- Home

- »

- Organic Chemicals

- »

-

Solvent Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Solvent Market Size, Share & Trends Report]()

Solvent Market (2024 - 2030) Size, Share & Trends Analysis Report, By Product (Alcohols, Hydrocarbons), By End Use (Paints & Coatings, Printing Inks, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: 978-1-68038-221-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solvent Market Summary

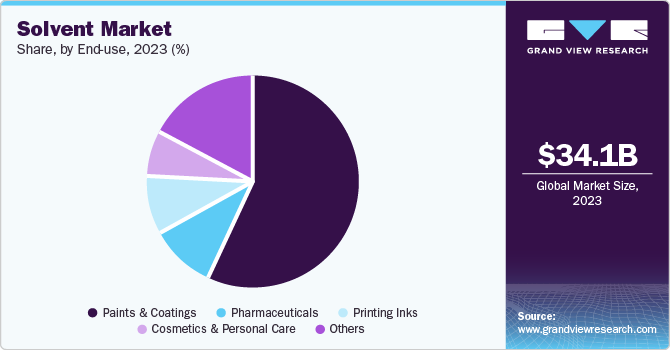

The global solvent market was estimated at USD 34.1 billion in 2023 and is projected to reach USD 51.6 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. The demand has surged by the extensive usage of solvents in the application of ketones, hydrocarbons, and alcohols in end-use industries, including pharmaceuticals, paint and coatings, cosmetics, and others.

Key Market Trends & Insights

- Asia Pacific dominated the global solvent market with the largest revenue share of 30.4% in 2023.

- The solvent market in China led the Asia Pacific market and held the largest revenue share in 2023.

- By product, the hydrocarbons segment led the market, holding the largest revenue share of 71.3% in 2023.

- By end use, the paints & coatings segment held the dominant position in the market and accounted for the leading revenue share of 56.5% in 2023.

- By end use, the printing inks segment is expected to grow at the fastest CAGR of 6.7% from 2024 to 2033.

Market Size & Forecast

- 2023 Market Size: USD 34.1 billion

- 2030 Projected Market Size: USD 51.6 billion

- CAGR (2024-2030): 6.2%

- Asia Pacific: Largest market in 2023

The increasing construction activities and positive industrial outlook in Asia Pacific and Europe are further expected to drive the demand for solvents over the estimated period.

In addition, solvents are chemicals that liquefy in the chemically diverse solute to make a solution that is majorly used in several end-use industries. Organic solvents are majorly used in traditional applications such as dry cleaning and in manufacturing industries. They are inflammable, except for chlorinated ones which can cause health hazards including damage to the kidney and lungs.

Furthermore, solvents, which dissolve, absorb, and dilute other substances without changing them chemically, are essential in industries including automotive, pharmaceuticals, personal care, and others. For instance, solvents are widely applied to water-based coatings and the manufacturing of electronic vehicles in the automotive industry. In the pharmaceutical industry, solvents are used in the formulation and production of drugs.

Innovative methods of synthesizing solvents and utilization processes have increased the effectiveness and versatility of solvents. The market also witnessed a surge in the emphasis on research and development to improve solvent characteristics and explore more opportunities in high-growth applications such as 3D printing and nanotechnology.

Moreover, bio-solvents and green solvents have increasingly gained prominence over chemical-based ones. Alcohol and glycol ethers, derived from cellulose, sugars, oils, and agricultural products, offer non-toxic and eco-friendly properties. Factors including increasing VOC emissions, pollution concerns, and government regulations have further driven the adoption of bio-based solvents.

Product Trends

Hydrocarbons registered the dominant market share of 30.4% in 2023 attributed to their versatile nature and effectiveness that is suitable for industries such as paints and coatings, adhesives, pharmaceuticals, and household care. Moreover, these products offer solvency power, low viscosity, and faster evaporation rates making them ideal in the industrial process. In addition, hydrocarbon solvents are also applied in insecticides and pesticides. Their use in formulations for agricultural chemicals and pest control has significantly contributed to market expansion. Aromatic solvents, commonly used in printing inks, also played a pivotal role in driving demand for hydrocarbon solvents.

The alcohol segment is expected to emerge as the fastest-growing CAGR during the forecast period owing to the increased demand for ethanol used in perfumes, vegetable essences, and medical drugs. Alcohol is more polar than hydrocarbons and ketones. Their low toxicity, volatile organic compound emissions, and excellent solvency make them ideal for a wide range of applications including cosmetics, and pharmaceuticals. In addition, bio-based alcohols are renewable and can be produced from sustainable sources, further augmenting the market growth.

End Use Trends

Paints & Coatings accounted for the largest revenue share of 56.5% in 2023. This is attributable to the growing construction sector in developing countries that translated into higher requirements for decorative paints and coatings. Infrastructure development in regions such as North America, Asia Pacific, and Latin America further fueled the need for protective and aesthetic coatings. According to the Associated General Contractors of America, around USD 2.1 trillion worth of structures are created in the U.S. each year. In addition, the construction sector in India experienced a growth of 13.3% from July to September 2023, and a 7.9% increase compared to the previous quarter, contributing to the rise in the country’s GDP. Furthermore, solvent-enhanced coatings played a crucial role in protecting industrial structures, machinery, and equipment in industries such as marine, coil coating, general manufacturing, and protective coatings.

