- Home

- »

- Automotive & Transportation

- »

-

Vehicle Electrification Market Size And Share Report, 2030GVR Report cover

![Vehicle Electrification Market Size, Share & Trends Report]()

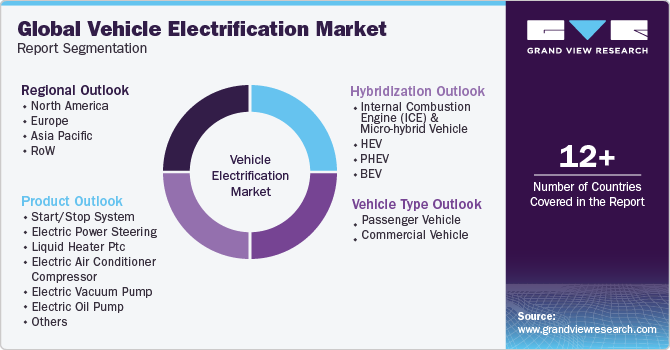

Vehicle Electrification Market Size, Share & Trends Analysis Report By Product (Start/Stop Systems, Electric Power Steering, Liquid Heater Ptc, Electric Oil Pump), By Hybridization, By Vehicle Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-278-5

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Vehicle Electrification Market Size & Trends

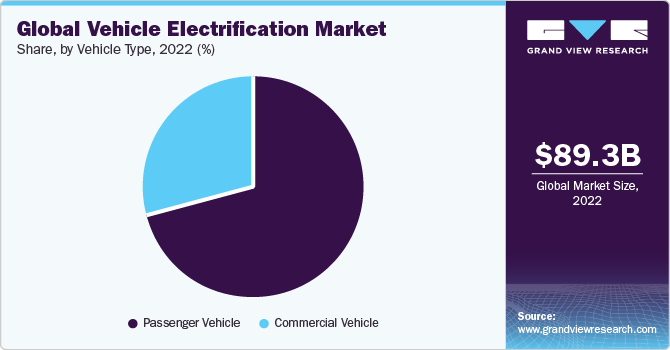

The global vehicle electrification market size was valued at USD 89.26 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.9% from 2023 to 2030. The market is expected to grow significantly due to the automotive industry's demand for alternatives to petroleum-based fuel and government initiatives for environmentally sustainable transportation options globally. The governments of various nations are launching green initiatives; various environmental agencies are setting aggressive targets for emission cuts globally. At the same time, environmentally conscious consumers are increasingly adopting electric vehicles and contributing toward reducing their overall carbon footprint. As a result, the demand for vehicle electrification products is expected to increase during the forecast period. Furthermore, various advantages linked to electrification are improving the vehicle's performance, adding additional features, and providing benefits such as reduced vehicle weight, fewer emissions, higher fuel economy, enhanced driving comfort, and safety. All these factors are expected to propel the growth of the market.

The COVID-19 pandemic significantly impacted the automobile sector. Lockdowns and travel restrictions worldwide resulted in the closure of factories, affecting everything from supply chain and operations to capital investment, financing, and long-term strategy. The epidemic increased the pressure on vehicle electrification technology manufacturers to change their business models as the sector dealt with a financial downturn and an uncertain timescale.

Although the crisis has left a significant financial hole and hampered various new vehicle programs, including EVs, the automobile industry's drive toward electrification remains strong. On the other hand, increased demand for cost-effective solutions and the growing trend of electrification of commercial vehicles and fleets are expected to provide lucrative opportunities for worldwide market advancement during the forecast period.

The greater inclination in recent years toward products has resulted in considerable demand for vehicle electrification and supporting infrastructure. An increase in the number of charging outlets coupled with financial incentives from the government is emerging as a crucial factor triggering the demand for electric vehicles. The lower operating costs of electric vehicles compared to those of conventional ICE-operated cars are expected to drive the growth of the market.

Growing consumer demand for fuel-efficient vehicles has increased demand for vehicle electrification. However, electric vehicles are quite expensive despite the various benefits. This is due to the high cost of batteries used in electric vehicles and the expense of charging the batteries. Product charging stations are still in the early stages of development. As a result, utilizing electric vehicles to go considerable distances is likely to cause issues along the way.

