- Home

- »

- Petrochemicals

- »

-

Global Synthetic Lubricants Market Size & Share Report, 2030GVR Report cover

![Synthetic Lubricants Market Size, Share & Trends Report]()

Synthetic Lubricants Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Esters, PAO, PAG), By Application (Engine Oil, HTFs, Transmission Fluids, Metalworking Fluids), By Region, And Segment Forecasts

- Report ID: 978-1-68038-124-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Lubricants Market Summary

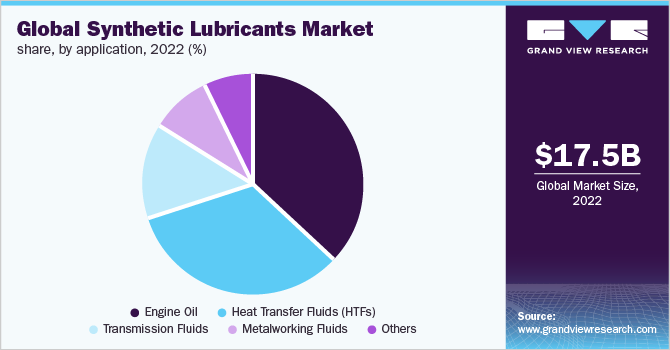

The global synthetic lubricants market size was estimated at USD 17.5 billion in 2022 and is projected to reach USD 23.4 billion by 2030, growing at a CAGR of 3.7% from 2023 to 2030. The market growth is attributed to the superior properties of synthetic lubricants such as assisting in temperature control by absorbing the heat generated by the moving vehicle parts and transmitting them to a cooler or sump.

Key Market Trends & Insights

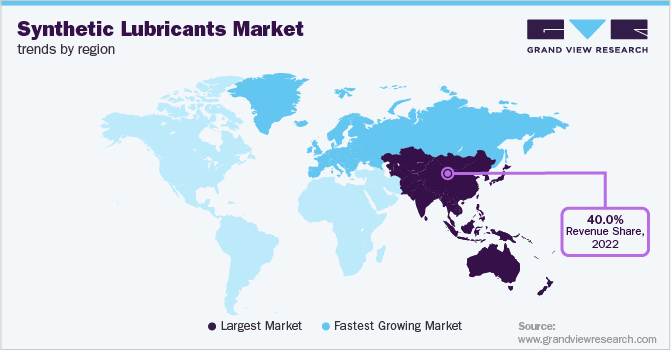

- Asia Pacific accounted for the largest revenue share of over 40.0% in 2022.

- Europe is another region witnessing quick growth in the market.

- Based on application, the engine oil segment dominated the global market with a revenue share of over 35.0% in 2022.

- In terms of product, polyalphaolefin (PAO) held the largest revenue share of over 50.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 17.5 Billion

- 2030 Projected Market Size: USD 23.4 Billion

- CAGR (2023-2030): 3.7%

- Asia Pacific: Largest market in 2022

- Europe: Fastest growing market

This is driving their demand in the end-use industries such as automobile and industrial machinery and equipment sector. Synthetic lubricants have better properties compared to mineral lubricants, including better hardware compatibility with automotive components. Thus, the advancement of technology leading to consistent changes, upgradations in designs of vehicles, and the introduction of new-age engines and high-end automotive parts are driving the demand for synthetic lubricants over the forecast period.

Rising demand in Asia Pacific due to increased production of cars and new machine installations is further expected to augment the demand for the product. Additionally, technological advancements such as the NSF Food lubricants standard set for the use of synthetic lubricants by major equipment builders in the food industry are boosting the demand for synthetic lubricants.

Manufacturers are coming up with new products and technologies that make them suitable for different equipment with extreme pressures and temperatures. However, the preference of customers for cheaper substitutes of synthetic lubricants is expected to hamper the growth of the market. The rising need for reducing maintenance costs in the manufacturing sector is further expected to trim down the scope of synthetic lubricants. Additionally, the incompatibility of Polyalphaolefins (PAOs) and conventional mineral oils with Polyalkylene Glycol (PAG)-based oils are expected to create obstacles for future market growth.

