- Home

- »

- Plastics, Polymers & Resins

- »

-

Vinyl Acetate Monomer Market Size And Share Report, 2030GVR Report cover

![Vinyl Acetate Monomer Market Size, Share & Trends Report]()

Vinyl Acetate Monomer Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Polyvinyl Alcohol, Polyvinyl Acetate), By End-use (Packaging, Construction), By Region, And Segment Forecasts

- Report ID: 978-1-68038-302-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vinyl Acetate Monomer Market Summary

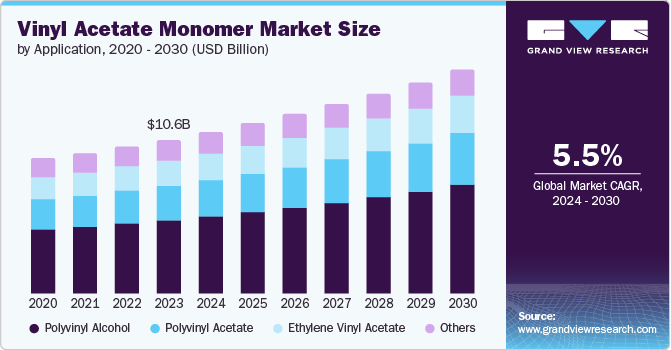

The global vinyl acetate monomer market size was estimated at USD 10,638.7 million in 2023 and is projected to reach USD 15,437.8 million by 2030, growing at a CAGR of 5.5% from 2024 to 2030. One of the primary drivers is its extensive use in various industrial applications. Vinyl acetate monomer (VAM) is a crucial component used in adhesives, paints, coatings, textiles, and films.

Key Market Trends & Insights

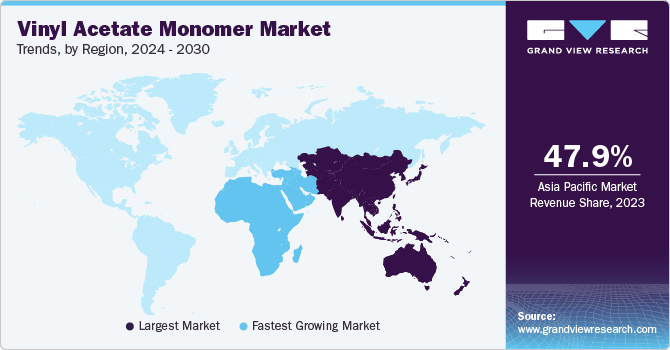

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, polyvinyl alcohol accounted for a revenue of USD 10,638.7 million in 2023.

- Polyvinyl Alcohol is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 10,638.7 Million

- 2030 Projected Market Size: USD 15,437.8 Million

- CAGR (2024-2030): 5.5%

- Asia Pacific: Largest market in 2023

Vinyl acetate monomer (VAM) is a crucial component used in adhesives, paints, coatings, textiles, and films. The increasing demand for these products in the construction, automotive, packaging, and textile industries is significantly boosting the need for (VAM).

Another factor contributing to the increased demand for VAM is the growing emphasis on sustainable and eco-friendly products. VAM-based materials are often preferred due to their versatility and environmental benefits. For instance, ethylene-vinyl acetate (EVA) is used in solar panel encapsulants and is essential for renewable energy solutions. With the global push towards green energy and sustainable practices, the adoption of VAM in such applications is expected to rise, further driving its demand.

Additionally, advancements in production technologies and the establishment of new manufacturing facilities are making VAM more accessible and cost-effective. Catalyst development and process optimization innovations have enhanced production efficiency, reduced costs and increasing output. This, coupled with expanding production capacities in key regions such as Asia-Pacific, where industrial growth is robust, supports the upward trend in VAM demand.

Lastly, increasing urbanization and infrastructural development worldwide are indirectly fueling the demand for VAM. As urban areas expand and infrastructure projects increase, there is a growing need for construction materials, paints, and adhesives, all of which rely on VAM-based products. This trend is particularly pronounced in emerging economies, where rapid industrialization and urbanization create substantial market opportunities for VAM manufacturers.

