- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Protective Coatings Market Size, Share, Trends Report, 2030GVR Report cover

![Protective Coatings Market Size, Share & Trends Report]()

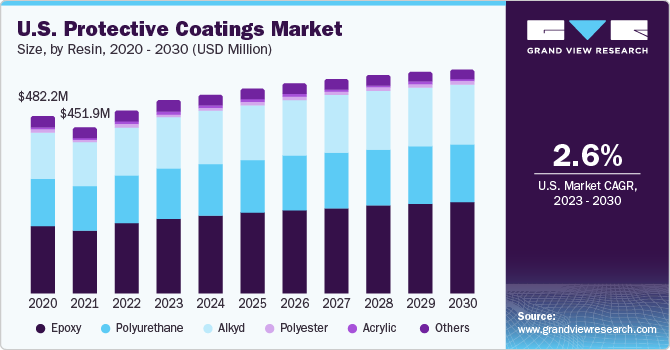

Protective Coatings Market (2023 - 2030) Size, Share & Trends Analysis Report By Resin (Acrylic, Epoxy, Polyurethane, Alkyd, Polyester), By Technology (Water Borne, Solvent Borne, Powder Based), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-351-5

- Number of Report Pages: 192

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protective Coatings Market Summary

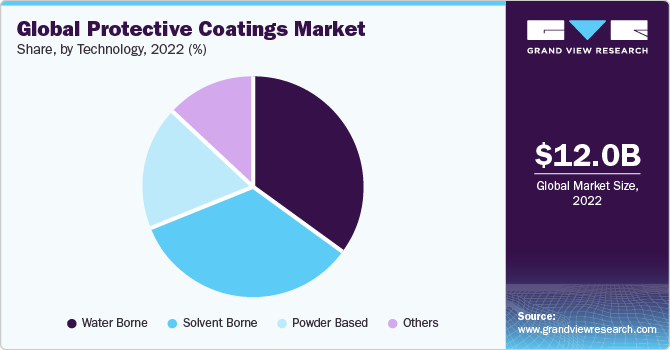

The global protective coatings market size was valued at USD 12.01 billion in 2022 and is anticipated to grow at a CAGR of 6.3% from 2023 to 2030. The burgeoning construction industry is playing a pivotal role in propelling market growth.

Key Market Trends & Insights

- Asia Pacific dominated the market with a revenue share of 78.4% in 2022.

- By technology, the solvent borne coatings segment accounted for a revenue share of 33.5% in 2022.

- By application, the construction segment accounted for the largest revenue share of 22.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 12.01 Billion

- 2030 Projected Market Size: USD 19.55 Billion

- CAGR (2023-2030): 6.3%

- Asia Pacific: Largest market in 2022

Protective coating finds extensive utilization across diverse end-use sectors, encompassing construction, oil and gas, aerospace, industrial, marine, automotive, power generation, mining, and others. This coating is applied onto diverse surfaces to ensure safeguarding against the external environment, which otherwise has the potential to compromise the functionality or integrity of an item or component.

The growth in the construction industry globally has been a significant factor contributing to the demand for protective coatings. Rising population, urbanization, and industrial growth have resulted in the rising need for infrastructure development and construction across the globe, most notably in fast-emerging regions such as Asia Pacific, Central and South America, and the Middle East.

The construction industry is witnessing a favorable growth across the globe on account of increasing infrastructural developments. The construction industry requires several protective coating formulations to meet the requirements of different applications. Abrasion and wear-resistant, high-temperature, intumescent, and water-resistant coatings are some of the commonly used protective coating products in the industry. Protective coatings are also applied to different construction equipment to ensure resistance to corrosion and wear & tear, durability, and operational efficiency.

Strong economic growth and growing government impetus to develop infrastructure in their respective countries are prominently fueling the growth of the construction industry, especially in emerging economies such as India and China. Moreover, the rising infrastructural spending in China is expected to potentially fuel the growth of the protective coating market over the forecast period.

For instance, in January 2019, the China Railway Corporation announced plans to construct 6,800 km of new railway line, including 3,200 km of high-speed rail, indicating a 40% increase in the construction of new tracks from 2018. Similarly, rising investments from leading MNCs in the country owing to the easy availability of raw materials and cheap labor are further propelling the growth of the construction industry.

However, strict regulations regarding toxic solvents are anticipated to impact market growth. Volatile Organic Compounds (VOCs) are required to conform to various statutory regulations and legislations. These organic compounds, widely utilized in protective coatings and technical applications, are subject to several governmental and federal regulations for controlling VOC emissions and to limit human exposure to toxic substances.

The construction industry requires various protective coating formulations to fulfill the needs of different applications. Growing population, increasing urbanization rate, and industrial growth have resulted in the growing need for infrastructure development and construction globally, most notably in developing regions such as Asia Pacific, the Middle East, and Central & South America. Countries such as China, Japan, India, among others, are contributing to the rise of the construction industry in the Asia Pacific. Increasing industrialization & urbanization, growing middle-class population, and improving living standards are the major factors driving regional construction growth.

