- Home

- »

- Clinical Diagnostics

- »

-

Real-time PCR, Digital PCR, And End-point PCR Market Report 2030GVR Report cover

![Real-time PCR, Digital PCR, And End-point PCR Market Size, Share & Trends Report]()

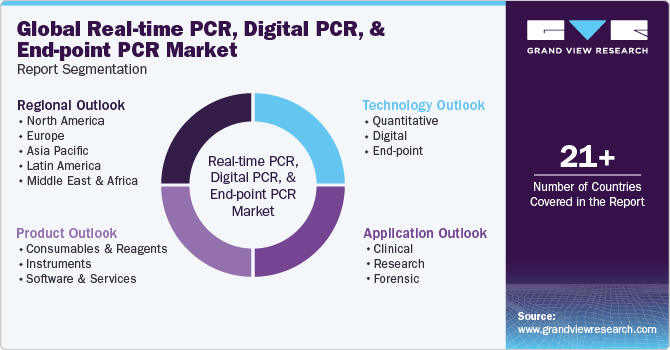

Real-time PCR, Digital PCR, And End-point PCR Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Quantitative, Digital, End-point), By Product, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-552-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Real-time PCR, Digital PCR, And End-point PCR Market Summary

The global real-time PCR, digital PCR, and end-point PCR market size was estimated at USD 5.59 billion in 2023 and is projected to reach USD 7.18 billion by 2030, growing at a CAGR of 4.2% from 2024 to 2030. The increasing prevalence of genetic disorders is likely to further drive the real-time, digital, and end-point PCR market in coming years.

Key Market Trends & Insights

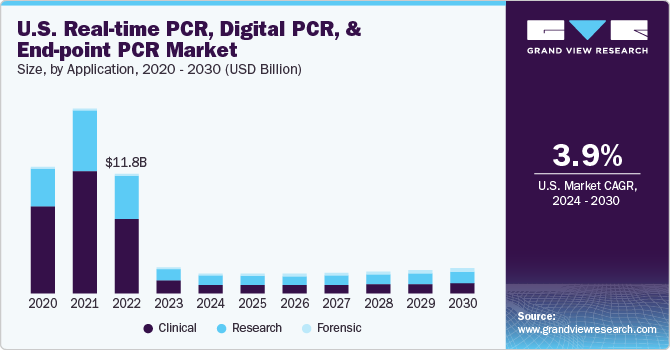

- The North America dominated the market with a revenue share of over 35.94% in 2023.

- The U.S. Another factor driving the market growth is several technological advancements.

- Based on application, the clinical segment held the largest revenue share of over 51.91% in 2023.

- Based on product, the consumables and reagents segment held the largest revenue share of over 62.62% in 2023.

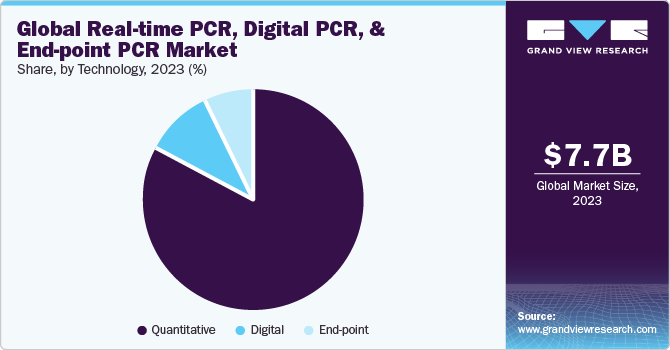

- Based on technology, the quantitative PCR segment held largest revenue share of over 83.34% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.59 Billion

