- Home

- »

- Consumer F&B

- »

-

Meat Substitutes Market Size, Share, Industry Report, 2030GVR Report cover

![Meat Substitutes Market Size, Share & Trends Report]()

Meat Substitutes Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Plant-based Protein, Mycoprotein, Soy-based), By Distribution Channel (Foodservice, Retail), By Region, And Segment Forecasts

- Report ID: 978-1-68038-405-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Meat Substitutes Market Summary

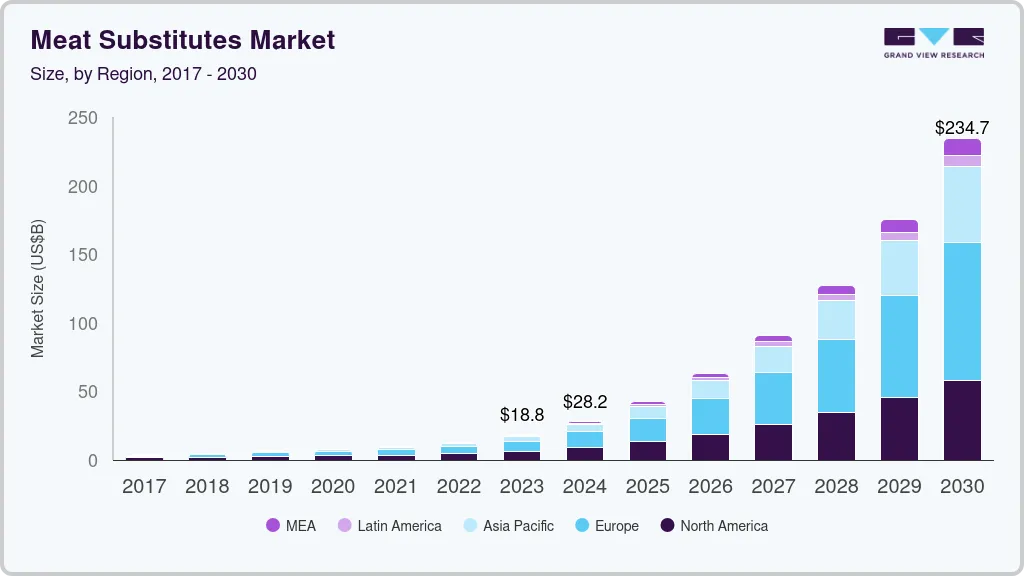

The global meat substitutes market size was estimated at USD 18.78 billion in 2023 and is projected to reach USD 234.66 billion by 2030, growing at a CAGR of 42.4% from 2024 to 2030. Diets that reduce or eliminate animal products are gaining popularity, which is expected to fuel the growth of the market.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2023.

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, plant-based protein accounted for a revenue of USD 11,727.2 million in 2023.

- Mycoprotein is the most lucrative source segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 18.78 Billion

- 2030 Projected Market Size: USD 234.66 Billion

- CAGR (2024-2030): 42.4%

- Europe: Largest market in 2023

Additionally, the fear of increasing animal-borne diseases has heightened health concerns, leading to a decline in animal product consumption. As awareness of meat substitutes grows, more consumers are turning to these alternatives, recognizing their potential health benefits, including the prevention of non-communicable diseases, digestive issues, and obesity.

The rising importance of a flexitarian diet, driven by increased awareness of the cardiovascular risks associated with red meat and a growing emphasis on health and active lifestyles, is expected to boost the growth of the pea protein segment in the plant-based meat market. Pea proteins, known for their benefits in weight loss, muscle repair, and energy balance, are gaining global popularity. For example, Beyond Meat Inc. uses pea proteins to develop products with a chewy, meat-like texture, and Lightlife offers its Lightlife Burger with pea proteins as a key ingredient. This burger contains 20 grams of pea protein, 2.5 grams of saturated fat, and zero cholesterol, compared to 9.3 grams of saturated fat and 80 milligrams of cholesterol in a traditional beef patty.

