- Home

- »

- Semiconductors

- »

-

Microprocessor Market Size, Share & Trends Report, 2030GVR Report cover

![Microprocessor Market Size, Share & Trends Report]()

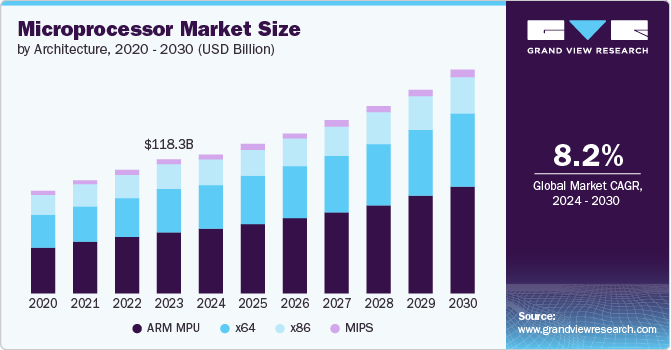

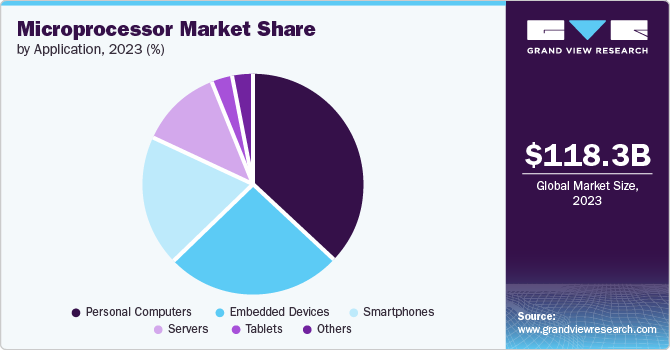

Microprocessor Market Size, Share & Trends Analysis By Architecture (ARM MPU, x64, x86, MIPS), By Application (Smartphones, Personal Computers, Servers, Tablets, Embedded Devices), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-666-0

- Number of Report Pages: 250

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Microprocessor Market Size & Trends

The global microprocessor market size was estimated at USD 118.30 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. Moreover, the market volume accounted for 2.66 billion units in 2023 and is projected to reach 3.90 billion units in 2030. The market is anticipated to experience growth due to the increasing utilization of microprocessors in consumer electronics like Personal Computers (PCs), smartphones, and laptops. A microprocessor, an electronic component integrated into a single Integrated Circuit (IC), contains millions of small elements such as transistors, diodes, and resistors working in unison. This chip performs functions like data storage, timing, and interaction with peripheral devices. These ICs are employed in various electronic devices, including tablets, servers, smartphones, and embedded devices, among others.

Rapidly growing demand for smartphones and tablets is expected to fuel the market growth over the forecast period. A microprocessor enhances the performance of the smartphone as it is used for enhancing the speed and efficiency of a smartphone. The performance speed of any smartphone is directly proportional to the performance of the microprocessor. Moreover, with the advent of ‘smart’ devices, electrical products such as digital cameras, televisions, laptops, and wearables devices offer various advanced technologies such as touch screen monitors and displays, flat screens, and Bluetooth, which require a larger number of ICs.

Microprocessors were initially designed for their use in personal computers and servers. These ICs are now being used in automotive applications, such as infotainment systems and Advanced Driver-Assistance Systems (ADAS), to offer improved connectivity and high-speed to vehicle systems. Besides, microprocessors act as the brains of servers, PCs, and large mainframes. Moreover, they are used for embedded processing in various systems, such as networking gear, wearable devices, computer peripherals, set-top boxes, medical, televisions, industrial equipment, video-game consoles, and Internet of Things (IoT) applications. Microprocessors used for digital consumer applications, PCs, and communications generally use one of several Reduced Instruction Set Computer (RISC) architectures or a generic x86 processor. RISC cores decrease chip complexity by using simple instructions and keeping the instruction size constant without a microcode layer or associated overhead.

Conversely, factors such as the high manufacturing costs of microprocessor ICs, expensive circuit design, increasing sales of low-cost mobile devices, declining shipments of personal computers, and high raw material prices are expected to impede market growth in the coming years. Nonetheless, advancements in server processors, driven by developments in the Internet of Things (IoT) and Artificial Intelligence (AI), are making them more favorable compared to standard desktop processors for certain applications.

