- Home

- »

- Consumer F&B

- »

-

Soy Milk Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Soy Milk Market Size, Share & Trends Report]()

Soy Milk Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Conventional, Organic), By Flavor (Plain/Unflavored, Flavored), By Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-086-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Soy Milk Market Summary

The global soy milk market size was valued at USD 5.51 billion in 2024 and is estimated to reach USD 7.40 billion by 2030, growing at a CAGR of 5.1% from 2025 to 2030. This growth is attributed to several factors, including consumer health consciousness, increased lactose intolerance, and a growing preference for plant-based diets.

Key Market Trends & Insights

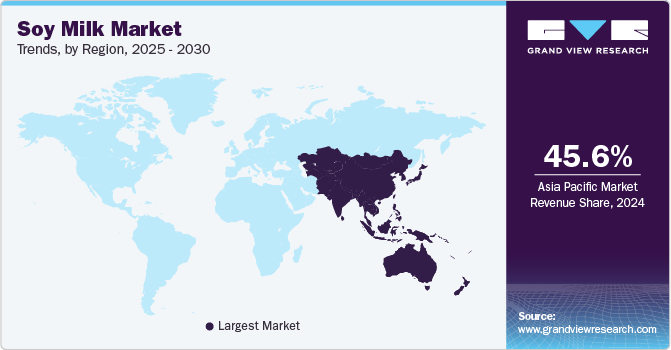

- Asia Pacific soy milk market dominated with the largest revenue share of 45.6% in 2024.

- By product, the conventional segment dominated with the largest revenue share of 86.9% in 2024.

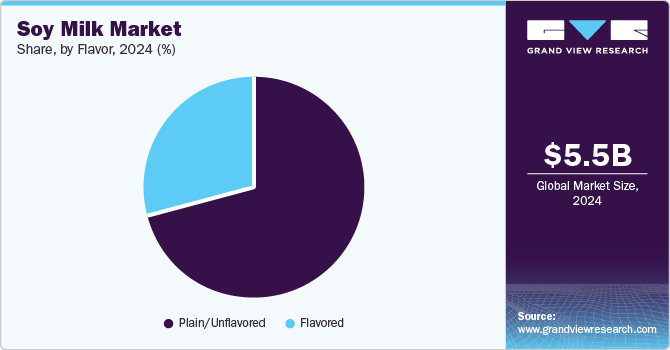

- By flavor, the plain/unflavored segment dominated the industry with the largest revenue share in 2024.

- By type, the unsweetened segment dominated the industry with the largest revenue share in 2024.

- By distribution channel, the supermarkets/hypermarkets segment dominated the industry with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.51 Billion

- 2030 Projected Market Size: USD 7.40 Billion

- CAGR (2025-2030): 5.1%

- Asia Pacific: Largest market in 2024

As more individuals seek alternatives to dairy products, soy milk has become popular due to its nutritional benefits and versatility in various cooking applications.Due to increasing health and wellness awareness, consumers are becoming more informed about the benefits of plant-based diets. These diets are often perceived as healthier than traditional dairy products, which has driven the soy milk industry expansion. Soy milk is low in saturated fat and cholesterol-free, making it an attractive alternative for improving dietary habits. In addition, it is rich in protein and contains essential nutrients, further enhancing its appeal among health-conscious individuals.

The rise in veganism and vegetarianism is another significant factor contributing to the growth of the soy milk industry. People adopt these diets for ethical, environmental, or health reasons, and the demand for plant-based products rises. Soy milk is a staple ingredient in many vegan diets, providing a source of protein and calcium without the animal-derived components found in cow's milk. This shift toward plant-based diets has led manufacturers to innovate and expand their product offerings, catering to diverse consumer preferences.

An instance of this trend can be seen in the increasing availability of flavored soy milk products. Companies are diversifying their product lines to include various flavors, such as vanilla and chocolate, appealing to a broader audience, including children who may prefer sweeter options. This strategy enhances consumer choice and contributes to the overall growth of the soy milk industry as it attracts new customers seeking enjoyable alternatives to traditional dairy products.

Product Insights

The conventional segment dominated the soy milk industry with the largest revenue share of 86.9% in 2024, primarily due to its widespread availability and affordability compared to organic alternatives. Conventional soy milk products are more accessible in supermarkets and grocery stores, making them the preferred choice for many consumers who prioritize convenience and cost-effectiveness. In addition, the perception of conventional soy milk as a reliable source of nutrition contributes to its popularity among health-conscious individuals seeking dairy alternatives. An instance illustrating this trend is the increasing presence of conventional soy milk brands in major retail chains, enhancing consumer access and encouraging trial among new customers.

