- Home

- »

- Pharmaceuticals

- »

-

Antibiotics Market Size, Share, Trends, Industry Report, 2033GVR Report cover

![Antibiotics Market Size, Share & Trends Report]()

Antibiotics Market (2025 - 2033) Size, Share & Trends Analysis Report By Drug Class (Cephalosporin, Fluoroquinolone), By Type (Branded Antibiotics, Generic Antibiotics), By Action Mechanism, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-149-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antibiotics Market Summary

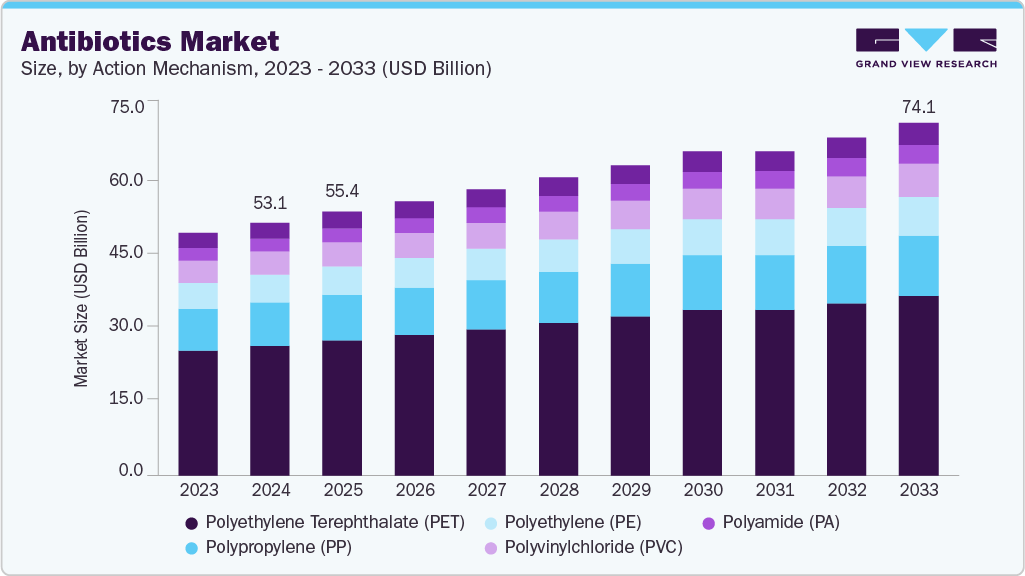

The global antibiotics market size was estimated at USD 53.07 billion in 2024 and is projected to reach USD 74.07 billion by 2033, growing at a CAGR of 3.71% from 2025 to 2033, major factor contributing to market growth. The antibiotics market is driven by the prevalence of bacterial infections.

Key Market Trends & Insights

- North America antibiotics market held the largest share of 39.36% of the global market in 2024.

- The antibiotics industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the generic antibiotics segment held the highest market share of 81.48% in 2024.

- By drug class, the Penicillin segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 53.07 Billion

- 2033 Projected Market Size: USD 74.07 Billion

- CAGR (2025-2033): 3.71%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Respiratory tract infections (RTIs), such as pneumonia and bronchitis, are among the most widespread, for instance, in May 2025, the CDC estimated that the U.S. experienced between 47-82 million flu illnesses, 21 million medical visits, and 640,000 hospitalizations, based on data from 2024 - 2025. These preliminary figures, derived from weekly influenza surveillance and mathematical modeling, reflect the season's disease burden, often leading to secondary bacterial infections requiring antibiotics. Urinary tract infections (UTIs) follow closely, with over 150 million cases annually worldwide, according to BMC Infectious Diseases, making them a leading cause of antibiotic use. Skin and soft tissue infections (SSTIs), such as cellulitis, are also significant, especially in outpatient care. Hospital-acquired infections (HAIs), including Clostridium difficile and methicillin-resistant Staphylococcus aureus (MRSA), further increase demand. These infections are fueled by urbanization, aging populations, and rising antimicrobial resistance (AMR), which reduces the efficacy of existing treatments. High infection rates in developing regions with limited healthcare access further amplify the need for antibiotics, sustaining market growth despite resistance challenges.

