- Home

- »

- Automotive & Transportation

- »

-

Luxury Car Market Size And Share, Industry Report, 2030GVR Report cover

![Luxury Car Market Size, Share & Trends Report]()

Luxury Car Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Hatchback, Sedan, Sports Utility), By Propulsion Type (Internal Combustion Engine (ICE), Electric), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-033-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Luxury Car Market Summary

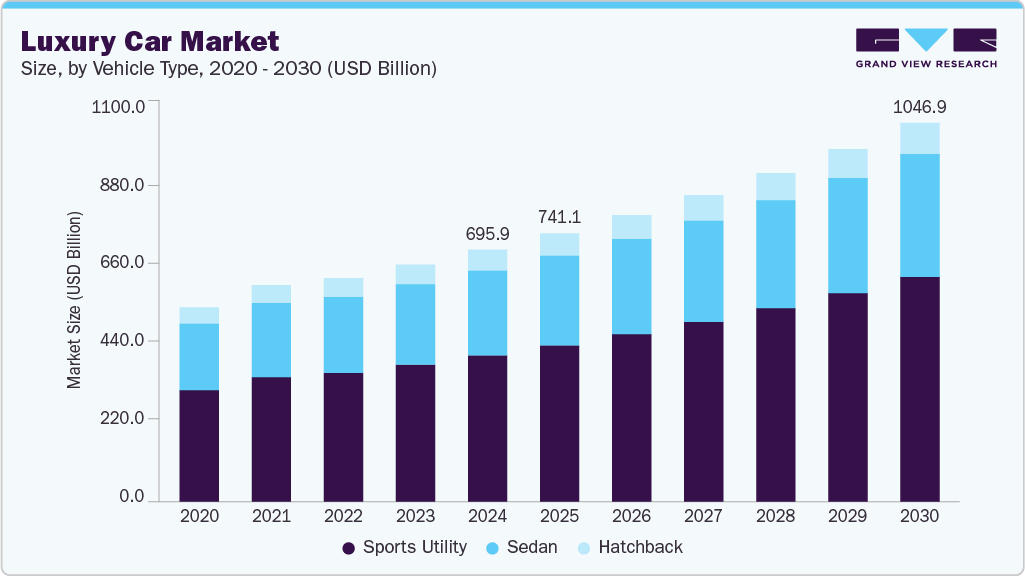

The global luxury car market size was estimated at USD 695.92 billion in 2024 and is projected to reach USD 1,046.87 billion by 2030, growing at a CAGR of 7.2% from 2025 to 2030. The electrification of luxury vehicles is driving market growth as consumer demand shifts toward high-performance EVs that offer both sustainability and advanced technology.

Key Market Trends & Insights

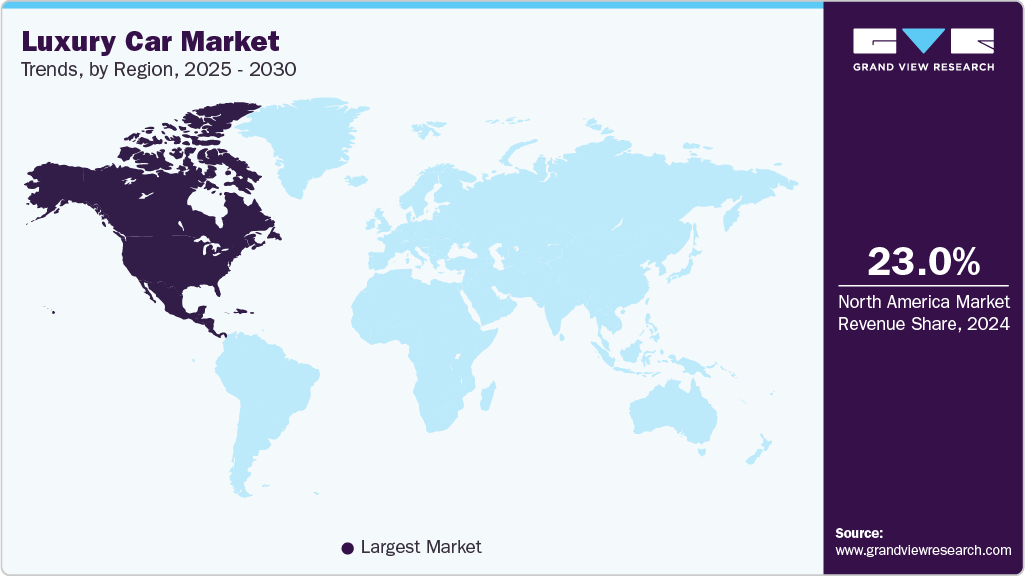

- The North America luxury car market accounted for the largest share of 23.0% in 2024.