Central & South America and the Middle East & Africa are among the potential high-demand markets for the construction industry. Rising GDP, increasing disposable income, growing importance of manufacturing and industrial sectors, and low cost of production are the factors attracting investors to these regions. In addition, rising efforts by the governments to develop their respective country’s infrastructure and housing sector are further anticipated to fuel the growth of the construction industry, which, in turn, is anticipated to boost the demand for protective coatings over the forecast period.

Increasing need for treatment of water for efficient usage has increased rapidly during the decade. Treatment of wastewater has gained popularity throughout the globe to prevent damage to the environment since, wastewater contains harmful substances such as human waste, oils, food scarp, chemicals, soaps, and others which require treatment before letting off to the environment. Concrete due to its higher water retention attribute is used in manufacturing of water tanks, but when exposed to chemicals for long, the concrete gets damaged, hence to avoid such long term damages, protective coatings are applied over the substrate which has led to the increase in demand for protective coatings.

As per Clean Air Act amendments, the EPA has implemented programs to reduce emissions of VOC and related elements that lead to ozone degradation. The agency has implemented the National Ambient Air Quality Standards (NAAQS) and may also sanction areas where the manufacturers have to follow the set of standards. Thus, stringent regulations by the EPA, OSHA, EU, and other regional agencies across the globe are expected to challenge the growth of the market for protective coatings over the forecast period.

Technology Insights

The solvent borne coatings segment accounted for a revenue share of 33.5% in 2022. Solvent borne protective coating is widely used in industrial, oil and gas, marine, and automotive sectors. In the industrial sector, solvent-borne coatings are used where the components may be susceptible to rusting and where it is not advisable to use water-borne coatings. In addition, they are used in industries having high humidity and corrosive gases. However, stringent regulations regarding VOC emissions in developed economies, particularly in the U.S. and the U.K., are expected to challenge the growth of the segment.

Solvent borne coatings are now being replaced by greener alternatives and bio-solvents owing to their environmental benefits, which may challenge the growth of this segment over the forecast period. These newer coatings are expected to witness a growth in demand in emerging countries such as China, India, Brazil, and Russia owing to the rapid infrastructure development in these countries.

The water borne segment is expected to expand at the fastest CAGR of 7.5% during the forecast period. The growth is driven by the fostering of construction activities globally due to rapid industrialization and urbanization. An excessive shift in coatings trend from low or high-volatility organic solvents to complete solvent-free coatings that have fewer emissions is likely to contribute to the growing demand for waterborne coatings in residential as well as commercial coating applications. Interior and exterior wall paint formulations mainly rely on waterborne coatings.

Application Insights

The construction segment accounted for the largest revenue share of 22.0% in 2022. Protective coatings are used for enhancing the durability and protecting the structure from hazards such as fire, corrosion, and UV radiation. They are used to boost thermal resistance and reduce the impact of corrosive gases on industrial structures.

Favorable government policies concerning tax benefits for infrastructure development have boosted the growth of this segment in Asia Pacific economies, such as India and China. Infrastructure development is anticipated to gain momentum over the forecast period on account of new socio-economic development plans. Construction companies such as Larsen & Toubro Limited, DLF Limited, Vinci SA, Bechtel Corporation, and Balfour Beatty plc, are some of the potential customers of protective coatings.

The aerospace segment is expected to expand at the fastest CAGR of 7.9% during the forecast period. The global aerospace industry has been experiencing steady growth due to rising air travel demand and the expansion of commercial aviation activities. This growth has led to an increase in aircraft production, resulting in a higher demand for protective coatings. With an increase in aircraft manufacturing, there is a greater need for coatings that provide long-lasting protection against environmental factors and extend the lifespan of critical components.

Regional Insights

Asia Pacific dominated the market with a revenue share of 78.4% in 2022 and is expected to expand at the fastest CAGR of 7.2% during the forecast period. The region is projected to account for a significant market share over the forecast period on account of the ascending demand for protective coatings from end-users, such as aerospace, automotive, mining, power generation, industrial, oil and gas, and others. Asia Pacific has a dense population, mainly in China and India; this has led to a significant number of infrastructural and construction activities in the region. The availability of raw materials, as well as less stringent laws regarding VOC radiations compared to North America and Europe, have given huge opportunities for the growth of end-use sectors such as automotive, marine, construction, and manufacturing. Asia Pacific is anticipated to contribute significantly to the growth of the aerospace industry over the forecast period. Rising air passenger traffic and increasing aerospace budget of countries such as India, China, and Japan are potentially fueling the growth of the regional aerospace industry.

