- Home

- »

- Consumer F&B

- »

-

Plant-based Beverages Market Size & Share Report, 2030GVR Report cover

![Plant-based Beverages Market Size, Share & Trends Report]()

Plant-based Beverages Market Size, Share & Trends Analysis Report By Type (Coconut, Soy, Almond), By Product (Plain, Flavored), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-194-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global plant-based beverages market size was valued at USD 26.80 billion in 2022 and will expand further at a compound annual growth rate (CAGR) of 13.1% from 2023 to 2030. Plant-based beverages, such as milk and smoothies, are witnessing high demand owing to their health benefits, nutritional properties, and least contribution to the global carbon footprint. These beverages are not only consumed by health-conscious people but also by lactose-intolerant consumers. The increasing trend of veganism is also promoting the demand for plant-based beverages across the globe. According to a research study conducted by British Nutrition Foundation (BNF) in January 2021, younger consumers aged between 18 and 40 years are more likely to choose a plant-based diet and are the primary promoter of plant-based beverage trends across the globe.

The COVID-19 pandemic has generated a lot of opportunities for manufacturers as consumers have become more conscious of their health. Consumers emphasize immunity improvement in simple and nutritious vegetarian and plant-based foods and beverages. Key players capitalized on the early growing trend of immunity-boosting drinks and launched innovative products to gain the maximum market share during the pandemic.

For instance, in March 2020, Asahi Group Holdings launched a plant-based version of its Calpis milk drink in Japan. With increasing awareness regarding global warming as well as animal cruelty, people have been restricting their consumption of all products, including meat, eggs, milk, and any milk by-products, such as butter and cheese.

These consumer trends are expanding the industry's scope for plant-based beverages. Shifting inclination toward vegan and vegetarian diets, particularly among millennials, coupled with an increased number of healthier alternatives available in the market, is expected to boost product sales in near future.

For instance, in January 2021 Nescafé launched a line of vegan flat white latte pods in the U.K, available in almond, oat, and coconut variations. Increasing health concerns have also compelled consumers to shift their preference to vegan foods and beverages. The vegan population is significantly increasing.

The prevalence of lactose intolerance and other food-related allergies among children and adults has changed the food preferences of consumers in recent years. According to data provided by the National Institute of Diabetes and Digestive and Kidney Diseases, in 2020, on average, 65% of the world’s population was reported to be lactose intolerant. Key players are launching new products to increase customer penetration across the globe. For instance, in July 2020, Vita Coco, a renowned New York-based brand of coconut water, launched a new line of functional coconut water with MCT in the spring of 2021.

Vita Coco Boosted is a blend of coconut cream, coconut water, coconut MCT oil, vitamin B, and tea extract for a refreshing and energy-filled experience for consumers and is available in three flavors, vanilla latte, coconut chocolate, and chai. Such trends and industry initiatives are anticipated to boost product sales across the globe over the forecast period. In recent years, e-commerce has become increasingly popular among consumers owing to the availability of a wide range of plant-based foods and beverages from across the globe. In addition, the platform serves as a wide and efficient distribution network, thereby encouraging several manufacturers to sell their products through online channels.

For instance, in January 2021, according to an exclusive interview with Koita, a Dubai-situated dairy, and non-dairy manufacturer, the firm is aggressively expanding in the U.S. with a new website and distributor. The company is aiming to expand its customer reach through e-commerce. As per company data, Koita has witnessed 57.0% growth in overall sales of its products in the U.S. despite the COVID-19 pandemic. It has also witnessed a 370% surge in its year-on-year sales through e-commerce during 2020.

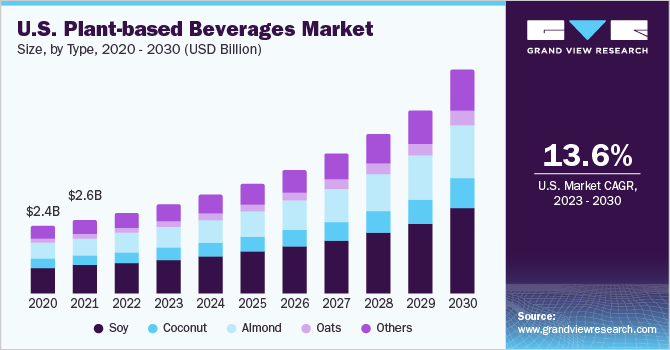

By Type

The soy beverage led the industry in 2022 and accounted for the maximum share of 38.4% of the overall revenue. Soy milk is being widely consumed across the globe as it has similar benefits as dairy-based milk. It is also used by bakers and confectioners. In addition, it is a good source of protein, vitamin A, vitamin B-12, potassium, and isoflavones. It is also considered the best alternative for lactose-intolerant consumers. Manufacturers are promoting their plant-based beverages and other products to cater to the increasing demand. The coconut beverages are expected to register the fastest CAGR from 2023 to 2030.