The server processor with IoT and AI-embedded microprocessors helps in reducing the unit cost for microprocessors, which, in turn, is having a positive impact on the market growth across the globe. These microprocessors are extensively being used in connected devices, data center facilities, and public clouds that allow organizational data to move faster across the IT network. Thus, organizations are incorporating these ICs to support the functioning of advanced technologies in devices, resulting in less operational cost.

Market Concentration & Characteristics

The microprocessor market growth stage is medium, and the pace is accelerating. The market is competitive, with the presence of numerous microcontroller manufacturers. The market is characterized by a high degree of innovation, and microprocessor providers are focusing on Research & Development (R&D), which in turn would help increase their market presence. For instance, in February 2022, Intel introduced new Intel Xeon D processors named D-1700 and D-2700. These processors feature computing capabilities beyond the core data center, offering a better experience for edge usages, critical networks, and workloads.

The target market is also characterized by many product launches by the leading companies. For instance, in January 2023, Renesas Electronics Corporation unveiled the RZ/G3S, a general-purpose microprocessor (MPU). This MPU boasts low power consumption, rapid Linux OS startup, and enhanced security with tamper detection. Featuring an Arm Cortex-A55 core and two Cortex-M33 sub-CPUs, the RZ/G3S offers high-speed connectivity and efficient task management, making it perfect for smart meters, home gateways, and tracking devices.

Microprocessor manufacturers are subject to numerous laws and regulations, including those pertinent to labor and employment, such as Occupational Safety and Health Administration (OSHA) standards. Moreover, the manufacturers have to comply with quality and safety standards and environmental regulations.

Microprocessors are integral components in modern computing and electronics, performing a wide range of tasks from basic arithmetic operations to complex data processing. However, Field Programmable Gate Arrays (FPGAs) and microcontrollers are alternatives to microprocessors. Hence, the threat of substitutes can be considered medium.

The microprocessor market caters to a diverse array of end-users across multiple industries and applications, including healthcare, consumer electronics, automotive, and industrial manufacturing. Each sector has distinct requirements and trends, driving innovation and specialization among microprocessor manufacturers. The ongoing technological advancements in these industries ensure a strong demand for advanced microprocessors in a variety of applications.

Architecture Insights

In 2023, the ARM MPU segment held the largest revenue share of over 46.0% in the market. This can be attributed to the growing adoption of ARM processors across smartphones and personal computers. The ARM architecture offers various advantages, such as simple design, power efficiency, and ease of management. Its high power efficiency makes it highly compatible with portable and low-powered embedded devices such as notebooks and smartphones. Moreover, continuous developments in the ARM architecture have enabled these processors to offer higher-performance computing capabilities compared to x86 processors.

The x64 segment is expected to grow at a considerable CAGR of 8.4% from 2024 to 2030. The x64 processor is an improvement in the x86 architecture, and both processors are based on Complex Instruction Set Computing (CISC). Among x86 and x64, the x64 processors dominate the market due to their higher memory and processing power compared to the x86 processors. Moreover, x64 processors can better handle double instructions compared to the 32-bit architecture of x86 processors, due to which they work more efficiently. The x64 processors find applications in mobile processing, video game consoles, supercomputers, and virtualization technology, among others. The x86 processors find applications in personal computers, gaming consoles, laptops, and intensive workstations, among others.

Application Insights

The personal computers segment dominated the target market with a revenue share of over 37.0% in 2023. This segment offers strong commercial opportunities for key market players to tap on, supported by the increasing use of microprocessor chips within personal computers across the globe. Microprocessor offers various advantages including increased storage, improved volatile memory, logical functions, more operating system tasks, and low power consumption, leading to increased adoption of the component in the personal computer application. Moreover, key players in the market are continuously launching new products enabled with advanced technology to gain key market share in the PC segment. For instance, in January 2024, Advanced Micro Devices, Inc. unveiled the Ryzen 8000G Series desktop processors for the AM5 platform. Utilizing the "Zen 4" architecture, these processors ensure robust performance and energy efficiency for gaming and content creation.

The smartphone segment is expected to register the fastest CAGR of 9.6% from 2024 to 2030. All smartphones are equipped with microprocessors, which allow them to perform a wide range of tasks, including making phone calls, sending text messages, browsing the internet, and running various apps. The adoption of microprocessors in smartphones has also contributed to the increasing power and capabilities of these devices. As microprocessor technology has improved, smartphones have become more powerful and able to handle more complex tasks. This has enabled the development of increasingly sophisticated apps and has made smartphones an integral part of our daily lives.

