- Home

- »

- Consumer F&B

- »

-

Coconut Water Market Size & Share, Industry Report, 2030GVR Report cover

![Coconut Water Market Size, Share & Trends Report]()

Coconut Water Market (2025 - 2030) Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Packaging (Tetra Pack, Plastic Bottle, Cans, Pouches, Glass), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-167-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coconut Water Market Summary

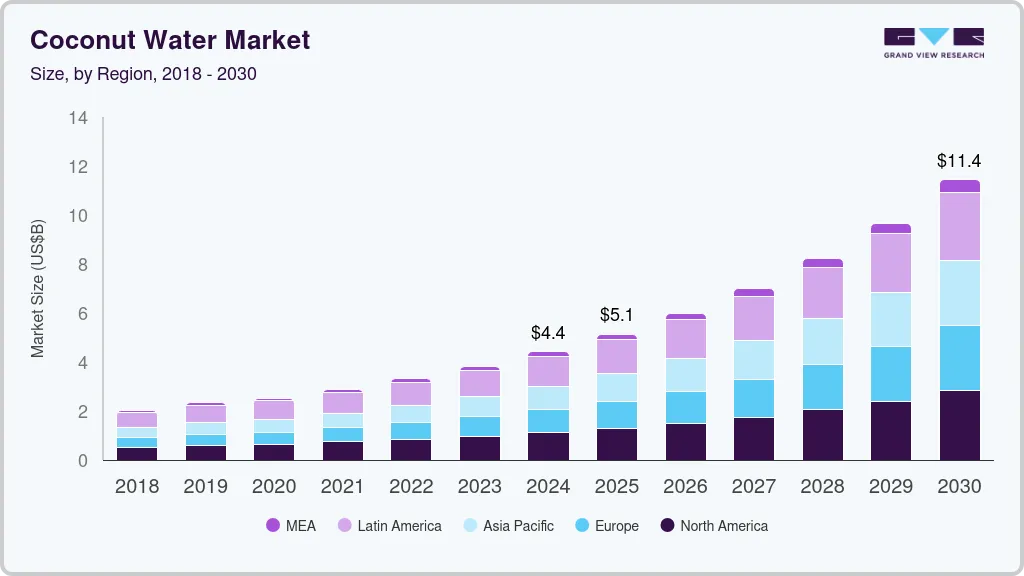

The global coconut water market size was estimated at USD 4.43 billion in 2024 and is projected to reach USD 11.43 billion by 2030, growing at a CAGR of 17.3% from 2025 to 2030. Coconut water, often promoted for its electrolyte content and hydrating properties, has emerged as a popular choice among fitness enthusiasts and health-conscious consumers.

Key Market Trends & Insights

- Asia Pacific coconut water market dominated with a revenue share of 33.1% in 2024.

- Based on nature, Conventional segment dominated the industry with the largest revenue share of 81.7% in 2024.

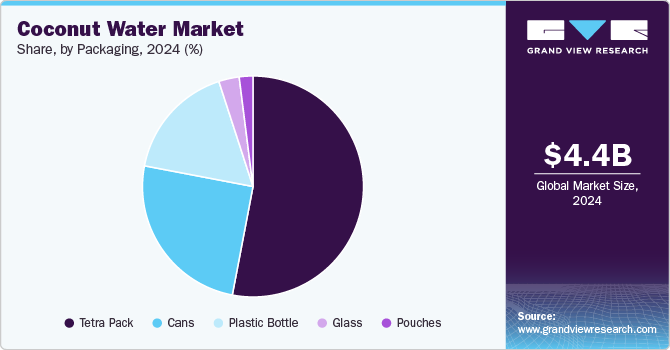

- Based on packaging, Tetra pack segment dominated the industry with the largest revenue share of 52.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.43 Billion

- 2030 Projected Market Size: USD 11.43 Billion

- CAGR (2025-2030): 17.3%

- Asia Pacific: Largest market in 2024

This shift from traditional sugary drinks to natural, functional beverages represents a pivotal trend reshaping the packaged coconut water industry. Moreover, the rising popularity of tropical flavors among consumers and the growing inclination towards plant-based and naturally sourced products ensures a sustainable demand for coconut drinks.The increasing trend of health consciousness among consumers, rising demand for natural and organic beverages, and a growing preference for functional drinks are major factors contributing to the coconut water market growth.