- The U.S. luxury car industry held a dominant position in 2024.

- By vehicle type, the sports utility segment accounted for the largest share of 58.0% in 2024.

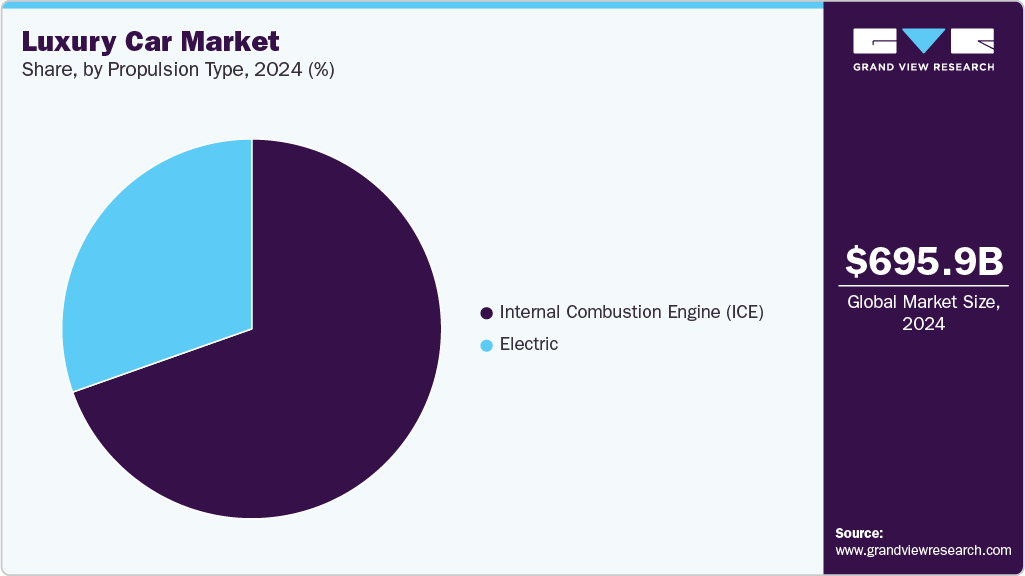

- By propulsion type, the Internal Combustion Engine (ICE) segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 695.92 Billion

- 2030 Projected Market Size: USD 1,046.87 Billion

- CAGR (2025-2030): 7.2%

- North America: Largest Market in 2024

Tesla’s dominance with the Model Y as the top-selling luxury CUV in 2021 and 2022 underscores a rising consumer preference for electric luxury vehicles. The increase in U.S.-produced luxury CUVs from 37.9% of domestic sales in 2018 to 49.4% in 2022 reflects both manufacturing expansion and growing consumer trust, propelling the luxury EV segment forward. Pressure from Tesla’s success is forcing traditional luxury brands to accelerate their EV roadmaps, especially in regulated markets, thereby pushing the overall luxury market toward electrification.Luxury automakers’ push to integrate lightweight materials is driven by the need to meet global emissions standards and enhance fuel economy. Partnerships with suppliers like Toray Industries have enabled brands such as BMW and Mercedes-Benz to reduce vehicle weight by at least 10%, increasing performance efficiency. This gives them a competitive edge in sustainability-conscious markets, and innovations like BMW’s carbon fiber-reinforced i-series vehicles extend battery range, boosting the appeal of luxury EVs and fueling the luxury car industry’s growth.

The expansion of U.S.-based luxury vehicle production from 59.3% in 2018 to 77.6% in 2022 is driven by consumer preferences for domestically assembled cars, supply chain resilience, and trade policy incentives. Facilities like BMW’s Spartanburg plant, which exports 70% of its output, illustrate how localization is positioning the U.S. as a global hub for luxury SUV manufacturing. This trend supports market growth by reducing trade risks and leveraging domestic incentives like the Advanced Technology Vehicles Manufacturing Loan Program.

