- Home

- »

- Animal Health

- »

-

Animal Health Market Size And Share, Industry Report, 2030GVR Report cover

![Animal Health Market Size, Share & Trends Report]()

Animal Health Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Biologics, Pharmaceuticals), By Animal Type (Companion, Production), By Distribution Channel, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-763-6

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Health Market Summary

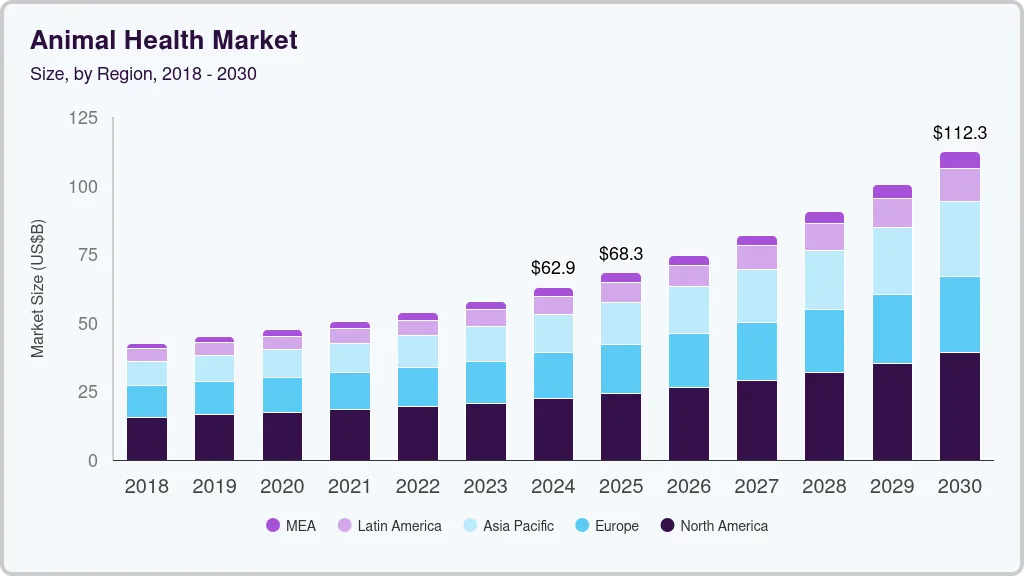

The global animal health market size was valued at USD 62.89 billion in 2024 and is projected to reach USD 112.33 billion by 2030, growing at a CAGR of 10.46% from 2025 to 2030. Factors driving the market growth include rising animal health expenditure, the increasing inculcation of Artificial Intelligence (AI), evolving regulatory scenario, prevalence of diseases in animals, concerns over zoonoses, initiatives by key companies, uptake of pet insurance, and pet humanization.

Key Market Trends & Insights

- North America animal health market held the highest share of about 35.69% in 2024.

- The animal health market in the U.S. held the dominant share of the North American market in 2024.

- Based on product, the pharmaceutical segment dominated the market with a share of about 43.42% in 2024.

- Based on animal type, the companion animal segment is expected to grow at a lucrative rate during the forecast period.

- Based on distribution channel, the hospital/clinic pharmacy segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 62.89 Billion

- 2030 Projected Market Size: USD 112.33 Billion

- CAGR (2025-2030): 10.46%

- North America: Largest market in 2024

However, the most dominant factor is the increasing inculcation of AI across multiple technologies in the animal health sector. In January 2025, Absci and Invetech announced a partnership to utilize Absci's generative AI drug creation platform known as “Half-Life Extension (HLE)” for developing veterinary medicines. This collaboration is aimed at enhancing the development of novel therapeutics for veterinary applications and utilizing cutting-edge technology to streamline the drug discovery process. By combining their expertise, the two companies seek to improve treatment options for animals, ultimately benefiting both pet owners and the broader veterinary industry. The initiative highlights the growing intersection of AI and biotechnology in addressing health challenges across species.

