- Home

- »

- Plastics, Polymers & Resins

- »

-

Polymethyl Methacrylate (PMMA) Market Size Report, 2033GVR Report cover

![Polymethyl Methacrylate (PMMA) Market Size, Share & Trends Report]()

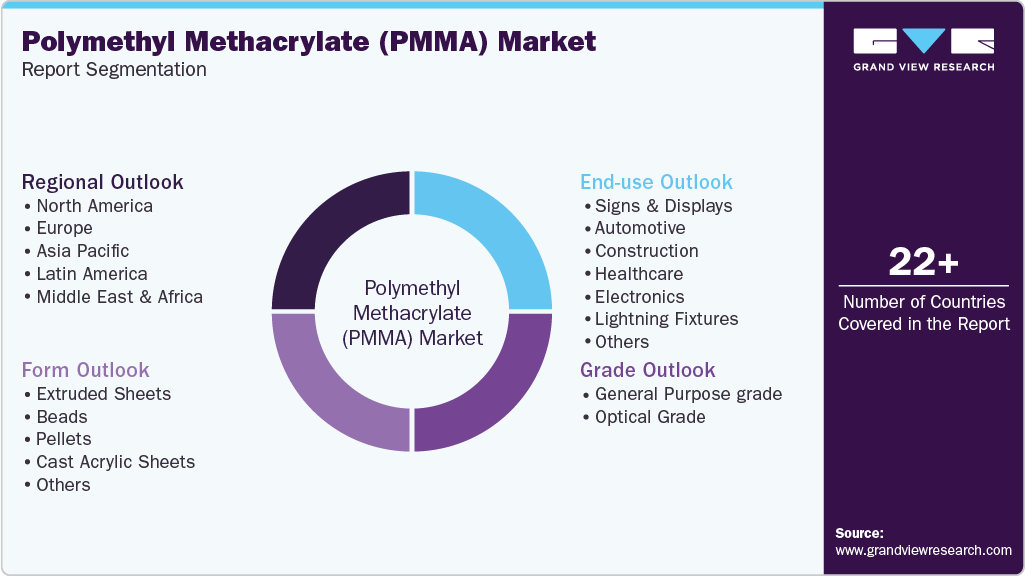

Polymethyl Methacrylate (PMMA) Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Extruded Sheet, Cast Acrylic Sheet, Pellets, Beads), By Grade, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-056-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polymethyl Methacrylate (PMMA) Market Summary

