- Home

- »

- HVAC & Construction

- »

-

Agriculture Equipment Market Size, Industry Report, 2033GVR Report cover

![Agriculture Equipment Market Size, Share & Trends Report]()

Agriculture Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Tractors, Harvesters), By Application (Hay & Forage Equipment, Land Development & Seed Bed Preparation), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-455-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Agriculture Equipment Market Summary

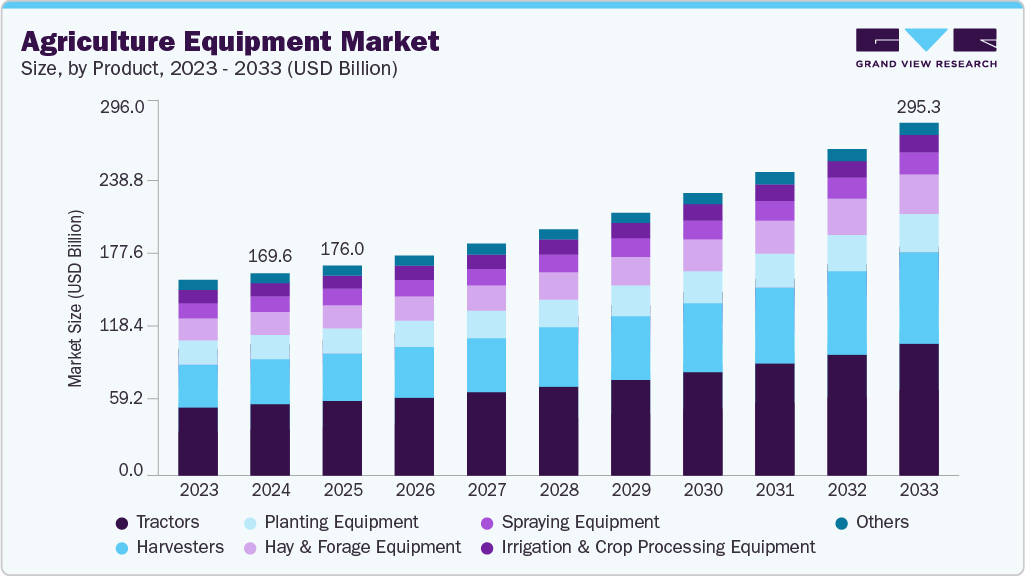

The global agriculture equipment market size was estimated at USD 169.55 billion in 2024 and is projected to reach USD 295.28 billion by 2033, growing at a CAGR of 6.7% from 2025 to 2033. Increasing mechanization in the agriculture sector, coupled with a surge in farmers’ income, is expected to be a primary factor driving the market growth.

Key Market Trends & Insights

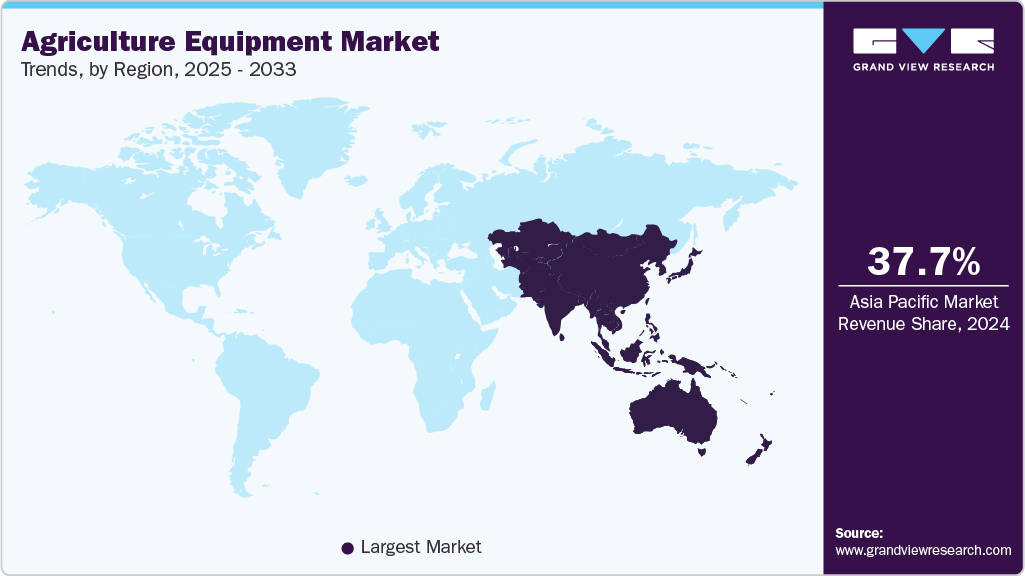

- Asia Pacific held a 37.7% revenue share of the global agriculture equipment market.