The increasing trend of health consciousness among consumers, rising demand for natural and organic beverages, and a growing preference for functional drinks are major factors contributing to the coconut water market growth. As more individuals seek alternatives to sugary sodas and synthetic energy drinks, coconut water has become popular because of its natural hydrating properties and electrolyte content. Moreover, consumers, particularly millennials and health enthusiasts, are increasingly turning to packaged coconut water for its numerous health benefits, including its ability to aid in hydration, reduce fatigue, and provide essential nutrients. This shift in consumer behavior has propelled packaged coconut water into the spotlight as a favored beverage in the wellness sector, further stimulating market growth.

The fitness revolution has contributed to the demand for ready-to-drink (RTD) coconut water as a popular post-workout drink, positioning it as a natural alternative to traditional sports drinks laden with artificial ingredients. Moreover, the trend of clean labels and transparency in food and beverage sourcing has played a crucial role, prompting brands to emphasize organic and non-GMO certifications, which resonate with eco-conscious consumers. Besides, the convenience of packaged coconut water has contributed to its rising popularity, particularly among busy urban dwellers seeking on-the-go options that fit into their active lifestyles.

As health-conscious consumers seek alternatives to sugary drinks, manufacturers are capitalizing on this trend by launching an array of innovative products and expanding their offerings. Many brands are also tapping into the growing demand for natural and organic beverages, which are perceived as healthier and more sustainable. Moreover, major players are adopting aggressive expansion strategies, including entering new geographic markets and exploring e-commerce channels to increase accessibility. This proliferation of product variety, including flavored coconut water and functional blends enhanced with vitamins and minerals, reflects the market's responsiveness to diverse consumer preferences.

Innovation and technological advancements continue to play a crucial role in shaping the future of the market. Companies are investing in advanced extraction techniques that optimize the retention of nutrients while extending the product's shelf life, addressing concerns about freshness and flavor degradation. Moreover, key players are experimenting with infusions of popular fruits and functional ingredients such as probiotics and vitamins to create unique product offerings that attract diverse consumer segments. Furthermore, advancements in digital technology and data analytics enable brands to gain deeper insights into consumer preferences and market trends, allowing for more targeted marketing strategies and product development.

Nature Insights

Conventional segment dominated the industry with the largest revenue share of 81.7% in 2024 due to its affordability and widespread availability. Conventional coconut water is typically less expensive than organic options, making it more accessible to budget-conscious consumers. This segment benefits from established supply chains and production efficiencies that help keep costs low, allowing for distribution across various retail formats, including supermarkets and convenience stores. For instance, Vita Coco, a U.S.-based coconut water brand, offers a range of conventional coconut water products that are readily available in many grocery chains, appealing to a broad demographic seeking hydration without the premium price associated with organic varieties.

The organic segment is expected to grow at the fastest CAGR of 18.9% over the forecast period due to increasing consumer demand for natural and pesticide-free products. As health consciousness rises, more consumers, particularly millennials and Gen Z, prefer organic options that align with their values of sustainability and transparency in food sourcing. This trend is driven by a growing awareness of the benefits associated with organic products, such as lower chemical residues and higher antioxidant levels.

Packaging Insights

Tetra pack segment dominated the industry with the largest revenue share of 52.7% in 2024, primarily due to its convenience and effectiveness in preserving product quality. Tetra packs are designed to protect the contents from light and air, which helps maintain coconut water's natural flavor and nutritional value for an extended period without the need for preservatives. This packaging is also lightweight and easy to transport, making it ideal for consumers seeking healthy beverages. The combination of practicality, freshness, and consumer preference for ready-to-drink products has solidified the tetra pack's leading position in the market.

