- Home

- »

- Medical Devices

- »

-

Spinal Implants And Devices Market Size, Share Report 2030GVR Report cover

![Spinal Implants And Devices Market Size, Share & Trend Report]()

Spinal Implants And Devices Market Size, Share & Trend Analysis By Product, By Technology, By Surgery Type, By Procedure Type (Discectomy, Laminotomy, Foraminotomy), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-031-6

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2016 - 2021

- Industry: Healthcare

Market Size & Trends

The global spinal implants and devices market size was worth USD 12.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. The market growth is driven by the rise in spinal cord injuries (SCIs) globally. The compression of the spinal nerve or damage results in injury to the external side of the vertebral column. The main causes of this compression include spine degeneration, bone fractures, or abnormalities like hematomas or herniated discs.

The rising prevalence of spinal disorders, fractures, and injuries and the rising demand for advanced medical technology and implantsare estimated to boost the market's growth over the forecast period. For instance, according to WHO statistics, approximately 250,000 to 500,000 SCI cases are reported worldwide annually. Preventable causes like falls, auto mishaps, and violence cause most SCIs. WHO estimates that there are 40 to 80 instances of SCI per million adults globally every year. Patients with SCI have a greater risk of fatality since they have a 2 to 5 times higher risk of dying before their time than patients without SCI. A large number of traumatic SCIs result from accidents at work or in athletics.

Additionally, a growing elderly population and an increase in the number of obese people regularly develop signs of vertebral column disorders like spinal stenosis, which increases the need for spinal surgery and fuels the market's growth. Furthermore, obesity frequently causes more severe lower back issues and increases the risk of return, resulting in increased adoption of spinal devices during treatment. The most common spine-related diseases affecting older people include degenerative disc disorders, vertebral compression fractures, spondylolisthesis, and spinal stenosis.

The number of SCIs has considerably increased as a result of an increase in traffic accidents. According to statistics from the National Spinal Cord Injury Statistical Center (NSCSC), some of the main causes of SCI include motor vehicle accidents involving cars and bulldozers, steamrollers, forklifts, and other unspecified vehicles. As per the NCBI study, the lumbosacral spine was the most affected area in research that included all patients with vertebral column fractures following auto accidents. Whiplash (a neck/cervical spine injury), herniated discs, and vertebral fractures are typical spine injuries caused by car crashes.

The National Spinal Cord Injury Statistical Center at UAB reports that fall-related SCIs accounted for 31.8% of all SCIs in 2018-19. Similar to this, 2021 reports from the Spinal Injury Association United Kingdom stated that 50,000 people in the UK are thought to be living with SCIs and that approximately 2500 people are injured or diagnosed with them annually. Thus, the demand for spinal implants and surgical devices is expected to increase due to the high prevalence of SCIs, diseases, and fractures among the global population over the forecast period.

The existence of renowned market players, accompanied by funding generated by government organizations for R&D, encourages technological advancement. One of the key technological trends expanding the spinal implants and devices market is the adoption of computerized navigation systems and titanium implants, which offer real-time spinal cord images and clear MRI images. These expanded the range of minimally invasive surgeries compared to open-back surgeries. The introduction of NuVasive's Pulse integrating platform marked a major development in the spine surgery sector. It is the initial singular platform with various technologies for all spine procedures that allow doctors to use safer, more efficient, and less disruptive surgical techniques.

The market is consolidating, with the key players acquiring potential start-ups and medium-sized competitors to strengthen their position as market leaders. For instance, in March 2023, Xtant Medical Holdings acquired the Coflex and Cofix product line from Surgalign Holdings for $17 million. Similarly, in March 2021, IMPLANET purchased Orthopaedic & Spine Development (OSD), a company specializing in designing, manufacturing, and distributing implants for spine surgery.

