- Home

- »

- Consumer F&B

- »

-

Soft Drinks Market Size & Share Report, 2028GVR Report cover

![Soft Drinks Market Size, Share & Trends Report]()

Soft Drinks Market (2022 - 2028) Size, Share & Trends Analysis Report By Product (Carbonated, Non-carbonated), By Distribution Channel (Hypermarkets And Supermarkets, Convenience Store, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-924-8

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Soft Drinks Market Summary

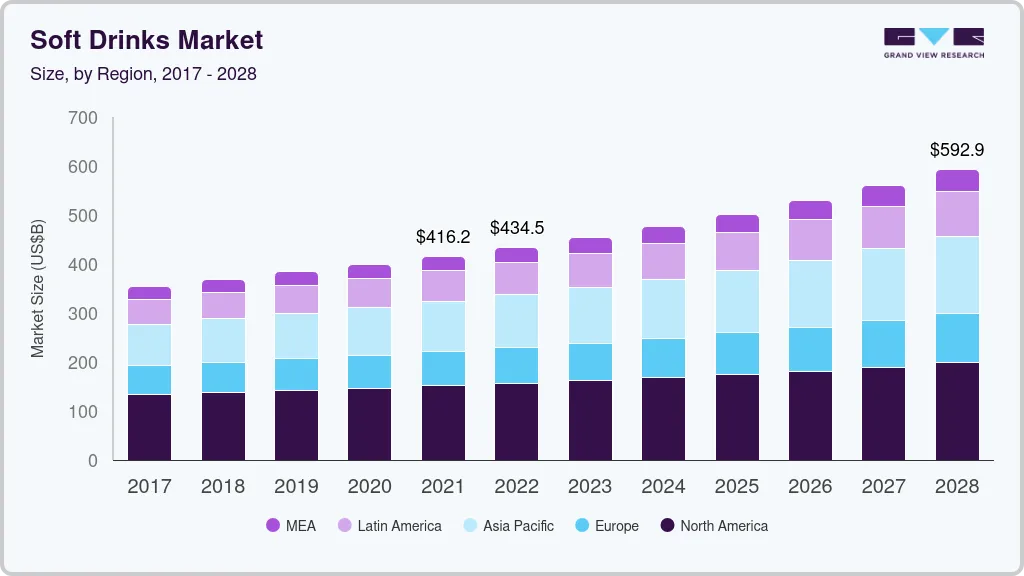

The global soft drinks market size was valued at USD 416.19 Billion in 2021 and is projected to reach USD 592.86 billion by 2028, growing at a CAGR of 5.2% from 2022 to 2028. Rising disposal incomes, changing lifestyle, and a growing population is expected to promote market growth over the next few years.

Key Market Trends & Insights

- North America contributed the largest market share of above 35% in 2021 and is forecasted to witness a CAGR of 4.0% from 2022 to 2028.

- Asia Pacific is forecasted to register the highest CAGR of 6.2% from 2022 to 2028.

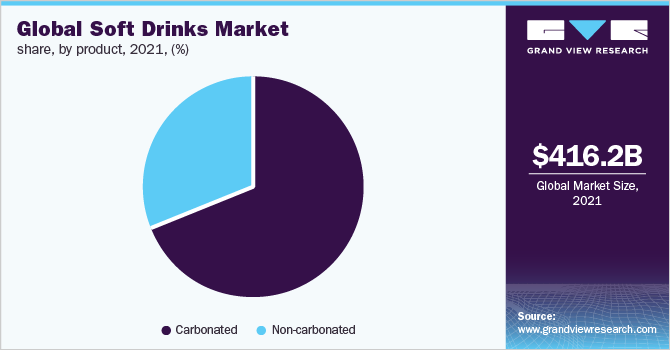

- Based on product, the carbonated segment contributed to the largest revenue share of around 70% in 2021 and is forecasted to expand with a CAGR of 4.3% from 2022 to 2028.

