- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Wheat Protein Market Size, Share And Growth Report, 2030GVR Report cover

![Wheat Protein Market Size, Share & Trends Report]()

Wheat Protein Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Wheat Gluten, Wheat Protein Isolate, Textured Wheat Protein, Hydrolyzed Wheat Protein), By Concentration, By Form, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-790-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wheat Protein Market Size & Trends

The global wheat protein market size was valued at USD 6.77 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. The growth of the wheat protein industry is expected to be driven by the rising adoption of plant-based diets as well as an increase in the number of people adopting vegan diets in developing economies. Furthermore, product demand is likely to be fueled by a rising geriatric population, income levels, and increased urbanization.

The growth of the wheat protein industry is expected to be driven by the rising adoption of plant-based diets as well as an increase in the number of people adopting vegan diets in developing economies. Furthermore, product demand is likely to be fueled by a rising geriatric population, income levels, and increased urbanization.

Weight control was always a concern in the global population and now obesity has become an epidemic worldwide. According to the World Health Organization, global obesity has tripled since 1975, with approximately 13% of adults obese and 39% of adults overweight. Furthermore, according to the Global Nutrition Report, 149.2 million children under the age of five are stunted, 38.9 million are overweight, and 45.4 million are wasted. As a result, people are focusing on eating a healthy, plant-based diet to maintain their overall health and weight, which is driving market growth.

Wheat protein offers exceptional capabilities for a broad range of industries due to several benefits. Among its many uses are bakery products, flour milling, meat replacer, pasta, aquafeed, breakfast cereal, milk replacer, and pet food. The baker's adjustment, also known as the flour miller, is the most fundamental and widely used application of wheat protein. As a result, such a wide range of applications for various end-use industries is anticipated to fuel market growth over the forecast period.

Lactose intolerance is a condition in which the body is unable to digest lactose, a type of natural sugar in dairy products such as milk. Although whey protein isolates are more filtered and processed to effectively remove more lactose than whey protein concentrates, individuals who have even a slight lactose intolerance should avoid such products. For consumers who want to boost protein intake for health or training purposes, plant-based alternatives such as wheat protein are the best option which may contribute to the market growth.

The limited supply of wheat for protein extraction in some regions is expected to limit market growth over the coming years. Furthermore, it contains gluten, which can cause diseases in consumers thereby limiting the product demand. Additionally, rising wheat prices with high protein content, the presence of a large number of alternatives, and increasing incidences of celiac disease are expected to limit growth over the projected timeframe.

Market Dynamics

The changing health trends, growing environmental sustainability concerns, and rising consumer preference toward plant-based proteins are driving the growth of cereal-derived proteins. Some of the most important factors driving consumer interest in plant-based foods are growing awareness regarding protein-rich diets, interest in health & wellness-promoting food options, and consumer sentiment toward animal cruelty. The increased interest in plant-based sources of protein is projected to remain one of the key market drivers for wheat protein demand worldwide.

Growing application of wheat protein in different industries, including animal feed, sports nutrition, and personal care products, is projected to drive market growth. Wheat gluten makes an ideal component for animal feed, especially for aquaculture, owing to its protein-rich content. The fiber content is also driving product usage in liquid formulations for animal feed. Effectiveness of wheat gluten in the binding and formation of hard pellets supports its demand in the animal feed sector. Wheat gluten is considered a good alternative to high-quality milk proteins such as casein in feed for young animals. Substitution of casein with wheat gluten is further supported by the cost-effectiveness of wheat proteins.

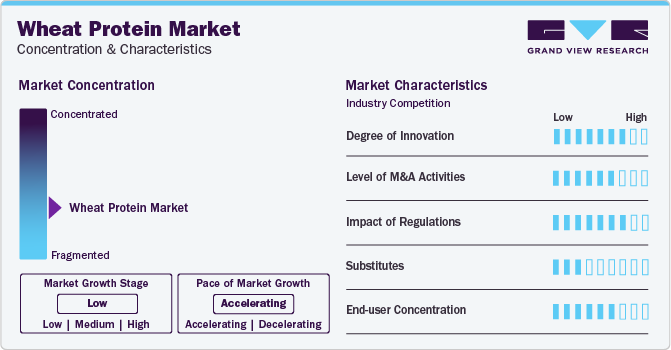

Market Concentration & Characteristics

The growth of this market can be attributed to innovations in wheat protein have been particularly significant in the context of plant-based and gluten-free products. Manufacturers are developing gluten-free wheat protein options to cater to consumers with gluten sensitivities or those following gluten-free diets.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their position in the market. Over the next few years, internationally reputed companies are likely to acquire small-and medium-sized companies operating in the industry in a bid to facilitate regional expansion.

