- Home

- »

- Sensors & Controls

- »

-

Automotive Sensor Market Size, Industry Report, 2030GVR Report cover

![Automotive Sensor Market Size, Share & Trends Report]()

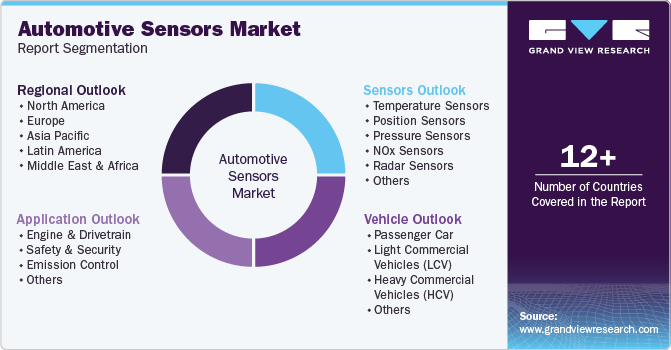

Automotive Sensor Market (2024 - 2030) Size, Share & Trends Analysis Report By Sensors (Temperature, Position), By Vehicle, By Application (Engine & Drivetrain, Safety & Security, Emission Control), By Region, And Segment Forecasts

- Report ID: 978-1-68038-433-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Sensor Market Summary

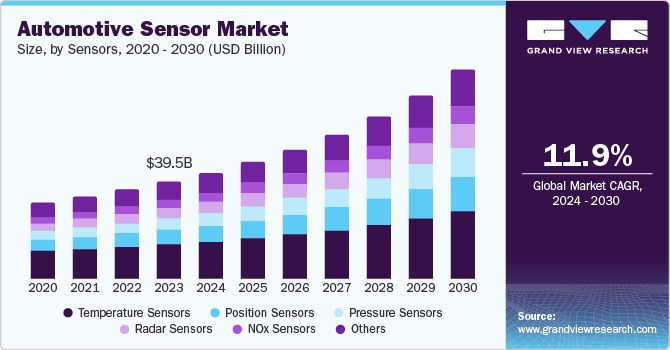

The global automotive sensor market size was estimated at USD 39.5 billion in 2023 and is projected to reach USD 85.1 billion by 2030, growing at a CAGR of 11.9% from 2024 to 2030. The increasing demand for advanced driver-assisted systems (ADAS) and autonomous vehicles (AVs) are the key factors driving the automotive sensors market.

Key Market Trends & Insights

- Asia Pacific automotive sensor market dominated the global market with a revenue share of 43.3% in 2023.

- China automotive sensor market is leading in the Asia Pacific region.

- By sensors, the temperature sensor segment dominated the market and accounted for a share of 35.0% in 2023.

- By vehicle, passenger cars segment accounted for the largest revenue share of 53.4% in 2023.

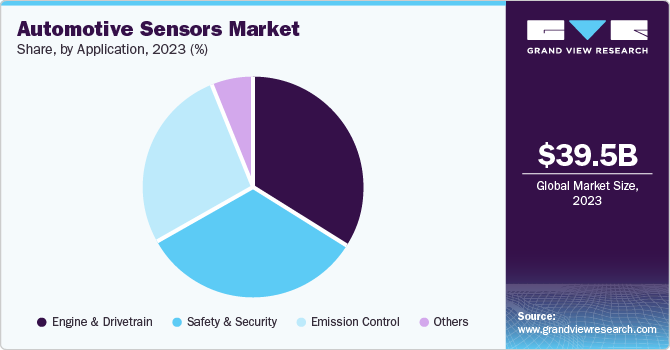

- By application, the engine & drivetrain segment dominated the market with a revenue share of 34.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 39.5 Billion

- 2030 Projected Market Size: USD 85.1 Billion

- CAGR (2024-2030): 11.9%

- Asia Pacific: Largest market in 2023

ADAS features such as blind-spot monitoring, lane departure warning, and automatic emergency braking largely rely on various automotive sensors such as LiDAR, radar, temperature, and positioning sensors. Self-driving cars require more extensive sensors such as video cameras, ultrasonic sensors, radio detection and range (Radar), and light detection and range (LiDAR), creating massive demand for automotive sensors.

