- Home

- »

- Animal Health

- »

-

Veterinary Diagnostics Market Size, Industry Report, 2030GVR Report cover

![Veterinary Diagnostics Market Size, Share & Trends Report]()

Veterinary Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Reagents & Kits, Equipment & Instruments), By Animal Type, By Testing Category, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-130-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Diagnostics Market Summary

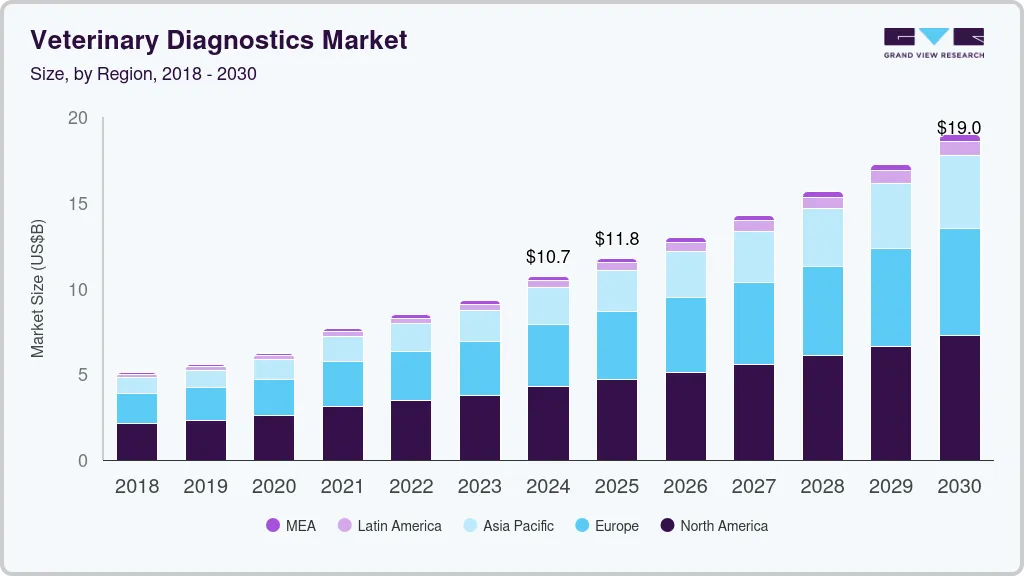

The global veterinary diagnostics market size was estimated at USD 10.71 billion in 2024 and is projected to reach USD 19.00 billion by 2030, growing at a CAGR of 10% from 2025 to 2030. Some of the key factors accounting for market growth include increased expenditure on animal health, rising incidence of diseases in animals, advancements in diagnostics, and growing medicalization rate.

Key Market Trends & Insights

- North America veterinary diagnostics market dominated the global market with the largest revenue share of 38.25% in 2024.

- The veterinary diagnostics market in the U.S. is growing rapidly.

- Based on testing category, the clinical chemistry segment led the market with the largest revenue share of 23.21% in 2024.

- Based on animal type, the companion animals segment led the market with the largest revenue share of 59.26% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.71 Billion

- 2030 Projected Market Size: USD 19.00 Billion

- CAGR (2025-2030): 10%

- North America: Largest market in 2023

In September 2024, Zoetis launched Vetscan OptiCell, an AI-powered, cartridge-based hematology analyzer to deliver lab-quality CBC analysis at the point of care. This innovation offers enhanced diagnostic accuracy, efficiency, and a compact design. It will debut at the London Vet Show in November 2024.

Continuous advancements in veterinary diagnostic technologies, including molecular diagnostics, imaging modalities, and point-of-care testing, have significantly expanded the capabilities of diagnosing animal diseases. These innovations enhance the accuracy and speed of diagnostics and contribute to the overall market growth as veterinarians and pet owners seek state-of-the-art solutions for comprehensive healthcare.Developing and adopting point-of-care diagnostic tools that provide rapid and on-site results has become a significant driver. These tools allow for quick decision-making in veterinary practices, enabling timely and efficient treatment, which is crucial for the health outcomes of animals.

