- Home

- »

- Medical Devices

- »

-

Medical Tourism Market Size, Share & Growth Report, 2030GVR Report cover

![Medical Tourism Market Size, Share & Trends Report]()

Medical Tourism Market Size, Share & Trends Analysis Report By Treatment Type (Cosmetic Treatment, Bariatric Treatment), By Service Provider (Private, Public), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-508-3

- Number of Report Pages: 269

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

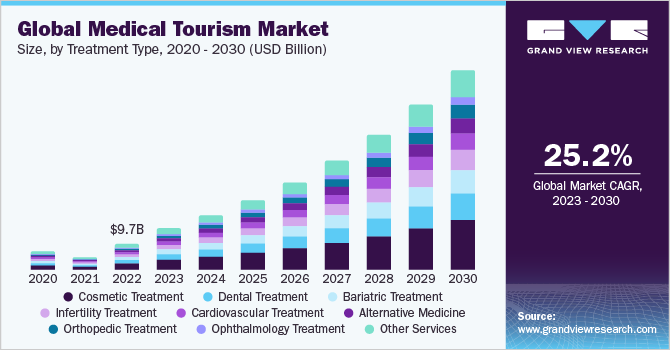

The global medical tourism market size was valued at USD 9.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 25.2% from 2023 to 2030. The medical tourism industry is expected to witness significant growth in the coming years. With the advancements in healthcare technology, increasing affordability, and rising demand for specialized treatments, more individuals are seeking medical services abroad, driving the expansion of this market. The high cost of health services in home countries is the primary factor propelling the market growth. In addition, the industry is being driven by rising demand for procedures that are not insured, such as gender reassignment surgeries, reproductive therapy, dental reconstruction, and aesthetic surgery.

In developing countries such as Thailand and Malaysia, a high-quality treatment can be availed at a lower cost, than that in developed countries. Even though the cost of treatments in developing countries is minimal, the quality of the procedure is not compromised due to the availability of resources at relatively lower costs. This factor results in the influx of people availing of health services in these countries. For instance, a coronary angioplasty procedure costs around USD 55,000 to USD 57,000 for an individual in the U.S., compared to approximately USD 4,500 to USD 10,000 in Malaysia. People travel from the U.S. and Europe for treatments to Singapore, Malaysia, India, and Thailand, saving between 55% and 70% on medical costs.

In addition, emerging countries are known to have renowned surgeons, which attract millions of patients per year for various treatments. The price of medical treatments in Malaysia is 30% to 40% lower than that in countries such as the U.S., UK, and other European economies. A large population of foreigners seeks surgeries such as facial aesthetics procedures, dental implants, breast implants, facelifts, and liposuction in these countries. Improvements in healthcare infrastructure and the availability of high-quality healthcare services at affordable prices will drive global market growth.

Furthermore, delaying necessary treatments might worsen pre-existing conditions, and the risks associated with delaying various surgeries can lead to other complications. For instance, delaying hip replacement surgery can lead to deterioration of the hip joint, limited mobility, and an increase in pain, as well as the possibility of undergoing minimally invasive surgery, such as hip resurfacing, would no longer be an option for the patient.

Similarly, delaying a root canal treatment can lead to the destruction of the tooth, resulting in tooth loss. For instance, in developed countries like the UK and Canada, there is at least a four-week wait period between the day a patient makes an appointment and the time they can see the physician. Canada has the highest percentage of patients (56%) who must wait four weeks for an appointment with a specialist. In the UK, waiting lists for non-essential surgeries, such as knee reconstructions, are up to 18 months, while in Australia and Canada, they can be up to two years.

The COVID-19 pandemic had a massive impact on the market, especially in the first half of 2020. The primary reasons for this impact were the imposition of travel restrictions and the global suspension of elective procedures. According to the Thailand Ministry of Tourism and Sports, overall tourist arrivals fell to 6.7 million in 2020, down from 39.9 million in 2019, an 83.2% fall. Similarly, as per the Malaysia Tourism Promotion Board (MTPB), the number of tourists declined by 83.4% in 2020 to 4.33 million. The market is not expected to return to the pre-pandemic level till 2024. This was mainly due to international tourists avoiding travel and many countries closed their borders in 2021 as well. The opening of borders in 2022 and vaccination drives have positively impacted the market.