Intensive animal farming has faced criticism due to its environmental impact and ethical concerns, leading companies to offer meat substitutes. Planterra Foods, for instance, is expanding its plant-based protein line with True Bite Plant-Based Chicken Cutlet, the first of its kind on the market. Additionally, Planterra Foods' Ozo brand introduced cutlets in various flavors, such as Sea Salt & Pepper and Garlic & Herb, in 2021. These innovations in flavor offerings are expected to drive growth in the cutlets segment. Similarly, Impossible Foods invested in developing plant-based tenders in 2020 as part of its goal to replace all animal agriculture with sustainable alternatives by 2035.

The substantial growth in the meat alternatives market is fueled by a combination of consumer concerns and manufacturers' ability to create products with superior texture, flavor, and mouthfeel. This demand is particularly driven by Gen Z and Millennials, who are motivated by concerns about health, climate change, and animal welfare. To meet this demand, many manufacturers are partnering with brands to expand their offerings. For example, Tokyo-based Next Meats partnered with Vegan Meat India in December 2021 to introduce meat-free products in India.

Consumers now enjoy a wide variety of products that offer more choices and innovative flavors, catering to their dietary needs. Even non-vegetarian and non-vegan consumers are turning to plant-based alternatives for reasons such as improved nutrition, weight management, concern for animal welfare, and environmental sustainability.

Additionally, there is an emerging trend towards including whole vegetables and grains in ingredient lists. Health-conscious consumers increasingly prioritize recognizable ingredients on product labels and seek products with reputable third-party certifications. In response, meat substitute producers are offering products with transparent labeling, indicating attributes such as non-GMO, gluten-free, vegan, and kosher. The rising demand for plant-based alternatives, coupled with significant investments in innovative products, is expected to continue creating profitable opportunities for market expansion.

Market Concentration & Characteristics

The Meat Substitutes market exhibits a medium to high level of innovation, with companies frequently introducing new flavors, formulations, and functional ingredients to meet changing consumer preferences. Significant advancements have been made in recent years, with companies developing new formulations and production techniques that closely mimic the taste, texture, and appearance of traditional meat. Lab-grown meat, also known as cultured or cell-based meat, is another innovative approach that has the potential to revolutionize the industry.

Mergers and acquisitions in the meat substitutes industry range from medium to high. Companies involved in these activities seek strategic partnerships to enhance their product offerings, expand market presence, and leverage each other's strengths. The competitive nature of the market further drives companies to explore synergies, leading to occasional mergers and acquisitions aimed at gaining a competitive advantage and achieving economies of scale.

Regulatory authorities enforce strict labeling standards for meat substitutes to ensure transparency and provide accurate information to consumers. This includes mandatory disclosure of specific food ingredients, their concentrations, and potential allergens, ensuring that consumers are fully informed about the products they purchase.

The presence of a large meat-eating population continues to drive the demand for animal-based meat. Additionally, the growing global population and rising income levels in certain regions have contributed to increased consumption of animal-based meat products, sustaining the demand for traditional meat.

Source Insights

In 2023, the plant-based protein segment held the lion's share and is expected to stay the same during the forecast period. There is growing interest in plant-based seafood, with an increasing number of these products being sold in the U.S. retail sector. This trend is driven by consumers' desire for healthier, customized options that do not sacrifice taste. In December 2023, Konscious Foods, a plant-based seafood brand, announced plans to expand its food service offerings across North America by 2024. The company has partnered with Affinity Group Canada to establish a presence in the Canadian market. Konscious Foods' diverse range of products includes sushi varieties, poke cubes, sno' crab packs, and plant-forward onigiri options. In 2023, their frozen sushi, poke bowls, and onigiri gained popularity and were introduced to numerous retail outlets across North America.

