- Home

- »

- Animal Health

- »

-

Pet Insurance Market Size, Share, Industry Report, 2033GVR Report cover

![Pet Insurance Market Size, Share & Trends Report]()

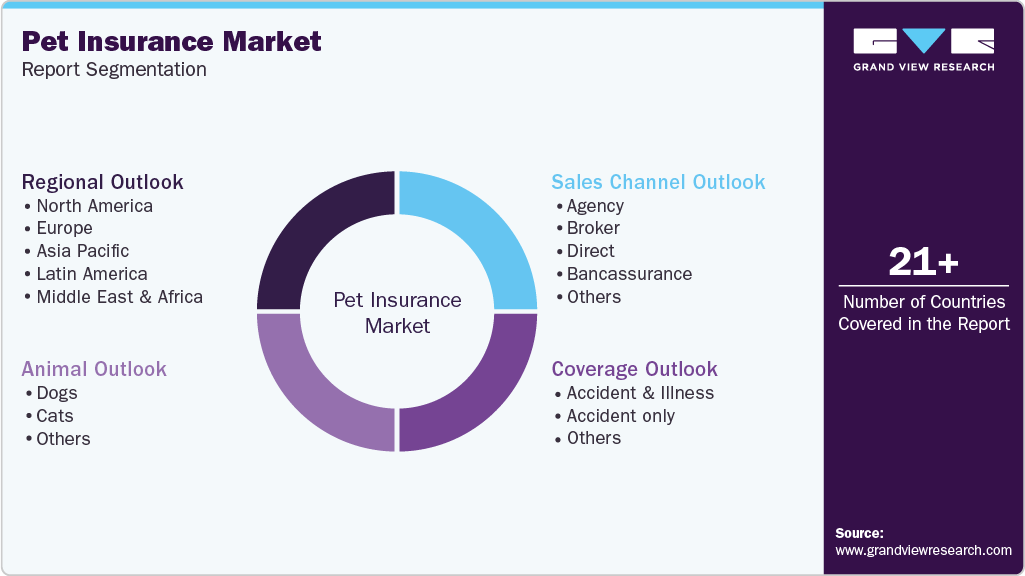

Pet Insurance Market (2026 - 2033) Size, Share & Trends Analysis Report By Coverage (Accident-only, Accident & Illness), By Animal (Dogs, Cats), By Sales Channel (Agency, Broker, Direct, Bancassurance), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-571-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Insurance Market Summary

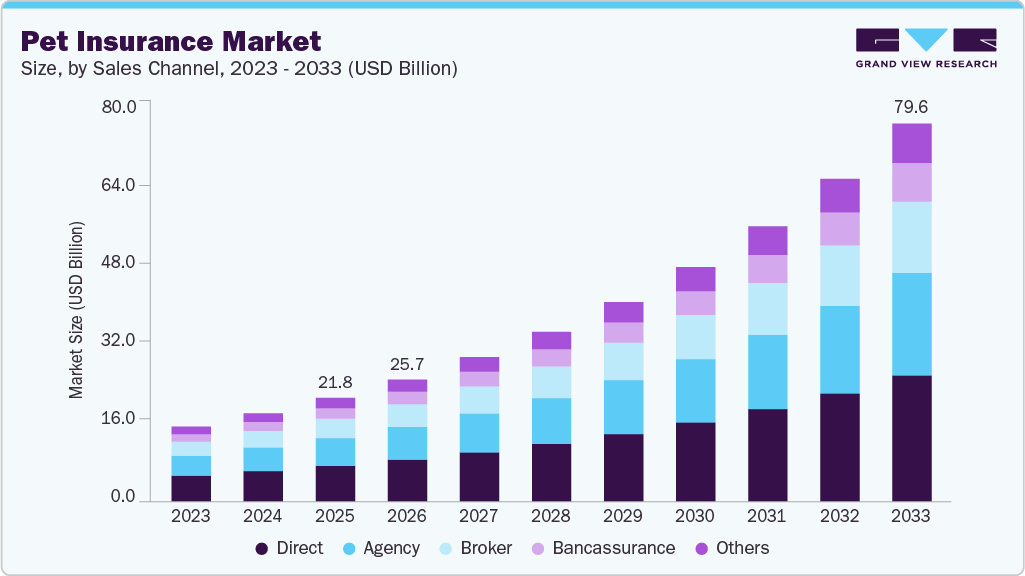

The global pet insurance market size was estimated at USD 21.84 billion in 2025 and is projected to reach USD 79.61 billion by 2033, growing at a CAGR of 17.53% from 2026 to 2033. The growing pet population, the adoption of insurance in underpenetrated markets, increasing veterinary care costs, initiatives by key companies, rising penetration of Insurtech, and humanization of pets are some of the critical drivers of this market.

