- Home

- »

- Medical Devices

- »

-

Smart Syringes Market Size & Share, Industry Report, 2033GVR Report cover

![Smart Syringes Market Size, Share & Trends Report]()

Smart Syringes Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Auto-Disable Syringes, Passive Safety Syringes), By Distribution Channel, By Application, By Technology, By Region, And Segment Forecasts

- Report ID: 978-1-68038-896-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Syringes Market Summary

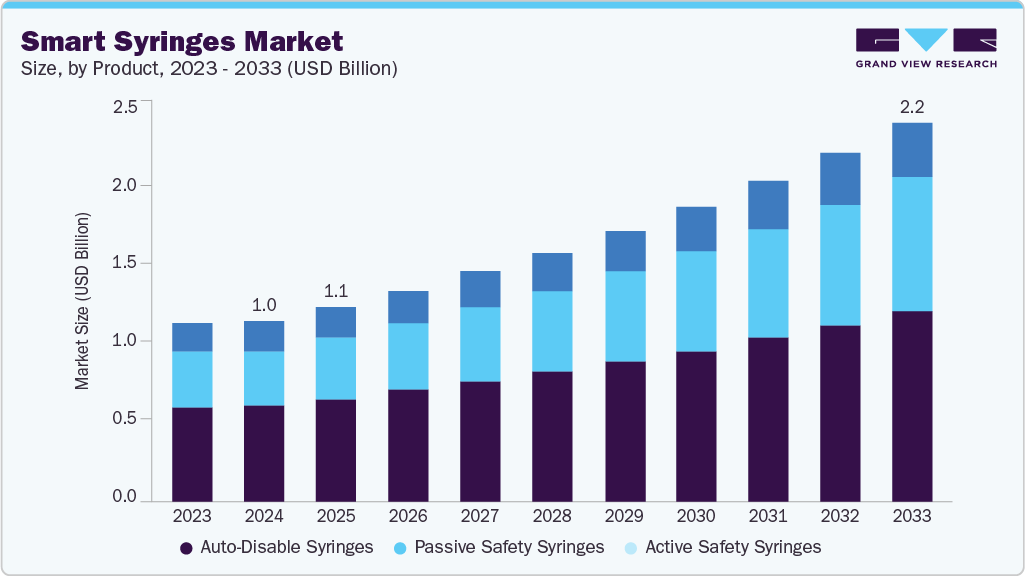

The global smart syringes market size was estimated at USD 1.05 billion in 2024 and is projected to reach USD 2.22 billion by 2033, growing at a CAGR of 8.7% from 2025 to 2033. The growth is attributed to the increasing focus on patient and healthcare worker safety, particularly with the rise in Needle Stick Injuries (NSIs) and the transmission of blood-borne infections such as HIV and hepatitis.