Research and development (R&D) in antibiotics face hurdles due to high costs and low profitability. Developing new antibiotics is expensive, with clinical trials and regulatory demands adding to the burden, while short treatment durations limit returns. However, initiatives such as in April 2025, CARB-X awarded ArrePath USD 3.7 million to develop a novel antibiotic targeting multidrug-resistant Enterobacterales, focusing on complicated urinary tract infections. Using an AI-driven platform, ArrePath identified inhibitors with a unique mechanism, potentially offering oral and IV treatment options to combat antimicrobial resistance effectively. For example, Pfizer partnered with AbbVie in 2023 to develop novel antibiotic combinations, sharing costs and risks. The Global AMR R&D Hub also coordinates international efforts to bolster the antibiotic pipeline. Despite these measures, challenges persist, as resistance develops quickly, reducing the lifespan of new drugs. Sustained public-private collaboration is critical to overcoming these barriers and ensuring the development of effective antibiotics to combat rising resistance.

Key players in the antibiotics market employ strategies such as mergers, partnerships, and innovation to stay competitive. In February 2025, key biotech deals included Novartis acquiring Anthos Therapeutics for up to $2.15 billion ($925 million upfront) for its stroke prevention program, Eli Lilly buying Organovo’s FXR program for inflammatory bowel disease (terms undisclosed), and the merger of Alumis and Acelyrin, focusing on immune-mediated diseases with a $737 million cash runway. In 2023, Merck invested over USD 674 million partnering with Exscientia to apply AI in drug development, manufacturing, and regulatory processes. Additionally, Merck joined forces with BenevolentAI, investing hundreds of millions more in AI drug discovery platforms. Smaller firms like Entasis Therapeutics, which gained FDA approval for Xacduro in 2023 for pneumonia, target niche markets. Companies such as GSK also promote antibiotic stewardship to encourage responsible use. However, generic competition and the need for constant innovation amid resistance pressures challenge profitability. These developments reflect a dynamic market where firms balance cost management with the pursuit of novel antibiotics to maintain their edge.

Pipeline Analysis

The antibiotics market is experiencing significant research and development to address antimicrobial resistance and expand treatment options. A notable advancements such as, In March 2025, McMaster University researchers, led by Gerry Wright, discovered a new antibiotic class featuring lariocidin, a lasso peptide published in Nature. This innovative molecule targets bacterial protein synthesis uniquely, addressing the growing threat of antimicrobial resistance. In June 2025, Roche's zosurabalpin, a new antibiotic developed with Harvard University, is entering phase 3 trials to tackle carbapenem-resistant Acinetobacter baumannii (CRAB), a deadly Gram-negative bacteria causing pneumonia and sepsis. In May 2025, Roche planned a phase 3 trial for zosurabalpin, targeting carbapenem-resistant Acinetobacter baumannii (CRAB), to launch late 2025 or early 2026, addressing a major antibiotic resistance challenge.

Antibiotics Market Patent Summary

Table: Antibiotics with patent expirations

Antibiotic

Brand Name

Estimated Patent Expiry

Notes

Ceftazidime-avibactam

Zavicefta/Avycaz

2032

β-lactam/β-lactamase inhibitor combo for multidrug-resistant Gram-negative infections; QIDP exclusivity

Aztreonam-avibactam

Emblaveo

2032

Novel combo targeting metallo-β-lactamase producers; patent and exclusivity protections ongoing

Delafloxacin

Baxdela

2031

Fluoroquinolone antibiotic approved for skin infections; patent protection active

Omadacycline

Nuzyra

2030

Tetracycline-class antibiotic for community-acquired infections; patent and exclusivity active