Microprocessors have enabled smartphones to connect to the internet, which has made them more useful and attractive to consumers. The ability to connect to the internet allows users to access a wide range of information and services, such as email, social media, and online shopping are the use cases of microprocessors in smartphones. Moreover, personal computer manufacturers are collaborating with technology providers to provide high-technology products to consumers.

In February 2022, Qualcomm Technologies, Inc. and SAMSUNG announced a partnership to provide Qualcomm Snapdragon 8 Gen 1 Mobile Platform for the Galaxy Tab S8 and Samsung Galaxy S22 Series. The Snapdragon 8 boasts an ultra-high-performance Qualcomm Hexagon processor, incorporating state-of-the-art 5G, AI, gaming, camera, Wi-Fi, and Bluetooth technologies.

Regional Insights

The microprocessor market in North America is projected to grow at a CAGR of 8.0% from 2024 to 2030. The growth is attributed to the significant presence of prominent players in the region, including Texas Instruments Incorporated, Intel Corporation, and Qualcomm Technologies, Inc. Moreover, the growing demand for smart devices and the expansion of the automotive electronics industry in the region drive the market's growth.

U.S. Microprocessor Market Trends

The microprocessor market in the U.S. is projected to grow at a CAGR of 8.1% from 2024 to 2030. The U.S. dominates the North American region. High development in consumer electronics products, healthcare monitoring systems, and electric & hybrid vehicles, among others, are key growth-contributing factors in the U.S.

Europe Microprocessor Market Trends

The microprocessor market in Europe was valued at USD 18.43 billion in 2023. The semiconductor chip production initiatives being pursued by the governments of various European countries are expected to boost the growth of the regional microprocessor market. For instance, Italy is pursuing investment plans for the domestic chip manufacturing industry. Plans envisage the nation contemplating to allocate over EUR 4 billion (USD 4.6 billion) by 2030 to enhance its domestic semiconductor production capabilities, as reported by Reuters in March 2022.

Germany microprocessor market is expected to grow at a CAGR of 7.9% from 2024 to 2030. The target market's growth in Germany can be attributed to its strong industrial base and the growing adoption of Industry 4.0 technologies. Moreover, the investments in the Research and Development (R&D) of advanced technologies. The country aims to spend 3.5% of its Gross Domestic Product (GDP) on R&D by 2025. This is expected to offer significant growth opportunities for the market in Germany.

Asia Pacific Microprocessor Market Trends

The microprocessor market in Asia Pacific dominated the market and accounted for over 58.0% of the revenue share in 2023. The growth is attributed to the rising penetration of smartphones and other electronics such as laptops, mobiles, desktops, and tablets in the region. Developing economies such as China and India are also supporting market growth due to various factors such as growing digitization, growing penetration of high-tech gadgets, and the advancement of automotive electronics, among others. Also, the rising usage of the Internet of Things (IoT), huge IT spending by the government, and increasing demand for cloud-based services are likely to drive regional market growth over the forecast period.

China microprocessor market is projected to grow at a CAGR of 9.4% from 2024 to 2030. China is one of the biggest electronic manufacturing hubs worldwide, manufacturing a variety of electronic components and products, including laptops and mobile phones, which use microprocessors. A developed supply chain, large reserves of vital elements required for electronics manufacturing, the availability of a skilled workforce, and lower labor costs are some of the factors driving the electronics manufacturing industry in China, driving the demand for microprocessors.

Key Microprocessor Company Insights

Some key companies operating in the market include Intel Corporation, Advanced Micro Devices, Inc., NVIDIA Corporation, and Qualcomm Technologies, Inc., among others.

-

Intel Corporation is a U.S.-based designer and manufacturer of microprocessors. The company’s hardware portfolio comprises of Intel Xeon CPU Max Series, the Intel Gaudi processors, and Intel eASIC devices, among others. It has a global presence with regional offices across Asia Pacific, Europe, North America, Latin America, and Middle East & Africa (MEA), employing about 131,000 people in 65 countries.