Compliance with food safety regulations is crucial. Wheat protein manufacturers must ensure that their products meet safety standards to prevent contamination and ensure consumer well-being. However, Soy protein, pea protein, and rice protein are common substitutes for wheat protein. These plant-based alternatives offer diverse nutritional profiles and are used in various food products, including meat alternatives, protein bars, and dairy replacements. The choice of substitute depends on specific dietary needs, functional properties, and flavor considerations in food formulations.

Product Insights

Wheat gluten accounted for a share of over 45% of the global revenues in 2023. Wheat gluten has a wide range of functionalities, including texturing, viscoelasticity, foaming, binding, and emulsification which leads to its widespread use in bakery products. It also acts as an excellent meat substitute for vegetarian and vegan products. These properties are expected to drive the segment demand during the forecast period.

However, due to rising gluten intolerance rates, demand for wheat gluten has been restrained in recent years. Celiac disease affects one out of every 133 individuals in the U.S. according to Beyond Celiac. The disease is inherited and is passed through generations. It raises the chances of developing arthritis, liver disease, obesity, peripheral neuropathy, lactose intolerance, and other diseases. Gluten intolerance can only be treated with a gluten-free diet. Furthermore, even those who are not allergic to gluten prefer a gluten-free diet which may hinder the segment growth.

Hydrolyzed wheat protein is anticipated to expand at a CAGR of 4.8% from 2024 to 2030. The rapid expansion of this segment is primarily due to the growing demand for plant-based ingredients in dietary supplements and technical advances in the personal care and cosmetics product sector. Furthermore, wheat protein isolate is experiencing a significant rate of growth in demand. It is a protein-rich dietary supplement that is widely used in sports supplements.

Form Insights

The dry wheat protein market is experiencing growth driven by several factors. A rising awareness of plant-based diets and a demand for alternative protein sources contribute to the increased popularity of dry wheat protein. Additionally, its extended shelf life, ease of storage, and versatility in various food applications, including bakery and meat alternatives, make it an attractive choice for manufacturers.

The liquid wheat protein market is witnessing growth due to its diverse applications and convenience in food and beverage formulations. As the demand for plant-based and clean-label products rises, liquid wheat protein serves as a versatile ingredient in the formulation of beverages, sauces, and dressings. Its soluble nature makes it easier to incorporate into liquid products seamlessly.

Concentration Insights

Wheat protein is made up of protein ingredients extracted from wheat using various methods. The global wheat protein market is segmented into three concentrations: 75% protein, 80% protein, and 95% protein. 75% protein led the market with the highest revenue share of over 41% in 2021 since it contains a higher concentration of diluted protein and is primarily used in dietary supplements.

Concentrations of 95% and 80% show some issues with characteristics such as aggregation, gelation, precipitation, and high viscosity. Therefore, the development of the formulation requires manufacturing process stability as well as several other delivery-related difficulties. This limits the overall demand for formulations with higher protein concentrations.