Despite localization, the need to control production costs and maintain global competitiveness is driving luxury automakers to expand their global manufacturing footprints. Investments such as Audi’s USD 1.3 billion plant in Puebla and GM’s USD 600 million in Mexican operations highlight efforts to balance cost efficiency with market access. Global sourcing, like carbon fiber from Japan and batteries from Europe, enables luxury brands to maintain quality and scale, sustaining their presence in multiple regions and fueling growth through operational flexibility.

The evolution toward software-defined vehicles is reshaping consumer expectations in the luxury segment. With premium models now containing up to 100 million lines of code, features like real-time diagnostics and over-the-air updates are emerging as core differentiators. The hiring of thousands of engineers by GM to develop vehicle software shows how digital innovation is becoming a primary driver of brand competitiveness. Technologies like Tesla’s Autopilot and Mercedes' MBUX are setting benchmarks, making software capabilities a key factor driving the demand for luxury vehicles.

Vehicle Type Insights

The sports utility segment accounted for the largest share of 58.0% in 2024. Luxury Sports Utility Vehicles (SUVs) have rapidly emerged as the flagship choice among affluent consumers, driven by a blend of status, performance, and practicality. This segment continues to thrive, largely due to evolving consumer lifestyles that prioritize versatility without compromising on opulence. High ground clearance, advanced all-wheel-drive systems, and tech-infused interiors have turned luxury SUVs into mobile command centers. Automakers such as Mercedes-Benz (GLS), BMW (X7), and Range Rover are redefining this space by offering bespoke customization, AI-assisted driving, and sustainability elements, appealing to both younger elites and traditional luxury buyers. The trend is further reinforced by the surge in female buyers and urban professionals seeking dominance on both the road and social feeds.

The Hatchback segment is expected to grow at a significant CAGR during the forecast period. This segment is being reimagined for city-dwelling elites who demand compact agility without compromising on premium finishes. Models like the Audi A1, BMW 1 Series, and Mercedes-Benz A-Class have infused the hatchback with high-tech cockpits, semi-autonomous driving features, and eco-conscious materials. While this category does not match SUV volumes, its rising appeal among environmentally aware, younger luxury buyers signals a steady niche growth. It's not about utility anymore, it's about efficient elegance.

Propulsion Type Insights

The Internal Combustion Engine (ICE) segment held the largest market share in 2024. ICE-powered luxury cars still dominate global sales, especially in regions where EV infrastructure lags. Buyers in this segment value the unmistakable growl of a V8 engine, long-distance range, and established maintenance networks. However, even ICE models are undergoing transformation-downsized turbocharged engines, mild-hybrid systems, and sustainable leather alternatives are now standard in premium ICE offerings. Automakers continue refining combustion performance while using this propulsion type as a bridge to electrification.

The electric segment is expected to grow at the fastest CAGR during the forecast period. Electric luxury cars have become more than just alternatives; they are trendsetters. Spearheaded by brands like Tesla, Lucid, and Porsche (Taycan), the electric segment is becoming synonymous with cutting-edge design, near-instant torque, and software-defined luxury. Discerning buyers increasingly associate EVs with modernity and eco-conscious prestige. Furthermore, the rollout of ultra-fast charging networks and government incentives in key markets (Europe, China, U.S.) is accelerating adoption. The electric propulsion segment is not only outpacing growth expectations but also redefining what "luxury" means for the next generation.

Regional Insights

The North America luxury car market accounted for the largest share of 23.0% in 2024, driven by consumer preferences for exclusivity, performance, and advanced technology. There is a notable rise in demand for electric and hybrid luxury vehicles, reflecting a shift towards environmentally friendly options. Additionally, SUVs and crossovers are gaining popularity due to their combination of luxury, versatility, and practicality. Domestic luxury car brands maintain a strong presence, offering performance and innovation that resonate with the market. Favorable macroeconomic factors, including a strong economy and high disposable income, further contribute to the development of the luxury cars market in North America.