-

Qualcomm Technologies, Inc. is a U.S.-based technology company that provides products for modems, platforms, processors, and Radio Frequency (RF) systems, among others. It operates in three business segments, namely, Qualcomm Technology Licensing (QTL), Qualcomm CDMA Technologies (QCT), and Qualcomm Strategic Initiatives (QSI). The company has a global presence and operates 170 offices in over 30 countries.

SiFive, Inc. and Nuvoton Technology Corporation are some emerging companies in the target market.

-

SiFive, Inc. is a U.S.-based developer of open-source enabled semiconductors, including RISC-V-based processors. The company’s products enable system designers reduce cost and time-to-market. It has a global presence with offices in India, France, Japan, Taiwan, the U.S., and the UK.

-

Nuvoton Technology Corporation is a Taiwan-based manufacturer of a wide range of semiconductor devices, including microprocessors, microcontrollers, motor drivers, and transistors. The company serves a wide range of industries, including consumers electronics, automotive, and industrial.

Key Microprocessor Companies:

The following are the leading companies in the microprocessor market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Texas Instruments Incorporated

- STMicroelectronics

- Microchip Technology Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- MediaTek Inc.

- NVIDIA Corporation

- Analog Devices, Inc.

- Broadcom

- Nuvoton Technology Corporation

- Samsung

- The Western Design Center, Inc.

- SiFive, Inc.

Recent Developments

-

In April 2024, Nuvoton Technology Corporation launched the NuMicro MA35D0 series, a microprocessor series. This microprocessor boasts extensive connectivity and security features and dual 64/32-bit Arm Cortex-A35 cores. It meets the needs of industrial IoT applications by providing cost efficiency, a compact size, and reliable operation across a wide temperature range.

-

In October 2023, Intel Corporation announced the launch of the Intel Core 14th Generation desktop processor family. This new lineup includes six unlocked processors, offering up to 24 cores, 32 threads, and frequencies up to 6 GHz, with the Intel Core i7-14700K featuring 20 cores and 28 threads.

-

In November 2022, SiFive, Inc. announced the launch of SiFive Performance P470 and P670 RISC-V processors, designed for high performance and efficiency in small sizes for applications like wearables, smart homes, and industrial automation. These processors offer superior computing performance and efficiency, providing significant cost savings and meeting industry demands.

Microprocessor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 122.44 billion

Revenue forecast in 2030

USD 196.50 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million units, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Architecture, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Advanced Micro Devices, Inc.; Intel Corporation; Qualcomm Technologies, Inc.; Texas Instruments Incorporated; STMicroelectronics; Microchip Technology Inc.; NXP Semiconductors; Renesas Electronics Corporation; MediaTek Inc.; NVIDIA Corporation; Analog Devices, Inc.; Broadcom; Nuvoton Technology Corporation; Samsung; The Western Design Center, Inc.; SiFive, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microprocessor Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global microprocessor market report based on architecture, application, and region:

-

Architecture Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

ARM MPU

-

By ARM Size

-

ARM 32-Bit

-

ARM 64-Bit

-

-

By End-use

-

Consumer Electronics

-

Networking & Communication

-

Automotive

-

Industrial

-

Medical Systems

-

Aerospace & Defense

-

Energy

-

Oil & Gas

-

Others

-

-

Others

-

-

-

x64

-

x86

-

MIPS

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Smartphones

-

Personal Computers

-

Servers

-

Tablets

-

Embedded Devices

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global microprocessor market size was estimated at USD 118.30 billion in 2023 and is expected to reach USD 122.44 billion in 2024.

b. The global microprocessor market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 196.50 billion by 2030.

b. Asia Pacific dominated the microprocessor market with a share of over 58.0% in 2023. This is attributable to the high semiconductor and electronics manufacturing activity in the region.

b. Some key players operating in the microprocessor market include Advanced Micro Devices, Inc., Intel Corporation, Qualcomm Technologies, Inc., Texas Instruments Incorporated, STMicroelectronics, Microchip Technology Inc., NXP Semiconductors, Renesas Electronics Corporation, MediaTek Inc., NVIDIA Corporation, Analog Devices, Inc., Broadcom, Nuvoton Technology Corporation, Samsung, The Western Design Center, Inc., and SiFive, Inc..

b. Key factors driving market growth include the growing adoption of consumer electronic devices and the rising proliferation of the Internet of Things (IoT). Moreover, the growing product innovations are contributing to the market’s growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."