- Home

- »

- Petrochemicals

- »

-

Heat Transfer Fluids Market Size And Share Report, 2030GVR Report cover

![Heat Transfer Fluids Market Size, Share & Trends Report]()

Heat Transfer Fluids Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Silicone Fluids, Aromatic Fluids), By Application (Oil & Gas, Chemical Industry), By Region, And Segment Forecasts

- Report ID: 978-1-68038-511-3

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Heat Transfer Fluids Market Summary

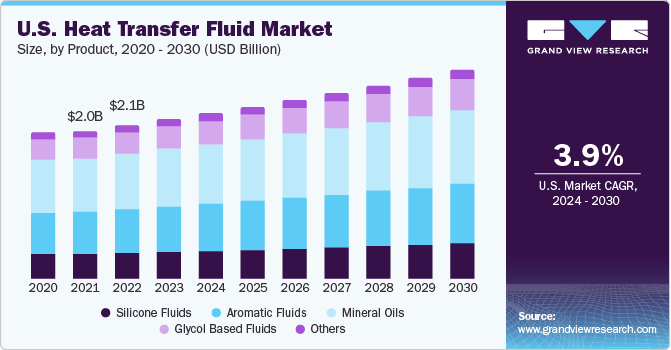

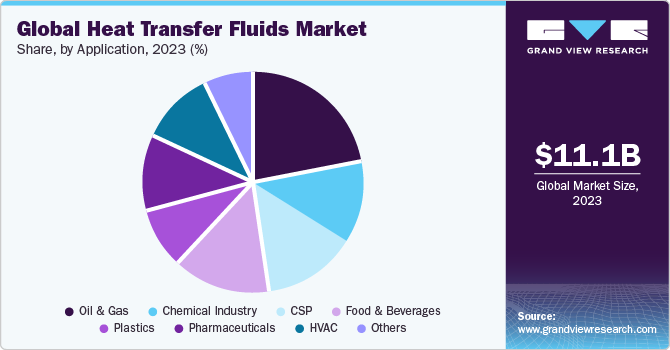

The global heat transfer fluids market size was estimated at USD 11.1 billion in 2023 and is projected to reach USD 14.22 billion by 2030, growing at a CAGR of 3.7% from 2024 to 2030. The rapid adoption of concentrated solar power globally is one of the major factors driving demand. Heat transfer fluids are industrial products derived from petroleum sources that prevent overheating and store thermal energy.

Key Market Trends & Insights

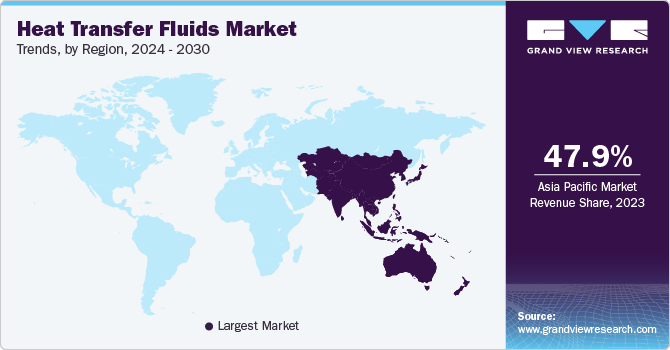

- Asia Pacific dominated the global industry in 2023 and accounted for a market share of 47.9%.

- By product, glycol based fluids segment is anticipated to exhibit a revenue CAGR of 4.1% over the forecast period.

- By application, the oil and gas segment dominated the market with a revenue share of 22.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.1 Billion

- 2030 Projected Market Size: USD 14.22 Billion

- CAGR (2024-2030): 3.7%

- Asia Pacific: Largest market in 2023

The primary raw materials involved in production are crude oil, silica, and base oils. The essential characteristics that define a heat transfer fluid are low viscosity, non-corrosive nature, high thermal conductivity and diffusivity, and extreme phase transition temperatures.

