- Home

- »

- Organic Chemicals

- »

-

Acetic Acid Market Size, Share, Growth Analysis Report 2030GVR Report cover

![Acetic Acid Market Size, Share & Trends Report]()

Acetic Acid Market Size, Share & Trends Analysis Report By Application (Vinyl Acetate Monomer, Acetic Anhydride, Acetate Esters, Purified Terephthalic Acid), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-077-4

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Acetic Acid Market Size & Trends

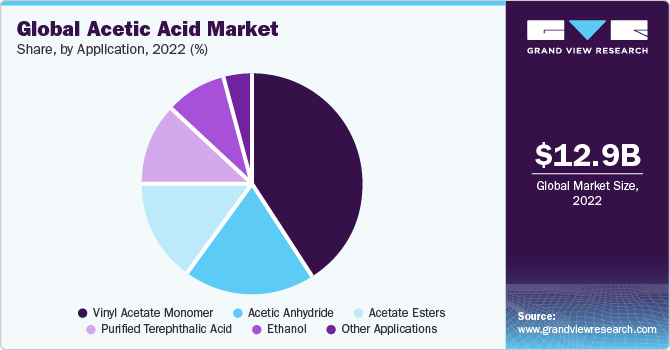

The global acetic acid market was valued at USD 12.89 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. The growth is attributed to its importance in building blocks for manufacturing several chemicals and usability in various industries such as plastic, rubber, ink, and textile. The rising growth in end-use industries including plastic, textiles, and chemicals across the globe is expected to drive demand for the product over the forecast years. On top of that, the substitution of PET bottles with glass bottles for alcoholic beverages is anticipated to drive demand for terephthalic acid, thereby positively impacting the product industry over the forecast years. Additionally, the presence of multinational players and their constant initiatives for expansion and joint venturing pertaining to the product are likely to boost the market growth during the predicted years.

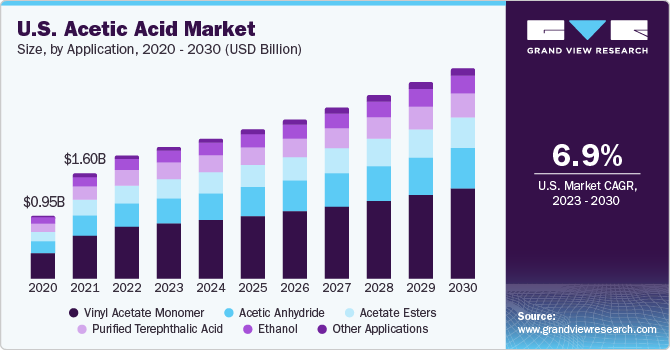

The U.S. is the largest consumer of the product in North America with a revenue share of 68.7% in 2022. The product is considered safe for utilization in foods if it is utilized in a manner that is consistent with excellent manufacturing practices, and is “food-grade”. If it meets the requirements of the food chemicals codex, it is considered "food-grade.". Owing to the increasing demand for food and its safe nature, the product is anticipated to see significant growth over the forecast year.

The global acetic acid market is highly competitive owing to the presence of multiple multinational corporations that are involved in extensive research and development activities and are open to taking initiatives for its expansion, collaborations, and joint venturing to gain a competitive edge. Thus, the impact of competitive rivalry is expected to remain high in the market for acetic acid over the forecast period.

The COVID-19 outbreak crippled numerous economies and severely impacted the supply chain across industries. The production and consumption of the product are highly dependent on its demand from end-use industries. Hence, inconsistency in demand for end-use industries is anticipated to directly impact the demand for the product. Owing to the negative impact of the pandemic the market witnessed the shutdown of chemical industries across the globe, which are the major end-users of the product. However, the market started to give positive signs in the second half of 2020 with the relaxation of cross-border trade restrictions and the re-opening of various industries globally.

Application Insights

The vinyl acetate monomer application segment dominated the market with a share of 40.9% in 2022. Its high share is attributed to the increasing demand for paints & coatings, paper coatings, and printed products which are driving the demand for vinyl acetate monomer. Acetic acid is a major raw material used in the production of vinyl acetate monomer which is further used for the production of Polyvinyl acetate. Polyvinyl acetate is further used in the manufacturing of paints & coatings. Improvements in consumer lifestyles and the increasing number of house renovations and redecoration are driving demand for paints and coatings, thereby directly influencing the demand for vinyl acetate monomer.

Acetic anhydride captured the second largest share globally in 2022 with a share of 19.2%. This growth is attributed to its extensive utilization of photographic films and various other coated materials. It is also used for the manufacturing of cigarette filters. It is considered a key raw material for the development of medicines such as aspirin, which helps in the treatment of headaches. Acetic acid is used extensively in the preservation of wood.