These products are highly nutritious and offer numerous health benefits. However, high lipid and saturated fat content in coconuts are limiting their demand, particularly among consumers suffering from cardiovascular ailments and hypertension. Consumption of coconut beverages is higher in the Asia Pacific and South America regions as compared to North America and Europe. Moreover, leading beverage companies are launching coconut-based products. For instance, in July 2022, Vita Coco, a New York-based brand of coconut water, launched its first Ready-To-Drink (RTD) juice.

Product Insights

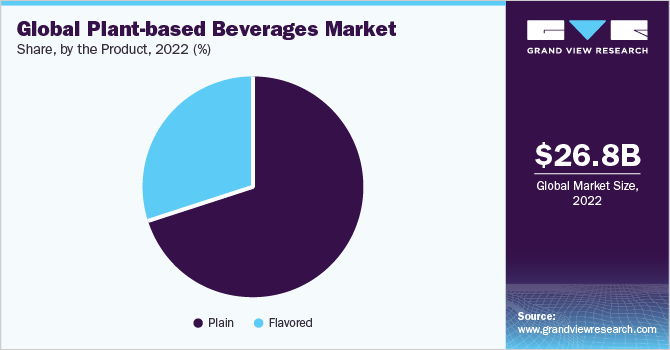

The plain beverages segment led the global industry in 2022 and accounted for the maximum share of more than 70.3% of the overall revenue. The segment is expected to maintain its leading position throughout the forecast period. Most consumers prefer unflavored or plain plant-based beverages as a direct replacement for dairy milk. Several drinks have their unique flavor profiles, which depend on the base of the beverage, such as almond, coconut, oats, and nuts flavors. In several drinks, these flavors are perceived as a desirable quality attribute. New product launches by key players are likely to favor overall segment growth. For instance, in November 2020, Calia Farms launched a vegan oat drink in the U.K., made with whole rolled oats, without any sugar.

The flavored beverages segment is expected to register the fastest CAGR from 2023 to 2030. The steady development of such products has led to the introduction of several flavored beverages in the market. Presently, these products are available in strawberry, French vanilla, coconut, berry, chocolate, banana, coconut, hazelnut, and several other flavors. Manufacturers are introducing and combining several flavors to stimulate the adoption of beverages in different applications, such as smoothies, protein shakes, yogurt drinks, and other beverages with favorite inclusions. An increasing number of developments and product launches are expected to drive segment growth over the forecast period.

Regional Insights

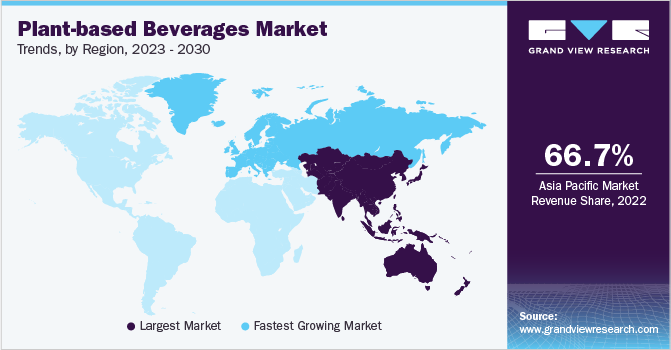

Asia Pacific held the largest share of more than 66.7% of the overall revenue in 2022. The increasing vegan population in the region, especially millennials’ inclination toward plant-based, natural, and healthy foods and beverages, is likely to fuel the product demand in the region. Countries, such as China, India, and Thailand, have been adopting a healthy lifestyle by opting for healthy food options According to a United Nations Food and Agriculture Organization (FAO) report 2020, India has a population of 1.2 billion, and vegetarians make a majority of 44%, which is around 500 million, and out of which 1% are strict vegans, i.e., approximately 5 million people.

