- Home

- »

- Plastics, Polymers & Resins

- »

-

Butyl Rubber Market Size And Share, Industry Report, 2030GVR Report cover

![Butyl Rubber Market Size, Share & Trends Report]()

Butyl Rubber Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Regular Butyl, Bromo Butyl, Chloro Butyl), By Application (Tires & Lubes, Adhesives, Sealants, Stoppers, Industrial & Medical Gloves), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-660-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Butyl Rubber Market Size & Trends

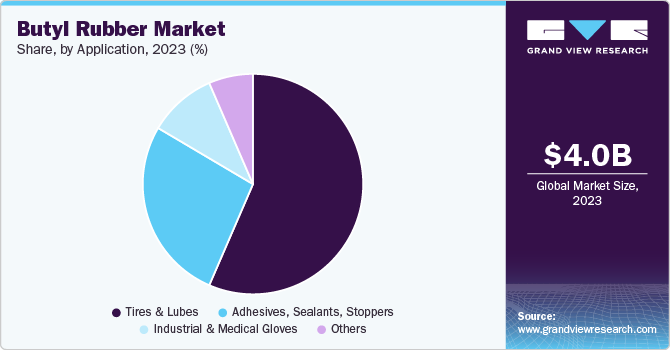

The global butyl rubber market size was valued at USD 4.04 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030. Due to the traction and grip offered by butyl rubber, the product is extensively used in tire production. As vehicle production increases globally, the demand for butyl rubber in tire manufacturing is also expected to grow accordingly. The increasing shift towards electric vehicles (EVs) further supports this growth, as EVs generally require specialized tires to handle different performance characteristics.

Butyl rubber also finds extensive applications in the pharmaceutical industry, as it is used in stoppers and seals of infusion bottles, injection vials, and pre-filled syringes, among other products. The constant need to protect sterile pharmaceutical goods from external contamination during storage, delivery, and use is an important factor for industry expansion.

Owing to its durability, flexibility, and weather resistance, butyl rubber is extensively used in sealants, adhesives, and waterproofing materials. The rapid urbanization and infrastructural development activities globally, especially in developing economies, are expected to drive the demand for butyl rubber. Additionally, continuous developments in industries and improvements in production processes have increased the application scope of this product. Properties such as resistance to heat aging, high damping, ozone resistance, and barrier properties make butyl rubber an ideal choice for manufacturing hoses, gaskets, and vibration controls in the automotive sector. It also enhances formulations for tank linings, conveyor belts, and condenser packaging.

The steady growth of the consumer goods industry also helps shape the global demand for butyl rubber. For instance, in sporting goods, it is used as a component in bladders due to its significant air retention properties. The material is additionally used to make the base of chewing gums. A growing emphasis on sustainability and environmental responsibility has driven the demand for butyl rubber, which has emerged as a more environment-friendly alternative to synthetic rubbers. Butyl rubber's longer lifespan and recyclability make it a preferred choice in various applications. Innovations aimed at reducing the carbon footprint of butyl rubber production and increasing the use of renewable resources also contribute to market growth. Companies invest heavily in developing greener production methods and sustainable sourcing practices to achieve global environmental goals and address consumer preferences for sustainable products.

Product Insights

Chloro butyl rubber accounted for a leading revenue share of 43.6% in the market in 2023. The automotive industry's steady growth and accelerated production of high-performance vehicles are major factors in the increasing demand for chlorobutyl rubber. This material's heat, chemical, and aging resistance are ideal for tire inner liners and other automotive components. Additionally, the increasing emphasis on fuel efficiency and reduced emissions drives the demand for high-quality tire materials, including chlorobutyl rubber, which enables tire pressure maintenance and enhances its longevity. The material also offers significantly better adhesion properties than conventional butyl rubber, leading to its better bonding ability with different substrates and materials.

The bromo butyl segment is expected to witness significant growth over the forecast period. Due to its mechanical properties and resistance to harsh environments, bromo butyl rubber is used in various industrial applications. It is employed in producing hoses, conveyor belts, gaskets and seals, which are essential components in many industries, including manufacturing, chemical processing, and mining. The growth of these industries, driven by increased industrial processes and trade activities, drives substantial demand for bromobutyl rubber. Furthermore, the material's vulcanization properties result in its improved strength and elasticity, and it further possesses high impermeability to gases, driving its use in applications such as airtight seals or barriers.

