- Home

- »

- Plastics, Polymers & Resins

- »

-

Antimicrobial Additives Market Size And Share Report, 2030GVR Report cover

![Antimicrobial Additives Market Size, Share & Trends Report]()

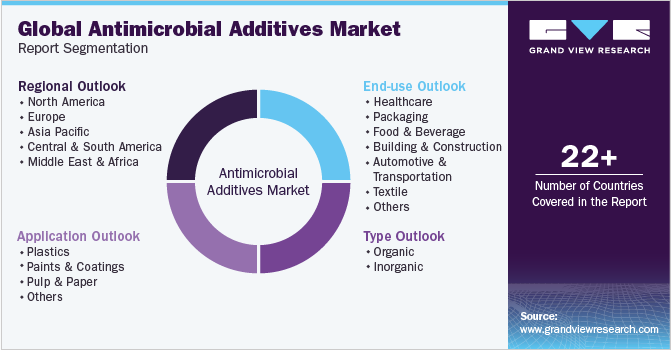

Antimicrobial Additives Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Organic, Inorganic), By Application (Plastics, Paints & Coatings, Pulp & Paper), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-227-3

- Number of Report Pages: 219

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Antimicrobial Additives Market Summary

The global antimicrobial additives market size was estimated at USD 3.11 billion in 2023 and is projected to reach USD 5.63 billion by 2030, growing at a CAGR of 9.0% from 2024 to 2030. Swiftly growing population and urbanization coupled with the increasing awareness regarding health-issues in emerging economies of Asia-Pacific are likely to assist end-use industries, which in turn is expected to escalate the demand for antimicrobial additives over the forecast period.

Key Market Trends & Insights

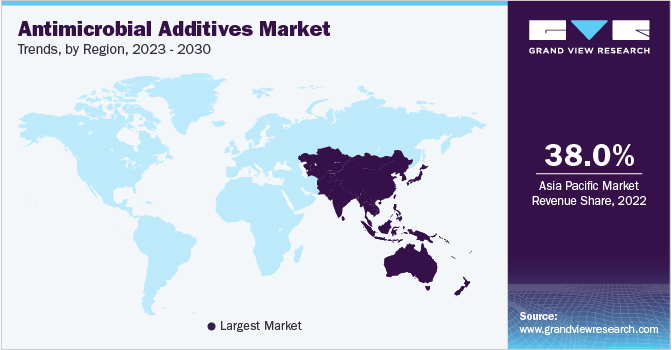

- The Asia Pacific region held the largest revenue share in 2023.

- By type, inorganic type segment led the market and accounted for more than 53.0% share of the global revenue in 2023.

- By application, plastic application segment led the market and accounted for more than 34.0% share of the global revenue in 2023.

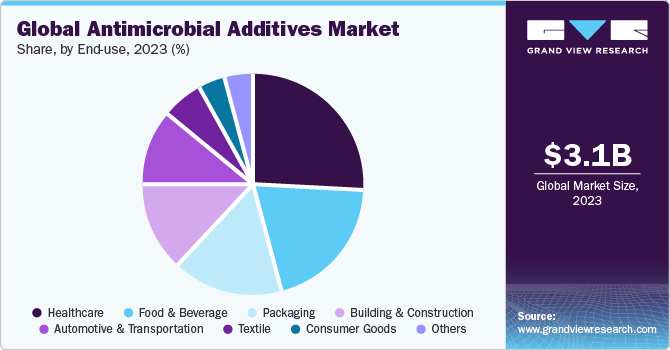

- By end use, the healthcare segment dominated the market with more than 26.0% of the revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.11 Billion

- 2030 Projected Market Size: USD 5.63 Billion

- CAGR (2024-2030): 9.0%

- Asia Pacific:Largest Market in 2023

The demand for antimicrobial additives is expected to increase majorly in the healthcare and packaging application industry owing to the increase in demand to tackle the COVID-19 pandemic situation around the world. The continuously rising demand of healthcare and packaging products for COVID-19 will positively impact the antimicrobial additives for plastics market. Asia Pacific is expected to dominate the rinsing demand of antimicrobial additives as the region has major healthcare products manufacturer.

