- Home

- »

- Renewable Chemicals

- »

-

Bio-succinic Acid Market Size, Share & Trends Report, 2030GVR Report cover

![Bio-succinic Acid Market Size, Share & Trends Report]()

Bio-succinic Acid Market Size, Share & Trends Analysis Report By Application (BDO, Polyester Polyols), By End-use (Industrial, Food & Beverages), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-085-9

- Number of Pages: 200

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Specialty & Chemicals

Bio-succinic Acid Market Size & Trends

The global bio-succinic acid market size was estimated at USD 126.04 million in 2023 and is anticipated to grow at a CAGR of 12.1% from 2024 to 2030. The anticipated surge in demand for the product is expected to stem from the escalating interest in natural products, given their non-toxic nature to both humans and the environment. The market is characterized by intense competition, largely owing to the involvement of numerous multinational corporations actively engaged in diverse production, research, and development endeavors. With a diverse array of products experiencing high demand, the market is poised for exponential growth. It is anticipated that various competitive strategies will further intensify the rivalry in the market in the foreseeable future.

Succinic acid finds applications in a variety of industries including food, skincare, and pharmaceuticals. Its utility extends beyond product formulations, as it plays a role in various chemical processes within the human body. When applied topically, the product can alleviate joint pain and arthritis discomfort. Additionally, it is known to mitigate signs of aging and aid in scar reduction on the skin.

Growing apprehensions regarding the use of chemicals detrimental to human health and the environment across various industries have prompted the exploration of substitutes. The production process of succinic acid entails the application of several such chemicals, resulting in adverse effects on the surrounding environment. Consequently, there has been an increase in demand for alternatives to the product, with bio-succinic acid emerging as a prominent substitute.

The production of natural succinic acid contributes to mitigating climate change. By replacing petrochemicals, this product promotes a cleaner environment through the utilization of waste streams. It is regarded as an ideal substitute for various chemicals that pose environmental risks, thus supporting efforts towards environmental sustainability.

Market Concentration & Characteristics

The global bio-succinic acid market exhibits traits reminiscent of a consolidated landscape, featuring several key players including BASF SE, DSM, Roquette Freres, BioAmber, Myriant Corporation, and Kawasaki Kasei Chemicals, alongside smaller and medium-sized market participants such as GC Innovation America, among others.

The market is currently experiencing high growth at an accelerating pace. Notably, the product market is marked by a high level of innovation. Ongoing research and development efforts, particularly in the realm of succinic acid extraction from natural sources, fuel advancements in both production techniques and application methodologies.

The manufacturing and utilization of bio-succinic acid are governed by a complex array of regulations and standards intended to ensure the safety and quality of these products. These regulations are formulated to protect both human health and environmental well-being. While the precise regulatory requirements may vary depending on the country or region, there are overarching frameworks that govern the industry as a whole. Key regulatory bodies and organizations overseeing the market include the Code of Federal Regulations in the United States, the Department of Energy, the U.S. Environmental Protection Agency (EPA), among others.

End-user concentration significantly influences the dynamics of the global market. As numerous product manufacturers integrate these substances into their formulations, there is a tendency towards larger volume purchases. This trend can lead to economies of scale for product suppliers, potentially resulting in cost efficiencies in both production and distribution processes. Furthermore, heightened end-user concentration often cultivates long-term relationships between product suppliers and major players in end-use industries. This stability provides a foundation for collaborative ventures, mutual understanding, and the establishment of enduring business partnerships.