- In China, the trend toward farm consolidation and the emergence of large agribusinesses is accelerating the demand for the agriculture equipment market.

- By product, the tractors segment held the largest revenue share of 34.9% in 2024.

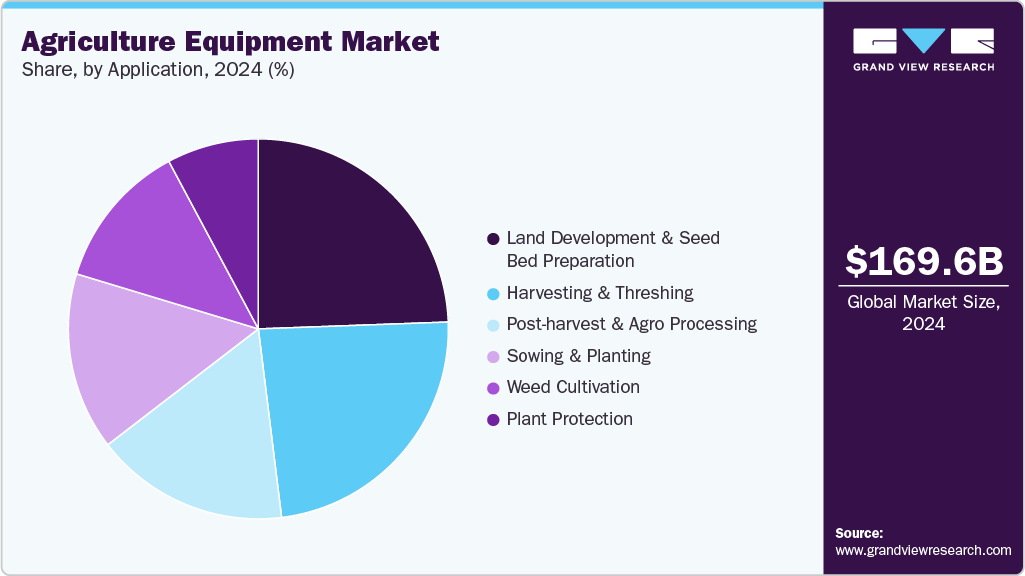

- By application, the land development & seed bed preparation segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 169.55 Billion

- 2033 Projected Market Size: USD 295.28 Billion

- CAGR (2025-2033): 6.7%

- Asia Pacific: Largest market in 2024

The rise of sustainable agriculture, which is pushing manufacturers to develop eco-friendly and energy-efficient equipment, is accelerating market growth. In response to tightening emissions regulations and climate goals set by international bodies and national governments, there is an increasing push for electric tractors, biofuel-compatible engines, and hybrid farm equipment. These machines not only reduce greenhouse gas emissions but also offer lower operating costs in the long run. European countries are actively promoting low-carbon farming technologies, which has created demand for new products of agricultural machinery designed for minimal environmental impact. The integration of sustainability with profitability is creating a fresh wave of innovation within the industry.The growth of custom hiring centers and machinery rental services is also expanding access to agriculture equipment, especially in developing markets, where purchasing large machines outright may be financially burdensome. These services allow small-scale farmers to rent modern machinery on a need-based basis, significantly lowering the barriers to mechanization. Governments, cooperatives, and private firms are increasingly investing in shared equipment hubs or pay-per-use platforms, fostering a more inclusive agricultural ecosystem. This trend is not only enabling higher productivity among resource-constrained farmers but also fueling demand for durable, multi-purpose machinery suitable for frequent rental usage.

The rise of contract farming and corporate agriculture is also contributing to the demand for specialized agricultural equipment markets. As multinational agribusiness firms enter into agreements with local farmers to produce specific crops at agreed-upon standards, there is a growing expectation for mechanized consistency and quality. These contracts often include recommendations or even requirements for the use of particular equipments to ensure uniform crop quality, timely delivery, and reduced spoilage. In response, farmers involved in these arrangements are turning to precision seeders, specialized sprayers, and post-harvest machinery that align with the quality and quantity targets set by the contracting companies. This structured form of agriculture is thus promoting a more consistent and predictable demand for equipment tailored to contract-based farming.

