- Home

- »

- Consumer F&B

- »

-

Butter Market Size, Share, Trends & Analysis Report 2028GVR Report cover

![Butter Market Size, Share & Trends Report]()

Butter Market (2022 - 2028) Size, Share & Trends Analysis Report By Product (Cultured Butter, Uncultured Butter), By Distribution Channel (Offline, Online), By Region, And Segment Forecast

- Report ID: GVR-4-68039-941-8

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Butter Market Summary

The global butter market was valued at USD 51.61 billion in 2021 and is projected to reach USD 61.94 billion by 2028, growing at a CAGR of 2.6% from 2022 to 2028. The global market growth is significantly driven by the increasing demand for the product.

Key Market Trends & Insights

- The Asia Pacific region held the largest market share, accounting for share of around 45% of the total market in 2021.

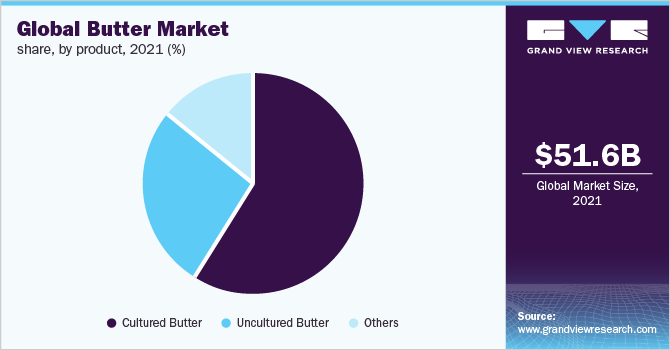

- By product, the cultured butter segment contributed to the largest share of around 60% of the global market revenue in 2021.

- By distribution channel, the offline segment contributed the largest share of the global butter market.

Market Size & Forecast

- 2021 Market Size: USD 51.61 Billion

- 2028 Projected Market Size: USD 61.94 Billion

- CAGR (2022-2028): 2.6%

- Asia Pacific: Largest Market in 2021

- Europe: Fastest growing market

Increasing manufacturing of food products and expansion of the foodservice industry are also expected to boost the market over the forecast period. Increasing consumption of bakery and confectionery products across the world is also expected to facilitate the growth of the product, where the butter is mainly used for tenderness and flavored shortening. Moreover, market growth is also driven by the rising trend of home baking. The home baking trend soared in popularity during the pandemic and is expected to remain strong.

The COVID-19 pandemic resulted in a decline in the growth rate of the butter market. Due to pandemics, as a precaution, various governments across the globe imposed lockdowns and restrictions. This affected the global supply chain, trade, and production of butter. Due to the lockdown, the supply of raw materials to the manufacturing plants also plummeted, decreasing production during the short period. Moreover, the sale of the product through supermarkets, grocery stores, etc. declined due to the lack of customers. However, the market is expected to recover to the pre-pandemic growth scenario over the forecast period, owing to relaxed restrictions, resumed activities, and growth in online delivery.

Technological development and advancement like the IoT in the transportation of butter and other milk products to ensure safe handling is propelling the market growth. However, in the U.S., government agencies such as the U.S. Department of Agriculture (USDA) and the Food and Drug Administration (FDA) have introduced multiple federal regulations and guidelines for butter and related product manufacturers. The published federal guidelines and rules ensure the quality of dairy products up to the hygienic standards for consumption.

The rising health concerns and increasing awareness about the benefits of milk products such as butter among consumers across the globe are major driving factors of the market growth over the forecast period. Butter can be included in moderation as a part of a balanced diet and may even be associated with several health benefits. In addition to this, the rising product introduction of low fat, low calories, and low cholesterol butter products in the global market is leading to consumer reach expanding to a wider group. Health-conscious and fitness enthusiast consumers are now able to consume these low fat, low calories butter, which is expected to accelerate the market growth over the forecast period.

Furthermore, the growing middle-class population coupled with increasing disposable income and urbanization across the globe are supporting the market growth over the forecast period. The rise in consumer purchasing power is expected to increase spending on bakery and confectionery products. Additionally, the continuous development of innovative products and attractive packaging is likely to increase the demand for dairy products in emerging economies.

The market growth is majorly affected by the fluctuating production and prices of raw materials. The fluctuating prices of the raw material are likely to impact the end prices of butter products. For instance, in 2018, drought-affected Europe’s production of milk declined due to limited grass growth, and prices increased. This also affected the production of butter in the European region.

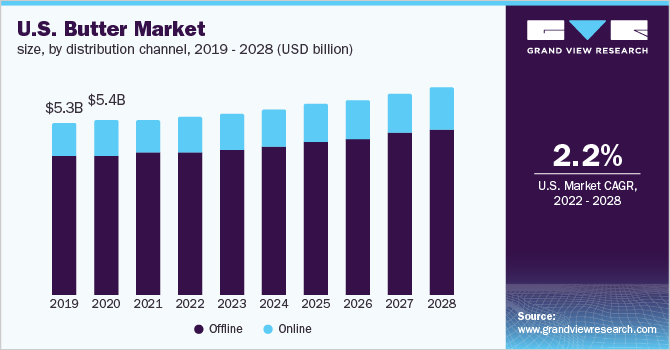

Distribution Channel Insights

By distribution channel, the offline segment contributed the largest share of the global butter market. In 2021, market revenue shares of offline channels accounted for more than 80% of the global butter market. Consumers’ preference for the offline channel for purchasing consumer goods, groceries, as well as dairy products is higher, which is significantly attributable to a higher segmental share. Offline channels enable physical verification of quality and authenticity. Consumers perceive offline channels as more trusty. Moreover, easy access and searching for various milk products through stores is likely to affect consumer behavior and shopping attitude. Additionally, the majority of the retailers sell products via offline channels with widespread availability and a well-established distribution network.

