- Home

- »

- Medical Devices

- »

-

Spinal Fusion Devices Market Size And Share Report, 2030GVR Report cover

![Spinal Fusion Devices Market Size, Share & Trends Report]()

Spinal Fusion Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Disease (Degenerative Disc, Complex Deformity, Trauma & Fractures), By Surgery, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-388-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spinal Fusion Devices Market Summary

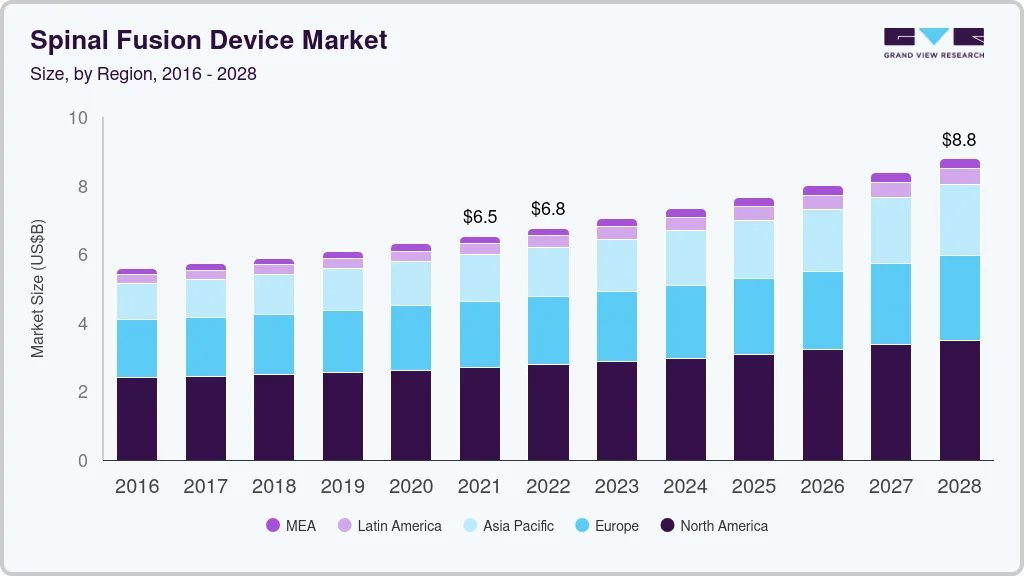

The global spinal fusion device market size was estimated at USD 7.03 billion in 2023 and is projected to reach USD 9.75 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The increasing prevalence of degenerative disc disorders and the rising geriatric population, who are more prone to spine-related ailments, are key contributors to the market growth.

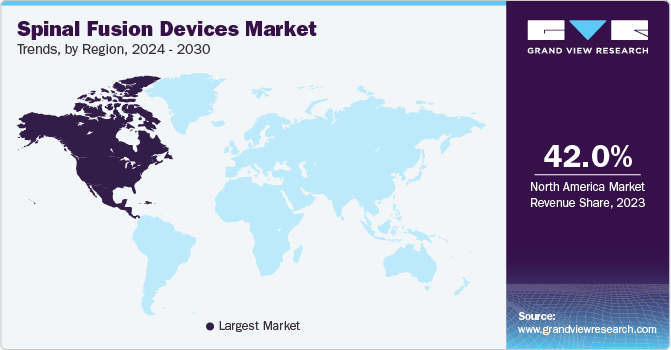

- North America spinal fusion devices market dominated the market with a share of 42.0% in 2023.

- The U.S. spinal fusion devices market dominated the North American market with a share of 74.8% in 2023.

- By product, the thoracolumbar devices product segment accounted for a revenue share of 55.9% in 2023.

- By Disease, the degenerative disc product segment accounted for the largest market revenue share in of 42.1% 2023.

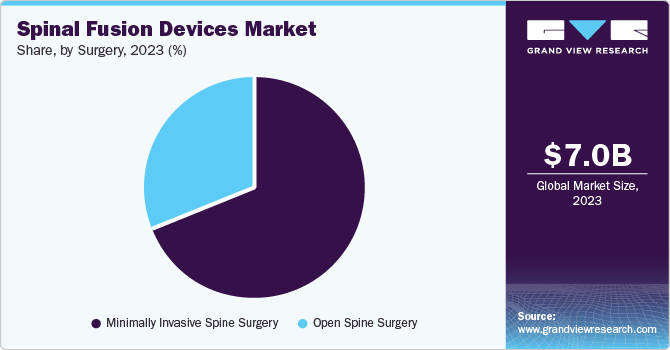

- By surgery, the minimally invasive spine surgery segment dominated the market with a share of 69.4% in 2023

Market Size & Forecast

- 2023 Market Size: USD 7.03 Billion

- 2030 Projected Market Size: USD 9.75 Billion

- CAGR (2024-2030): 4.9%

- North America: Largest market in 2023

Additionally, advancements in spinal fusion surgery techniques and the development of innovative spinal devices have also played a significant role. The growing awareness about the benefits of minimally invasive surgical procedures and the increasing healthcare expenditure in developing countries further fuel the demand for spinal fusion devices. In addition, the rise in the number of spine surgeries due to lifestyle-related factors and accidents adds to the market expansion.The spinal fusion devices industry is witnessing a trend toward the use of surgical robots, with a majority of hospitals now performing robotic surgery to treat spinal diseases. Many manufacturers are focusing on developing new models of surgical robots that can be used in spinal fusion surgeries in conjunction with precision implants and navigation systems. This has opened up numerous opportunities for strategic partnerships and new product introductions, factors that are anticipated to propel the growth of this market.

