- Home

- »

- Specialty Polymers

- »

-

Chromatography Resin Market Size & Share Report, 2030GVR Report cover

![Chromatography Resin Market Size, Share & Trends Report]()

Chromatography Resin Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Technique (Ion Exchange, Affinity), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-386-6

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Chromatography Resin Market Summary

The global chromatography resin market size was estimated at USD 2.47 billion in 2023 and is projected to reach USD 3.94 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. The growth in this market is attributable to growing demand for chromatography techniques from pharmaceutical, chemical, food & beverage, and other industries.

Key Market Trends & Insights

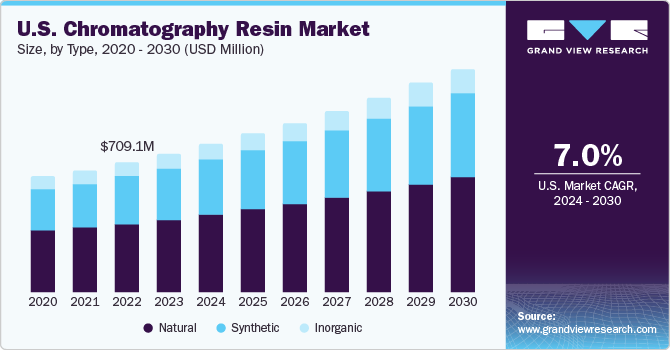

- North America region dominated the market with a revenue share of 33.1% in 2023.

- The U.S. is the major consumer of the product in North America accounting for 92.5% market share in 2023.

- Based on type, the natural segment dominated the market with a revenue share of 51.1% in 2023.

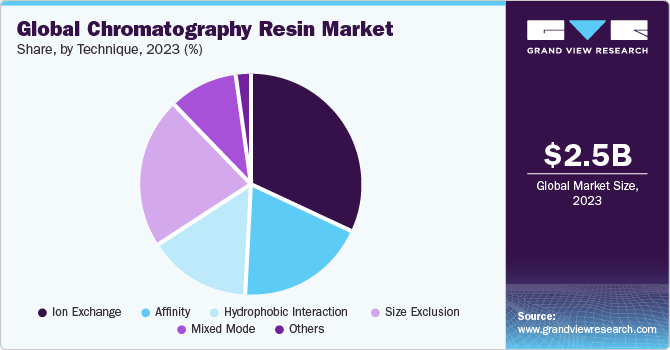

- Based on technique, the ion exchange segment dominated the market with a revenue share of 43.0% in 2023.

- Based on end use, the pharmaceutical & biotechnology segment dominated the market with a revenue share of 83.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.47 Billion

- 2030 Projected Market Size: USD 3.94 Billion

- CAGR (2024-2030): 6.8%

- North America: Largest market in 2023

High investments in R&D in the industry have propelled the development of several products, which have resulted in improved productivity compared to conventional products. Chromatography resin is among one of the examples of evolving industry dynamics. It has gained a considerable market share in recent years across several end-use industries owing to its high accuracy and ease of use.

The U.S. is expected to remain a major consumer in the industry as most of the pharmaceutical companies are based in the U.S. This region has seen a strong growth due to focused government spending on research and development. The rise in disposable income has also directly translated into increased spending on essential and preventive healthcare services, thereby boosting product consumption.

Increasing demand for therapeutic antibodies for treating patients is also a major driver that is triggering the industry growth. The shifting trend toward replacing conventional separation techniques, such as distillation and filtration using chromatography is also driving innovation for product use in numerous new segments.

Market Characteristics & Concentration

The global chromatography resin industry is oligopolistic in nature. The top players hold more than 60% share while regional players have a stronghold over the remaining share. The pricing and various other strategic initiatives of the market depend on the top market players. To sum up, since there are only a few firms in the market, they may have significant market power, which means they can control the prices of goods and services. This can limit competition, as smaller firms may not be able to enter the market and compete effectively.

The chromatography resin industry is a diversified one with the presence of both multinational and local players. Key players such as Thermo Fisher, Merck, Bio-Rad, and GE Healthcare have a wide-ranging product portfolio, extensive distribution network, and a high degree of operational integration. The major players in the market are investing extensively in R&D, which has led to the invention of several innovative products that can be utilized across previously niche market. For instance, Bio-Rad Laboratories, Inc. launched an innovative EconoFit Low-Pressure Prepacked Chromatography resin pack to support resin screening experiments.

Other product producers, such as Tosoh Corporation, also occupy a significant share in the marketspace. These companies are also actively engaged in mergers and acquisitions to improve their standing in the market. Such strategies are only serving to boost industry competitiveness and improve the company’s position in the overall market.

Type Insights

Based on type, the natural segment dominated the market with a revenue share of 51.1% in 2023. This high share is attributable to an increased consumption of naturally derived product, wide utilization in size chromatography, and paper chromatography in several industrial end-uses.

Chromatography resin types includes natural, synthetic, and inorganic. Natural resin consumption in North America is largely dominated by the U.S. considering the presence of several global pharmaceutical giants. Expanding pharmaceutical and biomedical sectors because of the rise in healthcare expenditure and increasing demand from F&B sector are key drivers for the market in North America. In addition, government allocation of funds in R&D of more productive product is anticipated to further drive natural product demand in various end-uses and end uses in North America.

Furthermore, synthetic resin segment is anticipated to grow at a faster pace owing to its growing utilization in ion exchange chromatography, which is used in the F&B industry, chemicals, pharmaceuticals, petrochemicals, sugar production, water treatment, and softening of industrial water. It is increasingly being used instead of natural resin to increase production figures.