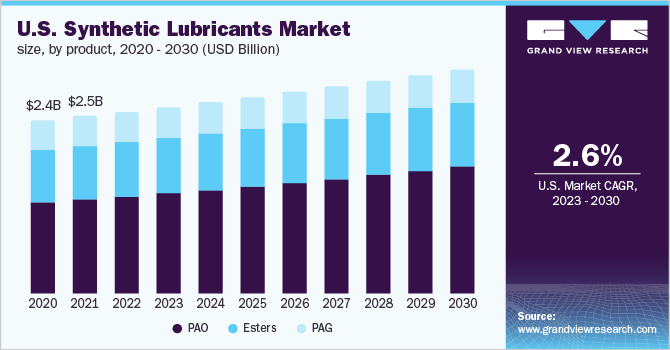

The U.S. is the largest consumer of synthetic lubricants in North America. This is attributed to the presence of major industrial machinery manufacturers in the region. Companies such as Deere & Co.; Caterpillar; Inc.; AGCO Corp.; Baker Hughes; Inc.; and Veritiv Corp. cater to the continuously growing demand for machinery used in mining, construction, mining, industrial products, automobile manufacturing, and agriculture in the region. This, in turn, is resulting in the increased demand for synthetic lubricants for the efficient functioning of machinery.

Product Insights

Polyalphaolefin (PAO) held the largest revenue share of over 50.0% in 2022. This is attributed to the fact that it offers hydrolytic stability and high viscosity index. Its growing use in gear oils and bearing oils, suitability in extremely cold conditions as well as high temperatures, and relatively lower cost compared to other base oils, are some of the other factors contributing to the growth of PAO.

Esters are anticipated to witness significant growth over the forecast period. This is attributed to the fact that synthetic esters can be used in both low and high-temperature applications and they respond positively to performance-enhancing additives such as corrosion inhibitors, antioxidants, load-carrying additives, and anti-wear agents. Thus, they are used in a wide variety of applications such as gearboxes, compressors, bearings, chains, jet engines, and hydraulic power packs.

Polyalkylene glycol (PAG) is expected to witness quick growth owing to its increasing application in metal-working and food-grade fluids. The biodegradable nature of PAG encourages its use in several environmentally sensitive applications. Thus, all these factors are contributing to its growth.

Application Insights

The engine oil segment dominated the global market with a revenue share of over 35.0% in 2022. This is attributed to the growing automotive industry, including cargo and personal vehicles, as engine oil is generally used in automobiles to minimize the friction between metals, thus reducing damage.

According to OICA, the production of automobiles increased from 77.6 billion to 80.1 billion from 2020 to 2021. Additionally, new-age high-performance petrol and diesel-based engines with improved specifications have further increased the demand for synthetic lubricants in the market due to their better viscosity as compared to conventional lubricants.

Heat transfer fluids (HTFs) are expected to witness the fastest growth over the forecast period. This is attributed to the fact that these fluids play a crucial role in gas & oil processing from the upstream to the downstream sector, which covers the processing of natural gas, crude oil, transportation, and refining. Additionally, the companies involved in recycling or reprocessing used lubricating oils utilize a hefty amount of heat transfer fluids. Thus, all these factors are contributing to the fast growth of heat transfer fluids.

Regional Insights

Asia Pacific accounted for the largest revenue share of over 40.0% in 2022. This growth is attributed to the increasing presence of automobile and petrochemical industries in the region. The market is dominated by some major oil companies producing synthetic lubricants with extensive distribution networks. Refinery business in the Asia Pacific, specifically in countries such as China, India, and Singapore, has capitalized on the low crude oil prices, which has resulted in increased production of petrochemicals in the region.

