- Home

- »

- Plastics, Polymers & Resins

- »

-

Emulsion Polymer Market Size, Share & Growth Report 2030GVR Report cover

![Emulsion Polymer Market Size, Share & Trends Report]()

Emulsion Polymer Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Paints & Coatings, Adhesives & Sealants, Paper & Paperboard), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-202-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Emulsion Polymer Market Summary

The global emulsion polymer market size was estimated at USD 32.02 billion in 2023 and is projected to reach USD 49.35 billion by 2030, growing at a CAGR of 6.5% from 2024 to 2030. The rise in infrastructure development and growth in the construction industry is driving the market growth.

Key Market Trends & Insights

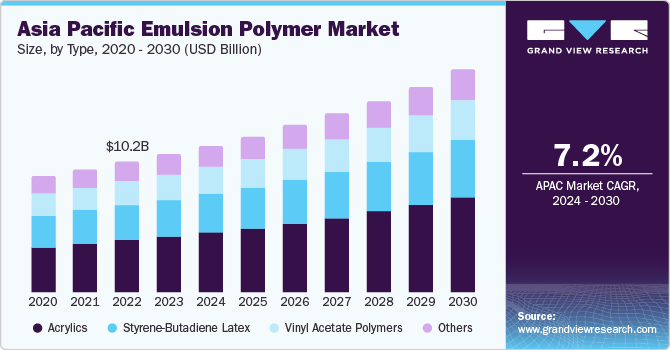

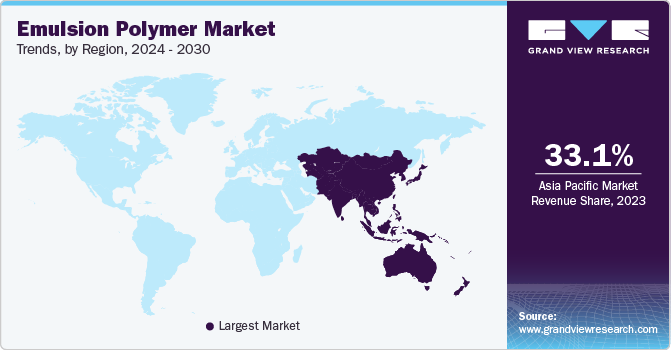

- Asia Pacific emulsion polymer market held the leading market share of 33.06% in 2023.

- By type, the acrylics Polymer segment held the largest market share of 41.58% in 2023.

- By application, the paints & Coatings segment held the largest revenue share in 2023.

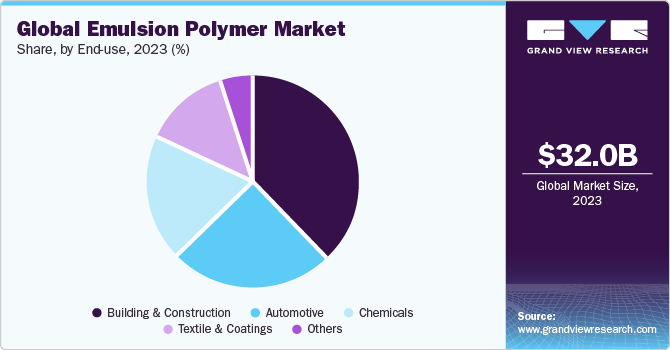

- By end use, the building & construction segment held the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 32.02 Billion

- 2030 Projected Market Size: USD 49.35 Billion

- CAGR (2024-2030): 6.5%

- Asia Pacific: Largest market in 2023

In addition, the increasing demand for environmentally friendly and biodegradable products is expected to boost market growth. The use of emulsion polymers in coating and other applications is preferred as they are non-toxic, biodegradable, and do not harm the environment. Furthermore, the use of emulsion polymers in the production of various textiles such as cotton, wool, and silk is expected to drive the demand.

The Asia-Pacific region is experiencing rapid industrialization and urbanization, leading to increased construction activity and infrastructure development. Polymer emulsion coatings, adhesives and sealants are widely used in these projects due to their versatility, durability and performance. Demand for polymer emulsions in the construction sector, including waterproofing coatings, paints, and flooring adhesives, has increased significantly.