Technique Insights

In terms of technique, the ion exchange technique segment dominated the market with a revenue share of 43.0% in 2023. This high share is attributable to increasing emphasis on drug discovery processes by major pharmaceutical companies and CROs (contract research organization). Furthermore, the ion exchange technique is one of the most creative and active fields in the food and beverages industry, which also plays a vital role in the growth of the food industry.

Synthetic resin is majorly used in ion exchange chromatography, which is used in the F&B industry, chemicals, pharmaceuticals, sugar production, petrochemicals, water treatment, and softening of industrial water. Synthetic resin is increasingly used instead of natural resin to increase production figures.

Furthermore, the affinity technique emerged as the second largest segment accounting for over 25% overall market share. The rise in the use of monoclonal antibodies, demand for protein purification, and nucleic acid purification processes are the major factors responsible for propelling the affinity resin market.

End-use Insights

The pharmaceutical & biotechnology segment dominated the market with a revenue share of 83.1% in 2023. Its high share is attributable to high consumption of resins in pharmaceutical processes to produce extremely pure materials in large quantities and to examine the purified compounds for contamination.

Moreover, growing use of monoclonal antibodies in critical therapeutic areas such as oncology, tuberculosis, and autoimmune diseases is likely to drive demand for chromatography resin. The increasing number of contract manufacturing organizations (CMOs) and contract research organizations (CROs) in the pharmaceutical sector is anticipated to drive product demand. The food & beverages end-use segment is anticipated to be the fastest-growing end-use segment owing to the increasingly strict guidelines issued by food regulatory authorities globally.

Regional Insights

North America region dominated the market with a revenue share of 33.1% in 2023. This high share is attributed to the growing demand for drug discovery to control diseases globally such as Ebola, Zika, and others. Growing interest in the use of monoclonal antibodies in therapeutic areas is also expected to fuel the North America chromatography resin market growth.

The U.S. is the major consumer of the product in North America accounting for 92.5% market share in 2023. The country offers a premier scope for chromatography resin on account of its highly developed pharmaceutical industry and growing use in end-use end-uses, combined with the presence of a highly skilled workforce and growing R&D initiatives to encourage innovative product end-use.

Europe is home to major manufacturers such as Merck KGaA. The European Union’s initiatives such as the Innovative Medicines Initiative (IMI), which aims to speed up the development of better and safe medicines, have given a major boost to the chromatography resin demand in the region.

Germany is the biggest consumer of chromatography resin in Europe, owing to the significant presence of research and development facilities of global pharmaceutical companies. The region is increasingly exporting medicines and related products to neighboring countries as well as other economies around the world.

The Asia Pacific chromatography resin market is witnessing high economic growth across major regional countries such as China, India, and Japan among others is likely to boost the market growth. The growing government support to domestic manufacturing is likely to boost regional production levels and reduce the dependence on imports, which is expected to present lucrative opportunities for global manufacturers.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In April 2023, Mitsubishi Chemical starts implementation of commercial polycarbonate (PC) resin recycling. By 2030, Mitsubishi Chemical will have an annual processing capacity of 10,000 tons of PC resin recycling material to commercialize the chemical recycling of PC resin.

-

In June 2022, Bio-Rad Laboratories, Inc. launched CHT prepacked Foresight Pro Columns, designed to support downstream process-scale chromatography applications across different stages of biological drug development and production.

Key Chromatography Resin Companies:

- Merck KGaA

- Bio - Rad Laboratories, Inc.

- WIPRO GE HEALTHCARE PVT LTD

- Purolite

- GRACE

- Mitsubishi Chemical Holdings Corporation.

- Danaher

Chromatography Resin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.64 billion

Revenue forecast in 2030

USD 3.94 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in thousand liters, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, technique, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy, Spain, Austria, Switzerland, China; India; Japan; South Korea; Australia; New Zealand; Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Merck KGaA, Bio - Rad Laboratories, Inc., WIPRO GE HEALTHCARE PVT LTD, Purolite, GRACE, Mitsubishi Chemical Holdings Corporation, Danaher

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chromatography Resin Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the chromatography resin market report based on type, technique, end-use, and region:

-

Type Outlook (Revenue, USD Million; Volume, Thousand Liters, 2018 - 2030)

-

Natural

-

Synthetic

-

Inorganic

-

-

Technique Outlook (Revenue, USD Million; Volume, Thousand Liters, 2018 - 2030)

-

Ion Exchange

-

Affinity

-

Hydrophobic Interaction

-

Size Exclusion

-

Mixed Mode

-

Others

-

-

End‑use Outlook (Revenue, USD Million; Volume, Thousand Liters, 2018 - 2030)

-

Pharmaceutical & Biotechnique

-

Food & Beverage

-

Water & Environmental Analysis

-

Other End-Uses

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Liters, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Austria

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global chromatography resin market size was estimated at USD 2.47 billion in 2023 and is expected to reach USD 2.64 billion in 2024.

b. The global chromatography resin market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 3.94 billion by 2030.

b. North America dominated the chromatography resin market with a share of 33.1% in 2023. This is attributable to the increasing demand for biopharmaceuticals along with the growing necessity for drug discovery to combat coronavirus disease.

b. Some key players operating in the chromatography resin market include Merck, Bio-Rad, Thermo Fisher, Purolite Life Sciences, CromaTan , and GE Healthcare

b. Key factors that are driving the chromatography resin market growth include the development of novel resin products, which have better productivity in comparison to conventional resins.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.