- Home

- »

- Automotive & Transportation

- »

-

Forklift Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Forklift Market Size, Share & Trends Report]()

Forklift Market (2026 - 2033) Size, Share & Trends Analysis Report By Class (Class 1, Class 2, Class 3, Class 4/5), By Power Source (ICE, Electric), By Load Capacity (Below 5 Ton, 5-15 Ton, Above 16 Ton), By Electric Battery Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-754-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Forklift Market Summary

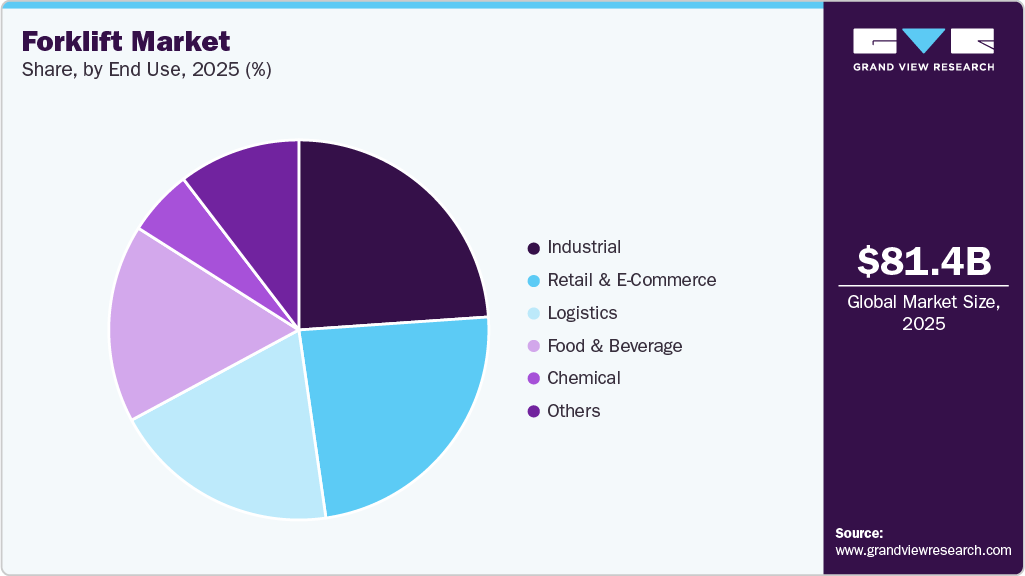

The global forklift market size was estimated at USD 81.44 billion in 2025 and is projected to reach USD 212.63 billion by 2033, growing at a CAGR of 12.7% from 2026 to 2033. The rapid shift toward electric forklifts, growth of automation and autonomous forklifts, and growing demand from e-commerce and warehouse sectors are major drivers behind the growth of the global forklift market.