Enhanced spinal surgery procedures yielding improved results are also crucially shaping the market. The benefits of these procedures, such as reduced blood loss, quicker recovery, and minimal discomfort, are increasing patient confidence in undergoing these surgeries. With an increase in R&D funding leading to technological and biological advancements, the market is poised for significant growth in the coming years.

Product Insights

The thoracolumbar devices product segment accounted for a revenue share of 55.9% in 2023 attributed to the advancements in the devices, including features such as expandable cages, 3D-printed implants, and bioactive materials. These enhancements have made the devices more stable, user-friendly, and compatible compared to their predecessors and other alternatives.

The cervical fixation devices product segment is anticipated to grow at a CAGR of 5.9% from 2024 to 2030. The growth drivers for this segment include the increasing usage of spine navigation software, improved health insurance facilities, and high demand for expandable inter-body devices. The rising trend of inter-body spacer devices is also contributing to the increased demand for these products, thereby significantly driving the growth of the overall cervical fixation devices segment.

Disease Insights

The degenerative disc product segment accounted for the largest market revenue share in of 42.1% 2023 attributed to increased investment in healthcare infrastructure, which has led to quality treatments for patients suffering from degenerative disc diseases. Additionally, the implementation of reimbursement policies in surgical procedures to manage costs, along with a shift towards patient-centric care models, have played significant roles in the growth of this segment.

Thecomplex deformity segment is anticipated to grow at the fastest CAGR of 5.2% from 2024 to 2030 driven by the increasing prevalence of spinal deformities such as scoliosis, kyphosis, and other related conditions. According to the American Association of Neurological Surgeons, scoliosis is found in 2 to 3% of the global population, with 6 to 9 million cases in the U.S. alone, primarily affecting individuals aged 10-15 years. These factors have led to an increased demand for technological advancements and innovative procedures, thus significantly contributing to the growth of this segment in the global spinal fusion devices market.

Surgery Insights

The minimally invasive spine surgery segment dominated the market with a share of 69.4% in 2023 attributed to changing patient preferences, such as shorter recovery time, reduced hospital stays, less pain, and cost-effective treatments. These preferences have led to technological advancements, including advanced imaging techniques in CT scans and robotic-assisted surgery, which have improved patient outcomes, reduced hospital stays, and led to more cost-effective treatments.

The open spine surgery segment is anticipated to witness significant growth with a CAGR of 4.5% from 2024 to 2030. The growth drivers for this segment include the rise in aging populations in many countries, leading to an increase in cases of spinal stenosis, herniated discs, and other diseases, thereby increasing the demand for this segment. Furthermore, rising investments in healthcare sectors, which have resulted in enhanced medical technologies and surgical procedures, along with increasing disposable incomes of patients, enabling them to avail of these surgeries, are playing a vital role in shaping the market.

End Use Insights

The hospitals segment dominated the market in 2023 driven by a combination of factors, including technology incorporation, demographic trends, economic conditions, regulatory changes, and shifts in healthcare trends. Collectively, these factors contribute to improved surgical outcomes and increased patient satisfaction, encouraging patients to seek treatment for spinal diseases in hospitals, thus significantly driving the growth of this segment.

The outpatient facilities end use segment is anticipated to witness the fastest growth from 2024 to 2030. The driving forces for this growth include innovations in surgical techniques that have shaped treatment procedures, increasing demand for personalized care, and the benefits of these facilities, such as cost-effectiveness and shorter wait times compared to alternatives. Enhanced Recovery After Surgery (ERAS) protocols, which aim to minimize postoperative pain and complications, also contribute to this growth. Additionally, changes in lifestyle leading to obesity and other diseases necessitate independent post-surgery care, further driving the growth of this segment in the global spinal fusion devices market.

Regional Insights

North America spinal fusion devices market dominated the market with a share of 42.0% in 2023. The factors for the growth are attributed to the growing cases of spinal fusion treatment procedures in ambulatory surgical centers, advancing technologies such as robot-assisted surgeries, spine navigation tools, and other technologies are growing the market in the region significantly.