Products made from plant protein and mycoprotein offer meat-like texture, flavor, and nutritional benefits but are derived from non-animal sources. Target plant proteins are processed through hydrolysis to enhance their functionality, and they are combined with various ingredients, such as food adhesives, oils, and flour, to replicate meat texture. The availability and affordability of plant-based protein inputs contribute to the high volume and dominance of this segment.

The mycoprotein segment is projected to grow at a CAGR of 43.5% from 2024 to 2030. Mycoprotein is preferred by consumers due to its high nutrient content, such as fiber, which helps control blood cholesterol and blood sugar levels. Compared to some animal proteins, it also provides a feeling of fullness, helping to prevent overeating and weight gain. Mycoprotein offers all essential amino acids, which are not commonly found in other protein sources. Brands like Quorn offer mycoprotein-based meals that are popular among consumers.

Additionally, jackfruit, a newcomer to the market, is gaining popularity due to its texture and nutritional benefits. It is often referred to as a superfood due to its numerous health advantages.

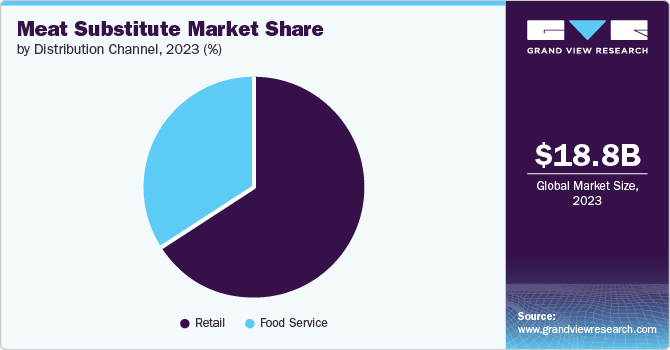

Distribution Channel Insights

Retail led the market in 2023, holding the major share. Plant-based meat companies are increasingly forming strategic partnerships with these grocery stores to introduce and expand their product offerings in the market. For example, Impossible Foods has significantly expanded its presence in the retail sector by collaborating with major U.S. retailers like Kroger Co. The company also partnered with Walmart, securing placement for its products in over 2,000 neighborhood market locations and supercenters, alongside various other retail partnerships. Additionally, Impossible Foods' products are available for purchase on the Walmart website.

To further expand its market reach, Impossible Foods also partnered with Publix Super Markets, increasing its presence in the Southeast by making its products available in 1,200 stores. The strategic decision to place its products in the meat section rather than the frozen or vegetable food sections has proven effective, boosting the company's sales by 23%.

The food service sector is expected to grow rapidly, with a projected CAGR of 42.8% from 2024 to 2030. An increasing number of fast-food chains, casual dining venues, and restaurants are dedicating a section of their menu to plant-based meat choices, which is expected to boost market growth. For instance, Beyond Meat Inc. will supply its products to Burger Bar across 32 restaurants. Similarly, other plant-based companies have established partnerships with new restaurant partners. For Instance, Impossible Foods Inc has placed its signature plant-based beef food in three dishes on the menu at Baja Fresh Mexican Grill.

Rising interest from consumers and increasing investments in plant-based meat foods have prompted more restaurants to modernize and collaborate with plant-based meat food companies to craft items that fit with similar concepts; for example, Little Caesar’s Pizza chain has partnered with Field Roast to produce a topping for the newly introduced Planteroni pizza.

The inclusion of plant-based meat allows manufacturers to differentiate their offerings in a competitive market landscape. These fibers not only enhance the nutritional profile of baked goods and confectionery items but also contribute to texture improvement and moisture retention, ensuring a satisfying sensory experience for consumers. Consequently, the trend toward utilizing plant-based meat reflects a broader shift toward functional ingredients and "better-for-you" products, aligning with evolving consumer preferences and driving innovation within the industry.

Regional Insights

Meat substitutes market in North America accounted for a share of 32.45% in 2023. Various health organizations have taken initiatives to increase awareness about the health issues associated with high consumption of red meat. The American Medical Association has passed a resolution to provide healthy plant-based meals and eliminate the use of processed meats in hospitals. The resolution was co-sponsored by the American College of Cardiology and the Medical Society of the District of Columbia.