Lefamulin

Xenleta

2031

Pleuromutilin antibiotic for respiratory infections; patent protection extends into early 2030s

Plazomicin

Zemdri

2032

Aminoglycoside antibiotic for complicated UTIs; patent protection ongoing

Vabomere

Meropenem-vaborbactam

2031

Carbapenem-β-lactamase inhibitor combo; patent and QIDP exclusivity

Relebactam (with Imipenem)

Recarbrio

2033

β-lactamase inhibitor combo; patent and exclusivity protections

Rifamycin SV

Aemcolo

2035

Antibiotic for travelers’ diarrhea; patent protection

Cefiderocol

Fetroja

2035

Siderophore cephalosporin antibiotic for multidrug-resistant Gram-negative infections; patent protected

Source: FDA Orange Book (2025)

Many older antibiotics face generic competition due to expired patents, while newer drugs benefit from extended exclusivity, driving innovation and market dynamics.

Market Concentration & Characteristics

The antibiotics market features a strong focus on innovation to counter antimicrobial resistance. Regulatory oversight from agencies such as the FDA and EMA imposes stringent approval standards, reflecting concerns over resistance and safety. Challenges include the economic feasibility of developing antibiotics with limited use to preserve efficacy, while opportunities arise from addressing unmet needs in multi-drug resistant infections and expanding into emerging markets. The competitive landscape includes dominant pharmaceutical firms and a significant generic sector.

The antibiotics market prioritizes innovation to tackle antimicrobial resistance. Companies invest in novel antibiotics and combination therapies, exemplified by the FDA-approved Xacduro for resistant pneumonia. Research also explores narrow-spectrum antibiotics to limit resistance development, alongside protein synthesis inhibitors for enhanced efficacy. These efforts sustain market growth by meeting critical health demands.

Entry into the antibiotics market requires overcoming high R&D costs for clinical trials and safety testing. Manufacturing complexity, especially for advanced drug classes, increases investment needs. Regulatory requirements from the FDA and EMA demand rigorous compliance, deterring new entrants and favoring established firms with substantial resources.

Regulatory bodies enforce strict standards for antibiotic safety and efficacy, addressing resistance concerns. The FDA’s fast-track designations and the GAIN Act incentivize development through expedited approvals and exclusivity extensions. However, extensive post-marketing surveillance and usage restrictions present ongoing compliance challenges.

Substitutes like bacteriophage therapy and vaccines remain underdeveloped, posing minimal competition. Generic antibiotics dominate as cost-effective alternatives to branded products, while new antibiotics with unique mechanisms address resistance, serving as substitutes for less effective treatments.

Expansion targets regions such as Asia Pacific, with its large population and healthcare growth, alongside Latin America and Middle East & Africa, where disease burdens drive demand. Companies must navigate diverse regulations and local dynamics to capitalize on these opportunities.

Drug Class Insights

Penicillin segment led the market and accounted for the largest revenue share of 23.74% in 2024, Penicillin is the first drug class to be discovered and is still widely used to treat various infections, especially those caused by staphylococci & streptococci, clostridium, and listeria. They act by either inhibiting cell wall synthesis or by preventing the formation of the peptidoglycan layer. In treating infections such as pharyngitis, skin infection, bronchial cough, gonorrhea and ear fungus, these medicines represent the first line of treatment. In April 2024, the U.S. FDA approved Pivya (pivmecillinam), a penicillin-class antibiotic, for treating uncomplicated urinary tract infections in women, reinforcing penicillin's market leadership. Antibiotic resistance development, allergic activities, and several other adverse effects are the main reasons these drugs are expected to lose market share over the forecast period.

