- Home

- »

- Communication Services

- »

-

Unified Communications Market Size & Share Report, 2030GVR Report cover

![Unified Communications Market Size, Share & Trends Report]()

Unified Communications Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment Mode (Hosted, On-premise), By Solution, By Organization Size, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: 978-1-68038-164-1

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Unified Communications Market Summary

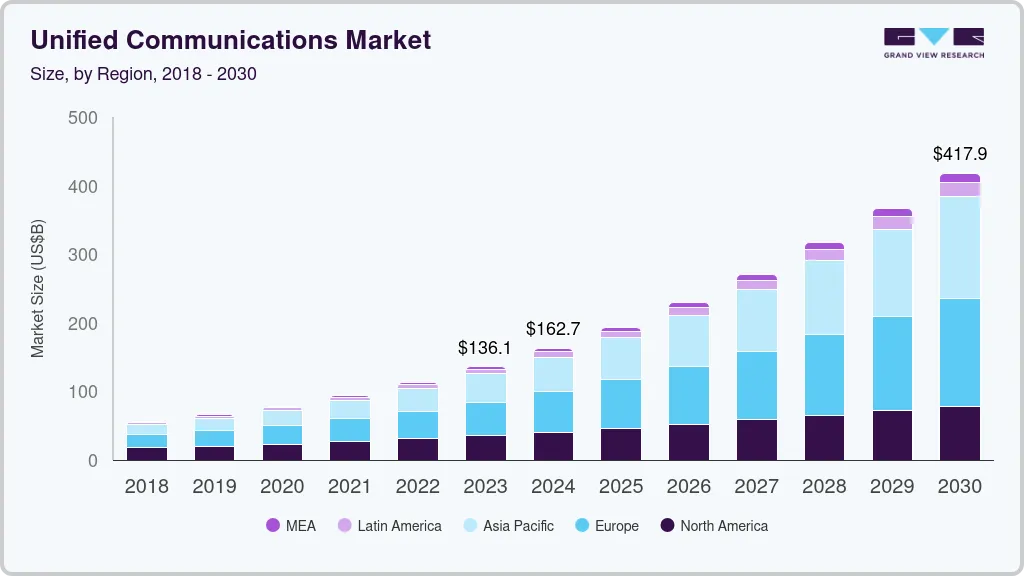

The global unified communications market size was valued at USD 136.11 billion in 2023 and is projected to reach USD 417.86 billion by 2030, growing at a compound annual growth rate (CAGR) of 17.4% from 2024 to 2030. Organizations are adopting Unified Communications (UC) solutions to increase revenues, lower operating expenses, and maintain customer relationships.

Key Market Trends & Insights

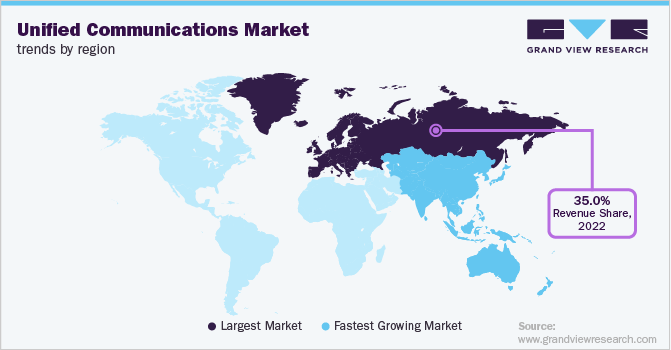

- In terms of region, Europe was the largest revenue generating market in 2023.

- U.S. is expected to register the highest CAGR from 2024 to 2030.

- Based on deployment mode, the hosted segment is expected to register the highest CAGR of over 20.0% from 2023 to 2030.

- Based on organization size, the SMEs (small & medium enterprises) segment is anticipated to expand at the highest CAGR of over 20.0% from 2023 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 136.11 Billion

- 2030 Projected Market Size: USD 417.86 Billion

- CAGR (2024-2030): 17.4%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

UC improves decision-making by incorporating various communication instruments, such as multimodal communication, into a single platform. The rising unified communications and collaboration market trends such as Bring Your Own Device (BYOD) coupled with an upsurge in the mobile workforce and the provision of a hybrid workplace model are being observed across the globe. Mobile devices support UC allow employees to upgrade from a single desktop workstation and work remotely, assuring high productivity.

