- Home

- »

- Consumer F&B

- »

-

Functional Drinks Market Size & Share, Industry Report 2030GVR Report cover

![Functional Drinks Market Size, Share & Trends Report]()

Functional Drinks Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Sports Drinks, Energy Drinks & Shots, Nutraceutical Drinks), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-415-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Functional Drinks Market Summary

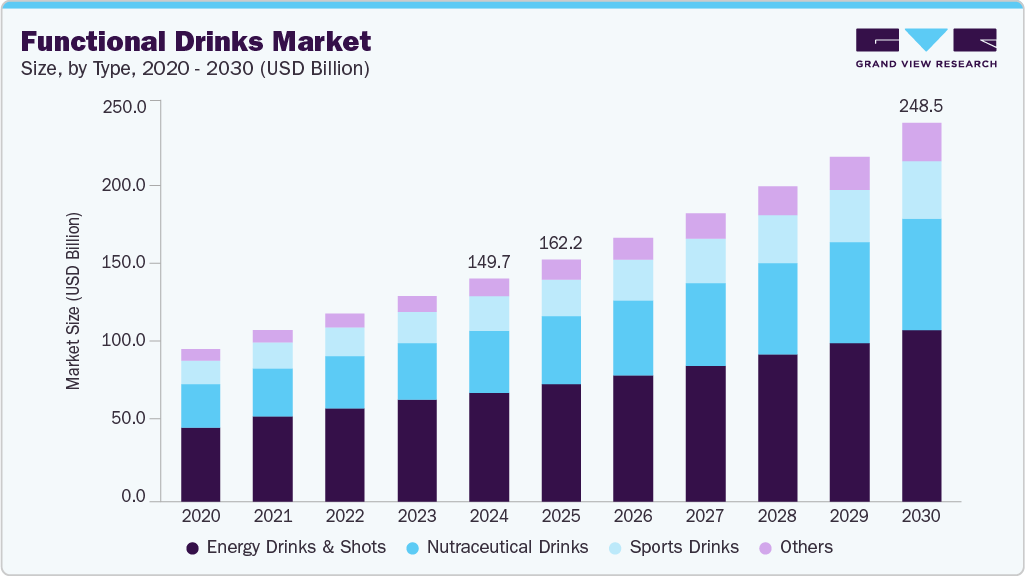

The global functional drinks market size was estimated at USD 149.75 billion in 2024 and is projected to reach USD 248.51 billion by 2030, growing at a CAGR of 8.9% from 2025 to 2030. Increasing awareness regarding the health benefits of consuming functional drinks, enriched with health-enhancing ingredients, including amino acids, vitamins, and minerals, among others, is a major driver boosting the growth of the functional drinks industry.

Key Market Trends & Insights

- The North America functional drinks market registered a high revenue share of 37.6% in 2024.

- The United States functional drinks market is significantly influenced by health trends among millennial consumers, a preference for convenience, and continuous product innovation.

- By type, energy drinks segment dominated the market with the highest revenue share of 53.1% in 2024.

- By distribution channel, the hypermarket and supermarket segment dominated the global market with a market share of 40.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 149.75 Billion

- 2030 Projected Market Size: USD 248.51 Billion

- CAGR (2025-2030): 8.9%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

In addition, dynamic marketing campaigns and innovative product launches by major players in the market are expected to fuel market growth during the forecast period. Recent product innovations are enabling the introduction of numerous new flavors, coupled with ease of consumption, further driving up product demand. Furthermore, increasing healthcare costs, trends toward disease prevention, and the inclination toward maintaining a healthy lifestyle are some of the main factors propelling the market. According to a consumer survey conducted by Matter Communications in 2024, 44% of the surveyed consumers in the U.S. are more inclined towards incorporating healthier soda, enhanced water, and sparkling beverages in their daily routine. These functional drinks offer various health benefits such as promoting gut health and boosting intake of macro and micronutrients.Functional drinks help improve a variety of body functions, including heart rate management, digestive health, the immune system, and weight management. They also help improve bone health, vision and eye health, mental energy, and cholesterol levels owing to the presence of various ingredients such as raw fruits and vegetables, amino acids, vitamins, and minerals. The consumption of healthy drinks that contain essential nutrients to address different health issues is becoming more prevalent among consumers, thus promoting the growth of the functional drinks industry.

