- Home

- »

- Automotive & Transportation

- »

-

Commercial Vehicles Market Size & Share Report, 2030GVR Report cover

![Commercial Vehicles Market Size, Share & Trends Report]()

Commercial Vehicles Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (LCVs, Heavy Trucks, Buses & Coaches), By End-use (Industrial, Mining & Construction), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-538-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Vehicles Market Summary

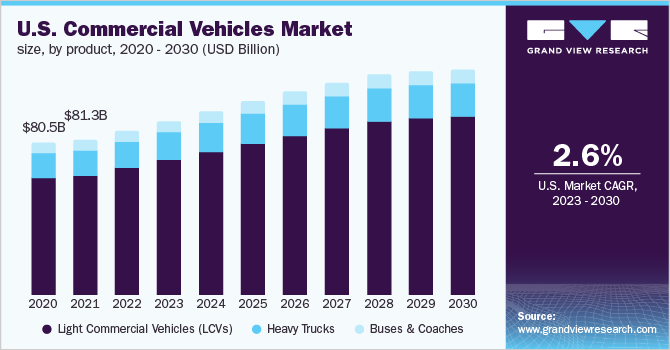

The global commercial vehicles market size was estimated at USD 1.35 trillion in 2022 and is projected to reach USD 1.85 Trillion by 2030, growing at a CAGR of 3.7% from 2023 to 2030. Implementation of vehicle scrappage programs, aggressive investments in infrastructure development and rural development, and drafting of stringent regulatory norms for vehicle length and loading limits, among other parameters, are anticipated to fuel the growth.

Key Market Trends & Insights

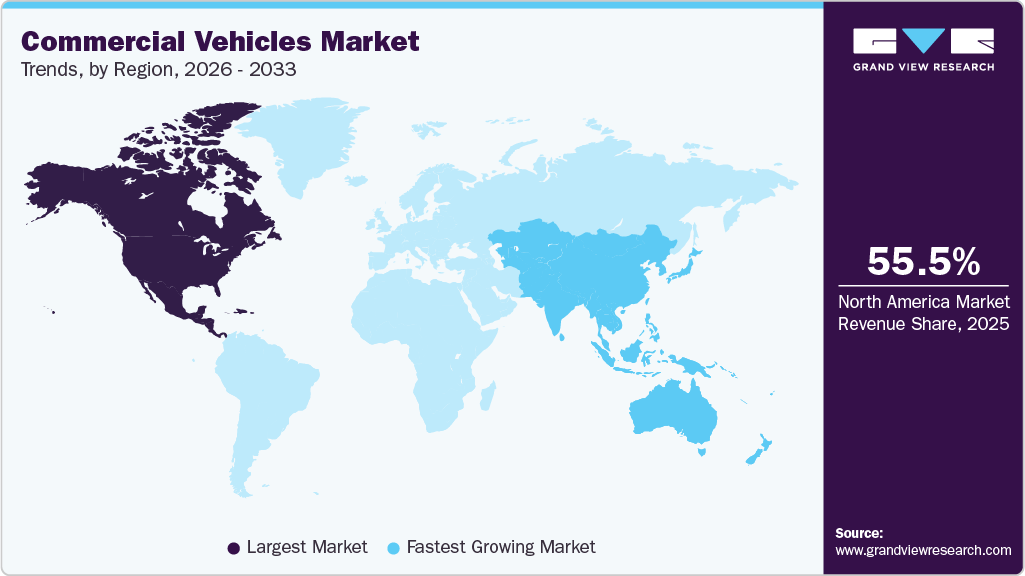

- North America accounted for the highest market share of 59.61% in 2022.

- The Asia Pacific regional market is expected to experience significant growth during the forecast period.

- By product, the light commercial vehicles (LCVs) segment accounted for the largest revenue share of over 77% of the overall commercial vehicles market in 2022.

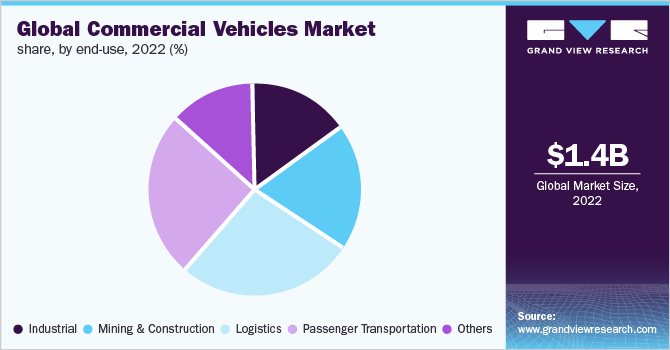

- By end-use, the logistics segment accounted for the largest share of over 26% of the overall market in 2022.