The rise in animal infectious diseases, including zoonotic diseases, has emphasized the need for accurate and timely diagnostics. Veterinary diagnostic products are crucial in identifying and managing diseases, enabling prompt treatment, and preventing the spread of infections.As with humans, animals are susceptible to chronic and age-related conditions. The aging pet population, coupled with an increased focus on preventive healthcare, drives the demand for diagnostics that can aid in the early detection and management of conditions such as arthritis, diabetes, and cancer. The growing incidence of infectious animal ailments and chronic diseases is expected to fuel the demand for veterinary diagnostics in the near future.

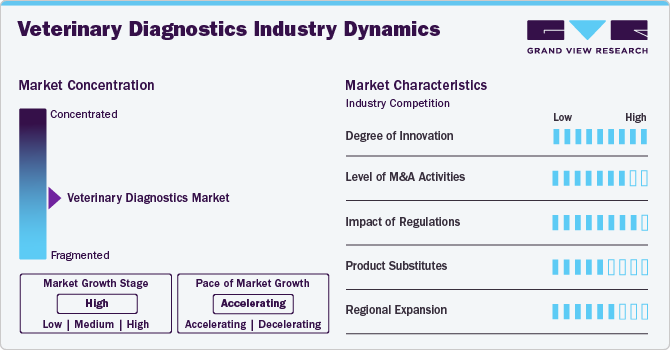

Market Concentration & Characteristics

The veterinary diagnostics industry exhibits several key characteristics influencing its dynamics, growth, and overall structure. These market characteristics are shaped by factors such as technological advancements, regulatory environment, animal health trends, and the evolving needs of veterinarians and pet owners. The market is characterized by a high degree of innovation. Companies are investing in R&D to introduce novel diagnostic technologies and improve existing ones. Innovations such as portable diagnostic devices, integration with information technology, and the development of more accurate and rapid diagnostic assays contribute to the dynamic nature of the market.

Ongoing research in veterinary medicine has led to identifying new biomarkers for various animal diseases. These biomarkers play a crucial role in enhancing the sensitivity and specificity of diagnostic tests, allowing for early detection and precise characterization of health conditions in animals.Moreover, integrating artificial intelligence and machine learning in veterinary diagnostics is becoming more prevalent. These technologies assist in data analysis, pattern recognition, and predictive modeling, improving diagnostic accuracy and efficiency.

The market is also witnessing a notable level of merger and acquisition (M&A) activities. Established companies engage in strategic partnerships or acquire smaller firms to expand their product portfolios, access new technologies, and strengthen their market presence. This trend aims to create synergies, streamline operations, and capitalize on complementary strengths. In August 2023, for instance, Synlab- a German diagnostics company specializing in both human and animal health, agreed to sell its animal health diagnostics business to Mars Inc. This would enable Synlab to focus on its core competencies while SYNLAB VET is expected to thrive as part of Mars.

The veterinary diagnostics industry features a range of diagnostic modalities and tools, offering veterinarians and pet owners multiple disease detection and monitoring options. For example, traditional methods such as physical examinations and basic laboratory tests may serve as substitutes for more advanced diagnostic technologies in certain cases.In certain scenarios, point-of-care testing (POCT) devices can serve as substitutes for traditional laboratory-based diagnostics. POCT allows for rapid on-site testing, reducing the need for sending samples to centralized laboratories.

Companies in the veterinary diagnostic products industry often engage in regional expansion strategies to broaden their market presence. This involves entering new geographic markets to tap into emerging opportunities, reach a larger customer base, and address the specific needs of diverse regions.Adapting products and strategies to suit regional preferences, regulatory environments, and specific healthcare needs is crucial for successful regional expansion. This may involve customizing diagnostic products to meet the unique requirements and characteristics of different markets.

Testing Category Insights

Based on testing category, the clinical chemistry segment led the market with the largest revenue share of 23.21% in 2024. The segment comprises tests that facilitate the study of the chemical composition of a sample and organ function tests. These tests can help identify specific disorders, such as pancreatitis or diabetes and may also be used to monitor how the animal is responding to treatment. The wide availability and adoption of these tests contribute to the high share of the segment.