Japan, India and Indonesia are expected to contribute towards the growth of construction sector in the Asia-Pacific owing to increasing consumer disposable income and rising government spending on large infrastructural projects. Ascending demand for commercial, residential and institutional buildings in China, on account of growing population, is in turn, contributing to the growth of market.

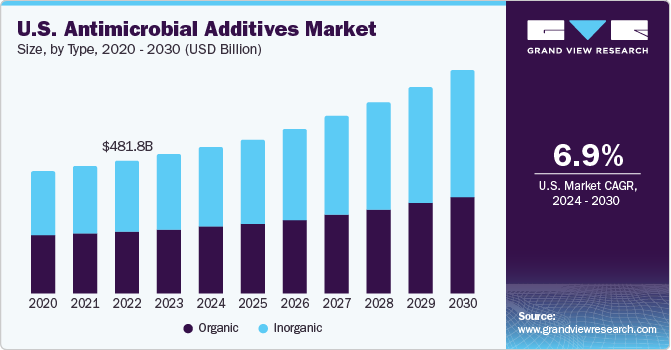

U.S. antimicrobial additives industry is expected to witness moderate growth over the coming years. High demand for advanced healthcare services owing to the availability of well-developed healthcare infrastructure and reimbursement coverage is anticipated to drive the growth of medical devices industry in U.S. Constantly rising patient population on account of aging and an increase in the number of car accidents is projected to propel the need for surgeries. Thus, the country is anticipated to maintain its demand for healthcare antimicrobial additives throughout the forecast period.

However, stringent regulations have made antimicrobial additives suppliers introduce and set up new compositions in order to meet the safe administration and anti-bacterial properties standards such as Biocidal Products Regulation (BPR) EU 528/2012 and Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). Thus, the presence of stringent regulation is expected to hamper the growth of antimicrobial additive in food science market over the forecast period.

Healthcare segment witnessed high penetration and accounts for a majority of the revenue share in the antimicrobial additives market. This can be attributed to extensive demand for antimicrobial additives for developing infection preventing & sterilized products like surgical tubing, cables, and orthopedic sutures. In addition, growing health awareness among consumers, increasing old age population in countries such as Japan, China, & the U.S., and rising demand for high quality medical equipment is expected to drive the market of antimicrobials additives market.

Market Concentration & Characteristics

The global antimicrobial additives market is highly consolidated in nature with the presence of key players such as NanoBioMatters Industries S.L.; BASF SE; RTP Company; Milliken Chemical; BioCote Limited; as well as a few medium and small regional players operating in different parts of the world.

The companies in the market compete on the basis of product quality offered and the technology used for the production of plastics. Major players, in particular, compete on the basis of application development capability and new technologies used in product formulation. Established players such as BASF SE are investing in research & development activities to formulate new and advanced plastics compounds, which gives them a competitive edge over the other players.

To maintain strong and healthy competitive environment across the marketspace, the global antimicrobial additives companies manufacturing compounded plastics have implemented various strategic initiatives such as acquisition & merger, new product launch, production expansion, and various others. For instance, in December 2023, Avient Corporation launched their new product line for antimicrobial additives for thermoplastic polyurethane (TPU) films in medical and outdoor applications.

Type Insights

Inorganic type segment led the market and accounted for more than 53.0% share of the global revenue in 2023. High demand silver-based, copper-based, and zinc-based additives is projected to fuel the growth of inorganic segment demand over the forecast period. Silver-based are used as antimicrobial agents owing to their properties such as non-toxicity, continual performance for a long duration, environment-friendly nature, high thermal stability, and protection against microbial growth. Zinc pyrithione is added to the materials that are prone to exposure to mold spore and fungi as the additive offers excellent antibacterial protection. Copper salts provide antimicrobial protection in preservative and sterilized applications with underlying substrates or layers being paints, coatings, and polymers.

Organic antimicrobial additives, when used with products and materials such as paints and coatings, provide long-lasting protection against stain and odor-causing microbes as well as biodegradation. For example, triclosan inhibits the growth of microbes with the help of a chemical reaction, which results in penetrating and damaging their cell walls. As the cell wall perforates and excludes the metabolites, other cell functions are damaged, which prevents microbes such as algae and bacteria from duplicating. The growth of organic antimicrobial additives market is expected to be sluggish over the forecast period due to the ban on the sales and use of OBPA and triclosan, which can be attributed to their high levels of toxicity.