Furthermore, in September 2024, the 25th International Conference on Veterinary Medicine at Khon Kaen University in Thailand emphasized the transformative role of AI and technology in veterinary science. Key discussions included advancements in imaging techniques, regenerative medicine, and minimally invasive surgical procedures, showcasing how these innovations enhance animal health and welfare. SK Telecom, a South Korean company, expanded its AI-based veterinary care service, X Caliber, to Southeast Asia, partnering with local companies to enhance veterinary diagnostics in Malaysia, Thailand, and Vietnam.

In addition, in October 2024, researchers from the University of Cambridge developed an AI algorithm to efficiently detect and grade heart murmurs in dogs using audio recordings from digital stethoscopes, achieving a sensitivity of 90%. This technology is crucial for early detection of mitral valve disease, a common heart condition in dogs, allowing for timely treatment that can extend their lives. The algorithm was trained on a large dataset of heart sounds from nearly 800 dogs, making it a valuable tool for primary care veterinarians to assess heart health efficiently. This advancement represents a significant step forward in veterinary medicine, enhancing the quality of care for dogs.

Such initiatives reflect a growing global focus on AI in animal health, aiming to improve animal welfare and support sustainable agricultural practices through innovative technologies.

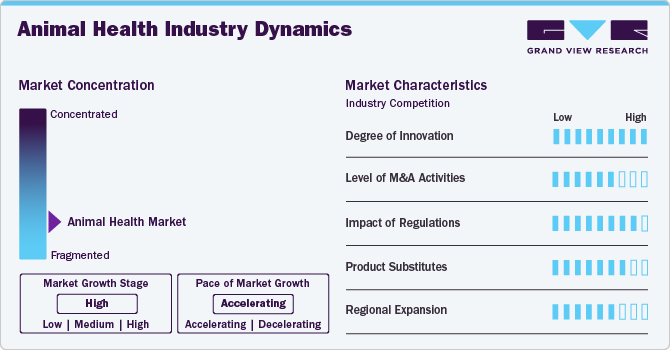

Market Concentration & Characteristics

The industry share is held by numerous companies, ranging from large corporations to small and medium-sized enterprises (SMEs). Given the diversity of the market, companies often specialize in particular areas or products. This specialization allows companies to cater to specific animal species, health conditions, or regional markets, creating niche opportunities within the broader animal health sector. Smaller players may focus on niche innovations, developing specialized products or technologies that address specific gaps or emerging trends in animal health. This emphasis on innovation can contribute to the overall growth of the market.

The market growth stage is estimated to be high while its pace is accelerating. This indicates a steady increase in demand for animal health products and services influenced by factors such as rising pet ownership, increased awareness of animal welfare, and advancements in veterinary care. Companies are also investing in educational initiatives to inform consumers about preventive care, nutrition, and the benefits of specific health products. The increase in consumer awareness is expected to positively impact the market growth in the coming years.

The industry is characterized by a high degree of innovation in terms of products. Multiple segments within the market are witnessing rapid developments and investments such as biologics, regenerative medicine, monoclonal antibodies, pharmaceuticals, software, diagnostic products, etc. Furthermore, the utilization of AI has been on a very high rise in the past few years. In 2024, Zoetis expanded its R&D capabilities by forging the Automation & Data Sciences group. Scientists & veterinarians collaborate in this platform to apply innovative technologies and also create digital analytical tools to generate data-driven insights, automate R&D processes as well as enhance data management.

The industry is also undergoing some consolidation as larger companies acquire other market players to boost their portfolios and capabilities. In September 2024, Boehringer Ingelheim acquired Saiba Animal Health. This strategic move was made to acquire the company's broad range of pipeline pet therapeutic products.

The industry is subject to diverse regulations. The development and manufacturing of medicines are strictly monitored by government agencies such as the FDA, while the regulations for veterinary diagnostics and other products are comparatively lax. Regulatory approval processes can be lengthy and complex, creating barriers to entry for new companies. This often results in established players holding notable animal health market share, as they have the resources and experience to navigate regulatory hurdles. For instance, in October 2024, The European Coordination for Animal Health Vaccination initiative was forged to enhance vaccination strategies across Europe to improve animal health and welfare.