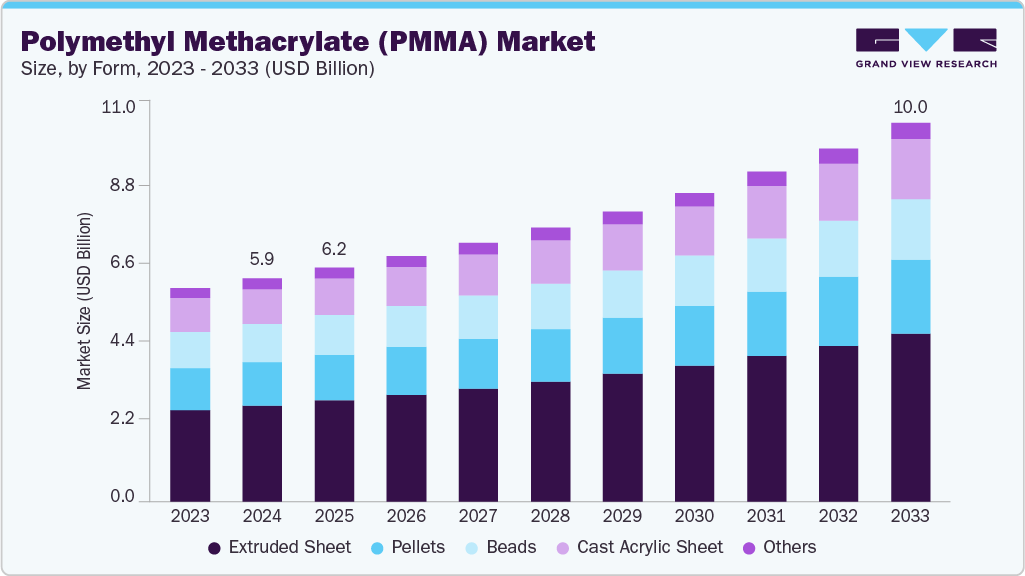

The global polymethyl methacrylate (PMMA) market size was estimated at USD 5.91 billion in 2024 and is projected to reach USD 10.01 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The increasing demand for lighter and more fuel-efficient vehicles in the automobile industry is one of the primary drivers for the growth of PMMA market.

Key Market Trends & Insights

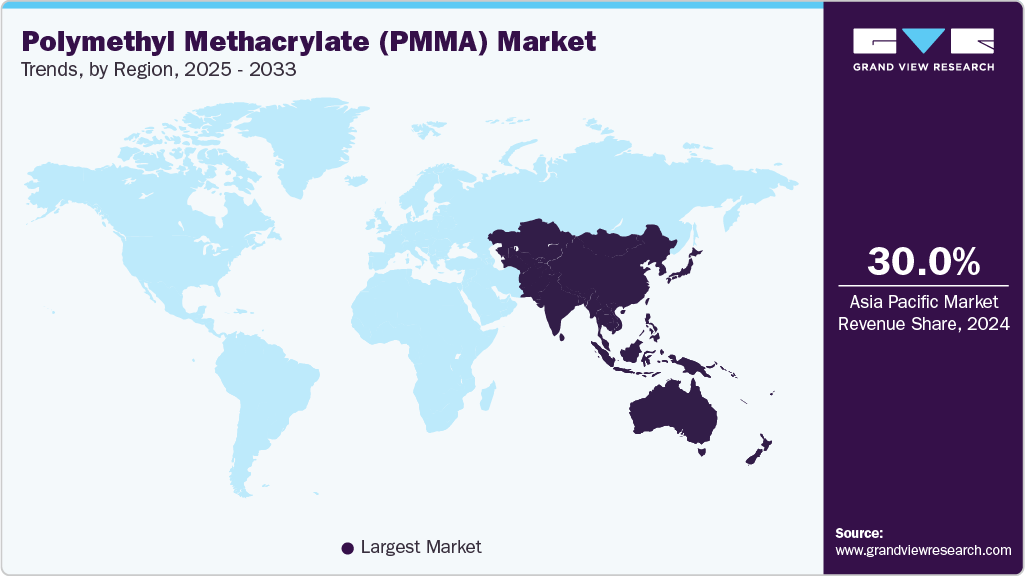

- Asia Pacific dominated the global polymethyl methacrylate (PMMA) market with the largest revenue share of 30.0% in 2024.

- The polymethyl methacrylate (PMMA) market in China accounted for the largest market revenue share in Asia Pacific in 2024.

- By form, the extruded sheet segment is expected to grow at the fastest CAGR of 6.5% from 2025 to 2033.

- By grade, the general purpose grade segment is expected to grow at the fastest CAGR of 6.4% from 2025 to 2033.

- By end use, the automotive segment is expected to grow at the fastest CAGR of 7.2% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 5.91 Billion

- 2033 Projected Market Size: USD 10.01 Billion

- CAGR (2025-2033): 6.2%

- Asia Pacific: Largest market in 2024

The automotive and transportation industries have emerged as key growth drivers for the polymethyl methacrylate (PMMA) industry, primarily due to the increasing adoption of lightweight and durable materials aimed at improving fuel efficiency and design flexibility. PMMA, commonly known as acrylic or acrylic glass, is widely used in headlamps, taillights, dashboards, windshields, and interior trims as a substitute for glass and polycarbonate. Its superior optical clarity, UV resistance, and weatherability make it a preferred choice among automakers seeking materials that combine aesthetics with performance.As global automotive manufacturers transition toward electric vehicles (EVs) and energy-efficient mobility solutions, the demand for PMMA-based components is rising, given the material’s capability to reduce vehicle weight while maintaining safety and visibility standards.

