- Home

- »

- Animal Health

- »

-

Veterinary Hospital Market Size, Share, Industry Report 2033GVR Report cover

![Veterinary Hospital Market Size, Share & Trends Report]()

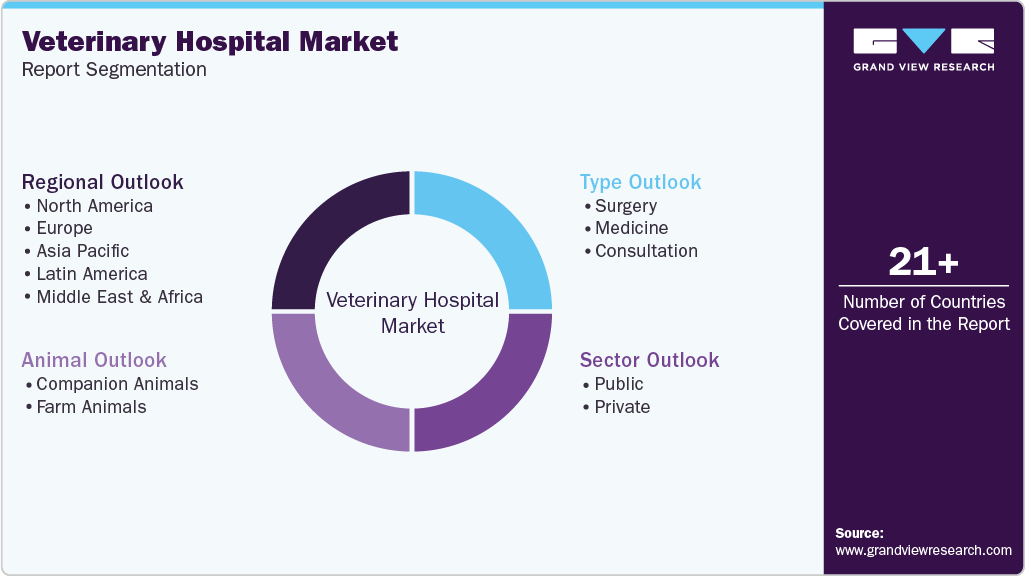

Veterinary Hospital Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal (Companion, Farm), By Type (Surgery, Medicine, Consultation), By Sector (Public, Private), By Region (Asia Pacific, North America, Europe, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-910-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Hospital Market Summary

The global veterinary hospital market size was estimated at USD 61.64 billion in 2024 and is projected to reach USD 120.13 billion by 2033, growing at a CAGR of 7.74% from 2025 to 2033. Some of the factors driving the market growth are the consolidation of animal hospitals, the growing animal population & adoption, the rising awareness of animal health, & increasing adoption of pet insurance.

Key Market Trends & Insights

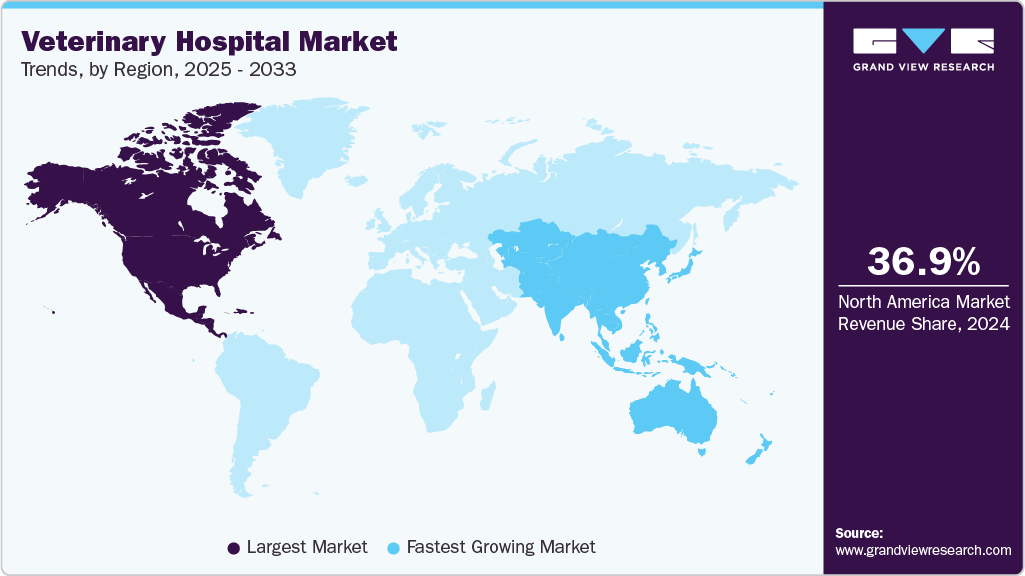

- On the basis of region, North America captured the largest market share with 36.95% in 2024.

