- Home

- »

- Animal Health

- »

-

Veterinary Imaging Market Size, Share, Industry Report 2033GVR Report cover

![Veterinary Imaging Market Size, Share & Trends Report]()

Veterinary Imaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Equipment, Accessories/Consumables, Software), By Type, By Animal Type, By Application, By Modality (Fixed, Portable), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-020-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Imaging Market Summary

The global veterinary imaging market size was estimated at USD 2.23 billion in 2025 and is projected to reach USD 4.02 billion by 2033, growing at a CAGR of 7.84% from 2026 to 2033. The market is primarily being driven by increasing prevalence of zoonotic diseases, rising number of pet owners, growing adoption of pet insurance, and rapid technological advancements in veterinary imaging.

Key Market Trends & Insights

- North America veterinary imaging market held the largest share of 38.81% of the global market in 2025.

- The veterinary imaging industry in the U.S. is expected to grow significantly over the forecast period.

- By animal type, the small animals segment held the highest market share of 51.53% in 2025.

- Based on product, the equipment segment held the highest market share in 2025.

- By type, the x-ray segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.23 Billion

- 2033 Projected Market Size: USD 4.02 Billion

- CAGR (2026-2033): 7.84%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

One such rapidly advancing technology is Artificial Intelligence (AI), especially incorporated into veterinary radiology and its respective software. It enables automated evaluation of various veterinary radiological parameters and directly uploads x-rays to servers securely. Implementing such AI-based strategies is a progressive step in veterinary practices. For instance, Rosetta Inc., a member of the Metalial Group, in December 2025 launched an AI agent MetaReal Vet Equip in 2025. This AI agent analyses veterinary clinic needs for new equipment. It scans social media posts, case data, pet insurance, and word-of-mouth in real time. The tool predicts demands for imaging, anesthesia, and testing gear. It generates proposals with subsidies and lease plans for sales teams. Additionally, in April 2024, MiReye Imaging launched its unique product line of veterinary X-ray machines that use AI for the diagnosis of diseases in animals.

Furthermore, the rising incidence of zoonotic diseases has increased the demand for effective diagnostic solutions, which is expected to drive market growth. According to 2024 data by WHO, out of the total infectious diseases that occur in the world, 60% are reported to be of zoonotic origin. Moreover, in a 2024 publication, WHO states that in the last 30 years, out of the 30 new pathogens detected among humans, 75% were of animal origin. This compels veterinary professionals to perform in-depth diagnostic evaluations of animals to curb the spread of these zoonotic diseases from animals to humans. For instance, the UTCVM Veterinary Medical Center a division of the University of Tennessee Institute of Agriculture, U.S. handles an estimated 11,000 imaging studies annually, with the majority of patients being cats, dogs, horses, and farm animals.

Furthermore, ongoing innovative studies in veterinary imaging industry also supports the market growth. For instance, there has been a surge in innovative research studies focusing on AI and machine learning technologies in veterinary imaging analysis. For instance, in November 2023, UF College of Veterinary Medicine initiated the process of using AI tools for managing clinical caseload by creating an imaging platform to collect, collate, & analyze veterinary patient data. The initiative received over USD 2.3 million in funding from the US Strategic Funding Initiative. The first phase of this project will focus on data collection to form a data warehouse, which includes a large diagnostic imaging database. This database will further aid clinical research into veterinary diseases such as cancer.

In addition, increasing uptake of pet insurance can further boost the market growth. For example, diagnostic imaging procedures can prove to be costly for pet owners. For example, an X-ray can cost the pet owner from USD 75 to USD 500 for dogs and USD 100 to USD 500 for cats. A comprehensive pet insurance plan can cover every diagnostic imaging test, such as CT, MRI, ultrasound, and radiography. Due to the recently evolving AI technology in veterinary diagnostics, insurance companies are expanding their coverage. For instance, the Embrace pet insurance plan, a part of the NSM Insurance Group, covers AI-based diagnostic imaging procedures for animals in the U.S. Increasing pet insurance adoption, coupled with expanding coverage for AI-based diagnostic imaging procedures, is expected to drive market growth. Accessibility of imaging procedures is expected to improve because they are covered by insurance.