Key Market Trends & Insights

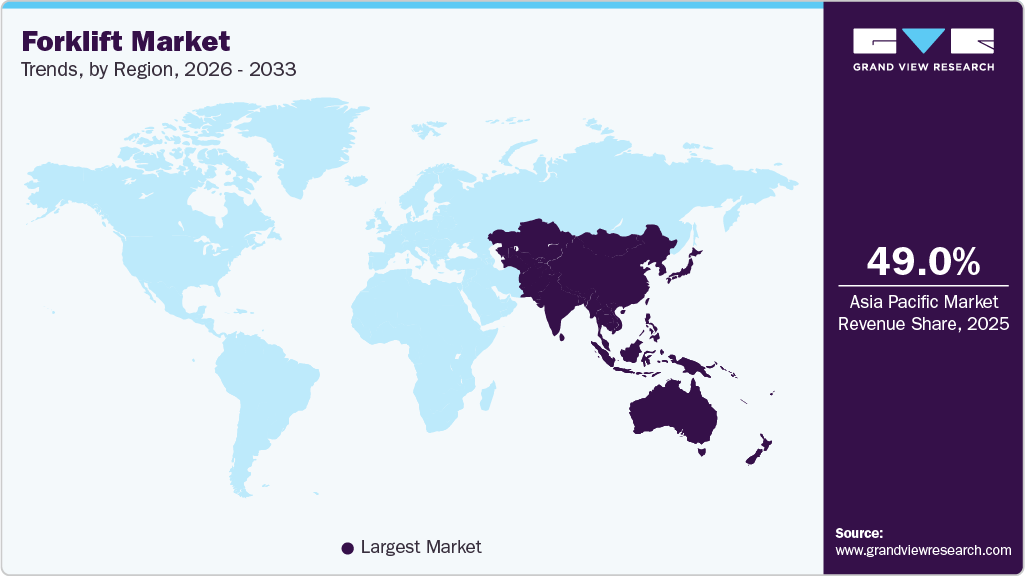

- Asia Pacific dominated the forklift industry and accounted for a share of 49.0% in 2025.

- By class, the class 3 segment dominated the market in 2025 and accounted for the largest share of 45.3%.

- By power source, the electric segment dominated the market in 2025.

- By load capacity, the 5-15 ton segment dominated the market in 2025.

- By electric battery type, the lead-acid segment dominated the market in 2025.

- By end use, the industrial segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 81.44 Billion

- 2033 Projected Market Size: USD 212.63 Billion

- CAGR (2026-2033): 12.7%

- Asia Pacific: Largest market in 2025

The global forklift market is accelerating its transition from diesel and LPG-powered machines to electric models. Stricter emissions regulations drive this shift, the rising cost of fossil fuels, and the increasing focus on workplace sustainability. Modern lithium-ion forklifts also offer lower maintenance requirements, reduced downtime, and longer operating cycles compared to traditional lead-acid or IC-engine units. As warehouses push for cleaner and quieter operations, electric forklifts are becoming the preferred choice across industries. This trend is expected to dominate future fleet replacements worldwide.Automation is reshaping material-handling operations, and autonomous forklifts are becoming a major growth area in the market. These vehicles use sensors, LiDAR, cameras, and advanced navigation technologies to operate with minimal human intervention. Labor shortages in warehousing, combined with the rising need for accuracy, safety, and round-the-clock operations, are accelerating their adoption. Autonomous forklifts also help companies reduce operational errors and improve throughput during peak workloads. Over the next decade, semi-autonomous and fully autonomous forklift models are expected to become a standard feature in large distribution and manufacturing facilities.

The ongoing global boom in e-commerce is one of the strongest forces driving forklift demand. Growth in online retail has led to rapid expansion of warehouses, fulfillment centers, and last-mile logistics hubs, each requiring large fleets of forklifts, pallet trucks, and narrow-aisle material-handling equipment. Increased throughput, faster delivery expectations, and higher inventory turnover are putting pressure on warehouses to scale up handling capacity. Logistics networks are expanding worldwide, making forklifts essential assets for supporting high-volume, multi-shift operations.

One of the key restraints in the forklift market is the high initial investment required for modern equipment, particularly electric, lithium-ion, and autonomous models. Many small and mid-sized warehouses struggle to justify the upfront cost of upgrading fleets, especially when operational margins are tight. In addition, the lack of charging infrastructure and limited technical expertise in emerging markets further slows adoption of advanced forklifts. Supply-chain disruptions, fluctuating raw material prices, and long delivery lead times also impact manufacturers’ ability to meet demand efficiently. Together, these challenges act as significant barriers to faster market growth, particularly in cost-sensitive regions.

Class Insights

The class 3 segment dominated the market in 2025 and accounted for the largest share of 45.3%. Class 3 segment includes electric motorized hand trucks. These are hand-controlled forklifts, where the operator steers the forklift with a tiller from the front of the vehicle. Hand trucks are often controlled by a handle at the back of the truck, with hand control used to steer as the driver rides or walks it to the destination. These forklifts are frequently used for moving items requiring low raises and can effortlessly transfer goods throughout the warehouse floor without requiring the product to be placed on a high shelf or rack.

The class 1 segment is expected to witness a significant CAGR over the forecast period. The high demand for electric rider trucks across end use areas such as retail stores, factories, the food service industry, and chemical factories is expected to support the segment growth. These forklifts generally have fewer moving parts, thereby reducing maintenance requirements and overall expenses. The ease of maneuverability and quiet operations make class 1 forklifts suitable for diverse work environments, from warehouses to manufacturing facilities, where noise levels and space constraints are significant considerations.