Growing demand for lactose-free and plant-based drinks among consumers, owing to the rising adoption of various diets such as keto and vegan, is driving the product demand. Furthermore, the growth of organic, non-GMO, and clean-label products is impacting consumer buying behavior. Thus, the demand for functional drinks is anticipated to increase due to consumer preferences for such drinks over carbonated beverages.

Ready-to-drink (RTD) beverages are gaining traction as consumers are inclined to maintain good health while keeping pace with their busy lifestyles. Products such as functional juices, functional sparkling water, functional sodas, and functional teas have become popular because of the rise in the consumption of nutritious and healthy drinks on the go. In addition, nootropic drinks are becoming consumed by consumers who are concerned about maintaining mental health.

Type Insights

The global functional drinks market is segmented into sports drinks, energy drinks, and nutraceutical drinks based on type. Energy drinks dominated the market with the highest revenue share of 53.1% in 2024. The main ingredients used in energy drinks are caffeine, which provides stimulation, and taurine, which is vital for skeletal muscle development and cardiovascular function. Energy drinks are a preferred functional drink type in western countries such as the U.S. and Canada due to their high caffeine content. Sports drinks are more common in developing nations due to the increasing popularity of physical and sports activities. For instance, Red Bull continues to innovate its limited-edition energy drink editions. In April 2025, it launched sugar-free Summer Edition White Peach flavor to attract younger consumers with a fresh taste.

Sports drinks are estimated to grow at a significant CAGR during the forecast period. The factors contributing to the segment growth include the rising trend of fitness & healthy lifestyle, an increasing number of fitness centers and gyms, and increasing commercialization of sports events in countries such as China and India. Sports drinks provides instant energy boosts and physical and mental stimulation and prove useful for reviving energy during high-intensity sports activities. Gatorade highlights “all-day hydration” for active people, and Coca-Cola’s Powerade brand emphasizes supporting athletes’ physical and mental well-being.

Distribution Channel Insights

The global functional drinks market is segmented into hypermarkets/supermarkets, specialty stores, online, and others based on the distribution channel. The hypermarket and supermarket segment dominated the global market with a market share of 40.7% in 2024. Hypermarkets and supermarkets offer a wide selection of functional drinks and attractive marketing schemes to attract buyers. Offering multiple brands (sports, energy, fortified waters) in one place encourages purchase. Globally, large retailers such as Walmart, Carrefour, and Tesco are the main sales channels for functional drinks due to their extensive shelf space and variety. High customer traffic and promotions in these stores drive significant sales. Health food stores, pharmacies, and gym/nutrition shops serve niche, health-focused customers seeking expert advice or premium options.

An online distribution channel is anticipated to have the highest expansion rate during the forecast period of 2025-2030. The increasing use of online platforms and the availability of user-friendly shopping applications for buying daily essentials are driving demand for online sales of functional drinks. Convenience and cost-effectiveness, coupled with busy lifestyles and a growing number of working women in developing nations, are promoting the use of online distribution channels. Besides, rising internet access in rural areas and high online shopping adoption among young adults and working individuals contribute to this growth. Companies have started to offer their functional beverages through their websites and platforms such as Amazon, often providing subscription services or online-exclusive options. For instance, Gatorade expanded beyond its core offerings by selling electrolyte tablets and powders through e-commerce, giving fitness enthusiasts convenient access.