The cytopathology segment is anticipated to grow at the fastest CAGR of 13.91% over the forecast period. The segment includes the study of cells from body fluids or tissues to determine a diagnosis. In January 2024, IDEXX introduced the IDEXX in Vue Dx Cellular Analyzer, a slide-free, AI-powered device offering rapid, lab-quality cytology and blood morphology results in 10 minutes. This innovative system streamlines workflows, enhances diagnostic accuracy, and integrates seamlessly with IDEXX's hematology analyzers and practice management tools.

Animal Type Insights

Based on animal type, the companion animals segment led the market with the largest revenue share of 59.26% in 2024. Amongst the companion animals category, the dog segment held the market with the largest revenue share of 54.67% in 2024, while the other companion animals segment is projected to grow at the fastest CAGR over the forecast period. The growing pet population, expenditure on pets, pet humanization, medicalization rate, and uptake of pet insurance are some of the key drivers of the segment. According to the American Pet Products Association (APPA) study conducted between 2023 and 2024, approximately 66% of households in the U.S. have at least one pet, totaling around 86.9 million households. Most insured pets are dogs, accounting for about 80% of the insured population, while cats comprise 20%.

The production animals segment is expected to register at the fastest CAGR from 2025 to 2030, due to rising demand for livestock health management, increasing collaborations, and R&D activities focused on innovative diagnostic solutions. These advancements enable early disease detection, enhancing productivity and supporting the growing global demand for animal-derived food products. For example, in October 2024, Norbrook, in collaboration with the University of Liverpool and Global Access Diagnostics, launched a rapid on-farm liver fluke test for cattle and sheep. This test delivers results in 10 minutes and is a portable and user-friendly kit that enables early detection and targeted treatment, helping farmers improve livestock health while combating anthelmintic resistance.

Product Insights

The consumables, reagents & kits segment led the market with the largest revenue share of 52.96% in 2024. Consumables, reagents, and kits are fundamental components necessary for conducting various diagnostic tests in veterinary medicine. These products are used in laboratories, veterinary clinics, and point-of-care settings for various diagnostic procedures, including blood tests, urinalysis, and immunoassays. The segment covers a broad spectrum of diagnostic applications. The versatility and diversity of consumables and reagents make them indispensable across various diagnostic scenarios.

The equipment & instruments segment is projected to grow at the fastest CAGR during the forecast period. This is owing to technological advancements in diagnostic equipment, increasing adoption of point-of-care testing (POCT) devices, demand for imaging equipment, and investment in veterinary healthcare. For instance, in July 2024, EKF Diagnostics launched the Biosen C-Line, an advanced glucose and lactate analyzer designed for enhanced usability. It features a touch screen and advanced connectivity options to integrate seamlessly with hospital and lab IT systems via EKF Link. This benchtop analyzer provides highly precise glucose and lactate measurements, used in clinical settings for diabetes management and by elite sports teams for tracking lactate production in training.

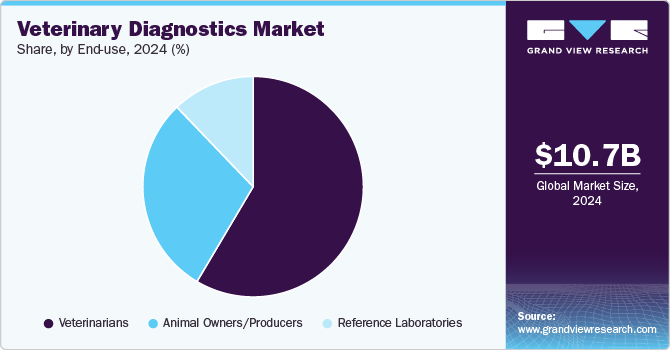

End-use Insights

Based on end use, the veterinarian segment led the market with the largest revenue share of 58.51% in 2024. This segment traditionally holds the largest market share because veterinarians play a central role in animal diagnosis, treatment, and overall healthcare.Veterinary professionals utilize various diagnostic tools and services, including imaging equipment, laboratory tests, and point-of-care diagnostic devices.The segment's dominance is driven by the reliance of animal owners on veterinarians for expert guidance and the comprehensive nature of the diagnostic services they offer.