Increasing availability of raw materials as well as the low cost associated with setting up production capacity is expected to drive the market in Asia Pacific. Low labor and manufacturing costs along with lower water and energy costs are contributing to the growth rate of the emulsion polymers market in Asia Pacific.

Furthermore, polymer emulsions are used as binders in water-based paints and coatings. They provide adhesion, improved film-forming, and durability. Furthermore, polymer emulsions are used in the construction industry for applications such as waterproofing, cement modification, and surface treatments, which contributes to increased demand. Additionally, the increase in disposable income has led to an increase in the demand for these products, which in turn has led to an increase in the demand for adhesives. Increasing consumption of adhesives in the automotive industry in recent years has stimulated the consumption of emulsion polymers.

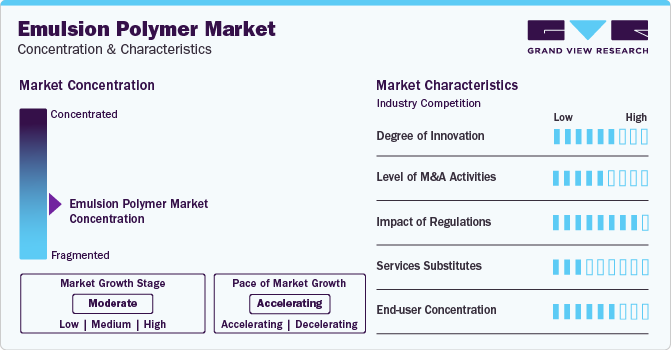

Market Concentration & Characteristics

Market growth stage is moderate, and pace of the market growth is accelerating. Emulsion polymer market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in the production of emulsion polymers, the availability of raw materials, and increasing plastics consumptions. Subsequently, innovative emulsion polymer applications are constantly emerging, disrupting existing industries and creating new ones.

The emulsion polymer market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new emulsion technologies and talent, need to consolidate in a rapidly growing market, and the increasing strategic importance of emulsion polymer.

The emulsion polymer market is also subject to increasing regulatory scrutiny. This is due to concerns about the potential negative impacts of plastics, such as plastic waste management and production. As a result, governments around the world are developing regulations to govern the production and consumption of emulsion polymer. These regulations could have a significant impact on the market, affecting the development and usage of emulsion of polymers.

There are a limited number of direct product substitutes for emulsion polymer. However, there are a number of sustainable technologies that can be used to achieve similar outcomes to emulsion polymers, such as Bio-based emulsion and suspension. These technologies can be used as substitutes for emulsion polymer in certain applications, but they typically do not offer the same level of performance or flexibility as emulsion polymer.

End-user concentration is a significant factor in the market. Since there are a number of end-user industries that are driving demand for emulsion polymer solutions. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing emulsion polymer solutions for these industries. However, it also creates challenges for companies that are trying to compete in a crowded market.

Type Insights

Acrylics Polymer sector dominated the market and accounted for a share of 41.58% in 2023. This high percentage can be attributed to escalating product demand from the adhesives and sealants, as well as superabsorbent polymers, sectors. A rise in construction and building activity in developing nations is anticipated to further support acrylic polymer demand. Increasing usage of acrylic polymers in water treatment is also expected to propel the market growth. Vinyl acetate is anticipated to experience substantial growth in the coming years, primarily as a result of an expanded application base in the production of adhesives, paper, cloth, and wood.

One of the key factors driving the growth of the styrene butadiene (SB) latex market is the increasing demand for SB latex from the paper and paperboard packaging industry. Increasing demand from the packaging industry is contributing significantly to the growth of the market. The segment is projected to grow fastest CAGR over the forecast period. Additionally, SB latex is the most widely used latex binder for coated/pigmented paper and board. In addition, more than half of the world's paper is used for packaging; therefore, the packaging industry plays a vital role in driving the demand for SB latex.

Application Insights

Paints & Coatings application accounted for the largest market revenue share in 2023. Consumers' increasing focus on quality and aesthetics is likely to enhance the demand for technologically advanced coatings and premium paints throughout the course of the projected period. The paints and coatings segment are expanding as a result of consumers' growing preference for odor-free and low-VOC products. This preference is mostly due to the existence of strict environmental laws and policies that support eco-friendly products.