Key features of AI Agent - MetaReal

Feature

Details

Real-time analysis

Identifies equipment needs instantly from clinic social media posts and case data.

High-precision prediction

Scores introduction chances by matching case trends with equipment types.

Automated proposal materials

Produces full packages with specs, case matches, recovery periods, and maintenance schedules.

Subsidy and lease support

Builds sales-ready docs that cover funding, subsidies, and lease options for reps.

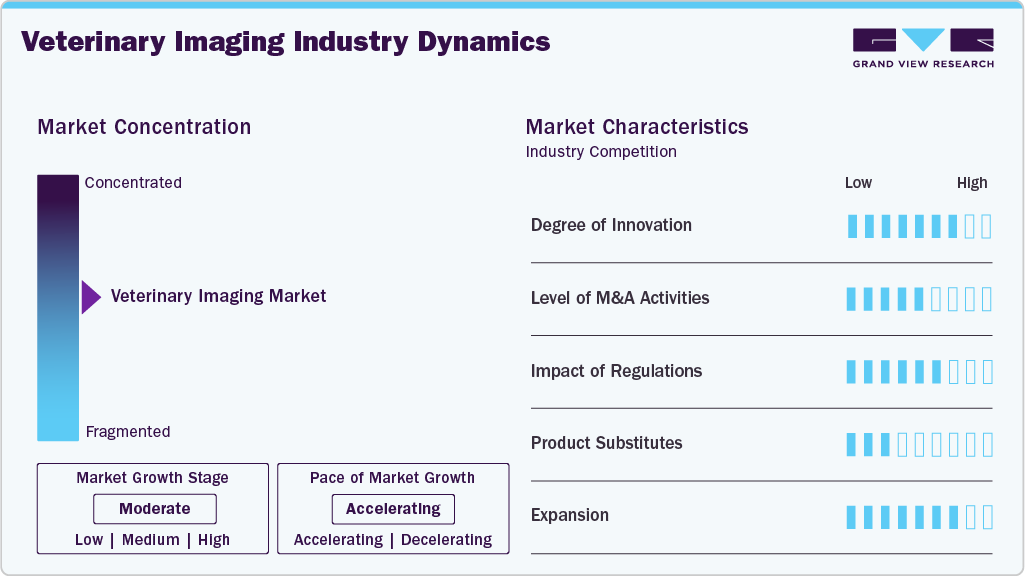

Market Concentration & Characteristics

The market shows moderate concentration and is moving through a steady expansion phase. Growth is being supported by active participation from established imaging providers. Effective imaging use depends on strong anatomical understanding and correct equipment handling. To address this need, manufacturers and service providers are expanding structured training and education programs. These initiatives are raising clinical confidence and supporting wider use of advanced imaging systems across veterinary practices.

The degree of innovation in veterinary imaging remains high, supported by steady technology upgrades and stronger clinical expectations. Manufacturers are introducing systems that improve image clarity, speed of diagnosis, and ease of use in daily practice. Product design is focusing on workflow efficiency, safety, and broader clinical applicability. This pace of innovation is strengthening imaging value across routine and advanced veterinary care. For instance, in November 2025, Imotek launched Esaote's new veterinary ultrasound and MRI systems at London Vet Show 2025. Products include MyLab Falcon portable ultrasound, AI-enhanced MyLab Wolf, and accessible O-Scan Vet MRI.

The veterinary imaging market has witnessed a moderate to high level of impact from mergers and acquisitions, as key players strategically consolidate to expand their product portfolios, enhance technological capabilities, and strengthen global distribution networks. For instance, in October 2025, OR Technology Group acquired VetEquip Ltd., an Irish veterinary equipment provider. The deal boosts OR's European reach and multimodality imaging services in Ireland.

