- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Emulsion Polymer Market Size, Industry Report, 2030GVR Report cover

![U.S. Emulsion Polymer Market Size, Share & Trends Report]()

U.S. Emulsion Polymer Market Size, Share & Trends Analysis Report By Type, By Application (Paints & Coatings, Adhesives & Sealants, Paper & Paperboard), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-221-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

U.S. Emulsion Polymer Market Size & Trends

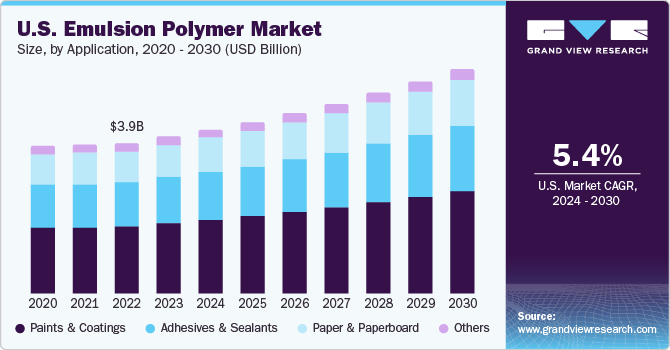

The U.S. emulsion polymer market size was estimated at USD 4.09 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. The market is driven by the expanding construction industry in the country. Rampant government and foreign investments for large civil contracts have bridged the gap between aging buildings and demand for redeveloped infrastructure. According to the United States Census Bureau’s March 2024 survey, construction spending in the country during January 2024 was estimated at USD 2.11 billion. The region is expected to witness the highest growth in the residential and single-family homeowners segment over the forecast period owing to lower interest rates being offered by numerous private banks.

The demand for construction chemicals or embellished coatings in the real estate and construction industry is factored in due to rising investments. For instance, in September 2023, Ferrovial announced an investment of USD 1.0 billion for nine construction projects in Florida and Texas. Work includes the reconstruction and widening of roadways bridges, and drainage maintenance for the surrounding communities.

Emulsion polymers find application across various end-use industries including paints & coatings, adhesives, and paper & paperboard. The growth of these end-use industries is expected to remain a key driving factor for the U.S. emulsion polymer industry over the forecast period. Among the various application segments of emulsion polymers, paints & coatings is a major consumer with a significant demand for acrylics in this segment which, is expected to drive market growth over the forecast period. The demand for emulsion polymers in paints & coatings segment is expected to grow at a rapid pace, on account of the high standard of living and stable economic conditions in the country, which have led to an increase in infrastructure activities.

Market Concentration & Characteristics

The market growth is medium and is accelerating at a significant pace owing to a moderately fragmented market. U.S. emulsion polymer manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, innovation, and production expansion, among others.

The degree of product innovation is significantly high. The innovation of load-bearing adhesives using polymer dispersion such as nonaqueous dispersion (NAD) of acrylic polymer by manufacturers including gluECO Adhesives has found key applications in the automotive sector. Furthermore, the development of silicon rubber waterproof paint has revolutionized water delivery engineering and water storage engineering. Kitchen, bathrooms, toilet, and corridor surfaces in buildings are coated with Grade I, Grade II, Grade III, or Grade IV silicon rubber waterproof paint.

The shift in trend towards the adoption of environment-friendly paints & coatings coupled with the favorable regulatory scenario is likely to support the development of low Volatile Organic Compounds (VOC) content or VOC-free paints and coatings in the market. Stringent regulations laid down by regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and Food and Drug Administration (FDA) to reduce and minimize the use of solvent-based emulsions have helped boost the demand for waterborne emulsions. U.S. EPA under the Clean Air Act Amendments (CAAA) has set stringent regulations for the emission of chemicals such as styrene-butadiene latex. Growth of the paper & paperboard industry coupled with increasing demand for adhesives is further expected to drive the market over the forecast period.

The threat of substitutes is moderate. Ecosphere biolatex is being used as a complete replacement for petroleum-based emulsion polymers such as styrene-butadiene and styrene acrylate latex. It is obtained using naturally renewable crop resources like corn. It is used as an internal substitute for emulsion polymers in the paper coating industry.

Application Insights

Paints & coatings held the largest revenue share of 45.1% in 2023. The segment is driven by the emerging trend of sustainable and odor-free products that contain low volatile organic compounds (VOCs). The primary reason for this preference is the presence of stringent environmental regulations and policies that favor of the production of eco-friendly products.

The adhesive & sealants segment held the second-largest revenue share in 2023. Emulsion polymer-based adhesives are extensively used in various industries including packaging, footwear, textile, shipbuilding, automotive, electronics, and consumer goods.

End-use Insights

Based on end-use, the building & construction segment held the largest revenue share of 37.4% in 2023. The country is witnessing a rise in residential and single-family homeowners owing to affordable interest rates offered by several private banks. Increasing construction spending and growing requirements for improved infrastructure in the U.S. are expected to drive the emulsion polymer in the construction sector during the forecast period.

The automotive segment is expected to expand at a significant CAGR from 2024 to 2030. The demand for underbody coatings formulated with emulsion polymers to ensure chemical and corrosion resistance to the metal parts underneath vehicles is driving the segment growth.