Application Insights

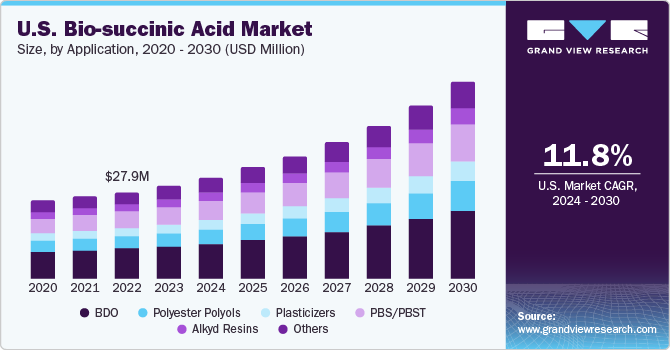

The 1,4-butanediol (BDO) application segment dominated the market with a revenue share of 34.50% in 2023 and is estimated to rise at 12.0% CAGR over the forecast period. This is attributed to the high product demand for the production of polyurethane, tetrahydrofuran, and polybutylene among other such products.

The application of 1,4-butanediol (BDO) spans a wide range of industries, from the production of prominent polymers to its use in plastics manufacturing. Major polymers such as polyurethanes, polyethers, and polyesters rely on BDO in their production processes. Notably, BDO plays a significant role in the production of polybutylene terephthalate (PBT) and tetrahydrofuran (THF) resins for plastic engineering applications. The increasing demand for BDO and its various derivatives, including THF, is expected to positively impact the demand for the acid, leading to robust growth in the market.

In 2023, the PBS/PBST application segment accounted for the second-largest revenue share, capturing 18.67% of the market. It is projected to grow at a compound annual growth rate (CAGR) of 12.5% over the forecasted period. This growth can be attributed to the increasing demand for Phosphate Balanced Saline Solution (PBS) and PBST from various end-use industries.

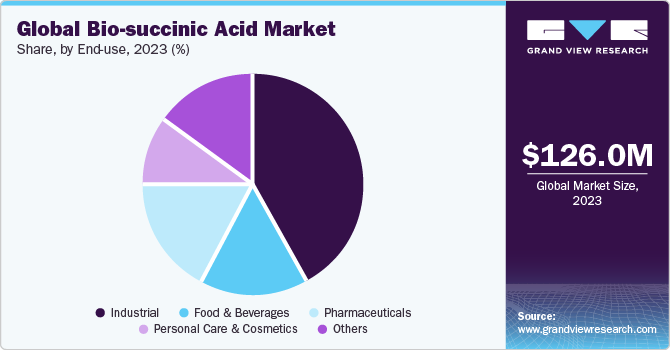

End-use Insights

The industrial end-use segment dominated the market with a revenue share of more than 41.68% in 2023. This high share is attributed to the growing demand for the products in the process of production of polyurethane, tetrahydrofuran, and polybutylene terephthalate among many other products. Bio-succinic acid serves as a versatile raw material in a broad spectrum of industrial applications, facilitating the production of adhesives, solvents, sealants, resins, elastomers, coatings, plastics, and lubricants. Its versatility enables its utilization across various end-use industries. The anticipated increase in its industrial usage for the manufacturing of diverse products is expected to propel the product market in the forthcoming years.

Amid the COVID-19 pandemic, the pharmaceutical sector experienced a surge in importance, leading to a rapid rise in demand. The pharmaceutical application segment held the second-largest revenue share globally, accounting for nearly 17.42% in 2023. It is anticipated to grow at a CAGR of 11.7% during the forecasted period. This growth can be attributed to the escalating demand for bio-succinic acid in the drug manufacturing process, particularly for formulations aimed at enhancing heart and blood flow circulations in the human body.

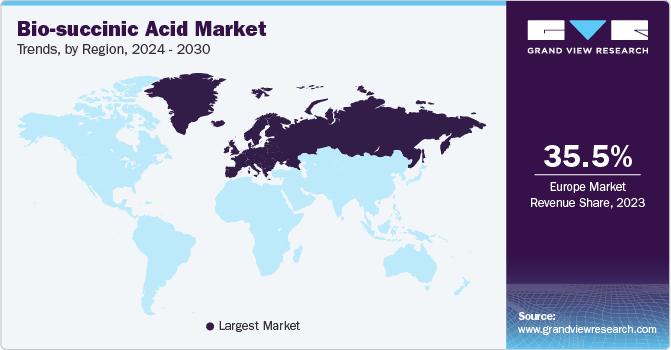

Regional Insights

Bio-succinic acid has diverse industrial applications, including bioplastics, pharmaceuticals, food additives, and coatings. The increasing demand for biodegradable and sustainable materials in these sectors contributes to the growth of bio-succinic acid demand in North America.

