- Home

- »

- Plastics, Polymers & Resins

- »

-

Specialty Carbon Black Market Size, Industry Report, 2030GVR Report cover

![Specialty Carbon Black Market Size, Share & Trends Report]()

Specialty Carbon Black Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (Conductive, Fiber, Food Contact, Other), By Region (Asia Pacific, Europe, North America, Latin America), And Segment Forecasts

- Report ID: GVR-1-68038-121-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Carbon Black Market Summary

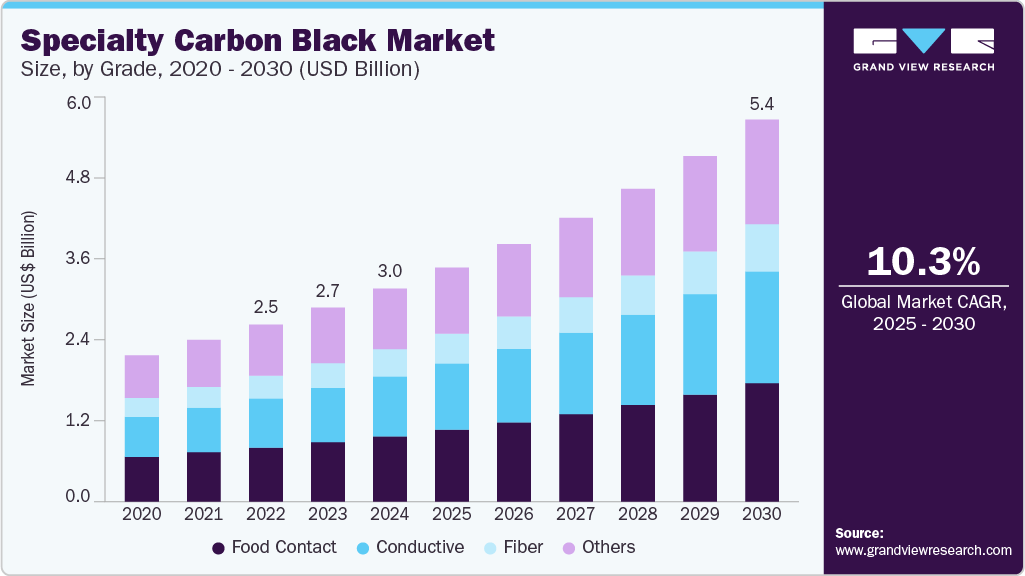

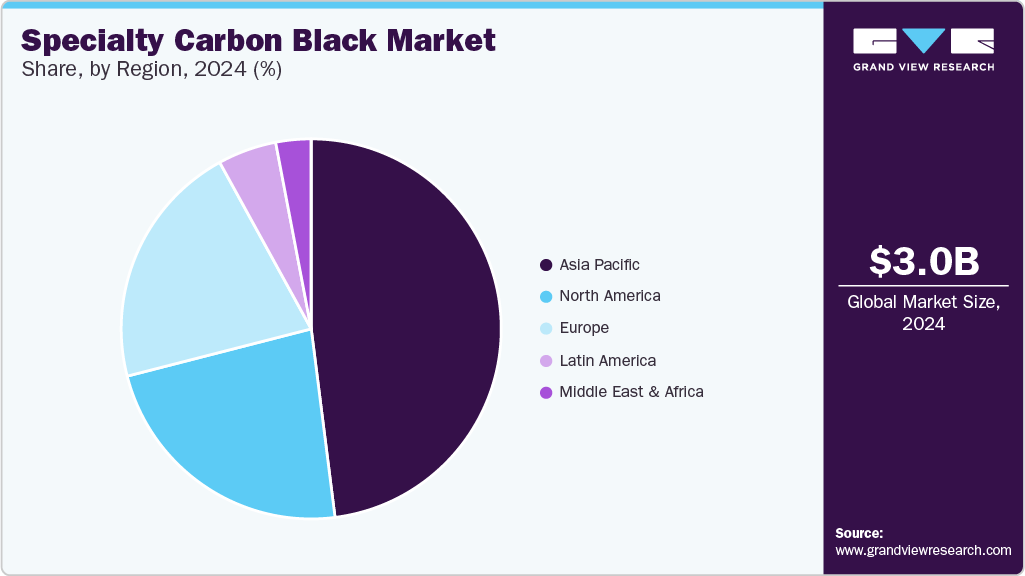

The global specialty carbon black market size was estimated at USD 3.0 billion in 2024 and is projected to reach USD 5.40 billion by 2030, growing at a CAGR of 10.3% from 2025 to 2030. This is attributed to the surging demand for the product as reinforcing agents, especially in tires.

Key Market Trends & Insights

- Asia Pacific dominated the specialty carbon black market with a revenue share of 47.8% in 2024.

- The specialty carbon black market in the U.S. is anticipated to grow significantly during the forecast period.

- Based on grade, the food contact segment led the market with the largest revenue share of 30.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.0 Billion

- 2030 Projected Market Size: USD 5.40 Billion

- CAGR (2025-2030): 10.3%

- Asia Pacific: Largest market in 2024

In addition, the growing utilization of the product in agriculture mulch film, stretch wrap, refuse sacks, and industrial bags is anticipated to contribute to the market growth in the near future. Specialty carbon black is a highly versatile component for non-rubber applications. It imparts protection from UV degradation, color, electrical conductivity, and opacity. The selection of carbon black entirely depends on the product's requirements. It is mainly used in key plastic segments, including molding, film, pipe, fiber, and cable.

Specialty carbon black dynamics are heavily dependent on applications such as non-tire rubber, electrostatic discharge, packaging, paints and coatings, printing ink consumption, and regulations formulated for manufacturing technologies and raw materials. It provides enhanced viscosity, conductivity, UV protection, and sharp color.

The global transition towards electric vehicles is driving the market for specialty carbon black, which plays a critical role in lithium-ion battery technology, improving electrode conductivity and durability. For instance, nearly 300,000 new EVs were sold in the first quarter of 2025 in the U.S.

Rapid urbanization and infrastructure development, particularly in emerging economies such as India and China, propel the demand for specialty carbon black. Its application in automotive, electronics, consumer goods, and industrial parts aligns with the growing needs of expanding urban centers. This infrastructural boom offers significant growth prospects for the specialty carbon black market.