- 2030 Projected Market Size: USD 7.18 Billion

- CAGR (2024-2030): 4.2%

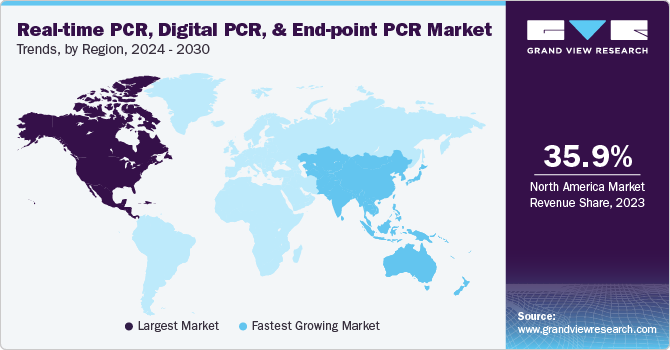

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

According to a CDC report, congenital heart defects were the most common birth defects, affecting approximately 1% of births annually in the U.S. Early detection of genetic variations via prenatal testing may aid in rapid disease prevention, diagnosis, and choice of suitable treatment.

In addition, growing incidence of STIs, such as HIV and HPV, chronic & infectious diseases, and genetic disorders, such as Alzheimer’s disease, Streptococcal infection, Turner syndrome, & Parkinson’s disease, is expected to expand the target population, thereby boosting the market growth. For instance, as per the article published by UpToDate, Inc., many European countries, including England, France, Ireland, the Netherlands, and Sweden, observed a higher incidence of invasive group A streptococcal (GAS) infections among children under 10 years during the fall and winter of 2022 to 2023, compared to previous years.

Furthermore, rapid detection of infectious diseases with the use of polymerase chain reaction facilitates timely intervention and can enable the delivery of appropriate treatments. For instance, slow detection of tuberculosis through traditional methods can be overcome by utilizing polymerase chain reaction, which provides faster and more efficient results. Thus, an increase in prevalence of chronic diseases is expected to create growth opportunities for the market.

The adoption of PCR techniques is increasing owing to their accuracy, automation, precision, real-time quantification, and sensitivity. For instance, in May 2023, the state government of Orissa, India, decided to expand the NAT-PCR testing facility to all blood centers in a comprehensive manner rather than in phases. This expansion was estimated to cost approximately Rs 200 crore (USD 24.3 Million). This decision came in response to two PILs urging the introduction of NAT-PCR facility in all blood banks in India due to its ability to detect HIV-1, HIV-2, hepatitis B, and hepatitis C at an earlier stage compared to the traditional ELISA test.

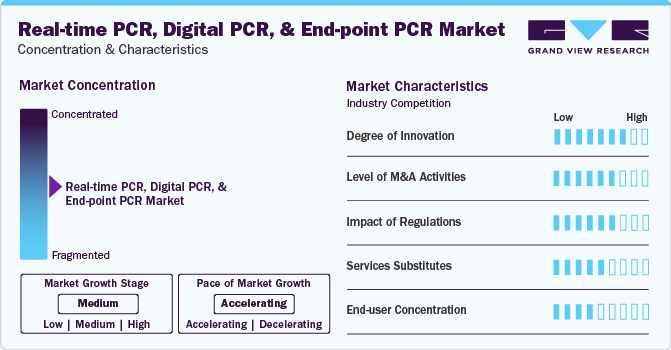

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the increasing introduction of novel dPCR and qPCR for different in vitro diagnostic applications. Moreover, key players are actively involved in developing novel POC testing products to capture market opportunities.

The market is also characterized by a medium level of merger and acquisition (M&A) activity by the leading players. In February 2023, Thermo Fisher Scientific, Inc. partnered with Mylab, a leading biotech company in India, to design and development of RT-PCR kits. Companies are adopting these strategies to increase their expertise and gain access to new regions in the emerging market.

The market is subject to increasing regulatory scrutiny. The regulatory framework for diagnostic product approvals is one of the major factors restraining the market growth. Moreover, the U.S. FDA plans to regulate laboratory-developed tests (LDTs) under medical device regulations, which is further anticipated to restrain the market uptake after implementing new rules.

Presence of substitute technologies such as immunoassay and other molecular diagnostic techniques can hamper the market uptake of PCR-based products. The increasing introduction of novel immunoassay tests, NGS, and others are becoming core substitutes for polymerase chain reactions. Moreover, the cost-effectiveness and increasing accuracy of immunoassay coupled with rapid test results make it a suitable substitute for the market.