The animal owners/producers segment is estimated to grow at the fastest CAGR during the forecast period. This is due to the rising popularity of point-of-care testing (POCT) devices that allow on-site diagnostic testing. These devices enable quick and convenient testing at home or on the farm without the need to visit a veterinary clinic, making them attractive to animal owners and producers.For livestock owners and producers, diagnostic tools are crucial for managing herd health, optimizing production, and ensuring the safety of food products. The integration of diagnostics into on-farm practices enhances decision-making and contributes to overall farm management.

Regional Insights

North America veterinary diagnostics market dominated the global market with the largest revenue share of 38.25% in 2024. This is owing to established veterinary healthcare infrastructure, advanced technology adoption, high disposable income, and the presence of key players. Strategic initiatives undertaken by these companies are expected to continue fueling regional market growth. For instance, in September 2023, Embark Veterinary partnered with Assistance Dogs International (ADI) to provide DNA testing kits to North American members of ADI's breeding cooperative. This partnership helps screen for over 250 genetic health conditions in assistance dogs, ensuring healthier breeding practices and longer service dog careers. Thus, partnerships between companies like Embark Veterinary and Assistance Dogs International and Mars Petcare's collaboration with the Broad Institute are expected to enhance access to genetic testing and expand research capabilities.

U.S. Veterinary Diagnostics Market Trends

The veterinary diagnostics market in the U.S. is growing rapidly due to the rise in technological advancements to enhance early disease detection and personalized treatment options for pets, along with the presence of key market players. For example, in September 2022, Antech expanded its canine cancer diagnostic capabilities with new molecular tests like SearchLight DNA and OncoK9 to enhance early detection. These innovations integrate digital cytology, imaging technologies, and molecular diagnostics to support veterinarians and improve outcomes for dogs with cancer. Furthermore, key trends in the U.S. market include the adoption of advanced molecular tests, such as DNA-based assays and biomarker identification tools, which improve diagnostic accuracy in veterinary oncology and other specialized fields.

Europe Veterinary Diagnostics Market Trends

The veterinary diagnostics market in Europe is influenced by several trends, driven by the rising prevalence of several animal disease outbreaks, advancements in disease surveillance, rising pet ownership rates, and the need for effective diagnostic solutions. There were reported outbreaks of various other infectious animal diseases across Europe, including Avian influenza A, Lumpy skin disease, Rift Valley fever, Aujeszky's disease, Bluetongue virus, and African swine fever.

The Germany veterinary diagnostics market is anticipated to grow at a constant CAGR during the forecast period, due to rising animal disease outbreaks, increasing demand for accurate and rapid disease diagnosis, and the adoption of veterinary diagnostic products and solutions. For instance, Germany has reported outbreaks of various diseases, such as African Swine Fever (ASF), Avian Influenza, and Bovine Viral Diarrhea (BVD). According to a new report published by the European Food Safety Authority (EFSA) in 2022, Germany reported 1,444 ASF cases in wild boar, with a significant increase in cases in the eastern part of the country. Similarly, Germany reported 144 outbreaks of Avian Influenza in poultry, with a significant increase in cases in the northern part of the country in 2022.

The veterinary diagnostics market in the UK is anticipated to grow at a significant CAGR during the forecast period, due to rising pet ownership and increased awareness of preventive care. Pets are commonly found in homes everywhere in the UK. A 2024 article published by Pet Keen stated that the pet population in the UK in 2021 was estimated to be 12.5 million dogs & 12.2 million cats. Due to the COVID-19 pandemic and the isolation that followed, there has been a rise in pet ownership in recent years. In addition, people are adopting new pets for love, company, and fun. Currently, 62% of UK residents are pet owners.

Asia Pacific Veterinary Diagnostics Market Trends

The veterinary diagnostics market in Asia Pacific is driven by rising pet ownership, increased awareness of pet health, and a growing demand for breed identification and genetic insights. In countries like Japan and Australia, pet owners are increasingly investing in DNA tests to monitor health risks and hereditary conditions. In addition, the expansion of e-commerce platforms in the region has made veterinary diagnostics testing kits more accessible. Market growth in the region can be attributed to a significantly large cattle population. For instance, China & India constitute more than 30% of the global cattle population. The large livestock population has enhanced the demand for meat & dairy production, which is expected to further boost the demand for veterinary medicines for livestock animals. An increase in the number of veterinary hospitals and clinics in countries such as China is further boosting market growth.

