- Home

- »

- Petrochemicals

- »

-

Carbon Black Market Size, Share And Growth Report, 2030GVR Report cover

![Carbon Black Market Size, Share & Trends Report]()

Carbon Black Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Tire, Non- Tire Rubber, Plastics, Inks & Coatings, Other), By Grade, By Region, And Segment Forecasts

- Report ID: 978-1-68038-802-2

- Number of Report Pages: 92

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Black Market Summary

The global carbon black market size was estimated at USD 22.35 billion in 2023 and is projected to reach USD 31.04 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030. Rising product usage in the production of plastics is anticipated to drive growth.

Key Market Trends & Insights

- The Asia Pacific carbon black market led the global market with a revenue share of 63.3% in 2023.

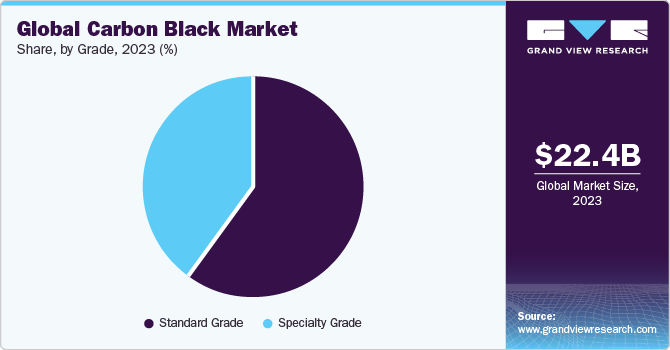

- Based on grade, the standard segment dominated the market and accounted for the largest revenue share of over 60% in 2023.

- Based on type, the furnace black segment dominated the market and accounted for a share of over 40% in 2023.

- Based on application, the tires emerged as a dominant segment accounting for 68.8% of the overall revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 22.35 Billion

- 2030 Projected Market USD 31.04 Billion

- CAGR (2024-2030): 4.8%

- Asia Pacific: Largest market in 2023

Moreover, the rising usage of these plastics in electrical and electronic components will boost product demand. It is produced either by thermal decomposition or partial combustion method, which includes oil or natural gas as a feedstock. It is produced by four different processes, which are the furnace black process, channel process, acetylene black process, and Lampblack process.

Growing environmental concerns coupled with the developing automotive industry is expected to drive the growth of the U.S. market. The refurbishing trend has resulted in increased demand for high-performance coatings in automotive as well as other industries, such as marine, aerospace, and industrial.

The product helps improve the strength and longevity of tires by providing better abrasion resistance and tensile strength. Also, growing construction and manufacturing sectors utilizing industrial rubber and equipment are anticipated to positively impact the demand over the forecast period.

Carbon black market prices are mainly based on raw materials, auxiliary materials, and utilities. The crude oil price fluctuation has a major impact on the pricing of carbon black. Some other macro-level factors influencing the price include working capital and pre-operational costs. The installation and setup, capitalized interests, project engineering and management, and commissioning costs are included under the pre-occupational costs.

Carbon black is formed by incomplete combustion of different petroleum-based constituents. It is an essential component for a range of end-use applications such as consumer goods, automobiles, appliances, electronics, and others. Since it is a petroleum-derived product the manufacturers rely on sourcing their key raw materials at the right prices with no supply hindrance. Raw materials are critically selected by the manufacturers depending on their product quality, offering price, product portfolio holding, and market accessibility.

Market Concentration & Characteristics

The carbon black market is fragmented in nature with the presence of large number of domestic and global players operating in the market. Market players are adopting the product differentiation strategy that insulates them from price wars. The merger and acquisition activity in the market has been high for the past few years. Tokai Carbon has been leading the way as it has acquired a majority stake in 3 companies in the past 3 years. Growing automotive sales together with the implementation of progressive technologies in tire manufacturing are further estimated to fuel market progress in the region. Mounting high-performance coatings consumption in the aerospace and defense industry is anticipated to remain a key growth driving factor. Carbon blacks are cautiously aimed to transmute electrical characteristics from insulating to conductive in goods such as safety applications, and automotive parts. Carbon black for packaging market is used for electronic packaging.

The market dynamics are largely dependent on the usage of rubber, electronic discharge compounds, and inks along with several regulations formulated for manufacturing technologies and raw materials used. The market is also influenced by the regulatory laws put in place by major North American and European government bodies. Within this industry, transportation is poised to be the dominant segment over the next seven years owing to the increasing demand for tires and rubber.