The COVID-19 pandemic has impacted the spine implant and devices market to a great extent due to the decline in spine surgery across the globe. For instance, according to a study conducted in Central Europe, 90% of the participants observed a decline in patients with degenerative spinal diseases in outpatient clinics. Additionally, the research found that about 50% of the surgeons who contracted SARS-CoV2 postponed all elective and semi-elective surgeries. Decompression surgery or lumbar disc with minor symptoms was delayed by 36% of the doctors.

Product Type Insights

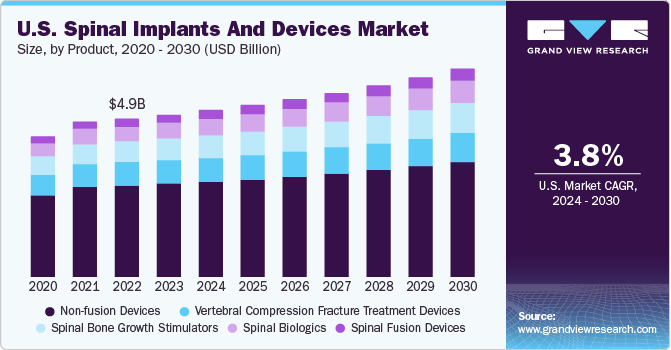

The market is divided into spinal biologics, spinal fusion devices, non-fusion devices, vertebral compression fracture treatment devices, and spinal bone growth stimulators based on the types of products. Spinal fusion devices continued to hold the highest market share of 58.7% in 2022 due to a rise in spinal fusion surgeries. Technological advancements in spine fusion surgery with or without internal fixation have led to high growth. For instance, in May 2022 ,A Carlsbad company developed a personalized device that improves spinal surgery. This device could rebuild movement, and reduce pain, for millions of individuals suffering from various kinds of scoliosis. In addition, expanded indications for spine fusions have also contributed to the high demand.

Vertebral compression fracture treatment devices are expected to experience the fastest growth of 6.3% over the forecast period due to an increase in spine disorders and patients' preference for minimally invasive surgery. Furthermore, several key players seek approval from various regulatory bodies to expand their geographical presence. These geographical expansions are anticipated to fuel segment growth. For instance, in September 2020, IZI Medical, a US-based interventional radiology device producer, obtained CE Mark authorization for the Kiva Vertebral Compression Fracture (VCF) Treatment System in Europe.

Technology Insights

Based on technology, the market has been classified into spinal fusion & fixation technologies, vertebral compression fracture treatment, and motion preservation technologies. In 2022, spinal fusion and fixation technologies accounted for the largest market share of 68.2% due to their coverage of a broad range of surgical methods, including both posterior and anterior methods. Additionally, growing FDA approvals for spinal fusion and fixation systems aided segment growth. For instance, in August 2022, the FDA granted Surgalign’s Cortera Spinal Fixation System 510(k) clearance. The Cortera Spinal Fixation System, one of the company’s new flagship posterior fixation platforms, is intended to fuel future development.

Motion preservation technologies are anticipated to experience the highest CAGR of 8.1% during the forecast period since they offer individuals suffering from lumbar spinal stenosis, degenerative disc disease, and facet pain a better option for spinal fusion. This technology is subdivided into total disc replacement (TDR), posterior dynamic devices, prosthetic nucleus, and facet replacement.

Surgery Type Insights

Based on surgery type, the market for spinal implants and devices is divided into open surgery and minimally invasive surgery (MIS). Open spine surgery is still frequently done, despite a steady decline. Open surgery includes numerous adverse effects, including prolonged operating times and high levels of invasiveness, which cause most procedures to lose excessive amounts of blood and increase the risk of infection or harm to healthy tissues.

On the other hand, MIS is often preferred by both patients and doctors. Therefore, MIS is anticipated to experience the highest growth rate of 6.8% over the forecast period. Spine related operations are carried out through tiny incisions by surgeons using cutting-edge equipment. MIS uses much smaller incisions than open surgery, which reduces the chance of muscle and soft tissue injuries. Moreover, MIS is computer-based, guided by cutting-edge navigation systems, and ensures a higher degree of accuracy, and thus expected to grow significantly in coming years.