Key Market Trends & Insights

- The Europe pet insurance market held the largest share of 41.23% of the global market in 2025.

- By coverage, the accident & illness segment held the largest share of 85.17% in 2025.

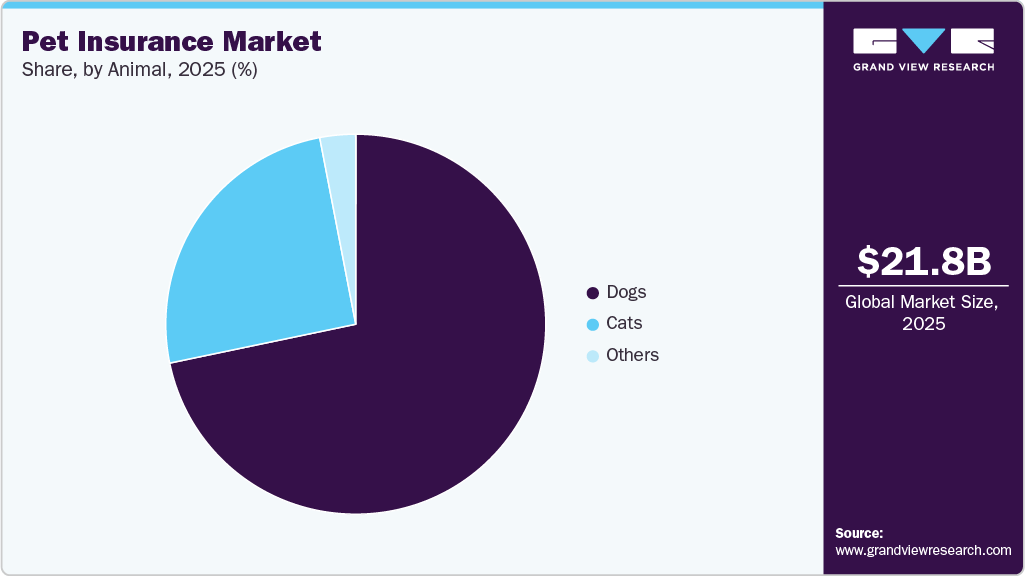

- By animal, the dogs segment dominated the global pet insurance market in 2025.

- Based on sales channel, the others segment is expected to grow at the fastest rate over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 21.84 Billion

- 2033 Projected Market Size: USD 79.61 Billion

- CAGR (2026-2033): 17.53%

- Europe: Largest market in 2025

- Asia Pacific: Fastest-growing market

According to the most recent data from NAPHIA's 2024 State of the Industry (SOI) report, 6.25 million pets are insured in North America at the moment. Compared to 2022, when there were 5.36 million pets insured in the region, this indicates a 16.6% growth. The market for pet insurance is anticipated to grow as a result of the rising prevalence of diseases in dogs and cats, as well as the growing trend of pet adoption. The industry is growing because insurance has emerged as a vital tool for pet owners to manage the costs of serious medical conditions like cancer, chronic illnesses, and unintentional injuries. Since treatments often require substantial capital investments, specialized staff, and cutting-edge diagnostic technology, which increases costs for pet owners, the rise in demand for veterinary healthcare facilities further encourages adoption.The rise in pet adoption, particularly during the COVID-19 pandemic, played a catalytic role in reshaping the market. A survey by Petplan in the UK revealed that nearly 26% of owners welcomed a new pet during lockdowns, with companionship and work-from-home flexibility cited as major reasons. This surge in pet ownership translated into stronger demand for financial protection, with about one-fifth of new owners considering insurance policies. Companies like Animal Friends Insurance have also innovated by offering coverage for remote veterinary consultations, reflecting the trend of digital healthcare integration in the pet sector.