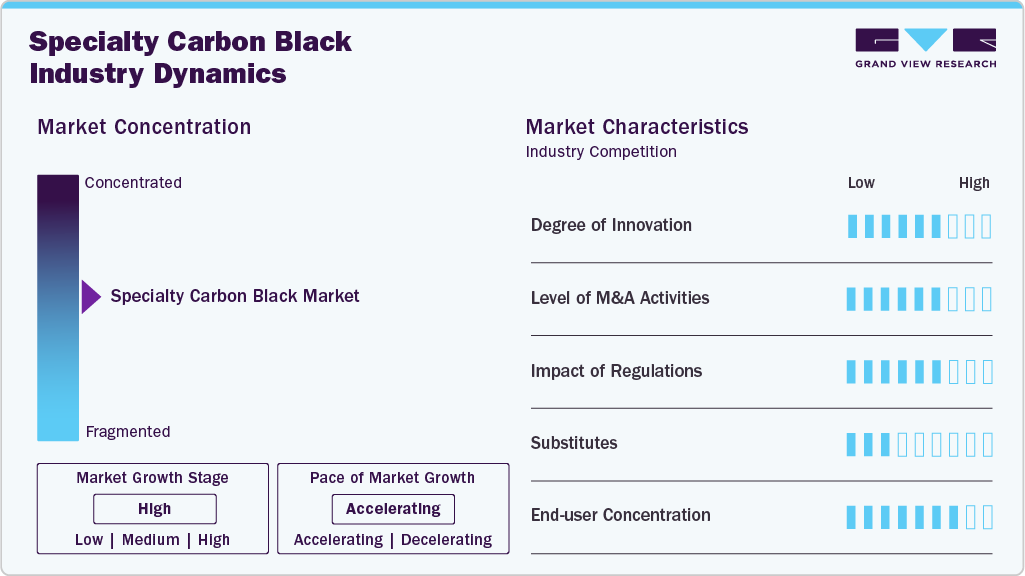

Market Concentration & Characteristics

The market is concentrated, with a few companies accounting for a majority share of the global market. The market leaders are companies that have initially established a significant presence in the specialty carbon black industry. The companies have developed well-accepted product formulations and established a significant geographical presence.

Emerging players in the market have integrated manufacturing and distribution along with a focus on product innovation. The companies have developed processes and formulated products to adopt the product differentiation strategy. These companies also work with end users to develop customized products.

Grade Insights

Based on grade, the food contact segment led the market with the largest revenue share of 30.7% in 2024. Increasing packaging, films & sheets, and plastic molded goods usage in the food industry is expected to drive market growth over the forecast period. Food-grade products adhere to various requirements imposed by the FDA, The European Plastics Regulation, and the Japan Hygienic Olefin & Styrene Plastics Association (JHOSPA). Specialty carbon blacks are used for packaging a diverse range of products and thus have extensive applications across several end-use industries, including food and agriculture.

The conductive segment is expected to grow at the fastest CAGR of 11.0% over the forecast period. Conductive carbon blacks are used to manufacture cost-efficient electrically conductive plastic compounds, which are used in various processing methods and final applications. Several companies are investing in the production of conductive carbons. For instance, in February 2025, PCBL Chemical Ltd. formalized an agreement with Ningxia Jinhua Chemical Co. to commence the production of acetylene black within India. The inclusion of acetylene black in its product line will significantly augment PCBL's capabilities in the conductive sector.

Increasing demand from end-use industries such as automotive, architecture, and consumer goods is anticipated to fuel conductive carbon black demand in the paints & coatings industry. A growing manufacturing sector and strong economic growth are expected to drive conductive product consumption over the forecast period. Asia Pacific market is one of the largest manufacturers and consumers of polymers and is expected to fuel market growth over the next five years.

Regional Insights

North America held a significant position in the global specialty carbon black market in 2024. There is a substantial demand for conductive and food-grade products in North America due to the growth of the packaging and polymer industries. The region is also expected to benefit from a rapidly expanding automotive industry, where these products are mainly utilized as sealants for gaskets, liners in automobile dashboards, arm liners, instrument panels, and other components.

U.S. Specialty Carbon Black Market Trends

The specialty carbon black market in the U.S. is anticipated to grow significantly during the forecast period. The U.S. is home to one of the largest automotive markets in the world. Major automakers have responded to new domestic cost advantages by shifting production from other countries to the U.S. A large consumer market, open investment policy, available infrastructure, a highly skilled workforce, and government incentives have made the U.S. a premier hub for the auto industry. The U.S. market is expected to benefit from a revitalized automotive sector.

In addition, there's a growing emphasis on sustainable carbon black solutions in North America, with companies such as Cabot introducing products with certified recycled content. In March 2024, the U.S.-based specialty chemical firm, Cabot Corporation, introduced PROPELE8, an engineered reinforcing carbon black. This product is formulated to improve the performance characteristics of elastomers, especially in rigorous applications such as tires and industrial rubber goods.

Europe Specialty Carbon Black Market Trends

Europe's specialty carbon black market is anticipated to grow rapidly during the forecast period. High demand from the polymer industry is expected to drive demand in Europe. Recovery of the automotive industry in the region in countries such as Germany, France, the UK, and Russia is anticipated to boost market growth over the forecast period. Demand for specialty carbon black in paints & coatings and inks is expected to increase in the near future.

Germany Specialty Carbon Black Market Trends

Germany's specialty carbon black market is anticipated to grow at the fastest CAGR during the forecast period. The growth of key end-use industries such as the automotive and plastics industries drives the German market. Increasing demand for molded parts for consumer goods and the development of non-rubber automotive applications are anticipated to drive market growth in the country.