Application Insights

The tires & lubes segment accounted for the largest revenue share in 2023. Butyl rubber is a key material in tire manufacturing due to its ideal properties, such as air retention, durability, and resistance to chemicals, ozone, and aging. These characteristics are essential for maintaining tire pressure, improving fuel efficiency, and extending tire lifespan. The increasing production of automobiles globally, especially in emerging markets, drives the demand for butyl rubber in tire manufacturing. Additionally, the growing shift towards electric and hybrid vehicles with specific tire performance requirements is expected further to ensure this segment’s expansion in the market.

The adhesives, sealants, and stoppers segment is expected to witness significant growth over the forecast period. Butyl rubber offers adhesive properties, flexibility, and high resistance to moisture and chemicals. These characteristics make it ideal for creating strong and durable bonds in major industries, including construction, automotive, and consumer goods. Moreover, butyl rubber sealants are waterproof, weather-resistant, and flexible, making them ideal for sealing joints and gaps in buildings and infrastructure projects. The fast-expanding construction industry, driven by urbanization and infrastructure development, significantly drives the demand for this material. Stoppers made from butyl rubber are extensively used in the pharmaceutical sector, as they can tightly seal medicine vials and bottles. Furthermore, they are utilized in the primary packaging of parenteral drugs, ensuring their sterility and preventing contamination.

Regional Insights

The butyl rubber market in North America accounted for the largest revenue share of 41.3% in 2023. The region's advanced healthcare infrastructure and significant pharmaceutical development and research investments drive the demand for butyl rubber. Due to its impermeability to gases, moisture, and chemicals, the product is widely used in pharmaceutical stoppers, seals, and medical devices. These properties make them ideal for sealing vials, bottles, and other pharmaceutical containers, ensuring the integrity and safety of the contents. Additionally, the well-established automotive industry in the region also presents substantial growth avenues for this market, owing to its use in improving tire performance and its function as an adhesive.

U.S. Butyl Rubber Market Trends

The U.S. butyl rubber market held the largest revenue share in the region in 2023. The growing focus on electric and hybrid vehicles in the country, which require advanced materials for better efficiency and performance, further boosts the demand for butyl rubber in the automotive sector. The U.S. is home to major automobile manufacturers and has a highly developed automotive supply chain, which drives the demand for high-performance tires. Additionally, the growing popularity of larger and more advanced vehicles, such as SUVs and luxury cars, increases the need for high-quality tires, aiding the demand for butyl rubber.

Asia Pacific Butyl Rubber Market Trends

The Asia Pacific butyl rubber market is expected to witness the fastest CAGR over the forecast period. Butyl rubber-based adhesives and sealants assemble household appliances, electronics, and various consumer products. The growing consumer electronics market, driven by technological advancements and increasing demand for innovative products, has propelled the demand for high-quality adhesives and sealants. Butyl rubber's ability to provide reliable performance in electronic assemblies and appliances supports its rising demand in these sectors. The shift towards smart homes and connected devices further enhances the demand for butyl rubber in consumer goods and electronics products.

China Butyl Rubber Market Trends

The China butyl rubber market is expected to witness significant growth in the coming years. The increasing number of residential, commercial, and infrastructure projects across the country drives the demand for high-quality construction materials. Government initiatives and investments in infrastructural development, such as housing, transportation, and public buildings, further drive the market for butyl rubber. Sealants made from this material are weather-resistant, flexible, and waterproof and are used to seal joints and gaps in buildings and infrastructure projects. Additionally, the noticeable growth of the automotive industry and consumer preference for electric vehicles has boosted the production of specialty components, which has led to market expansion.

Europe Butyl Rubber Market Trends

Europe's butyl rubber market contributes substantially to global revenue. The industrial sector in Europe is a significant consumer of butyl rubber, particularly for applications requiring excellent mechanical properties and resistance to harsh environments. Butyl rubber is used to produce hoses, gaskets, seals, and conveyor belts, essential components in various industries, including manufacturing, chemical processing, and mining. The increased pace of manufacturing activities and technological advancements fuel the regional demand for butyl rubber in industrial applications.