End-user concentration is a major factor in the market. Increasing penetration of novel and portable PCR devices in hospitals, physician offices, central laboratories, POC facilities, and others is driving the market. Moreover, increasing demand for rapid and POC tests for oncology, biological markers, genetic tests for inherited conditions, and others is increasing demand for PCR tests.

Market Dynamics

In recent years, PCR witnessed technological advancements in terms of sensitivity, accuracy, efficiency, and cost-effectiveness. In February 2023, researchers at the Korea Institute of Science and Technology (KIST) made a significant breakthrough in PCR technology. Dr. Sang Kyung Kim and Dr. Seungwon Jung, along with their team, developed an ultrafast PCR method that reduces test time by 10-fold compared to existing tests and can be completed in just 5 minutes, maintaining same diagnostic accuracy as current methods. This advancement in PCR technology is caused due to the use of photothermal nanomaterials, which generate rapid heat upon exposure to light.

Key market players are undertaking strategic initiatives such as collaborations, partnerships, etc., and introducing novel technologies to maintain a competitive edge in real-time, digital, and end-point polymerase chain reaction market. For instance, in September 2022, BD (Becton, Dickinson, and Company), in collaboration with CerTest Biotec, developed a molecular PCR assay for research use and application by laboratories globally. Moreover, major players in industry are focusing on approval of reagents and tests for SARS-CoV-2. For instance, in March 2022, Kaneka launched novel PCR test kits capable of detecting the COVID-19 Omicron variant. Thus, various initiatives by market players are expected to boost the market.

Although procedural cost associated with polymerase chain reaction products and instruments is low, the overall cost of products is higher as compared to other devices or technology that can be used as a substitute for polymerase chain reaction products. For instance, manual dPCR instrument costs between USD 65,000 and USD 70,000, whereas automated dPCR instruments can cost nearly USD 100,000. high cost associated with technologies and assays is anticipated to limit their adoption under certain circumstances. This is mainly observed in countries with low budgets for genetic research. Moreover, commercial kits and reagents available in market are expensive. Hence, high cost of instruments and reagents required for real-time, digital, and end-point polymerase chain reaction technology is expected to impede market growth.

Application Insights

Clinical segment held the largest revenue share of over 51.91% in 2023. This can be attributed to increasing adoption of PCR in clinical diagnostics owing to its wide application in pathogen detection, genetic testing, oncology, pharmacogenomics, prenatal testing, and forensic According to an article published by the International Journal of Pharmaceutical Research and Applications in June 2023, polymerase chain reaction techniques are extensively applicable in investigating and assessing the relationship between an individual’s genetic makeup and its response to drugs polymerase chain reaction amplifies and analyzes specific genetic markers and helps predict an individual’s response to certain medications.

The forensic segment is expected to register the fastest growth rate over the forecast period. The advantages of polymerase chain reaction in forensic studies include augmented sensitivity & and specificity, reduced assay time and labor, and elimination need for an isotopic label. In addition, real-time, digital, and end-point polymerase chain reaction allows the amplification of degraded DNA samples, enabling subsequent typing because polymerase chain reaction-generated alleles are much smaller in size compared to alleles detected through RFLP analysis. Moreover, usage of polymerase chain reaction in conjunction with VNTR loci and high-resolution electrophoretic systems has been proven useful in human identification. Such capabilities are driving the segment.

Product Insights

Consumables and reagents segment held the largest revenue share of over 62.62% in 2023. Consumables and reagents influence the overall performance of an assay. They help create standardized workflows to support researchers in various fields, such as food testing, cancer detection of cancer & infectious diseases, and forensics. Global burden of diseases increased over past few years, and pandemic has contributed largely to high demand for consumables & reagents. Development of novel reagents has increased exponentially, which can be attributed to the demand for polymerase chain reaction reagents in diverse applications. For instance, in January 2023, F. Hoffmann-La Roche Ltd developed a novel COVID-19 PCR test, VirSNiP SARS-CoV-2 Spike F486P, to target XBB.1.5 Omicron sub-variant for research only. These strategies are propelling segment growth.

