- Home

- »

- Plastics, Polymers & Resins

- »

-

Bioplastics Market Size, Share, Growth Analysis Report 2030GVR Report cover

![Bioplastics Market Size, Share & Trends Report]()

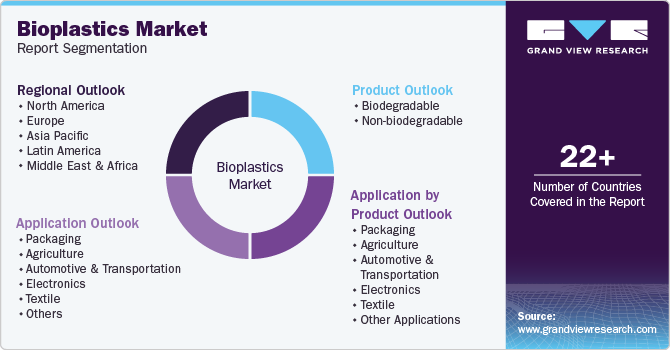

Bioplastics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Biodegradable, Non-biodegradable), By Application (Packaging, Agriculture, Automotive & Transportation, Electronics, Textile), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-587-8

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioplastics Market Summary

The global bioplastics market size was estimated at USD 15.57 billion in 2024 and is projected to reach USD 44.77 billion by 2030, growing at a CAGR of 19.5% from 2025 to 2030. The growth of the market is primarily driven by the increasing restrictions on the utilization of single-use non-biodegradable plastics in developed regions such as North America and Europe, as well as in emerging economies of Asia Pacific.

Key Market Trends & Insights

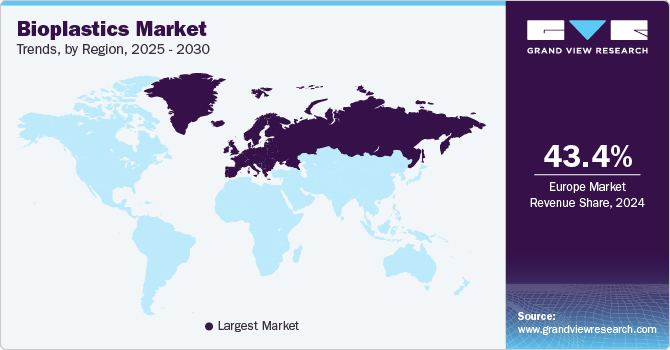

- Europe bioplastics market is dominated and accounted for largest revenue share of 43.38% in 2024.

- The bioplastic market in the U.S. is experiencing significant growth.

- Based on product, the biodegradable segment accounted for the largest revenue share of 50.02% in 2024.

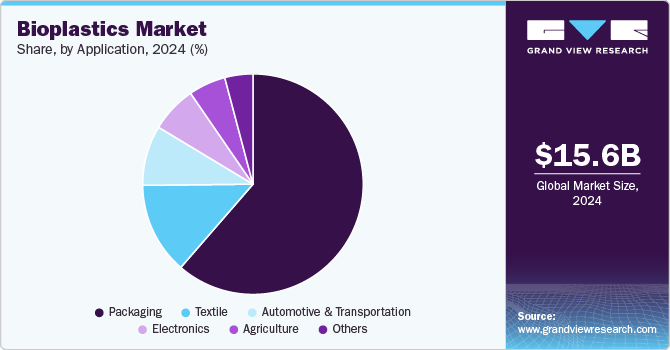

- Based on application, the packaging segment accounted for the largest revenue share of 61.36% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.57 Billion

- 2030 Projected Market Size: USD 44.77 Billion

- CAGR (2025-2030): 19.5%

- Europe: Largest market in 2024

Bioplastics is widely utilized for manufacturing boxes, films, and bags in the packaging industry. The inclination of consumers toward sustainable packaging and rising landfill issues across the globe are expected to boost the demand for bioplastics in industrial packaging, food & beverage packaging, and household care packaging, which in turn, is expected to drive the market over the forecast period. Moreover, bioplastics are gaining importance as an alternative to conventional plastics with consumers increasingly looking for products that are green and less hazardous for the environment.

Drivers, Opportunities & Restraints

Increasing concerns about toxic issues related to petrochemicals and depleting crude oil reserves have been driving the development of bio-based polymers. Government regulations restricting the consumption of petrochemicals in certain applications, such as food packaging and medical devices, are expected to further incentivize the adoption of bioplastics, including biodegradable plastics in the plastic industry.

An increase in demand for plastic alternatives has been observed in the market, owing to the rising concerns over the use of plastics. This is expected to create opportunities for the market in the coming years. With the rapid pace of innovation and new product development, manufacturers in the market are shifting their focus toward the development of bioplastics. Companies are continuously developing product lines using biodegradable & non-biodegradable bioplastics and recycled materials to address the concerns regarding the toxic effects of plastic waste. Several small and medium-scale businesses have committed to using recycled or sustainably sourced materials by a specific time frame.