The impact of regulations on veterinary imaging is moderate to high, as frameworks shape safety, quality, and ethical use of technologies. Authorities require compliance with standards for device performance, radiation safety, and clinical use to protect patients and users. Ethical guidelines for AI and software tools are also emerging to prevent bias and promote responsible deployment in diagnosis. These requirements can extend development timelines and add cost. They also build trust and support wider clinical adoption of reliable imaging solutions.

Product substitutes in veterinary imaging include physical examination, laboratory tests, and exploratory procedures. These options are used on a case-to-case basis and support initial assessment rather than definitive diagnosis. Each method serves a specific clinical role and cannot fully replace imaging for internal evaluation. This limits the overall impact of substitutes on imaging demand. Advanced cases are still driving consistent reliance on imaging tools.

The veterinary imaging sector is expanding through new imaging centers, service network growth, and training partnerships. Providers are adding advanced modalities such as MRI, CT, and high-end ultrasound to widen clinical coverage. Companies are pairing equipment expansion with education programs to raise diagnostic skill levels. These moves are improving access, supporting referral volumes, and strengthening long-term imaging adoption across practice types.

Product Insights

Based on product, the equipment segment accounted for the largest revenue share of 55.5% in 2025. Imaging equipment such as MRI, CT, ultrasound, and X-rays have become widely accessible to veterinarians, driven by their broad applicability and market penetration. Among these, radiography is expected to remain a cornerstone in veterinary diagnostics due to its affordability, ease of access, and widespread availability. Meanwhile, the use of MRI and CT scans for comprehensive, whole-body imaging has grown significantly in recent years. These advanced modalities are particularly valuable for imaging a variety of animal species, including reptiles, whose small body size often poses challenges for conventional X-ray diagnostics.

The software segment is projected to grow at the fastest rate over the forecast period, by enhancing diagnostic accuracy, workflow efficiency, and data management. Advanced imaging software enables real-time image processing, 3D reconstruction, and AI-assisted diagnostics, which help veterinarians make faster and more precise clinical decisions. For example, cloud-based PACS (Picture Archiving and Communication System) software allows veterinary clinics to store, access, and share imaging data across multiple locations, streamlining collaboration between specialists and general practitioners. Additionally, AI-enabled tools like SignalPET and Vetology use machine learning algorithms to automatically analyze X-rays and flag potential abnormalities, reducing diagnostic time and minimizing human error. This integration of intelligent software not only improves patient outcomes but also boosts the operational efficiency of veterinary practices, thereby driving market growth.

By Animal Type Insights

Based on animal type, small animals held the largest share of 51.53% in 2025. Among small animals, dogs are the primary species for which veterinary diagnostic imaging technology is utilized. The uptake of these technologies is being driven by an increase in the number of pet (especially dog) owners, growth in the overall pet population, higher healthcare costs, and improvements in pet insurance coverage. Besides, the segment is expected to witness the fastest growth over the forecast period due to a rise in painful and inflammatory disorders in animals and an increase in product launches specifically for small animals.

Large animal segment is expected to grow at the fastest CAGR over the forecast period, due to the increasing demand for advanced diagnostic tools in livestock and equine healthcare. In particular, the equine segment contributes notably, as horses are prone to musculoskeletal issues that require sophisticated imaging techniques such as digital radiography, ultrasound, and MRI for accurate diagnosis and treatment planning. Additionally, large animals such as cattle and horses require imaging for reproductive assessments, lameness evaluations, and internal health monitoring, prompting veterinary facilities to invest in portable and high-resolution imaging equipment. This growing focus on large animal health, especially in breeding and performance management, continues to propel market expansion.

By Type Insights

Based on type, the X-ray segment accounted for the highest revenue share of 37.87% in 2025. This can be attributed to an increased focus on animal health innovation, need for diagnostics, increased pet adoption, and a rise in adoption of radiography in veterinary orthopedics, dentistry, and several other indications. Radiography is one of the most common diagnostic tests covered by pet insurance. Thus, rising adoption of pet insurance and increased awareness of the various diagnostic & treatment options available for pets are some of the factors driving the market growth.