- By end-use, the passenger transportation segment is estimated to register a CAGR exceeding 4.3% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 1.35 Trillion

- 2030 Projected Market Size: USD 1.85 Trillion

- CAGR (2023-2030): 3.7%

- North America: Largest market in 2022

The resumption of mining activities in some parts of the world, which has triggered the demand for tippers, is also expected to drive growth.

The rising levels of disposable income in both developing and developed countries and the continued infrastructure development are also projected to bode well for the growth of the market. The rise in awareness for environmentally sustainable transportation solutions has motivated commercial vehicle manufacturers to develop vehicles that reduce carbon emissions. Manufacturers are working on innovating vehicle design, reducing load factors & size, and customizing vehicles according to weight regulations.

Infrastructure conditions, driver technique, weather management, and national policy are additional influential factors considered by automakers for developing vehicles. Research & development for manufacturing such vehicles requires a significant investment. Thus, there is a requirement for policy action and investment initiatives to be taken by the government, private and public sectors. Such initiatives will support manufacturers in reducing operational & production costs.

Furthermore, the demand for small, medium-, and heavy commercial vehicles has increased for logistics and transportation purposes in association with e-commerce. The logistics market has shifted from just being a service provider to offering customer-centric solutions. Thus, the requirement for commercial vehicles has increased for transportation purposes. Supportive regulatory frameworks and additional incentives from governments have raised the demand for commercial electric vehicles. There has been an increase in electric buses and heavy-duty truck registrations in North America, Europe, and the Asia Pacific regions.

With the emerging economies in the Asia Pacific region, China dominates the overall electric bus and electric truck market. According to IEA, with more than 78k buses and 31k trucks registered, local policies of the Chinese government are a significant contributor to high sales of Electric Commercial Vehicles (ECVs). Thus, with the rapid increase in the adoption of electric vehicles, electric commercial vehicles are also expected to witness considerable traction over the forecast period.

While various factors contribute to the growth of the commercial vehicle market, COVID-19 has posed a severe challenge. Global lockdowns stalled all manufacturing and transportation activities. Disruption of the supply chain and economic slowdowns impacted several sectors such as automobile, transportation, and logistics. As the transportation and logistics sectors hold around 50% share in the market for commercial vehicles, less demand from this sector resulted in declining sales of commercial vehicles.

Product Insights

The light commercial vehicles (LCVs) segment accounted for the largest revenue share of over 77% of the overall commercial vehicles market in 2022. The LCVs are considered a cost-effective option for the transportation of goods and passengers. LCVs offer numerous tax benefits and aid in reducing emissions. Moreover, these vehicles are highly dynamic and can be modified for transporting both goods and passengers. They are also cost-effective, which is expected to bode well for the growth of the segment.

The buses & coaches segment is expected to witness a CAGR of 3.1% from 2023 to 2030. The growth of the segment can be attributed to the increased adoption of buses and coaches in the healthcare and tourism industries. Buses and coaches are the most cost-effective mode of transportation, thereby driving their demand and sales. The growing adoption of electric buses in both developed and developing countries to curb vehicular emissions also bodes well for the growth of the buses and coaches segment.

End-use Insights

The logistics segment accounted for the largest share of over 26% of the overall market in 2022. Continued advancements in global trade and the strengthening of the logistics infrastructure are some of the prime factors that are expected to drive the growth of the logistics segment over the forecast period. The unabated growth of the e-commerce industry also bodes well for the development of the logistics segment.

The passenger transportation segment is estimated to register a CAGR exceeding 4.3% from 2023 to 2030. The increase in the adoption of public transportation is anticipated to drive the demand for commercial vehicles. Public transportation is often well-developed in urban areas and individuals find it effective as compared to commuting by car, in terms of time and cost. The accessibility and affordability of passenger transport, coupled with the rising total cost of ownership of personal vehicles in developed and developing economies, are essential contributors to the passenger transportation market.

