- Home

- »

- Medical Devices

- »

-

Global Digital Stethoscope Market Size & Share Report, 2030GVR Report cover

![Digital Stethoscope Market Size, Share & Trends Report]()

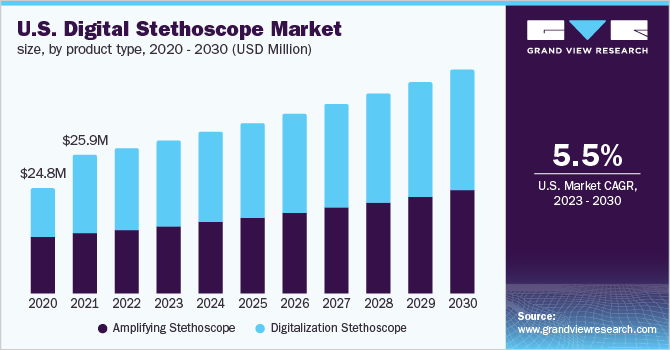

Digital Stethoscope Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Amplifying Stethoscope, Digitalization Stethoscope), By Technology, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-037-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Stethoscope Market Summary

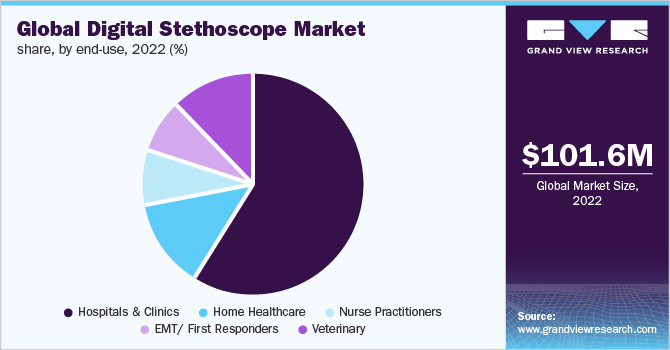

The global digital stethoscope market size was estimated at USD 101.57 million in 2022 and is expected to reach USD 165.81 million by 2030, growing at a CAGR of 6.36% from 2023 to 2030. The rising prevalence of chronic diseases such as cardiovascular and respiratory diseases, the rising geriatric population, and the adoption of next-generation technology such as artificial intelligence in stethoscopes are the factors anticipated to fuel the market’s growth.

Key Market Trends & Insights

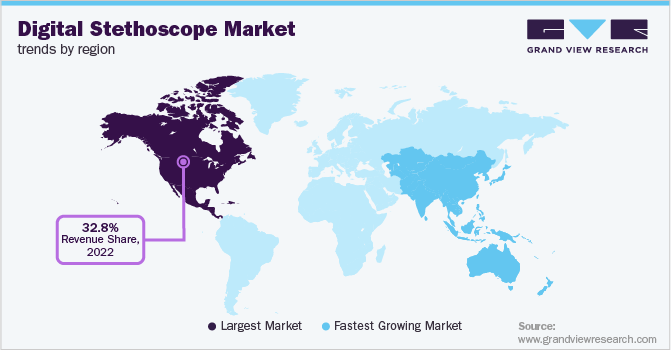

- North America dominated the digital stethoscope market with a revenue share of 32.85% in 2022.

- By product type, the digitalization stethoscope segment held the largest revenue share of 54.63% in 2022.

- By technology, the wireless transmission system segment held the largest revenue share of 40.07% in 2022.

- By application, the cardiology segment held the largest revenue share of 24.81% in 2022.

- By end use, the hospitals & clinics segment held the largest revenue share of 59.35% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 101.57 Million

- 2030 Projected Market Size: USD 165.81 Million

- CAGR (2023-2030): 6.36%

- North America: Largest market in 2022

The global market is experiencing rapid technological advancements offering machine learning such as artificial intelligence, which enables electrocardiograms as well as phonocardiograms in a single device. For instance, in February 2020, Eko Device received FDA approval for nearly half a dozen of its digital stethoscope with algorithmic design, which would help healthcare providers in detecting irregular heartbeats, as well as atrial fibrillation that could assist professionals to diagnose stroke and blood clots.