U.S. Spinal Fusion Devices Market Trends

The U.S. spinal fusion devices market dominated the North American market with a share of 74.8% in 2023. This growth is primarily driven by the increasing incidence of traumatic spinal cord injuries (TSCI). The National Spinal Cord Injury Statistical Center reported approximately 54 cases of TSCI per million people in 2023, resulting in around 18,000 new cases annually. This increases the burden on the healthcare organization for the treatment, creating new opportunities for industry players and leading to substantial market growth in the country.

Mexico spinal fusion devices market is expected to grow fastest in the North American region from 2024 to 2030. Key drivers for this growth include rising cases of spinal diseases, an aging population, improved healthcare infrastructure, greater utilization of minimally invasive surgical techniques, economic development and medical tourism, and technological advancements enhancing treatment outcomes.

Europe Spinal Fusion Devices Market Trends

Europe spinal fusion devices market was identified as a lucrative region in 2023 driven by several key factors including favorable reimbursement policies, government health programs incentivizing patients to undergo surgeries, increasing awareness among healthcare professionals and patients about treating chronic back and spine diseases, and the advancement of healthcare facilities offering specialized care services.

Specifically, the UK spinal fusion devices market is anticipated to experience substantial growth in the near future. This growth can be attributed to the rising elderly population, the rising prevalence of spinal disorders, improved healthcare infrastructure, and heightened awareness and diagnosis capabilities, all of which are significantly contributing to the market's expansion in the region.

Asia Pacific Spinal Fusion Devices Market Trends

Asia Pacific spinal fusion devices market is anticipated to grow at a CAGR of 6.7% from 2024 to 2030 owing to several factors, including a rising geriatric population, increasing disposable income, and growing healthcare expenditures, which lead to improved healthcare facilities. Enhanced surgical services and advanced technologies result in better treatment outcomes, increasing patient confidence and thus significantly driving market growth in the region.

The spinal fusion devices market in China held a significant share in 2023 due to its competitive nature. This competition has resulted in many partnerships and collaborations, leading to price reductions and innovations that make surgery more appealing to patients. Additionally, favorable government reimbursement policies offer financial support to patients undergoing surgeries. The growing elderly population in China has also contributed to an increase in degenerative disc diseases, scoliosis, and other spinal disorders, further driving market growth.

Key Spinal Fusion Devices Company Insights

Some of the key companies in the spinal fusion devices market include Medtronic, NuVasive, Inc., SeaSpine, Stryker, B. Braun SE, ATEC Spine, Inc., and many other companies. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

ATEC Spine, Inc. offers a diverse portfolio of products, such as anterior cervical discectomy fusion, Transforaminal Lumbar Interbody Fusion, Prone Transpsoas, Posterior fixation, and many others, with enhanced technologies, such as integrating AI with its EOS imaging.

-

XTANT MEDICAL offers an advanced portfolio of orthobiologics and other spinal fixation systems. They provide orthobiologics products such as 3Demin, Dual layer Amniotic Membrane, and many other products with fixation products such as Aranax, Atrix-C Union, and many others products.

Key Spinal Fusion Devices Companies:

The following are the leading companies in the spinal fusion devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medical Device Business Services, Inc.

- Stryker

- Medtronic

- Orthofix Medical Inc.

- NuVasive, Inc.

- Zimmer Biomet.

- Captiva Spine, Inc.

- Institute for Spine & Scoliosis

- Spine Wave, Inc.

- XTANT MEDICAL

- B. Braun SE

- Globus Medical

- ATEC Spine, Inc.

- SeaSpine

- Spineology Inc.

Recent Developments

-

In August 2024, NanoHive secured a USD 7 million investment to advance the development and commercialization of its 3D-printed titanium spinal interbody fusion devices. The funding will accelerate market penetration within the United States and facilitate expansion into global territories.

-

In October 2023, Silony Medical International acquired the global fusion business of Centinel Spine to expand its presence in the U.S. spinal fusion market.

Spinal Fusion Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.32 billion

Revenue forecast in 2030

USD 9.75 billion

Growth Rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, disease, surgery, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, Kuwait, South Africa

Key companies profiled

Medical Device Business Services, Inc.; Stryker; Zimmer Biomet.; Orthofix Medical Inc.; B. Braun SE; Medtronic; NuVasive, Inc.; Globus Medical; ATEC Spine, Inc; Captiva Spine, Inc.; SeaSpine; Institute for Spine & Scoliosis; Spine Wave, Inc.; Spineology Inc.; XTANT MEDICAL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spinal Fusion Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Grand View Research has segmented the global spinal fusion devices market report for this study based on product, disease, surgery, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Thoracolumbar Devices

-

Anterior Lumbar Plates

-

Pedicle Screw and Rods

-

Others

-

-

Cervical Fixation Devices

-

Anterior Cervical Plates

-

Hook Fixation Systems

-

Others

-

-

Interbody Fusion Devices

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Other Nondestructive Technologies

-

Degenerative Disc

-

Complex Deformity

-

Trauma & Fractures

-

Others

-

-

Surgery Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Spine Surgery

-

Minimally Invasive Spine Surgery

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.