Moreover, increasing prevalence of chronic conditions and widespread adoption of polymerase chain reaction technology have raised a demand for consumables and reagents. Additionally, pharmaceutical and healthcare sectors' growing acceptance of technological advancements, along with heightened research efforts to develop innovative preventive and therapeutic products, have further contributed to segment growth.

Technology Insights

Quantitative PCR segment held largest revenue share of over 83.34% in 2023. Quantitative PCR is also referred to as real-time PCR. It is more accurate, precise, and time-saving. qPCR has wide applications in quantifying gene expression, pathogen detection, copy number variation, microarray verification, viral quantification, Single Nucleotide Polymorphisms (SNP) genotyping, and microRNA analysis. The segment growth can be attributed to rapid technological advancements in devices, high usage in gene expression analysis, and genotyping as a validation tool. For instance, in February 2023, Applied Biosystems TaqPath PCR kits were launched by Thermo Fisher Scientific Inc. These kits can test and diagnose M. tuberculosis complex, hepatitis C virus, multi-drug resistant tuberculosis, hepatitis B virus, and genetic analysis.

Digital PCR segment is estimated to grow at the fastest CAGR over the forecast period owing to technological advancements in chip and droplet-based dPCR is expected to drive segment growth. Moreover, favorable initiatives undertaken by market players are further anticipated to drive real-time, digital, and end-point polymerase chain reaction market growth. For instance, in July 2022, QIAGEN added 12 new kits and tests to its QIAcuity digital PCR portfolio for quantifying residual host cell DNA and Adeno-associated Virus (AAV) viral titer in cell and gene therapy. In addition, various strategic initiatives undertaken by leading players and ongoing regulatory approvals from Emergency Use Authorization (EUA) are other factors contributing to the adoption of novel real-time, digital, and end point PCR products. For instance, in March 2023, Stilla Technologies and Atila Biosystems entered into an agreement to launch oncological digital PCR kits. Such initiatives are expected to increase the market penetration of these products.

Regional Insights

North America dominated the market with a revenue share of over 35.94% in 2023. Growth can be attributed to rising prevalence of chronic diseases, genetic disorders, infectious diseases, and increasing demand for rapid diagnostic tests and growing geriatric population. For instance, according to the U.S. Census Bureau, 16.9% of the U.S. population, which is over 56 million, is aged 65 years and above. Furthermore, significant investments in gene-based research and presence of leading players, such as Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; & Agilent Technologies, have also positively influenced market. In January 2023, BD and CerTest Biotec received EUA from the U.S. FDA for a PCR test for Mpox virus detection in the U.S. Another factor driving the market growth is several technological advancements, such as microfluidic PCR in droplets, on-chip & off-chip thermocycling, and on-chip integration. For instance, in January 2021, LexaGene launched a microfluidic PCR device as an EUA test.

Asia Pacific is the most lucrative and fastest growing market, primarily driven by high unmet clinical needs, untapped market opportunities, and increasing healthcare expenditure. Technological advancements and rising prevalence of various target diseases are also expected to increase the demand for real-time, digital, and end point. Furthermore, the demand for healthcare products and government initiatives, to improve population’s health, will drive real-time PCR, digital PCR, and end-point PCR market during forecast period.

Key Companies & Market Share Insights

Some of the key players operating in the market include F. Hoffmann-La Roche Ltd.; Abbott, Thermo Fisher Scientific Inc.; and Danaher, among others. Major market players are adopting marketing strategies such as product launches, geographical expansion, partnerships, collaborations, and mergers and acquisitions in emerging and economically favorable regions. Market players are collaborating for application expansions of their existing products. Companies are developing novel tests for different disease indications compatible with their existing PCR instruments.