Key Market Trends & Insights

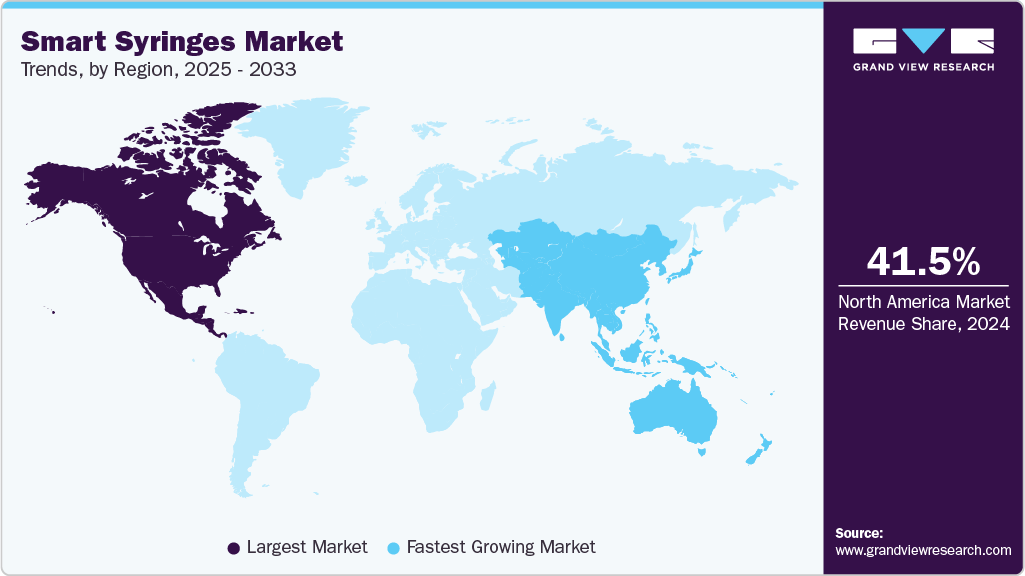

- North America dominated the smart syringes market with the largest revenue share of 41.46% in 2024.

- The smart syringes market in the U.S. accounted for the largest market revenue share of 82.93% in North America in 2024.

- By product, the auto-disable syringes segment led the market with the largest revenue share of 52.92% in 2024.

- By application, the drug delivery segment led the market with the largest revenue share of 66.58% in 2024.

- By distribution channel, the direct tenders (government & NGOs) segment led the market with the largest revenue share of 51.60% in 2024.

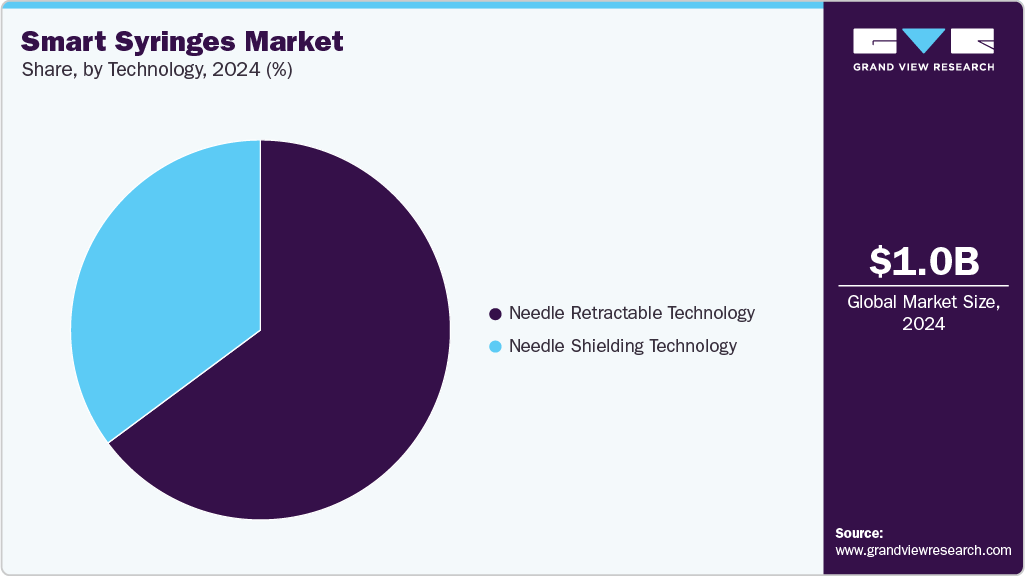

- By technology, the needle retractable technology segment led the market with the largest revenue share of 64.85% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.05 Billion

