- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Cool Roof Coatings Market Size, Share, Growth Report, 2030GVR Report cover

![Cool Roof Coatings Market Size, Share & Trends Report]()

Cool Roof Coatings Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Elastomeric, IR Reflective), By Application (Low-sloped, Steep-sloped), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-177-1

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cool Roof Coatings Market Summary

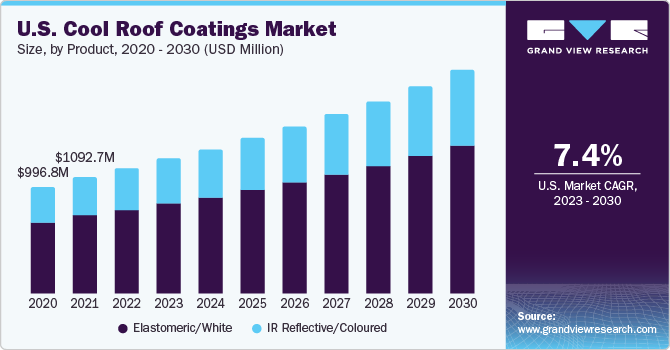

The global cool roof coatings market size was valued at USD 4.03 billion in 2022 and is projected to reach USD 7.02 billion by 2030, growing at a CAGR of 7.2% from 2023 to 2030. The growth is attributed to the energy savings offered by this product.

Key Market Trends & Insights

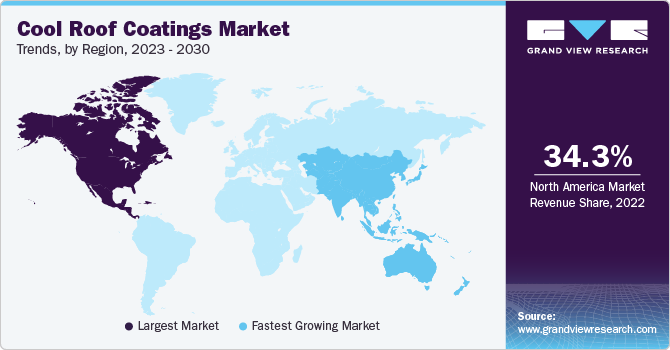

- North America dominated the market and accounted for the largest revenue share of 34.3% in 2022.

- By product, the elastomeric coatings segment accounted for the largest revenue share of 67.1 % in 2022.

- By application, the low-sloped segment accounted for the largest revenue share of 60.2 % in 2022.

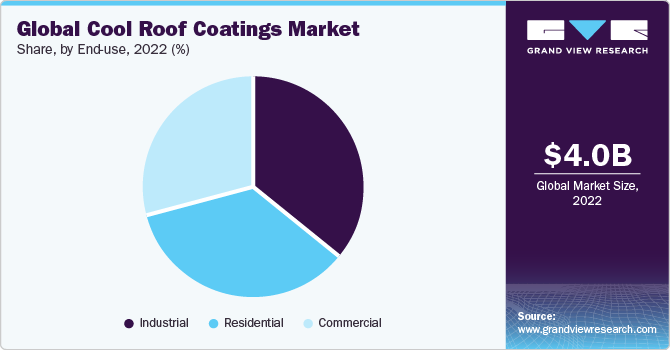

- By end-use, the industrial segment accounted for the largest revenue share of 35.9 % in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.03 Billion

- 2030 Projected Market Size: USD 7.02 Billion

- CAGR (2023-2030): 7.2%

- North America: Largest Market in 2022

- Asia Pacific: Fastest growing market

The rising adoption of green building codes by the emerging economies across the globe is anticipated to further fuel the demand for cool roof coatings. Rising concerns regarding rising carbon emission and energy consumption are encouraging governments to implement regulations for environmentally responsible buildings. This factor is expected to create growth opportunities for the cool roof coating market in near future. Cool roof coating includes the reflective type of tiles, sheet covering, and protective coating that enable roofs to remain cooler and thus help reduce the temperature of the building. It helps to save the amount of money spent on air conditioning and other cooling systems. These coatings consist of white coatings or special reflective pigments that reflect sunlight and help protect the surface of roofs from ultra-violet radiations, water rusting, and chemical damages.

Cool roof coatings provide various advantages such as cost-effective and high solar reflectivity which ultimately results in minimizing the heat buildup within commercial and residential spaces and reduces the dependence on air-conditioning, thus saving energy and diminishing air pollution. The rising inclination of consumers toward energy savings and favorable government policies concerning tax benefits encourages the usage of green building materials and is anticipated to propel the demand in the forthcoming years.

A prominent trend observed in the market is shifting consumer preference for cost-effective and long-lasting coatings as opposed to short-term, quick-fix solutions. Property managers and industrialists are studying the lifecycle assessment of cool roof coatings. Although cheaper variants help save expenses, the inevitable need to re-coat after three to five years turns out to be exponentially costlier in terms of material, labor, and time. This factor may challenge growth in the near future.