- The U.S. veterinary hospital market is expected to grow at a significant CAGR over the forecast period.

- Based on animal, the companion animals segment dominated the market with the share of 62.56% in 2024.

- On the basis of type, the surgery segment is expected to grow at the highest CAGR of 8.58% during the forecasted period.

- On the basis of sector, the private segment is expected to grow at the considerable CAGR during the forecasted period.

Market Size & Forecast

- 2024 Market Size: USD 61.64 Billion

- 2033 Projected Market Size: USD 120.13 Billion

- CAGR (2025-2033): 7.74%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The consolidation of veterinary hospitals is reshaping the competitive landscape of the animal healthcare sector, creating a structural shift from fragmented, independently run clinics to streamlined, multi-unit networks owned by corporate groups and private equity firms. This trend is driven by the growing complexity of veterinary services, which now increasingly require capital-intensive infrastructure such as diagnostic labs, surgical suites, digital imaging, and cloud-based practice management systems, investments that are difficult for single-site operators to make independently.As pet ownership surges and clients demand more sophisticated, 24/7 services, large consolidators are stepping in to bridge this gap, acquiring independent hospitals and folding them into branded platforms with centralized procurement, HR, marketing, and administrative support. For veterinarians nearing retirement, these buyouts offer a clean exit and financial upside, while younger practitioners benefit from reduced managerial burden and improved access to technology. Meanwhile, corporate groups are utilizing these roll-ups to introduce tiered care models, subscription-based wellness plans, and scalable telehealth services across entire regions. This allows them to capture more lifetime value per client while standardizing quality and pricing, resulting in higher margins and enhanced customer retention.

Furthermore, the consolidation of animal hospitals is unlocking new revenue streams and accelerating the transformation of veterinary care into a consumer-centric, multi-channel service model. By integrating independent practices into larger corporate ecosystems, consolidators can deploy uniform pricing structures, launch centralized booking platforms, and implement AI-enabled analytics to monitor clinical performance and client engagement across hundreds of locations. This level of coordination enables strategic service expansion, such as adding dermatology, dentistry, oncology, and rehabilitation units within existing hospital footprints, boosting the value of each patient visit. It also supports the bundling of services like diagnostics, pharmacy fulfillment, and follow-up care into cohesive care plans that enhance customer loyalty and lifetime spend. Large groups benefit from superior purchasing power, allowing them to negotiate better rates for medical supplies and pharmaceuticals, which in turn fuels reinvestment in clinic upgrades and staff training.