Such factors are likely to contribute to regional market growth. On the other hand, Europe is estimated to register the fastest CAGR from 2023 to 2030. The growing adoption of highly nutritious plant-based beverages by consumers, along with expected amendments in governing laws to support plant-based beverages, is expected to drive the region’s growth during the forecast period. Product launches by key players in countries, such as Germany, the U.K., and Spain, are driving the regional market. For instance, in September 2020, Nestlé launched a new variety of Nesquik in Europe. This RTD combines oats, peas, and cocoa.

Key Companies & Market Share Insights

Key players face intense competition from each other as some of them are among the top manufacturers. These companies have large customer bases in both regional and international markets as they have strong and vast distribution networks, which help them reach a larger customer base:

-

In June 2021, Plant Veda, a Vancouver-based dairy-alternative company, announced the launch of a new line of vegan lassi (an Indian yogurt drink) from cashews and real fruits. This product is free of cane sugar and contains gut-healthy probiotics.

-

In February 2021, Heartbest Foods, a Mexican food tech company, launched its plant-based milk nationwide. This plant-based milk is available in plain and quinoa flavors. The product is also available in a sugar-free option.

-

In July 2020, Starbucks Canada expanded its non-dairy options by launching oat beverages as its latest plant-based offering. The growing adoption of plain plant-based milk in several drinks is anticipated to boost the sales of plant-based beverages over the forecast period.

Some of the key players operating in the global plant-based beverages market include:

-

Danone S.A.

-

Pacific Foods of Oregon, LLC

-

Blue Diamond Growers, Inc.

-

SunOpta

-

The Hain Celestial Group, Inc.

-

Noumi Ltd.

-

Califia Farms, LLC

-

Harmless Harvest

-

Koia

-

Vitasoy International Holdings Ltd.

Plant-based Beverages Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 29.59 billion

Revenue forecast in 2030

USD 71.83 billion

Growth rate

CAGR of 13.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, brand share analysis, and trends

Segments covered

Type, product, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada; Mexico, U.K.; Germany, France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Danone S.A.; Pacific Foods of Oregon, LLC; Blue Diamond Growers Inc.; SunOpta; The Hain Celestial Group, Inc.; Noumi Ltd.; Califia Farms, LLC; Harmless Harvest; Koia; Vitasoy International Holdings Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant-based Beverages Market Report Segmentation

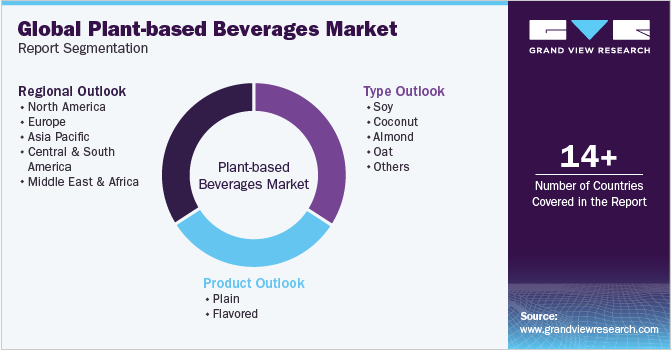

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the plant-based beverages market on the basis of type, product, and region.

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Soy

-

Coconut

-

Almond

-

Oat

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Plain

-

Flavored

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plant-based beverages market size was estimated at USD 26.80 billion in 2022 and is expected to reach USD 29.59 billion in 2023.

b. The global plant-based beverages market is expected to grow at a compound annual growth rate of 13.1% from 2023 to 2030 to reach USD 71.83 billion by 2030.

b. The Asia Pacific dominated the plant-based beverages market with a share of 66.73%% in 2022. This is attributable to the increasing vegan population in the region, especially the millennials’ inclination toward plant-based, natural, and healthy foods and beverages.

b. Some key players operating in the plant-based beverages market include Danone S.A., Califia Farms, Vitasoy International Holdings Limited, and Blue Diamond Growers

b. Key factors that are driving the plant-based beverages market growth include increasing health concerns that have compelled consumers to shift their preference to vegan food & beverages and increasing lactose intolerance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."