The sector is also being shaped by new trends that are specific to each country. The majority of insurance claims in Australia are for "designer dogs," according to data from April 2025. This suggests that there is an increasing need for plans that cover health risks specific to certain breeds and genetics. According to data from June 2025, the total number of pet owners in South Korea rose to over 15 million, indicating a sizable untapped insurance market. Long-term market potential is further stimulated by expanding urbanization and pet humanization. Another changing aspect is regulatory scrutiny. The Australian Securities and Investments Commission (ASIC), aiming to investigate consumer protection and compliance practices, temporarily halted pet insurance plans from well-known companies, such as Medibank and Woolworths, in 2023. These instances highlight the importance of transparent product design and a reasonable price in maintaining consumer trust.

Furthermore, a crucial trend in the sector is the inclusion of pet insurance in employee benefits. Employers are including pet insurance benefits in their employee health insurance packages with the aim of retaining Gen Z and millennial employees. This illustrates how pet care is becoming more deeply rooted in the corporate and consumer ecosystems.

Overall, with rising pet ownership, higher veterinary costs, growing pet humanization, and innovations in policy design, the global pet insurance market is poised for robust growth. However, evolving regulatory oversight and shifting consumer expectations will remain critical determinants of how insurers design sustainable and consumer-friendly offerings.