Europe is another region witnessing quick growth in the market. This growth is attributed to factors such as the recovery of the manufacturing sector in the region, increased focus on the reduction of CO2 emission from vehicles, product quality improvement, and supply of base oil. The increased investment in synthetic lubricant blending plants in Netherlands and Russia is also driving the demand for the product in the region. However, the rules and regulations laid down by the European Union for the safety of health and the environment may pose a threat to the market.

The supply of synthetic lubricants in North America is also expected to be spurred on account of increasing demand from the engine oil application segment. The engine oil supply is rising on account of growth in the automotive sector in the region. Synthetic lubricants are required as an essential functional consumable due to superior thermal stability and reduction in friction resistance offered. Thus, all these factors are contributing to the growth in the region.

Key Companies & Market Share Insights

Most companies are focusing on improving their presence in emerging as well as potential markets such as Asia Pacific by entering into strategic collaborations and establishing new plants. For instance, over the past few years, companies such as ExxonMobil, Total, and Shell have formed partnerships with gearbox manufacturers, such as Stäublito, Bonfiglioli, and Shanthi, where the latter set of companies have recommended synthetic gear lubricants use. Some prominent players in the global synthetic lubricants market include:

-

BP Lubricants Pvt. Ltd.

-

Chevron Corporation

-

LANXESS

-

Valvoline

-

FUCHS

-

Pennzoil

-

Phillips 66 Company

-

Motul

-

AMSOIL INC.

-

Agip

Synthetic Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.1 billion

Revenue forecast in 2030

USD 23.4 billion

Growth Rate

CAGR of 3.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Netherlands; Norway; Turkey; China; India; Japan; Brazil; Argentina; UAE

Key companies profiled

BP Lubricants Pvt. Ltd.; Chevron Corporation; LANXESS; Valvoline; FUCHS; Pennzoil; Phillips 66 Company; Motul; AMSOIL INC.; Agip

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

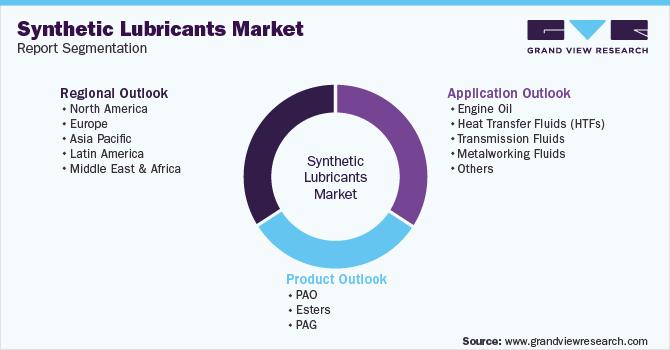

Global Synthetic Lubricants Market Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global synthetic lubricants market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

PAO

-

Esters

-

PAG

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Engine Oil

-

Heat Transfer Fluids (HTFs)

-

Transmission Fluids

-

Metalworking Fluids

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Netherlands

-

Norway

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global synthetic lubricants market size was estimated at USD 17.5 billion in 2022 and is expected to reach USD 18.1 billion in 2022.

b. The global synthetic lubricants market is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 23.4 billion by 2030.

b. Asia Pacific dominated the synthetic lubricants market with a share of more than 46% in 2022. This is owed to increasing automobile industry as well as refinery business in the region. Countries such as India, China and Singapore has capitalized on low crude oil prices which has impacted in increased production in petrochemicals in Asia Pacific thus improving the product market in the region.

b. Some key players operating in the synthetic lubricants market include BP Lubricants Pvt. Ltd, Chevron Corporation, LANXESS, Valvoline, FUCHS, Pennzoil, Phillips 66 Company, Motul, AMSOIL INC., Agip.

b. The key factors driving the synthetic lubricants market are the growing demand from industrial machinery & equipment and automotive manufacturers owing to their superior properties of assisting in temperature control by absorbing the heat generated by the moving vehicle parts and transmitting them to cooler or sump

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.