- Home

- »

- Next Generation Technologies

- »

-

U.S. Unified Communications Market, Industry Report, 2030GVR Report cover

![U.S. Unified Communications Market Size, Share & Trends Report]()

U.S. Unified Communications Market Size, Share & Trends Analysis Report By Component, By Deployment Mode (Hosted, On-premise), By Solution, By Organization Size, By Industry Vertical, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-215-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Unified Communications Market Trends

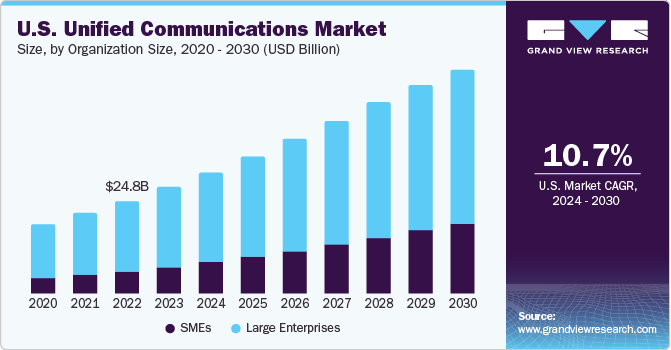

The U.S. unified communications market size was valued at USD 28.37 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.7% from 2024 to 2030. Unified Communications (UC) solutions are now being adopted by organizations in order to increase revenues, lower operating expenses, and maintain customer relationships. UC improves decision-making by incorporating various communication instruments such as multimodal communication into a single platform. Thus, unified communications solutions promote cross-functional communication activities and generate positive results by the integration of enterprise communication services such as chat, IP telephony, audio-video & web conferencing, FMC etc.

In 2023, the U.S. accounted for over 20% of the unified communications market. The rising trends of Bring Your Own Device (BYOD), an upsurge in the mobile workforce, and the provision of a hybrid workplace model are expected to impact the market over the forecast period. Smart appliances replace the traditional work culture using desktops, PC, and computers as primary means of business communications. Mobile devices that support UC allow employees to stay connected from anywhere at any time. Hence, employees must expand beyond a single desktop workstation and work remotely, assuring high productivity.

UC technology introduces integrated communications devices that enable institutions to streamline business processes, lower communications' overall cost, and enable room for collaboration. Organizations specializing in UC services accentuate simplifying their solutions, which makes the services easier to manage, deploy and purchase. There has been an improved focus on utilizing past user experience as a crucial tool for designing new solutions and improving existing ones which would lead to the overall growth of the market in the forecast period.

With rising business communications, organizations are looking for methods to manage complexity, control costs, and improve overall productivity. This has led to the increasing adoption of UC solutions. Organizations are redefining their business models to gain flexibility, productivity, and agility. Incorporating real-time data, video communications, and telephony systems become critical to business activities in the ever-changing business environment. Thus, associations adopt these UC solutions to enhance communications and collaborations internally with remote staff and externally with clients and suppliers.

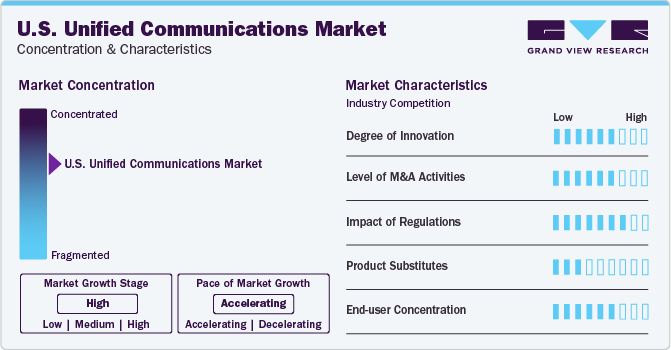

Market Concentration & Characteristics

The market is witnessing a medium to high degree of innovation. With the advent of Artificial Intelligence (AI), investments by the companies are aimed at enhancing their ability to innovate, adapt, and gain maximum return on investment (ROI) in the future. The integration of AI with unified communications is helping companies to automate routine tasks and provide valuable insights.