Adhesives & Sealants application is expected to grow at a significant CAGR during the forecast period. Adhesives and sealants are widely used in this sector to fill cracks, seal holes, and secure seams. This increased adoption in the construction industry has helped increase the popularity of the product and consequently stimulated market growth.The use of adhesive bonding offers various advantages over traditional mechanical fastening approaches, including improved appearance, reduced weight, greater design adaptability, and improved performance. The industry is gradually recognizing the benefits of adhesive bonding in terms of efficiency, durability and cost-effectiveness. The shift from mechanical fastening to adhesive bonding, seen in sectors such as automotive and building & construction is a major driver of the growing demand for adhesives and sealants.

End-use Insights

The building & construction segment dominated the market in 2023. Emulsion polymers are used as binders and additives in construction materials such as paints, coatings, adhesives, and mortar. The demand for emulsion polymer is directly proportional to the construction industry growth. The use of emulsion polymers in construction materials provides several benefits, including improved durability, flexibility, and resistance to extreme weather and moisture. These factors, combined with the growth of the construction industry, are contributing to the growth of the market.

The automotive industry is projected to grow at a significant CAGR over the forecast period. Factors such as increased investment in the sector to increase production, continuous efforts by automakers to develop and launch new vehicles, and efforts to develop and promote electric vehicles in the industry are likely to contribute to the growth of the automobile industry, thus creating demand for emulsion polymers in the industry.

Chemicals segment is also anticipated to witness a substantial upsurge in the adoption of emulsion polymer. Developing countries are witnessing rapid urbanization and infrastructure development, which is driving the demand for paints, coatings and adhesives, further driving the emulsion polymers market. Advances in polymer chemistry and manufacturing technology are leading to the development of high-performance emulsion polymers designed for specialized applications.

Regional Insights

Asia Pacific dominated the market and accounted for a 33.06% share in 2023. The rise in construction activities, especially in emerging economies such as China, India, and Southeast Asia, is driving the demand for paints and coatings, which, in turn, is driving the demand for emulsion polymers. In addition, the Asia Pacific region is also home to some of the world's largest emulsion polymer manufacturers including DIC Corporation, China Petrochemical Corporation, KCC Corporation, and others who are investing in research and development to develop new products and technologies. This is further expected to drive the growth of the Asia Pacific market.

North America is anticipated to witness a significant CAGR in the forecast period. This growth owes to the nation's robust economy, favorable commercial real estate market fundamentals, and increased federal and state funding for infrastructure projects and institutional buildings, the construction industry in the United States continues to grow. The country's population growth is expected to increase demand for housing. Additionally, the US market held the largest market share, while the Canadian market was the fastest growing market in the region.

Key Companies & Market Share Insights

Key players operating in the market include Arkema, DIC CORPORATION, BASF SE, Celanese Corporation, Wacker Chemie AG, Momentive, Solvay, Clariant, and Asahi Kasei Corporation

-

BASF SE is engaged in the production of a broad range of products such as petrochemicals, catalysts, nutrition products, coatings, monomers, intermediates, construction chemicals, performance materials & chemicals, dispersions & pigments, crop protection products, and personal care chemicals.

-

Solvay is engaged in manufacturing chemicals. It operates its business through four segments including advanced formulations, advanced materials, performance chemicals, and functional polymers. The products manufactured by the company find applications in various industries including aeronautics, automotive, electronics & electrical, packaging, pharmaceuticals, oil & gas, healthcare, wires & cables, packaging, and semiconductors.

Synthomer, OMNOVA Solutions, Allnex GMBH, are some of the emerging market participants in the market.

-

Synthomer Plc (Syntomer) is a specialized chemical company. It produces and markets adhesives, foams and specialty chemicals, including liquid polybutadiene (LPBD), Alcotex polyvinyl alcohol (PVOH) and polyvinyl acetate (PVAc), among others. Synthomer products find applications in the construction, coatings, adhesives, textiles, medical and healthcare, paper and packaging, carpet and foam markets.