The notable threat of product substitutes may restrain the growth of the market. Point-of-care diagnostic tools and at-home testing kits, for example, are becoming more common, offering alternatives to traditional veterinary diagnostic procedures. These alternatives provide convenience for pet owners and farmers. Also, herbal and natural remedies, including supplements and extracts, are often considered substitutes for conventional pharmaceuticals. They are perceived by some pet owners and farmers as more natural alternatives with potentially fewer side effects.

Regional expansion in the market is estimated to be moderate to moderate owing to several initiatives undertaken by key companies. For instance, in September 2024, Patterson Companies Inc. acquired two business units, Infusion Concepts (UK) and Mountain Vet Supply (U.S.) with an aim to expand into respective country markets.

Product Insights

Based on products, the pharmaceutical segment dominated the market with a share of about 43.42% in 2024. It is estimated to retain its dominant position throughout the forecast period due to consistent advancements in veterinary drugs. Pharmaceuticals primarily include anti-inflammatory drugs, parasiticides, antibiotics, and others. There is an increasing awareness and concern among pet owners, farmers, and animal caretakers about the importance of animal health. This heightened awareness, combined with product development by key companies, drives the demand for pharmaceuticals that address various health conditions, from common infections to chronic diseases.

The other segment, comprising veterinary telehealth, veterinary software, and livestock monitoring solutions, is expected to grow the fastest at a rate of about 14.10% in the near future. The COVID-19 pandemic, in particular led to a surge in the adoption of telehealth Apps and software to facilitate patient and veterinarian visits virtually. Many new players have entered the market since 2020, while existing companies enhanced their service offerings. In October 2024, a startup from Chicago, Mella Pet Care, collaborated with Vetster to expand its country portfolio UK, and Canada, apart from its presence in the U.S.

Animal Type Insights

In 2024, the production animal segment dominated the market and accounted for the largest revenue share. The substantial segment share results from increased concern for food safety and sustainability among end users as well as market stakeholders such as government healthcare organizations. As livestock farming modernizes to suffice the food demand of the global population, market stakeholders are increasingly adopting precision livestock farming techniques, biosecurity measures, and periodic programs such as annual vaccinations. This is expected to contribute to the continued dominance of the segment over the forecast period.

The companion animal segment is expected to grow at a lucrative rate during the forecast period. This is owing to the increasing uptake of pet insurance, pet humanization, expenditure on pets, and medicalization rate. The trend of humanizing companion animals, considering them as integral family members, has led to increased spending on their healthcare. This trend includes a willingness among pet owners to invest in advanced veterinary pharmaceuticals and medical treatments. Pet owners are thus increasingly seeking medical treatments, preventive care, and pharmaceutical solutions to ensure the health and well-being of their animals.

Distribution Channel Insights

The hospital/clinic pharmacy segment accounted for the largest revenue share in 2024 in terms of distribution channels. The increasing number of hospital pharmacies and high procedural volume have supported segment growth. Retail channels and e-commerce platforms also accounted for a significant share of the total market. The e-commerce segment is anticipated to witness the fastest growth rate throughout the forecast period. This can be attributed to various advantages such as increased convenience for patients not willing to purchase medicines from retail or hospital pharmacies.

Moreover, e-commerce channels also facilitate a consistent supply of drugs, and as medications, these can be preordered. Benefits such as these are anticipated to accentuate the demand for e-commerce throughout the forecast period. With the help of online pharmacies, order procurement and tracking become easy as associated Supply Chain Management (SCM) eliminates other market intermediaries of the delivery channel. This reduces overall costs, thereby increasing customer preference. Retail pharmacies for animal health products are expected to grow moderately throughout the forecast period.