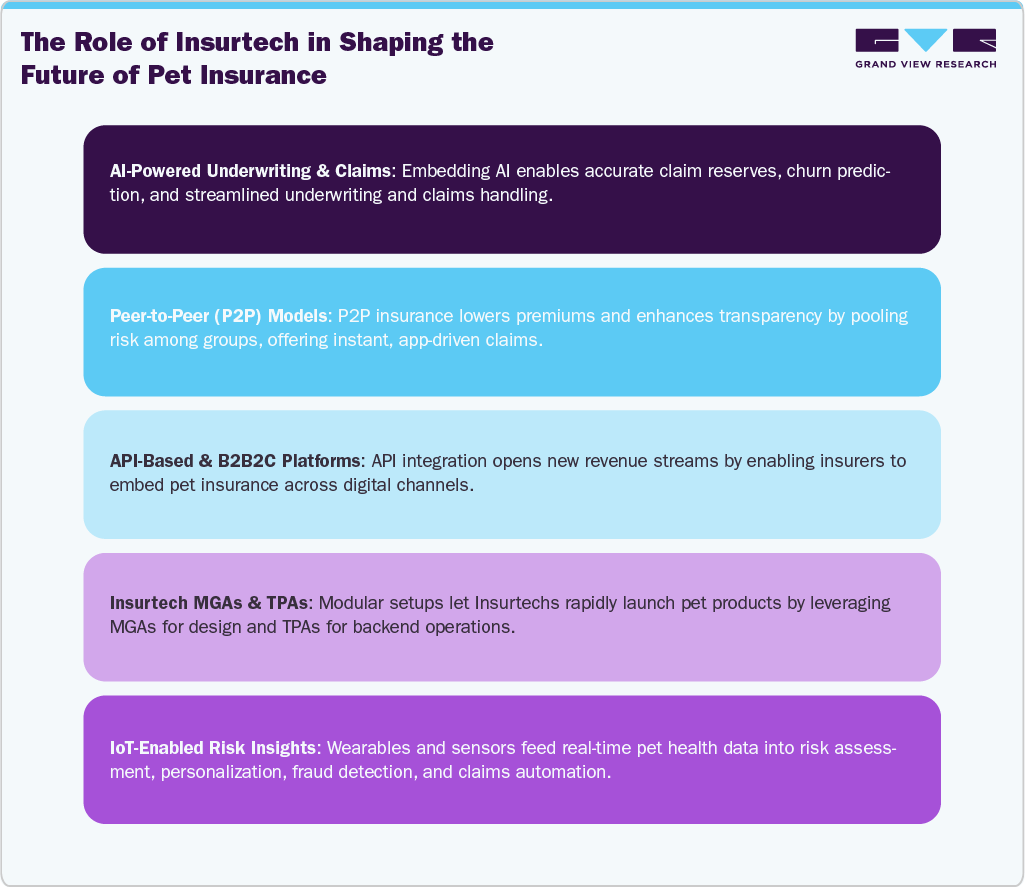

In addition, Insurtechs are reshaping the industry by introducing AI-driven underwriting, digital claims management, and telehealth integration, which streamline processes and improve customer experience. Entry of these platforms into the sector highlights global momentum, with technology-driven platforms enabling faster product launches and tailored plan coverage. Automation and big data analytics are allowing insurers to assess risk more accurately, reduce fraud, and improve pricing structures. Insurtechs also leverage mobile-first distribution channels, expanding accessibility and engagement with younger, digital-native pet owners. Besides, partnerships with veterinary networks and embedded insurance models are making policies more relevant and easier to purchase. Overall, insurtech is driving efficiency, affordability, and personalization, accelerating the adoption of pet insurance worldwide.

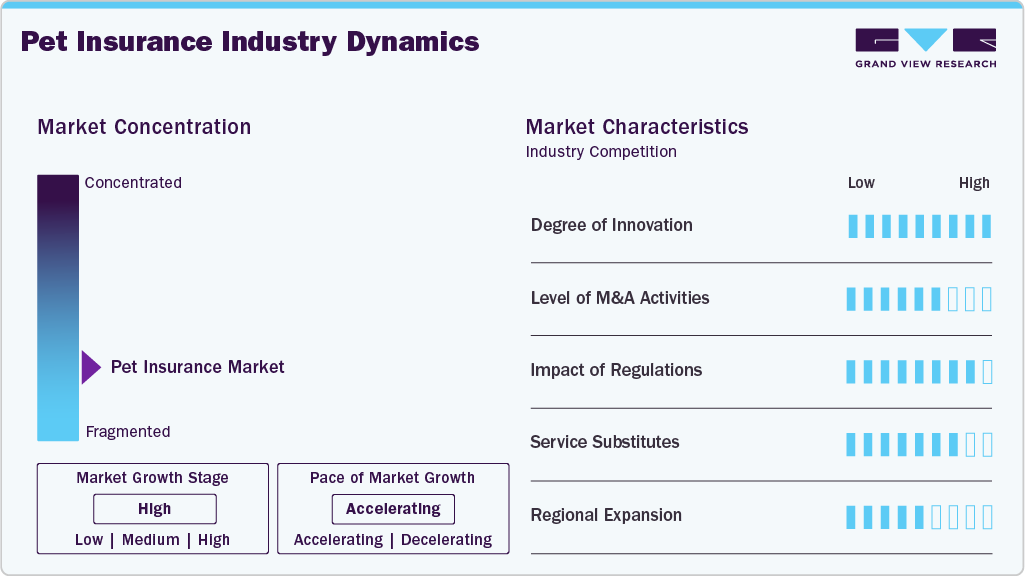

Market Concentration & Characteristics

The pet insurance industry is experiencing a high degree of innovation, driven not only by advanced veterinary medicine and diversified coverage plans, but also by the growing role of insurtech. Chinese InsurTech players and global digital-first insurers are entering the market, with the help of technologies such as AI, big data, and digital platforms to streamline underwriting, personalize coverage, and enhance claims management. These technologies improve customer experience, reduce fraud, and enable real-time policy adjustments. Rising pet adoption and humanization trends further amplify demand, while the expansion of treatment options and increasing veterinary costs make tech-enabled insurance solutions increasingly attractive.

Expansion in the market is marked by both geographic reach and broadening of coverage offerings. Apart from business expansion strategies, such as Trupanion’s 2024 launch in Switzerland and Germany, domestic insurers are also diversifying their portfolios. Universal Sompo, for instance, is an Indian insurance company that has recently expanded into pet insurance. This reflects a rise in awareness of pet healthcare and also demand for financial security. Such initiatives highlight how insurers are tailoring products to local markets while tapping into global trends of increasing pet ownership and the growing need for affordable veterinary care.

The market for pet insurance continues to witness active M&A activity as players pursue consolidation and growth. In addition to JAB Holding Company’s 2023 acquisition of Pumpkin, recent business activities such as the July 2025 acquisition of a UK-based pet insurer, Tedaisy Insurance Group, by Sant Vet Group, showcase industry consolidation trends. This reflects a strategy of expanding service offerings, reaching new customer bases, and enhancing competitiveness in a fast-growing sector. M&A remains a key lever for insurers to scale rapidly and reinforce market presence across geographies.