- 2033 Projected Market Size: USD 2.22 Billion

- CAGR (2025-2033): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Government-led vaccination drives and immunization initiatives, especially in countries such as India through the Universal Immunization Programme (UIP), have accelerated demand for auto-disable smart syringes. Moreover, regulatory bodies across the U.S. and Europe have mandated the use of safety-engineered injection devices, pushing healthcare facilities toward smart syringe adoption. Smart syringes have safety-engineered features such as retractable needles or auto-disable mechanisms, significantly reducing the risk of accidental needle-stick injuries. This has become a major public health priority, especially among healthcare workers in hospitals and clinics. For Instance, according to a report by International Journal of Surgery Global Health in 2024, Needlestick injuries (NSIs) are predominantly reported in medical and surgical departments, accounting for over 50% of all incidents.High-risk areas include trauma and emergency rooms (38%) and operating rooms (3%). Among the key products contributing to NSIs, insulin administration in diabetic patients is a significant cause. Healthcare professionals such as emergency personnel, surgeons, and nurses are particularly at risk. Globally, the prevalence of NSIs is estimated at 42.8% among nurses, 46.4% among doctors, and 45.3% among nursing students. In general, NSI rates among nurses are approximately 41%, while nursing student rates vary widely from 8.7% to 71%.

Global initiatives aimed at expanding immunization coverage, particularly in developing regions, are significantly boosting the demand for auto-disable smart syringes. These syringes are designed for single use, effectively preventing reuse and enhancing vaccine safety. In India, the Universal Immunization Programme (UIP) is one of the largest public health efforts, reaching approximately 26.7 million newborns and 29 million pregnant women annually. Recognized as one of the most cost-effective health interventions, the UIP has significantly reduced under-five mortality rates caused by vaccine-preventable diseases.

The rising incidence of blood-borne infections such as HIV, hepatitis B (HBV), and hepatitis C (HCV) is a major driver for the smart syringe market. Unsafe injection practices, including the reuse of syringes and needles, are significant contributors to the spread of these infections, especially in developing and resource-limited healthcare settings. Smart syringes, including auto-disable and safety-engineered models, are designed to prevent reuse and accidental needlestick injuries, thereby playing a critical role in reducing transmission risks.

Global HIV Data

Metric

2020

2024

People living with HIV

38.9 million [35.3–43.5M]

40.8 million [37.0–45.6M]

New HIV Infections

1.5 million [1.2–1.9M]

1.3 million [1.0–1.7M]

AIDS-related Deaths

740,000 [570K–960K]

630,000 [490K–820K]

New HIV Infections (Adults 15+)

1.4 million [1.1–1.8M]

1.2 million [950K–1.5M]

New HIV Infections (Children 0–14)

150,000 [110K–220K]

120,000 [82K–170K]

Source: UNAIDS 2025 epidemiological estimates, Grand View Research

Smart packaging solutions are significantly driving the growth of the smart syringes market by enhancing safety, traceability, and compliance in healthcare settings. These innovative packaging systems, often integrated with RFID tags, barcodes, or sensors, enable real-time tracking of syringe usage, reduce the risk of counterfeiting, and ensure that syringes are used appropriately in clinical and hospital environments. This is particularly beneficial in clinical trials, where accurate monitoring of dosage and administration is critical. For instance, in June 2025, the introduction of Schreiner MediPharm’s smart packaging solution for tracking syringes in clinical trials is expected to positively influence the smart syringe market by enhancing drug traceability, patient safety, and data accuracy. This solution integrates digital technologies, such as RFID or NFC chips, into syringe packaging, allowing real-time monitoring of medication administration. For clinical trials, this ensures proper dosing, reduces human error, and supports regulatory compliance through accurate documentation. As precision and accountability become more critical in healthcare and drug development, such innovations are likely to drive the demand for smart syringes integrated with digital tracking systems.

A key driver propelling the smart syringe market is the increasing emphasis on patient safety and infection control. Auto-disable (AD) syringes offer a single-use, tamper-proof mechanism that eliminates cross-contamination risks, ensuring compliance with sterilization standards without requiring additional resources. Their fixed-needle design minimizes medication and blood wastage, and their cost-effectiveness makes them ideal for large-scale immunization programs. In addition, their eco-friendly disposal and affordability further enhance their appeal for hospitals and health authorities seeking safer, budget-friendly, sustainable injection solutions.