Moreover, the trend toward electric and autonomous vehicles (EVs/AVs) is further accelerating PMMA usage in the transportation sector. PMMA is extensively employed in light-diffusing panels, illuminated logos, display screens, and advanced lighting systems that are integral to EV and AV designs. These applications benefit from PMMA’s high light transmittance and ease of molding into complex geometries, allowing for sleek and futuristic vehicle aesthetics.

The integration of advanced lighting systems, such as LED and OLED technologies, also complements PMMA’s optical properties, reinforcing its relevance in next-generation vehicle designs. As governments globally tighten emission standards and promote vehicle lightweighting through regulatory initiatives, PMMA is positioned as a critical enabler of sustainable automotive manufacturing.

In addition, PMMA’s recyclability and sustainability attributes contribute to its growing acceptance in the automotive industry, which is increasingly focusing on circular economy principles. Leading manufacturers are investing in the development of bio-based and recycled PMMA grades to meet OEM sustainability targets and regional environmental mandates, particularly in Europe and North America.

For instance, initiatives promoting eco-friendly acrylic sheets and resins have gained traction in line with stricter waste management directives. This evolution toward sustainable PMMA formulations is not only helping automakers meet regulatory compliance but also attracting eco-conscious consumers, thereby expanding the material’s market potential.

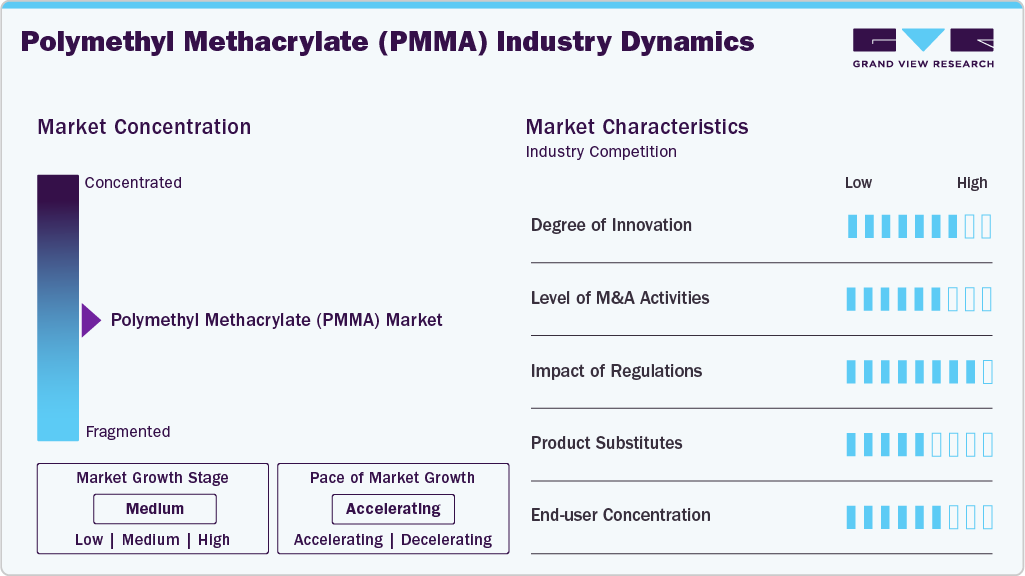

Market Concentration & Characteristics

The polymethyl methacrylate (PMMA) industry exhibits cyclical growth patterns linked to macroeconomic and sectoral trends. Demand tends to fluctuate with the performance of construction and automotive industries, which together account for a substantial portion of global consumption. Regional growth dynamics are also notable, Asia Pacific dominates global production and consumption, driven by robust manufacturing infrastructure in China, Japan, and South Korea, while Europe and North America emphasize innovation and sustainable product development. Regulatory frameworks promoting recyclable and eco-friendly materials further influence industry evolution.