Moreover, electric vehicles are not feasible in cities with power shortages. The battery backup time of electric car batteries is likewise relatively short. These limitations of electric vehicles are projected to hamper the market. On the other hand, vehicle electrification's replacement and maintenance costs are high. However, the rising fuel prices and growing environmental concerns are also expected to drive the growth of the market during the forecast period.

Product Insights

The electric vacuum pump segment accounted for the largest revenue share of 13.3% in 2022 and is expected to grow at the fastest CAGR of 12.4% over the forecast period. Technological developments are being carried out in the automotive industry to save fuel, gaining prominence due to increased engine energy efficiency. The reliable performance of electric vacuum pumps in vehicles helps automakers meet new emission marks by fulfilling the vacuum required for the brake booster. The rise in demand for electric vacuum pumps can be attributed to their ability to deliver customers a smooth and consistent break-pedal feel.

The electric power steering segment is expected to witness significant growth during the forecast period with a CAGR of 7.2%. The end-users prefer the EPS segment to other steering systems. It offers many advantages, such as energy economy, decreased mechanical complications, and the ability to adjust a more straightforward interface. EPS is smaller and lighter than HPS, resulting in an energy-efficient vehicle option. The lack of dependability in hydraulic power steering contributes to the market's growth.

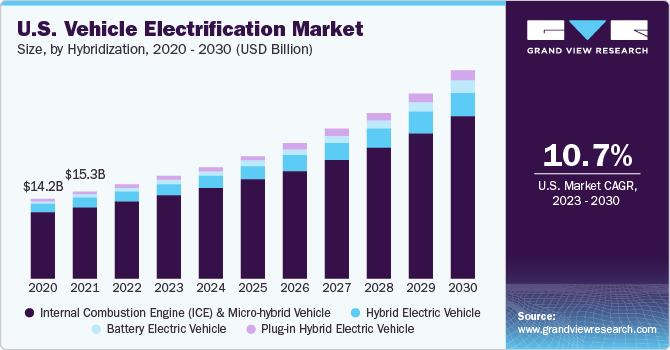

Hybridization Insights

The Internal Combustion Engine (ICE) and micro-hybrid vehicle segment accounted for the largest revenue share of around 58.5% in 2022. Technological advancements in the automotive industry have led to the introduction of battery electric vehicles. Demand for the product is increasing across agriculture, construction, mining, and power generation sectors. The lack of global EV infrastructure availability is also responsible for the uptake of the ICE market. Also, the growing popularity of vehicles using gasoline and the ever-increasing shale gas production is an additional factor driving the market growth.

The Plug-In Hybrid Electric Vehicle (PHEV) segment is estimated to register the fastest CAGR of 14.6% over the forecast period. Collaborations between private and government agencies to develop smart cities nationwide and growing charging infrastructure are expected to increase the demand for plug-in hybrid electric vehicles. Additionally, plug-in hybrid electric vehicles have risen substantially in technologically advanced nations. Integrated electrification systems for all kinds of transport vehicles, such as freight delivery vehicles, public transport, and 2-wheelers, are being encouraged by government agencies across the globe to reduce reliance on fossil fuels. All these factors add to the market’s growth.

Vehicle Type Insights

The passenger vehicle segment held the largest revenue share of 71.1% in 2022 and is expected to grow at the fastest CAGR of 10.2% over the forecast period. Increasing environmental consciousness among consumers, government incentives promoting electric vehicles (EVs), advancements in battery technology leading to longer ranges, and expanding charging infrastructure have all contributed to the rising popularity of electric passenger vehicles. Additionally, automakers' efforts to offer a wide range of EV models with improved performance and attractive features have further fueled the adoption of electric cars among consumers worldwide.

The commercial vehicle segment held a significant market share of 28.9% over the forecast period. The commercial vehicle segment within the vehicle electrification market is also experiencing substantial growth, driven by various factors. Increasing environmental awareness among consumers and regulatory pressure to reduce emissions have prompted a shift toward electric commercial vehicles. Government incentives and policies promoting electric vehicle adoption, including commercial ones, have played a crucial role. Advancements in battery technology have allowed for extended ranges, making electric commercial vehicles more practical for various applications, from delivery vans to buses and trucks. This extended range is particularly advantageous in commercial operations that require vehicles to cover longer distances throughout the day.