In addition, a stethoscope with an electrocardiogram (ECG), combined with various other important parameters, such as temperature, respiration rate, heart rate, blood pressure trend, and pulse oximeter, would assist healthcare professionals to deliver service to remote patients as well as telehealth to home. According to the Economic Research Service, 2021 edition, in 2020 nearly 46 million U.S. population, that is 14%, lived in rural areas.

Furthermore, according to an article published by NIH News in Health, in March 2022, approximately 20% of American citizens live in rural areas and they are more likely to die prematurely from the leading causes of death such as heart disease, lung disease, cancer, and stroke in the U.S. Rural health is one of the prominent drivers fueling the market growth.

A rise in the prevalence of cardiovascular diseases such as heart attack, rheumatic heart disease, and strokes among many others in several countries is anticipated to fuel the digital stethoscope market growth. Cardiovascular diseases are considered to be one of the leading causes of death globally. The majority of cardiovascular diseases are caused due to unhealthy lifestyles, consumption of unhealthy diets, alcohol, and tobacco, as well as lack of physical inactivity.

According to a WHO article published in June 2021, nearly 2% of deaths globally are related to rheumatic heart disease. Furthermore, about 32% of global deaths, which is estimated to be around 17.9 million people, died from cardiovascular diseases in 2019, out of which 85% of deaths were caused due to stroke and heart attack. Additionally, high cholesterol, diabetes, cigarette smoking, and high blood pressure increase the risk of cardiovascular diseases, such as stroke and heart attack.

According to an article released by IDF Diabetes Atlas Tenth edition 2021, in September 2021, approximately 537 million people between the age group of 20 to 79 years have diabetes. Furthermore, it is anticipated to rise to 643 million and 738 million by 2030 and 2045 respectively. Thus, the prevalence of unhealthy lifestyle patterns among youth worldwide is expected to fuel the growth of the digital stethoscope industry in the coming future.

According to the data from the National Health Interview Survey performed in October 2022, in the year 2021, approximately 20% of U.S. adults who were 18 years and above, used telemedicine. The use of telemedicine increased with the geriatric population and was higher in women, which was 42% compared to men, which was around 31%. Nearly 29% of adults were in between 18 years to 29 years, while around 63% were 65 years and above. According to an ASPE article, in 2021, nearly 1 in every 4 adults was reported to have a video or audio appointment with healthcare professionals This factor is anticipated to boost the market growth.

Product Type Insights

The digitalization stethoscope segment held the largest revenue share of 54.63% in 2022. The advancement of Bluetooth technology has paved the way for the development of wireless stethoscopes. Digital stethoscopes with ECG combined with various other parameters can assist healthcare providers to monitor remote patients and thus deliver telehealth to individuals at their respective homes. In addition, many telemedicine companies, such as Steth IO, have launched digital stethoscopes built within smartphones, which allow physicians to listen to and measure lung sound and heart rates using the mobile application just by holding the phone up to an individual’s chest.

The amplifying stethoscope segment is however anticipated to witness the fastest CAGR during the forecast period. Since the internal body sounds contain low frequency, amplification of the auscultated sound below the threshold is required. Thus, the microphone on the chest piece on amplifying stethoscope captures the acoustic resonances and amplifiers to intensify acoustic sound to a distinct level along with transducers to categorize cardiac sounds. For instance, 3M Littmann digital stethoscopes include a piezoelectric sensor that further amplifies the sound signal up to 24 times.

Technology Insights

The wireless transmission system segment held the largest revenue share of 40.07% in 2022. According to PHARMIWEB.COM LIMITED, in September 2020, Spanish company eKuore which is a mobile health device company developed a wireless stethoscope, which enables wireless auscultation, thus minimizing the infection among healthcare professionals. Smartphone stethoscope apps have been developed for real-time graphical visualization of auscultation sounds by connecting with digital stethoscopes. Thus, the rising adoption of technological advancements by healthcare professionals impels the growth of the digital stethoscope industry.