The unified communication and collaboration market has been growing at a rapid pace over the past decade with the continuous introduction of integrated communications devices. This trend has enabled the institutions to achieve multiple benefits, such as streamlining business processes, lowering communications' overall cost, and enabling enhanced collaboration. Organizations specializing in UC services emphasize simplifying their solutions, which makes the services easier to manage, deploy and purchase. There has been an improved focus on utilizing past user experience as a crucial tool for designing new solutions and improving existing ones, which would further lead to the overall growth of the market.

Furthermore, the evolving business communications have enabled the organizations to look for methods to manage complexity, control costs, and improve overall productivity. This has led to an increased adoption of UC solutions, primarily delivered in a cloud-based or hosted Unified Communications as a Service (UCaaS) model. Rising demand for organizations to transform their business models through flexibility, productivity, and agility is fueling the growth of unified communications as a service market.

Incorporation of real-time data, video communications, and telephony systems has become critical to business activities in an ever-changing business environment. Thus, companies are moving towards UC solutions to enhance communications and collaborations internally with remote staff and externally with clients and suppliers.

The COVID-19 pandemic caused a temporary halt to the on-premises operations of enterprises and drove the trend of work-from-home facilities. The pandemic enabled SMEs and large enterprises to leverage advanced technologies to ensure seamless communication among team members and co-working teams, supporting the growth of a unified communications and collaboration market. The COVID-19 outbreak also encouraged the healthcare providers, educational institutes, and government agencies to adopt vital business communications tools, which caused a paradigm shift in communication processes in the post-pandemic period.

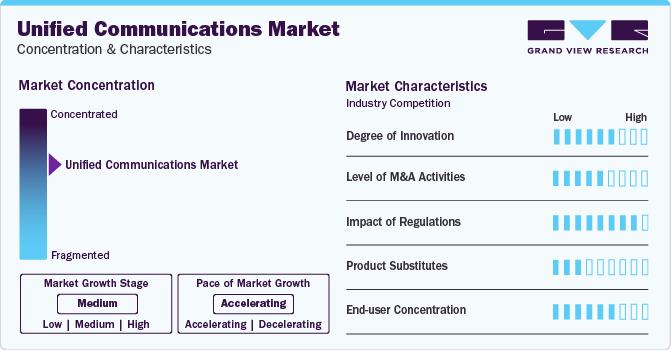

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The Unified communications market is witnessing a high degree of innovation, particularly with the advent of Artificial Intelligence (AI). The technology investments by the market companies are aimed at enhancing their ability to innovate, adapt, and gain maximum return on investment (ROI) in the future. The integration of AI with unified communications is helping companies to automate routine tasks and provide valuable insights.

The Unified Communications (UC) industry is witnessing a high impact of government regulations and policies owing to the sensitive nature of the information transmitted through UC platforms. Top impacting regulations in the unified communication market include data privacy, telecommunications, and E-discovery, among others. Businesses operating in the market need to stay up to date with government regulations and ensure their solutions are strictly in compliance with the law. The UC solutions are also being used in highly regulated sectors such as healthcare and finance, which further adds to the regulatory impact on the market.

The unified communications market is also observing a rising number of mergers and acquisition activities that help companies increase market share, expand the customer base, and strengthen product portfolios. For instance, in October 2023, Mitel Network Corporation acquired Unify, an Atos company that offers communication and collaboration solutions.

End-user concentration is moderate to high in the unified communications market, as several industry verticals are adopting various unified communications to increase productivity, enhance collaboration, and improve customer services. The features offered by advanced unified communications, such as voicemail to email transcription, call routing, and presence indicators, leading to an increase in the number of end-user concentration.

Deployment Mode Insights

The on-premise segment accounted for a market revenue share of around 47.0% in 2022. The growth of this segment is driven by rising demand for greater control and customization of communication infrastructure in large enterprises. The adoption of on-premise unified communications solution helps companies to adapt their communication systems to meet specific needs and integrate them with other on-premise applications. In addition, the organizations with sensitive communication data prefer on-premise solutions rather than relying on cloud-based solutions.