Power Source Insights

The electric segment dominated the market in 2025.Electricity is an eco-friendly alternative to gasoline and diesel-powered forklifts. Rising environmental concerns and depleting fossil fuel resources are driving the need for sustainable, efficient, and durable forklifts, which can also ensure a healthier, emission-free environment for employees. Advances in battery technology and the strong emphasis on ensuring a healthier working environment for employees are expected to play a potent role in driving the growth of the electric forklift market over the forecast period.

The ICE segment is expected to witness a moderate CAGR over the forecast period. The internal combustion engine (ICE) power source segment remains a significant part of the global forklift market, particularly in heavy-duty outdoor applications such as construction, manufacturing yards, ports, and logistics terminals. ICE forklifts, powered by diesel, gasoline, or LPG are valued for their high lifting capacity, strong torque, and ability to operate for long hours without frequent refueling or downtime. Their durability on uneven terrain and suitability for challenging environments also make them a preferred choice where electric models may struggle. However, growing environmental regulations, rising fuel costs, and the industry’s shift toward cleaner technologies are gradually pressuring the segment. Despite this, ICE forklifts continue to maintain substantial demand in regions where infrastructure for electric charging or hydrogen fueling remains limited.

Load Capacity Insights

The 5-15 ton segment dominated the market in 2025. Forklifts with capacities between 5 tons and 15 tons are commonly used for handling a wide range of materials, including pallets, steel, and bricks. They can be considered highly efficient equipment for mechanized loading and short-distance transportation. They can be used both indoors and outdoors and can be fired by natural gas, liquid propane, or gasoline. These forklift trucks are usually sit-down models and happen to be the most common types of forklifts used to lift and position heavy objects promptly and with precision. This versatility is expected to create lucrative opportunities for the growth of the segment.

The below 5 ton segment is expected to witness the fastest CAGR over the forecast period.These compact forklifts are highly versatile, allowing businesses to handle various load sizes efficiently. These compact forklifts facilitate the safe and easy movement of products across limited floor space. Manufacturing, warehousing, material handling, logistics, and freight handling are some of the application fields of these forklifts. Furthermore, when used to transport risky cargo in small warehouse spaces, these forklifts also protect the workforce.

Electric Battery Type Insights

The lead-acid segment dominated the market in 2025.Lead-acid batteries can be considered a reliable energy source due to their ability to provide a high-power surge. Hence, they are popularly used in electric forklifts. Electric forklifts call for high current output to perform heavy lifting and maneuvering tasks. Lead-acid batteries can deliver the necessary power output, making them well-suited for these applications without confronting any significant voltage drops or power fluctuations.

The Li-ion battery segment is expected to grow at the fastest CAGR over the forecast period.Growing environmental concerns are prompting businesses to seek eco-friendly solutions to reduce their carbon footprint. Lithium-ion batteries offer a cleaner alternative to conventional lead-acid batteries, which feature toxic chemicals, such as lead and sulfuric acid. By adopting lithium-ion technology in electric forklifts, vendors are demonstrating their commitment to sustainability by adhering to the increasingly stringent environmental regulations, which bodes well for the growth of the forklift Li-ion battery market.

End Use Insights

The industrial segment dominated the market in 2025. Forklifts are extensively used for undertaking material handling and warehousing tasks in industrial environments. In manufacturing plants, forklifts play a crucial role in moving raw materials, intermediate products, and finished goods within production lines. Their ability to handle heavy loads and navigate tight spaces helps ensure a smooth material flow, reducing production bottlenecks and enhancing operational efficiency.

The retail & e-commerce segment is expected to grow at the fastest CAGR during the forecast period. The segment growth is driven by changing consumer preferences and the rise of online shopping. The retail & e-commerce industry has been evolving significantly over the past few years, driven by changing consumer preferences and the growing preference for online shopping. In this dynamic landscape, forklifts have become integral to the industry, offering tailored applications to support efficient material handling and logistics operations. Forklifts play a vital role in streamlining warehouse operations and ensuring the seamless movement of goods from order receipt to storage and order fulfillment. Their compact design and precise control enable agile maneuvering in tight spaces, optimizing space utilization and expediting inventory management.