The online segment of the market is anticipated to register the fastest growth with a CAGR of 3.5% from 2022 to 2028. The rising smartphone penetration rate and improved internet connectivity across the globe have led to the significant growth of the e-commerce sector globally, which is propelling the growth of this segment. Manufacturers of these products are increasingly offering products via their own websites and/or on e-commerce platforms. For instance, India-based Amul delivers milk and dairy products via its mobile application which in turn will drive the segment demand.

Product Insights

By product, the cultured butter segment contributed to the largest share of around 60% of the global market revenue in 2021 and is expected to grow at a CAGR of 2.7% from 2022 to 2028. The increasing popularity of the cultured product is expected to propel the growth of the segment over the forecast period. Cultured butter has a more pronounced butter flavor. It is creamier with a slight tang. Moreover, the growing health concerns among the consumers have increased the demand for low calories and low-fat milk products to improve the immune system, which is stimulating the growth of the market.

The uncultured butter segment is expected to grow with the fastest growth rate over the forecast period. In the global butter market, uncultured segment is anticipated to grow at a CAGR of 2.9% from 2022 to 2028. Uncultured butter is derived from fresh, pasteurized cream by a churning process. This uncultured butter has a neutral flavor and unsalted taste and is used widely in baking since it does not alter the end product taste.

The increasing demand for uncultured butter from the bakery and confectionery industry is expected to propel segmental growth. Uncultured butter is widely used in North America. Owing to the increasing popularity of the products outside North America is likely to contribute to the segment’s growth over the forecast period.

Regional Insights

In the global butter market, by region, Asia Pacific accounted for the higher market revenue share. In 2021, Asia Pacific recorded around 45% market revenue share in the global butter market. This is significantly attributed to the higher population, which is contributed mainly by India and China. According to the United Nations data, Asia Pacific is home to over half of the world’s population. A large consumer base and high consumption of fast food, bakery, and other processed food are credited for the higher market share of the Asia Pacific. Moreover, the region is expected to witness promising growth over the forecast period, owing to the expansion of the food processing and manufacturing industry and population growth.

Europe is the fastest-growing butter market in the global market. Over the forecast period, the European region is anticipated to register a CAGR of 2.9% in the global butter market. Changing consumer perception about the consumption of butter is driving the growth of the market. Consumers are returning to butter from margarine and other substitutes and butter consumption is rebounding in the European market. The increasing awareness about the health benefits of consuming butter in this region is propelling the growth of the butter market. Recent studies show that butter consumption might not be as unhealthy as previously believed. Moreover, increasing innovative product launches in the market are expected to drive growth.

Key Companies & Market Share Insights

The global market consists of various established players such as Lactalis International, Fonterra Co-operative Group, Ornua Co-operative Limited, and Organic Valley coupled with local manufacturers. Various manufacturers and suppliers focus on the logistic development and strengthening of the distribution channel to enhance their business. Such initiatives are expected to boost the adoption rate of the product among consumers around the globe. Key players are also focusing on brand improvement, product innovation, and launches to increase revenue and market share. For instance, Land O’Lakes, Inc. introduced new packaging for its butter product in February 2020. The new packaging will mention the phrase “Farmer-Owned” on the front. Some of the key players in the global butter market include:

-

Lactalis International

-

Fonterra Co-operative Group

-

Ornua Co-operative Limited

-

Organic Valley

-

Dairy Farmers of America, Inc.

-

Amul Dairy, Anand

-

Meadow Foods Ltd.

-

Arla Foods amba

-

MS Iceland Dairies

-

Muller

Butter Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 52.59 billion

Revenue forecast in 2028

USD 61.94 billion

Growth Rate

CAGR of 2.6% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Lactalis International; Fonterra Co-operative Group; Ornua Co-operative Limited; Organic Valley; Dairy Farmers of America; Inc.; Amul Dairy; Meadow Foods Ltd.; Arla Foods amba; MS Iceland Dairies; and Müller

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the butter market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Cultured Butter

-

Uncultured Butter

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global butter market size was estimated at USD 51.61 billion in 2021 and is expected to reach USD 52.59 billion in 2022.

b. The global butter market is expected to grow at a compound annual growth rate of 2.6% from 2019 to 2027 to reach USD 61.94 billion by 2028.

b. Asia Pacific dominated the butter market with a share of 43.7% in 2021. This is attributable to rising healthcare awareness and rise in the demand for breakfast food among region.

b. Some key players operating in the butter market include Lactalis International, Fonterra Co-operative Group, Ornua Co-operative Limited, Organic Valley, Dairy Farmers of America, Inc., Amul Dairy, Meadow Foods Ltd., Arla Foods amba, MS Iceland Dairies, and Müller.

b. Key factors that are driving the butter market growth include growing demand for milk products and changing consumer's preferences from meat to milk products for protein enhancement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.