Technological advancement is another defining characteristic of the polymethyl methacrylate (PMMA) industry, particularly in the development of sustainable and high-performance grades. The industry is witnessing a shift toward bio-based PMMA and closed-loop recycling technologies to align with global sustainability goals. Manufacturers are also investing in the enhancement of optical and mechanical properties to expand PMMA’s usability in high-end applications such as LED lighting, electric vehicle components, and smart display technologies. The integration of nanotechnology and advanced polymer blending is further extending the performance boundaries of PMMA, enabling greater durability, scratch resistance, and environmental stability. Continuous R&D and patent innovation play a pivotal role in shaping competitive differentiation and market expansion.

Form Insights

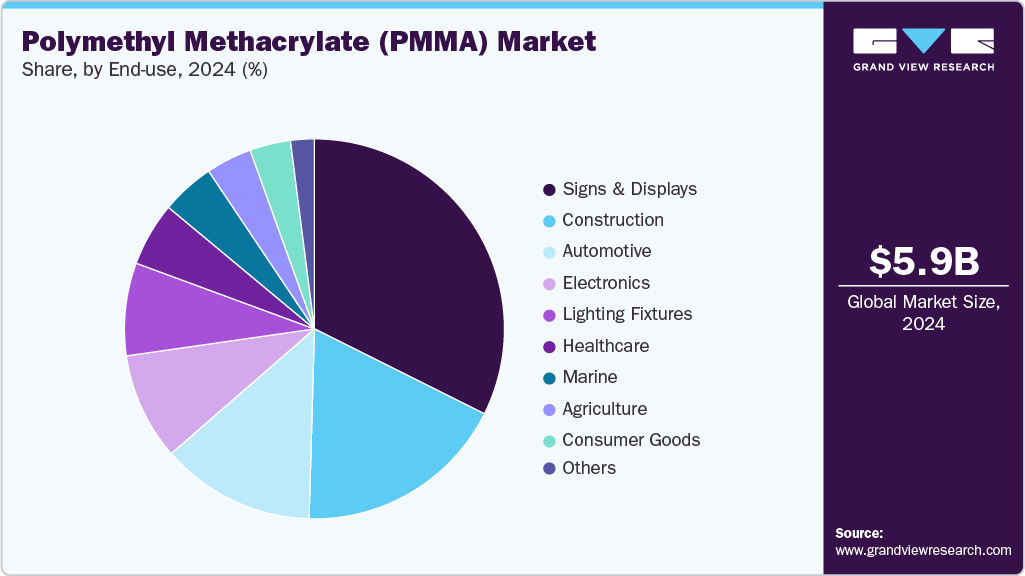

The extruded sheet segment led the market with the largest revenue share of 43.0% in 2024 and is expected to grow at the fastest CAGR of 6.5% over the forecast period 2025-2033. This outlook is due to its widespread use in signage, display panels, lighting fixtures, and protective barriers. Its superior optical clarity, surface uniformity, and cost-effectiveness make it the preferred form of PMMA for large-scale applications. In addition, growing demand from the construction and retail sectors for durable and aesthetically appealing transparent materials continues to strengthen the dominance of extruded PMMA sheets in the market.

The cast acrylic sheet segment anticipated to grow at a significant CAGR during the forecast period, driven by its exceptional optical clarity, surface hardness, and weather resistance. Unlike extruded sheets, cast acrylic offers greater thickness flexibility and superior chemical resistance, making it ideal for aquariums, skylights, sanitary ware, and premium display applications. Its ability to maintain dimensional stability and visual quality under varying environmental conditions continues to support its demand across architectural and high-end industrial uses.

Grade Insights

The general-purpose grade segment led the market with the largest revenue share of 60.0% in 2024 and is projected to grow at the fastest CAGR of 6.4% during the forecast period. This dominance is attributed to its versatility, cost-effectiveness, and balanced performance across a wide range of applications, including signage, lighting, automotive components, and construction materials. The increasing adoption of PMMA in everyday products requiring optical transparency, UV resistance, and durability continues to drive strong growth in this segment globally.