The entry of new digital-first and specialized insurers is reshaping competition in the industry. The December 2024 data indicates that Zhibao Technology is expanding through its Chong Bao Bao platform by integrating AI-driven solutions to provide flexible coverage and enhance customer engagement. Similarly, Korea launched its first dedicated pet insurer, MyBrown, in July 2025, marking a significant shift toward specialized services in Asia. These developments highlight how innovative platforms and niche providers act as substitutes to traditional offerings, intensifying competition and diversifying consumer choices.

The sector is subject to rigorous rules and regulations, with variations among jurisdictions and countries. There is currently a lack of consistent coverage, as only 14 U.S. states provide pet owners with additional consumer protections. The recent approval of a pet insurance regulation law in Florida signals potential for the further implementation of state-level frameworks. Furthermore, mounting disputes and class-action lawsuits, such as one brought against Nationwide, highlight client concerns over claims handling and transparency. In addition, regulatory monitoring has increased as a result of pet and travel insurance concerns. Although pet insurance is not mandated by law, oversight is constantly evolving as a result of initiatives like the NAIC's 2022 Pet Insurance Model Act and new state legislation that establishes more precise requirements, enhances consumer protection, and increases insurer accountability.

Coverage Insights

By coverage, the accident & illness segment dominated the market with an 85.17% share in 2025. This growth can be attributed to several critical factors, including the high costs associated with veterinary treatments and diagnostics, the increasing population of companion animals, and a growing awareness of the importance of pet insurance. Pet insurance companies typically offer accident and illness policies that provide comprehensive coverage for various conditions, including acute and chronic diseases, medications, and diagnostic tests, among others. Given the comprehensive protection they afford to owners, this segment is anticipated to continue to witness rapid growth in the coming years.

The others segment, including liability insurance policies among others, is projected to experience the fastest growth rate from 2026 to 2033. The boost can be attributed to certain countries such as Germany, Italy, France, Switzerland, Austria, and Spain, making it mandatory for pet owners to get pet (dogs & cats) liability insurance. Luko, for example, provides dog liability insurance across various European nations such as France, Germany, and Spain. Their policy offers coverage for pet owners against both physical and material damages caused by their pets, extending up to 30 million euros.

Animal Insights

Based on animal, the dogs segment held the largest market share in 2025. This can be attributed to the high adoption of dogs as pets across the globe. For instance, according to the American Pet Products Association (APPA) study conducted between 2023 and 2024, approximately 66% of households in the U.S. have at least one pet, totaling around 86.9 million households. Most insured pets are dogs, accounting for about 80% of the insured population, while cats comprise the remaining 20%. The growing pet population across the region and the availability of various insurance policies to support the different needs of pets are expected to fuel future market growth.

The cats segment is expected to grow at the fastest CAGR over the forecast period. This is largely due to the rising recognition of cats as integral family members, with owners increasingly willing to invest in their long-term health. Cats are prone to chronic conditions such as kidney disease, diabetes, and thyroid disorders, which often require ongoing treatment and regular vet visits-making insurance an attractive safety net. Compared to dogs, cats can also mask illnesses until they are advanced, leading to higher treatment costs when issues are finally detected. Growing urban lifestyles and apartment living have further boosted cat ownership, especially among younger demographics who are more inclined to seek structured financial protection. Furthermore, insurers are now tailoring products to feline needs-such as coverage for hereditary conditions and wellness add-ons-which is helping the segment gain traction faster than before.

Sales Channel Insights

By sales channel, the direct sales channel segment held the largest share of the market in 2025. The significant adoption of direct sales strategies by major pet insurance providers has been a driving factor. For example, Deutsche Familienversicherung AG, a direct insurer, exhibited around 7% growth in insurance revenue in 2024, with direct claims at 63.9%.