Heat transfer fluids are traditionally used for the sole purpose of transferring heat to the process stream. However, the selection of the right HTF is a multi-dimensional complication wherein factors such as pumpability, thermal stability, and pressure requirements are put into consideration. Heat transfer fluids are gaining significant importance in their applications, such as extracting heat from the sun in concentrated solar panels to processing gas & oil in cold climatic conditions.

The COVID-19 pandemic caused severe disruption in businesses and supply chains. The negative impact of a pandemic on the oil & gas industry also hampered the growth of the heat transfer fluid market growth. The decrease in supply and demand for oil & gas, especially in North America and Europe, halted the onshore and offshore production processes, impacting the growth of the heat transfer fluids market. The suspension of new solar power projects installation work and disruption in activities of operational plants also obstructed the market.

The U.S. is one of the critical contributors to the global installed CSP capacity. The country strategically delivers its power outputs using CSP units when the demand is exceptionally high. Heat transfer fluids have been identified as one of the crucial components used to improve the efficiency of concentrated solar power plants. They play an essential role in the collection of energy from the solar field and transport it to the energy storage systems.

This stored energy is later utilized for generating electricity after sunset or even in cloudy weather conditions. Compared to PV systems, CSP plants possess capabilities to add storage capacity of an extra six hours, which leads to the operational value of USD 35.8/MWh. The increasing scope of CSP and its competitive advantages over other renewable energy sources is responsible for the high growth and significant penetration of heat transfer fluids in the segment.

Heat transfer fluids are used in the oil and gas industry, a key contributor to the U.S. economy. The country is projected to up its liquids and natural gas production over the foreseeable future as a result of shale resource development, thereby boosting product demand.

Major manufacturers are involved in the captive consumption of these thermal oils. Others distribute them to target markets through third-party suppliers. Some significant suppliers of heat transfer fluids in the industry are Paratherm, Hubbard Hall, Thermic Fluids Pvt. Ltd., and Inlet Petroleum Co. (IPC).

Most of these suppliers offer multi-brand fluids and have a separate internet-based portal for selling their products. With heavy investments in research and development activities, major industry participants are shifting toward bio-based thermic oils to comply with government regulations. The shift from synthetic to bio-based thermic oils is anticipated to be a disrupting trend fueled by stringent regulations and strict scrutiny of available products in the marketplace.

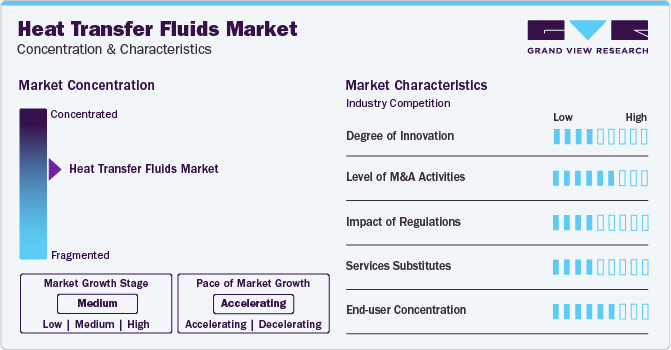

Market Concentration & Characteristics

The heat transfer fluids market is moderately consolidated in nature with the presence of large players like Dow Inc, Exxon Mobil Corporation, British Petroleum, Eastman Chemical Company and Royal Dutch Shell operating in the market. Market players are adopting the product differentiation strategy that insulated them from price wars.

The merger and acquisition activity in the market has been high for the past few years. For instance, Indian oil and gas producer Oil & Natural Gas Corp (ONGC) completed the acquisition of Hindustan Petroleum Co. Ltd. (HPCL) by purchasing 51.11% shares to become the country’s first vertically integrated oil manufacturer. These varied strategic implementations worldwide by key companies reflect their operational strategies to remain sustainable key players in the global heat transfer fluids ecosystem. Some prominent players in the global heat transfer fluids market include:

Companies operating in the heat transfer fluids market sphere are highly competitive and integrated along the value chain. Based on a comprehensive analysis of 24 leading producers across the globe, it has been identified that nearly 55% of the producers of heat transfer fluids are also involved in captive manufacturing of basic raw materials and allied feedstock.