In regions with fragmented landholding patterns, especially in South Asia and sub-Saharan Africa, the development of multipurpose and modular agricultural equipment is gaining momentum. These machines are designed to perform multiple functions, such as tilling, sowing, and spraying, within a compact, adaptable format, which makes them ideal for small and irregularly shaped plots. Farmers benefit from cost savings, as one machine can fulfill several roles across the cultivation cycle. Moreover, these modular designs make it easier to perform maintenance or upgrade certain components as technology evolves. This trend addresses a crucial structural challenge in global agriculture: making modern equipment viable and practical for farmers who do not operate on a large scale.

Product Insights

The tractors segment dominated the market with a revenue share of 34.9% in 2024. The emergence of equipment leasing services and tractor-on-demand platforms is reducing entry barriers for farmers who cannot afford outright purchases. These platforms, often supported by agri-tech startups and cooperatives, allow farmers to rent tractors for specific tasks or seasons. This growing model of shared equipment access is further driving the demand for durable and easy-to-maintain tractors, creating a recurring revenue stream for manufacturers and service providers. As this ecosystem of support services grows around the tractor segment, it enhances the long-term sustainability and accessibility of tractor use, ensuring continued growth in both mature and developing markets.

The harvesters segment is projected to be the fastest-growing segment from 2025 to 2033. The increasing prominence of contract farming and agri-business models is creating institutional demand for harvesters. Large food processing companies, commodity traders, and agri-cooperatives often work directly with farmers to ensure supply chain efficiency and quality control. These entities frequently supply or lease harvesters to partner farmers as part of an integrated value chain approach. This practice ensures crops are harvested at peak maturity with minimal damage, enabling a seamless transition to processing or storage. The integration of harvesters into contract farming models is particularly impactful in emerging economies where smallholder farmers may lack the capital to invest in their machinery. However, it can still benefit from mechanization through collaborative agreements.

Application Insights

The land development & seed bed preparation segment dominated the market. The expansion of commercial and mechanized farming, particularly in countries such as Brazil, the U.S., and India, has significantly contributed to the demand for land preparation equipment. With the consolidation of farmland into larger plots, manual preparation methods are no longer viable for large-scale operations. Farmers increasingly rely on mechanized implements that can quickly prepare extensive tracts of land with minimal effort and labor costs. Moreover, timely land development is becoming even more crucial in areas with shrinking planting windows due to unpredictable weather patterns caused by climate change. In this context, efficient mechanized tools ensure farmers can prepare the soil and sow seeds quickly, minimizing the risk of delays that can affect the entire crop cycle.

The harvesting & threshing segment is projected to be the fastest-growing segment from 2025 to 2033. The emergence of equipment-as-a-service (EaaS) models is yet another factor accelerating the uptake of harvesting and threshing machinery. Digital platforms and local entrepreneurs are now offering machinery rental services that provide access to high-end equipment without requiring farmers to invest heavily in ownership. These platforms allow flexible, on-demand use of harvesters and threshers, often bundled with operator support and maintenance. This model has proven especially effective in regions like South Asia and East Africa, where smallholder farmers dominate, and capital investment in such machines would otherwise be unfeasible. With EaaS, the benefits of mechanized harvesting and threshing are extending to even the most resource-constrained agricultural communities.

Regional Insights

The North America agriculture equipment industry is expected to grow with a CAGR of 7.2% from 2025 to 2033. North America’s strong aftermarket and equipment servicing infrastructure supports long-term investment in high-end machinery. Farmers are more likely to invest in technologically advanced equipment when they have reliable access to maintenance services, spare parts, and upgrade support. The presence of global and regional manufacturers in the U.S. ensures that innovations reach the market quickly and are adapted to meet local agricultural conditions. The robust dealer and service network across rural North America also facilitates equipment accessibility and training, making it easier for even smaller farmers to participate in the mechanization trend.

U.S. Agriculture Equipment Market Trends

The agriculture equipment industry in the U.S. is expected to grow during the forecast period. The U.S. agriculture sector’s deep integration with data analytics and GPS technologies has accelerated the use of smart equipment. Farmers are increasingly investing in precision agriculture systems that combine sensors, satellite mapping, and real-time data to inform everything from soil preparation to harvest timing. The integration of these digital tools with farm equipment has given rise to a new generation of machines that offer remote monitoring, automated adjustments, and predictive maintenance. As farm profitability becomes more tightly linked to efficiency and resource optimization, equipment that supports data-driven decision-making is quickly becoming a critical asset across farming operations.