Regional Insights

Asia Pacific dominated the forklift industry and accounted for a share of 49.0% in 2025. The Asia Pacific region is home to several prominent forklift manufacturers, such as Doosan Corporation and Hangcha Forklift, fostering technological innovations and driving industry competitiveness. As companies continuously develop advanced electric forklift models with enhanced performance and features, end use industries upgrade their fleets to remain competitive and efficient. As the market evolves, collaborations among governments, manufacturers, and businesses are expected to play a pivotal role in driving further advancements and widespread adoption of forklifts in Asia.

Forklift market in China held a substantial market share in 2025. The market in China is experiencing rapid growth, driven by industrial expansion, government policies promoting smart manufacturing, and the booming e-commerce sector. The country’s focus on sustainability and carbon neutrality is accelerating the shift from internal combustion engine (ICE) forklifts to electric and hydrogen-powered alternatives.

Japan forklift market held a significant share in 2025. In Japan, the market is evolving in response to an aging workforce and the increasing need for automation in logistics and manufacturing. Companies are investing in robotic and AI-driven forklifts to enhance operational efficiency and reduce dependency on manual labor. Sustainability goals are also shaping the industry, with a growing preference for electric forklifts over traditional fuel-based models.

Europe Forklift Market Trends

Europe forklift market is expected to register a moderate CAGR from 2026 to 2033. The Europe market is evolving in response to regulatory changes, technological advancements, and growing e-commerce activities. The push for sustainability is accelerating the transition from diesel and gas-powered forklifts to electric and hydrogen-powered models across various industries. Automation and robotics are gaining traction, with companies increasingly adopting autonomous forklifts to improve logistics efficiency and reduce labor dependency. The expansion of smart warehouses and digital supply chains is also driving demand for IoT-integrated material handling solutions.

The UK forklift market is expected to grow at the fastest CAGR from 2026 to 2033. The UK forklift market is driven by the country’s strong logistics, retail, and manufacturing sectors, which continue to expand in response to rising e-commerce activity and supply chain modernization. Demand for electric forklifts is growing rapidly as businesses prioritize sustainability and comply with stricter emissions regulations.

Forklift market in Germanyheld a substantial market share in 2025. The German forklift market is being shaped by its strong industrial base, stringent environmental regulations, and advancements in automation. As a leader in manufacturing and logistics, the country is witnessing increased demand for electric forklifts, driven by sustainability initiatives and the European Union’s carbon reduction goals.

North America Forklift Market Trends

The North America forklift market is expected to grow at a notable CAGR during the forecast period. The market in North America is being driven by rising automation, the expansion of e-commerce, and increasing demand for sustainable material handling solutions. With the rapid growth of warehouse and distribution centers, businesses are investing in electric and autonomous forklifts to enhance operational efficiency and reduce carbon emissions. Stringent environmental regulations and government incentives are also accelerating the shift from internal combustion engine (ICE) forklifts to battery-powered and hydrogen fuel cell alternatives.

The U.S. Forklift Market Trends

The forklift market in the U.S. held a dominant position in the region in 2025.The market in the U.S. is witnessing significant transformation, driven by automation, sustainability initiatives, and the expansion of industrial and retail sectors. The surge in e-commerce has heightened the need for efficient warehouse management, increasing the adoption of electric and autonomous forklifts.

Key Forklift Company Insights

Some of the key companies in the Forklift industry include Toyota Motor Corporation (Toyota Material Handling), KION Group AG, Jungheinrich AG, Crown Equipment Corporation, and Mitsubishi Logisnext Co., Ltd. These companies focus on product innovation, R&D, and strategic initiatives such as new product launches, business expansions, partnerships, collaborations, and mergers and acquisitions.