The India veterinary diagnostics market is witnessing notable growth, driven by increasing adoption of advanced PCR-based techniques for early disease detection in livestock and companion animals, growing supportive government initiatives, and rising demand for improved animal healthcare across the country. In addition, the rise in government initiatives to encourage the animal health sector in India is expected to drive market growth during the forecast period. For instance, the Indian Council of Agricultural Research (ICAR) & Indian Veterinary Research Institute (IVRI), under the “Make in India” initiative, developed two diagnostic kits, Bluetongue Sandwich ELISA (sELISA) and Japanese Encephalitis IgM ELISA kits for application in sheep, goats, cattle, buffalo, camel, & other dairy animals. In 2023, the Central Institute for Research on Buffaloes launched an early pregnancy diagnosis test kit called the Preg-D kit, which uses a urine-based diagnostic technique.

Latin America Veterinary Diagnostics Market Trends

The veterinary diagnostics market in Latin America is experiencing significant growth, driven by rising pet ownership and increased awareness of animal health and genetics. The demand for animal protein is increasing in Latin America, expanding the livestock industry. This has resulted in a greater need for accurate and rapid disease diagnosis to ensure animal health and prevent disease outbreaks. In addition, Latin America has experienced outbreaks of various animal diseases, such as Foot-and-Mouth Disease, Avian Influenza, and Porcine Reproductive and Respiratory Syndrome (PRRS). The need for accurate and rapid diagnosis of these diseases drives market growth.

The Brazil veterinary diagnostics market is anticipated to grow at a significant CAGR during the forecast period, as there is an increase in pet ownership, advancements in diagnostic technologies, and rising awareness of animal health. Growth in livestock farming and government initiatives to combat zoonotic diseases further support market expansion. In Brazil, high mortality rates among beef cattle due to infectious diseases underscore the urgent demand for skilled veterinary professionals proficient in molecular diagnostics. This necessity addresses significant financial losses and supports market growth in one of the world's leading beef-producing nations.

Middle East & Africa Veterinary Diagnostics Market Trends

The veterinary diagnostics market in the Middle East & Africa is witnessing significant growth, driven by rising pet adoption rates and increasing awareness about animal health. Growing investment in veterinary healthcare infrastructure and the adoption of advanced diagnostic technologies are also expected to boost market growth. For instance, countries like South Africa and the UAE are leading the adoption with increased spending on veterinary services and diagnostic tools, reflecting the region's evolving healthcare landscape.

The South Africa veterinary diagnostics market is witnessing significant growth driven by increased product launches from domestic players. Companies are introducing innovative testing solutions tailored to local pet owners' needs. For example, the launch of breed identification and health screening tests by local firms like EasyDNA South Africa and International Biosciences South Africa has expanded consumer access to affordable genetic testing options. These products help identify breed composition and screen for potential genetic health risks, empowering pet owners to make informed care decisions. This surge in domestic offerings fosters competition and enhances market awareness, ultimately driving growth in the veterinary diagnostics sector across South Africa.

The veterinary diagnostics market in Saudi Arabia is experiencing significant growth due to the rapid expansion of poultry production in line with the Saudi Vision 2030 initiative. This strategic plan by the Saudi Ministry of Environment, Water and Agriculture (MEWA) aims to significantly increase local poultry production, reducing dependence on oil and diversifying the economy. In 2020, Saudi Arabia produced 900,000 MT of chicken meat, meeting 60% of its domestic consumption needs. The country's poultry production is projected to reach 1.55 million metric tons annually. This expansion in poultry production is driving market growth in Saudi Arabia. As the poultry industry grows, there is an increasing demand for advanced diagnostic tools to ensure animal health and productivity. The focus on improving veterinary diagnostics aligns with the broader goals of enhancing food security and supporting sustainable agricultural practices.