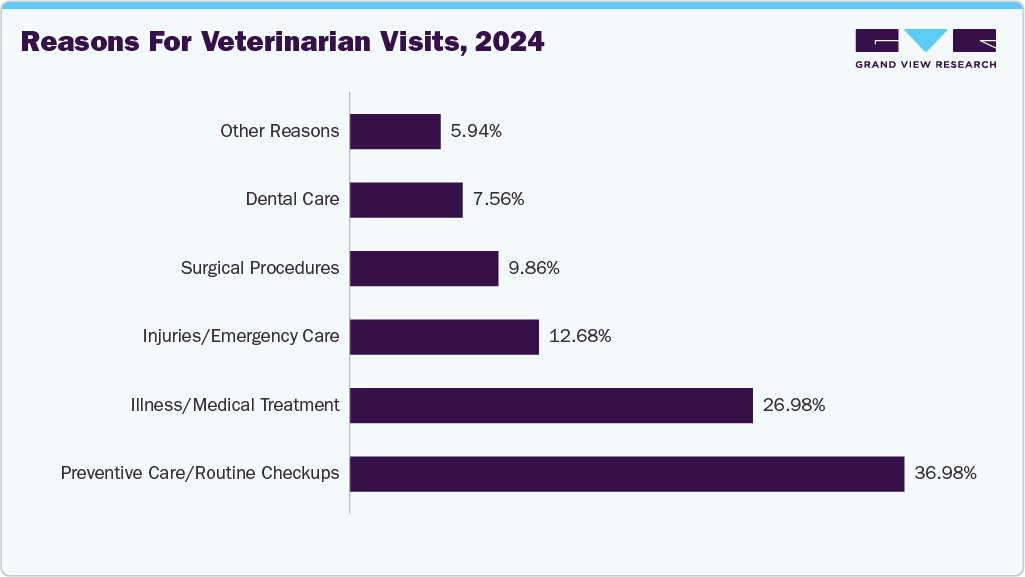

Increasing awareness of animal health among pet owners and livestock producers is driving demand for preventive, diagnostic, and specialty veterinary care. Informed by digital resources, veterinary advocacy, and government programs, consumers prioritize wellness checks, disease prevention, and early detection. This trend boosts hospital visits, expands long-term care adoption, and positions veterinary hospitals as critical hubs for comprehensive animal healthcare across markets.

The chart below highlights various reasons of pet parents for veterinarian visits, 2024:

Rising pet insurance adoption is boosting veterinary hospital visits, enabling access to advanced care and preventive services. Affordable, customizable plans, digital platforms, and quick claims drive uptake, especially among millennials. Insured pet owners pursue timely treatments, encouraging hospitals to expand specialty services, invest in technology, and offer integrated care packages, elevating pet healthcare standards and fuelling market growth.

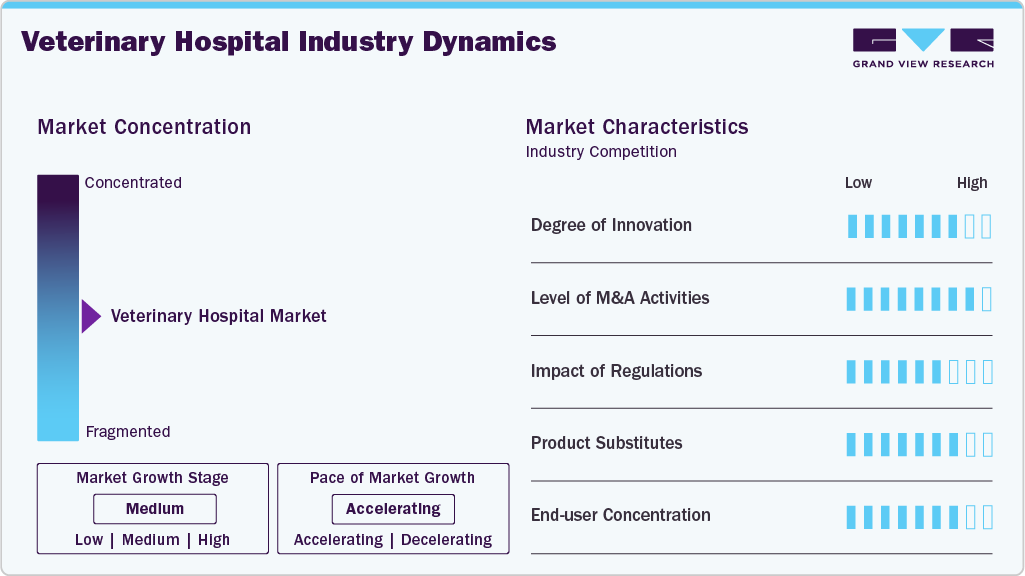

Market Concentration & Characteristics

The industry exhibits a moderate concentration in the market, and the pace of the growth is accelerating. The market is dominated by global players such as The Animal Medical Center, VCA Animal Hospitals, VetStrategy and Royal Veterinary College (RVC). These hospitals leverage strong R&D, broad portfolios, and global distribution networks to maintain competitiveness.

Veterinary hospitals are rapidly innovating through the adoption of AI diagnostics, telemedicine, minimally invasive surgeries, and digital health records. In January 2025, Petvisor Hub was launched as a platform integrating AI and PetDesk solutions to help enterprise veterinary groups streamline operations, enhance client experience, optimize marketing, and improve care across hospital networks. These advances improve care accuracy, treatment outcomes, and client convenience, fueling industry growth. Innovation also includes specialized services in oncology, cardiology, and advanced imaging, driven by rising pet owner expectations and tech integration in animal healthcare.

The industry is experiencing significant mergers and acquisitions as companies aim to consolidate specialized services, expand geographic reach, and enhance operational efficiency. According to the report of August 2025, Inspire Veterinary Partners is planning to acquire its first New Jersey animal hospital and expand its network to 15 clinics across 11 states. Such strategic partnerships further boost innovation and market penetration amid growing demand for veterinary services.