The expansion of distributors in growing economies significantly drives the market by improving product accessibility, streamlining supply chains, and enhancing customer service. In emerging markets, where healthcare infrastructure is rapidly developing, expanding distribution networks ensure that advanced medical products, such as smart syringes are available in both urban and rural healthcare settings. This boosts market penetration and builds trust among local healthcare providers.

List of Suppliers and Brands for 0.05ml AD syringes + Fixed Needle

Supplier Name

FCA location (country)

Product/Brands

Price (USD) 2025

Abu Dhabi Medical Devices (United Arab Emirates)

UAE

MEDECO INJECT

Anhui Tiankang Medical Technology (China)

China

SANZHONG / TKMD

0.0304

Becton Dickinson International (Belgium

Spain

BD Soloshot MINI

0.051

Helm Medical (Germany)

China

Helmject

KD Medical Hospital Products (Germany)

UAE

MEDECO® INJECT

0.0375

Sanavita Pharmaceuticals (Germany)

China

Helmject

TKMD Rwanda (Rwanda)

Rwanda

SANZHONG / TKMD

0.041

Source: UNICEF

Technological innovations in syringe design, such as auto-disable mechanisms, retractable needles, dose-tracking features, and RFID-enabled smart syringes, are significantly propelling market growth. These advancements address critical healthcare challenges by enhancing patient safety, reducing needle-stick injuries (NSIs), and eliminating syringe reuse, a major source of cross-contamination and infection transmission. For instance, auto-disable syringes automatically lock after a single use, making them ideal for large-scale immunization programs. Similarly, connected smart syringes with dose-memory functions aid in chronic disease management by ensuring adherence to prescribed therapies. As healthcare systems modernize and emphasize safe, efficient delivery, the adoption of these technologically advanced syringes continues to rise across hospitals, clinics, and homecare settings.

Technological Advancements

Company Name

Product Launch

KOLs

Hindustan Syringes and Medical Devices (HMD)

In March 2024, Hindustan Syringes and Medical Devices (HMD) introduced Dispojekt, a line of single-use syringes equipped with safety needles, to enhance healthcare safety standards. The innovative Dispojekt safety syringes are designed to significantly reduce the incidence of accidental needle-stick injuries (NSIs) among healthcare professionals. By minimizing the risk of infections, these syringes also help lower the associated costs of infection control, medical waste disposal, and training. This development is expected to deliver long-term financial and operational benefits to the healthcare sector while promoting a safer working environment for medical personnel.

"The Hindustan Syringes and Medical Devices (HMD) healthcare’s recent launch of the most innovative and first-of-its kind Dispojekt syringes with safety needles will further strengthen India's position in becoming global powerhouse in medical devices, said Rajiv Nath, managing director, HMD, adding that India is all poised to become global powerhouse in manufacturing and exporting of medical devices in sync with the spirit of Aatmanirbhar Bharat."

BD

In October 2024, BD, a global leader in medical technology, and Ten23 Health, a strategic CDMO partner for the pharmaceutical and biotech industries, announced a collaborative effort to enhance traceability of prefillable syringes (PFS) through RFID technology. This partnership will pilot an innovative RFID-based solution developed by BD to boost manufacturing efficiency and enable precise tracking of individual syringe units throughout the production and supply chain process.

“We are excited about this collaboration with BD, as it aligns perfectly with our commitment to innovation and quality,” said Hanns-Christian Mahler, CEO of ten23 health.

“This new RFID-based traceability solution has the potential to further enhance our manufacturing processes and also provides significant benefits to our pharmaceutical customers by ensuring greater transparency and reducing risks,” added andrea Allmendinger, CSO of ten23 health.”

