disorders. The rising prevalence of chronic diseases is expected to further boost the growth of the diagnostics segment. In addition, advancements in IHC technologies and the growing emphasis on early diagnosis are likely to support further expansion. With more healthcare facilities adopting IHC testing, its role in personalized medicine is expected to become more prominent. This increasing demand for accurate, efficient diagnostic tools will drive continued growth in the diagnostics application segment.

The research segment is expected to grow significantly during the forecast period. With the rising number of cancer cases, there is an increasing reliance on IHC techniques for rapid and efficient diagnosis. Pharmaceutical companies increasingly invest in research and development (R&D) to create innovative therapies, further driving the demand for IHC solutions. The growing focus on cancer research and drug discovery is expected to contribute to this segment's growth. For instance, in 2025, the American Cancer Society projected over 2 million new cancer cases in the United States, highlighting the need for advanced diagnostic tools. This growing demand for IHC solutions in cancer research is expected to fuel the rapid expansion of the segment.

End use Insights

The hospitals and diagnostic laboratories segment dominated the market, accounting for the largest revenue share of over 70.4% of the overall revenue in 2024. This growth is driven by the high volume of Immunohistochemistry (IHC) tests conducted in hospital settings. The demand for hospitals with advanced diagnostic capabilities is increasing as the healthcare industry evolves. Furthermore, with the growing need for accurate and efficient diagnostic services, hospitals are investing in state-of-the-art facilities, which is expected to further fuel the expansion of this segment. Continuous advancements in diagnostic technology are likely to enhance the market potential of hospitals and diagnostic laboratories.

Research institutes are expected to experience strong growth during the forecast period. This growth is driven by the advantages IHC offers over traditional staining techniques used in pharmaceutical research and development (R&D). For example, human-specific IHC-approved VISTA rabbit monoclonal antibodies, such as those made by Cell Signaling Technology, are commonly used for biomedical research. The increasing use of IHC techniques for drug testing in research institutes also contributes to this growth. IHC helps evaluate biomarker distribution, localization, and protein expression in tissue sections, which is important for research. Research institutes play a key role in using IHC techniques for drug development, especially in testing the effectiveness of new drugs.

Regional Insights

North America dominated the Immunohistochemistry market with the largest revenue share of over 37.77% of the global revenue in 2024. This high revenue share is attributed to the presence of key market players, the easy availability of IHC solutions, and the higher adoption of advanced IHC instruments. In addition, continuously integrating innovative IHC solutions into the market further boosts growth. Companies are actively expanding their presence, contributing to the region's leading position in the global market.

For instance, in August 2024, Agilent Technologies received FDA approval for its MAGE-A4 IHC 1F9 pharmDx assay. This assay aids in identifying patients with synovial sarcoma who may be eligible for treatment with TECELRA, a MAGE-A4-directed engineered TCR T-Cell therapy. The approval underscores Agilent's commitment to advancing companion diagnostics in oncology.

U.S. Immunohistochemistry Market Trends

The U.S. immunohistochemistry market is experiencing significant growth, driven by increased research and substantial investments in advanced diagnostic technologies. The rising focus on personalized medicine and the application of IHC in disease diagnosis, particularly in oncology, is propelling market expansion. The presence of leading healthcare companies, research institutions, and a supportive regulatory environment fosters innovation in the sector. In addition, the growing demand for more accurate and efficient diagnostic tools, coupled with the ongoing development of advanced IHC platforms and automation technologies, strengthens the U.S.'s role as a key player in the global immunohistochemistry market.

Europe Immunohistochemistry Market Trends

Europe immunohistochemistry market is witnessing steady growth, supported by strong academic research, advanced clinical infrastructure, and a regulatory landscape that promotes diagnostic innovation. Countries such as Germany, the UK, and France are at the forefront of integrating IHC techniques in pathology, particularly for cancer diagnostics and biomarker detection. Academic institutions and hospitals across the region are actively applying IHC in translational research and clinical practice. The European Medicines Agency (EMA) and national regulatory bodies support the approval and clinical integration of IHC-based diagnostic tools. In addition, EU-funded initiatives like Horizon Europe are fostering cross-border collaborations to improve disease detection technologies. Partnerships between research organizations and diagnostic companies continue accelerating the development of precise and scalable IHC platforms, reinforcing Europe’s role in shaping the global immunohistochemistry landscape.