Asia Pacific Agriculture Equipment Market Trends

Asia Pacific agriculture equipment industry held the largest revenue share globally in 2024, accounting for 37.7% of the global revenue. The growing presence of private agritech firms, cooperatives, and machinery rental services has improved access to equipment for smallholder farmers, who dominate the agricultural landscape in Asia Pacific. Through machinery banks, digital platforms, and custom hiring centers, even farmers with limited capital can use advanced equipment during critical phases of the crop cycle. This shift is democratizing access to technology and creating a more inclusive market for agriculture equipment across the region. As rural connectivity and digital literacy continue to improve, such models are expected to scale further, cementing the region's path toward widespread agricultural mechanization.

The China agriculture equipment industry is projected to grow during the forecast period. The digital transformation of agriculture in China, particularly through the integration of smart technologies, is playing a transformative role in boosting the demand for high-end, data-enabled farm equipment. Agricultural drones, GPS-guided tractors, and sensor-based irrigation systems are no longer limited to experimental or pilot projects but are gradually entering mainstream use. These technologies help farmers monitor crop health, manage soil conditions, and optimize resource use in real-time, thus reducing costs and enhancing yields. The Chinese government has supported this transition through pilot zones for smart farming and rural broadband expansion, making it easier for farmers to access, operate, and benefit from smart machinery. As awareness of these technologies spreads, the appetite for digital-enabled equipment is expected to grow substantially.

The agriculture equipment industry in India is projected to grow during the forecast period. The diversification of cropping patterns and the increased demand for high-value crops, horticulture, and dairy integration drive the market growth. As farmers shift from traditional staple crops like wheat and rice to fruits, vegetables, pulses, and cash crops, there is a growing need for specialized machinery to suit different soil conditions and crop requirements. Equipment such as transplanters, sprayers, and drip irrigation systems is becoming more prevalent in areas where farmers are intensifying cultivation and adopting modern practices. This shift is especially prominent in states such as Maharashtra, Karnataka, Punjab, and Tamil Nadu, where government and private efforts to promote agribusiness clusters and export-oriented farming are strong.

Europe Agriculture Equipment Market Trends

The agriculture equipment industry in Europe is projected to grow during the forecast period. The rise of agriculture-as-a-service (AaaS) models and the increasing integration of digital platforms in farming are expanding the reach of modern equipment. Startups and cooperatives are offering shared access to high-end machinery via subscription or rental, reducing the financial burden on smaller farms. These platforms often bundle machinery with software for crop planning, weather forecasting, and equipment diagnostics, creating a more holistic ecosystem for farm management. As rural broadband connectivity improves, these digitally enabled solutions are becoming more practical and widespread, enhancing overall market adoption of advanced equipment.

The agriculture equipment industry in the UK is projected to grow during the forecast period. Digital agriculture and data integration are driving the UK market growth. Farmers are increasingly leveraging farm management software, remote sensing, GPS-guided machinery, and data analytics tools to make informed decisions about crop health, irrigation, fertilization, and machinery usage. This digital shift is fueling demand for advanced machinery equipped with sensors, telemetry, and automated controls. In particular, precision farming tools that enable site-specific application of inputs are helping farmers maximize yield while minimizing resource waste. The UK's strong infrastructure and high digital penetration make it an ideal environment for the deployment of such technologically sophisticated equipment.

The agriculture equipment industry in Germany is projected to grow during the forecast period. Germany’s emphasis on export-oriented agriculture and participation in global value chains motivates farmers to maintain high product quality and traceability standards, both of which are supported by modern equipment. The use of advanced machinery enables better control over planting, harvesting, storage, and transport, all of which are critical for meeting international food safety and quality benchmarks. As global demand for sustainably produced, high-quality food continues to rise, German farmers’ reliance on cutting-edge agricultural equipment will remain essential to preserving their competitiveness and fulfilling the country’s agricultural export potential.

Key Agriculture Equipment Company Insights

Some of the key companies operating in the market include AGCO Corporation, CNH Industrial N.V., among others, that are leading participants in the market.