The others segment, which contains animal care centers, veterinary clinics, and more, is expected to grow at the fastest rate during the forecast period. This can be attributed to providers forging multi-pronged partnerships with companies from various sectors to enhance pet benefits and penetrate a larger market. For instance, in February 2024, Tractive, the UK and Europe's largest pet wearables firm launched Tractive Pet Cover, its first insurance product in partnership with Ignite (a digital platform for insurance brokers) and Covéa (a mutual insurance group).This comprehensive lifetime insurance is available to dog and cat owners in the UK. It covers up to GBP 9,000 (USD 11,479.29) in vet fees annually, including accidents, illness, dental treatment, and third-party liability. This increased pet owners' access to high-quality and affordable healthcare offerings.

Regional Insights

The Europe pet insurance industry held the largest revenue share of over 41.23% in 2025. This is due to the increasing adoption of pet insurance, rising ownership, and the presence of key companies. According to the European Pet Food Industry Federation (FEDIAF) study published in 2025, 139 million households in Europe had a pet in 2023, with 25% of households owning at least one dog, while 26% owning at least one cat. Key market players such as Petplan are headquartered in the UK, while DFV is headquartered in Germany. These companies continuously implement strategic initiatives to increase their market share, thus contributing to regional growth.

The UK pet insurance industry is being driven by rising awareness of emergency preparedness, with owners increasingly recognizing insurance as a vital financial safety net alongside first aid knowledge. Marketing campaigns by players like Napo and Animal Friends Insurance, using humor, storytelling, and relatable scenarios, are boosting adoption and consumer engagement. Industry innovation is growing, with insurers addressing affordability challenges and building integrated care ecosystems through collaborations and the use of digital tools. M&A activity is gradually picking up, with acquisitions focused on expanding digital capabilities and services. Regulatory bodies, such as the FCA and CMA, are pushing for greater transparency and fairness, while policy reforms ensure consumer choice. Despite competition from substitutes such as savings, veterinary care plans, and low-cost clinics, demand remains strong as pet owners prioritize comprehensive protection and peace of mind.

The pet insurance industry in Germany is being driven by the sharp rise in pet ownership, with more households embracing dogs and cats as family members, increasing the demand for financial protection. Escalating veterinary treatment costs for surgeries, chronic diseases, and routine care are prompting owners to seek insurance to manage expenses without compromising on quality. Regulatory factors, such as mandatory dog liability insurance in several states and the veterinary fee schedule (GOT) that stabilizes pricing, further support adoption. Innovation is also a key driver, with insurers like Dalma and Hepster leveraging AI, telemedicine, and embedded insurance to simplify claims and expand access. Rising M&A activity and global entrants, such as Trupanion, highlight market consolidation and international confidence in Germany’s growth potential. Although substitutes like savings and payment plans exist, the need for comprehensive, long-term coverage continues to propel insurance uptake.

North America Pet Insurance Market Trends

The pet insurance industry in North America held the second-largest revenue share in 2025. The market is being shaped by rising veterinary costs, evolving regulations, and innovative product offerings across the U.S., Canada, and Mexico. In the U.S., the industry is facing greater scrutiny, with new regulations being introduced in states like Florida to promote transparency and consumer protection. Meanwhile, legal actions, such as class-action lawsuits against major insurers, highlight ongoing concerns about fairness and coverage clarity. At the same time, employers in Canada are increasingly offering pet insurance as part of workplace benefits, reflecting the growing role of pets in family life and employee wellbeing. Mexico is emerging as a unique growth pocket, with many Americans crossing the border for more affordable veterinary care, which underscores the price pressures driving demand for financial protection across the region. Together, these dynamics illustrate a market characterized by high costs, strong consumer demand for comprehensive care, and a regulatory and competitive environment that is steadily professionalizing and expanding access.

U.S. Pet Insurance Market Trends

The U.S. pet insurance industry is rapidly expanding, fueled by a surge in pet ownership and sharply rising veterinary costs, with gross written premiums more than doubling between 2019 and 2023. Pet parents are increasingly seeking financial protection as treatments for chronic conditions and emergencies can run into tens of thousands of dollars, and urban vet service costs have surged nearly 60% over the past decade. Industry initiatives, such as Spot Pet Insurance’s partnership with YouTuber MrBeast to cover adopted pets, highlight the growing integration of insurance into broader pet welfare efforts. At the same time, the market remains highly innovative and competitive, with players enhancing offerings through wellness programs, digital platforms, and partnerships, while M&A activity-led by firms like JAB Holding-reshapes the landscape. However, challenges such as Nationwide’s cancellation of 100,000 policies reveal the strain of rising costs, raising questions about the affordability and sustainability of these policies.