Stringent regulations ensure high standards of veterinary practice, animal welfare, and biosecurity. These frameworks promote the adoption of advanced technologies and preventive care, while ensuring quality and safety. Government initiatives and compliance requirements elevate market professionalism but may increase operational costs for providers.

Substitutes include telehealth consultations, Do-It-Yourself (DIY) pet care products, and over-the-counter diagnostics. In February 2025, Supertails launched India’s first fear-free pet clinic in Bengaluru, staffed by certified vets, aiming to create calm, compassionate vet visits. However, substitutes lack the comprehensive in-person diagnostics, treatments, and surgical interventions that veterinary hospitals provide, preserving strong demand for hospital services, particularly for complex and critical care.

The end user base is widely dispersed, ranging from individual pet owners to commercial farms. Companion animal owners predominantly drive demand for advanced veterinary hospitals. The rise of pet humanization and increasing awareness fosters a loyal consumer base. Livestock and poultry sectors also contribute significantly, demanding routine and specialized veterinary services.

Animal Insights

Companion animals represented the largest segment in the veterinary hospital market with a revenue share of 62.56% in 2024 and are expected to grow at the fastest rate over the forecast period, due to the growing global pet population and increased pet humanization. In 2025, it is estimated that over 50% of the world's population owns one or the other type of pet, with the U.S., EU, and China collectively housing more than 500 million dogs and cats. In the U.S. alone, 94 million households (71%) own pets, including 68 million dogs and 49 million cats.

This expansive companion animal base fuels growing demand for veterinary services such as preventive care, diagnostics, surgeries, and wellness treatments. The trend is propelled by rising disposable incomes, urbanization, and advanced care adoption, making companion animals the pivotal force behind veterinary hospital market growth worldwide. Increasing incidents of accidents, infectious diseases, and emergency care needs further expand hospital visits, contributing to robust market prospects in this segment.

Type Insights

The medicine segment is the largest in the veterinary hospital market with a revenue share of about 46% in 2024. The segment's growth is driven due to the increasing prevalence of chronic and infectious diseases in both companion and farm animals. Pets are living longer, leading to a higher incidence of age-related conditions such as arthritis, cardiovascular disease, diabetes, and skin disorders all of which require ongoing pharmacological management.In farm animals, the growth is driven by the need to manage herd health and prevent outbreaks that could result in significant economic losses.

The surgery segment is the fastest-growing in the veterinary hospital market over the forecast period. This growth is driven by technological advancements in surgical instruments, robotics, and imaging techniques such as 3D printing and VR training for vets. Increasing demand for efficient, minimally invasive, and specialized surgical procedures, along with heightened awareness of animal welfare, also fuels growth. In livestock animals, surgical services are also in demand for reproductive management, dehorning, hernia repairs, and trauma-related procedures. Although historically less common than in pets, the increasing economic value of livestock and the shift toward high-yield, intensive farming practices are encouraging farmers to seek veterinary surgical care to protect herd productivity.