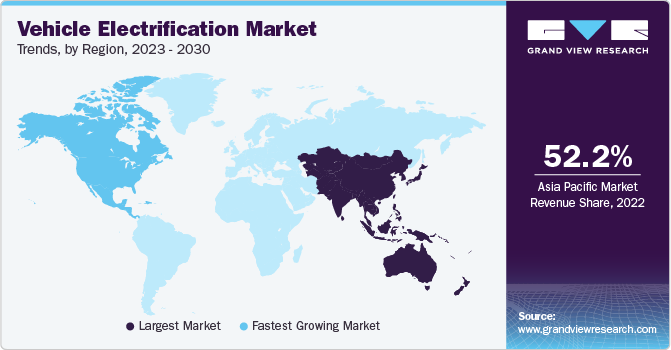

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 52.2% in 2022. The government’s initiatives to promote electric vehicles and give subsidies for purchases drive demand in the market within this region. The rising population in the countries and increasing per capita income stimulate the demand for personal transport automobile that supports a sustainable environment.

Europe is expected to see considerable growth in the vehicle electrification industry due to the government’s focus on implementing sustainable infrastructure growth. Furthermore, future investment because of government support is expected to boost the expansion of the market during the forecast period.

North America is expected to grow at the fastest CAGR of 11.0% during the forecast period. The expansion of charging infrastructure and major expenditures by OEMs in the development of vehicle electrification are the factors driving this region's growth. The evolution of the car electrification sector, notably in the U.S., is accelerated by federal tax credits and rebate incentives.

For instance, in 2021, General Motors, a prominent American automaker, revealed plans to introduce electric automobiles designed for personal usage in the following years. By 2025, they plan to release 30 electric vehicles worldwide, with around two-thirds accessible in North America. The lucrative nature of the market is projected to inspire more traditional vehicle manufacturers to enter the product market, thus boosting the market's growth for vehicle electrification.

Key Companies & Market Share Insights

Market players are focusing on inorganic growth strategies, such as acquisitions & mergers, and collaborations to augment their market share. For instance, in 2020, CATL, a Chinese EV battery manufacturer, is extending its relationships with Coach B.V. & VDL Bus in the Netherlands and Quantron AG in Germany to advance commercial vehicle electrification in Europe by improving local services and product solutions. Such partnerships, mergers, and acquisitions have created an environment for all contemporaries to employ ideas and innovation for enhanced manufacturing and technologies.

Many companies have introduced innovative technology that has enhanced the user experience. For instance, Continental Technology supplied the necessary components for a pleasant and straightforward user experience in the new BMW iX. Regarding vehicle digitalization, the continental's cockpit high-performance computer is integrated into the electric car.

It keeps track of the increasing software complexity and the cockpit's continuously expanding functional scope. Furthermore, it also includes ultra-wideband transceivers in the electrified variant for smartphone connectivity. Hence, these technological changes are further impacting the market.

Key Vehicle Electrification Companies:

- Robert Bosch GmbH

- Continental AG

- DENSO CORPORATION

- Aptiv

- Johnson Electric Holdings Limited

- Mitsubishi Electric Corporation

- BorgWarner Inc.

- Magna International Inc.

- AISIN CORPORATION

- Johnson Controls

- ZF Friedrichshafen AG

- Valeo SA

- JTEKT Corporation

- Hitachi Astemo, Ltd.

- Wabco Holdings Inc.

Recent Developments

-

In April 2022, BMW made a significant announcement, solidifying its dedication to the electric vehicle (EV) revolution. The renowned automaker announced its goal of achieving 50% of its total sales of electric vehicles by 2030. This commitment marks a decisive step towards reducing its reliance on internal combustion engines and embracing sustainable mobility solutions. The company also introduced two electric models, the BMW i4 and iX. These cutting-edge vehicles promise not only enhanced performance but also an extended driving range, showcasing the company's commitment to providing compelling and eco-friendly options for its customers.

