- Home

- »

- Consumer F&B

- »

-

Non-alcoholic Drinks Market Size, Industry Report, 2030GVR Report cover

![Non-alcoholic Drinks Market Size, Share & Trends Report]()

Non-alcoholic Drinks Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Soft Drinks, Bottled Water, Tea & Coffee, Juice, Dairy Drinks, Functional Drinks), By Distribution Channel (Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-440-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Non-alcoholic Drinks Market Summary

The global non-alcoholic drinks market size was estimated at USD 1.46 trillion in 2023 and is projected to reach USD 2.18 trillion by 2030, growing at a CAGR of 6.0% from 2024 to 2030. The market growth is attributed to the shifting consumer preferences towards healthier, nutrient-rich beverages, and a growing focus on wellness is at the forefront.

Key Market Trends & Insights

- North America non-alcoholic drinks market dominated the global market and accounted for the largest revenue share of 34.0% in 2023.

- The non-alcoholic drinks market in the U.S. is expected to grow significantly over the forecast period.

- By product, Soft drinks dominated the market and accounted for the largest revenue share of 23.9% in 2023.

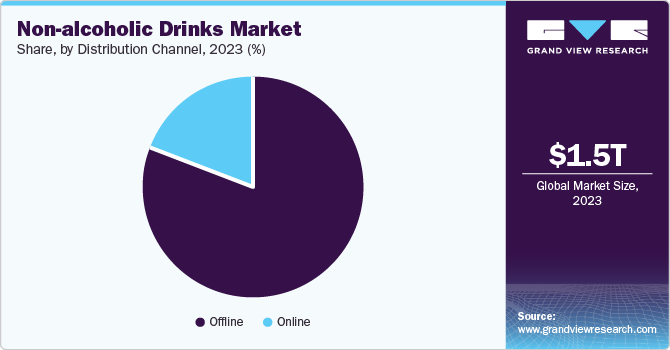

- By distribution channel, Offline distribution channels dominated the market and accounted for the largest revenue share of 80.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.46 Trillion

- 2030 Projected Market Size: USD 2.18 Trillion

- CAGR (2024-2030): 6.0%

- North America: Largest market in 2023

In addition, rising health consciousness and concerns over the adverse effects of alcohol consumption further contribute to this trend. Innovative product development catering to evolving tastes, particularly among millennials, and effective marketing strategies emphasizing taste and quality are also pivotal. Furthermore, relaxed trade barriers encourage global production expansion, while the increasing adoption of convenient, on-the-go beverage options and the rapid growth of e-commerce platforms boost online sales.

Non-alcoholic drinks are gaining popularity worldwide, especially among millennials. The shift towards a healthier lifestyle affects robust growth in the customer market. People worldwide are becoming more conscious of their food and drinks, comparing products to make the best choices. The harmful consequences of consuming alcohol are being increasingly recognized by individuals, leading them to opt for non-alcoholic beverages instead of wines, beers, spirits, and other alcoholic drinks with various flavors. As consumers become more aware of the benefits associated with non-alcoholic drinks, the adoption rate of these beverages has risen. Consequently, the market for non-alcoholic drinks is primarily driven by the growing demand for such beverages.

The number of restaurants worldwide is also projected to significantly align with the demand for bottled water in the upcoming years. In addition, consumer aspirations for improved physical well-being have led to a preference for beverages devoid of alcohol content. Many nations have enforced restrictions on the sale of alcohol on specific days, in certain locations, and in quantities to control alcohol consumption. Furthermore, many countries have established a minimum legal age for purchasing alcohol and have raised prices and taxes on alcohol to discourage its consumption. In addition, the prohibition of alcohol advertising by some governments has decreased public awareness of alcohol and has led to an increase in demand for non-alcoholic beverages.

Product Insights

Soft drinks dominated the market and accounted for the largest revenue share of 23.9% in 2023 attributed to the continuous innovation in flavors and packaging. In addition, there is a rising trend towards premium and craft soft drinks, as customers are willing to pay a higher price for high-quality and healthy products. Furthermore, various trends, such as macroeconomic factors, also contribute to the growth of the soft drinks market. Moreover, economic development and rising disposable incomes in emerging markets have increased consumer spending on soft drinks, fueling the market growth.