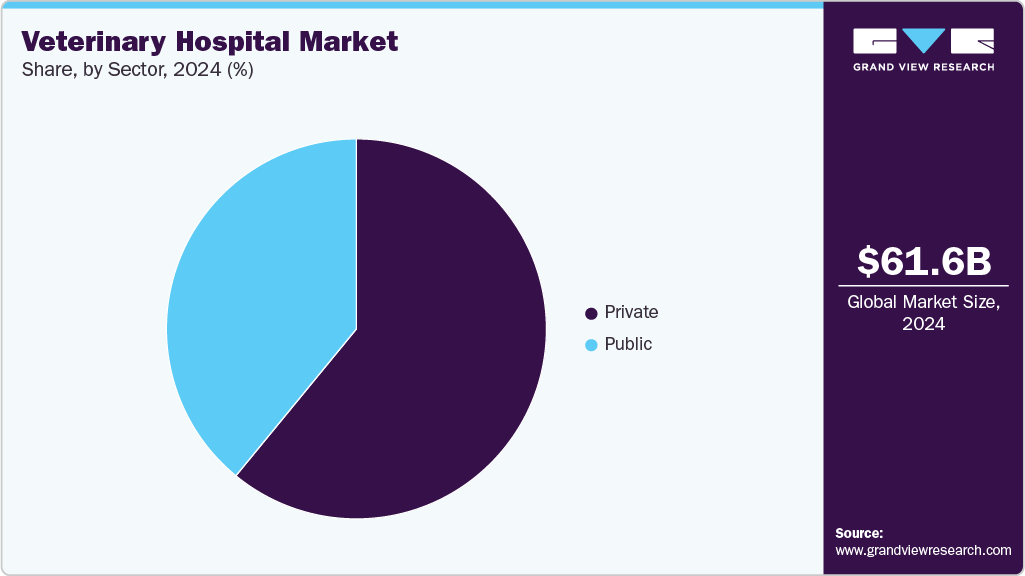

Sector Insights

The private segment is the largest in the veterinary hospital market, accounting for about 60% of the market share in 2024 and demonstrating the fastest growth rate from 2025 to 2033. This expansion is driven by rising disposable incomes, improving socio-economic conditions, and an increasing preference for high-quality, personalized veterinary care services. Technological advancements such as telemedicine, AI diagnostics, and advanced surgical tools further enhance the private segment’s appeal. Additionally, the adoption of pet insurance has made private veterinary care more accessible and affordable, reducing financial burdens on pet owners.

The shift from public to private veterinary services is especially evident in developed regions like North America and Europe, where consolidated hospital networks and specialized care thrive. This trend is bolstered by the growing companion animal population, heightened pet humanization, and demand for preventative and advanced treatments. Overall, the private segment’s blend of superior care, innovation, and operational efficiency positions it as the key driver of growth in the global veterinary hospital market through the next decade.

Regional Insights

North America veterinary hospital market led with the largest share of 36.95% in 2024. Growth drivers include rising pet ownership, increased animal health awareness, and growing pet humanization. Technological advancements like AI diagnostics, telemedicine, electronic health records, minimally invasive surgeries, and wearable monitoring enhance clinical outcomes and operational efficiency across urban and rural veterinary services. The region is witnessing significant expansion, for instance, in July 2023, Trupanion expanded partnerships with over 60 North American multilocation veterinary groups, enabling direct payment at checkout and simplifying billing for pet owners, veterinarians, and hospital teams.

U.S. Veterinary Hospital Market Trends

The veterinary hospital market in the U.S. is highly competitive, led by players like Banfield Pet Hospital, VCA, and BluePearl. Growth is driven by rising pet ownership, increased spending on pet healthcare, and demand for specialized services. Technological advancements, including telemedicine, advanced diagnostics, and minimally invasive procedures, are enhancing service quality and expanding market reach across urban and suburban regions. The market is marked by strategic expansions and service enhancements. In January 2025, MedVet opened two new hospitals MedVet Diley Hill and MedVet Hilliard offering 24/7 emergency and specialty care in Ohio, featuring expanded facilities and advanced equipment.