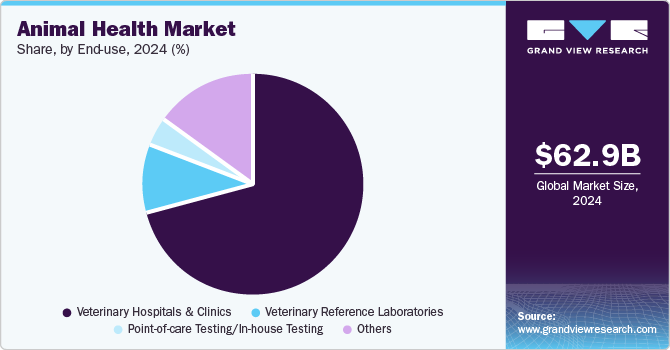

End-use Insights

By end-use, the veterinary hospitals and clinics segment accounted for the largest revenue share of the market in 2024. This is due to a large number of hospitals and clinics across the globe and highest footfall of patients at these care centers. The facilities have a wide range of treatment and diagnostic options, which is a key driver for this segment. Certain vaccines are only available in accredited veterinary hospitals and clinics, which is responsible for increasing the share of this end-user segment.

The point-of-care testing/in-house testing segment, on the other hand, is projected to grow at the highest CAGR from 2025 to 2030. An increase in the incidences of zoonotic diseases is expected to drive the demand for diagnostic procedures, which will drive the point-of-care testing/ in-house testing segments in the coming years. The increase in initiatives to create awareness among companion animal owners about the benefits and value of preventive care in pets is a key contributing factor to in-house animal health testing. Tests such as ELISA have been proven effective point-of-care tests for heartworm diagnosis.

Regional Insights

North America animal health market held the highest share of about 35.69% in 2024. The dominant share can be attributed to the high prevalence of livestock and zoonotic diseases leading to large-scale animal deaths. In addition, the presence of prominent market players, advanced healthcare infrastructure, and high healthcare expenditure are some of the factors responsible for the significant share. Furthermore, the presence of healthcare programs and initiatives to promote animal health is believed to widen the growth potential in this region. For instance, the North American Pet Health Insurance Association is promoting awareness about pet health insurance coverage and developing & exploring partnerships to address the challenges affecting the animal health industry. Efficient measures taken by animal welfare organizations in the event of an emergency or rapid illness breakout are also thought to be significant causes for growth in this region.

U.S. Animal Health Market Trends

The animal health market in the U.S. held the dominant share of the North American market in 2024. The dominant share can be attributed to a wide range of definitive measures adopted by the government animal care organizations consistently striving for overall improvement. For instance, the presence of Animal Health Emergency Management (AHEM) is aimed at ensuring food security and concentrates on aspects associated with animal products such as quality, safety, and affordability. In addition, these organizations also focus on the prevention of pathogenic agents, and management of sudden disease outbreaks and are involved in formulating strategies for efficient eradication and control of the disease.

Europe Animal Health Market Trends

The animal health market in Europe held the second-largest share in 2024. The region is expected to experience consistent growth over the forecast period because of the high production and companion animal population across this region. For instance, according to the FEDIAF 2022 report, 90 million households in the EU own a pet (46%), with around 110 million cats, 90 million dogs, and other pets. Furthermore, the European Medicines Agency (EMA) and its regulatory network partners identify action plans to improve and increase the availability of animal medicines in Europe. There are some action plans being implemented in the interest of public health & animal welfare. The EMA has undertaken many initiatives over time to encourage timely access to animal vaccines in the European market. Some initiatives are Minot Use Minor Species (MUMS) & restricted markets policy and support for Disease Control Tools project (DISCONTOOLS) analysis. Such initiatives are expected to impel regional market growth.

The UK animal health market held the largest share in Europe in 2024. A 2024 article published by Pet Keen stated that the pet population in the UK in 2021 was estimated to be 12.5 million dogs & 12.2 million cats. Due to the COVID-19 pandemic and the isolation that followed, there was a rise in pet ownership. In addition, people are adopting new pets for love, company, and fun. Currently, 62% of UK residents are pet owners. In addition, 4.5% of individuals obtained pet insurance in 2021, making 3.7 million people in the UK overall owners of pet insurance. The UK has 4.3 million insured pets, with dogs and cats being the most covered.

The animal health market in Germany is anticipated to grow at a constant rate due to the rising number of R&D activities and the influx of new animal products, rising animal adoption & cattle population, increasing adoption of preventive care for animals, and growing awareness about the significance of the health of farm & companion animals in the country. For instance, according to the German Livestock, the country has the largest dairy cattle herd & the second-largest cattle population in the EU. Furthermore, according to the International Committee for Animal Recording (ICAR), 50% of German farms specialize in livestock, which is anticipated to drive the veterinary medicine market.