U.S. Meat Substitutes Market

New product launches replicating the texture, flavor, and taste of meat are projected to boost the growth of the meat substitutes market in the U.S. For instance, Impossible Food launched its newest product, Impossible Chicken Nuggets, made from plants. A blind test was conducted among 201 meat-eating consumers, many of whom regularly consumed plant-based products. The test results showed that 7 out of 10 consumers preferred Impossible Chicken Nuggets in comparison to regular meat products offered at the restaurants. Retailers, including Kroger, Walmart, Gelsons, Albertsons, Giant stores, and ShopRite, will store it in their aisles. As per the survey by the International Food Information Council, 65% of respondents reported consuming products with the identical flavor and texture as animal protein but made entirely from plant products. Of these, 20% claimed to consume them at least weekly, and 22% said they did so daily.

Europe Meat Substitutes Market

Europe accounted for the lion’s share in the global meat substitutes market in 2023. According to Veganz, a Berlin-based plant-based supermarket chain, a significant portion of European flexitarians are planning to transition to vegan and vegetarian diets in the future. Of those surveyed, 8% expressed their intention to adopt a vegan diet, while 57% aimed to become vegetarians. Additionally, meat eaters are showing an increasing inclination towards plant-based foods. Similarly, in a survey conducted by ProVeg International in Europe, 85% of plant-based food consumers indicated a desire for more plant-based seafood choices. However, consumers are expressing a strong demand for vegan fish fillets and other fish-related products. This presents a significant opportunity for manufacturers to innovate and expand the plant-based fish segment by introducing new products.

Asia Pacific Meat Substitutes Market

The meat substitute market in Asia Pacific is expected to grow at a CAGR of 47.1% from 2024 to 2030. China and Australia are significant contributors to the plant-based meat market in the Asia-Pacific region. In these countries, rising health consciousness and the influence of social media have driven a surge in the consumption of meat substitutes. As consumers increasingly shift away from animal protein toward plant-based diets, there has been a notable rise in demand for high-quality plant-based alternatives. Historically, the options for vegetarian and vegan substitutes were limited, often consisting of unhealthy and heavily processed ingredients.

However, Asian consumers are now becoming more concerned about food safety, health, and the environmental impact of their dietary choices. This shift has led many to adopt healthier and more sustainable lifestyles proactively. The potential for introducing new, flavorful plant-based food options in Asia is substantial, with customers now preferring these products as their primary choice rather than merely as alternatives to meat.

In response to this growing demand, ADM inaugurated a state-of-the-art plant-based innovation laboratory at the Biopolis research hub in Singapore in April 2021. This facility is dedicated to developing cutting-edge, trendy, and nutritious products to meet the increasing food and beverage demands in the Asia-Pacific region.

Key Meat Substitute Company Insights

Companies like Tofurky, known for manufacturing vegan foods, are expanding their partnerships with ingredient companies to strengthen their market presence. They are also exploring new and emerging technologies, such as mycelium and algae-based innovations, to enhance their brand positioning.

Market players are adopting various strategies to improve their market standing, including expanding production capacity, forming partnerships, and developing new products. These strategies are driven by the rising consumer demand for plant-based proteins and the growing popularity of vegan foods. The increasing demand for plant-based meat products and heightened awareness about plant-based diets are compelling manufacturers to enhance their production capacities to meet the surging market demand.

Key Meat Substitute Companies:

The following are the leading companies in the meat substitute market. These companies collectively hold the largest market share and dictate industry trends.

- Amy’s Kitchen, Inc.

- Beyond Meat

- Impossible Foods Inc.

- Quorn Foods

- Kellogg Co.

- Unilever

- Meatless B.V.

- VBites Foods Ltd.

- SunFed

- Tyson Foods, Inc.