- Based on distribution channel, the hypermarkets and supermarkets segment contributed the largest market share of around 40% in 2021 and is estimated to expand at a CAGR of 3.9% from 2022 to 2028.

Market Size & Forecast

- 2021 Market Size: USD 416.19 Billion

- 2028 Projected Market Size: USD 592.86 Billion

- CAGR (2022-2028): 5.2%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

The growing demand for clean-label, gluten-free, low-calorie, and low-carb products drives the global soft drinks market. Additionally, rising popularity among the millennials and increasing investments in R&D in the food and beverage sector are expected to drive the industry demand.

During COVID-19 pandemic and lockdown situation, governments of various countries restricted or citizens prefer to stay at home as a precautionary measure. Various festivals, sports events, exhibitions, and other public events were cancelled across the world. Due to this complete production as well as supply chains were distressed. Due to the disturbed supply chains and reduced demand, the market experienced a shortfall in sales. Considering this short slack in market revenue is likely to observe a healthy market growth rate during the forecast period after COVID-19 restrictions.

Beverages are liquid food that can be consumed by citizens for hydration or as a source of energy. Different type of drinks is available in the market that satisfies the demand of the citizens. Soft drinks are made from flavors, sweetening agents, and edible acids. Soft drinks are broadly categorized as carbonated and non-carbonated which contain energy and sports drinks, soda, Ready-To-Drink (RTD), flavored water, and diet beverages. Considering public health, Food and Drug Administration (FDA) ensures guidelines and ensures soft drinks are safe for the citizens.

Soft drinks can be served cold, above ice cubes, or at normal temperature. They are accessible in several container formats, such as cans, glass bottles, as well as plastic bottles. Containers are available in different sizes, varying from small bottles to large containers. Lesser amounts of alcohol may exist in a soft drink, however, the alcohol content must be less than 0.5% of the overall volume of the drink in numerous countries. Moreover, soft drinks are extensively accessible at dedicated soda stores, restaurants, convenience stores, movie theatres, vending machines, casual dining restaurants, and bars with soda fountain machines.

The top three global soft drinks market players are Coca-Cola, PepsiCo, and Cadbury Schweppes. In the U.S., The Coca-Cola Company is the global leading company in the carbonated soft drinks market, which accounts for nearly 48% share of the total market's volume. In India, the major soft drink companies are Coca-Cola and Pepsi. This industry is largely dependent on the manufacture of quality bottles as well as drinking packs which are utilized to maintain the products fresh for a long period of time.

The soft drink market is increasing rapidly owing to continued attention on health and comfort. Soft drinks are the element of a balanced diet as well as a healthy lifestyle as they comprise health elements such as vitamins and calcium. Pure juice, bottled water, smoothies, dairy drinks, and fruit drinks, continue to drive development. Large opportunities for soft drinks producers are offered by augmented demand for functionality, like blood-pressure-reducing and also cholesterol-lowering drinks. The customers select soft drinks that suit their lifestyle, tastes, nutritional requirements, and physiological constraints.

Product Insights

The carbonated segment contributed to the largest revenue share of around 70% in 2021 and is forecasted to expand with a CAGR of 4.3% from 2022 to 2028. Carbonated drinks are more popular thus capturing more market revenue. The products are continually being improved and innovated to create something for everyone. The ingredients such as flavors, sugar, coloring agents, and sweeteners generate the taste and provide coolness for every sip. Moreover, manufacturing technology such as mass production lines and improved packaging systems are contributing to the market revenue.

The non-carbonated segment is expected to register the highest CAGR of 6.9% from 2022 to 2028. Non-carbonated drinks do not undergo the carbonation process thus, are healthier than carbonated. These drinks are pasteurized to protect them from spoilage during the manufacturing process. Considering the health benefits, this segment is expected to grow during the forecast period.

Distribution Channel Insights

Hypermarkets and supermarkets distribution channels contributed the largest market share of around 40% in 2021 and is estimated to expand at a CAGR of 3.9% from 2022 to 2028. Supermarkets and hypermarkets are a type of organized channel that offers more customer-oriented services by selling a variety of FMGC products directly to the consumers. These stores provide a choice of physical verification of products to the buyers and contribute to the market revenue.