Functional drinks are expected to grow at a CAGR of 6.7% over the forecast period driven by increasing health consciousness among consumers. As individuals prioritize wellness, they seek beverages that offer nutritional benefits, such as vitamins, minerals, and antioxidants. This trend is further fueled by the popularity of natural and organic ingredients, leading to innovations in product offerings such as kombucha and cold-pressed juices. In addition, the demand for beverages that support specific health concerns, such as immunity and energy levels, continues to rise, encouraging manufacturers to expand their functional drink portfolios.

Distribution Channel Insights

Offline distribution channels dominated the market and accounted for the largest revenue share of 80.9% in 2023. This segment includes supermarkets, hypermarkets, internet retailers, and other channels. Supermarkets and hypermarkets provide consumers with various brands and products under one roof, enhancing convenience. In addition, promotional offers and discounts in these retail environments attract price-sensitive consumers. Furthermore, the social aspect of shopping in physical stores allows for impulse purchases, particularly in convenience stores. Moreover, increasing food service outlets, such as cafes and restaurants, further supports offline sales by offering non-alcoholic beverages in social settings.

The online distribution channels are expected to grow at a CAGR of 6.3% over the forecast period, owing to the prevailing trend of online shopping. The increasing consumer inclination towards the ease of purchasing beverages online, particularly in large quantities, plays an important role in driving the expansion of this particular sub-segment. The rise of e-commerce and direct-to-consumer (DTC) channels has become significant catalysts for growth in the worldwide soft drinks industry. As online shopping gains more grip and convenience, soft drink manufacturers adjust their distribution methods to tap into the digital consumer market. Furthermore, online platforms have simplified the process for consumers to purchase a diverse range of soft drinks from their residences.

Regional Insights

North America non-alcoholic drinks market dominated the global market and accounted for the largest revenue share of 34.0% in 2023. North America is known for being one of the largest markets for soft drinks. This region offers various soft drink options, including carbonated soft drinks (CSDs), bottled water, fruit juices, energy drinks, and more. While the consumption of traditional CSDs has remained relatively steady, there is a noticeable shift towards healthier alternatives.

U.S. Non-alcoholic Drinks Market Trends

The non-alcoholic drinks market in the U.S. is expected to grow significantly over the forecast period. The U.S. is the home to many carbonated soft drink industries, such as The Coca-Cola Company and PepsiCo. Furthermore, the market demand surges for packaged beverages and foods, and there is a huge demand for carbonated soft drinks among youth. Functional beverages, flavored water, and low-sugar options are becoming increasingly popular due to the growing concerns about health and wellness. As a result, the consumption pattern and continuous rise influenced the high market demand for non-alcoholic drinks.

Asia Pacific Non-alcoholic Drinks Market Trends

Asia Pacific non-alcoholic drinks market is anticipated to grow at a CAGR of 6.8% over the projected period. This growth is driven by a rapidly expanding population with increasing disposable incomes, which enhances consumer spending on diverse beverage options. Urbanization trends lead to lifestyle changes, fostering a demand for convenient, on-the-go drinks. Furthermore, rising health awareness encourages consumers to opt for healthier alternatives, such as functional beverages. Cultural diversity in the region also promotes innovation, allowing brands to tailor products to local tastes and preferences, further stimulating market growth.

China Non-alcoholic Drinks Market Trends

China non-alcoholic drinks market is expected to grow significantly owing to its sizable and expanding population, which serves as a significant consumer market with a wide range of preferences and tastes. This has led to a considerable demand for non-alcoholic drinks. In addition, the region's growing disposable incomes and urbanization have contributed to increased consumer spending on beverages, further fueling market growth. A growing number of Chinese consumers are choosing non-alcoholic drinks as a more health-conscious option compared to conventional sugary and alcoholic drinks. This inclination is especially prominent among the younger demographic, who actively pursue beverages that complement their aspiration for a well-rounded and nourishing diet.

Europe Non-alcoholic Drinks Market Trends

Europe non-alcoholic drinks market is expected to witnesssubstantial growth owing to the region’s diverse and well-established soft drinks market, which encompasses many countries with varying consumer preferences and regulatory landscapes. In addition, the rising demand for low-calorie and low-sugar options, along with the popularity of plant-based beverages, enhances market expansion. Furthermore, innovative product offerings and effective marketing strategies targeting younger demographics contribute significantly to this growth. The convenience of purchasing through supermarkets and online platforms also supports the rising sales of non-alcoholic drinks across the region.