Application Insights

The polyvinyl alcohol segment held the largest market revenue share of 47.9% in 2023, owing to its versatile applications and superior properties. PVA is widely used in producing adhesives, films, and coatings, and it is essential in various industries, such as packaging, textiles, and construction. The material's superior adhesive strength, film-forming ability, and chemical resistance make it highly desirable for manufacturers looking to enhance the performance and durability of their products. Additionally, the growing emphasis on environmentally friendly materials has boosted the demand for PVA, as it is water-soluble and biodegradable, aligning with the increasing regulatory and consumer demand for sustainable solutions.

The polyvinyl acetate segment is expected to grow at the fastest CAGR of 5.9% over the forecast period. The demand for the polyvinyl acetate (PVA) segment is rising due to its extensive applications across various industries. PVA is widely used as an adhesive in woodworking, packaging, and construction due to its strong bonding properties and versatility. Additionally, it serves as a key ingredient in paints, coatings, and textiles, where its properties enhance durability and performance. The growing construction and packaging industries, coupled with increasing demand for high-performance adhesives and coatings, are driving the expansion of the PVA segment.

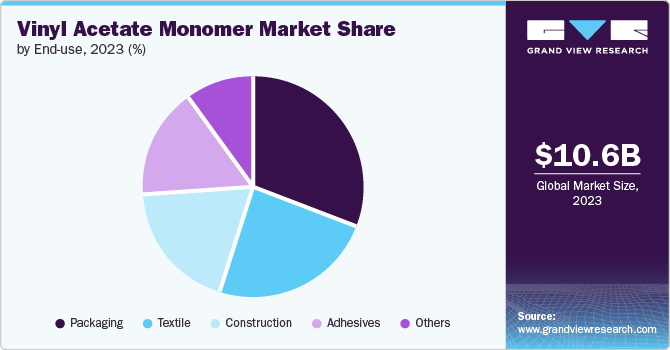

End-use Insights

The packaging segment dominated the market in 2023. The growth in e-commerce and consumer goods sectors has significantly amplified the need for durable, flexible packaging solutions. Additionally, the increasing emphasis on sustainability and recyclable materials has driven the adoption of VAM-based products, known for their effectiveness in producing eco-friendly packaging. Consequently, these trends collectively propel the demand for VAM in the packaging industry, addressing functional and environmental concerns.

The textile segment is expected to grow at the fastest CAGR over the forecast period. VAM is a critical component in producing polyvinyl acetate (PVA) and polyvinyl alcohol (PVOH), and it is widely used in textile processing for its adhesive properties. The growing textile industry, driven by increasing consumer demand for clothing and textiles, particularly in emerging economies, is boosting the need for VAM. Additionally, advancements in textile manufacturing technologies and the shift towards sustainable and efficient production processes are further propelling the demand for VAM-based products.

Regional Insights

North America vinyl acetate monomer market held a significant revenue in 2023, owing to increasing demand from end users and technological advancements. North America is a hub for various industries such as construction and building materials, automotive industry, packaging, consumer goods, and furniture industry that are end users of vinyl acetate monomer owing to its solid and reliable properties. Moreover, the region is one of the largest exporters of oil and gas, which drives the demand for efficient water-based adhesives vinyl acetate monomer to extract oil from onshore and offshore regions.

U.S. Vinyl Acetate Monomer Market Trends

U.S. market is projected to grow significantly in the coming years. The demand for vinyl acetate monomer (VAM) in the US is rising due to its extensive application in various industries, particularly in adhesives, paints, coatings, and packaging. The growth in construction and infrastructure projects has heightened the need for VAM-based products, such as adhesives and paints, which offer durability and strong bonding properties. Additionally, the packaging industry's expansion, driven by e-commerce and consumer goods, has further propelled the demand for VAM.

Europe Vinyl Acetate Monomer Market Trends

Europe vinyl acetate monomer market is anticipated to grow at a significant CAGR over the forecast period. The demand for vinyl acetate monomer (VAM) in Europe is mainly driven by its application in the production of PVA (polyvinyl acetate) and PVOH (polyvinyl alcohol), which are essential in the region's thriving adhesives and coatings industries. In Europe, PVA is widely used in the construction sector to produce wood adhesives, crucial for woodworking and furniture manufacturing. Additionally, VAM is a key component in producing emulsion polymers used in high-performance paints and coatings, meeting the stringent environmental regulations of European countries.

Germany vinyl acetate monomer market held a significant market revenue share in 2023. Germany's thriving automotive industry relies heavily on high-performance adhesives and coatings made from VAM for manufacturing and assembly processes. The construction sector also drives demand, with VAM being a key component in producing environmentally friendly building materials and energy-efficient insulation. Furthermore, Germany's commitment to sustainability and green building practices has led to a growing preference for VAM-based products with lower environmental impact.