Asia Pacific Pet Insurance Market Trends

The pet insurance industry in the Asia Pacific is evolving rapidly, supported by rising pet adoption, growing disposable incomes, and stronger veterinary healthcare systems across the region. Countries such as China, India, and South Korea are experiencing a wave of innovation, with new insurtech platforms and dedicated insurers entering the market to tap into a young, digitally savvy customer base. At the same time, Southeast Asia’s expanding “pet economy” and Australia’s mature insurance landscape highlight the diversity of market opportunities. However, challenges remain, as seen in Japan, where insurers have withdrawn due to cost pressures, reflecting the need for sustainable models. Overall, the region is characterized by high growth potential, regulatory progress, and increasing competition, making it one of the most dynamic frontiers for global pet insurance expansion.

The India pet insurance industry is rapidly gaining momentum, driven by soaring veterinary costs and evolving attitudes that treat pets as beloved family members-making insurance increasingly essential for managing emergency care and routine treatments. Despite lingering misconceptions about the complexity or necessity of policies, they offer valuable financial relief during high-stress situations, helping owners avoid delays in seeking care. The country's booming pet population and expanding pet care industry have prompted insurers to launch tailored, tech-enabled plans with digital onboarding, wellness add-ons, and broader coverage for animals. Yet, awareness and accessibility remain low, particularly outside urban centers, leaving considerable room for growth. Regulatory attention is on the horizon, with bodies like IRDAI beginning to explore the need for standardized guidelines to ensure consumer protection and drive market evolution.

Latin America Pet Insurance Market Trends

The pet insurance industry in Latin America has witnessed an increasing veterinary healthcare penetration, rising per capita income, and growing awareness of the numerous benefits of pet insurance. One key driver is the increasing pet ownership rates in the region, with dogs being the most popular pets, followed by cats and birds. Pet ownership sales have been evolving across Latin America. As more people move to cities, there is more demand for cats and small dogs, according to an article published by Pet Food Industry in June 2023.

The Brazil pet insurance industry has gained from the high pet population in the region. Brazil's pet population has grown significantly over the years, with September 2024 figures from the PetFoodIndustry report showing it to be at 160 million pets. However, the Brazilian Association of the Pet Products Industry (ABINPET) reports an even higher number, with pets totaling 168 million in the country. This suggests that there are nearly two pets per household in Brazil. This increase in ownership has led to a surge in the pet insurance industry, driven by the growing trend of humanization and ownership rates.

Middle East and Africa Pet Insurance Market Trends

The pet insurance industry in the Middle East and Africa is anticipated to grow over the forecast period because of rising awareness regarding animal health in developing countries such as Saudi Arabia and South Africa. South Africa has been involved in research activities to evaluate the effects of drugs on pets. In addition, the introduction of the South Africa Veterinary Association enhanced the regulatory control and provided a structure to the veterinary industry of the country. Leading global insurers and regional domestic players are actively launching new premium plans to gain more market penetration. Key players include Oneplan, Medipet, Dotsure, Pet Sure, and Hollard, among others.

The Saudi Arabia pet insurance industry growth can be attributed to the contributions of insurance agencies to improve pet insurance adoption. Tree Digital Insurance Agency launched a novel digital insurance platform in September 2024, specifically designed for pet owners.

Key Pet Insurance Company Insights

The market remains moderately fragmented, with a mix of established insurers, investment-backed groups, and emerging digital-first providers competing for share. Larger firms are pursuing consolidation strategies through mergers and acquisitions to expand their customer base, diversify coverage options, and strengthen their global presence. At the same time, regional and specialized players are entering the market with innovative, tech-enabled offerings designed to enhance affordability and improve the customer experience. This combination of consolidation among traditional leaders and disruption from newer entrants creates a highly dynamic environment. Market share distribution is influenced by factors such as technological innovation, regulatory changes, and the ability of companies to adapt products to evolving consumer needs and rising veterinary costs.