Cephalosporins are projected to significant market growth during the forecast period. As a subtype of beta-lactam antibiotics, they effectively target gram-positive and gram-negative bacteria, including Pseudomonas aeruginosa, Klebsiella pneumoniae, and Bacteroides fragilis. Like penicillins, generics dominate the cephalosporin market, showing similar seasonal usage patterns. Cephalosporins encompass five generations, with the third, fourth, and fifth generations widely used for resistant pathogens. Cefixime, a prevalent third-generation broad-spectrum cephalosporin, treats infections caused by P. aeruginosa and N. gonorrhoeae, with activity against S. aureus, S. pneumoniae, and Enterobacteriaceae. These factors drive increasing demand in the antibiotics market.

Type Insights

Generic antibiotics segment accounted for the largest revenue share of 81.48% in 2024, the affordability of generic formulations, presence of a large number of manufacturers leading to high bargaining power of buyers, and supportive regulatory framework are the key factors responsible for the dominance. In addition, favorable government initiatives to promote generic preparations and easy access to generic drugs is fueling segment expansion.

Branded Antibiotics segment is estimated to register the significant CAGR over the forecast period. Due to the robust investigational pipeline, rising need for new & novel antibiotics, and increasing focus of key players to strengthen their product offerings and distribution network. For instance, In July 2024, Pfizer announced that the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) granted approval for a novel antibiotic combination, Emblaveo (aztreonam-avibactam), targeting multidrug-resistant Gram-negative bacterial infections. These aspects are increasing the demand for the antibiotics market.

Action Mechanism Insights

Cell Wall Synthesis Inhibitors segment dominated the market with revenue share of 52.07% in 2024. Cell wall synthesis inhibitors are the primarily widely used antibiotics, as they are described with wide-spectrum action against gram-positive and gram-negative bacteria. These drugs inhibit the synthesis of the peptidoglycan layer, which is crucial for the structural activity of the cell wall. This category of drugs includes cephalosporins, penicillin, carbapenems, and others. In March 2025, Meiji Seika Pharma reported successful Phase III trial results for OP0595, a novel β-lactamase inhibitor, demonstrating enhanced efficacy in combination therapies targeting bacterial cell wall synthesis. This development, supported by increased government funding and research initiatives, strengthens the cell wall synthesis inhibitors segment, positioning OP0595 as a promising candidate for addressing antibiotic resistance, particularly in multidrug-resistant infections, and driving significant market growth over the forecast period.

The RNA Synthesis Inhibitors segment is projected to experience substantial growth over the forecast period, primarily due to intensified research and development efforts and the introduction of new products by market players. This growth is further supported by the success of clinically approved natural products, such as rifamycins and fidaxomycin, which are recognized for their ability to inhibit RNA polymerase (RNAP).

Regional Insights

North America antibiotics market is driven by advanced healthcare infrastructure with revenue share of 39.36%, high antibiotic consumption, and a significant burden of infectious diseases. The region benefits from extensive research and development (R&D) activities, particularly in the U.S., where pharmaceutical giants like Pfizer and Merck prioritize innovation to combat antimicrobial resistance (AMR). The aging population increases demand for antibiotics to treat conditions such as pneumonia, while government initiatives play a crucial role in supporting development efforts.

A key example is the U.S. Food and Drug Administration’s (FDA) approval of Innoviva Inc.’s Xacduro in May 2023 for hospital-acquired bacterial pneumonia, demonstrating the region’s focus on addressing resistant infections. The high prevalence of diseases such as tuberculosis (TB), During 2023, a total of 9,615 TB cases were provisionally reported by the 50 U.S. states and the District of Columbia (DC), representing an increase of 1,295 cases (16%) as compared with 2022. Challenges include antibiotic misuse, which exacerbates AMR, and stringent regulatory processes that can delay product approvals.