However, the video endoscopy segment is expected to be the fastest-growing segment with the fastest CAGR of 8.77% over the forecast period owing to increasing use of veterinary video endoscopy as a less invasive substitute for surgical operations. For instance, a flexible fiberoptic endoscope is used at Point Grey Veterinary Hospital in Vancouver, Canada, to perform endoscopy on organs such as the gastrointestinal tract, trachea, and colon without the need for surgery. To examine the upper airways, place feeding tubes, remove items from the stomach, and perform gastrointestinal exams & biopsies, video endoscopy is frequently employed.

By Application Insights

The orthopedics & traumatology segment held the largest share of 37.64% in 2025, owing to rising prevalence of orthopedic disorders in equines. According to an article published by Merck & Co., Inc, in September 2024, osteochondrosis, also known as osteochondritis dissecans (OCD), is a prevalent developmental orthopaedic disorder in horses that primarily affects the cartilage and subchondral bone within joints. Diagnosing OCD requires high-resolution imaging techniques such as digital radiography, ultrasound, and MRI to detect subtle lesions, assess joint involvement, and guide surgical or medical interventions. As awareness of early diagnosis and performance-related outcomes grows among horse owners, breeders, and equine veterinarians, the demand for advanced imaging solutions continues to rise. This drives market growth by increasing the adoption of precision diagnostic tools, particularly in equine specialty clinics and high-performance horse facilities, where early and accurate detection of joint abnormalities is critical for long-term health and athletic capability.

The oncology segment is anticipated to grow at a CAGR of about 10.24% from 2026 to 2033. Ultrasound and veterinary CT are effective non-invasive imaging methods that veterinarians frequently utilize for cancer staging (determining if cancer has spread to other sites) and early identification of suspected thoracic or abdominal cancers. Cancer is the main cause of death in the pet population. According to ANIMAL CANCER & IMAGING CENTER, cancer is estimated to be the reason for 50% of mortality in pets over 10 years of age and up to 25% of deaths in pets under 10 years, every year. Moreover, there are over 200 different disorders that can cause cancer. The ACIC hospitals provide CT, X-ray, and ultrasound services for animals suffering from cancer. This contributes to market growth.

By Modality Insights

The fixed imaging systems segment dominated the market in 2025, due to their superior image quality, advanced capabilities, and suitability for high-throughput clinical settings. These systems such as stationary digital radiography (DR), CT scanners, and MRI units are typically installed in specialized veterinary hospitals and referral centers, where consistent and high-resolution imaging is essential for diagnosing complex conditions. Fixed systems offer enhanced stability, allowing for precise imaging of both small and large animals, including equines, particularly in cases involving orthopedic, neurological, and internal medicine diagnostics. Their ability to handle a high volume of patients efficiently, combined with integrated software for image analysis and storage, makes them the preferred choice for practices focusing on accuracy and long-term investment.

The portable imaging systems segment is experiencing rapid growth within the market, due to their flexibility, affordability, and increasing use in field and rural settings. These compact, lightweight devices such as handheld ultrasound machines and portable digital X-ray units enable veterinarians to perform on-site diagnostics for large animals like horses and cattle, reducing the need for animal transport and minimizing stress. For instance, equine veterinarians frequently use portable ultrasound and X-ray systems for lameness evaluations or reproductive assessments directly at stables or farms. Additionally, small animal clinics with limited space benefit from the mobility and ease of use of portable units.