-

AGCO Corporation is engaged in the designing, manufacturing, and distribution of agricultural tractors and replacement parts worldwide. In 1990, the company offered products under the Gleaner and AGCO Allis brands in North America. Currently, it offers its agricultural tractors under the following brand names: Challenger, Fendt, Massey Ferguson, and Valtra. AGCO Corporation offers tractors with higher horsepower for use in large farms for cultivating row crops; utility tractors primarily for livestock, dairy, vineyards, and orchards; and compact tractors for small farms, landscaping, and specialty agricultural industries, as well as for residential use. The company focuses on product innovation and invests in the research & development of High Horsepower (HHP) tractors and advanced harvesting technology platforms.

-

CNH Industrial N.V. is engaged in the designing, production, marketing, sales, and financing of agricultural & construction equipment and commercial vehicles. Additionally, the company offers transmissions, engines, and axles for these vehicles. The company’s subsidiaries include CNH Industrial America LLC, CNH Industrial Asian Holding Limited N.V., CNH Industrial Belgium, CNH Industrial Capital LLC, CNH Industrial Finance S.p.A., CNH Industrial Russia LLC, CNH UK Limited, and CNH Industrial Services S.r.l.

MaterMacc S.p.A and ISEKI & Co., Ltd. are some of the emerging participants in the agriculture equipment industry.

-

MaterMacc S.p.A. is a specialist in precision agricultural machinery focused on enhancing modern farming efficiency. MaterMacc’s product lineup includes pneumatic precision seed drills for cereals, mechanical and pneumatic sowers for vegetables, direct drills, in-row weeders, fertilizer spreaders, and electronic irrigation and seeding control units, underlining its focus on delivering integrated solutions for crop establishment and management.

-

Iseki & Co., Ltd. is a manufacturer of agricultural machinery. The company expanded its offerings into tractors, rice transplanters, combine harvesters, riding and zero‑turn mowers, tillers, diesel engines, and related implements, all reflecting its evolution into a full‑line agricultural equipment provider. Iseki is Japan’s third-largest agricultural machinery maker, with global sales through brands like AGCO, Massey Ferguson, and Bolens.

Key Agriculture Equipment Companies:

The following are the leading companies in the agriculture equipment market. These companies collectively hold the largest market share and dictate industry trends.

- AGCO Corporation

- FlieglAgro-Center GmbH

- APV GmbH

- Bellota Agrisolutions

- CLAAS KGaAmbH

- CNH Industrial N.V.

- Deere & Company

- Escorts Limited

- HORSCH Maschinen GmbH

- ISEKI & Co., Ltd.

- J C Bamford Excavators Ltd

- Quivogne CEE GmbH (Kiwon RUS LLC)

- Rostselmash

- KRUKOWIAK

- KUBOTA Corporation

- KUHN SAS

- LEMKEN GmbH & Co. KG

- Mahindra & Mahindra Ltd.

- MascarSpA

- MaschioGaspardo S.p.A

- MaterMacc S.p.A

- Morris Equipment Ltd

- SDF S.p.A.

- Tractors and Farm Equipment Limited (TAFE)

- Väderstad AB

- Valmont Industries, Inc.

Recent Developments

-

In February 2025, AGCO Corporation signed a supply agreement with SDF to deliver a streamlined portfolio of low- to mid-range horsepower tractors under its renowned Massey Ferguson brand. This strategic partnership enhances Massey Ferguson’s global position in the low- to mid-horsepower tractor market, enabling the brand to offer more farmers reliable, high-quality, and easy-to-use equipment that boosts productivity and maximizes profitability.

-

In December 2024, Fliegl Agrartechnik GmbH partnered with Stapel GmbH to leverage and expand their existing synergies in the areas of liquid manure technology and agricultural semi-trailer tractor units. This collaboration is centered on creating innovative solutions that enhance the efficiency of agricultural tractor unit operations while addressing future demands. Additionally, the alliance is expected to accelerate product development in these sectors.

-

In September 2024, J C Bamford Excavators Ltd expanded its renowned X Series line of tracked excavators with the launch of its new 370X. This robust excavator is set to deliver industry-leading productivity, durability, and reliability in the 35-40-ton category. With the debut of the 370X, JCB continues to advance its mission of offering a complete range of heavy equipment solutions tailored to the needs of the construction sector.