Type Insights

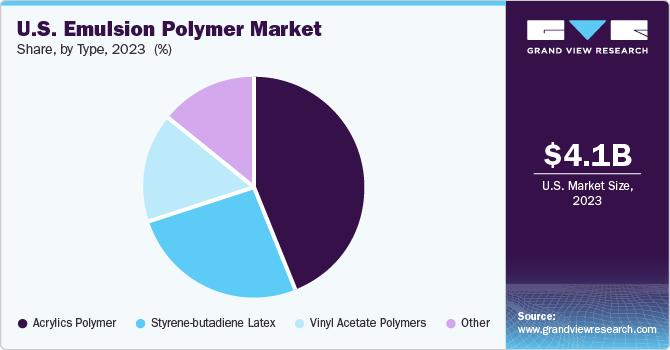

Acrylics polymer dominated the market, with a revenue share of 44.0% in 2023, and is projected to register the fastest CAGR during the forecast period owing to its quick-drying ability. Acrylics polymer find several applications in various end-use industries, especially adhesive sectors. Water resistance property of acrylics polymer is also expected to drive this segment's growth during the forecast period.

Styrene-butadiene latex held the second-largest revenue share in 2023 and is expected to grow at a significant rate during the forecast period. It is used as a replacement for natural rubber and the growth of the tire industry is expected to drive its demand. It is widely used in paper coating, carpet backing, and wood lamination applications owing to its features such as high elasticity, adhesive strength, excellent chemical stability, excellent low-temperature properties, and high resistance to acid, water, and alkali. Rising demand for high-end paper with vivid color graphics and high-quality printing is expected to drive the growth of SB-latex segment.

Key U.S. Emulsion Polymer Company Insights

The U.S. emulsion polymer market is highly capital-intensive and moderately fragmented. Emulsion polymers industry is a commodity-driven market and is exceedingly price-sensitive. The major challenge faced by the new entrants is to produce high-quality, better-performance products at competitive prices, which comply with the changing environmental norms and regulations in different states. Companies are adopting various strategies such as product innovations, partnerships, agreements, joint ventures, and collaborations to maximize their market penetration and to cater to the evolving requirements of end use industries. In November 2022, Solvay launched Reactsurf 2490, an alkylphenol ethoxylates-free (APE) polymerizable surfactant designed as a primary emulsifier for vinyl-acrylic, acrylic, and styrene-acrylic latex systems.

Key U.S. Emulsion Polymer Companies:

- OMNOVA Solutions

- 3M

- Trinseo

- Mallard Creek Polymers, Inc.

- Specialty Polymers Inc.

- STI Polymer

- Engineered Polymer Solutions

- Celanese Corporation

- The Dow Chemical Co.

- Arkema Group.

- Asahi Kasei Corporation

- Solvay Chemicals, Inc.

Recent Developments

-

In February 2024, Mallard Creek Polymers announced the launch of Tykote 6161, an all-acrylic water-based emulsion that can offer high barriers to grease and oil at both room and elevated temperatures and provides excellent water resistance properties. This product has a huge scope of application in the food packaging sector.

-

In June 2023, Arkema Group announced the acquisition of Glenwood Private to develop ultra-high performance polymers to strengthen Arkema’s advanced materials segment’s portfolio.

U.S. Emulsion Polymer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.28 billion

Revenue forecast in 2030

USD 5.86 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use,

Country scope

U.S

Key companies profiled

OMNOVA Solutions; Trinseo; Mallard Creek Polymers, Inc.; Specialty Polymers Inc.; STI Polymer; Engineered Polymer; Solutions; Celanese Corporation; The Dow Chemical Co.; 3M; Arkema Group.; Asahi Kasei Corporation; Solvay Chemicals, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Emulsion Polymer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. emulsion polymer market report based on type, application, and end-use:

-

Type Outlook (Volume, Kilo Ton; Revenue, USD Million, 2018 - 2030)

-

Acrylics Polymer

-

Styrene-butadiene Latex

-

Vinyl Acetate Polymers

-

Other

-

-

Application Outlook (Volume, Kilo Ton; Revenue, USD Million, 2018 - 2030)

-

Paints and Coatings

-

Adhesives & Sealants

-

Paper & Paperboard

-

Others

-

-

End-use Outlook (Volume, Kilo Ton; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive

-

Chemicals

-

Textile & Coatings

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. emulsion polymer market was valued at USD 4.09 billion in the year 2023 and is expected to reach USD 4.28 billion in 2024.

b. The U.S. emulsion polymer market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 5.86 billion by 2030.

b. Based on type, acrylic paints segment emerged as a dominating segment in the market with a share of 37.9% in 2023 due to rising construction activities.

b. The key market players in the U.S. emulsion polymer market include OMNOVA Solutions; Trinseo; Mallard Creek Polymers, Inc.; Specialty Polymers Inc.; STI Polymer; Engineered Polymer; Solutions; Celanese Corporation; The Dow Chemical Co.; 3M; Arkema Group.; Asahi Kasei Corporation; Solvay Chemicals, Inc.

b. The key factors that are driving the U.S. emulsion polymer market include growing innovations and R&D investments.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."