Acetate esters are developed from acetic acid and are majorly utilized in paint and coatings, and printing inks manufacturing. Increased desires of consumers to elevate the aesthetics of their houses are influencing global demand for paint and coatings. The automotive industry is also fueling the demand for paints owing to increased sales of vehicles. This is directly impacting the demand for acetate esters worldwide.

Purified terephthalic acid is generally consumed for developing polyester coatings for general metal applications, home appliances, automobiles, and coil coatings. Good chemical and stain resistance, high weather ability, and good glass transition balancing, along with appropriate temperature ranges for high flexibility are a few characteristics driving demand for purified terephthalic globally.

The ester of ethanol and acetic acid forms ethyl acetate, which is widely used as a diluent and a solvent. It is a highly demanded chemical due to its less toxicity and low cost. Ethyl acetate produced by ethanol is used in paints and perfumes that evaporate quickly and leave a fragrance on the skin.

Regional Insights

The Asia Pacific dominated the market with a revenue share of 33.6% in 2022. This growth is attributed to the increasing demand for acetic acid in various industries such as construction, pharmaceuticals, automotive, and textiles. The growth in demand for the product is accounted for by the development of the region’s pharmaceutical industry. Acetic acid is majorly used in the development of medicines. The increased dependencies of consumers on medicinal tablets are likely to drive the overall demand for the product in the region.

Asia Pacific was a major contributor to the global vinyl acetate monomer market in 2020. Furthermore, the growing building and construction industries, particularly in India and China, are likely to become a major contributor to the region’s market over the forecast period. The improved pharmaceutical industry and the increased demand for medicines in countries like Saudi Arabia, Qatar, the U.A.E., and Bahrain are anticipated to have a positive impact on the demand for the market in the Middle East and Africa. The presence of a large number of patients suffering from diabetes, cardiovascular disease, and ailments related to the aging population. The rising life expectancy is increasing the demand for acetic acid in the pharmaceutical industry in the region.

In North America, the market for acetic acid is driven by its high demand in the food & beverage industry. Acetic acid is widely used in the meat industry to keep it preserved. The application of acetic acid in the meat industry has witnessed a huge rise and has become one of the prominent application markets in the region. Another reason for the growth in demand for acetic acid in the region is the increased consumption of paints & coatings.

Key Companies & Market Share Insights

The market has become highly competitive in the presence of multiple multinational players. These companies are taking several initiatives for expansion and collaborations to improve their product portfolio and quality. Companies like Celanese Corporation, SABIC, HELM AG, and Indian Oil Corporation are some of the key players in the market. The market players are extensively involved in mergers & acquisitions and expansions to increase the availability of their products & services in diverse geographical areas and strengthen their position in the market. For instance, in September 2023, INEOS announced the acquisition of Eastman Chemical Company's Eastman Texas city site which also includes an acetic acid plant of 600 kilotons.

Key Acetic Acid Companies:

- Eastman Chemical Company

- Celanese Corporation

- LyondellBasell Industries Holdings B.V.

- SABIC

- HELM AG

- Indian Oil Corporation Ltd.

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- DAICEL CORPORATION

- Dow

- INEOS

Acetic Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.81 billion

Revenue forecast in 2030

USD 23.02 billion

Growth rate

CAGR of 7.5 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, volume in kilo tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Belgium; Netherlands; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; Egypt

Key companies profiled

Eastman Chemical Company; Celanese Corporation; LynodellBasell Industries Holding B.V.; SABIC; HELM AG; Airedale Chemical Company Limited; Indian Oil Corporation Ltd; Gujrat Narmada Valley Fertilizers & Chemicals Limited; Pentokey Organy; Ashok Alco Chem Limited; DAICEL CORPORATION; The Dow Chemical Product; DubiChem; INEOS.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acetic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acetic acid market report based on application, and region:

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Vinyl Acetate Monomer

-

Acetic Anhydride

-

Acetate Esters

-

Purified Terephthalic Acid

-

Ethanol

-

Other Applications

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Netherlands

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global acetic acid market size was estimated at USD 12.89 billion in 2022 and is expected to reach USD 13.81 billion in 2023.

b. The global acetic acid market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 23.02 billion by 2030.

b. The Asia Pacific dominated the market and accounted for 33.6% of the global revenue in 2022. This is attributable to the increasing penetration of polymer formulators in the region.

b. Some key players operating in the acetic acid market include Eastman Chemical Company, Celanese Corporation, LynodellBasell Industries Holding B.V., SABIC, HELM AG, Airedale Chemical Company Limited, Indian Oil Corporation Ltd, Gujrat Narmada Valley Fertilizers & Chemicals Limited, Pentokey Organy, Ashok Alco Chem Limited, DAICEL CORPORATION, The Dow Chemical Product, DubiChem, INEOS.

b. Key factors that are driving the acetic acid market growth include rising demand for the product from vinyl acetate monomer (VAM) producers worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."