Agriculture Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 176.02 billion

Revenue forecast in 2033

USD 295.28 billion

Growth Rate

CAGR of 6.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Netherlands; Spain; Denmark; Russia; China; India; Japan; Australia; South Korea; Singapore; Taiwan; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

AGCO Corporation; Fliegl Agro-Center GmbH; Agromaster; APV GmbH; Bellota Agrisolutions; CLAAS KGaA mbH; CNH Industrial N.V.; Deere & Company; Escorts Limited; HORSCH Maschinen GmbH; ISEKI & Co., Ltd.; J C Bamford Excavators Ltd; Quivogne CEE GmbH (Kiwon RUS LLC); Rostselmash; KRUKOWIAK; KUBOTA Corporation; KUHN SAS; LEMKEN GmbH & Co. KG; Mahindra & Mahindra Ltd; Mascar SpA; Maschio Gaspardo S.p.A, MaterMacc S.p.A; Morris Equipment Ltd; SDF S.p.A.; Tractors and Farm Equipment Limited (TAFE); Väderstad AB; Valmont Industries, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Agriculture Equipment Market Report Segmentation

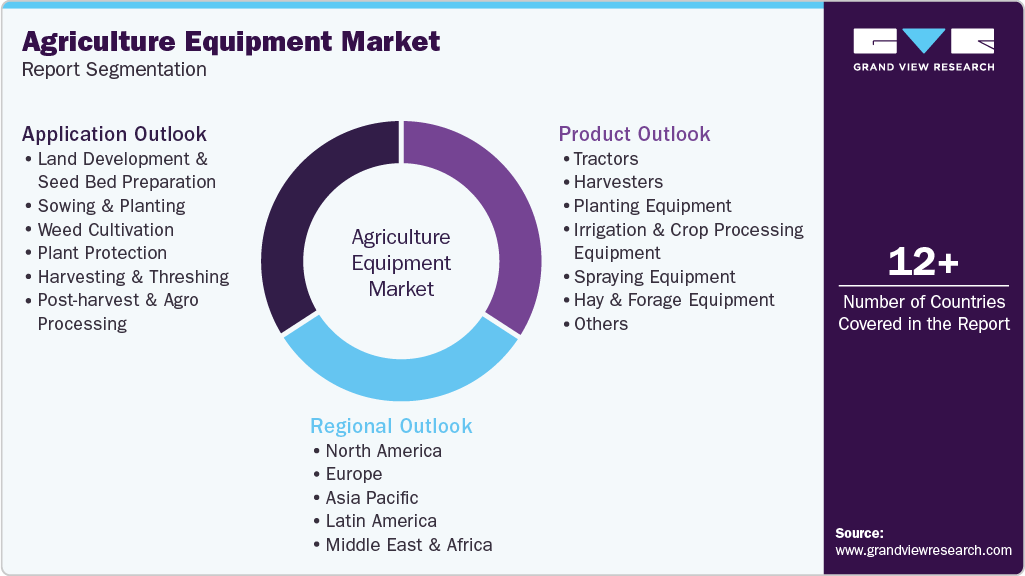

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global agriculture equipment market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Tractors

-

Harvesters

-

Planting Equipment

-

Row Crop Planters

-

Air Seeders

-

Grain Drills

-

Others

-

-

Irrigation & Crop Processing Equipment

-

Spraying Equipment

-

Hay & Forage Equipment

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Land Development & Seed Bed Preparation

-

Sowing & Planting

-

Weed Cultivation

-

Plant Protection

-

Harvesting & Threshing

-

Post-harvest & Agro Processing

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Netherlands

-

Spain

-

Denmark

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global agriculture equipment market size was estimated at USD 169.55 billion in 2024 and is expected to reach USD 176.02 billion in 2025.

b. The global agriculture equipment market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 295.28 billion by 2033.

b. The Asia Pacific dominated the agriculture equipment market with a share of over 37.7% in 2024. This is attributable to the presence of largely agricultural land and growing awareness among farmers regarding the need to enhance overall crop output and quality.

b. Some key players operating in the agriculture equipment market include AGCO Corporation, Agrocenter Ltd., Agromaster, AMAZONE Ltd., AMAZONE Ltd., APV – Technische Produkte GmbH, CLAAS KGaA mbH, CNH Industrial N.V, Escorts Group, Horsch Maschinen GmbH, and ISEKI & Co., Ltd.

b. Key factors that are driving the agriculture equipment market growth include rising mechanization in farm practices and government support in form of subsidies, especially in developing economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.