The integrated chest-piece system segment is however anticipated to witness the fastest CAGR during the forecast period. The microelectromechanical system (MEMS) piezoresistive electronic sensors also generate electrical signals with higher sensitivity and accuracy. Thus, the digital stethoscope contains a capacitive microelectromechanical system (MEMS), comprising an adaptive noise canceller, and can amplify acoustic sound by up to 100 times, resulting in better amplification. This factor thus anticipates the growth in the demand for digital stethoscopes in the upcoming years.

Application Insights

The cardiology segment dominated the market with a revenue share of 24.81% in 2022. Cardiovascular disease (CVD) has become the leading cause of death worldwide in the past three decades. According to WHO, in 2021, 17.9 million deaths occur due to CVD every year worldwide. Moreover, it is anticipated that more than 3.6 million people will die from CVD, mainly from heart disease and stroke by 2030. Heart diseases include cerebrovascular disease, coronary heart disease, rheumatic heart disease, and other conditions.

Diagnosing and treating these heart ailments could become easy with the variations in the sound produced due to the heart activity. Most heart diseases are associated with and reflected by the sounds that the heart produces. Thus, heart auscultation (listening to the heart sound) is the primary step taken by every physician for the early diagnosis of cardiac illness. Thus, increasing incidences of cardiovascular disorders globally are expected to boost the demand for digital stethoscopes over the forecast period.

The general medicine segment is anticipated to expand at the highest CAGR during the forecast period. A rise in the number of surgical procedures is a major driver for the stethoscope market. As per the 2020 report of Global Surgery & Anesthesia, more than 310 million surgeries are performed worldwide each year for various chronic conditions and this number has undergone a considerable annual increase.

The general physician uses a stethoscope to listen to bowel resonances throughout the postoperative period. However, the anesthesia used during the surgery tends to slow down the bowels. Hence, many patients wake up with nausea and loss of appetite after an operation. With the help of a digital stethoscope, to auscultate the belly sound, the doctor can often get an indication of the patient’s stage of recovery. Thus, a stethoscope is considered to be one of the important medical devices in surgery centers to trace auscultation. This is projected to strengthen segment growth in the coming years. Hence, a global rise in the number of surgical procedures performed is a key factor that drives the global market.

End-use Insights

In 2022, the hospitals & clinics segment dominated the digital stethoscope industry with the largest revenue share of 59.35%. It is anticipated to witness the fastest CAGR during the forecast period. In terms of the sheer volume of digital stethoscopes, hospitals are observed to be the largest consumers of related services and products. In addition, an increase in the number of chronic illnesses that lead to a high rate of hospitalization contributes to the rising demand for digital stethoscopes in this segment, which is projected to strengthen growth in future years.

Moreover, dental clinics use stethoscopes to record the pressure of the blood before the surgical process. Furthermore, the geriatric population and chronic disease patients prefer hospitals & clinics. Thus, the rising incidences of cardiovascular diseases & the growing geriatric population are anticipated to drive the electronic stethoscope market in the near future. For instance, according to CDC, an article released in October 2022 stated that approximately 20 million U.S. individuals aged 20 and above were diagnosed with coronary artery disease, which is around 7% of the population. This is impelling the demand for home healthcare throughout the forecast period.

Regional Insights

In 2022, North America dominated the market with a revenue share of 32.85%. The rising prevalence of chronic disorders, speedy adoption of technological advancements in devices, and growing geriatric population are driving the market growth in this region. For instance, according to the CDC, in the U.S., yearly, more than 795,000 people suffer from stroke, with 87% identified as ischemic stroke.

Furthermore, as per the CMS data, the U.S. healthcare expenditure grew 2.7% in 2021, reaching USD 4.3 trillion. According to the Canadian Institute for Health Information, in 2021, the total healthcare expenditure of Canada was USD 308 billion, representing the overall healthcare spending of 12.7% of the total GDP. Thus, growing healthcare expenditure is contributing further to driving the market for digital stethoscopes in North America.