Application Insights

Plastic application segment led the market and accounted for more than 34.0% share of the global revenue in 2023. This high share is attributable to extensive utilization in the production of soap dispensers, food containers, surgical products, and breathing devices owing to the adaptable nature of plastics. Plastic is susceptible to microbial growth including bacteria and mold, which is expected to negatively impact the functional lifetime of a product. Antimicrobial additives are incorporated during the production process of plastics and offer resistance against various microbes, thus, resulting in long-term durability of plastic products.

Antimicrobial additives find their application in all the types of paints and coatings including solvent, water, and oil as well as powder-based coatings. Specialty, industrial, and decorative coatings are considerably benefitted from antimicrobial additives. For instance, silver-based additives give cost-effective protection solutions when used with paints. The additives added in inks and lacquers impart durable top-coat protection when applied on paper, metal and plastic.

Pulp & paper is a highly diverse industry as it comprises specialized papers (intended for currency printing, tissue production and newsprint) and paperboards intended for packaging applications. Paper is prone to the fast accumulation of dirt, which provides an opportunity for microbes to colonize on the paper. Thus, it is crucial that the paper products have microbe-resistant properties before being handled in various end-use applications.

End-use Insights

Healthcare end-use segment led the market and accounted for more than 26.0% share of the global revenue in 2023. This high share is attributable to rising demand of healthcare products due to rising old age population and growing healthcare awareness among the consumers. Healthcare environment plays a key role, especially in Healthcare-Associated Infections (HAIs). HAIs which are additional infections that occur in patients during their stay in hospitals, and fatal and generally caused by antibiotic resistant bacteria.

According to U.S. Department of Health and Human Services, 1 in 25 patients is diagnosed with HAI in the U.S. each year. HAIs can lead to prolonged stay in hospital, readmission after discharge, and increase in expenses of patients. Thus, these challenges have led to increased interest in developing strategies and products to reduce the risk of HAIs. Incorporation of antimicrobial additives in healthcare furnishings and medical equipment is a step toward minimizing the risk of bacteria attack in healthcare environment.

Food & beverage end-use segment is expected to witness above average growth rate over the forecast period supported by continuous utilization of additives in shelving, flooring, food processing equipment, ice making machines, storage containers, water coolers, and water hydration systems in the food & beverage industry. Increasing population and changing lifestyle of consumers is anticipated to drive the demand for antimicrobial additives in the food & beverage sector over the forecast period.

Regional Insights

Asia Pacific dominated the antimicrobial additives market and accounted for over 38.0% share of the global revenue in 2023. The market is driven by the growth of the major end-use industries such as automotive, healthcare, construction, food and beverage, and packaging. Robust manufacturing base of automotive industry in China, Japan, and India coupled with increased sales of passenger vehicles is anticipated to augment antimicrobial additives market growth in the near future. In addition, favorable policies such as foreign direct investments (FDI) and Make in India implemented by the government of India are expected to create ample growth opportunities for automobile industry, which, in turn, is expected to increase the consumption of antimicrobial additives in automobile applications.

Industrial expansion in the region is anticipated to augment the demand for antimicrobial additives in industrial machinery, equipment, and containers. Growing construction industry in the emerging economies of Asia Pacific and increased infrastructure spending by the governments of India and China are the key factors responsible for driving the product demand over the forecast period.

The growth of antimicrobial additives market in Asia Pacific is projected to be negatively impacted by COVID-19 as there is limited cross-border trade among the economies. Healthcare end-use segment is driving the demand for antimicrobial additives in the region owing to the rising demand for syringes, surgical drapes, and personal protective clothing. The demand for antimicrobial additives in various end-use segments such as automotive, building & construction, textiles, and consumer goods is expected to grow in the near future, after the current lockdown situation in several country is revoked.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

- In March 2023, IFF, a food & beverage product manufacturer announced its strategic partnership with Grupo Drul for the distribution of FermaSure XL across the Brazilian market.

Key Antimicrobial additives Companies:

The following are the leading companies in the antimicrobial additives market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these antimicrobial additives companies are analyzed to map the supply network.