The UC industry is characterized by a high impact of government regulations and policies. This is due to the sensitive nature of the information transmitted through UC platforms. Data privacy, telecommunications, and E-discovery regulations are the most impacting regulations in the unified communication market. Businesses operating in the market need to stay up to date with government regulations and ensure their solutions are strictly in compliance with the law.

The market is also witnessing a moderate to high number of merger and acquisition activities. These moves help companies increase market share, expand the customer base, and strengthen product portfolios. For instance, in October 2023, Mitel Network Corporation acquired Unify, an Atos company that offers communication and collaboration solutions.

End-user concentration is moderate to high in the market. Several industry verticals are adopting various unified communications to increase productivity, enhance collaboration, and improve customer services. The features offered by advanced unified communications, such as voicemail to email transcription, call routing, and presence indicators, leading to an increase in the number of end-user concentration.

Solution Insights

Based on solution, the instant and unified messaging segment accounted for the highest market share in 2023. This can be attributed to the rise in the need among enterprises to engage in prompt communications among peers and gain real-time notifications of strategies in critical mission situations. Unified Messaging helps manage regular voice, fax and text messages, all uniting in a single platform that users can access via PC or telephone. UM is majorly suitable for mobile business users as it enables them to reach co-workers and clients easily.

The IP telephony segment captured the second largest share of the market in 2023. This is due to its functioning over internet protocol which offers privacy if encryption is enabled. The segment growth is also attributed to cheaper call charges compared to regular calls.

Organization-size Insights

Based on the organization size, large enterprises accounted for the highest market share in 2023. Large enterprises consist of multiple departments which require to be in constant communication with each other for efficient workflows. These enterprises focus on corporate network performance, keeping tight integration with emerging technologies such as SD-WAN. They are present in international locations and are constantly expanding which adds to the demand for secure and instantaneous unified communication solutions.

Small & medium enterprises are anticipated to grow with the highest CAGR from 2024 to 2030. SMEs use UC services to reduce the capital and operational expenses required to deploy a unified communications solution independently. Multiple vendors had redirected their focus to small & medium-sized businesses, which before did not incorporate the primary market because of the need for awareness about UC's potential benefits and the high cost of on-premise equipment.

Industry Vertical Insights

Based on industry vertical the IT and Telecom segment accounted for the significant market share in 2023. The rising adoption of unified communications solutions in the IT and telecom businesses to enhance collaboration, streamline organizational communication channels, and reduce the complexity of maintaining disparate communication tools is expected to boost the segment's growth. UC provides various services critical to increasing remote workers' productivity using available mobile devices. Higher number of cross-functional teams, remote workers, and improving business operations have enabled corporations to deploy unified communication solutions at the business level to ensure seamless communication techniques.

The government sector is expected to grow with a notable CAGR over the forecast period. Governments are increasingly deploying UC technology in order to meet the budgetary pressures and to fulfill the growing demands from citizens for enhanced communication. A collaborative approach is presumed to increase interaction and engagement between various government divisions and their stakeholders.

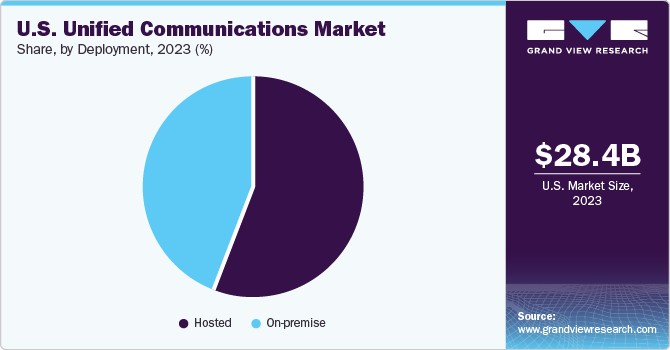

Deployment Insights

The hosted segment dominated the market with the highest share of around 56.0% in 2023. Due to lower total ownership costs, capital expenditure, and operating expenses, businesses are moving toward hosted UC solutions to upscale their storage capacity. The segment provides predictable and simple operating cost model and delivers a single UC platform to provide communication and collaboration solutions across numerous channels.