Regional Insights

North America accounted for the highest market share of 59.61% in 2022. The highly unified supply chain network in North America connects manufacturers and consumers efficiently through multiple transportation modes, including freight rail, air, and express delivery services; maritime transport; & truck transport, thus driving the market growth. Availability of convenient financing options, a strong emphasis by regional governments to ensure in-house automotive production, and aggressive investments in infrastructure development are some of the factors that are expected to contribute to the growth of the regional market.

The Asia Pacific regional market is expected to experience significant growth during the forecast period, in line with the growing demand for transportation, warehousing, and unified logistics solutions. The strengthening road infrastructure, easy availability of cost-effective labor and raw materials, and subsequently the rising number of manufacturing facilities, especially in developing economies such as China and India, are some of the factors that are expected to contribute to the regional market growth.

Key Companies & Market Share Insights

The key players that dominated the global market in 2022 include Tata Motors, Volkswagen AG, Ashok Leyland, AB Volvo, and General Motors. Most of these vendors are putting a strong emphasis on providing advanced products based on the latest technologies, as part of the efforts to enhance their respective product offerings in the market. The companies are also pursuing strategic initiatives, such as regional expansions as well as strategic acquisitions, mergers, partnerships, and collaborations, to cement their position in the market.

Organic growth remains a key strategy for most of the market incumbents. As such, market players are focusing on expanding their product offerings by developing and launching new and innovative products. For instance, in August 2022, Mahindra and Mahindra launched the New Jeeto Plus CNG, CharSau, which leads the segment in terms of range, mileage, maneuverability, and payload, leading to higher profits for inter- and intra-city applications. This last-mile transportation solution offers a range of stand-out features suitable for India's small and medium-scale business and trading needs. Some prominent players in the global commercial vehicles market include:

-

Ashok Leyland

-

Bosch Rexroth AG

-

Daimler

-

Volkswagen AG

-

Toyota Motor Corporation

-

Mahindra and Mahindra

-

TATA Motors

-

AB Volvo

-

Golden Dragon

-

General Motors

Commercial Vehicles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.43 trillion

Revenue forecast in 2030

USD 1.85 trillion

Growth rate

CAGR of 3.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Volume in Thousand Units, Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico

Key Companies Profiled

Ashok Leyland; Bosch Rexroth AG; Daimler; Volkswagen AG; Toyota Motor Corporation; Mahindra and Mahindra; TATA Motors; AB Volvo; Golden Dragon; General Motors

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

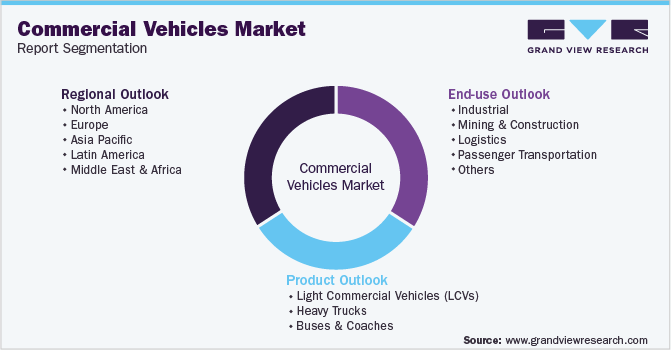

Global Commercial Vehicles Market Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global commercial vehicles market report based on product, end-use, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Light Commercial Vehicles (LCVs)

-

Heavy Trucks

-

Buses & Coaches

-

-

End-Use Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Industrial

-

Mining & Construction

-

Logistics

-

Passenger Transportation

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global commercial vehicles market size was estimated at USD 1,351.69 billion in 2022 and is expected to reach USD 1,431.92 billion in 2023.

b. The global commercial vehicles market is expected to grow at a compound annual growth rate of 3.7% from 2023 to 2030 to reach USD 1,850.31 billion by 2030.

b. The Light Commercial Vehicles (LCVs) segment accounted for the largest revenue share of around 75% in 2022 in the commercial vehicles market.

b. Some key players operating in the commercial vehicles market include Tata Motors, Volkswagen AG, Ashok Leyland, Volvo Car Corporation, and General Motors.

b. Key factors that are driving the commercial vehicles market growth include the rising integration of telematics services, demand for specific transport solutions by end-users, and the rising popularity of fleet sharing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.