UK Specialty Carbon Black Market Trends

The UK specialty carbon black market is anticipated to grow at a CAGR of 7.4% during the forecast period. Polyester fiber was the largest application segment in the UK fiber carbon black market, with rising demand for luxury apparel, mattresses, and other fiber products. The country's market is largely mature and driven by innovation and cost differentiation. Packaging also emerged as the prominent application segment in the food industry, with a shift towards packaged food & beverages along with rising regulatory guidelines, which is further estimated to contribute to the market growth.

Asia Pacific Specialty Carbon Black Market Trends

Asia Pacific dominated the specialty carbon black market with a revenue share of 47.8% in 2024. The growth in this region can be attributed to expanding end-use industries and growing consumer interest in recyclable & sustainable, yet luxurious and comfortable products. Increasing high-performance coatings demand from end-use industries such as marine, aerospace, decorative, wood, and industrial coatings is expected to drive regional market growth over the forecast period. Moreover, the presence of developing countries, including India and China, is anticipated to further drive the market growth due to the escalating industrial base in the Asia Pacific region. In January 2024, Birla Carbon announced greenfield expansions in the Asia Pacific region, aiming to increase its carbon black capacity by over 240 kilotons in India and Thailand.

China Specialty Carbon Black Market Trends

China dominated the regional specialty carbon black market in 2024, owing to the expansion of key downstream sectors, including automotive, electronics, and construction. China's advantageous access to affordable raw materials and labor positions it as an economically efficient center for the production of specialty carbon black.

India specialty carbon black market

The India specialty carbon black market is expected to witness a significant expansion during the forecast period, due to the textile industry's growth and rising automotive sales in the country. Several large-scale players such as Birla Carbon Company and Himadri mark the market. Increasing demand for food-grade carbon black from the packaged food industry is expected to drive market growth further over the forecast period. The growth of the polymer industry, coupled with increasing demand in the automotive and construction sectors, is anticipated to drive market growth in the country.

Latin America Specialty Carbon Black Market Trends

The specialty carbon black market in Latin America is anticipated to grow significantly during the forecast period. Latin America is expected to benefit from a rapidly expanding automotive industry, where these products are mainly utilized as non-rubber automotive components. Increasing consumer disposable income and rising living standards are also anticipated to foster demand for comfortable furniture and bedding, leading to an upsurge in fiber carbon black sales. In addition, increasing demand for food-grade carbon black from the packaged food industry is expected to further drive market growth over the forecast period.

Brazil Specialty Carbon Black Market

The Brazil specialty carbon black market is driven by increasing demand from thermosetting application in end-use industries such as automotive, construction, consumer goods and blow-molded containers. The country is characterized by a rapidly growing industrial sector, which is expected to influence industry growth in the near future positively. Increasing specialty carbon black demand for semi-conductive cable compounds, which is used for smoothness, conductivity, and chemical cleanliness, is anticipated to drive demand over the forecast period.

Middle East & Africa Specialty Carbon Black Market Trends

Increasing construction spending in emerging economies such as Saudi Arabia, Qatar, UAE, and Oman is anticipated to drive market growth in the Middle East & Africa (MEA) region. Rapid urbanization in these developing countries has shifted consumer preference towards packaged food & beverages, thus generating huge demand for fiber grade specialty carbon black. Increasing demand from thermoplastic molding for various applications in end-use industries such as consumer goods and automotive is further anticipated to boost market growth. The growth of the textile sector, along with strong demand from the packaged food industry, is expected to drive market growth in the region.

Saudi Arabia Specialty Carbon Black Market

Saudi Arabia's specialty carbon black market is expecting a surge in demand from the construction and automotive sectors. The growth of the industrial sector, along with rising automotive sales, is anticipated to drive industry growth in the country. In addition, rising packaged food consumption and textile industry growth are also expected to boost demand over the forecast period.