Application Insights

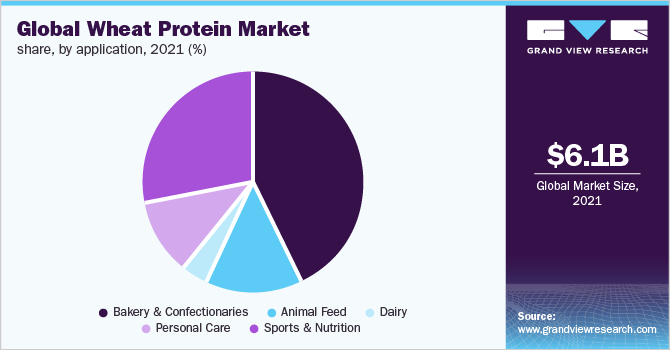

Bakery and confectionery accounted for a share of around 40% of the global revenues in 2023. The demand for wheat protein in bakery applications is being driven by factors like increased moisture content, improved water absorption, and softness of the finished product. Furthermore, increased consumption of quick-bite foods like confectionery and snacks as a result of changing lifestyles is fueling product demand. The market will grow further during the forecast period due to increased product adoption in the manufacturing of pastries, bread, cakes, rolls, and other bakery items to meet rising consumer demand.

Dairy in the application segment is expected to grow at a CAGR of 1.5% from 2024 to 2030. The large presence of lactose-intolerant people has increased demand in the dairy application segment. Additionally, this protein effectively replaces lactose in fermented dairy items. It is frequently used in vegetable beverages and desserts and serves primarily as a low-cost alternative to milk. People who are lactose intolerant are the products' target market. Additionally, hydrolyzed proteins work well to replace dairy proteins. As a result, the demand would continue to be supported in the coming years by expanding applications in the dairy industry.

Wheat proteins serve as an essential nutritional supplement for good health. Compared to whey and casein, it is a low-calorie supplement with a higher glutamine content. Additionally, it aids in the treatment of cardiovascular diseases and cholesterol management. It can be a vital component of a healthy diet because of its many advantages, thus driving up consumer demand. Furthermore, athletes and bodybuilders who engage in strength training prefer wheat-based protein isolates because they have higher nutritional content and few calories.

Regional Insights

North America held a share of over 33% of the global market in 2023. This region's market share can be attributed to several factors, including growing consumer awareness of the health benefits of wheat protein, and the well-established food processing industry. Additionally, an increasing vegetarian population, the growing consumption of bakery goods, and meat substitutes are fueling product demand. Other contributing factors include the enormous production of wheat and the rising demand for healthy and nutritional products in the region.

U.S. wheat protein market

The wheat protein market in the U.S. is expected to grow at a CAGR of 4.6% during the forecast period. The demand for wheat protein in the U.S. is rising due to growing consumer interest in plant-based and sustainable diets. With an increasing number of individuals adopting vegetarian and flexitarian lifestyles, wheat protein serves as a versatile and nutritious alternative, particularly in the production of plant-based meat substitutes, snacks, and bakery products. Additionally, the heightened awareness of health and wellness, coupled with the gluten-free trend, further contributes to the expanding market demand for wheat protein.

The market in Asia Pacific is expected to grow at a CAGR of 5.2% from 2024 to 2030.The growing vegan population and increased awareness of healthy food consumption among people seeking to live a healthy lifestyle. The industrial growth of the healthcare and cosmetics sectors in China, Australia, India, and South Korea, combined with rising domestic demand is boosting the product demand. Moreover, low protein manufacturing costs in comparison to the U.S. and developed European countries is anticipated to propel the market over the projected timeframe.

India wheat protein market

The wheat protein market in Indiais projected to grow at a CAGR of 13.2% during the forecast period. Driven by the demand for wheat protein is on the rise as dietary preferences shift towards healthier and plant-based options. With a growing focus on wellness, consumers are incorporating wheat protein into their diets for its nutritional benefits.

Key Companies & Market Share Insights

The global wheat protein market is expected to witness high competition among the companies owing to the presence of a large number of players across the globe. Manufacturers are increasingly engaged in R&D activities to formulate innovative products owing to increasing demand from consumers. The players focus on capacity and geographic expansions as well as strategic mergers & acquisitions to gain a competitive edge in the market.

For instance, in August 2021, Summit Ag along with its portfolio company named Summit Sustainable Ingredients announced the establishment of a wheat protein manufacturing facility worth USD 200 million to be built near Prairie Horizon Agri-Energy. The facility is expected to be operational by the summer of 2023 which will expand the production capacity of wheat protein to nearly double any existing unit in North America.

Key Wheat Protein Companies:

The following are the leading companies in the wheat protein market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these wheat protein companies are analyzed to map the supply network.

