- Home

- »

- Food Additives & Nutricosmetics

- »

-

Thiamine Market Size & Share Analysis Report, 2022-2030GVR Report cover

![Thiamine Market Size, Share & Trends Report]()

Thiamine Market Size, Share & Trends Analysis Report By Application (Food & Beverages, Animal Feed, Pharmaceuticals, Dietary Supplements), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-948-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

Report Overview

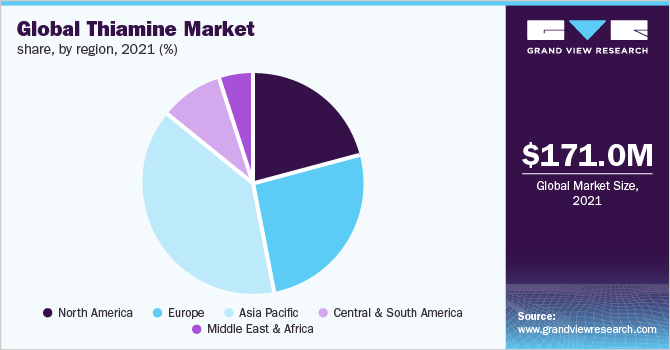

The global thiamine market size was valued at USD 170.98 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.9% from 2022 to 2030. The demand for the product is anticipated to be driven by its increasing usage in pharmaceutical, animal feed, and food preparation. The global market is currently dominated by companies such as DSM, Jiangsu Jubang Pharmaceutical Co., Ltd., Tianjin Zhongjin Pharmaceutical Co., Ltd. These companies strive to maintain governing position, generating the highest percentage of revenue and capturing a greater market share. The rising product demand and a smaller number of manufacturers give rise to multiple opportunities for the existing players to gain strategic and competitive advantage.

Thiamine or Vitamin B1 is one of the water-soluble B vitamins, found in many food sources such as whole grains, legumes, fish, beans, meat, and nuts. It is used as a dietary supplement and as a medication. It is manufactured in different forms like powder, tablets, and capsules. It is used to maintain the health of the nervous system and turn food into energy. Thiamine is a type of vitamin that has antioxidant, cognition- and mood-modulatory, erythropoietic, antiatherosclerotic, detoxification, and putative ergogenic properties. In animals, the product is found in animals to protect the rat liver and kidney against lead-induced lipid peroxidation. In humans, it plays an important role in energy metabolism and the development and growth of functional cells. In addition, it helps to strengthen the immunity in the human body.

The increasing number of diseases and little knowledge and awareness about thiamine deficiency can be a restraint for the market growth. This deficiency can cause many other serious health disorders. On the other hand, this can also prove to have a positive impact on the market as this gives manufacturers opportunities to grow and capture maximum market share by the means of their strategic initiatives.

Application Insights

Dietary supplements dominated the market with a revenue share of over 30.0% in 2021. This is attributed to the growing demand for dietary supplements from health-conscious individuals and the people who are into bodybuilding. The product is used in treating beriberi, which is numbness or tingling in the hands and feet, memory loss, muscle loss, and poor reflexes. Apart from the use of thiamine in dietary supplements, a large portion of the product is used in pharmaceutical applications. As a result, the pharmaceutical application segment held the second-largest revenue share in 2021. In the medical and pharmaceutical industry, it plays an important role in treating major diseases like heart failure, Alzheimer’s, diabetes, and Wernicke-Korsakoff syndrome.

The growth of the healthcare industries, primarily in India and China, coupled with the rise of medical tourism in the aforementioned economies, is expected to drive the market over the forecast period. In addition, rising technological advances in economies such as Japan and Australia for the use of vitamins in the healthcare industry are likely to drive the market over the forecast period. Increasing attention toward personal grooming and maintaining healthy skin is expected to drive the demand for vitamin-based cosmetic formulations, thereby ascending the product demand over the forecast period. In addition, rising consumer expenditure on beauty-enhancing products is expected to benefit the market growth over the forecast period.

Thiamine also finds its application in the food and beverages industry. It is used in the production of flavors, which can be added to food products. Also, it has application in food and beverages as a fortifying agent in products such as bread, flour, and breakfast cereal. In addition, the product is used as a food additive to certain foods so as to maintain the nutrient contents during the processing of those food products.

Regional Insights

Asia Pacific dominated the market with a revenue share of over 35.0% in 2021. This is attributed to the rising demand for product from various industries like food and beverages, and dietary supplements. Increasing population, rising disposable income, and increasing awareness among the population regarding thiamine deficiency and the diseases caused by it are propelling the growth in the region.