-

Allnex is a manufacturer and supplier of specialty chemicals to the construction, manufacturing and specialty markets.

Key Emulsion Polymer Companies:

- Synthomer

- OMNOVA Solutions

- Allnex GMBH

- Arkema

- DIC CORPORATION

- BASF SE

- Celanese Corporation

- Wacker Chemie AG

- Momentive

- Mallard Creek Polymers

- Solvay

- Clariant

- Asahi Kasei Corporation

Recent Developments

-

In October 2023, Asahi Kasei announced plans to invest in new coating equipment for its HiporeTM lithium-ion battery separators. The coating lines will be installed at the company's current facilities in the U.S., Japan, and South Korea, and operations will commence in the first part of fiscal 2026

-

In June 2023, Avient Corporation and BASF collaborated to introduce Color grades of Ultrason® high-performance polymers. Color grades of Ultrason® high-performance polymers were introduced to the global market through a collaboration between Avient Corporation and BASF. The collaboration will provide customers in the consumer and food service, electrical and electronics (E&E) and healthcare industries with particular benefits by providing end-to-end technical support from the base polymer to the final painted product

-

In May 2023, H.B. Fuller announced the acquisition of Beardow Adams, a British family-owned company that develops multipurpose industrial adhesives. The acquisition is expected to boost profitable growth in end markets along with generating business synergies through production optimization, a broader distribution platform, and differentiated innovation

Emulsion Polymer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 33.78 billion

Revenue forecast in 2030

USD 49.35 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; France; Germany; Spain; Italy; China; India; Japan; Australia; South Korea; Southeast Asia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Synthomer; OMNOVA Solutions; Allnex GMBH; Arkema; DIC CORPORATION; BASF SE; Celanese Corporation; Wacker Chemie AG; Momentive; Mallard Creek Polymers; Solvay; Clariant; Asahi Kasei Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Emulsion Polymer Market Report Segmentation

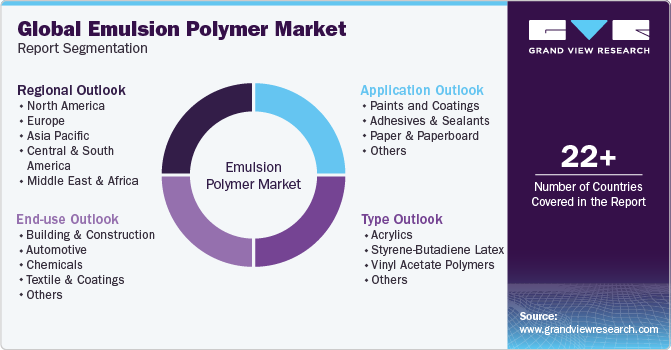

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global emulsion polymer market report based on type, application, end-use, and region:

-

Type Outlook (Volume, Kilo Ton; Revenue, USD Million, 2018 - 2030)

-

Acrylics

-

Styrene-Butadiene Latex

-

Vinyl Acetate Polymers

-

Other

-

-

Application Outlook (Volume, Kilo Ton; Revenue, USD Million, 2018 - 2030)

-

Paints and Coatings

-

Adhesives & Sealants

-

Paper & Paperboard

-

Others

-

-

End-use Outlook (Volume, Kilo Ton; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive

-

Chemicals

-

Textile & Coatings

-

Others

-

-

Regional Outlook (Volume, Kilo Ton; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America (MEA)

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global emulsion polymers market size was estimated at USD 32.02 billion in 2023 and is expected to reach USD 33.78 billion in 2024.

b. The global emulsion polymers market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 49.35 billion by 2030.

b. Asia Pacific dominated the emulsion polymers market with a share of 33.60% in 2023. This is attributable to rising spending on construction activities, the growing middle-class population, and the availability of raw materials.

b. Some key players operating in the emulsion polymers market include The Dow Chemical Co, Arkema SA, Clariant International, Specialty Polymers Inc., STI Polymer, and Kasei Corporation.

b. Key factors that are driving the market growth include emulsion polymers application in paints and coatings, and paper & paperboard coatings, and its application for adhesives used in automotive industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.