Medical tourism has offered a method for people where they can avoid long queues and prolonged wait-time for treatment in their native country, by traveling overseas for treatment. Thus, to save time and avoid aggravation of their medical issues, many international patients rely on medical tourism and travel overseas to countries that offer procedures immediately. Furthermore, many national governments are focusing on promoting health and wellness tourism in their countries through various strategies. Strong government support is thus anticipated to favor market growth.

Service Provider Insights

Based on service provider, the medical tourism market is segmented into public and private. The private segment dominated the market in 2022 and is projected to have the fastest CAGR of 25.86% from 2023 to 2030. The adoption of advanced healthcare technologies and the availability of internationally reclaimed and accredited private care providers are rendering high growth to the segment. In addition, the private sector provides faster services and offers more privacy than the government sector.

Healthcare facilities in developing countries are seeking international recognition from regulatory authorities, which can help them gain access to international healthcare insurance and purchaser networks. Insurance companies in developed nations are incorporating health tourism policies in their medical plans to promote availing care services in foreign lands. Furthermore, a rapid increase in healthcare expenses coupled with a large number of uninsured or underinsured individuals is encouraging tourists requiring medical treatment to avail affordable healthcare services and treatments in developing nations.

In terms of service provider, the public segment is projected to have a substantial CAGR of 24.43% during the forecast period from 2023 to 2030. Healthcare globalization and an increase in patient mobility across borders are driving the medical tourism industry. The growth is further accelerated by incorporating advanced technologies, such as telemedicine and e-health, thus, improving accessibility to care and treatments in foreign countries. In addition, easy access to transportation facilities, state-of-the-art hospitality and accommodation, and improved communication channels are boosting medical tourism.

Treatment Type Insights

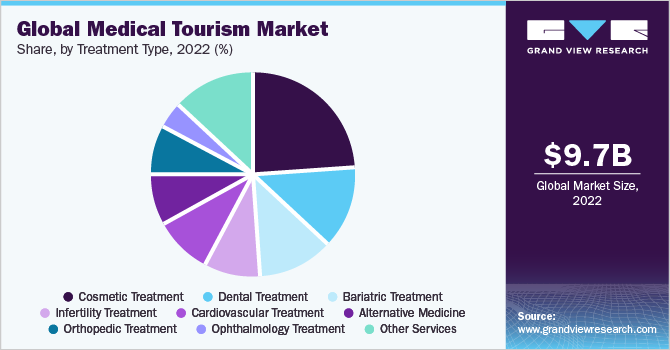

Based on the type of treatment, the market for medical tourism is segmented into alternative medicine, bariatric, cardiovascular, cosmetic, dental, infertility, ophthalmology, orthopedic, and others. The cosmetic segment held the largest revenue share of 23.9% in 2022. Various factors such as growing patient awareness, increasing demand for anti-aging treatments, and high cost of cosmetic implants in developed countries are propelling the market growth.

Thailand is mainly preferred for bariatric and cosmetic surgeries. Common procedures performed in Thailand include laser tattoo removal, breast augmentation, liposuction, hair transplantation, botox, and cool sculpting. On the other hand, procedures such as gastric bypass, hip replacement, and knee replacement, are more affordable in India, as compared to some of the developed nations including the UK and U.S. Costa Rica is preferred by tourists for dental procedures.

The most popular treatments in Malaysia are dental and cosmetic procedures. Heart disease, orthopedics, infertility, health examinations, dental treatment, and cancer are frequent reasons for international patients traveling to Indonesia. The country aims to focus on areas such as dentistry, physical examinations, and cosmetic surgery, particularly breast augmentation and rhinoplasty. Medical exams and dental procedures account for a large portion of inbound procedures in Indonesia.

Country Insights

Turkey dominated the market in 2022 with a revenue share of 19.5%. This can be attributed to a higher influx of health tourists in the country when compared to other nations. As per the Turkish Statistical Institute, a total of 670,730 inbound medical tourists visited Turkey in 2021, an increase of 62% from 2020. On the other hand, Singapore is estimated to register the highest CAGR of 39.7% from 2023 to 2030 owing to increasing government initiatives to promote the tourism industry.