The hosted UC segment is expected to register the highest CAGR of over 20.0% from 2023 to 2030. This growth can be attributed to lower total ownership costs, capital expenditure, and operating expenses associated with hosted UC solution. Businesses are moving toward hosted UC solutions to upscale their storage capacity due to the predictable and simple operating cost model. The hosted solution delivers a single UC platform to provide communication and collaboration solutions across numerous channels. Hybrid unified communications is another solution that integrates on-premises and cloud communication services. The hybrid solution permits sharing of parts of the communication on the premise or cloud platforms which makes it adaptable to multiple systems and business types.

Solution Insights

The instant & unified messaging segment accounted for the highest revenue share owing to a rise in the demand for enterprises to engage in prompt communications among peers and gain real-time notifications of the strategies in critical mission situations. Unified Messaging helps manage regular voice, fax, and text messages, all uniting in a single platform that users can access via PC or telephone. UM is majorly suitable for mobile business users as it enables them to reach co-workers and clients easily.

The collaboration platform and applications segment include speech recognition, desktop sharing, and other communication solutions. The segment is expected to expand at a notable CAGR of from 2023 to 2030, following the trend of remote work during COVID-19. Audio and video conferencing is gaining momentum owing to the rising demand and trend of video conferencing owing to its simple and hassle-free experience. Enterprises rely on video and audio conferencing to make meetings more interactive, efficient, and collaborative. For instance, in June 2023, Zoom partnered with Sony Group Corporation to integrate its video communications and collaboration platform into BRAVIA TVs. This collaboration will enable the users of Zoom Meetings to connect with colleagues for video meetings in hybrid or remote working situations.

Organization Size Insights

Large enterprises accounted for the highest market share in 2022. Large enterprises focus on corporate network performance, keeping tight integration with emerging technologies such as SD-WAN. Moreover, catering to the need of multi-regional and multinational enterprises, the service providers focus on improving the unified services as a service solution with enhanced offerings such as business process integration and centralized provisioning and service management. Additionally, large enterprises are present in international locations and are constantly expanding, which adds to the demand for secure and instantaneous unified communication solutions.

The SMEs (small & medium enterprises) segment is anticipated to expand at the highest CAGR of over 20.0% from 2023 to 2030. SMEs use cloud-based unified communications services to reduce the capital and operational expenses required to deploy a unified communications solution on-premise. Furthermore, multiple vendors have redirected their focus to SMEs and are offering cost-effective solutions to them. The latest subscription-based cloud UC services are favorably suitable for SMEs, giving them a key to the modern technologies with a lesser charge of ownership. As a result, cloud-based services such as hosted CRM solutions, Skype for Business, and Office 365 are widely used in SMEs.

Industry Vertical Insights

IT & Telecom accounted for the largest market share in 2022. The growth can be attributed to the rising adoption of unified communication solutions in IT companies to enhance the overall organizational performance of an enterprise. Unified communication provides various services critical to increasing remote workers' productivity using available mobile devices. Additionally, factors such as a higher number of cross-functional teams, remote workers, and improved business operations have enabled corporations in the IT & telecom industry to deploy unified communication solutions at the business level and ensure seamless communication techniques.

The government & defense sector is expected to register the highest CAGR during the forecast period. The growth can be attributed to the increasing deployment of this technology among governments worldwide to meet budgetary pressures and the growing demands from citizens for enhanced communication. A collaborative approach is presumed to increase interaction and engagement between various government divisions and their stakeholders.

Regional Insights

North America unified communications market is expected to grow at a CAGR of 12% from 2023 to 2030 owing to accelerated adoption of remote work and virtual collaborations across various industries in the region. The rising demand for integrated solutions that enhance collaboration, streamline communication channels, and improve the efficiency of communication is boosting the growth of the unified communications market in North America.

U.S. Unified Communications Market Trends

The U.S. unified communications market is expected to grow at a CAGR of 11% from 2023 to 2030. UC solutions enable the digitalization of businesses to evolve their communication infrastructure and foster seamless collaboration among teams from diverse regions or countries worldwide. The capability to integrate with cloud-based services and platforms to offer scalable and flexible solutions is accelerating the adoption of UC solutions, thereby boosting the growth of the unified communications market in the U.S.