Bioplastics are gaining popularity across the world; however, their high cost compared to conventional plastics is a major factor restraining the market growth. Furthermore, the low prices of conventional plastics make it difficult to obtain competitive prices for bioplastics. Moreover, the management of biodegradable plastic waste can release chemical substances into the environment if not stored, disposed of, and handled appropriately. Factors such as the lack of awareness regarding the health hazards caused by biopharma plastic waste, inadequate training for waste management personnel, and the absence of waste management & disposal systems are projected to restrain the growth of the biodegradable plastics market over the forecast period

Product Insights

Based on product, the market has been segmented into biodegradable and non-biodegradable. The biodegradable segment accounted for the largest revenue share of 50.02% in 2024. The rising demand for bio-based plastics across a range of end-use sectors over the forecast period is anticipated to fuel the segment growth. The rise in demand for biodegradable plastics is attributed to the increasing demand for personal protective equipment (PPE) and the preference for packaged food post-pandemic.

The non-biodegradable segment is expected to grow at a significant CAGR during the forecast period. Non-biodegradable bioplastics are commonly used in various products including automotive interiors, bottles, food packaging, shopping bags, films, carry bags, consumer goods, disposables, and electronics.

Application Insights

Based on application, the market has been segmented into packaging, agriculture, automotive & transportation, electronics, textile, and others. The packaging segment accounted for the largest revenue share of 61.36% in 2024 and is expected to grow at a rapid CAGR over the forecast period. Bioplastics are widely utilized in packaging applications, including films, sheets, household care items, food & beverage packaging, and packaging for personal care goods. The most popular bioplastics used for packaging are starch blends, PET, PLA, PBAT, PE, and PBS.

Automotive & Transportation is expected to grow at the fastest CAGR in the coming years. In the automotive industry, bioplastics are used in applications such as under-the-hood components and interior parts. Bioplastics are very effective in reducing the carbon footprint owing to their high bio content.

Textile segment is also likely to present lucrative opportunities for these bioplastics. Bioplastics is used in the textile industry to manufacture bags, apparel, footwear, home textiles, and technical textiles. In the automobile sector, technical textiles are utilized in interiors, including seats, side panels and various other parts owing to their high material strength and wear resistance. To lower their carbon footprint, major producers of technical textiles are transitioning to bioplastics from traditional polymers.

Regional Insights

Rapid infrastructure development in the U.S., Canada, and Mexico is anticipated to augment product demand in the coming years. National policies promoting the housing sector’s recovery are expected to positively influence future construction trends. These factors are expected to propel the demand for bioplastics over the forecast period.

U.S. Bioplastics Market Trends

The bioplastic market in the U.S. is experiencing significant growth, driven primarily by increasing consumer awareness and stringent environmental regulations. The rising demand for sustainable packaging solutions in the food and beverage industry has been a major contributor to this growth.

Asia Pacific Bioplastics Market Trends

The growth of the bioplastics market in Asia Pacific is expected to be driven by the increasing demand from various sectors, including automotive and consumer goods, alongside advancements in manufacturing infrastructure and rising disposable incomes. A shift in consumer preferences toward eco-friendly materials is also anticipated to significantly boost the market in the region in the coming years.

The bioplastics market in China is expected to experience substantial growth over the forecast period due to the rising demand for bioplastics across various applications, including packaging, automotive and transport, agriculture, consumer goods, building and construction, and textiles.

Europe Bioplastics Market Trends

Europe bioplastics market is dominated and accounted for largest revenue share of 43.38% in 2024. In Europe, stringent environmental regulations and the push towards a circular economy are key drivers for the bioplastics market. The market is anticipated to grow further with the increasing usage of bioplastics across various industries, such as textiles, automotive and transport, packaging, consumer goods, and medical devices, among others.

Key Bioplastics Company Insights

The bioplastics market is highly competitive, with several key players dominating the landscape. Major companies include TEIJIN LIMITED, TORAY INDUSTRIES, INC., Toyota Tsusho Corporation, Avantium, PTT MCC Biochem Co., Ltd., An Phat Holdings, NatureWorks LLC, SABIC, and BASF, among others. The bioplastics market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Bioplastics Companies:

The following are the leading companies in the bioplastics market. These companies collectively hold the largest market share and dictate industry trends.

- TEIJIN LIMITED

- Toray Industries, Inc.

- Toyota Tsusho Corporation

- Avantium

- PTT MCC Biochem Co., Ltd.

- An Phat Holdings

- NatureWorks LLC

- SABIC

- BASF

- Futerro

- Trinseo

- Braskem S.A.