Key Veterinary Diagnostics Company Insights

The market is characterized by the presence of several large, medium, to small companies. Some of the key players operating in the market include IDEXX Laboratories, Inc.; Zoetis; Antech Diagnostics, Inc. (Mars Inc.); and Agrolabo S.p.A.Market players often engage in collaborations and partnerships with veterinary clinics, research institutions, and academic organizations. These collaborations aim to enhance research and development efforts, share knowledge, and expand the reach of diagnostic products in the veterinary healthcare ecosystem.Market players are also increasingly expanding their geographical presence to tap into emerging markets and capitalize on the growing awareness of veterinary diagnostics. Globalization allows companies to reach a wider customer base and address the diverse needs of veterinarians and pet owners worldwide. Furthermore, the veterinary diagnostics industry has experienced some consolidation as larger companies aim to achieve economies of scale, gain a competitive edge, and establish a more comprehensive presence in the global market.

Key Veterinary Diagnostics Companies:

The following are the leading companies in the veterinary diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories, Inc.

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- Agrolabo S.p.A.

- Embark Veterinary, Inc.

- Esaote SPA

- Thermo Fisher Scientific, Inc.

- Innovative Diagnostics SAS

- Virbac

- FUJIFILM Corporation

Recent Developments

-

In September 2024, Zoetis Inc. introduced Vetscan OptiCell, a new cartridge-based hematology analyzer that employs AI-powered technology to deliver precise Complete Blood Count (CBC) analysis at the point of care, offering lab-quality results with time, cost, and space efficiencies for veterinary clinics.

-

In July 2024, EKF Diagnostics launched the Biosen C-Line, an advanced glucose and lactate analyzer designed for enhanced usability. It features a touch screen and advanced connectivity options to integrate seamlessly with hospital and lab IT systems via EKF Link. This benchtop analyzer provides highly precise glucose and lactate measurements, used in clinical settings for diabetes management and by elite sports teams for tracking lactate production in training.

-

In February 2024, MiDOG Animal Diagnostics introduced an advanced All-in-One Diagnostic Test capable of rapidly detecting bacterial and fungal infections, including antibiotic resistance, across various animal species. This innovation aims to enhance veterinary care by replacing traditional testing methods with efficient molecular-based diagnostics, supporting comprehensive treatment strategies for diverse animals, from pets to exotic species.

Veterinary Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.78 billion

Revenue forecast in 2030

USD 19.00 billion

Growth rate

CAGR of 10.04% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, testing category, animal type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Netherlands; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

IDEXX Laboratories, Inc.; Zoetis; Antech Diagnostics, Inc. (Mars Inc.); Agrolabo S.p.A.; Embark Veterinary, Inc.; Esaote SPA; Thermo Fisher Scientific, Inc.; Innovative Diagnostics SAS; Virbac; FUJIFILM Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary diagnostics market report based on product, animal type, testing category, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables, Reagents & Kits

-

Equipment & Instruments

-

-

Testing Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Chemistry

-

Microbiology

-

Parasitology

-

Histopathology

-

Cytopathology

-

Hematology

-

Immunology & Serology

-

Imaging

-

Molecular Diagnostics

-

Other Categories

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Cattle

-

Poultry

-

Swine

-

Other Production Animals

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Other Companion Animals

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Reference Laboratories

-

Veterinarians

-

Animal Owners/ Producers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global veterinary diagnostics market is expected to grow at a compound annual growth rate of 10.04% from 2025 to 2030 to reach USD 19.00 billion by 2030.

b. By region, North America held the largest market share of about 38.25% in 2024. This is owing to established veterinary healthcare infrastructure, advanced technology adoption, presence of key companies, and high disposable income.

b. Some key players operating in the veterinary diagnostics market include IDEXX Laboratories, Inc.; Zoetis; Antech Diagnostics, Inc. (Mars Inc.); Agrolabo S.p.A.; Embark Veterinary, Inc.; Esaote SPA; Thermo Fisher Scientific, Inc.; Innovative Diagnostics SAS; Virbac; and FUJIFILM Corporation.

b. Key factors that are driving the veterinary diagnostics market growth include increased expenditure on animal health, rising incidence of diseases in animals, advancements in diagnostics, and increasing medicalization rate.

b. The global veterinary diagnostics market size was estimated at USD 10.71 billion in 2024 and is expected to reach USD 11.78 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.