- Home

- »

- Advanced Interior Materials

- »

-

Roofing Materials Market Size, Share & Growth Report, 2030GVR Report cover

![Roofing Materials Market Size, Share & Trends Report]()

Roofing Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Asphalt Shingles, Concrete & Clay Tiles), By Application (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-734-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Roofing Materials Market Summary

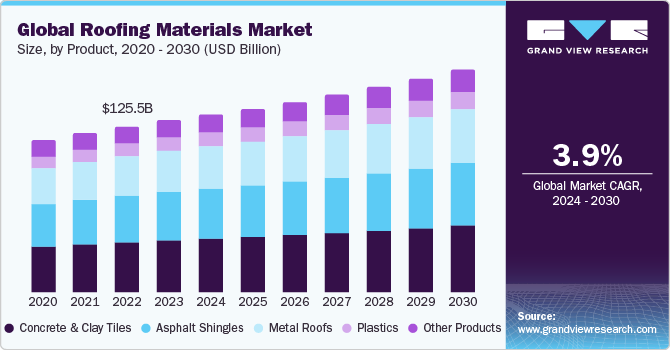

The global roofing materials market size was estimated at USD 129.62 billion in 2023 and is projected to reach USD 168.25 billion by 2030, growing at a CAGR of 3.9% from 2024 to 2030. Increasing expenditures in the renovation and redevelopment of commercial and residential buildings are expected to propel market growth.

Key Market Trends & Insights

- Asia Pacific led the market and accounted for a 33.1% share of global revenue in 2023.

- The roofing materials market in China is expected to grow at a CAGR of 4.4% in terms of revenue from 2024 to 2030.

- By product, the concrete and clay tiles product segment led the market and accounted for largest revenue share of 30.6% in 2023.

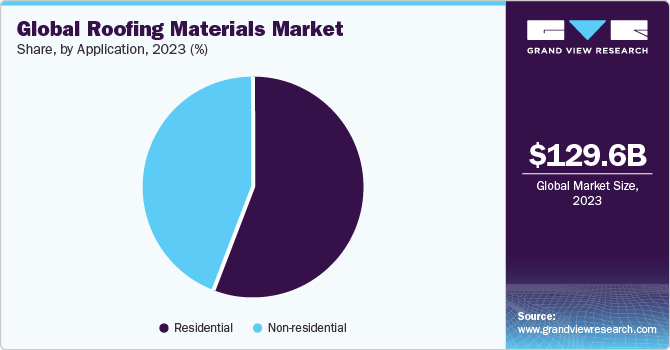

- By application, the residential application segment led the market and accounted for 56.2% of the global revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 129.62 Billion

- 2030 Projected Market Size: USD 168.25 Billion

- CAGR (2024-2030): 3.9%

- Asia Pacific: Largest market in 2023

Moreover, global construction sector is undergoing limited growth as a consequence of the economic recession caused by the COVID-19 crisis, which has resulted in low investor confidence and a decline in construction activities, thereby the market has also experienced a catastrophic setback in the year 2020.

The recent initiatives undertaken by governments of various countries of the world for the development of green buildings have also prompted consumers to carry out roof replacements. The demand for roof installations of solar panels surged in 2020 and is expected to continue increasing over the forecast period as well.

Increased solar panel installations are also expected to lead to a rise in roof replacements, thereby augmenting the demand for roofing materials over the forecast period. The advent of reflective coatings that can be applied to dark-colored roofing materials is expected to have a positive influence on the industry. Reflective coatings have excellent heat reflection properties and help to reduce the overall energy consumption of the building structure.

The power of suppliers is expected to be moderate owing to the presence of a large number of suppliers of raw materials in the market used for developing various roofing materials. A diversified product range, coupled with high-quality services, is anticipated to play a crucial role for suppliers to attain a competitive edge in the market.

Market Concentration & Characteristics

The growth stage of the market is moderate and the pace of growth is accelerating. The market is characterized by a high degree of innovation owing to the presence of cool roofing, impact-resistant shingles, green roofing, and solar roofing. Furthermore, the increasing demand for metal roofing has prompted manufacturers to adopt new roofing technologies such as standing seam metal roofing that lead to the development of versatile, architecturally superior, and weatherproof solutions.

The industry is subject to various building codes, energy conservation codes, and standards & compliances. For instance, ASTM D3462 is referenced in the International Building Code and International Residential Code as a minimum code requirement for asphalt shingles. Similarly, the International Energy Conservation Code (IECC) provides minimum requirements for building envelope and building systems insulation, including wall and roof insulation, windows and doors, mechanical system duct insulation, and water distribution system insulation.

A number of substitutes such as solar roofs, living roofs, restoration coatings, green roofs, and SPF roofs are available in the market. These materials offer better performance characteristics than common roofing materials available in the market. However, factors such as the high maintenance and installation costs of these roofing materials have restricted their demand across the world. Thus, the threat of substitutes in the roofing materials market is anticipated to be low in the coming years.