The UK Immunohistochemistry Market is making notable contributions to the growth of the immunohistochemistry market, supported by a strong academic and clinical research environment, government-backed diagnostic initiatives, and an evolving biotechnology sector. Leading universities and NHS-affiliated pathology labs are actively integrating IHC technologies into routine diagnostics and translational research, particularly in oncology and infectious disease management.

Targeted funding from UK Research and Innovation (UKRI) and other national health programs has encouraged the development of advanced IHC protocols and digital pathology integration. Regulatory support from the Medicines and Healthcare Products Regulatory Agency (MHRA) facilitates the adoption and validation of IHC-based diagnostics in clinical settings. In addition, the UK remains involved in collaborative efforts across Europe through research networks and innovation consortia to enhance diagnostic accuracy and scalability. These factors position the UK as a key contributor to the expansion of the immunohistochemistry market.

Germany immunohistochemistry market is a key player in the European market, driven by its robust research infrastructure, government-supported initiatives, and strong academic-industry collaborations. The country's well-established biotechnology and diagnostics ecosystem supports developing and integrating IHC technologies, with leading institutions such as the Fraunhofer Institute and the Max Planck Institute playing pivotal roles in advancing IHC-based research. Germany's regulatory framework, managed by the Federal Institute for Drugs and Medical Devices (BfArM), provides clear pathways for clinical validation and commercialization of IHC diagnostic tools. The country's focus on precision medicine is further bolstered by public-private partnerships that foster innovation in cancer diagnostics and biomarker research. Germany's aging population and increasing incidence of chronic diseases also drive the demand for advanced IHC solutions, positioning the country as a crucial contributor to the global immunohistochemistry market.

Asia Pacific Immunohistochemistry Market Trends

The Asia Pacific immunohistochemistry market is experiencing rapid growth, driven by the increasing prevalence of chronic diseases, advancements in diagnostic technologies, and rising investments in research and development. Countries such as Japan, China, and India are leading the adoption of IHC techniques, particularly in oncology diagnostics. The growing incidence of cancers and the rising demand for precise and personalized diagnostic tools fuel market expansion.

In addition to these trends, several companies are innovating to meet the demand for advanced diagnostic solutions. For instance, in September 2023, Cell Signaling Technology (CST) launched its SignalStar Multiplex IHC technology, designed for high-throughput immunohistochemistry assays. This cutting-edge technology aims to streamline laboratory processes, enhance diagnostic accuracy, and support the growing need for efficient and reliable cancer diagnostics.

China immunohistochemistry market is experiencing significant growth in the immunohistochemistry market, driven by increased government support, strategic investments, and a rapidly developing biotechnology sector. The country is placing substantial emphasis on enhancing diagnostic capabilities, particularly in oncology and personalized medicine. With research institutions like Tsinghua University playing a pivotal role, China is advancing innovations in immunohistochemistry technologies, such as multiplexing and AI-powered diagnostic tools, to improve diagnostic accuracy and workflow efficiency. These efforts, supported by government policies and funding, solidify China's global immunohistochemistry market position.

Japan immunohistochemistry market is experiencing significant growth in the immunohistochemistry market, driven by strong government backing, an advanced healthcare system, and an established biotechnology sector. The country's focus on personalized medicine and diagnostic precision fuels the demand for advanced immunohistochemistry technologies, such as multiplex IHC and AI-powered analysis tools. Renowned research institutions like RIKEN and Kyoto University are at the forefront of developing innovative diagnostic solutions, which are expected to propel Japan's leadership in the region's immunohistochemistry market in the coming years.

Latin America Immunohistochemistry Market Trends

The Latin America immunohistochemistry market is experiencing notable growth, driven by increasing healthcare investments, expanding diagnostic capabilities, and the rising burden of chronic diseases like cancer. Brazil and Argentina are leading the adoption of advanced IHC technologies, spurred by growing demand for precise diagnostics. Government initiatives to improve healthcare infrastructure and regional partnerships between global companies and local distributors are facilitating market access. Furthermore, supportive regulatory agencies are helping streamline the approval process, further contributing to market growth across Latin America.

Middle East and Africa Immunohistochemistry Market Trends

The Middle East and Africa (MEA) region is gradually expanding its presence in the immunohistochemistry market, driven by increasing investments in biotechnology and healthcare innovation. Several countries in the region, including the UAE, Saudi Arabia, and South Africa, are making strides in advancing immunohistochemistry research and diagnostics. Government-backed initiatives and partnerships with international research institutions are fostering the development of immunohistochemistry technologies, particularly in areas like cancer diagnostics and personalized therapies.