China’s protective coating market is expected to witness growth over the forecast period due to the high rate of infrastructure development and rising power generation capacity. Developments among key manufacturing industries including oil & gas, construction, and aerospace is likely to significantly contribute to the rising demand for protective coatings in China. In Asia Pacific, China led the protective coatings market both in terms of volume and revenue. Factors such as the presence of numerous end-users, close proximity to raw material suppliers, and rapid industrialization and urbanization, especially in India and China, are anticipated to boost regional product demand.

Europe is the second-largest market for protective coatings after Asia Pacific. Growing infrastructure spending, especially in countries such as Germany, France, and the UK, coupled with favorable economic conditions, is anticipated to significantly drive the market for protective coatings in the region. In addition, increasing demand from end-use industries such as power generation, aerospace, and automotive is expected to propel the demand for protective coatings in Europe over the forecast period.

The construction industry is witnessing significant growth in the North America region. Countries such as the U.S. and Canada are characterized by low-risk environment and a robust financial sector. This has provided a multitude of opportunities for investors in recent years, which is expected to trigger infrastructure spending in the region. This, in turn, is projected to positively impact the demand for protective coatings in the North American construction industry.

Resin Insights

The epoxy segment accounted for the largest revenue share of 39.1% in 2022 and is expected to further expand at the fastest CAGR of 7.0% during the forecast period. Epoxy coatings are used in structural parts in the construction sector to enhance durability, strength, and resilience of different structures. They are also used in floor toppings, grouts, crack injection, and adhesives.

In addition, the product is used in home appliances such as refrigerators and washing machines to protect them from food acids, corrosive gases, and humidity, as well as to extend service life and improve aesthetics. Rising demand for epoxy resin can be attributed to its low VOC content and excellent anti-corrosion performance, along with augmented requirements from aerospace and automotive industries. The increasing demand for shipbuilding and repair, petrochemicals, and steel in China has resulted in a strong demand for epoxy resins.

In addition, increasing investments in infrastructure development in the Asia Pacific and Middle East regions are expected to drive the demand for epoxy resin during the forecast period. Some countries, such as Indonesia and Thailand, are key automobile manufacturers and shipbuilding participants that majorly use epoxy protective coatings during manufacturing operations.

Key Companies & Market Share Insights

The global market is fragmented in nature with the presence of various key players. Global players face intense competition from each other as well as from regional players who have well-established supply chain networks and are well aware of the regulations and suppliers in their regional market.

Key Protective Coatings Companies:

- Akzo Nobel N.V.

- Arkema

- Axalta Coating Systems, LLC

- PPG Industries, Inc.

- The Sherwin-Williams Company

- RPM International Inc.

- Wacker Chemie AG

Recent Developments

-

In March 2023, Evonik introduced the new TEGO Flow 380 leveling agent for superior quality automotive clear coatings. The TEGO Flow 380 is ideal for solvent borne coatings, particularly clear coats. It is distinguished by superior anti-popping qualities and extensive compatibility. The primary uses are for automotive & general industrial coatings

-

In March 2023, Axalta Coating Systems, LLC announced the launch of its new ICONICA collection of Alesta SD powder coatings for the construction and architectural market in the U.S. ICONICA coatings are built on a system of polyester resin and are incredibly durable. The line blends superior-quality stabilizers and pigments with high external durability to increase the lifespan of architectural projects

-

In May 2023, Akzo Nobel N.V. introduced a super durable Interpon D powder coating that imparts aluminum surfaces with the exquisite natural appearance and texture of stone, all without the complications or expenses associated with using the actual material. This launch is targeted towards designers and architects within the Indian market

-

In June 2023, The Sherwin-Williams Company introduced a solution to mitigate the hazardous corrosion under insulation (CUI) condition, through the launch of its latest line of Heat-Flex CUI-mitigation coatings. Among all the formulations currently available on the market, the company states that this coating demonstrates the highest performance in reducing CUI

-

In June 2023, PPG Industries, Inc. introduced a new line of electro coat materials known as PPG ENVIRO-PRIME EPIC 200R coatings. These coatings cure at lower temperatures compared to competing technologies. Customers can derive benefits from the decreased energy consumption during production, resulting in reduced carbon dioxide emissions at manufacturing plants, along with other sustainability advantages

Protective Coatings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.11 billion

Revenue forecast in 2030

USD 19.55 billion

Growth Rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report update

November 2023

Quantitative units

Revenue in USD million, volume in kilo tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Akzo Nobel N.V.; Arkema; Axalta Coating Systems, LLC; PPG Industries, Inc.; The Sherwin-Williams Company; RPM International Inc.; Wacker Chemie AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protective Coatings Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global protective coatings market report on the basis of resin, technology, application, and region:

-

Resin Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Epoxy

-

Polyurethane

-

Alkyd

-

Polyester

-

Others

-

-

Technology Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Solvent Borne

-

Water Borne

-

Powder Based

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Oil & Gas

-

Aerospace

-

Industrial

-

Marine

-

Automotive

-

Power Generation

-

Mining

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.