The market serves a diverse range of end-users across residential and non-residential construction sectors. Therefore, the end use concentration is high in the market. Understanding the specific needs of end users along with providing efficient services to the clients are a few of the major factors for roofing material manufacturers.

Product Insights

The concrete and clay tiles product segment led the market and accounted for largest revenue share of 30.6% in 2023. These tiles offer benefits such as improved aesthetics, durability, and ease of recycling, hence driving the product demand. However, growing consumer preference for stone-coated steel roofing is projected to impede product demand.

The asphalt shingles segment is projected to register a CAGR of 3.9% in terms of volume over the forecast period. Low capital costs and an easy installation process are anticipated to drive the demand for asphalt shingles as roofing materials over the forecast period.

The metal roof segment is anticipated to grow at the fastest CAGR in terms of revenue from 2024 to 2030. Metal roofs are versatile and can be converted into any desired shape such as shingles or slates to fit the surface structures of different types of buildings. Moreover, the low lifecycle costs, less weight, and fire resistance of metal roofs are expected to drive their global demand over the forecast period.

Application Insights

The residential application segment led the market and accounted for 56.2% of the global revenue share in 2023. Factors such as the increasing global population and rising preference of consumers for single-family housing structures are anticipated to fuel the growth of residential segment of roofing materials market during the forecast period.

Asphalt shingles are used in residential applications by homeowners as they offer ease of installation and require less maintenance as compared to metal and concrete. These are available in a wide array of colors and textures which can offer a wood, cedar, or slate-like appearance and improve aesthetic value of roofing structures.

Evolving business models, new startups, and an increased need for office space are expected to drive the global demand for non-residential buildings. Furthermore, rising expenditures in the construction of data centers by major technological companies like as Microsoft, Google, and Amazon are expected to boost demand for roofing materials used in non-residential structures.

Rising investments for the renovation and replacement of roofs of commercial buildings, such as hospitals, educational institutions, sports facilities, government offices, and recreational buildings are anticipated to fuel the penetration of roofing materials in various non-residential applications.

Regional Insights

The North America roofing materials market is expected to witness significant growth over the forecast period owing to rising private investments and ongoing mergers & acquisitions in the industrial sector of North America.

U.S. Roofing Materials Market Trends

In 2023, the U.S. roofing materials market held over 64.3% revenue share. The rise in the number of newly constructed buildings and infrastructures, especially in the commercial and industrial sectors, is expected to lead to a steady demand for roofing materials in the U.S. over the forecast period. However, increasing costs of construction materials and equipment, along with supply chain disruptions, are the major factors limiting the growth of this industry.

Asia Pacific Roofing Materials Market Trends

Asia Pacific led the market and accounted for a 33.1% share of global revenue in 2023. The expansion of residential, commercial, and industrial sectors due to the sustainable economic growth of countries in region is expected to fuel construction activities, thereby driving the demand for roofing materials.In addition, ongoing urbanization and improving standard of living of the masses are anticipated to contribute to the expansion of residential and commercial construction activities in Asia Pacific, including the development of shopping malls and retail chains.

The roofing materials market in China is expected to grow at a CAGR of 4.4% in terms of revenue from 2024 to 2030. Rapid urbanization in China is one of the primary factors fueling the growth of the construction industry in the country. In addition, various demographic factors such as the continuously increasing elderly population and the improvement in the standards of living of the masses owing to urbanization are expected to drive the growth of the roofing material industry in China.

The Canada roofing materials market is projected to grow at a CAGR of 3.8% from 2024 to 2030 in terms of volume due to increasing demand for energy-efficient construction solutions.The growth of the sector is also expected to be supported by an increase in the number of natural disasters, including hurricanes and wildfires that affect different regions of Canada.

Europe Roofing Materials Market Trends

The roofing materials market in Europe is expected to grow at a significant CAGR of 3.5% from 2024 to 2030, owing to increased tourism, retail trade, and business turnover in the member states of the European Union, including Spain, Italy, and Turkey.

The Germany roofing materials market accounted for a major revenue share of Europe in 2023. The government of Germany plans to continue construction activities in the coming years as this industry is one of the important pillars of the domestic economy of the country.

The roofing materials market in the UK is projected to grow at the fastest CAGR of 4.0% over the forecast period. A favorable regulatory and legal environment is expected to have a positive impact on the growth of the construction industry in the UK, thereby boosting the overall product demand.

Middle East & Africa Roofing Materials Market Trends

The roofing materials market in Middle East & Africa witnessed high product demand owing to robust government spending in GCC countries, which is boosting expenditure on construction of hospitals, leisure projects, and schools, which in turn, is expected to propel growth of roofing materials in the region.