- TotalEnergies Corbion

- ECPlaza Network Inc.

- Solvay

Recent Developments

-

In June 2024, Floreon, a company specializing in bioplastics, secured USD 328.3 million in funding to scale up its bioplastics technology. This investment will help Floreon expand its production capabilities and enhance its product offerings in the sustainable materials market. The funding is expected to accelerate the development and commercialization of its innovative bioplastic solutions, helping the company fulfill the growing demand for environmentally friendly alternatives to traditional plastics.

-

In February 2024, Balrampur Chini Mills Limited (BCML), a leading sugar company in India, announced a USD 238.5 million forward integration project to build the country's first-ever industrial bioplastic plant. The project aims to produce Polylactic Acid (PLA), a sustainable alternative to traditional plastics, with a global-scale capacity of 75,000 tons per annum.

Bioplastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.40 billion

Revenue forecast in 2030

USD 44.77 billion

Growth rate

CAGR of 19.5% from 2025 to 2030

Historical data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil

Key companies profiled

TEIJIN LIMITED; Toray Industries, Inc.; Toyota Tsusho Corporation; Avantium; PTT MCC Biochem Co., Ltd.; An Phat Holdings; NatureWorks LLC; SABIC; BASF; Futerro; Trinseo; Braskem S.A.; TotalEnergies Corbion; ECPlaza Network Inc.; Solvay

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioplastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global bioplastics market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Biodegradable

-

Polylactic Acid

-

Starch Blends

-

PBAT

-

PBS

-

Others

-

-

Non-biodegradable

-

Polyethylene

-

Polyethylene Terephthalate

-

Polyamide

-

Polytrimethylene Terephthalate

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Agriculture

-

Automotive & Transportation

-

Electronics

-

Textile

-

Others

-

-

Application by Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Biodegradable

-

Polylactic Acid

-

Starch Blends

-

PBAT

-

PBS

-

Others

-

-

Non-biodegradable

-

Polyethylene

-

Polyethylene Terephthalate

-

Polyamide

-

Polytrimethylene Terephthalate

-

Others

-

-

-

Agriculture

-

Biodegradable

-

Polylactic Acid

-

Starch Blends

-

PBAT

-

PBS

-

Others

-

-

Non-biodegradable

-

Polyethylene

-

Polyethylene Terephthalate

-

Polyamide

-

Polytrimethylene Terephthalate

-

Others

-

-

-

Automotive & Transportation

-

Biodegradable

-

Polylactic Acid

-

Starch Blends

-

PBAT

-

PBS

-

Others

-

-

Non-biodegradable

-

Polyethylene

-

Polyethylene Terephthalate

-

Polyamide

-

Polytrimethylene Terephthalate

-

Others

-

-

-

Electronics

-

Biodegradable

-

Polylactic Acid

-

Starch Blends

-

PBAT

-

PBS

-

Others

-

-

Non-biodegradable

-

Polyethylene

-

Polyethylene Terephthalate

-

Polyamide

-

Polytrimethylene Terephthalate

-

Others

-

-

-

Textile

-

Biodegradable

-

Polylactic Acid

-

Starch Blends

-

PBAT

-

PBS

-

Others

-

-

Non-biodegradable

-

Polyethylene

-

Polyethylene Terephthalate

-

Polyamide

-

Polytrimethylene Terephthalate

-

Others

-

-

-

Other Applications

-

Biodegradable

-

Polylactic Acid

-

Starch Blends

-

PBAT

-

PBS

-

Others

-

-

Non-biodegradable

-

Polyethylene

-

Polyethylene Terephthalate

-

Polyamide

-

Polytrimethylene Terephthalate

-

Others

-

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Europe dominated the bioplastics market with a share of 43.38% in 2024. This is attributable to the presence of stringent governmental laws pertaining to single use plastics, increasing environmental concerns among consumers, and rising R&D investments in the bioplastics sector by private as well as public organizations.

b. Some key players operating in the bioplastics market include Teijin Limited; Toray Industries; Toyota Tsusho; M& G Chemicals; PTT Global Chemical Public Company Limited; Showa Denko K.K.; NatureWorks LLC; SABIC; BASF SE; Futerro SA; E. I. du Pont de Nemours and Company; Braskem; Total Corbion PLA; Galactic; and Solvay SA.

b. Key factors that are driving the market growth include rising demand of bioplastics in various applications such as packaging, agriculture, consumer goods, textile, automotive & transportation, building & construction, and rising environmental concerns to reduce the carbon footprint.

b. The global bioplastics market size was estimated at USD 15.58 million in 2024 and is expected to reach USD 18.41 million in 2025.

b. The global bioplastics market is expected to grow at a compound annual growth rate of 19.5% from 2025 to 2030 to reach USD 44.77 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.