Key Specialty Carbon Black Company Insights

The market competition is highly dependent upon the product mix, number of sellers and location. As the products are application specific the product mix of any market player is expected to have a profound impact. Companies are tailoring their product portfolio to gain leadership in a specific application. The strategy helps the companies to enjoy higher margins while adopting the product differentiation strategy. Companies such as Orion and Cabot Carbon are working on strategies to achieve product leadership.

The number of sellers is considerably low, as the market comprises manufacturers with specialty offerings. Another major distinctive factor about the market is the presence of large-scale carbon black manufacturers that have the geographical and product expertise they have developed over the years by being in the business. The competition terms in the market are mainly dictated by these companies, and the rest of the companies try to exploit small pockets either by geographical expansion or new product development.

-

OMSK Carbon Group is a Russian carbon black company with manufacturing locations in Omsk and Volgograd. The company’s product portfolio comprises both OMCARB special grades for paint and polymer applications and commodity grades for rubber and tire product industries.

-

Tokai Carbon Co. Ltd. is a Japanese carbon black manufacturer. The company operates through its seven business segments: graphite electrodes, carbon black, fine carbon, smelting and lining, furnaces, friction materials, and anode materials. The company operates through its carbon black production plants based in Ishinomaki, Shonan, Chita, Shiga, Hofu, Kyusyu Wakamatsu and Tanoura.

Key Specialty Carbon Black Companies:

The following are the leading companies in the specialty carbon black market. These companies collectively hold the largest market share and dictate industry trends.

- Omsk Carbon Group

- Tokai Carbon Co., Ltd.

- Atlas Organics Private Limited

- Continental Carbon Company

- Birla Carbon

- Cabot Corporation

- Oak Investment Partners

- Himadri Specialty Chemical Ltd

- Philips Carbon Black Limited

- Orion S.A.

- Ralson Carbon Black Limited

Recent Developments

-

In January 2025, Sumitomo Rubber Industries and Mitsubishi Chemical partnered to recycle carbon black from end-of-life tires. Sumitomo Rubber will provide tire materials to Mitsubishi Chemical for processing into sustainable carbon black, which will then be used in new tires, promoting a circular economy.

-

In January 2025, Tokai Carbon Co., Ltd, Kyushu University, Bridgestone Corporation, and Okayama University initiated a collaborative technology development project. The project focuses on secondary processing of recovered carbon black (rCB) extracted from polymeric materials, notably end-of-life tires.

-

In July 2024, Himadri Specialty Chemical Ltd, via its wholly-owned subsidiary Himadri Clean Energy Limited (HCEL), strategically acquired Himadri Green Technologies Innovation Limited. This acquisition is intended to broaden Himadri's operational footprint, aiming for business expansion and improved internal efficiency.

-

In January 2024, Birla Carbon announced Greenfield Expansions in the Asia Pacific region. The company shall expand its carbon black capacity by over 240 kilotons in the identified locations of India and Thailand

Specialty Carbon Black Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.30 billion

Revenue forecast in 2030

USD 5.40 billion

Growth Rate

CAGR of 10.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Russia; China; Japan; India; South Korea; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Omsk Carbon Group; Tokai Carbon Co., Ltd.; Atlas Organics Private Limited; Continental Carbon Company; Birla Carbon; Cabot Corporation; Oak Investment Partners; Himadri Specialty Chemical Ltd; Philips Carbon Black Limited; Orion S.A.; Ralson.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Carbon Black Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty carbon black market report based on grade and region.

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Conductive Carbon Black

-

Conductive Polymers

-

Paints & Coatings

-

Battery Electrodes

-

Printing Inks

-

Others

-

-

Fiber Carbon Black

-

Polyester Fiber

-

Pp Masterbatches

-

Nylon Textiles

-

Other Synthetic Fibers

-

-

Food Contact Carbon Black

-

Packaging

-

Film & Sheet

-

Consumer Molded Parts

-

Others

-

Other Carbon Black

-

-

-

Regional Outlook (Revenue, USD million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.