Procedure Type Insights

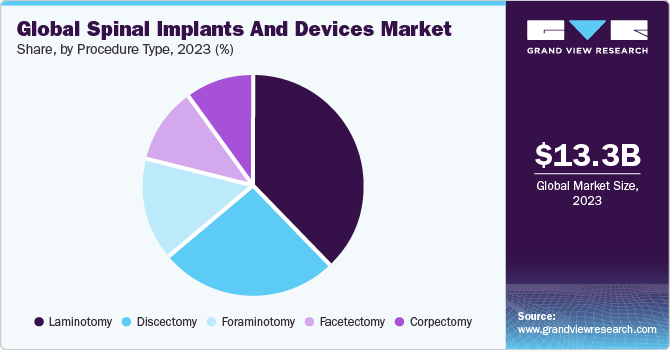

The global market for spinal implants and devices is split up by procedure type into discectomy, laminotomy, foraminotomy, corpectomy, and facetectomy segments. Laminotomy held the highest market share of 38.1% in 2022 since this is one of the most common types of spine procedures performed. Discectomy and laminectomy are frequently performed in combination. These decompressive surgeries are the ones most frequently carried out in the U.S. In the U.S., a spinal decompression procedure typically costs around $ 23,500.

Foraminotomy is expected to experience the highest CAGR of 5.9% over the forecast period. The increasing adoption of MIS surgery by patients is projected to propel the market during the forecast period. This type of surgery is used primarily for foraminal stenosis and pinched nerve treatment. Most patients succeed with this surgery, and foraminotomy complications are also rare; thus, the demand for this surgery is expected to grow during the forecast period.

Regional Insights

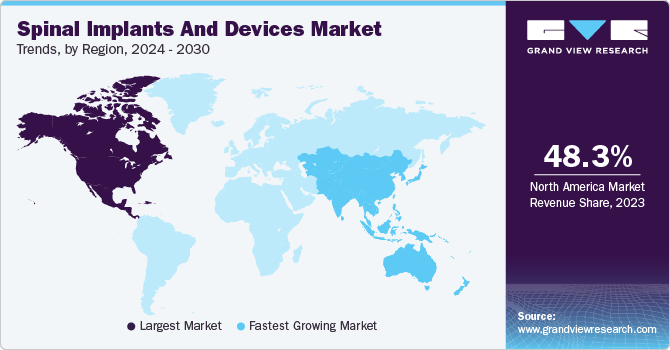

North America dominated the market in 2022 with a revenue share of 48.8% due to a rise in SCIs in the U.S. Moreover, with technological advances and increased FDA approvals, key players have experienced a substantial increase in market revenue in the U.S. For instance, in January 2022, the U.S. Food and Drug Administration (FDA) granted 510(k) approval for VUZE Medical's VIZE device, used to perform spine surgery. VUZE Medical specializes in visualization and verification for surgical procedures such as minimally invasive spine surgery. Furthermore, healthcare reimbursement has greatly influenced the country's need for spinal implants.

Asia Pacific is expected to grow the fastest during the forecast period due to growing SCI cases in India and China. Furthermore, Japan has also contributed to the rapid development of its highly sophisticated spine-related procedures. The rising elderly population and increased traffic accidents are also significantly driving regional growth.

Key Companies & Market Share Insight

Key players are getting involved in several strategic initiatives to strengthen their market position, including mergers and acquisitions, partnerships, collaborations, and developing and introducing cutting-edge products. For instance, in August 2022, Nexus Spine launched the PressON posterior lumbar fixation system. This innovative system is about one-fourth the size of conventional systems, more rapid to the implant, biomechanically stronger, less susceptible to set screw releasing, and can create patient-specific rods intraoperatively.