U.S. Luxury Car Market Trends

The U.S. luxury car industry held a dominant position in 2024. In the U.S., the market is characterized by a growing demand for electric and hybrid vehicles, as consumers become more conscious of their carbon footprint. Luxury car manufacturers are responding by investing in research and development to create eco-friendly options that meet high customer standards. The increasing popularity of SUVs and crossovers, offering a blend of luxury and practicality, is also shaping the market. American luxury car manufacturers continue to have a loyal customer base, contributing to the unique dynamics of the U.S. luxury cars market.

Europe Luxury Car Market Trends

The Europe luxury car industry was identified as a lucrative region in 2024. This growth is driven by economic stability, increasing disposable incomes, and a shift in consumer preferences toward vehicles that signify status and feature the latest automotive technologies. A prominent trend is the swift adoption of electric vehicles (EVs), with luxury automakers introducing high-performance EVs equipped with advanced driver-assistance systems (ADAS) and autonomous driving capabilities. The expansion of fast-charging infrastructure across Europe enhances the feasibility of EVs for consumers. Moreover, luxury brands are focusing on bespoke customization, allowing clients to personalize their vehicles, thereby amplifying the allure of luxury brands.

The Germany luxury car market is expected to grow during the forecast period. As a major player in the European automotive industry, Germany is experiencing trends similar to those in the broader European market. However, the luxury vehicle market in Germany is vulnerable to wealth outflows, which impact demand recovery. Nonetheless, the presence of established luxury car manufacturers in Germany offers a strong foundation for potential growth.

The luxury car market in the UK is experiencing steady growth, driven by customer preferences for sustainable luxury, market trends such as the rise of electric and hybrid vehicles, and local special circumstances, including a strong heritage in luxury car manufacturing. Luxury car manufacturers are responding to the demand for personalized and bespoke vehicles by offering a wide range of customization options.

Asia Pacific Luxury Car Market Trends

In Asia Pacific (APAC), the luxury car industry is witnessing steady growth fueled by strong economic expansion, increasing urbanization, and rising wealth among the middle and upper classes. Consumers in countries such as China, Japan, and India are demonstrating a significant preference for technologically advanced and environmentally friendly luxury vehicles, particularly electric and hybrid models. This transition is supported by government policies that promote clean mobility and lower emissions. Luxury SUVs, known for their combination of comfort, prestige, and practicality, are gaining considerable traction among urban consumers. Automakers are responding to these trends by localizing production, expanding dealership networks, and customizing offerings to regional preferences, which enhances accessibility and brand loyalty. The convergence of consumer demand for innovation, green technology, and brand exclusivity is shaping a dynamic and competitive luxury cars market across APAC.

China’s luxury car market is evolving rapidly as rising incomes, a burgeoning middle class, and a cultural shift towards status-oriented consumption drive demand for premium vehicles. Urban consumers increasingly prioritize brand prestige, advanced features, and environmental awareness, leading to strong interest in electric and hybrid luxury cars. Government incentives promoting new energy vehicles and strict emission regulations are also encouraging both domestic and foreign manufacturers to heavily invest in the electric luxury segment. The popularity of luxury SUVs continues to rise, reflecting a preference for spacious, tech-rich, and versatile models. Furthermore, the expansion of localized manufacturing and dealership networks by global brands enhances accessibility, customization, and after-sales service, contributing to sustained market momentum.

The luxury car market in India is gradually expanding, fueled by rising disposable income, aspirational lifestyles, and the increasing influence of younger, tech-savvy consumers. There is a growing preference for premium vehicles featuring sophisticated design, advanced safety features, and connectivity, while electric and hybrid luxury cars are gaining traction due to rising fuel costs and government-led sustainability initiatives. Although the market remains niche compared to global standards, luxury SUVs are becoming a popular choice because of their adaptability to Indian road conditions and urban family needs. International automakers are enhancing their local presence through assembly plants, digital showrooms, and financing options tailored to India’s distinct consumer behavior, reflecting a long-term commitment to the market’s evolving demands.