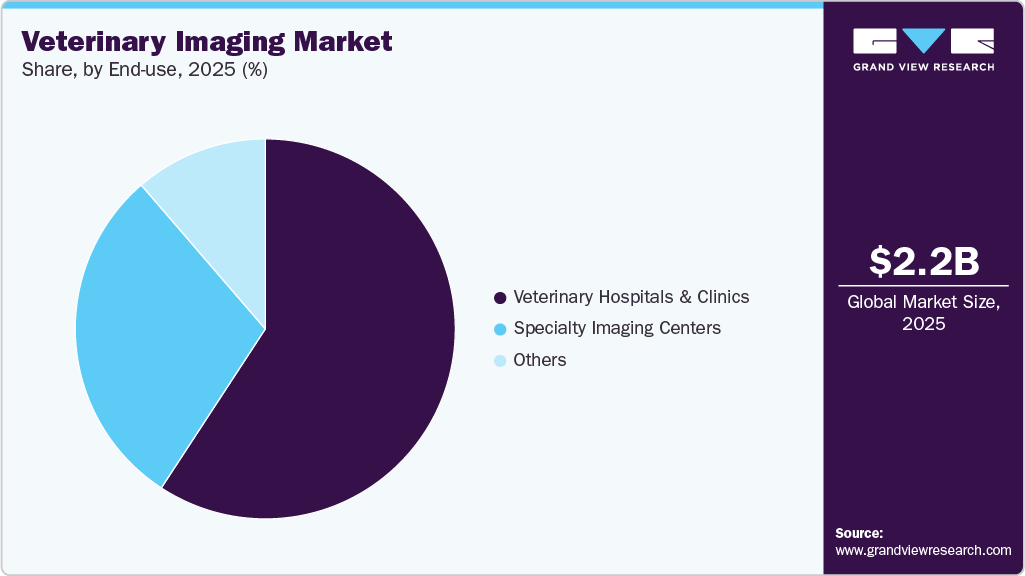

End Use Insights

Based on end use, the veterinary clinics & hospitals segment held the largest share of 59.22% in 2025. This is because these healthcare settings enable faster diagnosis, allowing patients to receive treatment as soon as possible. Moreover, veterinary hospitals offer a wide range of diagnostic imaging options, which is a high-impact driver of this market. Advanced veterinary imaging systems, such as CT, for diagnosis and usage during specialty surgeries for cardiac & dental procedures and trauma situations are available at veterinary hospitals.

The others include research institutes, diagnostic laboratories which is emerging as the fastest-growing segment in the Veterinary Imaging market. Nowadays, many veterinary diagnostic laboratories provide 90% coverage for pet diagnostic tests and procedures related to any accident, disease, or injury. Furthermore, the demand for high-quality veterinary equipment and diagnostic tools is expanding as a result of modern lifestyle changes and rising spending on animal healthcare. Furthermore, the increase in the adoption of veterinary diagnostic imaging across the globe is another factor responsible for segment growth.

Regional Insights

North America veterinary imaging market held the largest share of 38.81% of the global market in 2025. North America, particularly the U.S. and Canada, has one of the highest rates of pet ownership globally. This large pet population drives the demand for veterinary healthcare services, including diagnostic imaging. Furthermore, an increase in strategic advancements and initiatives undertaken by key players in the form of product launches, acquisitions, mergers, and alliances is expected to boost the North America market.

U.S. Veterinary Imaging Market Trends

The U.S. market is witnessing robust growth, primarily fueled by the increasing incidence of osteoarthritis, obesity, injuries, and various chronic health conditions among the pet population. This upward trend is further supported by the growing number of surgical interventions performed on pets, coupled with the expanding availability of qualified veterinary professionals throughout the country. Notably, data from Zoetis highlights the significant burden of osteoarthritis, affecting nearly 40% of dogs and cats in the U.S., underscoring the urgent need for effective veterinary care and treatment solutions.

Europe Veterinary Imaging Market Trends

The veterinary imaging market in Europe is driven by the rising prevalence of chronic diseases in pets, which necessitates adequate diagnostic imaging and the growth in the number of pet owners. For instance, there is a high prevalence of obesity, osteoarthritis, and mobility issues among the pet population. Excess body fat and weight put more strain on joints, causing arthritis to worsen and making movement difficult. As a result, it is projected that the prevalence of joint inflammatory illnesses will increase along with a rise in obesity, which has been identified as the most prevalent nutritional health issue in dogs. In addition, the expanding use of digital ultrasonography and radiography is anticipated to significantly boost the regional market for veterinary imaging.