The organic segment is expected to grow at the highest CAGR over the forecast period due to increasing consumer preference for organic products, which are perceived as healthier and free from synthetic additives. As awareness of the potential health risks associated with pesticides and genetically modified organisms (GMOs) rises, more consumers opt for organic soy milk as a safer alternative. Growing environmental concerns further support this shift, as organic farming practices are often seen as more sustainable. This trend can be observed in manufacturers' recent launch of new organic soy milk products, reflecting consumers' demand for healthier options. For instance, Milkadamia, a plant-based company from Australia, introduced its first USDA organic macadamia nut milk in June 2024, catering to the rising interest in organic plant-based beverages.

Flavor Insights

The plain/unflavored segment dominated the industry with the largest revenue share in 2024 primarily due to its simplicity and versatility, as many individuals prefer plain soy milk as it can be easily incorporated into various recipes, such as smoothies, baking, and cooking, without altering the flavor profile of the dishes. In addition, plain soy milk is often viewed as a healthier option, as it typically contains fewer additives and sugars than flavored varieties. Furthermore, the increasing use of plain soy milk in coffee shops and cafes, commonly offered as a dairy alternative for lattes and other beverages, is growing acceptance and demand as consumers seek healthier drink options.

The chocolate segment is expected to grow at the fastest CAGR over the forecast period due to increasing consumer demand for flavored plant-based beverages that appeal to younger audiences and those seeking alternative options to traditional dairy products. The popularity of chocolate-flavored soy milk is particularly strong among children and adolescents, who often prefer sweeter tastes, making it an attractive choice for parents looking for nutritious yet appealing drink alternatives. This trend is further fueled by effective marketing strategies highlighting soy milk's health benefits while offering enjoyable flavors.

Type Insights

The unsweetened segment dominated the industry with the largest revenue share in 2024. Many individuals opt for unsweetened soy milk as it contains no added sugars, making it a healthier choice for those looking to reduce their sugar intake or manage weight. This trend is particularly strong among health-conscious consumers who prefer products that align with their dietary goals and lifestyle choices.

The sweetened segment is expected to grow at a significant CAGR over the forecast period due to the increasing consumer preference for flavorful and enjoyable plant-based beverages, which are sweeter in taste and particularly appealing for children and younger people. This trend is further supported by the rising demand for convenient and ready-to-drink products that enhance the overall consumer experience.

Distribution Channel Insights

The supermarkets/hypermarkets segment dominated the soy milk industry with the largest revenue share in 2024, primarily due to their extensive reach and convenience in providing a wide variety of soy milk products to consumers. These retail formats offer a one-stop shopping experience, allowing customers to easily access different brands and flavors of soy milk, which enhances visibility and encourages trial among new consumers. In addition, supermarkets and hypermarkets often have proper refrigeration facilities, ensuring that soy milk products are stored under optimal conditions, thereby maintaining quality and freshness.

The online/e-commerce segment is expected to grow at the fastest CAGR over the forecast period due to the increasing ease and accessibility that online shopping offers consumers. As more people turn to digital platforms for their grocery needs, e-commerce provides an efficient way to purchase various soy milk products, including specialty and organic options that may not be available in local stores. This shift is further driven by the growing trend of health-conscious consumers who prefer researching and comparing products online before purchasing.

Regional Insights

The North America soy milk market is expected to grow at a significant CAGR over the forecast period due to the increasing consumption of non-dairy alternatives driven by health consciousness among consumers. As more individuals seek cholesterol-free and plant-based options, soy milk has become popular for those looking to reduce their intake of animal products and improve their overall health. The rising awareness of lactose intolerance and the benefits of plant-based diets further contribute to this trend, making soy milk an appealing alternative to traditional dairy. This trend is further supported by the growing number of grocery stores and supermarkets expanding their plant-based product sections, which increasingly feature a variety of soy milk options.

U.S. Soy Milk Market Trends

The U.S. soy milk market dominated North America, driven by increasing health consciousness among consumers and a growing preference for plant-based alternatives to dairy products. As more Americans become aware of the health benefits associated with soy milk, such as its lower cholesterol content and suitability for lactose-intolerant individuals, the demand for soy milk has surged significantly. Soy milk is often fortified with vitamins and minerals (such as calcium and vitamin D), making it a nutritious alternative for those seeking to enhance their dietary intake. This trend is further supported by the rise in veganism and the availability of a wide range of soy milk products in retail outlets and online platforms.