Source: BD, HMD, Grand View Research

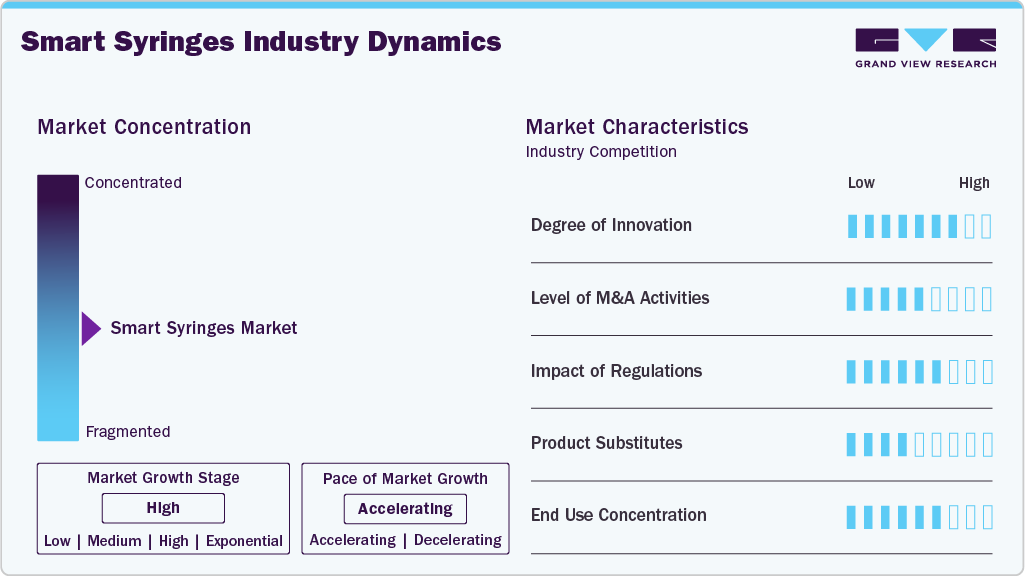

Market Concentration & Characteristics

The smart syringes market is experiencing a high degree of innovation, driven by the growing emphasis on safety, infection prevention, and efficient drug delivery. Key advancements include auto-disable mechanisms, passive safety-engineered devices, and RFID-enabled tracking technologies that ensure one-time use and help monitor usage across healthcare systems. Innovations such as needle-stick injury prevention designs, integrated dose-tracking features, and innovative packaging for clinical trial monitoring are transforming the landscape. Additionally, new product developments focus on ergonomic designs for better handling and cost-effective manufacturing, especially tailored to support mass immunization programs in developing economies.

Regulatory frameworks are pivotal in shaping the smart syringes market by enforcing safety and quality standards that drive innovation and adoption. Regulatory bodies such as the U.S. FDA, European Medicines Agency (EMA), and World Health Organization (WHO) have established stringent guidelines mandating the use of auto-disable (AD) syringes for immunization and therapeutic purposes, especially in mass vaccination programs. These regulations aim to minimize needle-stick injuries, prevent the reuse of syringes, and reduce cross-contamination and bloodborne infections.

The smart syringes market has seen a moderate to high level of M&A activity over the past several years, driven by the need to reduce technological capabilities, expand global reach, and meet growing regulatory demands. Companies are actively acquiring or partnering with innovators in safety syringes, RFID-enabled packaging, and auto-disable (AD) technologies to strengthen their product portfolios and stay competitive. These strategic moves help manufacturers gain faster access to emerging markets, enhance production scalability, and leverage established distribution networks.

Product substitutes for smart syringes primarily include traditional disposable syringes, safety syringes without smart features, jet injectors, and needle-free injection systems. These alternatives vary in complexity, cost, and safety, offering varying degrees of usability depending on the application and healthcare setting.

The smart syringe market shows high end user concentration, primarily dominated by hospitals, government immunization programs, and major healthcare organizations like the WHO and UNICEF. These entities account for substantial bulk procurement, particularly for vaccination campaigns, infectious disease prevention, and chronic disease management. Hospitals and clinics represent the largest consumer segment due to routine use in emergency, critical care, and surgical settings. Moreover, public health agencies and NGOs in developing regions contribute significantly to demand through centralized, high-volume procurement strategies.