For instance, in November 2022, OCI announced the approval of the spin-off of the organization’s primary business in the chemical & carbon chemical sectors and the development of a new organization. In the sector of carbon chemicals, the new firm plans to fabricate a portfolio of high-value-added carbon products, and execute new businesses, including highly conductive carbon black deployed for conductive additives for rechargeable batteries and high-voltage cables.

Grade Insights

There are two grades: standard grade, and specialty grade carbon black. The standard grade segment dominated the market and accounted for the largest revenue share of over 60% in 2023. The segment is projected to grow owing to increasing demand for rubber and plastics across various industries, coupled with technological advancements and quest sustainable solutions. Standard grade is expected to grow due to standard grades wide range of applications in tire rubber, non-tire rubber, inks and coatings and plastics. Specialty grade carbon black market also held the significant share in the market.

Type Insights

Furnace Black dominated the market and accounted for a share of over 40% in 2023. Furnace black is the most commonly used method owing to its maximum production capacity. Industrially, it is produced by the combustion of heavy petroleum products, such as coal tar and Fluid Catalytic Cracking (FCC) tar, with vegetable oil. The U.S. tire industry is expected to witness a surge in demand owing to increasing automotive sales in the country. Tire manufacturers in the region are establishing new units in the vicinity of automobile production centers. Moreover, the quick adoption of advanced technologies in tire production is further expected to fuel market growth.

Application Insights

Tires emerged as a dominant application segment accounting for 68.8% of the overall revenue share in 2023. The product is widely used in tire manufacturing by adding rubber as a strengthening agent and as a filler. It is used in carcasses, inner liners, treads, and sidewalls utilizing different types based on specific performance requirements.

The plastics segment emerged as the fastest-growing segment in 2023. Carbon blacks are widely used for films, conductive packaging, moldings, fibers, semi-conductive cable compounds, and pipes in products, such as industrial bags, refuse sacks, stretch wraps, agriculture mulch film, and photographic containers. It is used in the production of conductive plastics as it exhibits antistatic and electrical conductivity properties.

Regional Insights

Asia Pacific carbon black market led the global market with a revenue share of 63.3% in 2023 followed by Europe and North America. Stringent environmental regulation may harm the North America and European markets. However, the high demand for tire manufacturing is expected to support the market. High economic growth along with rapid industrialization and urbanization in the emerging regions of Asia Pacific has boosted the regional demand. Rising foreign investments and favorable regulatory policies are also contributing to market growth. The region is rapidly transforming into a manufacturing hub, which has increased the demand for the material over the past few years.

India carbon black market

Major manufacturers are shifting their manufacturing facilities to countries like India, and Vietnam, as they have lower labor costs and support from the respective governments.

China carbon black market

Rising automotive production is also expected to drive product demand over the forecast period. Initially, the chemical was exported to developing countries like China, but with a rise in their production capacities, the exports have reduced.

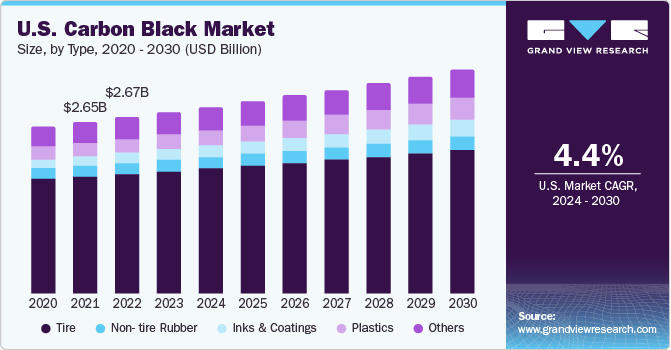

U.S. carbon black market

North America carbon black market is dominated by the U.S., both in terms of product consumption and production. The demand for tires in North America has increased with a rise in the number of tires being replaced every year. Moreover, the constant recovery of ongoing construction and automobile industries giving rise to the demand for paints, coatings, and non-tire rubber will drive the market further. Plastics manufactured from carbon black are lightweight and thus help reduce carbon emissions and fuel consumption. North America is expected to witness significant demand over the forecast period over the forecast period owing to increasing tire, rubber, and high-performance coatings demand from end-use industries.