U.S. Antibiotics Market Trends

U.S. antibiotics market is growing due to substantial healthcare spending, cutting-edge R&D, and a strong emphasis on innovation. The country leads globally in developing next-generation antibiotics to counter AMR, supported by policies such as the Generating Antibiotic Incentives Now (GAIN) Act of 2012, which provides incentives such as extended exclusivity periods. A notable instance is the collaboration between Merck and the National Institute of Allergy and Infectious Diseases (NIAID) in 2023 to develop novel antibiotics targeting multidrug-resistant bacteria. The U.S. faces a high infectious disease burden, with TB cases notably affecting Hispanic or Latino populations. Regulatory oversight by the FDA ensures quality but often slows market entry due to rigorous evaluation.

Europe Antibiotics Market Trends

Europe’s antibiotics market is driven by advanced healthcare systems, stringent regulations, and a concerted effort to address AMR. The region’s large geriatric population drives demand for antibiotics to treat age-related infections, while the European Medicines Agency (EMA) enforces high standards that ensure quality but complicate approvals. A significant development is the Global Antibiotic Research & Development Partnership (GARDP) working with Bugworks Research Inc. in June 2024 to develop BWC0977, a broad-spectrum antibiotic targeting resistant bacteria. Public-private partnerships, such as the AMR Action Fund, bolster innovation, though high R&D costs and regulatory fragmentation across countries pose barriers. Antibiotic stewardship programs, particularly robust in nations such as the UK and France, aim to curb misuse, reflecting Europe’s commitment to sustainable antibiotic use and maintaining market stability.

UK’s antibiotics market is underpinned by a sophisticated healthcare system and significant R&D investment. The National Health Service (NHS) leads efforts in antibiotic stewardship to reduce misuse and preserve efficacy, aligning with the UK’s 5-year action plan on AMR (2019-2024, extended to align with global targets). A key instance is In 2024, GARDP received significant funding (EUR 60 million) to support large-scale clinical trials such as NeoSep1, targeting neonatal sepsis in low- and middle-income countries, with GSK as a key partner supporting access and policy frameworks. The rising prevalence of bacterial infections and government-backed R&D initiatives drive market growth, though Brexit-related regulatory shifts introduce complexities. The UK remains a hub for antibiotic innovation, supported by its public health policies and focus on combating AMR effectively.

Germany’s antibiotics market is strengthened by its advanced healthcare infrastructure and a robust pharmaceutical sector. The country actively addresses AMR through participation in European initiatives, with a high incidence of bacterial infections driving demand. For example, in January 2023, BioVersys receiving support from the AMR Action Fund for clinical trials of novel antibiotics. Germany’s regulatory framework, aligned with EMA standards, ensures quality production but imposes strict approval timelines. The aging population and rising healthcare expenditure further stimulate the market. Bayer AG’s efforts to develop new antibiotic classes targeting resistant strains, backed by government research programs, exemplify Germany’s commitment to innovation and its strong market position within Europe.

France’s antibiotics market is driven by a substantial geriatric population and government support for healthcare innovation. The country emphasizes antibiotic stewardship to limit misuse, particularly of broad-spectrum drugs. Companies like Sanofi invest in novel antibiotics, though regulatory hurdles and high R&D costs present challenges. France’s focus on targeted therapies and regional collaboration sustains market growth, positioning it as a vital contributor to Europe’s antibiotics landscape.

Asia Pacific Antibiotics Market Trends

The Asia Pacific antibiotics market is propelled by a vast population, increasing infectious disease prevalence, and expanding healthcare access. The region is a hub for generic antibiotic production, led by countries such as India and China, though unregulated over-the-counter sales and counterfeit drugs fuel AMR. Government initiatives, such as India’s National Action Plan on AMR, aim to regulate use and enhance surveillance. Rapid urbanization and healthcare investments further drive growth, with China and India leading in consumption. The market benefits from local manufacturing strengths, despite challenges in quality control and resistance management.