Printing inks are projected to register the fastest CAGR of 6.7% during the forecast period. The market was majorly driven by the packaging industry. Solvent-based inks were widely used for printing on packaging materials, making them visually appealing and promoting products effectively. As consumer needs shifted toward digitalization and attractive packaging, brands increasingly used printing inks to differentiate their products with visually appealing labels, designs, and images on packaging. Moreover, the demand for solvent-based inks has continued to grow due to their versatility and compatibility with various substrates. In addition, advancements in processing technologies in the food sector in the U.S. and European countries are expected to augment the growth of packaged food industry thus driving the demand for solvent-enhanced printing inks.

Regional Trends

Asia Pacific solvent market dominated the market with a 42.2% share in 2023. The market surge can be credited to the increased expenditure of the automobile manufacturing and construction industry in India and China. Furthermore, the increasing paint and coatings industry in the region is expected to drive the demand for the product market over the forecasted period. For instance, in 2024 Berger Paints plans to invest around USD 250.0 million over three years to set up plants in India.

China Solvent Market Trends

The China solvent market held the largest market share in 2023 owing to its robust industrial sector as a global manufacturing leader. The country’s increasing demand in the automotive, electronics, and construction sectors is expected to augment the market growth. In addition, the continuous government initiatives have significantly influenced domestic manufacturing and industrial growth, further increasing the demand for solvents in the country.

North America Solvent Market Trends

The solvent market in North America held 26.0% of the global revenue share in 2023. The market was propelled by the gradual shift towards eco-friendly and bio-based solvents. Moreover, the region has increasingly focused on research and development to innovate sustainable solvents, fueling market growth.

The U.S. solvent market dominated the North America market in 2023 with its increasing focus on more oxygenated solvents, particularly in industrial cleaning. Furthermore, the pharmaceutical and electronics industries have been key growth areas in the region, as they increasingly drove demand for high-purity solvents.

Europe Solvent Market Trends

The Europe solvent market secured 23.8% of the market share in 2023 owing to the shift toward bio-based products over chemical alternatives. The product market in the region has experienced growth due to proactive green initiatives by regulatory authorities. Notably, Germany ranks as the 5th largest e-commerce market globally, with a significant surge in online shopping preferences. This e-commerce growth has led to increased demand for corrugated cardboard, product packaging, and printed labels, contributing to overall solvent demand in the region.

Key Solvent Company Insights

The solvent market is fairly fragmented featuring key players such as BASF SE, Dow, SABIC, and more. These companies have increasingly focused on increasing customer base to gain a competitive edge in the industry. They have undertaken several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Dow is a global material science company operated in three primary business segments namely packaging & specialty plastics, industrial intermediates & infrastructure, and performance materials & coatings Dow's solvents are used in applications ranging from paint formulations and industrial cleaners to pharmaceutical processes and electronic materials. The company's focus on innovation and sustainability has led to the development of bio-based solvents and other green alternatives, helping customers meet regulatory requirements and sustainability goals.

-

INEOS is a global petrochemical manufacturer that makes the raw materials and energy used for everyday life. Its products make an indispensable contribution to society and are essential in applications ranging from the preservation of food to the provision of clean water; from the construction of wind turbines, solar panels, and other renewable technologies to the construction of lighter and more fuel-efficient vehicles and aircraft; from medical devices and pharmaceuticals to clothing and apparel.

Key Solvent Companies:

The following are the leading companies in the solvent market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Dow

- Exxon Mobil Corporation

- SABIC

- LyondellBasell Industries Holdings B.V.

- Shell Chemicals

- Akzo Nobel N.V.

- INEOS

- Huntsman International LLC.

- Eastman Chemical Company

- Mitsubishi Chemical Group Corporation

- Sumitomo Chemical Co., Ltd.

- LG Chem

- Formosa Plastics Corporation

Recent Developments

-

In April 2024, BASF launched the next generation dispersing agent, Efka PX 4360, during the 2024 American Coatings Show. This specialized agent targets solvent-based industrial coatings. Developed using BASF’s Controlled Free Radical Polymerization (CFRP) technology, Efka PX 4360 boasts a well-defined polymer architecture. It enhances color characteristics, exhibits excellent compatibility with pigments and coatings systems, and offers improved processability. Notably, it is suitable for aromatic- and tin-free formulations.

Solvent Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.0 billion

Revenue forecast in 2030

USD 51.6 billion

Growth Rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Billion/Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, UAE, Oman, Qatar, Saudi Arabia

Key companies profiled

BASF SE; Dow; Exxon Mobil Corporation; SABIC; LyondellBasell Industries Holdings B.V.; Shell Chemicals; Akzo Nobel N.V.; INEOS; Huntsman International LLC.; Eastman Chemical Company; Mitsubishi Chemical Group Corporation; Sumitomo Chemical Co., Ltd.; LG Chem; Formosa Plastics Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solvent Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global solvent market report based on product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030, Volume in Kilo Tons)

-

Alcohols

-

Hydrocarbons

-

Ketones

-

Esters

-

Chlorinated Solvents

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030, Volume in Kilo Tons)

-

Paints & Coatings

-

Printing Inks

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030, Volume in Kilo Tons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Oman

-

Qatar

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.