Europe carbon black market

Europe is characterized by favorable regulatory policies regarding plastics usage in automotive component applications. Additionally, automotive OEMs in the region are actively incorporating thermoplastics as a substitute for metals to provide automobiles with better performance and fuel efficiency while reducing the overall curb weight of the vehicle. These factors are expected to drive demand for carbon black in automotive applications.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In June 2023, Bridgestone Corporation announced the commencement of the development of tire-derived oil and recovered carbon black via pyrolysis of worn tires with the help of test units established at the Bridgestone Innovation Park in Tokyo. This is aimed at encouraging the social deployment of chemical recycling technologies that allow the efficient pyrolysis of worn tires.

-

In April 2023, Orion Engineered Carbons announced the implementation of its new cogeneration technology producing renewable energy in its Ivanhoe plant (Louisiana, U.S.). The system comprises a steam turbine generator, which ingests the waste steam from the production process of the carbon black plant and alters it to electricity.

-

In March 2023, Tokai Carbon Co., Ltd. entered into a strategic partnership with Sekisui Chemical Co., Ltd., for the real-world application of the Carbon Capture and Utilization (CCU) technology. This deal was aimed at manufacturing varied carbon products and materials for the capture and storage of carbon dioxide (CO2) as solid carbon.

Key Carbon Black Companies:

- Orion Engineered Carbons Holdings GmbH

- OMSK Carbon Group

- Sid Richardson Carbon & Energy Co.

- Tokai Carbon Co. Ltd.

- Asahi Carbon Co. Ltd.

- Ralson Goodluck Carbon

- Atlas Organic Pvt. Ltd.

- Continental Carbon Co.

- OCI Company Ltd.

- Birla Carbon

- Bridgestone Corp.

- Cabot Corp.

- China Synthetic Rubber Corporation (CSRC)

- Himadri Companies & Industries Ltd. (HCIL)

- Mitsubishi Chemicals

- Nippon Steel & Sumikin Chemical Co. Ltd.

- Jiangxi Black Cat Carbon Black Inc.

Carbon Black Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.39 billion

Revenue forecast in 2030

USD 31.04 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year of estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, grade, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; China; India; Japan; Indonesia; Malaysia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Orion Engineered Carbons Holding GmbH; OMSK Carbon Group; Tokai Carbon Co. Ltd.; Bridgestone Corp.; Atlas Organic Pvt. Ltd.; Birla Carbon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Black Market Report Segmentation

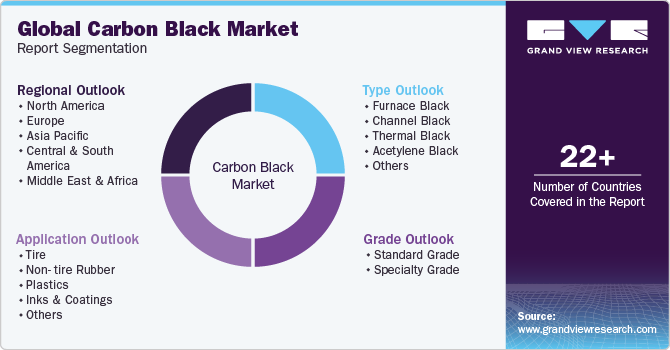

This report forecasts revenue and volume growth at the global, regional, and country levels and provides a carbon black market analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon black market report based on type, application, grade, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Furnace Black

-

Channel Black

-

Thermal Black

-

Acetylene Black

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tire

-

Non- tire Rubber

-

Plastics

-

Inks & Coatings

-

Others

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Standard Grade

-

Specialty Grade

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Malaysia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global carbon black market size was estimated at USD 21.36 billion in 2022 and is expected to reach USD 22.34 billion in 2023.

b. The global carbon black market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 31.04 billion by 2030.

b. Tires emerged as a dominant application segment accounting for 68.8% of the overall revenue in 2022. The product is widely used in tire manufacturing by adding it to rubber as a strengthening agent and as a filler

b. Some of the key players in the carbon black market include Orion Engineered Carbons Holdings GmbH, OMSK Carbon Group, Sid Richardson Carbon & Energy Co., Tokai Carbon Co. Ltd., Asahi Carbon Co. Ltd., Ralson Goodluck Carbon, Atlas Organic Pvt. Ltd., Continental Carbon Co., OCI Company Ltd.

b. Rising usage of carbon black in the production of plastics is anticipated to drive the global market over the forecast period. Moreover, the rising usage of these plastics in electrical and electronic components will boost the product demand further

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.