-

Mitsubishi Logisnext Co., Ltd is engaged in developing, designing, and selling engine and electric-powered forklifts, local area networks, electric vehicles, automated warehouses, monorails, transportation robots, and other logistics equipment. The company has a strong market presence in North America, Europe, Asia & Oceania, and China. For the company, Asia is the most promising market for future growth.

-

Jungheinrich AG is an intralogistics solutions provider offering a wide product portfolio comprising material handling equipment, digital solutions, automated systems, and related services, including rental services and aftermarket services. The company provides its customers with tailor-made solutions from a single source to help them expand their intralogistics services. The company has developed an automated intralogistics workflow using various automated warehouse equipment, mobile robots, and software.

Key Forklift Companies:

The following are the leading companies in the forklift market. These companies collectively hold the largest market share and dictate industry trends.

- Anhui Heli Co., Ltd.

- Clark Material Handing Company, (Clark Equipment Company)

- Crown Equipment Corporation

- Doosan Corporation

- Hangcha Forklift

- Hyster-Yale Materials Handling, Inc.(Hyster-Yale Group, Inc.)

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Toyota Motor Corporation (Toyota Material Handling)

Recent Developments

-

In December 2025, Clark Material Handling Company unveiled its new S25-35XE Renegade Lithium Series, a lineup of electric forklifts offered in 5,000, 6,000, and 7,000 lbs. (2.3, 2.7, and 3.75-ton) lifting capacities.

-

In November 2025, Bobcat introduced its first 3-wheel electric forklift range featuring advanced lithium-ion technology. The new B16-20-NT series, including the B16NT, B18NT, and B20NT models is designed specifically for light to medium-duty applications. Built with a compact structure and excellent maneuverability, these forklifts offer efficient performance in tight spaces. Their zero-emission operation and modern battery technology make the series a future-ready solution for in-plant logistics and sustainable material handling.

Forklift Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 91.84 billion

Revenue forecast in 2033

USD 212.63 billion

Growth rate

CAGR of 12.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Units and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Class, power source, load capacity, electric battery type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Anhui Heli Co. Ltd.; Clark Material Handing Company, (Clark Equipment Company); Crown Equipment Corporation; Doosan Corporation; Hangcha Forklift; Hyster-Yale Materials Handling, Inc.(Hyster-Yale Group, Inc.); Jungheinrich AG; KION Group AG; Komatsu Ltd.; Mitsubishi Logisnext Co. Ltd.; Toyota Motor Corporation (Toyota Material Handling)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Forklift Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global forklift market report based on class, power source, load capacity, electric battery type, end use, and region:

-

Class Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

Class 1

-

Class 2

-

Class 3

-

Class 4/5

-

-

Power Source Outlook (Volume, Units; Revenue, USD Million, 2021 - 2033)

-

ICE

-

Electric

-

-

Load Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 5 Ton

-

5-15 Ton

-

Above 16 Ton

-

-

Electric Battery Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Li-ion

-

Lead Acid

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Logistics

-

Chemical

-

Food & Beverage

-

Retail & E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global forklift market is expected to be estimated at USD 81.44 billion in 2025 and is expected to reach USD 91.84 billion in 2026.

b. The global forklift market is expected to grow at a compound annual growth rate of 12.7% from 2026 to 2033 in terms of revenue to reach USD 212.63 billion by 2033.

b. Asia Pacific dominated the forklift industry and accounted for a share of 49.0% in 2025. The Asia Pacific region is home to several prominent forklift manufacturers, such as Doosan Corporation and Hangcha Forklift, fostering technological innovations and driving industry competitiveness.

b. Some key players operating in the forklift market include Anhui Heli Co., Ltd., Clark Material Handing Company, (Clark Equipment Company), Crown Equipment Corporation, Doosan Corporation, Hangcha Forklift, Hyster-Yale Materials Handling, Inc.(Hyster-Yale Group, Inc.), Jungheinrich AG, KION Group AG, Komatsu Ltd., Mitsubishi Logisnext Co., Ltd., and Toyota Motor Corporation (Toyota Material Handling)

b. Key factors driving the forklift market growth include development in the automotive industry; growth of warehousing and logistics; industrialization in emerging markets such as Latin America.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.