Asia Pacific Soy Milk Market Trends

Asia Pacific soy milk market dominated with the largest revenue share of 45.6% in 2024, primarily due to the region's long-standing cultural acceptance of soy products and the increasing shift toward plant-based diets. Furthermore, the growing concerns about environmental sustainability and animal welfare motivate consumers to choose plant-based options over traditional dairy. An instance of this trend is seen in countries such as China and Japan, where soy milk has been a staple for decades, leading to a robust market presence and continuous innovation in flavors and formulations to meet evolving consumer preferences.

China dominated the Asia Pacific soy milk market due to its long-standing cultural acceptance of soy-based products and increasing health consciousness among consumers. Soy has been a staple in Chinese cuisine for centuries, with products such as tofu and soy milk being integral to traditional diets. This long-standing cultural acceptance facilitates the widespread consumption of soy milk. Chinese consumers are increasingly aware of the health benefits associated with soy consumption, including its potential to lower cholesterol levels and reduce the risk of certain diseases, driving demand for soy milk. Beyond being a beverage, soy milk serves as an ingredient in various recipes such as sauces, soups, and baked goods, providing creaminess without dairy.

Europe Soy Milk Market Trends

Europe soy milk market is expected to grow significantly over the forecast period, driven by the rise in the number of vegans and vegetarians across Europe, which has significantly boosted the demand for plant-based alternatives such as soy milk as consumers seek nutritious options that align with their dietary choices. Growing awareness about the health benefits of soy milk, including its high protein content and potential cardiovascular benefits, is influencing consumer preferences toward plant-based diets. Many coffee drinkers use soy milk as a non-dairy creamer option due to its ability to froth well and complement coffee flavors. Certain brands focus on traditional Asian recipes that incorporate soy milk into culturally significant dishes or beverages, enhancing authenticity in European offerings.

Key Soy Milk Company Insights

Some key players in the soy milk market are Eden Foods, Organic Valley, PURE HARVEST SMART FARMS, American Soy Products, Inc., Vitasoy International Holdings Ltd, SunOpta., Pacific Foods, PANOS brands, Sanitarium, and others. These companies prioritize launching innovative products, including organic and flavored soy milk, to meet the diverse preferences of health-conscious consumers. They emphasize sustainable production practices to address environmental concerns and consumer demand for eco-friendly options. In addition, they are expanding into emerging markets to capitalize on the growing trend toward plant-based diets, enhancing their market share and brand visibility.

-

Danone S.A. offers a diverse range of plant-based products, including soy milk, under its well-recognized brands, such as Alpro and Silk. Danone focuses on innovation by developing new flavors and formulations to cater to the growing demand for nutritious and environmentally friendly dairy alternatives.

-

Eden Foods is a prominent organic food company known for its Edensoy line of organic soy milk. Eden Foods emphasizes health and sustainability by offering various organic, kosher, and vegan products. Eden Foods continues to innovate with its soy milk offerings, focusing on clean ingredients and environmental responsibility, which aligns with the growing consumer demand for nutritious and eco-friendly alternatives to dairy.

Key Soy Milk Companies:

The following are the leading companies in the soy milk market. These companies collectively hold the largest market share and dictate industry trends.

- Eden Foods

- Organic Valley

- PURE HARVEST SMART FARMS

- American Soy Products, Inc.

- Vitasoy International Holdings Ltd

- SunOpta.

- Pacific Foods

- PANOS brands

- Sanitarium

- Danone S.A.

Recent Developments

-

In December 2022, Vitasoy International Holdings Ltd launched its new plant-based beverages, Milky Almond and Milky Oat, which are designed to cater to the growing demand for dairy alternatives. These innovative products aim to provide consumers with nutritious and delicious options that align with the increasing trend toward plant-based diets and sustainability.

Soy Milk Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.77 billion

Revenue forecast in 2030

USD 7.40 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; UAE

Key companies profiled

Eden Foods; Organic Valley; PURE HARVEST SMART FARMS; American Soy Products, Inc.; Vitasoy International Holdings Ltd; SunOpta.; Pacific Foods; PANOS brands; Sanitarium; Danone S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soy Milk Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global soy milk market report based on product, flavor, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Plain/Unflavored

-

Flavored

-

Vanilla

-

Chocolate

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Unsweetened

-

Sweetened

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online/E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.