U.S. Bio-succinic Acid Market Trends

The U.S. bio-succinic acid marketis growing at a fast pace and is anticipated to continue witnessing similar trends during the forecast period, on the account of increasing usage of the product in various end-use industries like pharmaceuticals, food & beverages, and personal care & cosmetics.

Europe Bio-succinic Acid Market Trends

Europe dominated the market with a revenue share of 35.51% in 2023. This is attributed to the increasing demand for environmentally friendly construction in the region. The increase in carbon footprints, rising preference for using locally accessible raw materials, and the fluctuations that can be seen in the prices of fossil fuel are some of the major factors that are driving the market growth in Europe region.

The Germany bio-succinic acid market has a strong emphasis on sustainability and reducing carbon emissions. Bio-succinic acid is produced from renewable resources such as biomass, which makes it more environmentally friendly compared to traditional petrochemical-derived succinic acid.

The bio-succinic acid market in the UK often implements strict regulations related to environmental impact and chemical usage. Bio-succinic acid may be preferred over its petroleum-based counterpart, i.e. succinic acid, due to regulatory pressures to reduce dependence on fossil fuels and promote sustainable alternatives.

In the France bio-succinic acid market, technological advancements and production processes have improved the cost competitiveness of bio-succinic acid compared to its petrochemical-derived counterpart. Cost parity or cost advantages make bio-succinic acid more attractive to industries in France, further driving its demand.

Asia Pacific Bio-succinic Acid Market Trends

Changing consumer preferences, particularly among younger demographics, towards eco-friendly and sustainable products influence market trends. This shift in consumer behavior drives demand for bio-based alternatives, including bio-succinic acid, across various industries.

The bio-succinic Acid market in China is increasing on the account of support from the government, overall industrial growth, changing environmental concerns & consumer awareness, technological advancements, and growing bioplastics industry.

Central & South America Bio-succinic Acid Market Trends

Increasing awareness of environmental issues and sustainability drives demand for bio-based products, including bio-succinic acid. Consumers and businesses in Central and South America are increasingly seeking environmentally friendly alternatives to traditional petrochemical-derived chemicals.

The Brazil bio-succinic acid market is experiencing rapid demand in the country on the account of increasing focus on renewable energy and sustainable policies. Brazil has been a global leader in promoting renewable energy and sustainability. The country's favorable policies, such as the National Biofuels Policy (RenovaBio), encourage the use of renewable resources and promote sustainability across various sectors. These policies create a conducive environment for the adoption of bio-based chemicals like bio-succinic acid.

Middle East & Africa Bio-succinic Acid Market Trends

Numerous countries in the MEA region are investing in biotechnology and sustainable manufacturing infrastructure. Investments in research and development, as well as the establishment of biorefineries and bio-based chemical production facilities, are expected to support the growth of bio-succinic acid demand.

Key Bio-succinic Acid Company Insights

The global market is consolidated in nature with the presence of several key players, such as BASF SE, DSM, Roquette Freres, BioAmber, Myriant Corporation, and Kawasaki Kasei Chemicals among others. The players face intense competition from each other as well as from regional players, who have strong distribution networks and good knowledge about suppliers and regulations.

-

BASF SE is a global chemical company headquartered in Ludwigshafen, Germany. It is one of the largest chemical producers in the world, operating in various segments including chemicals, plastics, performance products, agricultural solutions, and oil & gas. BASF has a significant presence in the bio-based chemicals market, including the production of bio-succinic acid. BASF offers bio-succinic acid under its portfolio of sustainable solutions. Bio-succinic acid is produced through the fermentation of renewable feedstocks such as sugars, starches, and cellulosic biomass. It serves as a sustainable alternative to petroleum-derived succinic acid and finds applications in various industries including bioplastics, pharmaceuticals, food & beverages, and personal care & cosmetics.