The on-premise segment offers control over the communication systems. Businesses that deploy such a UC solutions model have control over all their data and systems, ensuring critical business infrastructure to reside in-house, enabling data security and privacy. Moreover, such communication models allow companies to have dedicated IT staff for maintenance, custom disaster recovery procedures, and support. However, on premise solutions have limited storage capacity, high-priced hardware and software, and need manual updating for new functionality and features.

Key U.S. Unified Communications Company Insights

Some of the leading companies in the market include IBM Corporation, Alcatel-Lucent Enterprise, and Microsoft Corporation.

-

IBM provides a diverse set of consulting and technology services. The company specializes in consulting, information technology services, enterprise architecture, outsourcing, and semiconductors and microprocessors.

-

Microsoft Corporation is involved in the licensing, maintenance, and development of a variety of software services and products. The company supports intelligent cloud and intelligent edge digital transformation.

Tata Communication, Cisco Systems, and Verizon Communications Inc. are some other participants in the market.

-

Tata Communication is a digital ecosystem facilitator, powering the rapidly expanding digital economy. The company is advancing intelligence through cloud, mobility, the internet of things (IoT), collaboration, security, and network services.

-

Cisco System Inc. provides intelligent networks and technological architectures to clients based on integrated products, services, and software platforms.

Key U.S Unified Communications Companies:

- 8x8, Inc.

- Alcatel-Lucent Enterprise

- Avaya Inc.

- Cisco Systems Inc.

- LogMeIn, Inc.

- IBM Corporation

- Microsoft Corporation

- Mitel Network Corporation

- NEC Corporation

- Poly Inc.

- RingCentral, Inc.

- Unify (Atos SE)

- Verizon Communications Inc.

- Zoom Video Communications, Inc.

Recent Developments

-

In May 2022, Tata Communications introduced DIGO, an in-network cloud communication platform to boost customer engagement for businesses that prioritize going digital. The platform offers a complete set of communications capabilities that work with any device and can be integrated with an enterprise's existing applications easily.

-

In August 2022, HP Inc. announced the acquisition of Poly which is expected to accelerate HP’s Strategy to create a more growth-oriented portfolio, strengthen its industry opportunity in hybrid work solutions, and position the combined organization for long-term, sustainable growth, and value creation.

U.S. Unified Communications Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 28.37 billion

Revenue forecast in 2030

USD 59.0 billion

Growth rate

CAGR of 10.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Deployment Mode, Solution, Organization Size, Industry Vertical

Country scope

U.S.

Key companies profiled

8x8, Inc.,Alcatel-Lucent Enterprise, Avaya Inc., Cisco Systems Inc., Microsoft Corporation, Mitel Network Corporation, NEC Corporation, Poly Inc., Unify (Atos SE), Verizon Communications Inc., IBM Corporation, LogMeIn, Inc., Zoom Video Communications, Inc., and RingCentral, Inc.,

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Unified Communications Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest market trends in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. unified communications market report based on component, deployment, solution, organization size, and industry vertical:

-

U.S. Unified Communications Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

U.S. Unified Communications Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-premise

-

-

U.S. Unified Communications Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instant & Unified Messaging

-

Audio & Video Conferencing

-

IP Telephony

-

Collaboration Platform and Applications

-

-

U.S. Unified Communications Organization-size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

U.S. Unified Communications Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Manufacturing

-

IT & Telecom

-

Retail & E-commerce

-

Government & Defense

-

Healthcare & Life Sciences

-

Education

-

Travel & Hospitality

-

Transport & Logistics

-

Media & Entertainment

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. unified communications market size was estimated at USD 28.37 billion in 2023 and is expected to reach USD 32.30 billion in 2024.

b. The U.S. unified communications market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 59.40 billion by 2030.

b. The instant and unified messaging segment accounted for the highest market share in 2023. This can be attributed to the rise in the need among enterprises to engage in prompt communications among peers and gain real-time notifications of strategies in critical mission situations.

b. The key players in this U.S. unified communications market include IBM Corporation, Alcatel-Lucent Enterprise, Zoom Video Communications, Inc., and Microsoft Corporation, among others.

b. Key factors that are driving the market growth include the rising adoption of remote working trends and the digitalization of businesses across the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."