A notable aspect of the industry competition is product offerings. It has been identified that on average company offer seven different variants of heat transfer fluids with Dynalene, Dow, Radco Industries, BASF and Eastman bringing the highest number of products to the market space. Though companies operating on a smaller-scale have specialized offerings with their HTF products catering to larger range of temperature performance and broader customer-base at national levels.

Product Insights

Glycol-based heat transfer fluids form the fastest-growing product category as they exhibit excellent antifreeze properties; the segment is anticipated to exhibit a revenue CAGR of 4.1% over the forecast period. Bio-based glycols are increasingly gaining significance as one of the critical ingredients in heat transfer fluid formulations, as they are compatible with high and low-temperature applications.

Mineral oils are generally utilized in diverse convenient radiator heaters, which are used broadly for commercial and residential applications. These oils have a high level of resistance toward chemical oxidation and thermal cracking and are simultaneously non-toxic and non-corrosive. They provide high thermal conductivity and specific heat, which helps them efficiently transfer heat. Mineral oils are also used in multiple heat transfer mediums but have a high degradation rate when exposed to higher temperatures.

Alkylated aromatic compounds are typically formulated for closed-loop heating systems based on the Rankine cycle. Major operational areas include asphalt plants, gas processing, tank cleaning, and plastic production. These aromatic HTFs are utilized in both the vapor phase and liquid phase and possess excellent fluid properties and heat transfer properties for applications involving low temperatures.

Application Insights

The oil and gas segment dominated the market with a revenue share of 22.2% in 2023. The oil & gas processing dynamics require very specific heat transfer fluids that are formulated to suit desired temperatures and compatibility. These products find application in processes such as recycling, production, refining, and transportation. Offshore platforms utilize heat transfer liquid in the aqueous phase for regenerating glycols and facility heating, which eventually removes water from the produced natural gas.

In the chemical industry, reboilers are heat exchangers to provide heat to distillation column bottoms. Reboilers boil the liquids from the bottom of the distillation column to form vapors that drive the distillation column separation. Heat transfer fluids or steam are used to heat the vaporization process. The products also find application in components such as tubes, pipes, bushes, and gaskets that carry chemicals, fluids, and acids owing to their properties, such as inertness to chemicals and high thermal stability.

Heat transfer fluids are extensively used to manufacture PET, polyester, nylon, and other synthetic fibers. The products are formulated to provide optimum efficiency across a diverse range of temperatures. Refined heat transfer fluids provide optimum stability at high temperatures, which eventually helps avoid premature degradation of fluids when exposed to high temperatures. Owing to stagnating plastic production in developed countries, the application segment accounted for a meager share of around 9.26% of the market in 2023.

Regional Insights

Asia Pacific heat transfer fluid market is the dominant market with key macroeconomic indicators, such as high per capita income and manufacturing output, supporting market growth. The region accounted for a market share of 47.9% in 2023. The use of heating, ventilation, and air conditioning (HVAC) systems is growing tremendously in the Asia Pacific region because of the increasing population, changing climatic conditions, increasing urbanization, and demographic changes in the two economic giants, India and China. These two factors are likely to drive the growth of the Asia Pacific heat transfer fluid market.

The chemical industry in Mexico has observed multiple high-level investments as well as constant sourcing of diverse raw materials to strengthen its core. Rapid industrialization, coupled with the growing export of chemicals to NAFTA countries, is expected to drive demand for heat transfer fluids. The country also has a strong presence in the plastic manufacturing industry.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In September 2023, Valvoline invested in a European manufacturer of heat transfer fluids in order to broaden its product portfolio and cater to the consumers globally.

-

In May 2023, ORLEN Południe announced the completion of the first operational year of its BioPG plant, involving the conversion of glycerol into renewable propylene glycol. BASF provided its BioPG technology for the purpose, while Air Liquide Engineering & Construction contributed with the licensing, proprietary equipment, and basic engineering services

-

In February 2022, Chevron announced the agreement to acquire Renewable Energy Group which further helped the company in delivering lower carbon energy.

Key Heat Transfer Fluids Companies:

- Dynalene, Inc.