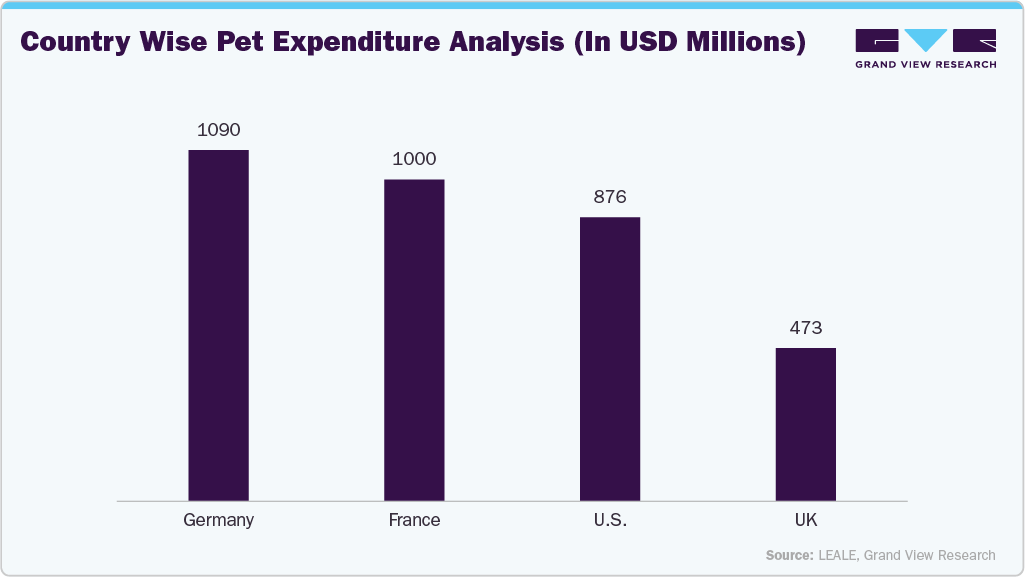

Europe Veterinary Hospital Market Trends

The veterinary hospital market in Europe is led by independent clinics and large networks, particularly in the UK, Germany, and France. Growth is driven by rising preventive care demand, and technological adoption, including AI diagnostics and telemedicine. Private equity-backed consolidations, clinical specialization, and regulatory compliance further enhance service quality and expand market reach across urban and semi-urban regions. In May 2023, Ardian acquired a minority stake in Mon Véto, France’s second-largest veterinary group, supporting its growth plan. Mon Véto operates 231 clinics, employs 1,200 staff, and continues founder-led expansion.

The UK veterinary hospital market is dominated by large networks like CVS Group and independent clinics. Growth is driven by rising pet ownership, preventive care demand, and premium services. Private equity-backed consolidations, clinical specialization, and advanced technologies such as digital diagnostics, telemedicine, and in-house labs enhance service quality, operational efficiency, and regional expansion, strengthening market presence across urban and suburban areas. In November 2023, Royal Veterinary College partnered with Mumbai’s AVCF to foster collaboration in veterinary medicine and One Health, supporting and advancing high-quality veterinary care in India.

Asia Pacific Veterinary Hospital Market Trends

The veterinary hospital market in Asia-Pacific is driven by rising pet ownership, increasing disposable incomes, and growing awareness of animal health. Key players include AVCF, VCA affiliates, and regional hospital chains. Market growth is supported by advanced diagnostics, specialty services, telemedicine adoption, and government initiatives promoting pet welfare, while consolidations and private investments are strengthening regional networks and service quality.

India veterinary hospital market is rapidly growing, driven by growing awareness of animal health, increasing livestock productivity needs, and the proliferation of pet care as a consumer lifestyle segment. Key players such as Zigly as reported in April 2025, are expanding through new hospitals, omni-channel stores, and 24/7 facilities. Growth is supported by tech-enabled services, holistic care models, and experiential centers, while millennials and Gen-Z pet owners increasingly demand comprehensive, high-quality veterinary services.

Latin America Veterinary Hospital Market Trends

The veterinary hospital market in Latin America is driven by a rising middle-class population, increased awareness of pet health, and the growing importance of animals in households and agribusiness. Besides, the demand for veterinary care, particularly preventive treatments, vaccinations, and emergency services, has surged in countries such as Brazil and Argentina as pet ownership continues to rise. Additionally, the livestock sector, especially cattle and poultry, requires veterinary services to maintain productivity and ensure animal welfare in compliance with export standards, which is anticipated to drive the market over the estimated period.

Brazil veterinary hospital market is fueled by a robust pet economy, rising pet insurance adoption, and demand for specialized services. Major cities like São Paulo and Rio de Janeiro host modern, multispecialty hospitals, while rural areas rely on basic clinics. Growth is driven by preventive care, telemedicine adoption, and investments in advanced diagnostics, emergency services, and skilled veterinary training. In November 2024, L Catterton invested in WeVets, Brazil’s independent veterinary hospital group, to accelerate its expansion.

Middle East & Africa Veterinary Hospital Market Trends

The veterinary hospital market in the Middle East is driven by rising pet adoption, rising incidence of zoonotic diseases, and government efforts to modernize animal health systems. Efforts by governments to enhance veterinary public health systems and modernize the livestock sector are driving demand for veterinary services, particularly in GCC countries and parts of Sub-Saharan Africa. Advanced facilities, such as Salam Equine Hospital expanded in Buraidah in August 2025, highlighting the region’s investment in specialized care and global partnerships. The major markets like the UAE and Saudi Arabia lead in technology adoption, while private hospital chains expand in urban centers. Growth is further fueled by public-private collaborations, regulatory reforms, and increasing demand for high-quality veterinary services across companion and livestock segments.

South Africa veterinary hospital market is fueled by rising pet ownership, increased preventive care awareness, and expanding livestock health initiatives. Urban centers like Johannesburg, Cape Town, and Durban host advanced hospitals offering specialty services, while rural areas rely on smaller clinics and mobile units. Key drivers include telemedicine adoption, community-based interventions for stray populations, and government-backed disease control programs. In July 2025, The University of Pretoria’s Onderstepoort Veterinary Academic Hospital, in partnership with Royal Canin, launched Gauteng’s first Gold Status Cat-Friendly Clinic, earning ISFM’s highest accreditation for excellence in feline care, handling, and stress-free veterinary environments.