In addition, the growing demand for advanced medical treatments and a rising healthcare burden due to chronic diseases propel interest in immunohistochemistry-based diagnostic solutions. While the regulatory landscape across MEA is still evolving, there is a clear focus on creating frameworks that support the safe application and commercialization of immunohistochemistry technologies. With the region continuing to invest in healthcare innovation and research, its role in the immunohistochemistry market is expected to expand, particularly with more collaborations and clinical trials being initiated.

Key Immunohistochemistry Company Insights

Key players in the immunohistochemistry market are focusing on gaining market approvals for innovative products for the diagnosis of various conditions, regional and product expansions, and collaborations to maintain their market presence. For instance, in March 2023, Aptamer Group launched a new reagent solution, Optimer-Fc, for use in automated immunohistochemistry workflows. This development supports the growing demand for efficient diagnostic solutions.

Key Immunohistochemistry Companies:

The following are the leading companies in the immunohistochemistry market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd.

- Merck KGaA

- Danaher Corporation

- PerkinElmer Inc.

- Bio-Rad Laboratories, Inc.

- Cell Signaling Technology, Inc.

- Bio SB

- Agilent Technologies, Inc.

- Abcam Limited.

Recent Developments

-

In April 2025, Roche's VENTANA TROP2 RxDx Device was granted FDA Breakthrough Device Designation. This AI-powered diagnostic tool aims to assist in treatment decisions for patients with non-small cell lung cancer (NSCLC). By combining an immunohistochemistry test with AI technology, the device helps improve the accuracy of diagnoses and patient selection for targeted treatments.

-

In November 2024, the U.S. Food and Drug Administration (FDA) approved zanidatamab (brand name Ziihera) for adults with HER2-positive (IHC 3+) biliary tract cancer that has not been surgically removed or has spread to other areas, and who have previously undergone treatment. This approval highlights the importance of immunohistochemistry (IHC) in identifying patients with HER2 overexpression, specifically those with IHC 3+ results, who can benefit from targeted therapies. It further emphasizes the growing role of IHC in personalized cancer treatment.

-

In December 2023, Biocare Medical introduced the intelliPATH+ Advanced Staining Instrument, an upgrade to their intelliPATH FLX system. This new platform enhances IHC staining automation, offering features like continuous random access and STAT capabilities, which streamline processes and improve efficiency in diagnostic workflows. This advancement supports the growing demand for precise immunohistochemistry solutions in clinical and research settings.

Immunohistochemistry Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.51 billion

Revenue forecast in 2030

USD 3.50 billion

Growth rate

CAGR of 6.93% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd.; Merck KGaA; Danaher Corporation; PerkinElmer Inc.; Bio-Rad Laboratories, Inc.; Cell Signaling Technology, Inc.; Bio SB; Agilent Technologies, Inc.; Abcam Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immunohistochemistry Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global immunohistochemistry market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibodies

-

Primary Antibodies

-

Secondary Antibodies

-

-

Equipment

-

Slide Staining System

-

Tissue Microarrays

-

Tissue Processing Systems

-

Slide Scanners

-

Others

-

-

Reagents

-

Histological stains

-

Blocking Sera and Reagents

-

Chromogenic Substrates

-

Fixation Reagents

-

Stabilizers

-

Organic Solvents

-

Proteolytic Enzymes

-

Diluents

-

-

Kits

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Cancer

-

Infectious Diseases

-

Cardiovascular Diseases

-

Autoimmune Diseases

-

Diabetes Mellitus

-

Nephrological Diseases

-

Research

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Diagnostic Laboratories

-

Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global immunohistochemistry market size was estimated at USD 2.33 billion in 2022 and is expected to reach USD 2.36 billion in 2023.

b. The global immunohistochemistry market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 3.50 billion by 2030.

b. Antibodies dominated the immunohistochemistry (IHC) market with a share of 40.96% in 2022. This is attributable to their continuous usage in IHC procedures for disease diagnosis and drug testing.

b. Some key players operating in the IHC market include Abcam plc; Agilent Technologies; Bio SB; Bio-Rad Laboratories, Inc.; Cell Signaling Technology, Inc.; Danaher Corporation; F. Hoffmann-La Roche AG; Merck KGaA; PerkinElmer, Inc.; and Thermo Fisher Scientific, Inc.

b. Key factors that are driving the IHC market growth include the emergence of multiplexed immunohistochemistry, the implementation of automation and machine learning in IHC, and an increase in the prevalence of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.