UK veterinary imaging market is anticipated to grow at a significant rate over the forecast period, According to an article published by Pangolia Pte. Ltd, in February 2025, there are 50 million pets in the UK, with dogs & cats accounting for the highest proportion. With the growing pet adoption rate, the prevalence of illnesses and burden of osteoarthritis in dogs is growing in the country. According to an article published by Royal Veterinary College, London, osteoarthritis affects between 2.5% and 6.6% dogs of all breeds & ages and affects up to 20% dogs older than 1 year in the country. Canine osteoarthritis is a significant problem for veterinarians, owners, and breeders in the UK, in addition to its effects on canine wellbeing. These factors are expected to contribute to the country’s market growth.

Asia Pacific Veterinary Imaging Market Trends

The Asia Pacific veterinary imaging market is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing adoption of pet animals, growing health concerns, increasing vigilance about animal health, rising livestock population, and increasing prevalence of animal diseases. Furthermore, rising healthcare expenditure on animal health and veterinary services is contributing to market growth.

The veterinary imaging market in India is anticipated to grow at a healthy rate over the forecast period. The launch of India’s first dedicated small animal hospital by Tata Trusts in Mumbai is expected to significantly drive the veterinary imaging market by increasing the demand for advanced diagnostic tools such as X-rays, ultrasounds, CT scans, and MRIs. Spanning over 98,000 sq ft with a capacity of 200+ beds, the hospital is poised to handle a high volume of complex cases, thereby necessitating sophisticated imaging infrastructure. This facility will not only improve access to specialized veterinary care but also promote the adoption of advanced imaging techniques among veterinary professionals through training and collaboration. As the hospital serves as a regional referral center, it is likely to stimulate the broader use of imaging technologies in routine diagnostics, surgical planning, and chronic disease management, ultimately accelerating market growth over the forecast period.

Latin America Veterinary Imaging Market Trends

The veterinary imaging market in Latin America is expected to grow at a steady rate due to lower awareness regarding point-of-care imaging systems in the region. There is a rise in pet ownership across Latin America, driven by rising disposable income, urbanization, and changing lifestyles. Furthermore, pet owners in Latin America are becoming more aware of the importance of preventive healthcare and early diagnosis for their pets. This has led to an increased demand for advanced veterinary imaging technologies to encourage the diagnosis and treatment of various medical conditions. In addition, the expansion of veterinary clinics, hospitals, and diagnostic centers across Latin America increased access to veterinary services, including imaging, for pet owners. This expansion is driven by growing investments in the veterinary healthcare sector and the establishment of partnerships with international veterinary companies. The Latin American market includes Brazil, Mexico, & Argentina.

Brazil is expected to play a pivotal role in driving veterinary market growth due to several key factors. The country has one of the largest pet populations in the world, with a growing number of households treating pets as family members, leading to increased demand for quality veterinary care. Rising disposable incomes, coupled with growing awareness of pet health and wellness, are encouraging owners to invest in advanced diagnostic services, including veterinary imaging. Additionally, Brazil has seen significant investments in veterinary infrastructure, with a rising number of animal hospitals, clinics, and diagnostic centers adopting modern imaging technologies such as digital radiography, ultrasound, and MRI.

Middle East & Africa Veterinary Imaging Market Trends

The market for veterinary imaging in MEA is anticipated to expand steadily over the projected period due to the growing animal disease outbreak and rising need for effective diagnostic solutions. In addition, the market is anticipated to grow as a result of rising demand for advanced imaging services and insurance, as well as increased awareness of animal diseases. Moreover, the need for improved diagnostics and advanced imaging solutions increases as the number of zoonotic diseases in animals and their transmission to humans rises.

South Africa is expected to drive market growth in the veterinary imaging sector due to several key factors, including the rising pet ownership, growing awareness of animal health, and increasing demand for advanced veterinary care. The country is witnessing a steady increase in companion animal adoption, particularly in urban areas, leading to higher demand for veterinary imaging services.