The cans segment is expected to grow at the fastest CAGR over the forecast period. Canned coconut water offers convenience and portability, making it an attractive option for consumers with busy lifestyles seeking healthy, on-the-go hydration. In addition, cans provide excellent protection against light and air, which helps preserve the flavor and nutritional quality of the product for longer periods. The lightweight nature of cans also reduces transportation costs, reducing retail prices. Furthermore, the increasing consumer preference for sustainable packaging options drives demand for widely recyclable aluminum cans.

Distribution Channel Insights

Supermarkets & hypermarkets segment dominated the industry with the largest revenue share of 48.0% in 2024 due to their extensive reach and ability to provide a wide variety of products under one roof. These large retail formats offer consumers the convenience of bulk purchasing, competitive pricing, and consistent availability of coconut water brands, which fosters brand loyalty and repeat purchases. In addition, supermarkets and hypermarkets often feature strategic product placements that enhance visibility, encouraging impulse buying among shoppers. This combination of convenience, variety, and competitive pricing significantly contributes to the dominance of this segment in the coconut water industry.

The online segment is expected to grow at the fastest CAGR over the forecast period due to the increasing convenience and accessibility that e-commerce platforms provide. As more consumers turn to online shopping for their grocery needs, they appreciate the ability to purchase coconut water from home, avoiding the hassle of in-store shopping. This trend particularly appeals to health-conscious individuals seeking various options, including organic and flavored coconut waters, which may not be available in local stores. Moreover, online retailers often offer competitive pricing and promotions, encouraging purchases.

Regional Insights

The North America coconut water market is expected to grow significantly over the forecast period due to a notable shift toward healthier lifestyles, with consumers increasingly seeking natural and low-calorie beverage options. Coconut water is perceived as a nutritious alternative to traditional soft drinks and sports drinks, appealing to health-conscious individuals. In addition, the rise of social media and influencer marketing has heightened awareness of coconut water's benefits, driving its popularity among younger demographics. Expanding product offerings, including flavored varieties and organic options, cater to diverse consumer preferences and enhance market appeal. For instance, Harmless Harvest, a U.S.-based company, emphasizes its commitment to sustainable practices, which resonates well with environmentally conscious consumers and enhances demand for sustainable and organic products. This convergence of health trends, innovative marketing, and product diversity positions the North American coconut water market for robust growth.

U.S. Coconut Water Market Trends

The U.S. coconut water market dominated North America, driven by its strong consumer demand for healthy, natural beverage options. This market is characterized by a growing awareness of the health benefits associated with coconut water, such as its hydrating properties and high electrolyte content, which appeal to fitness enthusiasts and health-conscious consumers. In addition, the U.S. has a well-developed retail infrastructure, with widespread availability of coconut water in supermarkets, convenience stores, and online platforms, making it easily accessible. For instance, major retailers in the U.S., such as Walmart and Trader Joe's, prominently feature various coconut water brands, enhancing consumer exposure and encouraging trial purchases. This combination of health trends, extensive distribution networks, and diverse product offerings has solidified the U.S.'s leading position in the North American coconut water market.

Europe Coconut Water Market Trends

Europe's coconut water market is expected to grow at the fastest CAGR of 19.4% over the forecast period due to a significant shift in consumer preferences toward healthier and functional beverages. As European consumers become increasingly health-conscious, there is a rising demand for natural drinks that offer hydration without added sugars or artificial ingredients. This trend is bolstered by the popularity of plant-based diets and the growing interest in low-calorie options that provide nutritional benefits. In addition, innovative marketing strategies and product diversification, such as flavored coconut water and blends with other health-focused ingredients, are attracting a broader audience.

The U.K. coconut water market dominated Europe in 2024, due to its robust consumer demand for health-oriented beverages and well-established retail infrastructure. The increasing awareness of the health benefits of coconut water, such as its natural hydration and electrolyte content, has significantly influenced consumer preferences, leading to higher sales. Furthermore, the U.K. benefits from diverse distribution channels, including supermarkets, health food stores, and online platforms, which enhance product accessibility.