-

In April 2022, BYD Motors, a prominent electric vehicle (EV) manufacturer introduced the ECC32 advanced battery electric forklift. This remarkable forklift, weighing 7,000 pounds, stands out for its cutting-edge design that eliminates charge restrictions.

-

In September 2021, ABB, an automation company based in Switzerland, unveiled Terra 360. This cutting-edge electric car charger offers an unparalleled charging experience for EV owners. It is a highly customizable all-in-one charger that boasts simultaneous charging capabilities for up to four vehicles. With its dynamic power distribution technology, it can deliver an impressive 100 kilometers of range in less than three minutes.

-

In July 2021, Suzuki Motor Corporation and Daihatsu Motor Co., Ltd (DMC) joined forces for commercial vehicle. The primary objective of this joint effort was to advance their carbon neutrality initiatives in the mini-vehicle sector by promoting the adoption of CASE technologies and services. Through this partnership, both companies aim to expedite the electrification of mini-vehicles and drive positive changes in the automotive industry.

-

In June 2021, XL Fleet Corp., a prominent provider of fleet electrification solutions catering to municipal and commercial fleets, revealed a significant collaboration with Rubicon, a software platform renowned for its smart waste and recycling solutions. Under this arrangement, XL Fleet’s industry-leading fleet electrification solutions will be made available to Rubicon’s waste and recycling hauling partners, providing a strong foundation for sustainable operations and innovative solutions in the waste management space.

-

In June 2021, Ford made an announcement regarding its acquisition of Electriphi, a California-based company known for its charging management and fleet monitoring software tailored for electric automobiles. As part of this acquisition, Electriphi's talented team and services will be seamlessly integrated into "Ford Pro".

-

In February 2021, Ford Motors Company announced plans to completely phase out fossil fuel-powered vehicle manufacturing in its European division. As part of this initiative, Ford aims to offer only plug-in hybrid and electric models by 2026.

Vehicle Electrification Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 96.47 billion

Revenue forecast in 2030

USD 187.13 billion

Growth rate

CAGR of 9.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, hybridization, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; RoW

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Latin America; MEA

Key companies profiled

Robert Bosch GmbH; Continental AG; DENSO CORPORATION.; Aptiv.; Johnson Electric Holdings Limited.; Mitsubishi Electric Corporation; BorgWarner Inc.; Magna International Inc.; AISIN CORPORATION; Johnson Controls.; ZF Friedrichshafen AG; Valeo SA; JTEKT Corporation.; Hitachi Astemo, Ltd.; Wabco Holdings Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vehicle Electrification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vehicle electrification market based on product, hybridization, vehicle type, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Start/Stop System

-

Electric Power Steering

-

Liquid Heater Ptc

-

Electric Air Conditioner Compressor

-

Electric Vacuum Pump

-

Electric Oil Pump

-

Electric Water Pump

-

Starter Motor & Alternator

-

Integrated Starter Generator

-

Actuators

-

-

Hybridization Outlook (Revenue, USD Billion, 2018 - 2030)

-

Internal Combustion Engine (ICE) & Micro-hybrid Vehicle

-

HEV

-

PHEV

-

BEV

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger vehicle

-

Commercial vehicle

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

RoW

-

Latin America

-

Middle East and Africa

-

-

Frequently Asked Questions About This Report

b. The global vehicle electrification market size was estimated at USD 89.26 billion in 2022 and is expected to reach USD 96.47 billion in 2023.

b. Some key players operating in the vehicle electrification market include Robert Bosch GmbH, Continental AG, Denso Corporation, Delphi Automotive PLC, Johnson Electric, and Mitsubishi Electric Corporation.

b. The global vehicle electrification market is expected to grow at a compound annual growth rate of 9.9% from 2023 to 2030 to reach USD 187.13 billion by 2030.

b. Asia Pacific dominated the vehicle electrification market with a share of 52.2% in 2022. This is attributable to the government’s initiatives to promote electric vehicles and give subsidies for purchases.

b. Key factors that are driving the market growth include reduced tailpipe emission standards, rising social Influence & growing concern, and strengthening CO2 regulations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."