Standard BioTools, Stilla, Sensible Diagnostics, BGI Genomics, Virax Biolabs Group Limited, and others are emerging market participants in the real-time PCR, digital PCR, and end-point PCR market. Mid-level companies are developing novel tests and collaborating with overseas players to increase their global market footprint by offering innovative diagnostic solutions for difficult-to-detect diseases.

Key Real-time PCR, Digital PCR, And End-point PCR Companies:

- Abbott

- Qiagen

- Bio-Rad Laboratories Inc.

- Agilent Technologies, Inc.

- Thermo Fisher Scientific, Inc.

- GE Healthcare

- bioMérieux

- F. Hoffmann-La Roche Ltd

- Fluidigm Corporation

Recent Developments

-

In December 2023, Walgreens is offering flu and COVID-19 testing during peak respiratory illness season in the U.S.

-

In October 2023, MAWD Laboratories Received Emergency Use Authorization (EUA) for its COVID-19 PCR Test from the U.S. FDA.

-

In May 2023, Standard BioTools announced the launch of the X9 High-Throughput Genomics System. The launch will allow the consumers to perform RT-PCR and NGS-based applications on a single benchtop system.

-

In April 2023, Curative, Inc. announced the spin-off of Sensible Diagnostics, focusing on the commercialization of a novel POC PCR testing platform to provide results within 10 minutes with high accuracy.

-

In March 2023, BGI Genomics and Zentya entered into a partnership to launch a PCR fecal test for colorectal cancer in Slovakia.

-

In March 2023, QIAGEN entered into a strategic partnership with Servier to develop a PCR test capable of detecting isocitrate dehydrogenase-1 mutations in acute myeloid leukemia patients.

Real-time PCR, Digital PCR, And End-point PCR Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.59 billion

Revenue forecast in 2030

USD 7.18 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD billion/million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Qiagen; Bio-Rad Laboratories Inc.; Agilent Technologies, Inc.; Thermo Fisher Scientific, Inc.; GE Healthcare; bioMérieux; F. Hoffmann-La Roche Ltd; Fluidigm Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Real-time PCR, Digital PCR, And End-point PCR Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global real-time PCR, digital PCR, and end-point PCR market report based on technology, application, product, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Quantitative

-

Consumables & Reagents

-

Instruments

-

Software & Services

-

-

Digital

-

Consumables & Reagents

-

Instruments

-

Software & Services

-

-

End-point

-

Consumables & Reagents

-

Instruments

-

Software & Services

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables & Reagents

-

Instruments

-

Software & Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Pathogen Testing

-

Oncology testing

-

Blood Screening

-

Liquid Biopsy

-

dPCR-based Non-Invasive Prenatal Testing (NIPT)

-

Others

-

-

Research

-

Stem Cell Research

-

DNA Cloning & Sequencing

-

Recombinant DNA Technology

-

Rare Mutation Detection

-

Gene Expression

-

Single Cell Analysis

-

Microbiome Analysis

-

Copy Number Variation Analysis

-

Library Quantification (NGS)

-

Characterization of Low-fold Changes in mRNA and miRNAExpression"

-

Species Identification

-

GMO Detection

-

-

Forensic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global real-time PCR, endpoint PCR, and digital PCR market size was estimated at USD 7.68 billion in 2023 and is expected to reach USD 5.59 billion in 2024.

b. The global real-time PCR, endpoint PCR, and digital PCR market is anticipated to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 7.18 billion by 2030.

b. The consumables and reagents segment held the largest market share over 62.62% in terms of value in 2023. This can be attributed to the increased demand for COVID-19 testing and technological advancements in PCR techniques.

b. Some key players operating in the real-time PCR, endpoint PCR, and digital PCR market include Bio-Rad Laboratories Inc.; Thermo Fisher Scientific, Inc.; Qiagen; Abbott; Agilent Technologies, Inc.; BIOMÉRIEUX; Fluidigm Corporation.; and F. Hoffmann-La Roche Ltd.

b. Key factors that are driving the real-time PCR, endpoint PCR, and digital PCR market growth include the high prevalence of target diseases and rapid technological advancements such as the development of high-performance and superior qPCR and dPCR systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.