Key Veterinary Imaging Company Insights

The market is slightly competitive, with the presence of many large- and small-scale players. Most companies focus on R&D efforts, mergers, acquisitions, collaborations, and partnerships to achieve greater market share. In addition, industry players are expanding into other countries with their AI technologies to enhance their market reach. For instance, in January 2024, SK Telecom Co., a South Korean company, introduced its AI pet diagnostic assistant service-X Caliber-in the U.S. by partnering with Vetology.

Key Veterinary Imaging Companies:

The following are the leading companies in the veterinary imaging market. These companies collectively hold the largest market share and dictate industry trendsv

- IDEXX Laboratories, Inc.

- Esaote SPA

- Antech Diagnostics, Inc.

- General Electric Company

- Midmark Corporation

- FUJIFILM Holdings America Corporation

- Hallmarq Veterinary Imaging

- CANON MEDICAL SYSTEMS EUROPE B.V.

- Shenzhen Mindray Animal Medical Technology Co., LTD

- Siemens Healthcare Limited

Recent Developments

-

In October 2025, Probo Veterinary partnered with Improve Veterinary Education and Mindray Animal Medical. The aim is to boost ultrasound training with Mindray Vetus 80 machines in UK courses, and they also plan to conduct global rollout.

-

In September 2025, IMV Imaging and Asto CT formed a partnership to combine IMV's ultrasound, X-ray, CT, and MRI tools with Asto's Equina standing CT scanner for horses. The deal targets equine and mixed practices worldwide.

-

In September 2025, UC Davis opened the All Species Imaging Center. The center houses advanced CT, MRI, PET/CT scanners for small and large animals, including a large-bore equine CT

-

In August 2025, Hallmarq Veterinary Imaging unveiled iNAV software at British Equine Veterinary Association (BEVA) Congress in September 2025. The tool corrects motion in standing equine MRI scans for clearer images of hard-to-see limbs.

Veterinary Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.37 billion

Revenue forecast in 2033

USD 4.02 billion

Growth Rate

CAGR of 7.84% from 2026 to 2033

Historical Period

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, animal type, application, modality, end use

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

IDEXX Laboratories, Inc., Esaote SPA, Antech Diagnostics, Inc., General Electric Company, Midmark Corporation, FUJIFILM Holdings America Corporation, Hallmarq Veterinary Imaging, CANON MEDICAL SYSTEMS EUROPE B.V., Shenzhen Mindray Animal Medical Technology Co., LTD, Siemens Healthcare Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary imaging market report based on product, type, animal type, application, modality, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment

-

Accessories/ Consumables

-

Software

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

X-ray

-

Ultrasound

-

MRI

-

CT Imaging

-

Video Endoscopy

-

-

Animal Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Animals

-

Large Animals

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Orthopedics and Traumatology

-

Oncology

-

Cardiology

-

Neurology

-

Respiratory

-

Dental Applications

-

Others

-

-

Modality Outlook (Revenue, USD Million, 2021 - 2033)

-

Fixed

-

Portable

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals and Clinics

-

Specialty Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary imaging market size was estimated at USD 2.23 billion in 2025 and is expected to reach USD 2.37 billion in 2026.

b. Some key players operating in the global veterinary imaging market include IDEXX Laboratories, Inc., ESAOTE SPA, SOUND, General Electric Company, Universal Medical Systems, Inc., FUJIFILM Holdings America Corporation, Hallmarq Veterinary Imaging Ltd., VetZ GmbH, Shenzhen Mindray Animal Medical Technology Co., LTD., Heska Corporation.

b. The global veterinary imaging market is expected to grow at a compound annual growth rate (CAGR) of 7.84% from 2026 to 2033 to reach USD 4.02 billion by 2033.

b. North American region registered the highest market revenue share of 38.81% in 2025 owing to growing pet ownership, implementing strategic initiatives by the key manufacturers, and the increasing disease burden in animals.

b. The key factors driving the market growth include the rising need for timely diagnosis of chronic conditions, increased adoption of imaging technologies in veterinary orthopedics, dentistry, and several other indications, and increased pet adoption & ownership rates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.