The roofing materials market in Saudi Arabia accounted for a revenue share of 17.9% in 2023 in the region. The increasing manufacturing sectors, especially petrochemical, metal, and fertilizers are expected to augment demand for industrial building construction in the region, thereby positively impacting the market.

Central & South America Roofing Materials Market Trends

Central & South America roofing materials market exhibits a growing trend over the forecast period. Brazil, Argentina, and Columbia are emerging as hubs for foreign investors and the respective governments are directing their focus on internal development through initiatives such as building special economic zones (SEZs) for more robust economic growth, leading to high demand for roofing materials.

The Brazil roofing materials market is expected to grow at the fastest CAGR of 3.0% from 2024 to 2030, due to the development of high-rise luxury apartment buildings and hotels in the country. In addition, Brazil is expected to be the biggest contributor to the revival of construction industry in Central & South America as the country is focusing on recovering its economy and initiating new infrastructure projects.

Key Roofing Materials Company Insights

Some of the key players operating in market are GAF, Inc.; Owens Corning; CertainTeed, LLC;Johns Manville; and Wienerberger AG:

-

GAF, Inc. specializes in supplying and installing GAF roofing systems for commercial buildings, residential houses, and resorts. It offers a wide range of product portfolios under its broad categories, namely residential roofing systems, solar and other products, commercial roofing systems, and commercial solutions.

-

Owens Corning is engaged in the development, manufacturing, and marketing of building materials and composite systems. It operates through three business segments, namely composites, insulation, and roofing. It sells roofing components and shingles through home centers, lumberyards, distributors, retailers, and contractors across the globe.

Crown Building Products LLC, Atlas Roofing Corporation, CSR Limited, and Carlisle Companies Inc. are some of the emerging participants in Roofing Materials market.

-

Atlas Roofing Corporation is a manufacturer of residential and commercial building materials. The company offers Polyiso roof insulation, wall insulation, roof shingles, roof underlayments, and molded polystyrene. It has 33 manufacturing plants spread across the U.S. and sells its products globally.

-

CSR Limited's operations are spread across Australia and New Zealand, and it operates through three business segments, namely building products, property, and aluminum. Through building products segment, it offers masonry & insulation products, interior systems, and construction systems.

Key Roofing Materials Companies:

The following are the leading companies in the roofing materials market. These companies collectively hold the largest market share and dictate industry trends.

- GAF, Inc

- Owens Corning

- CertainTeed, LLC

- Johns Manville.

- Wienerberger AG

- Crown Building Products LLC

- Atlas Roofing Corporation

- CSR Limited

- Carlisle Companies Inc.

- TAMKO Building Products LLC.

Recent Development

-

In February 2023, Air TAMKO Building Products LLC. announced the product launch of innovative shingles called New Titan XT. The product has a layer of curated asphalt coating and aggressive modified sealants. The product was aimed to offer contractors and property owners a Class 3 Impact Rating and UL 2218-certified product.

-

In November 2023, CertainTeed, LLC announced the opening of a roofing material manufacturing and distribution center in Texas, U.S. This strategic investment reaffirms its position in the roofing market and allows the company to efficiently serve its customers in the southern part of the U.S.

Roofing Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 133.97 billion

Revenue forecast in 2030

USD 168.25 billion

Growth rate

CAGR of 3.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Volume in billion square feet, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Norway; Sweden; Denmark; Italy; Spain; China; India; Japan; Brazil; Saudi Arabia; UAE

Key companies profiled

GAF, Inc; Owens Corning; CertainTeed, LLC; Johns Manville.; Wienerberger AG; Crown Building Products LLC; Atlas Roofing Corporation; CSR Limited; Carlisle Companies Inc.; TAMKO Building Products LLC.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Roofing Materials Market Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global roofing materials market report based on product, application, and region:

-

Product Outlook (Volume, Billion Square Feet; Revenue, USD Billion, 2018 - 2030)

-

Asphalt Shingles

-

Concrete & Clay Tiles

-

Metal Roofs

-

Plastics

-

Other Products

-

-

Application Outlook (Volume, Billion Square Feet; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Volume, Billion Square Feet; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Norway

-

Sweden

-

Denmark

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global roofing materials market size was estimated at USD 129.62 billion in 2023 and is expected to reach USD 133.97 billion in 2024.

b. The global roofing materials market is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 168.25 billion by 2030.

b. The key factors driving the roofing materials market include increasing product use in several residential, industrial, and commercial sectors. This increased demand is primarily driven by population growth, rapid urbanization, and rising per capita income in developing countries.

b. Concrete & clay tiles product segment dominated the market and accounted for a 30.6% share of global revenue in 2023. These tiles offer benefits such as improved aesthetics, durability, and ease of recycling, hence driving the product demand

b. Some of the key players operating in the roofing materials market include GAF, Inc., Owens Corning, CertainTeed, LLC, Johns Manville., Wienerberger AG, Crown Building Products LLC, Atlas Roofing Corporation, and CSR Limited.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.