Japan’s antibiotics market is characterized by an aging population and a preference for branded antibiotics, supported by an advanced healthcare system. Companies like Astellas Pharma Inc. lead R&D efforts to develop novel antibiotic classes addressing AMR, with government initiatives improving healthcare access. The Pharmaceuticals and Medical Devices Agency (PMDA) enforces strict standards, often lengthening approval processes. Japan’s market remains robust, driven by its pharmaceutical expertise and commitment to tackling resistance through innovation.

China dominates the Asia Pacific antibiotics market with its large population, high antibiotic use, and growing healthcare infrastructure. Rising bacterial infections and urbanization fuel demand, while local generic manufacturers strengthen supply. The National Action Plan on AMR (2016-2020, extended) regulates use and improves surveillance, exemplified by China’s collaboration with international bodies to combat counterfeit drugs. Challenges such as over-the-counter sales persist, but investments in R&D and healthcare reforms, alongside Pfizer’s strategic partnerships, enhance market growth. China’s role as a major exporter underscores its pivotal position in the region.

Latin America Antibiotics Market Trends

Latin America’s antibiotics market is emerging, driven by improving healthcare systems, growing awareness of bacterial infections, and a high disease burden, including TB. Generic antibiotics dominate due to affordability, supported by global health initiatives. A key instance is Pfizer’s 2023 partnership with a Brazilian firm to enhance antibiotic distribution in underserved areas. Challenges like AMR and supply chain disruptions persist, but expanding healthcare infrastructure and public-private collaborations drive progress. Brazil’s Unified Health System (SUS) boosts access, positioning the region for steady market development.

Brazil’s antibiotics market is propelled by its large population, urbanization, and government healthcare programs like SUS, which subsidizes antibiotics. The high prevalence of infectious diseases drives demand to develop affordable generics. AMR and regulatory complexities pose challenges, but Brazil’s growing pharmaceutical sector and efforts to curb counterfeit drugs support growth. The country leads Latin America’s market, leveraging its population size and healthcare reforms.

Middle East & Africa Antibiotics Market Trends

The Middle East & Africa (MEA) antibiotics market is driven by a high infectious disease burden, including TB, and improving healthcare access. Generic antibiotics prevail, supported by initiatives such as the Global Fund’s provision of TB treatments in Africa. Challenges include resistance and supply issues, but government investments, especially in Saudi Arabia, foster growth. The market is poised for expansion through infrastructure development and partnerships.

Saudi Arabia’s antibiotics market grows with healthcare investments under Vision 2030 and reliance on imported antibiotics from firms such as Pfizer and GSK. Local production is emerging, though regulatory oversight remains a hurdle. High infection rates and population growth drive demand, with generics gaining traction, positioning Saudi Arabia as a key MEA market player.

Key Antibiotics Company Insights

The antibiotics market features dominant players such as AbbVie, Inc., Merck & Co., Inc., Pfizer Inc., and Novartis AG. Merck, established in 1891 and based in the U.S., excels in developing and commercializing pharmaceuticals for human and animal health. Pfizer, founded in 1849 and headquartered in New York, focuses on pharmaceutical innovation and manufacturing. Emerging companies such as Nabriva Therapeutics PLC, a biopharmaceutical firm targeting infectious diseases, and Viatris, Inc., a multinational based in Canonsburg, Pennsylvania, alongside Teva Pharmaceutical Industries Ltd., are also making strides, enhancing competition and innovation in this vital healthcare sector.

Key Antibiotics Companies:

The following are the leading companies in the antibiotics market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie, Inc.

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- Lupin Pharmaceuticals, Inc.

- Viatris, Inc.

- Melinta Therapeutics LLC

- Cipla, Inc.

- Shionogi & Co., Ltd.

- KYORIN Pharmaceutical Co., Ltd.

- GSK plc

- Nabriva Therapeutics PLC

Recent Developments

-

In October 2024, Iterum Therapeutics received FDA approval for ORLYNVAH, a new oral antibiotic combining sulopenem etzadroxil and probenecid for uncomplicated UTIs, targeting resistant bacteria like Escherichia coli.