The advancements in sensor technology are making them more efficient, and affordable. This allows for wider sensor integration for various functionalities such as fleet management, monitoring vehicle conditions, and tracking vehicle movement. Furthermore, the rise in demand for electric vehicles (EVs) requires a more robust suite of sensors for safety features such as parking assistance and collision avoidance. The growth of EVs creates a new market for safety and security sensors.

Governments worldwide are implementing stricter regulations on safety features for commercial vehicles and passenger vehicles. This will mandate the inclusion of advanced driver-assistance systems (ADAS) such as automatic emergency braking, lane departure warning, and blind-spot monitoring in HCVs. These ADAS features rely mostly on automotive sensors, including LiDAR, radar, and cameras. Pedestrian detection and automatic emergency braking rely heavily on advanced automotive sensors. Therefore, for safety and security purposes, the demand for these sensors will rise in the future as well.

Sensors Insights

The temperature sensor segment dominated the market and accounted for a share of 35.0% in 2023. Temperature sensors are a well-established and mature technology, these sensors are relatively simple and inexpensive to manufacture compared to complex sensors. Temperature sensors are used in various automotive applications such as seat heating, air conditioning, battery management systems, and others. The wide range of applications of temperature sensors across multiple vehicles such as passenger cars, heavy commercial vehicles (HCV), light commercial vehicles (LCV), and others further strengthen the dominance of temperature sensors in the market.

The position sensors segment is anticipated to grow at the faster CAGR of 13.9% over the forecast period. Various features of autonomous vehicles and advanced driver assistance systems (ADAS) require position sensors to track vehicle movement. Position sensors play a crucial role in safety and comfort features. The increasing emphasis on safety and driver comfort will continue to drive the growth of the position sensor segment. Developments in sensor technology are making position sensors more accurate, and reliable. This allows for their integration into a wider range of applications.

Vehicle Insights

Passenger cars segment accounted for the largest revenue share of 53.4% in 2023. The sales of passenger cars are much higher than that of commercial vehicles. The higher passenger car sales volume generates a high demand for automotive sensors. A wide range of sensors are used in passenger vehicles for different purposes. For instance, advanced driver assistance systems use sensors such as radar, LiDAR, and cameras. Sensors such as ultrasonic sensors and cameras are used in parking assistance systems, and additional sensors are used for comfort and convenience. The sensors used in passenger cars cater to a wide range of functionalities, which ultimately leads to a higher revenue share of the segment.

The heavy commercial vehicles (HCV) segment is expected to grow at a significant CAGR of 12.7% over the forecast period. The e-commerce sector and the demand for goods delivery services are rising, which requires heavy commercial vehicles for transportation. Technologically advanced sensors are used in heavy commercial vehicles, which help in fleet management and predictive maintenance. In addition, governments across the globe are implementing stringent rules and regulations on safety features for heavy commercial vehicles.

Application Insights

The engine & drivetrain segment dominated the market with a revenue share of 34.4% in 2023 as they are an essential fundamental part of a vehicle; they are responsible for generating power and are crucial for the vehicle's basic functionality. The engine and drivetrain are a progressing sector. Advancements in emission control, fuel efficiency, and power output drive the demand for upgraded engines and drivetrain components. Engines and drivetrain components require replacement after a certain period; therefore, the demand for replacement drives the segment. Even though electric vehicles (EVs) are becoming popular, there is still a high demand for traditional gasoline-powered cars, and they depend largely on engines and drivetrains for their function.

The safety and security segment is projected to grow at the fastest CAGR over the forecast period. Taking into account the safety & security of customers, the demand for advanced driver assistance systems (ADAS) is increasing. ADAS relies on various automotive sensors such as cameras, radar, and LiDAR; hence, the demand for such sensors is growing. The development of autonomous and self-driven cars requires sensors to get information about the environment and surroundings. The government is more concerned regarding the safety of people and is enforcing strict regulations on vehicle safety features. Therefore, the demand for safety sensors is increasing in the market.

Regional Insights

Asia Pacific automotive sensor market dominated the global market with a revenue share of 43.3% in 2023. Asia Pacific region is a major car manufacturing hub. The mass production of vehicles generated more demand for automotive sensors in the region. The number of tech-savvy consumers has increased in the region in the recent past. Consumers are demanding advanced features such as driver assistance systems and connected car technologies; these technologies highly rely on various automotive sensors. In addition, the government is also imposing strict regulations regarding vehicle safety and emission standards, and automotive sensors such as airbags, emission control systems, and anti-lock braking systems (ABS) are in high demand.