- Archer Daniels Midland Company (ADM)

- Agridient

- MGP Ingredients

- AB Amilina

- Cargill Inc

- Manildra Group

- Crespel & Deiters GmbH and Co. KG

- Kroener Staerke

- Crop Energies AG

- Roquette

Recent Developments

-

In January 2023, Amber Wave has initiated operations at the largest wheat protein facility in North America, following an investment from Summit Agricultural Group. The company is currently manufacturing AmberPro™ Vital Wheat Gluten, serving as a domestic gluten source for various industries including commercial bakeries, food ingredient plants, alternative meat producers, pet food processors, and specialty feed companies.

-

In January 2021, MGP Ingredients, Inc., a prominent provider of high-quality distilled spirits and specialized wheat proteins and starches, finalized the acquisition of Luxco, Inc., and its affiliated companies, as per the definitive agreement announced. Luxco, boasting over 60 years of business heritage, stood out as a top-tier branded beverage alcohol company across diverse categories. The acquisition marked a significant development in MGP Ingredients, Inc.'s strategic expansion within the industry.

Wheat Protein Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.27 billion

Revenue forecast in 2030

USD 9.28 billion

Growth rate (Revenue)

CAGR of 4.2% from 2024 to 2030

Actuals

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in volume, kilotons; revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, concentration, form, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Russia; Ukraine; France; Germany; Poland; UK; Benelux; China; India; Japan; Australia; Argentina; Brazil; Turkey; Egypt

Key companies profiled

Archer Daniels Midland (ADM); Agridient; MGP Ingredients; AB Amilina; Cargill Inc.; Manildra Group; Crespel & Deiters GmbH and Co. KG; Crop Energies AG; Kroener Staerke; Roquette

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Wheat Protein Market Segmentation

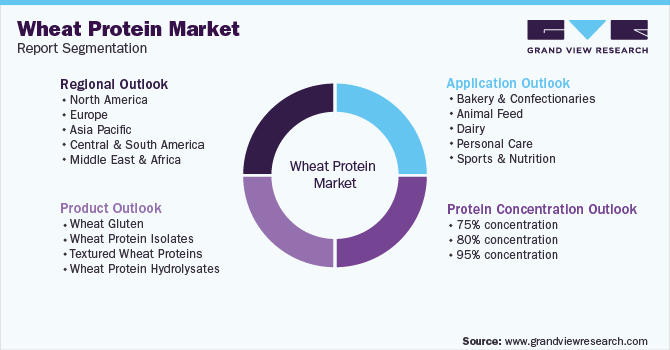

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global wheat protein market report on the basis of product, concentration, form, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2017 - 2030)

-

Wheat Gluten

-

Wheat Protein Isolate

-

Textured Wheat Protein

-

Hydrolyzed Wheat Protein

-

Others

-

-

Concentration Outlook (Volume, Kilotons; Revenue, USD Million; 2017 - 2030)

-

75% concentration

-

80% concentration

-

95% concentration

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million; 2017 - 2030)

-

Dry

-

Liquid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2017 - 2030)

-

Bakery & Confectionery

-

Animal Feed

-

Dairy

-

Personal Care

-

Sports & Nutrition

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

Ukraine

-

Poland

-

France

-

Benelux

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Turkey

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global wheat protein market size was estimated at USD 6.13 billion in 2021 and is expected to reach USD 6.50 billion in 2022.

b. The global wheat protein market is expected to grow at a compound annual growth rate of 4.5% from 2022 to 2030 to reach USD 9.28 billion by 2030.

b. North America dominated the wheat protein market with a share of 34.2% in 2021. This is attributable to the increasing consumption of nutritional supplements, bakery products, and snacks.

b. Some key players operating in the wheat protein market include Archer Daniels Midland (ADM), Agridient, MGP Ingredients, AB Amilina, Cargill Inc., Manildra Group, Crespel & Deiters GmbH and Co. KG, Crop Energies AG, Kroener Staerke and Roquette.

b. Key factors that are driving the market growth include increasing demand in the cosmetics industry owing to the presence of gluten which acts as an emulsifier.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.