Europe Unified Communications Trends

Europe unified communications market is expected to witness a CAGR of over 18% from 2023 to 2030. This can be attributed to the increased use of BYOD services coupled with the need to achieve operation and performance efficiency in enterprises. The increasing demand for unified communications in Europe has enabled numerous vendors to improve their business processes. For instance, in July 2023, Alcatel-Lucent Enterprise launched Alcatel-Lucent Enterprise Rainbow Hub in the UK, combining its Unified Communications (UC) and Private Branch eXchange (PBX) solutions in a fully cloud-based service.

The unified communications market in Europe is further driven by the need for cost-effective communication solutions and the proliferation of 5G and artificial intelligence in the region.

U.K. unified communications market accounted for nearly 14.0% revenue share of the European market in 2022. The growing number of investments in digital transformation initiatives by the U.K. government is supporting the growth of the unified communications market in U.K.

Unified communications market in Germany is expected to witness a CAGR of around 16% from 2023 to 2030. High growth of remote work culture in the country and increased focus on 5G technology development in the country is fueling the growth of the UC market in Germany.

France unified communications market is expected to witness high growth from 2023 to 2030. The high-speed 5G networks and the ongoing trend of BYOD, along with the rise in demand for solutions with CRM (customer relationship management) integration and omnichannel communication capability, are fueling the growth of the unified communications market in France.

Asia Pacific Unified Communications Trends

Asia Pacific unified communications market is expected to exhibit the highest CAGR of around 20.0% from 2023 to 2030. The growing trend toward mobilization of enterprises is fueling regional market growth. Growing investment and the presence of a large customer base are expected to boost high-speed data networks in economies such as India. Also, an upsurge in the need for remote work solutions and a rise in the implementation of mobile devices has boosted the growth of the unified communications market across India and the rest of Asia Pacific.

China unified communications market is expected to witness a CAGR of over 18% from 2023 to 2030. Sectors such as Banking & Financial Services (BFS), Business Process Outsourcing (BPO), government, telecom, logistics, and Travel & Hospitality have turned to unified communications to enable efficient services in China.

The Japan unified communications market is expected to witness a high CAGR from 2023 to 2030. The increasing adoption of remote work and significant growth in a number of digital transformation initiatives in Japan drive the growth of the unified communications market in Japan.

Unified communications market in India is expected to grow at an exponential growth rate from 2023 to 2030 due to lucrative growth opportunities such as integration of Artificial Intelligence (AI), Machine Learning (ML), Advanced Analytics, and Internet of Things (IoT). The demand for UC solutions to enable streamlined communications across diverse teams and support client interactions is boosting the growth of the India UC market.

Middle East and Africa (MEA) Unified Communications Trends

Middle East and Africa (MEA) unified communications market is anticipated to reach USD 13.3 Billion by 2030. Digital transformation trends in different industries, along with the rise in the number of SMEs in the region, are boosting the growth of the unified communications market in MEA.

Saudi Arabia unified communications market is driven by increasing government investment in Saudi Arabia’s Information and Communications Technology (ICT) development. In addition, the proliferation of 5G networks is expected to create lucrative growth opportunities for the Saudi Arabia UC market in the upcoming years.

Key Unified Communications Company Insights

Companies such as Cisco System Inc., Avaya Inc., and Microsoft Corporation have vast flagship offerings in the market, providing enhanced application experience across diverse sectors. Moreover, the market has noticed several mergers & acquisitions and product launch activities in the last few years. For instance, in July 2023, Telefónica expanded its strategic partnership with Microsoft Corporation to strengthen the portfolio of UC solutions, focused on large organizations and SMEs.

In October 2022, Cisco Systems, Inc., and Microsoft Corp. announced a new partnership to provide customers with more choices and flexibility in UC solutions. Microsoft and Cisco are also focusing on offering the capability to run Microsoft Teams on Cisco Desk and Room Devices Certified for Microsoft Teams.

The partnership is focused on improving Microsoft Teams' compatibility with other solutions. The collaboration is expected to enhance interoperability and enable Cisco to build compatible and certified devices for the Microsoft teams. The partnership has helped companies offer ease in integration and provide an array of services in one software.