The online distribution channel is forecast to expand with a higher CAGR of 7.1 from 2022 to 2028. An increasing trend among consumers regarding online shopping portals and mobile apps for shopping due to simplicity and convenience. Products are available at economic rates via online channels compared to offline. End-users choose and believe the brands, those who manufacture and check the quality of products. Moreover, end-users choose the most believed shopping portals or mobile apps to purchase.

Regional Insights

North America contributed the largest market share of above 35% in 2021 and is forecasted to witness a CAGR of 4.0% from 2022 to 2028. Early adoption and well-developed economic countries including the U.S. and Canada are positively contributing to the market revenue. The growing demand for soft drinks is supported by the increasing production of drinks and investments in developing manufacturing assembly lines and packaging technology. The presence of globally known brands such as PepsiCo and Coca-Cola in this region will drive the industry demand.

Asia Pacific is forecasted to register the highest CAGR of 6.2% from 2022 to 2028. Countries such as China, and India are positively contributing to the market revenue. Japan is also projected to account for major sales volume, while revenue from the market in China is projected to register the fastest CAGR. Increasing disposal income of citizens, an increasing number of food processing units, and huge consumption by a growing population are expected to drive the growth rate of the market.

Key Companies & Market Share Insights

The market is characterized by the presence of various well-established players and several small and medium players. The soft drink companies are mainly focused on constant innovation and development of the quality of elements used; manufacturing methods, packaging & associated materials, and marketing to improve sales. In January 2020, Coca-Cola expanded its 2 new sugar-free products to its PowerAde for Athletes. Top players such as Sprite have started to concentrate on introducing improved and rebranded products that have minor sugar content, are condensed at least by 50%, and comprise mixtures of sugar, acesulfame, as well as aspartame. Such initiatives are expected to boost the adoption rate of the products among consumers. The soft drink extractors are aggressively following the organic as well as inorganic strategies to expand their footprints across the geography. Some of the prominent players in the global soft drinks market include:

-

Pepsico, Inc.

-

Nestlé

-

The Coca-Cola Company

-

Keurig Dr Pepper Inc (KDP)

-

Red Bull GmbH

-

Unilever PLC

-

Monster Energy Company

-

Appalachian Brewing Company

-

ITO EN INC.

-

AriZona Beverages USA LLC

Soft Drinks Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 434.50 billion

Revenue forecast in 2028

USD 592.86 billion

Growth rate

CAGR of 5.2% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; France, U.K.; China, India; Brazil; South Africa

Key companies profiled

Pepsico, Inc.; Nestlé; The Coca-Cola Company; Keurig Dr Pepper Inc (KDP); Red Bull GmbH; Unilever PLC; Monster Energy Company; Appalachian Brewing Company; ITO EN INC.; and AriZona Beverages USA LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the soft drinks market on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Carbonated

-

Non-carbonated

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Hypermarkets and Supermarkets

-

Convenience Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global soft drinks market size was estimated at USD 416.19 billion in 2021 and is expected to reach USD 434.50 billion in 2022.

b. The global soft drinks market is expected to grow at a compound annual growth rate of 5.2% from 2022 to 2028 to reach USD 592.86 billion by 2028.

b. North America dominated the soft drinks market with a share of 36.30% in 2021. This is attributable to rising popularity among the millennials and increasing investments in R&D in the food and beverage sector.

b. Some key players operating in the soft drinks market include Pepsico, Inc.; Nestlé; The Coca-Cola Company; Keurig Dr Pepper Inc (KDP); Red Bull GmbH; Unilever PLC; Monster Energy Company; Appalachian Brewing Company; ITO EN INC.; and AriZona Beverages USA LLC.

b. Key factors that are driving the soft drinks market growth include rising disposable incomes, changing lifestyles, along with increasing trends among consumers regarding online shopping portals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.