- Indian Oil Corporation Ltd. (IOCL)

- KOST USA, Inc.

- Hindustan Petroleum Corporation Ltd. (HPCL)Delta Western, Inc. (DWI)

- British Petroleum (BP)

- Huntsman Corporation

- Royal Dutch Shell Plc

- Eastman Chemical Company

- Phillips 66

- Chevron Co.

- BASF SE

- Exxon Mobil

- DowDuPont Chemicals

- Dalian Richfortune Chemicals Ltd.

- GJ Chemical

- Radco Industries Inc.

- LANXESS AG

- Schultz Chemicals

- Sasol Limited

- Evermore Trading Corporation

- Tashkent Industrial Oil Corporation

- Shaeffer Manufacturing Co.

- Paras Lubricants Limited.

Heat Transfer Fluids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.46 billion

Revenue forecast in 2030

USD 14.22 billion

Growth rate

CAGR of 3.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; China; India; Japan; South Korea; Malaysia; Thailand; Australia; Brazil, Argentina; South Africa; Saudi Arabia

Key companies profiled

Dynalene, Inc., Indian Oil Corporation Ltd. (IOCL)

, KOST USA, Inc.,Hindustan Petroleum Corporation Ltd. (HPCL), Delta Western, Inc. (DWI)

, British Petroleum (BP), Huntsman Corporation, Royal Dutch Shell Plc, Eastman Chemical Company

Phillips 66, Chevron Co., BASF SE, Exxon Mobil, DowDuPont Chemicals, Dalian Richfortune Chemicals Ltd., GJ Chemical, Radco Industries Inc.

LANXESS AG, Schultz Chemicals, Sasol Limited, Tashkent Industrial Oil Corporation, Shaeffer Manufacturing Co., Paras Lubricants Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

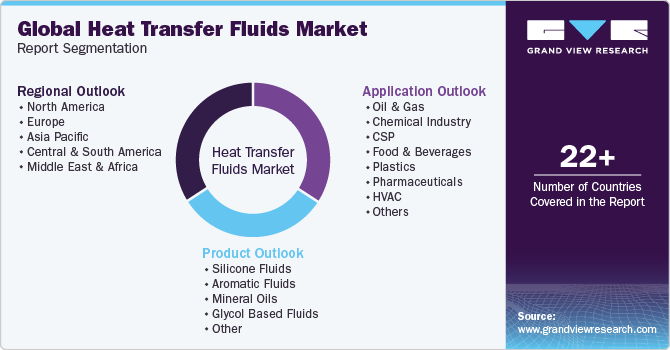

Global Heat Transfer Fluids Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides a heat transfer fluid market analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heat transfer fluid market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Silicone Fluids

-

Oil & Gas

-

Chemical Industry

-

CSP

-

Food & Beverages

-

Plastics

-

Pharmaceuticals

-

HVAC

-

Others

-

-

Aromatic Fluids

-

Oil & Gas

-

Chemical Industry

-

CSP

-

Food & Beverages

-

Plastics

-

Pharmaceuticals

-

HVAC

-

Others

-

-

Mineral Oils

-

Glycol based Fluids

-

Other (including molten salts & HFPE)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemical Industry

-

CSP

-

Food & Beverages

-

Plastics

-

Pharmaceuticals

-

HVAC

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Malaysia

-

Thailand

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global heat transfer fluids market size was estimated at USD 10.7 billion in 2022 and is expected to reach USD 11.1 billion in 2023.

b. The global heat transfer fluids market is expected to grow at a compound annual growth rate of 3.2% from 2023 to 2030 to reach USD 14.2 billion by 2030.

b. The Asia Pacific dominated the heat transfer fluids market with a share of 47.7% in 2022. This is attributable to the rising focus on the development of the manufacturing sector in the region.

b. Some key players operating in the heat transfer fluids market include Dow Chemicals, Eastman Company, Exxon Mobil, Shell, and BP.

b. Key factors that are driving the heat transfer fluids market growth include the growing concentrated solar power industry globally, FDA Approval of food-grade heat transfer fluids, and growing natural gas production in GCC countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.