UK Non-alcoholic Drinks Market Trends

The non-alcoholic drinks market in the UK is expected to witness significant growth over the forecast period. This growth is expected to be driven by the shift towards healthier choices. In addition, the embrace of innovative flavors and diverse product offerings caters to a multicultural population. Furthermore, sustainability concerns drive the shift towards eco-friendly packaging and organic ingredients, while the rise of social media marketing effectively engages younger demographics, enhancing brand visibility and consumer interest in non-alcoholic drinks.

Key Non-alcoholic Drinks Company Insights

Some of the key companies in the global non-alcoholic drinks marketinclude PepsiCo, Inc.; The Coca-Cola Company.; Danone S.A.; Starbucks Coffee Company; Nestle S.A.; Parle Agro; Suntory Beverages & Food Ltd.; Keurig Dr Pepper Inc.; Red Bull Inc.; Unilever

-

PepsiCo Inc. is a global food and beverage company renowned for its extensive range of non-alcoholic drinks. Established in 1965 through the merger of Pepsi-Cola and Frito-Lay, the company manufactures popular soft drinks such as Pepsi, Mountain Dew, and Gatorade alongside bottled water brands such as Aquafina. PepsiCo's diverse portfolio also includes juices and flavored beverages, making it a significant player in the non-alcoholic beverage market across over 200 countries.

-

Parle Agro is an Indian beverage company that specializes in non-alcoholic drinks. Established in 1985, the company has been at the forefront of creating innovative products and iconic brands. Parle Agro's portfolio includes popular non-alcoholic beverages such as Frooti, Appy, Appy Fizz, and B-Fizz. The company also manufactures and markets dairy products under the Smoodh brand. With over 5,500 employees and a strong presence across India, Parle Agro continues to shape the non-alcoholic beverage market, focusing on quality and innovation.

Key Non-Alcoholic Drinks Companies:

The following are the leading companies in the non-alcoholic drinks market. These companies collectively hold the largest market share and dictate industry trends.

- PepsiCo, Inc.

- The Coca-Cola Company.

- Danone S.A.

- Starbucks Coffee Company

- Nestle S.A.

- Parle Agro

- Suntory Beverages & Food Ltd.

- Keurig Dr Pepper Inc.

- Red Bull GmbH.

- Unilever

Recent Developments

-

In June 2024, Coca-Cola India introduced a new line of affordable sparkling beverages packaged in 100% recycled PET (rPET) bottles. This initiative aims to promote sustainability and reduce plastic waste. The new packaging will be smaller, making it more accessible to consumers. This move aligns with Coca-Cola's global commitment to using sustainable materials and enhancing the circular economy in the beverage industry.

-

In April 2024, Starbucks launched a new line of "spicy" beverages, featuring Spicy Cream Cold Foam and Spicy Lemonade Refreshers inspired by the increasing trend of sweet and spicy flavors. The Refreshers come in three tropical flavors: Spicy Pineapple, Spicy Strawberry, and Spicy Dragonfruit. They blend sweetness with zesty lemonade and a unique chili powder blend. Available in U.S. stores starting April 16, these limited-time offerings aim to captivate customers looking for bold flavor combinations this spring.

Global Non-alcoholic Drinks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.54 trillion

Revenue forecast in 2030

USD 2.18 trillion

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channels, region

Regional scope

North America, Europe, Asia Pacific, Latin America

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Brazil

Key companies profiled

PepsiCo, Inc.; The Coca-Cola Company.; Danone S.A.; Starbucks Coffee Company; Nestle S.A.; Parle Agro; Suntory Beverages & Food Ltd.; Keurig Dr Pepper Inc.; Red Bull Inc.; Unilever

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-alcoholic Drinks Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-alcoholic drinks market report based on product, distribution, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Soft Drinks

-

Bottled Water

-

Tea & Coffee

-

Juice

-

Dairy Drinks

-

Functional Drinks

-

Others

-

-

Distribution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.