Asia Pacific Vinyl Acetate Monomer Market Trends

Asia Pacific vinyl acetate monomer market held the largest market revenue share of 47.9% in 2023. Vinyl acetate monomer is used to produce adhesives, crucial in the booming construction and packaging sectors in countries like China and India. VAM is also vital in manufacturing paints and coatings, and it is widely used in infrastructure projects and the automotive industry, which is experiencing rapid growth in the region. Additionally, VAM produces ethylene-vinyl acetate (EVA) copolymers essential in the footwear and solar panel industries. The textile industry also heavily relies on VAM to produce polyvinyl alcohol used in fabric finishing and sizing. These diverse applications, driven by the fast-paced industrial and economic development in the Asia Pacific, underscore the growing demand for VAM in the region.

China vinyl acetate monomer market held the market revenue share in 2023. China's construction boom, driven by rapid urbanization and government-led infrastructure projects, significantly increases the need for VAM in paints, coatings, and adhesives. Furthermore, China's large and expanding manufacturing sector, particularly in the electronics and automotive industries, uses VAM extensively to produce various components and materials. The Chinese packaging industry, bolstered by a growing e-commerce market, relies on VAM for flexible packaging materials.

Middle East & Africa Vinyl Acetate Monomer Market Trends

Middle East and Africa vinyl acetate monomer market is anticipated to grow at the fastest CAGR over the forecast period. Countries such as Saudi Arabia and the UAE heavily invest in large-scale infrastructure projects in the Middle East as part of their economic diversification plans. These projects require substantial quantities of VAM to produce adhesives, paints, and coatings used in construction. In Africa, rapid urbanization and a growing population are boosting the construction industry, leading to increased use of VAM in building materials. Moreover, there is a rise in local manufacturing activities aimed at reducing reliance on imports, further supporting the growth of VAM demand in the region.

Key Vinyl Acetate Monomer Company Insights

Some of the key companies in the vinyl acetate monomer marketinclude, DowDuPont, Celanese Corporation, Sinopec China Petrochemical Corporation and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key Payers are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Celanese Corporation; Celanese Corporation is a global producer of Speciality materials and chemicals. Celanese has diversified into four different products segments namely, Cellulose acetate, Nutrinova, Engineered materials and Acetyl chain. The company has headquartered in Texas and operates in 11 countries mainly North America, Europe and Asia.

-

DuPont; DuPont, is an American chemical company specializes in Speciality materials and chemicals industry, focusing on innovative products widely used in range of applications. DuPont product line caters to wide range of industries across the world including, Adhesives, construction materials, consumer products, healthcare solutions and many more.

Key Vinyl Acetate Monomer Companies:

The following are the leading companies in the vinyl acetate monomer market. These companies collectively hold the largest market share and dictate industry trends.

- DowDuPont (DuPont)

- Wacker Chemie AG

- Celanese Corporation

- KURARAY CO., LTD

- Solventis

- Sipchem

- Innospec

- Exxon Mobil Corporation

- Sinopec China Petrochemical Corporation

- Arkema

- LyondellBasell Industries N.V.

Recent Developments

-

In February 2023, Celanese Corporation announced the expansion of its sustainable product portfolio within its acetyl chain. This initiative includes developing and integrating eco-friendly materials and processes to meet the growing demand for sustainable solutions. The company aims to address environmental concerns by enhancing its product offerings with innovations that reduce environmental impact.

Vinyl Acetate Monomer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.18 billion

Revenue forecast in 2030

USD 15.44 billion

Growth Rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America, Europe, APAC, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China’ India, Japan, Australia, South Korea, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE Kuwait.

Key companies profiled

DuPont; Wacker Chemie AG; Celanese Corporation; KURARAY CO., LTD; Solventis; Sipchem; Innospec; Exxon Mobil Corporation; Sinopec China Petrochemical Corporation; Arkema; LyondellBasell Industries N.V.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vinyl Acetate Monomer Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Vinyl Acetate Monomer market report based on application, end-use, and region.

-

Application Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

Polyvinyl Alcohol

-

Polyvinyl Acetate

-

Ethylene Vinyl Acetate

-

Others

-

-

End-use Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

Packaging

-

Construction

-

Textile

-

Adhesives

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.