Key Veterinary Hospital Companies Insights

Key players operating in the veterinary hospital market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Veterinary Hospital Companies:

The following are the leading companies in the veterinary hospital market. These companies collectively hold the largest market share and dictate industry trends.

- The Animal Medical Center

- VCA Animal Hospitals

- VetStrategy

- Royal Veterinary College (RVC)

- École Nationale Vétérinaire d'Alfort (ENVA)

- Tierärztliche Hochschule Hannover (TiHo)

- Beijing Xintiandi International Animal Hospital

- MaxPetZ

- Daktari Animal Hospital

- SASH Vets

- HVM Brasil

- OVAH South Africa

- CVS Group

- Greencross Vets

- National Veterinary Associates, Inc. (NVA)

- Pets at Home Group PLC

- Animal Hospital, Inc.

- All Pets Veterinary Hospital

Recent Developments

-

In August 2025,Inspire Veterinary Partners signed an exclusive, non-binding LOI to acquire a New Jersey animal hospital, aiming to add USD 2 million in revenue and expand its network to 15 hospitals.

-

In July 2025, the animal husbandry department launched a mobile veterinary surgery unit in Thiruvananthapuram, India, staffed by two surgeons and attendants, and began operations with three surgeries registered at Attingal government veterinary hospital.

-

In February 2025, DoveLewis Veterinary Emergency & Specialty Hospital opened a specialty facility in Portland, Oregon, featuring advanced equipment, specialty services, and educational spaces, becoming one of the largest non-university veterinary medical centers in the U.S.

Veterinary Hospital Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 66.17 billion

Revenue forecast in 2033

USD 120.13 billion

Growth rate

CAGR of 7.74% from 2025 to 2033

Actual data

2024

Historical Period

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, type, sector, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

The Animal Medical Center; VCA Animal Hospitals; VetStrategy; Royal Veterinary College (RVC); École Nationale Vétérinaire d'Alfort (ENVA); Tierärztliche Hochschule Hannover (TiHo); Beijing Xintiandi International Animal Hospital; MaxPetZ; Daktari Animal Hospital; SASH Vets; HVM Brasil; OVAH South Africa; CVS Group; Greencross Vets; National Veterinary Associates; Inc. (NVA); Pets at Home Group PLC; Animal Hospital, Inc.; All Pets Veterinary Hospital

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Hospital Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary hospital market report based on animal, type, sector, and region.

-

Animal Outlook (Revenue, USD Billion, 2021 - 2033)

-

Companion Animals

-

Farm Animals

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Surgery

-

Medicine

-

Consultation

-

-

Sector Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public

-

Private

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary hospital market size was estimated at USD 61.64 billion in 2024 and is expected to reach USD 66.17 billion in 2025.

b. The global veterinary hospital market is expected to grow at a compound annual growth rate of 7.74% from 2025 to 2033 to reach USD 120.13 billion by 2033.

b. By sector, the private segment is the largest in the veterinary hospital market, accounting for about 60% of the market share in 2024 and demonstrating the fastest growth rate from 2025 to 2033. This expansion is driven by rising disposable incomes, improving socio-economic conditions, and an increasing preference for high-quality, personalized veterinary care services. Technological advancements such as telemedicine, AI diagnostics, and advanced surgical tools further enhance the private segment’s appeal.

b. Some key players operating in the veterinary hospital market include The Animal Medical Center, VCA Animal Hospitals, VetStrategy, Royal Veterinary College (RVC), École Nationale Vétérinaire d'Alfort (ENVA), Tierärztliche Hochschule Hannover (TiHo), Beijing Xintiandi International Animal Hospital, MaxPetZ, Daktari Animal Hospital, SASH Vets, HVM Brasil, OVAH South Africa, CVS Group, Greencross Vets, National Veterinary Associates, Inc. (NVA), Pets at Home Group PLC, Animal Hospital, Inc., and All Pets Veterinary Hospital

b. Key factors that are driving the veterinary hospital market growth include increasing consolidation of animal hospitals, growing animal population & adoption, rising awareness of animal health, & increasing adoption of pet insurance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.