China Automotive Sensor Market Trends

China automotive sensor market is leading in the Asia Pacific region. China is a global leader in car manufacturing, and there is a high demand for such vehicle sensors. The production cost for automotive components is relatively low in China owing to low labor costs and mass production, boosting the demand for automotive sensors in the market.

North America Automotive Sensor Market Trends

North America automotive sensor market is anticipated to grow significantly due to various reasons. As North America is a highly advanced region in the automotive sensors market, it focuses on innovating vehicles with the latest and more efficient sensors. The growing electric vehicle market in the region requires a greater number of sensors. North America has a huge vehicle fleet that requires sensor replacements, contributing to the region's market expansion.

Canada is expected to grow with the highest CAGR in North America as the government is actively promoting vehicle safety and adopting newer technologies. They promote electric vehicles (EVs) and vehicles with advanced driver assistance systems (ADAS). The government has strict regulations regarding carbon emission standards. Therefore, the demand for various emission control censors is increased in the market.

Europe Automotive Sensors Market Trends

The European automotive sensors market was identified as a lucrative region in this industry. Europe has a strong automotive industry with leading car manufacturers such as BMW and Volkswagen. The regulatory body enforces strict safety standards for vehicle manufacturers and makes it mandatory to include automotive sensors for features such as ABS, driving sensors, airbags, and Electronic stability control.

Germany automotive sensor market held a substantial market share in 2023. Germany is a major car manufacturing market, driving high demand for automotive sensors in the domestic market. Germany has major sensor manufacturers, making the country a global leader in automotive sensor manufacturing.

Key Automotive Sensors Company Insights

Some key companies operating in the automotive sensor market include Power Grid Corporation of India Limited (POWERGRID), MYR Group Inc., KEPCO, Hitachi Energy Ltd., and Siemens. Companies in the market focus on increasing their customer base by adopting technologies such as advanced driver-assistance systems (ADAS) & autonomous vehicles. The key players take strategic initiatives such as partnerships, mergers, and acquisitions with other companies.

-

Power Grid Corporation of India Limited (POWERGRID) is an Indian establishment. The government of India holds a major percentage of shares in POWERGRID. It is a world-class, global transmission company with dominating leadership in emerging power markets across the globe.

-

MYR Group Inc. is an American corporation that primarily provides electrical construction services. They serve commercial and industrial sectors of the U.S. market. MYR Group Inc. is a parent company to 12 subsidiaries of electrical construction companies.

Key Automotive Sensor Companies:

The following are the leading companies in the automotive sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Power Grid Corporation of India Limited (POWERGRID)

- MYR Group Inc.

- KEPCO

- Hitachi Energy Ltd.

- Siemens

- General Electric Company

- Cisco Systems Inc.

- Schneider Electric SE

- ABB

- Eaton

Recent Developments

-

In May 2024, Samsung Electronics Co. and KEPCPO signed a memorandum of understanding (MOU) under which the companies are expected to share technologies for evaluating and diagnosing power facilities. Both the companies are anticipated to share AI-based power facility condition assessment and operations.

-

In April 2024, POWERGRID Corporation bagged three interstate transmission projects under tariff-based competitive bidding.

Automotive Sensor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 43.3 billion

Revenue forecast in 2030

USD 85.1 billion

Growth rate

CAGR of 11.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sensors, vehicle, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

Power Grid Corporation of India Limited (POWERGRID); MYR Group Inc.; KEPCO; Hitachi Energy Ltd.; Siemens General Electric Company; Cisco Systems Inc.; Schneider Electric SE; ABB; Eaton

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive sensor market report based on sensors, vehicle, application, and region:

-

Sensors Outlook (Revenue, USD Million, 2018 - 2030)

-

Temperature Sensors

-

Position Sensors

-

Pressure Sensors

-

NOx Sensors

-

Radar Sensors

-

Others

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Car

-

Light Commercial Vehicles (LCV)

-

Heavy Commercial Vehicles (HCV)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Engine & Drivetrain

-

Safety & Security

-

Emission Control

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.