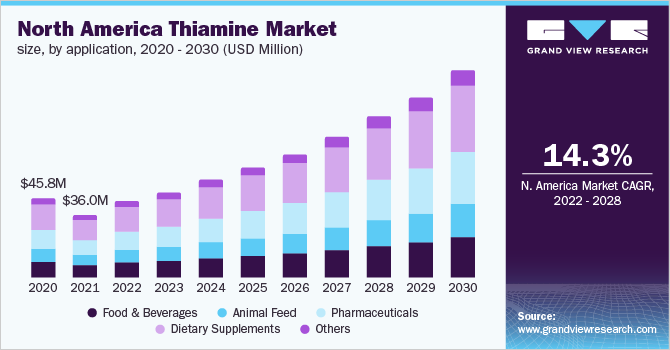

The European market is known for its developed cosmetics and personal care industries. This is because of the presence of multinational companies like Unilever, Avene, Emma Hardie, and MartiDerm. Thiamine is used in cell reproduction that ensures clear and healthy skin. It is also used in various hair protection products. Due to the increasing demand for cosmetic and personal care products, the demand for thiamine is also on the rise. The market demand for thiamine in North America is dependent on the growing application in the food and beverages and pharmaceutical industries. North America, especially the U.S., is known for its healthcare and medical facilities. The vast applicability of thiamine in the pharmaceutical industry in treating various diseases is propelling the demand in the region.

The U.S. is one of the prominent consumers of protein ingredients due to the rising healthcare expenditure in the country, growing geriatric population, better medical facilities, progressive distribution channel of pharmacies, and advanced technologies. In recent years, there has been a stable growth in the occurrence of lifestyle-related diseases owing to changing lifestyles as well as the hectic schedule of individuals. Consumers are, therefore, taking precautions and are consuming vitamins to decrease the incidences of such lifestyle-related diseases. Growing vitamin intake in the U.S. due to an unhealthy lifestyle can trigger the thiamine demand in the near future. In addition, the growing inclusion of protein ingredients in dietary supplements, along with the increasing demand for sports nutrition, especially in the developed economies, such as the U.S., the U.K., Japan, and the Southeast Asian countries, is expected to drive the market demand over the forecast period.

Key Companies & Market Share Insights

The key players in the market are working to gain a competitive advantage over others. Establishing several research programs, decreasing the prices, delivering customer satisfaction, and implementing profit-making and strategies of expansion are some of the strategic decisions taken by the key market players to gain a competitive advantage. Companies like DSM, Chemizo Enterprise, and Nutricost are some dominant players. The global market is open and has a wide scope for new players to enter into it. There is an increase in the product demand and the market has a limited number of manufacturers to meet the demand. This creates a vast opportunity for new players to get into the manufacturing of the product and establish their position. Some prominent players in the global thiamine market include:

-

DSM

-

Chemizo Enterprise

-

Xinfa Pharmaceutical Co., Ltd.

-

Jiangxi Tianxin Pharmaceutical Co., Ltd.

-

Nutricost

-

McCartan’s Pharmacy

-

Jiangsu Jubang Pharmaceutical Co., Ltd.

-

HPC

Thiamine Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 211.1 million

Revenue forecast in 2030

USD 549.9 million

Growth rate

CAGR of 13.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD thousand/million, volume in tons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

DSM; Chemizo Enterprise; Xinfa Pharmaceutical Co., Ltd.; Jiangxi Tianxin Pharmaceutical Co., Ltd.; Nutricost; McCartan’s Pharmacy; Jiangsu Jubang Pharmaceutical Co., Ltd.; HPC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global thiamine market report on the basis of application and region:

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Food and Beverages

-

Flavors

-

Others

-

-

Animal Feed

-

Pharmaceuticals

-

Dietary Supplements

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global thiamine market size was estimated at USD 170.98 million in 2021 and is expected to reach USD 211.1 million in 2022.

b. The global thiamine market is expected to grow at a compound annual growth rate of 13.9% from 2022 to 2030 to reach USD 549.93 million by 2030.

b. Asia Pacific dominated the thiamine market with a share of 38.8% in 2021. This is attributable to its increasing usage in pharmaceutical, animal feed, and foods preparation in the region.

b. Some key players operating in the thiamine market include DSM, Chemizo Enterprise, Xinfa Pharmaceutical Co., Ltd., Jiangxi Tianxin Pharmaceutical Co., Ltd., Nutricost, McCartan’s Pharmacy, Jiangsu Jubang Pharmaceutical Co., Ltd., HPC

b. Key factors that are driving the thiamine market growth include growing demand for dietary supplements from health-conscious individuals, development of healthcare industries, primarily in India and China, coupled with the rise of medical tourism in the aforementioned economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."