Asia Pacific Animal Health Market Trends

The animal health market in Asia Pacific is expected to grow at a lucrative rate during the forecast period. The market is driven by the high investments in R&D by global market players as well as consistent efforts for the commercialization of veterinary pharmaceuticals and vaccines at relatively lower prices. In addition, in the upcoming years, the urgent requirement to handle disease outbreaks like swine flu and Ebola as well as the increased incidence rate of zoonotic illness, is anticipated to drive market expansion. Asia Pacific is one of the most diverse regions in terms of changing food consumption preferences and economic growth, among others.

India animal health market is witnessing a surge in demand for veterinary products and services to address existing and emerging diseases in animals. Global regulatory initiatives promoting responsible antibiotic use and the growing significance of animal welfare standards are shaping the industry. Additionally, the market is experiencing heightened investments in R&D, portfolio acquisition, etc., fostering market growth in the country. For example, in October 2024, the Government of India (GoI), in partnership with the Asian Development Bank and FAO, announced USD 25 million in funding to enhance “animal health security” with the help of multiple initiatives to develop holistic health coverage.

Latin America Animal Health Market Trends

The animal health market in Latin America is expected to show growth over the forecast period owing to increasing reforms in the healthcare industry in this region. The rising incidence of chronic livestock diseases is a factor driving market growth. Furthermore, the rise in supportive government funding in countries such as Brazil is another contributing factor. The presence of untapped opportunities, economic development, and rising awareness levels are some of the factors that can account for the rapid growth of this region. Agriculture is an extensive practice in the region, and, as a result, animal husbandry practices are being increasingly adopted, which supports market growth.

Brazil accounts for a higher revenue share in the region. This can mainly be attributed to the high number of pet owners in the country. Brazil has the exclusive distinction of having the greatest variety of animals-more than any country across the globe. The consumption of feed in the country is very high as it is a center for meat production worldwide.

Middle East & Africa Animal Health Market Trends

The animal health market in the middle east & africa is anticipated to show growth during the forecast period due to the high incidence of diseases like animal influenza and viral diseases, such as foot-and-mouth disease, coupled with rising awareness. These factors led to an increase in the need for effective management of the aforementioned chronic diseases in regions such as South Africa. The rising urgency can be attributed to inadequate treatment alternatives present in this region. The growing consumer preference for a healthy lifestyle is also fueling the market. The MEA countries aim at decreasing the prevalence of malnutrition. Hence, increasing consumption of meat & growing demand for protein-rich animal food are among the factors boosting the market demand in MEA.

South Africa animal health market is anticipated to grow at a lucrative rate during the forecast period. This is believed to be a consequence of certain government programs focused on overall animal health care improvement in the country. For instance, an EU-funded Integrated Control of Neglected Zoonosis Africa program is a strategy developed to address diseases such as rabies through consistent animal health checks. Infectious diseases are particularly problematic in the country. Livestock production accounts for up to 25% of national income. South Africa produces chicken at the 6th lowest price per kilo in the world; hence, it is competitive in the global poultry industry. Increasing government initiatives for advancing the poultry sector are key factors driving market growth in the country

Key Animal Health Company Insights

The market is highly fragmented and competitive in nature due to the presence of numerous companies. Companies that excel in product development, market understanding, strategic decision-making, and regulatory compliance hold a substantial share in the dynamic and evolving animal health industry.

Animal health market share by a company is determined by factors such as product penetration, regional presence, strategic initiatives, and the company’s financial performance. Leading companies in the market include Zoetis, Merck, Mars, IDEXX, and Boehringer Ingelheim. Leading companies have a diverse portfolio of effective and innovative veterinary pharmaceuticals, biologics, diagnostics, and other solutions that enable them to hold a notable market share by addressing a wider spectrum of animal health needs. These companies also have a strong and well-established presence in key markets and are better positioned to capture significant market share. They also engage in effective strategic planning to expand their capabilities, enter new markets, or enhance their product offerings, which supports positive shifts in market share.