Product Insights

The auto-disable syringes segment led the market with the largest revenue share of 52.92% in 2024. This growth can be attributed to their built-in safety mechanism that prevents reuse, significantly reducing the risk of needle-stick injuries and the transmission of blood-borne infections. Growing awareness of infection control, stringent government regulations, and widespread immunization programs drive the adoption of AD syringes across hospitals, clinics, and vaccination campaigns. Their reliability, ease of use, and alignment with global health initiatives make them the preferred choice among healthcare providers, securing a leading share in the smart syringes market.

The passive safety syringes segment is expected to witness a significant growth over the forecast period, owing to the increasing demand for needle-stick injury prevention without requiring active user intervention. These syringes automatically shield or retract the needle after use, offering enhanced safety and convenience. Rising awareness of healthcare worker safety, stringent regulatory mandates, and expanding vaccination and injection programs drive rapid adoption of passive safety syringes across hospitals, clinics, and immunization initiatives.

Application Insights

The drug delivery segment led the market with the largest revenue share of 66.58% in 2024, and is expected to witness the fastest CAGR over the forecast period. This growth can be attributed to the growing demand for precise, safe, and efficient administration of medications, including vaccines, insulin, and biologics. The increasing prevalence of chronic diseases, the rise of immunization programs, and the need to minimize dosing errors and contamination have driven healthcare providers to adopt smart syringes for drug delivery. Additionally, government initiatives promoting safe injection practices further reinforced the dominance of this segment in 2024.

Distribution Channel Insights

The direct tenders (government & NGOs) segment led the market with the largest revenue share of 51.60% in 2024. This growth can be attributed to hospitals, government health agencies, and large healthcare institutions. Direct tendering enables cost-effective purchasing, streamlined supply chains, and guaranteed product quality, making it a preferred procurement method for high-volume users. Additionally, government-led immunization programs and initiatives to promote safe injection practices contributed to the dominance of the direct tenders segment during this period.

Hospital pharmacies segment is expected to witness the fastest CAGR over the forecast period. This growth can be attributed to increasing adoption of smart syringes for safe medication administration and infection control within hospitals. Growing patient volumes, rising chronic disease prevalence, and stringent safety protocols for healthcare workers are driving demand. Furthermore, hospital pharmacies’ role in bulk procurement and distribution of smart syringes for inpatient and outpatient care supports rapid market growth in this segment.

Technology Insights

The needle retractable technology segment led the market with the largest revenue share of 64.85% in 2024. This can be attributed to built-in safety mechanism that automatically retracts the needle after use, effectively preventing reuse and reducing the risk of needle-stick injuries. Widespread adoption in hospitals, vaccination programs, and chronic disease management, combined with stringent regulatory mandates for safe injection practices, reinforced the preference for retractable needle syringes. Their reliability, ease of use, and ability to enhance healthcare worker and patient safety contributed to the segment’s leading market share in 2024.

However, needle shielding technology segment is projected to witness the fastest growth rate over the forecast period. This can be attributed to its automatic protective mechanism that covers the needle immediately after use, reducing the risk of accidental needle-stick injuries and cross-contamination. Rising awareness of healthcare worker safety, stringent regulatory guidelines, and increasing adoption in hospitals, clinics, and immunization programs are driving demand. Additionally, the ease of use and enhanced protection offered by needle shielding syringes make them a preferred choice in both developed and emerging markets, fueling rapid growth.

Regional Insights

North America smart syringes marketdominated the global market with the largest revenue share of 41.46% in 2024. The growth is attributed to the increased focus on patient safety, rising prevalence of blood-borne infections, and the growing adoption of advanced healthcare technologies. The U.S. leads the region due to stringent regulatory frameworks mandating safe injection practices and the implementation of needle-stick injury prevention legislation. Furthermore, robust healthcare infrastructure, high immunization coverage, and substantial R&D investments have accelerated the adoption of auto-disable and safety-engineered syringes. Technological advancements, such as RFID-enabled tracking and innovative packaging solutions, are also shaping the market landscape, positioning North America as a key hub for innovation in syringe safety.