Regional Insights

The North America functional drinks market registered a high revenue share of 37.6% in 2024. The major factor driving the sales of fortified plant-based drinks and energy drinks is the rising prevalence of cardiovascular issues, arthritis, and osteoporosis, coupled with the increasing demand for convenience beverages and consumers' changing lifestyles. A strong emphasis on health and fitness among consumers is a key driver for the demand for sports drinks, energy drinks, and vitamin-enhanced waters. This market is supported by a robust sports culture, encompassing both scholastic and professional levels, alongside a significant fitness industry. The well-established retail infrastructure and high levels of disposable income in the region further contribute to market growth. For instance, BodyArmor's recent expansion into Canada in 2024 capitalized on a comparable consumer preference for premium sports beverages observed in the United States.

U.S. Functional Drinks Market Trends

The United States functional drinks market is significantly influenced by health trends among millennial consumers, a preference for convenience, and continuous product innovation. American consumers demand various products, including ready-to-drink protein shakes and specialized energy drinks. Notably, there is substantial interest in formulations targeting cognitive function and immune system health. For instance, in 2023, PepsiCo's collaboration with Celsius, a fitness energy drink, achieved sales of USD 1 billion in the U.S. In addition, in February 2025, Coca-Cola introduced Simply Pop, a prebiotic soda, which launched and focused on digestive health. These trends highlight the importance of functional benefits, such as digestive health, and innovation in packaging formats, including convenient pods, tablets, and online subscription services, which are gaining prominence.

Europe Functional Drinks Market Trends

The European functional drinks market is expected to grow at a significant rate over the forecast period. The regional market operates under strict regulations concerning health claims and sugar content, alongside strong consumer interest in gut health, immunity, and sustainability. Government-led nutrition policies and increasing demand for transparent product labeling mainly drive the market. For instance, European Regulation (EC) No 1924/2006 requires scientific evidence and authorization for any health or nutrition claims on food products, protecting consumers from unsubstantiated statements.

Many European consumers actively focus on their health, showing a preference for probiotic and natural products. The European market for functional drinks also exhibits trends in sports nutrition, such as Nestlé's collaboration with UEFA, and an increasing adoption of plant-based options. The European functional drinks market is driven by health-conscious and environmentally aware consumers looking for functional benefits and sustainable attributes in their beverage selections.

Asia Pacific Functional Drinks Market Trends

Asia Pacific is expected to grow at the highest CAGR of 10.2% from 2025 to 2030. According to the International Diabetes Federation, in 2024, China had the highest number of diabetic people (141.0 million), followed by India with more than 74.0 million adults. Therefore, major players such as Coca-Cola and PepsiCo are focusing on removing artificial ingredients and lowering the sugar content in their beverage products, as well as developing new functional drinks for the health-conscious consumers in the region. Furthermore, rapid urbanization, increasing middle-class incomes, and a long-standing cultural focus on preventive healthcare, including herbal ingredients, are driving the market. The region's expansion is propelled by modern lifestyles and traditional health practices, making it the world's fastest-growing functional drinks market. In addition, there is a rapid expansion in plant-based and lactose-free alternatives driven by dietary preferences. For instance, in April 2025, Otsuka's significant investment in the region, including the opening of its first Pocari Sweat bottling plant in Vietnam, aimed at meeting the demand for its well-known hydration beverage in a tropical climate.

China Functional Drinks Market Trends

China represents the most rapidly expanding functional drinks market worldwide, with an exceptionally high rate of new product introductions. Chinese consumers' fast-paced urban lifestyles are a significant driver of the demand for convenient energy and health-focused beverages. In addition, a cultural emphasis on traditional remedies contributes to the popularity of functional teas and herbal drinks, alongside substantial investment in developing novel formulations.

According to China daily new functional beverage launches in China experienced a remarkable increase of 58.5% between 2022 and 2023, significantly exceeding the global average. Manufacturers are engaged in intense competition. For instance, in December 2023, Nestlé launched N3 milk, specifically for the Chinese market, utilizing an innovative process to convert lactose into prebiotic fiber to support healthy aging. This product addresses the Chinese population's needs for bone and muscle health in the context of an aging demographic and relatively low dairy consumption.

Key Functional Drinks Company Insights

The global market is highly competitive with many international and regional players. Major companies enter into strategic partnerships, mergers & acquisitions, and joint ventures to gain a competitive edge in the market. In addition, manufacturers focus on capacity expansions and research & development for new product development to offer trending products to consumers.