Asia Pacific is anticipated to witness the fastest CAGR over the forecast period, owing to factors such as the rising incidences of cardiovascular diseases, growing geriatric population, rising unhealthy lifestyle among youngsters, and increasing incidence of acute ischemic stroke. Moreover, the presence of a large patient base is anticipated to present notable growth opportunities. In addition, high R&D investments by major market players due to their low-cost structure also act as a high-impact rendering growth driver for the regional market.

According to an article by ResearchGate, published in April 2020, the prevalence of obesity in individuals 18 years and above in ASEAN countries is Cambodia at 50.20%, Indonesia at 28%, Laos at 20.9%, Malaysia 15.4%, Singapore at 44.1%, Myanmar at 8.4%, Vietnam at 2.53%, Thailand at 12.7%, and Brunei Darussalam at 29.5%. Furthermore, in all ASEAN countries, obesity is more prevalent in females.

In developing nations like Australia and India, various companies are trying to capture the growing opportunity by launching novel and affordable equipment in the market for digital stethoscopes. For instance, in April 2020, an India-based start-up, Ayu Devices, designed AyuSynk, a digital stethoscope that assists doctors to pay attention to the heart and lung sounds of patients while maintaining a safe distance from them. In addition, in January 2018, M3DICINE, based in Brisbane, Australia, revealed the world's first FDA-approved AI-enabled digital stethoscope.

Key Companies & Market Share Insights

Companies are focusing on the development of novel medical devices, expansions, and technological innovations. Moreover, mergers and acquisitions for new product development and strengthening of supply chain networks constitute some of the strategic initiatives implemented by major players. For instance, in October 2020, 3M and Eko launched the 3M Littmann CORE Digital Stethoscope for clinicians that offer access to both digital & analog auscultation selections and links to Eko’s software & AI algorithms to support clinicians in better interpreting the sounds and perceiving heart murmurs. Thus, due to such activities, the electronic stethoscope market is expected to grow in near future. Some prominent players in the global digital stethoscope market include:

-

3M

-

eKuore

-

American Diagnostic Corporation

-

Contec Medical Systems Co., Ltd.

-

Meditech Equipment Co., Ltd.

-

Ayu Devices

-

Thinklabs Medical LLC

-

Cardionics

Digital Stethoscope Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 107.72 million

Revenue forecast in 2030

USD 165.81 million

Growth rate

CAGR of 6.36% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M; eKuore; American Diagnostic Corporation; Contec Medical Systems Co., Ltd.; Meditech Equipment Co., Ltd.; Ayu Devices; Thinklabs Medical LLC; Cardionics

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Stethoscope Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital stethoscope market report based on product type, technology, application, end-use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Amplifying Stethoscope

-

Digitalization Stethoscope

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated Chest-Piece System

-

Wireless Transmission System

-

Integrated Receiver Head-Piece System

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Medicine

-

Cardiology

-

Telemedicine

-

Veterinary

-

Pediatrics

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Home Healthcare

-

Nurse Practitioners

-

EMT/ First Responders

-

Veterinary

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global digital stethoscope market size was estimated at USD 101.57 million in 2022 and is expected to reach USD 107.72 million in 2023.

b. The global digital stethoscope market is expected to grow at a compound annual growth rate of 6.36% from 2023 to 2030 to reach USD 165.81 million by 2030.

b. North America dominated the digital stethoscope market with a share of 32.85% in 2022. The rising prevalence of chronic disorders, speedy adoption of technological advancements in devices and growing geriatric population are driving the digital stethoscope market growth in this region.

b. Some of the key players operating in the digital stethoscope market include 3M, eKuore, American Diagnostic Corporation, Contec Medical Systems Co., Ltd., Meditech Equipment Co., Ltd., Ayu Devices, Thinklabs Medical LLC, and Cardionics.

b. The rising prevalence of chronic diseases such as cardiovascular and respiratory diseases, the rising geriatric population, and adoption of next-generation technology such as artificial intelligence in stethoscopes are the factors that are anticipated to have an impact on the growth of the digital stethoscope market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.