Key Animal Health Companies:

The following are the leading companies in the animal health market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Ceva Santé Animale

- Merck & Co., Inc.

- Vetoquinol S.A.

- Boehringer Ingelheim Gmbh

- Elanco

- Virbac

- Mars Inc.

- Dechra Pharmaceuticals Plc

- Idexx Laboratories, Inc.

Recent Developments

-

In October 2024, VMD Sciences launched Expanded Access Programs (EAPs) for pets and livestock, providing veterinarians with access to innovative, life-saving treatments that are often unavailable through standard channels. This initiative aims to address unmet medical needs in veterinary medicine by ensuring safe and compliant access to advanced therapies in collaboration with community veterinarians.

-

In May 2024, USDA’s Animal and Plant Health Inspection Service (APHIS) announced funding of more than USD 22.2 million for enhancing early detection, preparedness, prevention, and rapid response towards leading livestock diseases in the U.S.

-

In November 2023, Bimeda inaugurated a new manufacturing facility in China for sterile injections and parasite-control products, thus extending its capabilities.

-

In October 2023, Zoetis commercially launched Librela- its anti-NGF monoclonal antibody treatment in the U.S. for control of canine osteoarthritis pain.

Animal Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 68.32 billion

Revenue forecast in 2030

USD 112.33 billion

Growth rate

CAGR of 10.46% from 2025 to 2030

Actual data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, animal type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain , Denmark, Sweden, Russia, Ireland, Norway, Netherlands, Switzerland, Poland, Japan, China, India, Australia, Thailand, South Korea, Philippines, Malaysia, Singapore, Indonesia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait, Turkey, Egypt, Iran, Israel

Key companies profiled

Zoetis; Ceva Santé Animale; Merck & Co., Inc.; Vetoquinol S.A.; Boehringer Ingelheim GmbH; Elanco; Virbac; Mars Inc.; Dechra Pharmaceuticals plc; IDEXX Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global animal health market report based on product, animal type, distribution channel, end-use and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicinal Feed Additives

-

Diagnostics

-

Consumables, reagents and kits

-

Instruments and devices

-

-

Equipment & Disposables

-

Critical Care Consumables

-

Anesthesia Equipment

-

Fluid Management Equipment

-

Temperature Management Equipment

-

Rescue & Resuscitation Equipment

-

Research Equipment

-

Patient Monitoring Equipment

-

-

Others

-

Veterinary Telehealth

-

Veterinary Software

-

Livestock Monitoring

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Reference Laboratories

-

Point-of-care Testing/In-house Testing

-

Veterinary Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Sweden

-

Denmark

-

Norway

-

Russia

-

Ireland

-

Poland

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Indonesia

-

Thailand

-

Australia

-

South Korea

-

Philippines

-

Malaysia

-

Singapore

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Turkey

-

UAE

-

Kuwait

-

Egypt

-

Iran

-

Israel

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global animal health market size was estimated at USD 62.89 billion in 2024 and is expected to reach USD 68.32 billion in 2025.

b. The global animal health market is expected to grow at a compound annual growth rate of 10.46% from 2025 to 2030 to reach USD 112.33 billion by 2030.

b. By region, North America held the highest share of about 35.69% of the market in 2024. The dominant share can be attributed to the high prevalence of livestock and zoonotic diseases leading to large-scale animal deaths. In addition, the presence of prominent market players, advanced healthcare infrastructure, and high healthcare expenditure are some of the factors responsible for the significant share.

b. Some key players operating in the animal health market include Zoetis; Ceva Santé Animale; Merck & Co., Inc.; Vetoquinol S.A.; Boehringer Ingelheim GmbH; Elanco; Virbac; Mars Inc.; Dechra Pharmaceuticals plc; IDEXX Laboratories, Inc.

b. Key factors that are driving the animal health market growth include rising animal health expenditure, the increasing inculcation of Artificial Intelligence (AI), evolving regulatory scenario, prevalence of diseases in animals, concerns over zoonoses, initiatives by key companies, uptake of pet insurance, and pet humanization.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.