Key Potassium Sulfate Companies:

The following are the leading companies in the pet insurance market. These companies collectively hold the largest Market share and dictate industry trends.

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- Jab Holding Company

- Direct Line

- Lassie

- Getsafe GmbH

- Waggel Limited

- Feather Insurance

- Napo Limited

- Tesco

- Sainsbury Bank Plc

- Fressnapf Holding SE

- EQT Group

- MetLife Services and Solutions, LLC

- HDFC Ergo

- AliPay

- Nationwide Mutual Insurance Company

- Anicom Insurance

Recent Developments

-

In July 2025, Korea’s first dedicated pet insurance company, MyBrown, was officially launched, marking the country’s initial move into containing and serving its growing companion animal sector.

-

In June 2025, Universal Sompo introduced Pet Assure, a personalized and customizable pet insurance offering in India, reflecting strong demand among pet owners. The product features flexible coverage amounts ranging from ₹10,000 to ₹200,000 (~USD 113 to USD 2,260) and policy durations of one to three years, with premiums starting as low as ₹1,499 per annum (~USD 16).

-

In May 2025, OnePack Plan, an insurance company, was launched in Canada, enabling employers to offer payroll-deducted pet insurance as an employee benefit-addressing rising veterinary costs and a growing desire for such coverage among Canadian pet parents.

-

In December 2024, Zhibao Technology launched its "Chong Bao Bao" digital platform via its subsidiary Sunshine Insurance Brokers-to enter China's pet insurance market. The move positions Zhibao to capitalize on Asia-Pacific’s rapid pet insurance growth by offering embedded, tech-enabled coverage.

Pet Insurance Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 25.70 billion

Revenue forecast in 2033

USD 79.61 billion

Growth rate

CAGR of 17.53% from 2026 to 2033

Historical Period

2021 - 2024

Actual data

2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Coverage, animal, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Austria; Hungary; Poland; Romania; Czech Republic; Switzerland; Luxembourg; Portugal; Belgium; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Trupanion, Inc.; Deutsche Familienversicherung AG (DFV); Petplan (Allianz); Jab Holding Company; Direct Line; EQT Group; Lassie; Getsafe GmbH; Waggel Limited; Feather Insurance; Napo Limited; Tesco; Sainsbury Bank Plc; Fressnapf Holding SE; MetLife Services and Solutions, LLC; HDFC Ergo; Nationwide Mutual Insurance Company; Anicom Insurance; AliPay

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Insurance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pet insurance market report based on coverage, animal, sales channel, and region.

-

Coverage Outlook (Revenue, USD Million, 2021 - 2033)

-

Accident & Illness

-

Accident only

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Dogs

-

Cats

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Agency

-

Broker

-

Direct

-

Bancassurance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Austria

-

Hungary

-

Poland

-

Romania

-

Czech Republic

-

Switzerland

-

Luxembourg

-

Portugal

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global pet insurance market size was estimated at USD 21.84 billion in 2025 and is expected to reach USD 25.70 billion in 2026.

b. The global pet insurance market is expected to grow at a compound annual growth rate of 17.53% from 2026 to 2033 to reach USD 79.61 billion by 2033.

b. The North American pet insurance market, the second-largest in 2025, is shaped by rising veterinary costs, evolving regulations, and innovative product offerings. The U.S. faces tighter scrutiny with new laws and lawsuits, while Canada sees growth through employer-sponsored benefits. Mexico is emerging as a cost-sensitive market, driven by cross-border veterinary care and increasing demand for financial protection.

b. Some key players operating in the pet insurance market include Trupanion, Inc., Deutsche Familienversicherung AG (DFV), Petplan (Allianz), Jab Holding Company, Direct Line, EQT Group , Lassie, Getsafe GmbH, Waggel Limited, Feather Insurance, Napo Limited, Tesco, Sainsbury Bank Plc, Fressnapf Holding SE, MetLife Services and Solutions, LLC, Bajaj Allianz, HDFC Ergo, Nationwide Mutual Insurance Company, Anicom Insurance, and AliPay

b. The growing pet population, adoption of insurance in underpenetrated markets, increasing veterinary care costs, initiatives by key companies, rising penetration of InsurTech and humanization of pets are some of the critical drivers of this market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.