- NanoBioMatters Industries S.L

- BASF SE

- RTP Company

- Milliken Chemical

- BioCote Limited

- Microban International

- Clariant AG

- PolyOne Corporation

- Momentive Performance Materials Inc.

- Life Materials Technologies Limited

- SteriTouch Limited

- Sanitized AG

- Dow Inc.

- LyondellBasell Industries Holdings B.V.

- Plastics Color Corporation

- Lonza

Recent Developments

-

In July 2023, BioCote Limited entered into a strategic partnership with Eco Finish to leverage BioCote technology for antimicrobial surfaces in residential & commercial pools. Antimicrobial additives in the solution are purposed to inhibit the growth of bacteria, algae, viruses, and other microbes, delivering additional safety and protection for swimmers.

-

In April 2023, Microban International announced its partnership with Berry Global for introducing Color Scents scented trash bags featuring antimicrobial technology. The partnership was aimed at combining Berry Global’s manufacturing capabilities with Microban’s robust market leadership in antimicrobial technology solutions.

-

In April 2022, Momentive Performance Materials Inc. announced plans to relocate its Tarrytown, New York location and commence a Global Innovation Center (GIC). This new center was planned to feature an advanced R&D lab and office space for fostering better exchange & collaboration of ideas and a development facility for innovative, trend-centric solutions to support the proliferating Performance Additives business.

-

In January 2022, Polygiene AB announced an agreement to acquire SteriTouch. This transaction was aimed at aligning with Polygiene’s new strategy of growth and to leverage Biomaster’s antimicrobial business.

-

In May 2021, Avient announced the launch of GLS thermoplastic elastomer formulations featuring antimicrobial technology to deliver protection against microbial growth. The antimicrobial additives aid in safeguarding molded plastic components by restricting the growth of bacteria by 99.9% and resisting mold and fungal growth.

-

In May 2021, SteriTouch in collaboration with Enso Rings, launched antimicrobial silicone wedding rings. These rings are available in two style variations, Thin and Standard, and come in an array of sizes and colors. The rings help prevent ring avulsion which is an injury caused by forceful removal of metal rings

-

In March 2021, Lonza Specialty signed a distribution agreement with LifeClean International for the commercialization of healthcare disinfectant solutions in Europe. These solutions deliver short contact time and high antimicrobial capabilities.

Antimicrobial additives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.37 billion

Revenue forecast in 2030

USD 5.63 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024-2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Netherlands, China, India, Japan, South Korea, Malaysia, Singapore, Thailand, Vietnam,Australia, Brazil, Argentina, Saudi Arabia, United Arab Emirates (UAE), South Africa

Key companies profiled

NanoBioMatters Industries S.L, BASF SE, RTP Company, Milliken Chemical, BioCote Limited, Microban International, Clariant AG, PolyOne Corporation, Momentive Performance Materials Inc., Life Materials Technologies Limited, SteriTouch Limited, Sanitized AG, Dow Inc., LyondellBasell Industries Holdings B.V., Plastics Color Corporation, and Lonza

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Antimicrobial Additives Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global antimicrobial additives market report based on type, application, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Organic

-

Silver

-

Copper

-

Zinc

-

-

Inorganic

-

OBPA

-

DCOIT

-

Triclosan

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Paints & coatings

-

Pulp & paper

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Food & beverage

-

Packaging

-

Building & construction

-

Automotive & transportation

-

Textile

-

Consumer goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

Indonesia

-

Thailand

-

Vietnam

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global antimicrobial additives market size was estimated at USD 2.87 billion in 2022 and is expected to reach USD 3.10 billion in 2023.

b. The global antimicrobial additives market is expected to witness a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 5.63 billion by 2030.

b. The inorganic type segment led the global antimicrobial additives market and accounted for more than a 53% share of the global revenue in 2022.

b. The plastics application segment led the global antimicrobial additives market and accounted for more than 34% share of the global revenue in 2022.

b. The Asia Pacific dominated the antimicrobial additives market with a revenue share of 38% in 2022. The regional market is driven by the growth of the major end-use industries, such as automotive, healthcare, construction, food and beverage, and packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.