Similarly, in November 2022, NuVasive Inc. launched the NuVasive Tube device (NTS) and Excavation Micro, a brand-new minimally invasive surgery (MIS) device that offers complete solutions for both TLIF and decompression. Thus, the growing innovations and product launches are expected to boost the demand for spinal implants and devices over the forecast period.

Furthermore, several key players are acquiring small-scale manufacturers to expand their product lines and strengthen their market positions. For instance, in January 2023, Companion Spine acquired Backbone SAS. With the addition of Backbone's primary medical device, the LISA implant, the acquisition expanded the number of companies offering medical implant solutions. Due to this, Companion Spine can provide a full range of therapy options for spine diseases, including lumbar stenosis and degenerative disc disease, by matching implants to the disease's severity. Some of the key players in the global spinal implants and devices market include:

-

Medtronic

-

Johnson & Johnson

-

Stryker

-

NuVasive

-

Zimmer Biomet

-

Globus Medical, Inc.

-

Alphatec Spine, Inc.

-

Orthofix Holdings, Inc.

-

RTI Surgical Holdings

-

Ulrich GmbH & Co. KG

-

B. Braun Melsungen AG

-

Seaspine Holdings Corporation

Spinal Implants And Devices Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 13.3 billion

The revenue forecast in 2030

USD 19.0 billion

Growth rate

CAGR of 5.2% from 2023 to 2030

The base year for estimation

2022

Actual estimates/Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment Covered

Product, technology, surgery type, procedure type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Russia; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Singapore; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Medtronic; Johnson & Johnson; Stryker; NuVasive; Zimmer Biomet; Globus Medical, Inc.; Alphatec Spine, Inc.; Orthofix Holdings, Inc.; RTI Surgical Holdings; Ulrich GmbH & Co. KG; B. Braun Melsungen AG; Seaspine Holdings Corporation

15% free customization scope (equivalent to 5-analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spinal Implants And Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of industry trends in each of the subsegments from 2016 to 2030. For this study, Grand View Research, Inc. has segmented the global spinal implants and devices market report based on product, technology, surgery type, procedure type and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2030)

-

Spinal Fusion Devices

-

Thoracic & Lumbar Fusion Devices

-

Cervical Fusion Devices

-

-

Spinal Biologics

-

Allografts

-

Xenografts

-

DBM

-

BMP

-

Synthetic Bone Grafts

-

-

Vertebral Compression Fracture Treatment Devices

-

Non-fusion Devices

-

Spinal Bone Growth Stimulators

-

-

Technology Outlook (Revenue, USD Million, 2016 - 2030)

-

Spinal Fusion and Fixation Technologies

-

Vertebral Compression Fracture Treatment

-

Vertebroplasty

-

Kyphoplasty/Vertebral Augmentation

-

-

Motion Preservation Technologies

-

-

Surgery Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Open Surgery

-

Minimally Invasive Surgery

-

-

Procedure Type Outlook (Revenue, USD Million, 2016 - 2030)

-

Discectomy

-

Laminotomy

-

Foraminotomy

-

Corpectomy

-

Facetectomy

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa(MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global spinal implants and devices market size was estimated at USD 12.8 billion in 2022 and is expected to reach USD 13.3 billion in 2023.

b. The global spinal implants and devices market is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 19.0 billion by 2030.

b. Spinal Fusion devices segment dominated the spinal implants & devices market with a share of 38.1% in 2022. This is attributable to the increasing number of spinal fusion surgeries and technological innovations in spine fusion procedures with or without internal fixation.

b. Some key players operating in the spinal implants and devices market include Stryker, Zimmer Biomet, Medtronic, NuVasive, and Johnson & Johnson.

b. Key factors that are driving the spinal implants & devices market growth include the increasing prevalence and subsequent increase in the treatment rates of degenerative spine disorders, advancements in medical technology, increasing demand for minimally invasive procedures, and the growing incidence of spinal cord injuries (SCIs) across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."