-

Roquette Frères is a global leader in plant-based ingredients and a major player in the bio-based chemicals industry, including the production of bio-succinic acid.Roquette Frères is committed to sustainability and innovation in its product offerings. The production of bio-succinic acid aligns with the company's goals of reducing reliance on fossil resources, minimizing environmental impact, and promoting the use of renewable feedstocks. Roquette Frères invests in research and development to enhance the performance and sustainability of its bio-based chemicals, including bio-succinic acid. The company collaborates with partners across industries to develop new applications and improve production processes.

Kawasaki Kasei Chemicals, Myriant Corporation, and BioAmber are some of the emerging participants in the global market.

- Kawasaki Kasei Chemicals Ltd., based in Kanagawa-ken, Japan, offers a wide range of products and services, including Succinic acid, Bio-succinic Acid, Organic acid, Chemical engineering, and others. Established in 1948, the company has since accumulated a total of 769 patents related to the development of novel products.

Key Bio-succinic Acid Companies:

The following are the leading companies in the bio-succinic acid market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- DSM

- Roquette Freres

- BioAmber

- Myriant Corporation

- Kawasaki Kasei Chemicals

- Mitsui & Co., Ltd

- Mitsubishi Chemical Corporation

Recent Developments

- In June 2022, NIPPON SHOKUBAI CO., LTD. increased the prices of succinic acid by USD 0.5/kg (JPY 50/kg)

- In June 2021, Roquette Frères announced that the company has earned the U.S. Department of Agriculture (USDA) certified Bio-based Product Label for their product BIOSUCCINIUM.

Bio-succinic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 137.27 million

Revenue forecast in 2030

USD 272.36 million

Growth rate

CAGR of 12.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; DSM; Roquette Freres; BioAmber; Myriant Corporation; Kawasaki Kasei Chemicals; Mitsui & Co., Ltd; Mitsubishi Chemical Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

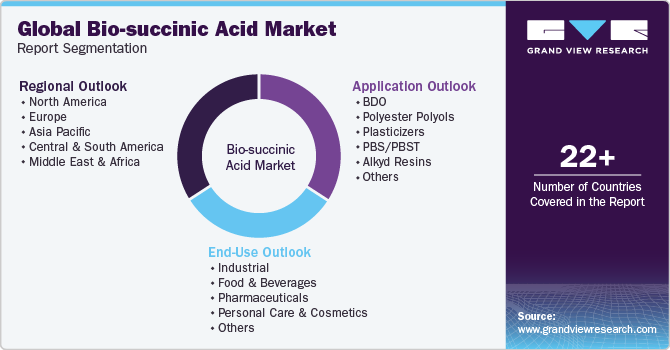

Global Bio-succinic Acid Market Report Segmentation

This report forecasts volume & revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bio-succinic acid market report based on application, end-use, and region:.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

BDO

-

Polyester Polyols

-

Plasticizers

-

PBS/PBST

-

Alkyd Resins

-

Others

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Food and Beverages

-

Pharmaceuticals

-

Personal Care and Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio-succinic acid market size was valued at USD 126.04 million in 2023 and is expected to reach USD 137.27 million in 2024.

b. The global bio-succinic acid market is anticipated to grow at a compound annual growth rate (CAGR) of 12.1% from 2024 to 2030 to reach USD 272.36 million by 2030.

b. 1,4-Butanediol (BDO) application type dominated the market with a revenue share of 34.50% in 2023. This is attributed to the high demand for the product in the market in the production of various products like polyurethane, tetrahydrofuran, and polybutylene among many such other products.

b. Some prominent players in the bio-succinic acid market include BASF SE, DSM, Roquette Freres, GC Innovation America, Kawasaki Kasei Chemicals, Mitsui & Co., Ltd, Mitsubishi Chemical Corporation

b. The demand for the product is anticipated to be driven by increased demand for bio-based products as it is harmless to humans and to the environment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."