The optical grade segment is anticipated to grow at a significant CAGR during the forecast period, driven by its superior light transmission, low haze, and excellent surface finish. It is extensively used in optical lenses, LED light covers, display screens, and automotive lighting systems, where high clarity and precision are critical. The growing demand for high-performance optical materials in electronics and automotive applications continues to fuel the expansion of this segment, supported by advancements in precision molding and optical-grade PMMA formulations.

End Use Insights

The signs & displays segment led the market with the largest revenue share of 32.0% in 2024, driven by the extensive use of PMMA sheets in advertising panels, illuminated signage, point-of-sale displays, and retail branding applications. PMMA’s superior light diffusion, weather resistance, and surface gloss make it an ideal material for both indoor and outdoor display solutions. The rapid expansion of the retail and advertising sectors, coupled with increasing demand for visually appealing and durable promotional materials, continues to reinforce the dominance of this segment in the polymethyl methacrylate (PMMA) industry.

The automotive segment is projected to grow at the fastest CAGR of 7.2% during the forecast period, driven by the rising adoption of lightweight and durable materials aimed at improving fuel efficiency and design flexibility. PMMA is increasingly used in headlights, taillights, interior trims, and glazing applications due to its excellent optical clarity, surface hardness, and weather resistance. The growing production of electric and autonomous vehicles, along with the trend toward aesthetic vehicle design and energy efficiency, is expected to further accelerate the use of PMMA in the automotive sector.

Regional Insights

The polymethyl methacrylate (PMMA) market in North America held a significant share in 2024, supported by strong demand from the automotive, construction, and medical device industries. The region’s focus on sustainable materials, advanced manufacturing technologies, and high-quality optical applications has driven the adoption of PMMA across diverse end uses. In addition, the growing presence of electric vehicle production, architectural glazing projects, and healthcare innovations continues to boost PMMA consumption. Ongoing R&D investments and regulatory emphasis on recyclable and bio-based polymers are further expected to strengthen North America’s market growth over the forecast period.

U.S. Polymethyl Methacrylate Market Trends

The polymethyl methacrylate (PMMA) market in the U.S. dominated the North American PMMA market in 2024, driven by strong demand from the automotive, construction, and electronics industries. The country’s advanced manufacturing infrastructure and growing focus on lightweight, energy-efficient materials have accelerated PMMA adoption in applications such as vehicle lighting systems, architectural glazing, and LED displays. Moreover, increasing investments in sustainable polymer innovation and the expansion of medical and consumer electronics sectors are expected to further strengthen the U.S. position as a key contributor to regional market growth over the forecast period.

Asia Pacific Polymethyl Methacrylate Market Trends

Asia Pacific dominated the polymethyl methacrylate (PMMA) market with the largest revenue share of 30.0% in 2024 and is expected to grow at the fastest CAGR of 6.9% during the forecast period. The region’s leadership is driven by rapid industrialization, strong manufacturing capabilities, and expanding end-use industries such as automotive, construction, electronics, and signage. Countries like China, Japan, South Korea, and India are major contributors, supported by rising infrastructure investments, growing consumer electronics production, and increasing demand for lightweight materials in transportation and packaging applications.

The polymethyl methacrylate (PMMA) market in Chinaaccounted for the largest market revenue share in Asia Pacific in 2024, driven by its robust manufacturing base and high consumption across automotive, construction, and electronics sectors. The country’s strong presence in LED lighting, display panels, and consumer electronics production continues to fuel demand for optical-grade PMMA. In addition, rapid urbanization and infrastructure expansion, coupled with increasing adoption of lightweight and energy-efficient materials, are expected to keep China at the forefront of regional market growth throughout the forecast period.

Europe Polymethyl Methacrylate Market Trends

The polymethyl methacrylate (PMMA) market in Europe is anticipated to grow at a significant CAGR during the forecast period. The region’s emphasis on sustainability, circular economy principles, and high-performance materials has driven the adoption of recyclable and bio-based PMMA grades. Countries such as Germany, France, and the UK are key contributors, benefiting from advanced manufacturing capabilities and the presence of leading PMMA producers such as Röhm GmbH and Trinseo. In addition, growing applications in LED lighting, solar panels, and architectural design continue to reinforce Europe’s position as a technologically advanced and environmentally conscious market for PMMA.