Recent Developments

-

In May 2024, Tofurky, a prominent producer of tasty plant-based meats in the U.S., is unveiled an enticing new product line for foodservice clients at the National Restaurant Association Show, booth #687: Next Generation Plant-Based Deli Slices.

-

In March 2024, The Kraft Heinz Not Company LLC introduced NotHotDogs and NotSausages, marking the first plant-based offerings under the Oscar Mayer brand and the inaugural plant-based meat innovation from the collaboration between The Kraft Heinz Company and TheNotCompany, Inc. Their mission is to craft irresistible plant-based foods for everyone.

-

In February 2024, Beyond Meat introduced its most recent advancement in plant-based beef products through the debut of the Beyond IV platform. This signifies the release of the fourth generation of its primary products, Beyond Burger and Beyond Beef, scheduled to launch exclusively at stores throughout the U.S. in spring.

-

In December 2023, Quorn, the top meat-free brand in the U.K., reintroduced its vegetarian Quorn Fillet Pieces.

-

In October 2023, Beyond Meat announced the inauguration of a unique dedicated concession stand at Madison Square Garden in New York City, known as the GO BEYOND GRILL. This collaboration with MSG Entertainment and MSG Sports marks a significant milestone as Beyond Meat becomes the primary vegan meat partner of the New York Knicks, Madison Square Garden, and the New York Rangers.

-

In September 2023, MorningStar Farms introduced the MorningStar Farms Steakhouse Style Burger, a high-quality plant-based alternative that authentically captures the essence of its namesake with enhanced flavor.

-

In August 2023, Beyond Meat, Inc. expanded its burger lineup by introducing its latest product innovation, the Beyond Stack Burger.

Major Deals & Strategic Alliances

-

In May 2024, Tofurky, a prominent producer of tasty plant-based meats in the U.S., introduced its Next Generation Plant-Based Deli Slices at the 2024 National Restaurant Association Show.

-

In December 2023, Nestlé introduced Maggi Soya Chunks globally, offering a plant-based meat substitute specifically designed for consumers in Central and West Africa.

-

In October 2022, Licious launched UnCrave, a brand of plant-based meat, in line with the company’s strategy to diversify its portfolio while capitalizing on its established brand equity.

Meat Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.17 billion

The revenue forecast in 2030

USD 234.66 billion

Growth Rate

CAGR of 42.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, distribution channel, region

Regional scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Amy’s Kitchen, Inc. , Beyond Meat, Impossible Foods Inc., Quorn Foods, Kellogg Co., Unilever, Meatless B.V. , VBites Foods Ltd., SunFed , Tyson Foods, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meat Substitutes Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global meat substitutes market report based on source, distribution channel, and region:

-

Source Outlook (USD Million; 2018 - 2030)

-

Plant-based Protein

-

Mycoprotein

-

Soy-based

-

Others

-

-

Distribution Channel Outlook (USD Million; 2018 - 2030)

-

Retail

-

Food Service

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global meat substitutes market size was estimated at USD 18.78 billion in 2023 and is expected to reach USD 28.17 billion in 2024.

b. The global meat substitutes market is expected to grow at a compound annual growth rate of 42.4% from 2024 to 2030 to reach USD 234.66 billion by 2030.

b. North America held a revenue share of 32.45% in 2023. This is attributable to the increasing preference for vegan diets, driven by a growing awareness of health benefits. Moreover, heightened consciousness regarding environmental and ethical concerns has further propelled the market's growth.

b. Some of the major players in the market include Amy’s Kitchen Inc., Beyond Meat, Impossible Foods Inc., Quorn Foods, Kellogg Co., Unilever, Meatless B.V. , VBites Foods Ltd., Sunfed, and Tyson Foods, Inc.

b. The awareness among consumers regarding plant-based meat substitutes is experiencing rapid growth, as an increasing number of individuals are seeking these alternatives due to their acknowledged health advantages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.