Thailand is one of the popular destinations for health tourism. Its popularity as a tourist destination is augmenting its market growth. The growing number of private institutions, improvements to the overall healthcare infrastructure, and lower treatment prices are contributing to the country’s growth in health tourism. Thailand currently has over 400 private hospitals, a figure that is likely to increase substantially in the coming years. The country was ranked 18th in the 2016 Medical Tourism Index. It was ranked 13th on the same index for the quality of facilities and services supplied, owing to its well-developed healthcare infrastructure and a growing population of medical experts.

Some of the factors contributing to Thailand’s growth are the presence of a highly developed tourism sector, an increase in the number of private healthcare providers, and reasonable treatment costs. Furthermore, improved quality of personal care and the use of the latest treatment technologies are responsible for the growing health tourism in the country. Thailand has more than 1,000 hospitals and is home to Asia's largest private hospital, Bumrungrad International Hospital. It is Asia's first hospital to be accredited by the Joint Commission International and to be certified ISO 9001.

Medical tourism generates significant revenue for developing economies, allowing them to continue expanding their healthcare businesses. This has resulted in increased government engagement and promotion of health tourism. For instance, medical tourists to Malaysia are primarily from Indonesia, the UK, Middle Eastern countries, China, India, Japan, Australia, and New Zealand.

Key Companies & Market Share Insights

These companies use a variety of methods to enhance their market position, including the development of new products and services employing cutting-edge technology, collaborations with other companies, outlet expansion, and corporate investments. For instance, in December 2021, Raffles Hospital, a wholly owned subsidiary of Raffles Medical Group, announced a strategic partnership with Myongji Hospital to provide a Travel Medicine Pass for travelers between Singapore and South Korea. Some prominent players in the global medical tourism market include:

-

MOHW Hengchun Tourism Hospital

-

Apollo Hospitals Enterprise Ltd.

-

Bumrungrad International Hospital

-

Mount Elizabeth Hospitals

-

Raffles Medical Group

-

Dr. B. L. Kapur Memorial Hospital

-

Kasemrad Hospital International Rattanathibet

-

Mission Hospital

-

Bangkok Hospital

-

Miot Hospital

-

Penang Adventist Hospital

Medical Tourism Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.6 billion

Revenue forecast in 2030

USD 75.3 billion

Growth rate

CAGR of 25.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment type, service provider, country

Country scope

Thailand; India; Costa Rica; Mexico; Malaysia; Singapore; Brazil; Colombia; Turkey; Taiwan; South Korea; Spain; Czech Republic; China; Australia; Indonesia

Key companies profiled

MOHW Hengchun Tourism Hospital; Apollo Hospitals Enterprise Ltd.; Bumrungrad International Hospital; Mount Elizabeth Hospitals; Raffles Medical Group; Dr. B. L. Kapur Memorial Hospital; Kasemrad Hospital International Rattanathibet; Mission Hospital; Bangkok Hospital; Miot Hospital; Penang Adventist Hospital

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Tourism Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical tourism market report on treatment type, service provider, and region:

-

Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Treatment

-

Orthopedic Treatment

-

Cosmetic Treatment

-

Bariatric Treatment

-

Dental Treatment

-

Ophthalmology Treatment

-

Infertility Treatment

-

Alternative Medicine

-

Other Services

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Thailand

-

India

-

Costa Rica

-

Mexico

-

Malaysia

-

Singapore

-

Brazil

-

Colombia

-

Turkey

-

Taiwan

-

South Korea

-

Czech Republic

-

Spain

-

China

-

Australia

-

Indonesia

-

Frequently Asked Questions About This Report

b. The global medical tourism market size was estimated at USD 9.7 billion in 2022 and is expected to reach USD 15.6 billion in 2023.

b. The global medical tourism market is expected to grow at a compound annual growth rate of 25.22% from 2023 to 2030 to reach USD 75.3 billion by 2030.

b. Turkey dominated the medical tourism market with a share of 19.5% in 2022. This is attributable to high influx of medical tourists in 2022, when compared to other countries.

b. Some key players operating in the medical tourism market are Bumrungrad International Hospital, Samitivej Hospitals, and Bangkok Hospital Group, Apollo Hospitals Enterprise Ltd., and Fortis Hospitals.

b. Key factors that are driving the medical tourism market growth include significant cost-saving and availability of additional benefits including better healthcare, latest technologies, innovative medicines, modern devices, better hospitality, and personalized care.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."