Cool roof coatings help decrease heat buildup within a building's structure, thereby lowering the demand for air conditioning and resulting in decreased energy expenses. In addition, structural deformations occurring due to temperature fluctuations and the damage caused by harmful UV radiation too can be mitigated by cool roof coatings.

High solar reflectance is essential for the functioning of cool roof coatings. Higher rate of thermal emittance along with lower rate of absorption helps the roof absorb less heat and stay up to 25°C to 35°C cooler than the traditional materials during the high temperature conditions.

The 2009 version rating system of Leadership in Energy and Environmental Design (LEED) by the U.S. Green Building Council, included cool materials which are rapidly emerging national standard for the purpose of developing sustainable and high-performance buildings. According to the revision, to receive Sustainable Sites Credit 7.2 Heat Island Effect-Roof; >75% of the roof surface area must use materials with Solar Reflective Index (SRI) of at least 78.

Under California state laws, Title 24 Building Energy Efficiency Code standards from 2014 prescribes requirement of cool roofs with minimum 0.70 reflectance and 0.75 emittance level that can help in saving ~30% on energy bills. The ENERGY STAR program introduced by the U.S. Department of Energy proposes that roof products which are qualified could decrease peak cooling demand by 11% to 16% percent and bring down the amount of air conditioning needed in buildings.

Government support in the form of financial incentives and tax benefits is expected to boost the demand for cool roof coatings. Increasing awareness in regards with energy savings along with the environmental benefits offered by cool enamels are anticipated to expand the market.

Product Insights

The elastomeric coatings segment accounted for the largest revenue share of 67.1 % in 2022. These coatings are extensively used in commercial and industrial constructions. The superior product performance and rising demand for energy-efficient roofing systems are the factors expected to drive the demand over the forecast period.

The IR reflective coatings segment is expected to grow at the fastest CAGR of 7.6% during the forecast period on account of the ability of the product to keep objects cooler as compared to that of conventional pigments. Pleasing aesthetic appeal offered by the dark-colored IR reflective coatings gives this segment a competitive edge. Visual appeal plays an integral part for a building owner, thus triggering the product demand.

Application Insights

The low-sloped segment accounted for the largest revenue share of 60.2 % in 2022 owing to its merits, such as low initial installation cost and less build-up material than the steep-sloped process. Low-sloped roofs are widely used for industrial and commercial buildings. Rising awareness regarding the importance of green building construction along with stringent regulations concerning roofing materials for industrial and commercial constructions have resulted in greater penetration in low-sloped roofing systems.

The steep sloped segment is expected to grow at the fastest CAGR of 7.5% during the forecast period on account of their increasing employment in the residential sector, particularly in regions with high rainfall and snowfall. Steep-sloped roof type needs lower maintenance due to the structural advantage which enables swiftly shed water and lower the risk of mold or mildew proliferation on the roof, resulting in lower penetration of coating products in such types of roofs. However, the demand for cool coatings is expected to grow in the steep-sloped roofs application segment in the forthcoming years, due to the increasing availability of quick-drying coatings and advanced techniques.

End-use Insights

The industrial segment accounted for the largest revenue share of 35.9 % in 2022. The constant development of the industrial sector, predominantly in North American and Asian countries including the U.S., China, and Canada, as a result of high disposable income levels is likely to drive the growth of the segment over the forecast period.

The residential segment is expected to grow at the fastest CAGR of 7.6% during the forecast period. The escalating popularity of colored enamels supported by the increasing adoption of green building codes in developing countries is expected to foster residential applications. The availability of colored IR reflective coatings has been responsible for the higher penetration in the residential segment. These enamels can be applied practically over any roofing material, and thus, have become a part of household renovations. Implementation of green building codes for individual homes and residential constructions, majorly in emerging countries, is expected to propel demand in the coming years.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 34.3% in 2022. The growth can be attributed to early implementation of building codes and increasing awareness in regards with the building energy consumption among consumers.

Furthermore, the construction industry in North America is expected to witness significant growth over the coming years owing to high demand for residential, non-residential, and commercial construction projects propelling the growth of cool roof coatings industry across the region during the forecast period.

The construction industry in the U.S. has witnessed significant expansion in recent years, owing to positive outlook of commercial real estate and a strong economic attribute along with rising federal & state funding for institutional buildings and public infrastructure. In addition, ongoing and planned projects, such as new homeless services and health centers, modernization of SFUSD sites, affordable housing developments, SoFi Stadium project in Inglewood, and Treasure Island redevelopment are expected to boost the demand for cool roof floor coatings applications over the forecast period.

Asia Pacific is expected to grow at the fastest CAGR of 7.7% during the forecast period, owing to the increased construction activities and infrastructure development, which leads to higher demand for solutions that enhance energy efficiency and reduce cooling costs. This factor is expected to trigger the need for cool roof coatings over the forecast period.