-

In November 2024, Zai Lab signed an agreement with Pfizer to commercialize XACDURO, a sulbactam-durlobactam combination for hospital-acquired bacterial pneumonia in mainland China, addressing multidrug-resistant infections.

-

In March 2024, Wockhardt reported positive results for Zidebactam/Cefepime, a novel antibiotic effective against drug-resistant skull bone infections and pneumonia in a renal transplant patient.

-

In June 2024, GARDP collaborated with Bugworks Research Inc. to develop BWC0977, a broad-spectrum antibiotic targeting multidrug-resistant bacteria, advancing global efforts against AMR.

Antibiotics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 55.35 billion

Revenue forecast in 2033

USD 74.07 billion

Growth rate

CAGR of 3.71% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, type, action mechanism, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie, Inc.; Pfizer Inc.; Novartis AG; Merck & Co.,Inc.; Teva Pharmaceutical Industries Ltd.; Lupin Pharmaceuticals, Inc.; Viatris, Inc.; Melinta Therapeutics LLC; Cipla, Inc.; Shionogi & Co., Ltd.; KYORIN Pharmaceutical Co., Ltd.; GSK plc; Nabriva Therapeutics PLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antibiotics Market Report Segmentation

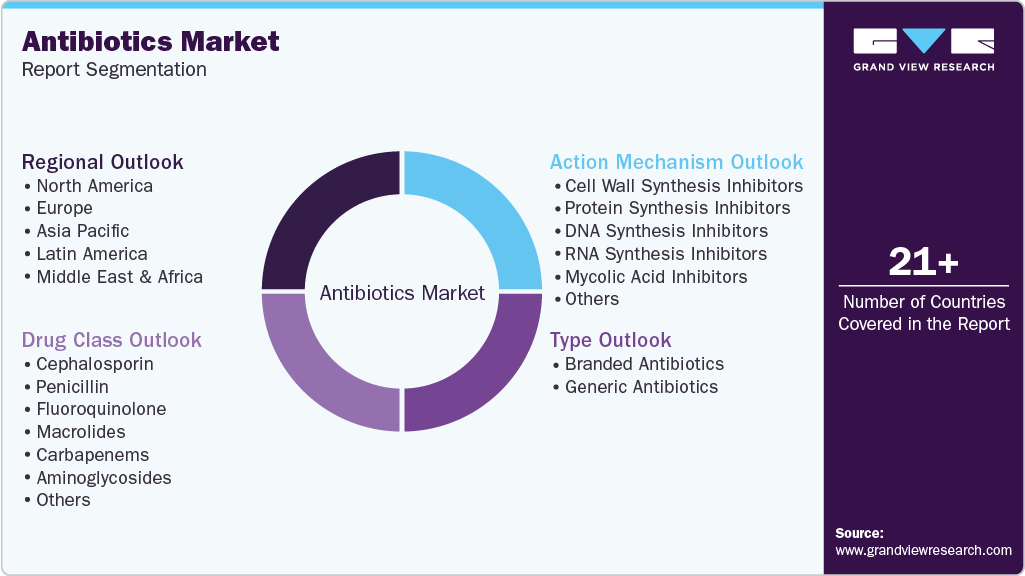

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global antibiotics market report on the basis of drug class, type, action mechanism, and region:

-

Drug Class Outlook (Revenue in USD Million, 2021 - 2033)

-

Cephalosporin

-

Penicillin

-

Fluoroquinolone

-

Macrolides

-

Carbapenems

-

Aminoglycosides

-

Sulfonamides

-

7-ACA

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Branded Antibiotics

-

Generic Antibiotics

-

-

Action Mechanism Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell Wall Synthesis Inhibitors

-

Protein Synthesis Inhibitors

-

DNA Synthesis Inhibitors

-

RNA Synthesis Inhibitors

-

Mycolic Acid Inhibitors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.