Asia Pacific Coconut Water Market Trends

Asia Pacific coconut water market dominated with a revenue share of 33.1% in 2024, due to the region's extensive coconut production and cultural affinity for coconut-based beverages. Countries such as Thailand, Indonesia, India, and the Philippines are among the largest producers of coconuts globally, ensuring a steady supply of raw materials for coconut water production. This local availability reduces production costs and enhances the freshness and quality of the products offered. In addition, there is a growing consumer awareness of the health benefits associated with coconut water, such as its hydrating properties and natural electrolytes, which appeal to health-conscious individuals. For instance, in Thailand, many enjoy coconut water, a traditional drink, further driving regional demand. The combination of high production capacity and cultural acceptance positions the Asia Pacific as a leader in the coconut water market.

Key Coconut Water Company Insights

Some key players in the coconut water market are PepsiCo, VITA COCO COMPANY, INC., C2O Coconut Water, Celebes Coconut Corporation., Taste Nirvana International, Inc., ZICO Rising, Inc., Goya Foods, Inc., Wichy Plantation Company (Pvt) Ltd, Harmless Harvest, Vaivai SAS and others. The global industry is characterized by intense competition. Major manufacturers in the market are expanding their presence on online retail channels to tap into the growing trend of online shopping. Moreover, these manufacturers are collaborating with influencers, actors, athletes, and other prominent figures for the launch of coconut water products to benefit from the influence and reach of these individuals.

-

PepsiCo has acquired a majority stake in O.N.E. (One Natural Experience), a California-based coconut water company. The company leverages its extensive distribution network and marketing expertise to enhance the visibility and availability of O.N.E.'s products, including various coconut water-based beverages. By establishing strong partnerships with major coconut processors in the Philippines and Indonesia, PepsiCo ensures a reliable supply chain.

-

VITA COCO COMPANY offers diverse flavors and product formats to cater to health-conscious consumers. The company emphasizes sustainability and ethical sourcing, ensuring that its products are made from high-quality coconuts harvested from farms that prioritize environmental stewardship.

Key Coconut Water Companies:

The following are the leading companies in the coconut water market. These companies collectively hold the largest market share and dictate industry trends.

- PepsiCo

- VITA COCO COMPANY, INC.

- C2O Coconut Water

- Celebes Coconut Corporation.

- Taste Nirvana International, Inc.

- ZICO Rising, Inc.

- Goya Foods, Inc.

- Wichy Plantation Company (Pvt) Ltd

- Harmless Harvest

- Vaivai SAS

Recent Developments

-

In April 2023, ITC's B Natural brand launched packaged tender coconut water across India. The company recognizes a shift in consumer preferences toward drinks that promote hydration, as indicated by rising internet search trends over the last three years. With this launch, B Natural aims to make tender coconut water easily accessible while ensuring high quality and taste retention.

-

In June 2022, Vita Coco introduced Vita Coco Coconut Juice, which combines coconut water with bold tropical flavors and is available in two varieties: Original with Pulp and Mango. This product aims to attract new consumers by providing a sweeter option while maintaining the nutritional benefits of coconut water.

Coconut Water Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.14 billion

Revenue forecast in 2030

USD 11.43 billion

Growth Rate

CAGR of 17.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Thailand; Brazil; South Africa

Key companies profiled

PepsiCo; VITA COCO COMPANY, INC.; C2O Coconut Water; Celebes Coconut Corporation.; Taste Nirvana International; Inc.; ZICO Rising, Inc.; Goya Foods, Inc.; Wichy Plantation Company (Pvt) Ltd; Harmless Harvest; Vaivai SAS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coconut Water Market Report Segmentation

This report forecasts revenue growth at global; regional; and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study; Grand View Research has segmented the global coconut water market report based on nature, packaging, distribution channel, and region:

-

Nature Outlook (Revenue; USD Million; 2018 - 2030)

-

Organic

-

Conventional

-

-

Packaging Outlook (Revenue; USD Million; 2018 - 2030)

-

Tetra Pack

-

Plastic Bottle

-

Cans

-

Pouches

-

Glass

-

-

Distribution Channel Outlook (Revenue; USD Million; 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue; USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.