Key Polymethyl Methacrylate (PMMA) Company Insights

The competitive environment of the polymethyl methacrylate (PMMA) industry is characterized by moderate consolidation and high technological differentiation, with a few global players dominating resin production and a wide base of regional converters and compounders serving localized demand. Major companies such as Mitsubishi Chemical Group, Röhm GmbH, Chi Mei Corporation, Trinseo, and Sumitomo Chemical hold significant market shares through strong vertical integration, extensive product portfolios, and global distribution networks.

Competition is primarily driven by innovation in bio-based and recycled PMMA grades, product quality, and optical performance enhancements, alongside cost optimization strategies. While entry barriers remain high due to capital-intensive production and proprietary polymerization technologies, regional manufacturers in Asia-Pacific continue to intensify competition by offering cost-effective extruded and cast sheet solutions. Strategic alliances, R&D collaborations, and capacity expansions are increasingly shaping the market landscape as players aim to strengthen their sustainability credentials and meet rising global demand across automotive, electronics, and construction applications.

Key Polymethyl Methacrylate (PMMA) Companies:

The following are the leading companies in the polymethyl methacrylate (PMMA) market. These companies collectively hold the largest market share and dictate industry trends.

- Dymatic chemicals, Inc.

- SK Geo Centric Co. Ltd.

- LG Chem

- Mitsubishi Chemical Group

- CHIMEI

- Asahi Kasei Corporation

- SABIC

- LOTTE Chemical CORPORATION

- Röhm GmbH

- Trinseo

- Sumitomo Chemical Co., Ltd.

Recent Developments

-

In December 2024, NEXTCHEM (MAIRE) signed a toll manufacturing agreement with Röhm to advance the chemical recycling of polymethyl methacrylate (PMMA) at MyRemono’s industrial-scale facility. This partnership leverages NEXTCHEM’s proprietary NXRe PMMA technology to enable efficient and sustainable recycling processes, supporting circular economy initiatives in the plastics industry.

-

In June 2024, Trinseo launched its PMMA depolymerization facility in Rho, Italy, advancing its circular economy strategy. Using EU-backed MMAtwo technology, the plant converts pre- and post-consumer PMMA waste into high-purity recycled MMA (rMMA), equivalent in quality to virgin material. This innovation enables recycling of previously hard-to-recycle PMMA types and supports sustainable production across mobility, construction, and consumer goods, aligning with Trinseo’s 2030 sustainability goals.

-

In February 2024, Röhm expanded its global PMMA capacity with a new energy-efficient production line and colored PMMA compounding facility in Worms, Germany, reducing its carbon footprint and supporting sustainability goals. The company also upgraded its Wallingford (U.S.) and Shanghai (China) plants to boost output and serve global markets. With facilities across Asia, Europe, and North America, Röhm reinforces its leadership in PLEXIGLAS molding compounds and advances its goal to become the world’s leading methacrylate producer.

Polymethyl Methacrylate (PMMA) Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.19 billion

Revenue forecast in 2033

USD 10.01 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Form, grade, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; and the Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Southeast Asia; Brazil; Argentina; GCC Countries; South Africa

Key companies profiled

Dymatic Chemicals, Inc.; SK Geo Centric Co. Ltd.; LG Chem; Mitsubishi Chemical Group; CHIMEI; Asahi Kasei Corporation; SABIC; LOTTE Chemical Corporation; Röhm GmbH; Trinseo; Sumitomo Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polymethyl Methacrylate (PMMA) Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polymethyl methacrylate (PMMA) market report based on form, grade, end use, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Extruded Sheets

-

Beads

-

Pellets

-

Cast Acrylic Sheets

-

Others

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

General Purpose grade

-

Optical Grade

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Signs & Displays

-

Automotive

-

Construction

-

Healthcare

-

Electronics

-

Lightning Fixtures

-

Marine

-

Agriculture

-

Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.