Key Unified Communications Companies:

- Alcatel-Lucent Enterprise

- Avaya Inc.

- Cisco Systems Inc.

- Microsoft Corporation

- Mitel Network Corporation

- NEC Corporation

- Poly Inc.

- Unify

- Verizon Communications Inc.

- Tata Communications

- IBM Corporation

Recent Developments

-

In August 2023, Avaya Inc., a customer experience solution provider, signed a cooperative purchasing contract with Sourcewell, a Government Cooperative Purchasing Organization in North America. This contract enabled U.S. and Canadian customers to procure Avaya solutions and services directly or via an authorized partner on a cooperative contract.

-

In August 2023, Mitel Network Corporation launched a new version of MiCollab, a collaboration tool providing a unified platform for messaging, voice, and meeting capabilities for its users. According to the company, the new version will provide the end users with the ability to select multiple meeting providers, enhancing the customization and ease of use.

-

In May 2023, NEC Corporation introduced UNIVERGE BLUE ARCHIVE, an innovative data retention solution for UNIVERGE BLUE CONNECT, a unified communications application. The new offering from NEC is designed to protect and support search and retrieval across different critical business communications channels, such as chat, phone call recordings, short message service (SMS), and voicemail.

-

In January 2023, Verizon Communications Inc. partnered with Microsoft Corporation to deliver Teams Phone Mobile, the solution to provide Public Switched Telephone Network (PSTN) connectivity with Microsoft Teams and Phone System. The company launched Verizon Mobile for Microsoft Teams, a service that combines mobile devices with Microsoft Teams for simpler collaboration and calling.

Unified Communications Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 136.11 billion

Revenue forecast in 2030

USD 417.86 billion

Growth rate

CAGR of 17.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, solution, organization size, industry vertical, regional

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, South Korea, Australia, New Zealand, Brazil, Saudi Arabia, South Africa

Key companies profiled

Alcatel-Lucent Enterprise; Avaya Inc.; Cisco Systems Inc.; Microsoft Corporation; Mitel Network Corporation; NEC Corporation; Poly (Platonics Inc.); Unify; Verizon Communications Inc.; Tata Communications; IBM Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Unified Communications Market Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global unified communications market report based on component, deployment mode, solution, organization size, industry vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instant & Unified Messaging

-

Audio & Video Conferencing

-

IP Telephony

-

Collaboration Platform and Applications

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Manufacturing

-

IT & Telecom

-

Retail & Ecommerce

-

Government & Defense

-

Healthcare & Life Sciences

-

Education

-

Travel & Hospitality

-

Transport & Logistics

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

New Zealand

-

-

South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

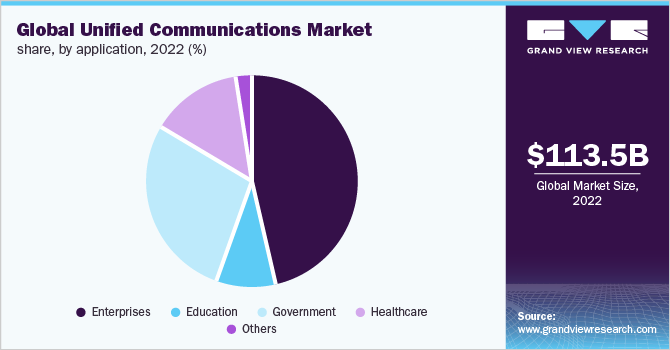

b. The global unified communications market size was estimated at USD 113.48 billion in 2022 and is estimated to reach USD 136.11 billion in 2023.

b. The global unified communications market is expected to grow at a compound annual growth rate of 17.4% from 2023 to 2030 to reach USD 417.86 billion by 2030.

b. In terms of application, the enterprise segment dominated the global unified communications market with a share of more than 46% in 2022. This is attributable to the rising adoption of unified communications across enterprises to offer web conferencing, communication tools, and collaboration portals.

b. Some of the key players in the global unified communications market are Alcatel-Lucent; Avaya Inc.; Cisco Systems, Inc.; Microsoft Corporation; IBM Corporation; NEC Corporation; and ShoreTel Inc.

b. Key factors that are driving the market growth include the increasing adoption of BYOD, the rising penetration of mobile devices, and the growing adoption of unified communications as a service.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.