U.S. Smart Syringes Market Trends

The U.S. smart syringes market is characterized by the increasing focus on healthcare worker safety and infection control, particularly the prevention of needle-stick injuries (NSIs) and cross-contamination. The Occupational Safety and Health Administration (OSHA) mandates using safety-engineered devices under the Needlestick Safety and Prevention Act, which has significantly fueled the demand for auto-disable and retractable syringes. Moreover, growing immunization efforts by agencies like the CDC, coupled with rising incidences of chronic diseases such as diabetes, have amplified syringe use in both clinical and homecare settings.

Europe Smart Syringes Market Trends

The Europe smart syringes market is witnessing strong growth, supported by strict regulatory frameworks, increased vaccination programs, and heightened awareness of healthcare worker safety. The European Medicines Agency (EMA) and national health authorities emphasize using safety-engineered syringes to prevent needle-stick injuries and reuse-related infections. Demand is further supported by public health initiatives promoting safe injection practices across hospitals and outpatient care settings. Moreover, the adoption of RFID-enabled and auto-disable syringes is growing in clinical trials and drug delivery applications.

The UK smart syringes market is experiencing significant growth, driven by stringent safety regulations, growing demand for infection control, and expanding immunization initiatives. The National Health Service (NHS) has increasingly adopted auto-disable and safety-engineered syringes to reduce needle-stick injuries among healthcare professionals and prevent cross-contamination. The surge in chronic diseases requiring injectable therapies, such as diabetes and rheumatoid arthritis, further fuels the demand for smart syringes. Coupled with rising awareness of safe injection practices and favorable procurement policies, these factors collectively support strong market growth in the UK.

Asia Pacific Smart Syringes Market Trends

The Asia Pacific smart syringes market is experiencing the fastest CAGR 10.3% from 2025 to 2033, fueled by rising immunization programs, increasing healthcare expenditure, and heightened awareness of needlestick injury prevention. Governments across countries such as India, China, and Japan are implementing large-scale vaccination campaigns that mandate the use of auto-disabled and safety syringes. The World Health Organization's (WHO) recommendations on safe injection practices are also influencing regulatory frameworks across the region, boosting smart syringe adoption.

The smart syringes market in China is undergoing a quick transformation, driven by government-led initiatives to improve injection safety and prevent the spread of bloodborne infections. The National Health Commission has emphasized the widespread adoption of auto-disable and safety-engineered syringes across public hospitals and vaccination programs. With China conducting millions of immunizations under its National Immunization Program, the demand for smart syringes has surged. Additionally, the growing concern over needlestick injuries among healthcare professionals pushes hospitals toward safer alternatives.

Latin America Smart Syringes Market Trends

The smart syringes market in Latin America is showing significant growth, supported by rising awareness of injection safety, government-led vaccination programs, and support from international health organizations. Countries such as Brazil and Argentina are implementing stricter regulations for safe injection practices, promoting the use of auto-disable and safety syringes to combat bloodborne infections such as HIV and hepatitis. The region’s increasing focus on universal immunization campaigns, especially in rural and underserved areas, is also accelerating demand.

Middle East Africa Smart Syringes Market Trends

The smart syringes market in the Middle East & Africa (MEA) region is gradually emerging, supported by efforts to improve public health infrastructure, reduce healthcare-associated infections, and enhance vaccination safety. Countries such as Saudi Arabia, the UAE, and South Africa are at the forefront of adopting smart syringe technologies, especially in large-scale immunization programs and infection control campaigns. Support from international health bodies like WHO, GAVI, and UNICEF has led to the increased use of auto-disable and safety syringes, particularly in low-income regions across Sub-Saharan Africa.

Key Smart Syringes Company Insights

The smart syringes market is extremely fragmented, with both major and local market competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority in smart syringes market, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, in an effort to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the smart syringes market is predicted to impel during the forecast period. Some of the major players in the smart syringes market include

Key Smart Syringe Companies:

The following are the leading companies in the smart syringes market. These companies collectively hold the largest market share and dictate industry trends.