The European market witnessed rise in demand for cool roof coatings, in recent years, across green building designs owing to their excellent environmental advantages providing enhanced building life, maximized energy efficiency, and improved indoor quality. Favorable government support to encourage green building construction in various countries including the UK, Germany, Hungary, the Netherlands, Ireland, Poland, and Sweden is expected to propel product demand over the forecast period.

In Germany, construction sector is significantly contributing to the demand for cool roof coatings applications. The country has witnessed a surge in new residential building permits owing to the rising demand for real estate, low borrowing costs, and increasing population and this growth trend is expected to continue over the forecast period. On account of the growing real estate and housing market, the construction sector is expected to grow rapidly, which is further anticipated to fuel the consumption of cool roof coatings over the forecast period.

Key Companies & Market Share Insights

The global market is oligopolistic in nature dominated by a few major players. Manufacturers are investing heavily in R&D activities and are relying on technological developments to achieve competitive advantage through product differentiation and low-cost offerings. Moreover, manufacturers are focusing on integrating their operations through supply and distribution channels to expand their reach to individual consumers.

Key Cool Roof Coatings Companies:

- NuTech Paint

- Valspar

- NIPPON PAINT (M) SDN. BHD.

- Sika AG

- Monarch Industrial Products India Private Limited

- Excel Coatings

- Indian Insulation & Engineering

- KST Coatings

- Dow

- GAF

- Huntsman International LLC

- PPG Industries, Inc.

Recent Developments

-

In March 2023, NanoTech Inc. introduced their primary product, the Nano Shield cool roof coat. This specialized coating is aimed to be used on commercial roofs. By applying this coating, buildings can experience a remarkable 30-40% reduction in HVAC usage. This leads to substantial savings in energy expenses and plays a crucial role in lowering scope 1 carbon emissions.

-

In May 2020, Nouryon has introduced an innovative solution for the construction industry. This solution enhances the performance of energy-saving cool roof coatings. The idea behind this new concept is to combine two key ingredients: Nouryon's Expancel, which help with light reflection, and its Levasil colloidal silica, which enhances the coatings' overall effectiveness. This advancement aims to provide improved products for the building and construction market.

Cool Roof Coatings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.32 billion

Revenue forecast in 2030

USD 7.02 billion

Growth rate

CAGR of 7.2 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in kilo liters, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, End-use, Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Belgium, Russia, China, Japan, India, South Korea, Argentina, Brazil, South Africa, Saudi Arabia

Key companies profiled

NuTech Paint, Valspar, NIPPON PAINT (M) SDN. BHD., Sika AG, Monarch Industrial Products India Private Limited, Excel Coatings, Indian Insulation & Engineering, KST Coatings, Dow, GAF, Huntsman International LLC, PPG Industries, Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cool Roof Coatings Market Report Segmentation

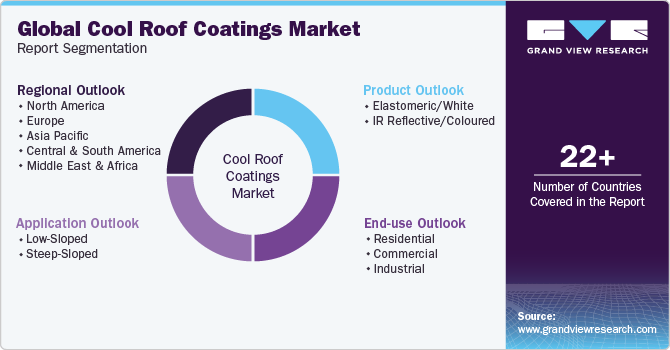

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cool roof coatingsmarket report on the basis of product, application, end-use, and region:

-

Product Outlook (Volume, Kilo Liters; Revenue, USD Million, 2018 - 2030)

-

Elastomeric/White

-

IR Reflective/Coloured

-

-

Application Outlook (Volume, Kilo Liters; Revenue, USD Million, 2018 - 2030)

-

Low-Sloped

-

Steep-Sloped

-

-

End-use Outlook (Volume, Kilo Liters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, Kilo Liters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cool roof coatings market size was estimated at USD 4.03 billion in 2022 and is expected to reach USD 4.32 billion in 2023.

b. The global cool roof coatings market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 7.02 billion by 2030.

b. North America dominated the cool roof coatings market with a share of 34.35% in 2022. This is attributable to increasing awareness regarding building energy consumption, coupled with the implementation of the Leadership in Energy and Environmental Design (LEED) green building certification initiative in the region.

b. Some key players operating in the cool roof coatings market include Nutech Paint; The Valspar Corporation; Nippon Paint (M) Sdn. Bhd.; Sika AG; Monarch Industrial Products (I) Pvt. Ltd.; Excel Coatings; Indian Insulation & Engineering; KST Coatings; DOW Inc.; GAF; Huntsman Corporation L; PPG Industries Inc.

b. Key factors that are driving the market growth include the application of cool roof coatings to protect the surface of roofs from ultra-violet radiations, water rusting, and chemical damages, and its tendency to reduce the temperature of the building.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.