UK Butyl Rubber Market Trends

The UK butyl rubber market is expected to witness significant growth over the forecast period. The growing pace of infrastructural development, deployment of advanced manufacturing technologies, and increasing knowledge about butyl rubbers and their features support market growth in the economy. Efficient logistics and distribution networks ensure a timely supply of butyl rubber and its variants to end-use industries. The strategic location of manufacturing facilities and access to raw materials also contribute to market advancement. Furthermore, companies such as RH Nuttall, White Cross Rubber Products, and Butyl Products Ltd ensure competitiveness in this industry and launch advanced products.

Key Butyl Rubber Company Insights

Some of the key companies in the butyl rubber market include Exxon Mobil Corporation, Reliance Industries Limited, SABIC, and The Goodyear Tire & Rubber Company, among others.

-

Exxon Mobil Corporation is a leading chemicals company that functions across the entire oil and gas value chain, including exploration, production, refining, and distribution. It operates through Energy Products, Chemical Products, Specialty Products, and Upstream segments. The company’s major product offerings include petroleum, plasticizers, butyl rubber, natural gas, solvents and fluids, and lubricants. The Exxon butyl rubber features low permeability, aging resistance, low glass transition temperature, and vibration damping, among other properties. This product is used widely across the automotive and pharmaceutical segments.

-

Reliance Industries Limited operates in various sectors, including petrochemicals, refining, oil and gas exploration, retail, telecommunications, and textiles. The company produces polyester, fiber intermediates, plastics, petrochemicals, and synthetic rubbers for automotive, packaging, agriculture, and healthcare industries. The company’s synthetic rubber portfolio falls under the brand names Relflex and Reliance Sibur Elastomers Pvt Ltd. It includes Polybutadiene Rubber, Styrene Butadiene Rubber, and Butyl Rubber, which are used in applications such as tires, sports goods, footwear, and industrial rollers, among others.

Key Butyl Rubber Companies:

The following are the leading companies in the butyl rubber market. These companies collectively hold the largest market share and dictate industry trends.

- Exxon Mobil Corporation

- LANXESS

- SIBUR Holding

- Reliance Industries Limited

- JSR Corporation

- Kiran Rubber Industries

- SABIC

- Veolia

- ARLANXEO

- The Goodyear Tire & Rubber Company

Recent Developments

-

In July 2024, ARLANXEO announced that its Butyl plant in Singapore, EPDM plant in Geleen (The Netherlands), and EVM facility in Dormagen (Germany) had received ISCC PLUS certifications. This development is expected to help the company boost the production of sustainable synthetic rubber solutions under its ‘Eco’ label, with ARLANXEO currently producing Eco grades for X_Butyl, Keltan, Levamelt, and standard Levapren.

-

In December 2023, SIBUR's Nizhnekamskneftekhim announced that it had completed the upgradation of its halobutyl rubber (HBR) capacities, increasing them from 150 kilotons to 200 kilotons. This project saw the installation of six new production units and revamping 16 units. These upgrades are expected to fully address Russia's requirement for halobutyl rubbers and improve its exports to economies such as China, India, Thailand, and Vietnam.

Butyl Rubber Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.28 billion

Revenue forecast in 2030

USD 6.62 billion

Growth Rate

CAGR of 7.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Norway, Denmark, Russia, Japan, China, India, Australia, South Korea, Indonesia, Vietnam, Brazil, Argentina, UAE, South Africa, Saudi Arabia, Kuwait

Key companies profiled

Exxon Mobil Corporation; LANXESS; SIBUR Holding; Reliance Industries Limited; JSR Corporation; Kiran Rubber Industries; SABIC; Veolia; ARLANXEO; The Goodyear Tire & Rubber Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Butyl Rubber Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the butyl rubber market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Regular Butyl

-

Bromo Butyl

-

Chloro Butyl

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Tires & Lubes

-

Adhesives, Sealants, Stoppers

-

Industrial & Medical Gloves

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Russia

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Vietnam

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.