Key Luxury Car Company Insights

Some major players in the luxury car market include BMW AG, Aston Martin, General Motors, and Mercedes-Benz Group AG. These key market players are characterized by their strong global brand presence, cutting-edge technological innovation, and ability to adapt to changing consumer preferences. These companies invest heavily in research and development to integrate advanced safety systems, high-performance drivetrains, and digital features like autonomous driving capabilities and software-defined vehicle architectures. Their commitment to electrification, which includes hybrid and fully electric models, aligns with increasingly strict emissions regulations and the growing demand for sustainable mobility. Additionally, their global manufacturing and distribution networks enable efficient market penetration and localized production, allowing them to navigate geopolitical challenges and supply chain disruptions. With a consistent focus on design excellence, customer experience, and premium value offerings, these manufacturers continue to set benchmarks that define and drive the luxury automotive segment..

-

Mercedes-Benz Group AG is renowned for its legacy of engineering excellence, innovation, and brand prestige. The company has successfully expanded its luxury lineup to include cutting-edge electric vehicles under the EQ brand, signaling a firm commitment to sustainability and future mobility. Its global production capabilities, strong presence in key markets like Europe, China, and the U.S., and integration of advanced technologies such as Level 3 autonomous driving and MBUX infotainment system make it a benchmark for premium automotive experiences. Mercedes-Benz continues to lead through its strategic investments in electrification, digitalization, and customer-centric innovations, strengthening its position as a top-tier luxury automaker.

-

Volkswagen plays a critical role in the luxury car market through its ownership and strategic development of premium brands such as Audi, Bentley, Lamborghini, and Porsche. Leveraging its extensive global manufacturing network and R&D capabilities, the company has positioned itself as a powerhouse in both performance and luxury segments. Its commitment to electrification is evident through major investments in the Premium Platform Electric (PPE) architecture and the expansion of electric offerings across its luxury brands. Volkswagen also emphasizes digital transformation, integrating advanced software systems and autonomous features to meet evolving consumer expectations. By combining brand heritage, technological innovation, and scalable EV strategies, Volkswagen continues to drive growth and redefine the standards of the global luxury automotive industry.

Key Luxury Car Companies:

The following are the leading companies in the luxury car market. These companies collectively hold the largest market share and dictate industry trends.

- BMW AG

- Aston Martin

- Volkswagen

- General Motors

- Mercedes-Benz Group AG

- Stellantis NV

- Tesla

- TOYOTA MOTOR CORPORATION

- Tata Motors Limited

- Volvo Car Corporation

Recent Developments

-

In March 2025, Mercedes-Benz introduced the new CLA, featuring an electric variant with a range of 792 km (492 miles), set for sales later in 2025. This third-generation model strengthens Mercedes-Benz’s position in the luxury electric vehicle segment, targeting eco-conscious premium buyers.

-

In May 2025, Audi, a subsidiary of Volkswagen, announced the upcoming RS5 Avant, a plug-in hybrid with a V6 engine producing approximately 600 horsepower. This model blends high performance with fuel efficiency, expanding Audi’s electrified luxury offerings for performance-driven consumers.

Luxury Car Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 741.08 billion

Revenue forecast in 2030

USD 1,046.87 billion

Growth rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, propulsion type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

BMW AG; Aston Martin; Volkswagen; General Motors; Mercedes-Benz Group AG; Stellantis NV; Tesla; TOYOTA MOTOR CORPORATION; Tata Motors Limited; Volvo Car Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Car Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury car market report based on vehicle type, propulsion type, and region:

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hatchback

-

Sedan

-

Sports Utility

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Internal Combustion Engine (ICE)

-

Electric

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global luxury car market size was estimated at USD 617.36 billion in 2022 and is expected to reach USD 654.79 billion in 2023.

b. The global luxury car market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 1,046.87 billion by 2030.

b. Europe dominated the luxury car market with a share of 39.3% in 2022. This can be attributed to the presence of numerous luxury car market players in the region.

b. Some key players operating in the luxury car market include Mercedes-Benz Group AG, BMW Group, Volkswagen, Tesla, TOYOTA MOTOR CORPORATION (Lexus), Volvo Car Corporation, JAGUAR LAND ROVER AUTOMOTIVE PLC (Tata Motors), and Aston Martin.

b. Key factors driving the market growth include the continued increase of ultra-high-net-worth individuals and increasing disposable income.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.