-

Swiss multinational Nestlé, one of the largest food and beverage company, has a strong position in health and nutrition, including various functional drinks. Its focus on nutrition science R&D allows for specialized products like N3 prebiotic milk. Nestlé's "Nutrition, Health and Wellness" strategy uses innovations like probiotics and plant proteins to meet functional drink trends.

-

The Coca-Cola Company, headquartered in Atlanta, has broadened its focus beyond soft drinks into functional and hydration categories. Its product range includes sports drinks, Powerade, energy drinks through distribution and proprietary brands, vitamin-enhanced waters, and newer offerings like prebiotic sodas and caffeinated waters. Coca-Cola's key advantages are its extensive global distribution network, strong marketing capabilities, and efficiency in scaling up new product lines.

Key Functional Drinks Companies:

The following are the leading companies in the functional drinks market. These companies collectively hold the largest market share and dictate industry trends.

- The Coca-Cola Company

- Monster Energy Company

- PepsiCo

- Red Bull

- Otsuka Holdings Co., Ltd.

- SUNTORY HOLDINGS LIMITED.

- Danone S.A.

- Nestlé

Recent Developments

-

In April 2025, Red Bull introduced its Summer Edition White Peach energy drink, available with and without sugar. This limited-edition product features a white peach flavor with subtle notes of citrus and floral elements, targeting consumers looking for refreshing and functional drinks during the summer.

-

In March 2025, PepsiCo announced the acquisition of Poppi, a rapidly expanding prebiotic soda company, for USD 1.95 billion. This strategic transaction is intended to enhance PepsiCo's position within the functional beverage sector, specifically targeting the gut health category.

-

In February 2025, Coca-Cola launched Simply Pop, a new prebiotic soda line under the Simply brand. The product line features five flavors: Citrus Punch, Fruit Punch, Lime, Pineapple Mango, and Strawberry. Each soda contains six grams of prebiotic fiber, Vitamin C, and Zinc to support the immune system.

-

In September 2024, Danone introduced the Actimel+ Triple Action range across 20 European countries to commemorate Actimel’s 30th anniversary. This new yogurt drink is fortified with vitamins D and B6 to support immune function, vitamin C for its antioxidant properties, and magnesium to help reduce tiredness and fatigue.

Functional Drinks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 162.21 billion

Revenue forecast in 2030

USD 248.51 billion

Growth Rate

CAGR of 8.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

The Coca-Cola Company; Monster Energy Company; PepsiCo; Red Bull; Otsuka Holdings Co., Ltd.; SUNTORY HOLDINGS LIMITED; Danone S.A.; Nestlé.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Functional Drinks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels along with provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global functional drinks market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Energy Drinks & Shots

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Nutraceutical Drinks

-

Probiotic beverages

-

Dairy-based Probiotic Beverages

-

Plant-based Probiotic Beverages

-

Kombucha

-

Probiotic Juices

-

Others

-

-

Functional Water

-

Vitamin Water

-

Protein Water

-

Electrolyte water

-

CBD-infused Water

-

Others

-

-

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global functional drinks market size was estimated at USD 204.8 billion in 2022 and is expected to reach USD 220.6 billion in 2023.

b. The global functional drinks market is expected to grow at a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 353.4 billion by 2030.

b. Asia Pacific dominated the functional drinks market with a share of 36.06% in 2022. This is attributable to the rapidly growing consumption of herbal infused beverages along with rising awareness regarding health and fitness in developing economies.

b. Some key players operating in the functional foods market include The Coca-Cola Company, Monster Beverage Corporation, PepsiCo, Red Bull GmbH, Otsuka Holdings Co., Ltd, Suntory Group, Danone SA, and Nestlé.

b. Key factors that are driving the market growth include increasing demand for nutritional and fortified beverages is anticipated to drive the growth. Furthermore, increasing demand for sports nutrition in developed economies is also propelling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.