- Becton, Dickinson and Company (BD)

- Hindustan Syringes & Medical Devices (HMD)

- Terumo Corporation

- Nipro Corporation

- Retractable Technologies, Inc.

- SCHOTT Pharma

- Schreiner MediPharm

- Gerresheimer AG

- SPM Medicare

- Restek Corporation

- Shimadzu

- Trajan LPP

- Liaoning Kangyi Medical Equipment Co., Ltd

- AccuPoint (AdvaCare Pharma)

- Agilent

Recent Developments

-

In October 2024, BD, a global leader in medical technology, and Ten23 Health, a strategic CDMO partner for the pharmaceutical and biotech industries, have announced a collaborative effort to enhance traceability of prefillable syringes (PFS) through RFID technology. This partnership will pilot an innovative RFID-based solution developed by BD to boost manufacturing efficiency and enable precise tracking of individual syringe units throughout the production and supply chain process.

-

In March 2024, Hindustan Syringes and Medical Devices (HMD) introduced Dispojekt, a line of single-use syringes equipped with safety needles, to enhance healthcare safety standards. The innovative Dispojekt safety syringes are designed to significantly reduce the incidence of accidental needle-stick injuries (NSIs) among healthcare professionals. By minimizing the risk of infections, these syringes also help lower the associated costs of infection control, medical waste disposal, and training. This development is expected to deliver long-term financial and operational benefits to the healthcare sector while promoting a safer working environment for medical personnel.

Smart Syringes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.14 billion

Revenue forecast in 2033

USD 2.22 billion

Growth rate

CAGR of 8.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE.

Key companies profiled

Becton, Dickinson and Company (BD); Hindustan Syringes & Medical Devices (HMD); Terumo Corporation; Nipro Corporation; Retractable Technologies, Inc.; SCHOTT Pharma; Schreiner MediPharm; Gerresheimer AG; SPM Medicare; Restek Corporation; Shimadzu; Trajan LPP; Liaoning Kangyi Medical Equipment Co., Ltd; AccuPoint (AdvaCare Pharma); Agilent.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Syringes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart syringes market report based on product, application, distribution channel, technology, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Auto-Disable Syringes

-

Active Safety Syringes

-

Passive Safety Syringes

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Delivery

-

Insulin

-

Vaccines

-

Hormonal Therapies

-

Oncology Drugs

-

Others

-

-

Blood Specimen Collection

-

Catheter Syringe Flushing

-

Other Specialized Injection

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct Tenders (Government & NGOs)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Needle Retractable Technology

-

Needle Shielding Technology

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global smart syringes market size was estimated at USD 1.05 billion in 2024 and is expected to reach USD 1.14 billion in 2025.

b. The global smart syringes market is expected to grow at a compound annual growth rate of 8.70% from 2025 to 2033 to reach USD 2.22 billion by 2033.

b. North America dominated the smart syringes market with a share of 41.46% in 2019. This is attributable to increasing awareness about needle stick injuries, the continual improvements in healthcare practices, the presence of a huge geriatric population base, and the existence of well-developed primary and secondary healthcare centers across the region.

b. Some key players operating in the smart syringes market includeBecton, Dickinson and Company (BD); Hindustan Syringes & Medical Devices (HMD); Terumo Corporation; Nipro Corporation; Retractable Technologies, Inc.; SCHOTT Pharma; Schreiner MediPharm; Gerresheimer AG; SPM Medicare; Restek Corporation; Shimadzu; Trajan LPP; Liaoning Kangyi Medical Equipment Co., Ltd; AccuPoint (AdvaCare Pharma); Agilent.

b. Key factors that are driving the market growth include increasing prevalence of various target diseases, the increase in the number of vaccinations, the growth of the geriatric population, and the need to prevent hospital or clinic-acquired infections.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.